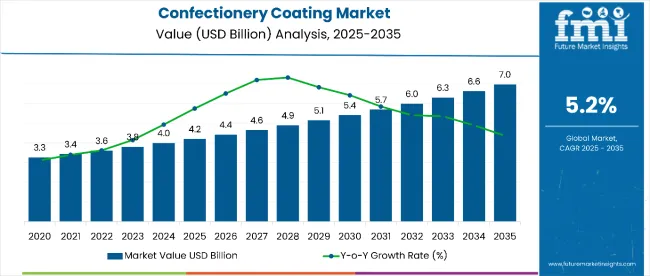

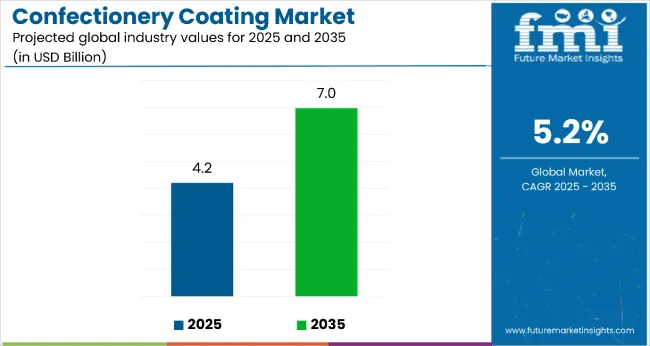

The confectionery coating market is estimated to be valued at USD 4.2 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a CAGR of 5.2% over the forecast period. The confectionery coating market is projected to add an absolute dollar opportunity of USD 3.6 billion over the forecast period.

This reflects 1.62 times growth at a compound annual growth rate of 4.9%. The market's evolution is expected to be shaped by rising demand for premium confectionery products, innovative flavor profiles, and indulgent treats, particularly where enhanced visual appeal and extended shelf life are required.

By 2030, the market is likely to reach approximately USD 7.3 billion, accounting for USD 1.5 billion in incremental value over the first half of the decade. The remaining USD 2.1 billion is expected during the second half, suggesting a moderately front-loaded growth pattern. Product innovation in compound coatings and functional ingredients is gaining traction due to confectionery coating's favorable cost-effectiveness and processing advantages.

Companies such as Barry Callebaut and Cargill are advancing their competitive positions through investment in advanced coating technologies and sustainable sourcing systems. Health-conscious formulation models are supporting expansion into sugar-free applications, organic variants, and clean-label products. Market performance will remain anchored in flavor innovation, coating efficiency, and regulatory compliance benchmarks.

The market holds approximately 45% of the chocolate and confectionery ingredients market, driven by its essential role in product differentiation, flavor enhancement, and visual appeal across confectionery applications. It accounts for around 38% of the food coating and glazing agents market, supported by its functional properties and compatibility with various confectionery manufacturing processes.

The market contributes nearly 32% to the specialty food ingredients market, particularly for applications requiring premium appearance and taste enhancement. It holds close to 28% of the bakery and confectionery processing aids market, where coatings are essential for product finishing and consumer appeal. The share in the indulgent food products market reaches about 35%, reflecting its preference among manufacturers seeking to create premium confectionery experiences.

The market is undergoing structural change driven by rising demand for premium, indulgent, and visually appealing confectionery products. Advanced coating technologies using compound formulations, natural colorants, and flavor innovations have enhanced product aesthetics, shelf stability, and consumer acceptance, making confectionery coatings viable alternatives to traditional chocolate coatings.

Manufacturers are introducing specialized formulations and customized coating solutions tailored for specific applications, expanding their role beyond basic chocolate alternatives. Strategic collaborations between coating suppliers and confectionery manufacturers have accelerated adoption in premium and artisanal products. Health-conscious positioning and clean-label trends have widened market acceptance, reshaping traditional coating formulations and forcing conventional suppliers to adapt.

Confectionery coating's cost-effectiveness, processing convenience, and ability to enhance product appeal make it an attractive alternative to traditional chocolate for confectionery manufacturers seeking to balance quality with economic efficiency.

Growing consumer demand for indulgent treats and premium confectionery experiences is further propelling adoption, especially in chocolate alternatives, seasonal products, and artisanal confections. Innovation in coating formulations, along with improvements in flavor profiles and visual aesthetics, is also enhancing product quality and market acceptance.

As confectionery consumption increases globally and premium product positioning becomes critical, the market outlook remains favorable. With manufacturers and consumers prioritizing taste innovation, visual appeal, and cost-effective premium experiences, confectionery coatings are well-positioned to expand across various sweet treat and bakery applications.

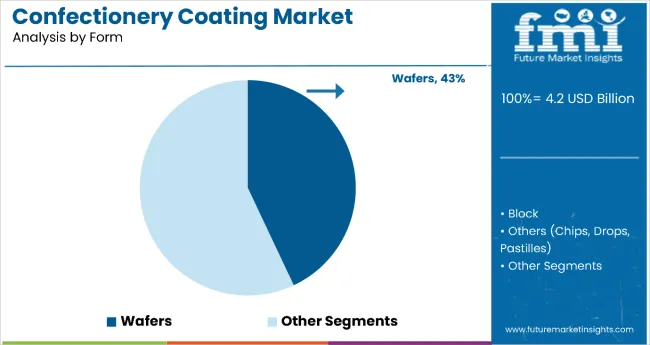

The market segments include nature, form, flavour, product type, and region. The nature segment comprises organic confectionery coating and conventional confectionery coating. The form segment includes wafers, blocks, and others (chips, pastilles, buttons, and slabs).

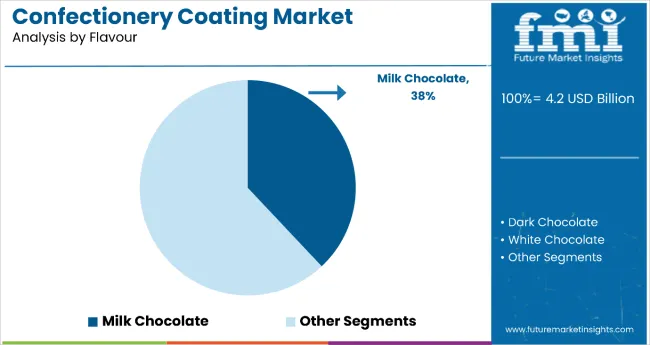

The flavour segment covers dark chocolate, white chocolate, milk chocolate, yoghurt, caramel, fudge, citrus, berries, and others (spice, nut butter). The product type segment includes candies, biscuits & cookies, dried fruits & nuts, soft candies, bars, lollipops, canes, toffees, and others (cereal snacks, marshmallows, ice cream coatings). The regional segment includes North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and the Middle East & Africa.

The wafers form segment holds a dominant position with 43.0% of the market share in 2025, primarily due to its wide application in chocolate bars, layered biscuits, and novelty snack items. The lightweight, crispy texture of wafers provides a complementary contrast to thick confectionery coatings such as milk or dark chocolate, enhancing sensory appeal and consumer satisfaction.

Wafers help manufacturers reduce overall product weight while maintaining volume and visual appeal, which is especially advantageous in cost-sensitive markets. The segment is also benefiting from innovations in wafer-based formats, including multi-layered bars, filled wafers, and protein-enriched variants that meet both indulgent and functional snacking trends.

Coated wafers are increasingly featured in seasonal launches and gift packs, boosting their visibility in the market. In emerging economies, rising disposable incomes and the growth of modern retail channels are driving higher demand for affordable luxury snacks, a segment where wafers are particularly well suited.

Milk chocolate leads the flavour category with a 38.0% market share in 2025, attributed to its smooth, creamy texture and moderate sweetness that appeals widely to children and families. Unlike dark chocolate, which can be bitter, or white chocolate, which may be overly sweet, milk chocolate offers a balanced taste that suits mainstream preferences.

Its dominance is supported by strong placement in mass-market offerings and seasonal confectionery products. Milk chocolate-coated items are core offerings across major supermarket and convenience store chains in countries such as the USA, UK, Germany, and India.

Although consumer interest in dark and niche flavours is increasing, milk chocolate continues to evolve through premium and hybrid formats. Manufacturers are introducing enhanced milk chocolate products that feature single-origin cocoa, added protein, reduced sugar, and organic milk to align with health and sustainability demands while retaining broad appeal.

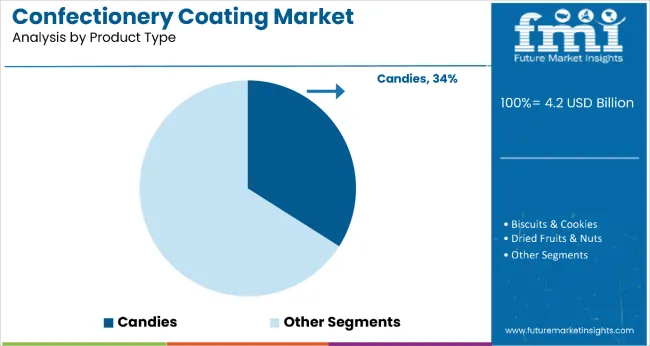

Candies hold the largest share among product types with 34.0% of the global confectionery coating market in 2025. Their leadership is supported by universal consumer appeal, affordability, and ongoing innovation in flavours, packaging, and formats. Chocolate-coated candies are a significant part of this segment, including milk chocolate shells, dark chocolate-covered centers, and dual-flavour options.

Candies appeal to a wide demographic. While sugar-based variants continue to attract children, an increasing number of premium or functional options target adults, featuring attributes such as added vitamins, exotic fruit fillings, and dark chocolate coatings. Brands are also focusing on reduced sugar content, organic coatings, and plant-based inclusions to cater to evolving health-conscious preferences.

North America and Europe represent mature yet profitable markets through strategies such as nostalgia marketing and premiumization. In contrast, the Asia Pacific region is experiencing the fastest growth, driven by increasing disposable incomes, western-influenced snacking habits, and a youthful consumer base. In these markets, coated candies serve both as daily treats and as gifting options during festivals and celebrations.

In 2024, global confectionery coating consumption increased by 12% year-on-year, with North America accounting for 35% of total demand. Applications include cost-effective chocolate alternatives, seasonal confectionery coatings, and premium finishing solutions for high-value products.

Manufacturers are investing in advanced compound formulations and natural ingredient blends to achieve superior taste profiles and processing efficiency. The market is witnessing an emphasis on clean-label solutions to support transparent ingredient positioning, while technology providers offer ready-to-use coatings with integrated flavor systems to simplify formulation and reduce processing complexity.

Cost-Effectiveness and Processing Efficiency Drive Market Adoption

Confectionery coatings are being increasingly adopted for their ability to deliver cost savings and operational advantages without compromising sensory quality. Compound coatings can reduce costs by up to 40% compared to pure chocolate while maintaining consumer acceptance levels above 85%.

These formulations ensure flavor stability and aesthetic appeal across production and distribution stages. High-volume manufacturers benefit from reduced processing times, as coating lines can lower production cycles by nearly 35% compared to traditional chocolate tempering. Such benefits make confectionery coatings essential for scaling operations while controlling raw material expenditure.

Ingredient Cost Volatility, Health Concerns, and Premium Positioning Challenges Restrict Expansion

The market faces constraints from raw material price fluctuations, rising health concerns, and brand positioning complexities. Cocoa and sugar costs range between USD 2,200 and USD 3,800 per metric ton, creating pricing instability and prompting frequent reformulation, sometimes increasing operational costs by up to 8%.

Additionally, the clean-label movement has lengthened product development timelines by 3 to 5 months due to regulatory and sourcing challenges for natural ingredients. Premium market segments present another hurdle, as consumer expectations for authentic chocolate experiences increase rejection rates for compound coatings by 15-25% compared to traditional products.

Key Trends Reshaping the Confectionery Coating Market

The industry is moving toward natural ingredient blends, clean-label certifications, and ready-to-use coating solutions to meet evolving consumer expectations. Functional inclusions, such as protein or fiber fortification, are emerging in premium coating applications, reflecting the convergence of indulgence and health.

Technological advancements in flavor encapsulation and heat-stable formulations are enhancing performance during processing and storage. Additionally, growing demand for seasonal and limited-edition offerings is pushing manufacturers to adopt versatile coating systems capable of delivering differentiated sensory experiences. These trends indicate a shift toward value-added solutions that balance cost control with premiumization and health-driven innovation.

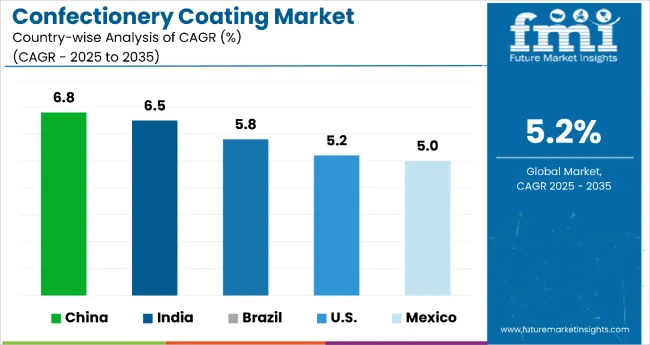

Between 2025 and 2035, China leads the confectionery coating market with a 6.8% CAGR, driven by large-scale manufacturing and strong export growth. India follows at 6.5%, supported by government investment and modernization of traditional sweets. Brazil grows at 5.8%, fueled by sustainable innovations and tropical flavour development.

The USA posts a 5.2% CAGR, focusing on advanced technologies like sugar-free and vegan coatings. Mexico, at 5.0%, emphasizes traditional sweet adaptations and export-ready solutions. While China and India dominate in scale, Brazil and the USA lead in innovation, and Mexico offers culturally tailored growth opportunities.

Sales of confectionery coating in China are projected to grow at a CAGR of 6.8% from 2025 to 2035, outperforming the global average by 1.9%. The growth is linked to rapid confectionery manufacturing expansion, rising urban consumption, and increasing adoption of western-style treats in Beijing, Shanghai, and Guangzhou metropolitan areas.

Compound coating production and chocolate alternative manufacturing are widely supported by domestic food processing investments and international technology partnerships. Market expansion has been driven by cost-effective production capabilities and growing export opportunities to Southeast Asian markets.

Sales of confectionery coating in India is forecast to grow at a CAGR of 6.5% from 2025 to 2035, ahead of the global average by 1.4%. Traditional sweet manufacturing regions, particularly Maharashtra, Gujarat, and Tamil Nadu, have expanded confectionery coating adoption for both domestic consumption and value-added confection production. Government support for food processing and increasing urbanization have supported coating technology development in commercial sweet manufacturing.

Demand for confectionery coating in Brazil is projected to grow at a CAGR of 5.8% from 2025 to 2035, outperforming the global average due to robust domestic demand and increasing investments in sustainable and functional confectionery coatings. Innovation is particularly strong in the São Paulo, Curitiba, and Belo Horizonte regions, where manufacturers are developing tropical fruit-flavoured coatings, reduced-sugar chocolate layers, and heat-resistant formulations suitable for the local climate.

The USA confectionery coating market is expected to expand at a CAGR of 5.2% from 2025 to 2035, driven by rapid advancements in coating machinery, allergen-free formulations, and sugar alternatives. Regions such as California, Illinois, and Pennsylvania are at the forefront of deploying microencapsulation, protein-infused coatings, and shelf-stable innovations for functional snacks and confectionery items.

Sales of confectionery coating in Mexico are projected to grow at a CAGR of 5.0% from 2025 to 2035, fueled by rising middle-class consumption and the modernization of traditional confections with new coating technologies.

Growth is concentrated in Mexico City, Monterrey, and Guadalajara, where local brands are adopting chocolate, yoghurt, and spiced coatings for both domestic and export markets. Emphasis is being placed on enhancing shelf stability for tropical climates, using ingredients like tamarind, chili, and cinnamon for culturally relevant coated products.

The market is moderately consolidated, featuring a mix of global chocolate giants, specialized coating manufacturers, and regional ingredient suppliers with varying degrees of processing technology, product innovation, and application expertise. Barry Callebaut AG and Cargill Incorporated lead the chocolate-based coating segment, supplying comprehensive coating solutions for confectionery manufacturers, bakeries, and food service operations. Their strength lies in extensive cocoa processing capabilities, global supply chain networks, and established relationships with major confectionery brands.

The Hershey Company and Mars Incorporated differentiate through brand-integrated coating solutions, proprietary formulations, and application-specific products that cater to both industrial manufacturing and consumer retail applications. Ferrero Group and Nestlé S.A. focus on premium coating development, addressing growing demand for high-quality alternatives and specialized formulations in luxury confection markets.

Regional specialists such as Blommer Chocolate Company, Clasen Quality Coatings Inc., and Puratos Group emphasize processing innovation, custom formulation services, and sustainable sourcing, creating value in artisanal markets and specialized coating applications.

Entry barriers remain significant, driven by challenges in ingredient sourcing, processing technology, and compliance with food safety and labeling standards across multiple application categories. Competitiveness increasingly depends on formulation flexibility, cost efficiency, and application development expertise for diverse confectionery manufacturing environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Product Type | wafers, blocks, and others (chips, drops, pastilles) |

| Application | Confectionery, Bakery, Ice Cream, Nutritional Bars, and Others |

| End-user | Large-Scale Manufacturers, Artisanal Producers, and Food Service |

| Form | Liquid, Solid, and Powder |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, and Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | Barry Callebaut AG, Cargill Incorporated, The Hershey Company, Mars Incorporated, Ferrero Group, Nestlé S.A., Mondelez International, Lindt & Sprüngli AG, Blommer Chocolate Company, Clasen Quality Coatings Inc., ADM Company, Fuji Oil Holdings Inc., Puratos Group, Chocoladefabriken Lindt & Sprüngli AG, and Kerry Group plc |

| Additional Attributes | Dollar sales by coating type and application method, regional demand trends, competitive landscape, buyer preferences for liquid versus solid formats, integration with clean-label positioning and natural ingredient sourcing, innovations in compound formulations, sustainable processing, and flavor enhancement technologies for improved taste profiles and cost-effectiveness. |

The global confectionery coating market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the confectionery coating market is projected to reach USD 7.0 billion by 2035.

The confectionery coating market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in confectionery coating market are organic confectionery coating and conventional confectionery coating.

In terms of form, wafers segment to command 47.6% share in the confectionery coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Confectionery Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Confectionery Fillings Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Packaging Market Size, Share & Forecast 2025 to 2035

Confectionery Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Confectionery Packaging Manufacturers

Confectionery Flexible Packaging Market Trends – 2024-2034

Confectionery Fats Market

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Sugar Confectionery Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Liquor Confectionery Market Insights - Indulgent Sweets & Alcohol-Infused Treats 2025 to 2035

Chocolate Confectionery Market Analysis by Product, Type, Distribution Channel, and Region Through 2035

US Convenience Confectionery Retail Sales Analysis - Size, Share & Forecast 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA