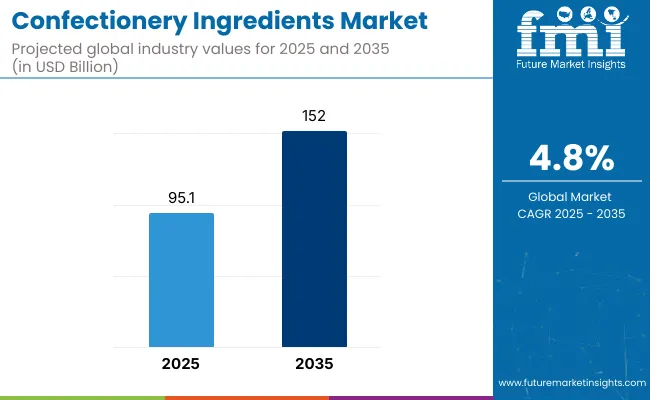

The global confectionery ingredients market is expected to grow from USD 95.1 billion in 2025 to USD 152 billion by 2035, reflecting a CAGR of 4.8%. This growth is driven by shifting consumer preferences towards healthier, natural, and clean-label ingredients.

| Metrics | Values |

|---|---|

| Industry Size (2025) | USD 95.1 billion |

| Industry Value (2035) | USD 152 billion |

| CAGR (2025 to 2035) | 4.8% |

Increased demand for premium confectionery products, particularly cocoa & chocolate and confectionery sweeteners, is anticipated to propel the market forward. Cocoa & chocolate holds the largest share, catering to rising consumer indulgence trends, while confectionery sweeteners continue to replace traditional sugars due to growing health concerns.

The market is also benefiting from technological advancements in ingredient formulation, which enables producers to create high-quality, versatile, and more sustainable ingredients. Furthermore, the expanding demand in emerging economies like India is boosting the market’s growth, driven by increasing disposable incomes, urbanization, and the rise of modern retail channels. This shift is resulting in an uptick in the demand for diverse confectionery products, ranging from chocolates to sugar-free candies.

The global confectionery ingredients market is projected to reach USD 95.1 billion in 2025. Within this market, cocoa plays a central role, accounting for approximately 40-45% of the total value, due to its foundational use in chocolate and sweet treats. Cocoa also contributes about 2-3% to the larger food and beverage ingredients market, valued in the trillions, thanks to its integration in bakery, dairy, and drink formulations.

In the natural flavoring agents market, cocoa holds around 4-6%, prized for its distinct aroma and sensory richness. Additionally, in the functional food ingredients market, cocoa comprises 1-2%, due to its antioxidant and mood-enhancing properties. As an agricultural commodity, cocoa represents roughly 0.5-1%, reflecting its high-value, export-driven nature.

In May 2025, Spectrum Chemical expanded its bioCERTIFIED™ portfolio with ~100 new bioprocess-grade antioxidants and cell-culture additives, enhancing bulk supply options for vitamin-C derivatives including Ascorbyl Palmitate. In Jan 2025 - Riken Vitamin approved a USD 20 million upgrade to its Guymon Extracts plant in Oklahoma, boosting pork-extract and antioxidant capacities 1.5-fold ahead of a September 2025 start-up.

The market is shaped by innovations in the extraction and processing of natural ingredients like cocoa and malt, coupled with a growing trend toward clean labels in confectionery products. As health-conscious consumers demand more sustainable and healthier alternatives, the global confectionery ingredients market is undergoing a significant transformation, positioning key players like Barry Callebaut and Cargill to lead in offering high-quality, natural ingredients that meet evolving consumer expectations.

The table below provides a comparative analysis of the semi-annual growth trajectory for the global confectionery ingredients industry across two periods: 2024 to 2034 and 2025 to 2035. This assessment highlights notable shifts in growth rates over six-month intervals, offering insights into evolving industry dynamics. The first half of each year (H1) spans from January to June, while the second half (H2) covers July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.6% |

| H2 (2024 to 2034) | 4.8% |

| H1 (2025 to 2035) | 4.6% |

| H2 (2025 to 2035) | 4.9% |

During the duration from 2025 to 2035, the industry is expected to witness a steady rise, with H1 reflecting a CAGR of 4.7% and H2 showing a slightly higher growth rate of 4.9%. This shift in momentum suggests increasing demand for natural and functional confectionery ingredients, driving industry expansion. Over the forecast period, the CAGR for H1 2025 to H2 2035 is anticipated to stabilize at 4.8%, maintaining a consistent growth pattern. The sector observed a rise of 10 BPS in H1, followed by a marginal dip of 10 BPS in H2.

The confectionery ingredients market is experiencing significant growth, with cocoa & chocolate leading at 35% market share in 2025. Liquid form ingredients capture 55%, and natural sources dominate with a 70% share. These segments are driven by the growing demand for healthier, natural, and premium ingredients in confectionery products.

Cocoa & chocolate ingredients are projected to hold 35% of the confectionery ingredients market share in 2025.

This segment benefits from the increasing consumer preference for premium chocolate products and the growing demand for higher cocoa content in sweets and baked goods. Key players like Barry Callebaut and Mars Incorporated are investing heavily in cocoa and chocolate ingredient innovations to meet evolving consumer preferences for high-quality and sustainable cocoa-based products. The growth of cocoa & chocolate ingredients is driven by:

The liquid form segment is expected to capture 55% of the market share in 2025.

The market is driven by its versatility and ease of use in various confectionery applications. Liquid ingredients are highly favored for their ability to seamlessly integrate into products such as chocolates, candies, and baked goods. Leading companies such as Cargill and Tate & Lyle continue to invest in liquid formulations to meet the growing demand for convenient, ready-to-use ingredients in the confectionery industry. The dominance of liquid form ingredients is supported by:

Natural sources are set to dominate the confectionery ingredients market with a projected 70% market share in 2025.

This growth is fueled by the increasing consumer preference for natural and clean-label ingredients in food and beverages. Companies like ADM (Archer Daniels Midland) and Ingredion Incorporated are focusing on sourcing natural ingredients to cater to the growing demand for healthier, non-artificial options in confectionery products. The preference for natural sources is driven by:

Sustainable and Functional Packaging Transformations

The industry is witnessing a significant shift toward sustainable and functional packaging strategies. Manufacturers are increasingly adopting biodegradable, compostable, and recyclable packaging materials to align with global sustainability goals. Edible packaging and minimalistic designs are also gaining traction, reducing waste while maintaining freshness and product integrity.

Functional packaging innovations, such as resealable pouches and controlled-portion packs, cater to consumer demand for convenience and portion control. Additionally, companies are integrating smart packaging solutions with QR codes and augmented reality to enhance consumer engagement, offering transparency about ingredient sourcing and nutritional benefits.

These advancements not only support environmental responsibility but also create differentiation in a competitive industry, reinforcing brand loyalty among eco-conscious and health-aware consumers.

Youth-Oriented Confectionery Innovations

Younger consumers are reshaping the confectionery industry with their preference for bold flavors, unique textures, and interactive experiences. Brands are focusing on product innovation, introducing limited-edition flavors, customizable confectionery, and multi-sensory treats that cater to adventurous palates.

Chewy candies with dual-layered flavors, aerated chocolates, and interactive confectionery formats such as DIY candy kits are capturing the interest of younger demographics. Social media influence plays a key role in driving demand, with brands leveraging viral marketing campaigns and collaborations with influencers to boost engagement.

Additionally, functional confectionery products fortified with vitamins, probiotics, or mood-enhancing ingredients are emerging to align with the health-conscious lifestyle of Gen Z and millennial consumers. The increasing demand for plant-based and organic confectionery further supports the development of clean-label options tailored to younger audiences.

Digital-First Commerce and Subscription Growth

E-commerce is transforming the global industry, providing brands with expanded reach and direct consumer engagement. Companies are leveraging digital platforms to introduce personalized shopping experiences, AI-driven recommendations, and subscription models that offer convenience and exclusivity.

Monthly confectionery boxes featuring artisanal and specialty ingredients are gaining popularity, providing consumers with a curated experience that aligns with evolving preferences. Brands are also utilizing social commerce strategies, selling directly through platforms like Instagram and TikTok to engage younger, tech-savvy consumers.

Moreover, the integration of digital payment solutions and AI-based inventory management is streamlining online sales and reducing logistical complexities. As digital commerce continues to expand, confectionery ingredient manufacturers are optimizing their direct-to-consumer (DTC) strategies to capture evolving purchasing behaviors and enhance brand loyalty.

Evolving Ingredient Preferences Shaping Product Categories

The global industry is experiencing a transformation driven by evolving ingredient preferences. The growing demand for natural sweeteners, plant-based alternatives, and reduced-sugar formulations is shaping new product categories. Manufacturers are increasingly incorporating organic cocoa, nut-based ingredients, and fruit extracts to cater to the health-conscious segment.

The rise of functional confectionery is further fueling demand for ingredients enriched with probiotics, collagen, and fiber, offering both indulgence and wellness benefits. Additionally, clean-label trends are pushing brands to eliminate artificial additives, preservatives, and synthetic emulsifiers, creating transparency in ingredient sourcing.

Innovations in protein-rich confections and energy-boosting snacks are also gaining traction, appealing to consumers looking for guilt-free indulgence. With shifting dietary habits, the demand for gluten-free, keto-friendly, and allergen-free confectionery ingredients continues to expand, redefining the landscape of the industry.

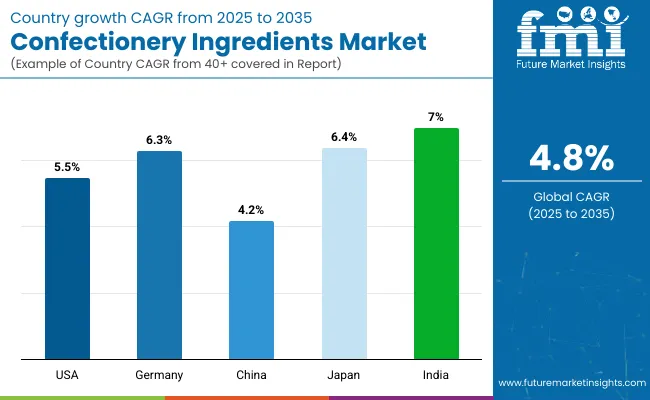

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| Germany | 6.3% |

| China | 4.2% |

| Japan | 6.4% |

| India | 7.0% |

FMI is of the opinion that the USA confectionery ingredients market is set to grow at CAGR of 5.5% from 2025 to 2035. High per capita consumption of confectioneries and constant product innovation drives this growth. In addition, changing consumer attitudes regarding healthier and premium confectionery products are transforming the demand for ingredients. Natural, organic, and functional ingredients are increasingly used in products by manufacturers to address health-conscious consumers.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| High Consumption of Confectionery | Per capita USA candy consumption is higher. |

| Natural & Functional Ingredients Demand | Customers prefer organic and plant-based confectionery ingredients. |

| Product Innovation by Industry Leaders | Companies are introducing healthier and premium confectionery products. |

As per FMI, Germany's market for confectionery ingredients is expected to grow at a CAGR of 6.3% during the forecast period. The nation has a strong tradition of consuming chocolate and baked goods, which remains a momentum driver for premium ingredient demand. Premium, handmade confectionery is the choice of German consumers; hence, manufacturers use the best ingredients.

The industry is also experiencing a trend toward sugar-free, organic, and functional confectionery, consistent with increasing health awareness. Natural sweetener and plant-based ingredient innovation is becoming increasingly popular to address these changing requirements. Sustainability and ethical sourcing are also emerging as purchase drivers, which are leading companies to adopt open supply chains and green processes.

Growth Drivers in Germany

| Key Drivers | Description |

|---|---|

| Strong Confectionery Consumption Tradition | Germany is a leading chocolate and baked goods industry. |

| Growing Demand for Organic & Sugar-Free Confectionery | Health-conscious customers demand better-for-you products. |

| Ethical & Sustainable Sourcing Priority | Firms focus on clean and sustainable supply chains. |

The industry for confectionery ingredients in China will grow at a CAGR of 4.2% during 2025 to 2035, as per FMI. Urbanization, westernized eating habits, and increasing disposable incomes fuel the consumption of confectionery products. Customers are focusing on quality ingredients and premium flavors, which is driving the industry's growth.

Health-focused trends are also transforming the marketplace as demand for low-sugar, natural, and functional confectionery increases. Local players respond by expanding their ranges to cover health-focused items like vitamin-enriched candies and lower-calorie sweets. In addition, growth in e-commerce has introduced product availability as consumers increasingly shop for a wider range of confectionery.

Growth Drivers in China

| Key Drivers | Description |

|---|---|

| Increase in Disposable Income & Westernization | Consumers are testing premium and global confectionery products. |

| Rising Demand for Healthier Options | Functional and low-sugar confectionery are becoming more popular. |

| Increase in E-Commerce Channels | Internet shopping is expanding the footprint of confectionery. |

The confectionery ingredients market in Japan is likely to expand at a CAGR of 6.4% from 2025 to 2035, driven by innovation in packaging, texture, and taste. Japanese consumers appreciate premium quality sweets, which drives demand for unique ingredients like matcha, yuzu, and sakura extracts.

The Japanese industry also favors functional confectionery driven by low-calorie, sugar-free, and collagen-based items. The unique Japanese limited series and the seasonal nature of confectionery also help in continuous product innovation, which increases demand for ingredients.

Growth Drivers in Japan

| Key Drivers | Description |

|---|---|

| Preference for Premium & Specialty Ingredients | Emerging flavors such as matcha and yuzu lead ingredient demand. |

| Increasing Trend of Functional Confectionery | Low-calorie and collagen-infused candies are gaining traction. |

| Seasonal & Limited-Edition Sweets Trend | Ongoing product innovation fuels ingredient innovation. |

India's confectionery ingredients market is expected to expand fastest among large markets, with a projected CAGR of 7.0% during the forecast period, as per FMI. Growing disposable incomes, urbanization, and rising demand for chocolate and sugar confectionery drive expansion.

The influence of Western confectionery brands, complemented by the strong domestic confectionery culture, has created a high demand for ingredients. Moreover, the trend toward sugar-free, organic, and fortified confectionery is growing. Retail chains and e-commerce have also complemented growth by increasing access to a diversified range of confectionery.

Growth Drivers in India

| Key Drivers | Description |

|---|---|

| Rising Middle-Class & Rising Disposable Incomes | Increased spending ability is fueling demand for confectionery. |

| Western Influence & Local Sweets Culture | Mixing international and domestic tastes is generating new opportunities. |

| E-Commerce Expanding & Urban Retail Chains | Increased availability is driving industry expansion. |

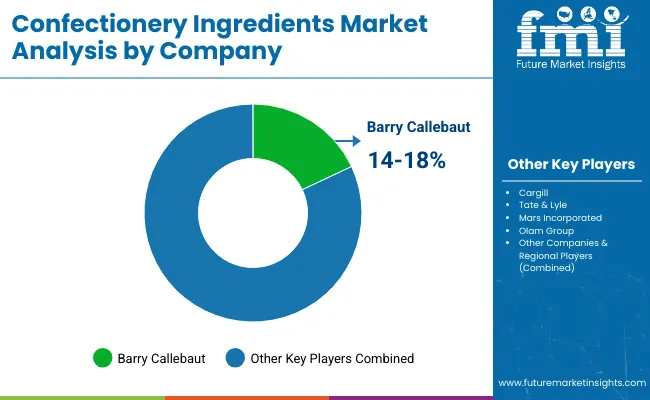

The global confectionery ingredients market is moderately fragmented, with the presence of multinational corporations (MNCs), regional manufacturers, and emerging players from China contributing to its competitive landscape. MNCs hold a significant industry share due to their extensive product portfolios, strong global distribution networks, and advanced research and development capabilities. These companies focus on expanding their industry presence through acquisitions, joint ventures, and strategic partnerships to strengthen their supply chains and introduce innovative ingredient solutions.

Regional players play a crucial role in catering to local demand by offering customized ingredient formulations that align with regional tastes, regulatory requirements, and dietary preferences. These companies emphasize sustainable sourcing, clean-label formulations, and cost-effective ingredient solutions to remain competitive. Many regional manufacturers are investing in capacity expansions and advanced processing technologies to enhance production efficiency and cater to the growing demand for premium and functional confectionery ingredients.

Chinese manufacturers have been rapidly expanding their presence in the global confectionery ingredients industry by leveraging cost-effective production capabilities and increasing exports. They are gaining traction by offering competitively priced ingredients such as cocoa derivatives, natural sweeteners, and emulsifiers. With government support and technological advancements, Chinese players are strengthening their position in the industry, competing with established multinational and regional firms.

Overall, the industry concentration remains diverse, with a balance between global giants, region-focused producers, and emerging Chinese suppliers. As competition intensifies, players across all segments are focusing on innovation, sustainability, and strategic collaborations to enhance their industry position.

The global confectionery ingredients market is characterized by dominant players, key players, and emerging players. Dominant players such as Cargill, Incorporated, Barry Callebaut, and Kerry Group lead the market with extensive product portfolios, strong R&D capabilities, and robust distribution networks across various confectionery applications.

Key players including Olam International, ADM, and Ingredion Incorporated offer specialized ingredients tailored to specific confectionery products and regional markets. Emerging players, such as Tate & Lyle, DuPont, and DSM-Firmenich, focus on innovative ingredient solutions and cost-effective alternatives, expanding their presence in the global market.

The confectionery market is shifting toward natural and functional ingredients, with over 70% of consumers preferring clean-label products. The demand for sugar alternatives is rising, with more than 50% of confectionery items now using natural sweeteners like stevia and monk fruit.

Plant-based confectionery alternatives are gaining popularity, with over 30% of new product launches featuring vegan or dairy-free ingredients. This trend reflects the growing demand for products catering to evolving dietary preferences and increasing consumer awareness of plant-based options.

Barry Callebaut (14-18%)

Industry leader in cocoa and chocolate solutions and investment in sustainability and product innovation.

Cargill (12-16%)

Expanding its confectionery ingredient portfolio with a focus on sustainable cocoa sourcing and clean-label solutions.

Tate & Lyle (10-14%)

A pioneer in sugar reduction and fiber-enriched solutions, which cater to the rising demand for healthier confectionery.

Mars Incorporated (9-13%)

Strengthening his presence in the natural and functional candy with good research and strategic acquisition efforts.

Olam Group (7-11%)

Prioritizing ethical sourcing and transparency in digital ingredient supply chains to affect their sustainability goals.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 95.1 billion in 2025.

The industry is predicted to reach USD 152 billion by 2035.

Leading confectionery ingredient brands include Barry Callebaut, Cargill, Tate & Lyle, Mars Incorporated, Olam Group, ADM (Archer Daniels Midland), Ingredion Incorporated, Kerry Group, Nestlé, and DSM-Firmenich.

India, slated to grow at 7.0% CAGR during the forecast period, is poised for the fastest growth.

Cocoa and chocolate are the most widely used confectionery ingredients globally.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Confectionery Coating Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Confectionery Fillings Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Distribution Among Confectionery Packaging Manufacturers

Confectionery Flexible Packaging Market Trends – 2024-2034

Confectionery Fats Market

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Sugar Confectionery Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Liquor Confectionery Market Insights - Indulgent Sweets & Alcohol-Infused Treats 2025 to 2035

Chocolate Confectionery Market Analysis by Product, Type, Distribution Channel, and Region Through 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA