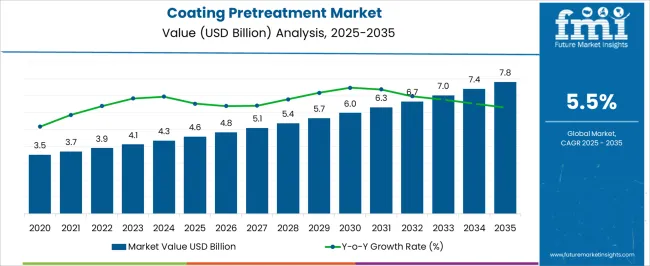

The coating pretreatment market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The coating pretreatment market is valued at USD 4.6 billion in 2025 and is expected to grow to USD 7.8 billion by 2035, with a CAGR of 5.5%. Between 2021 and 2025, the market grows steadily from USD 3.5 billion to USD 4.6 billion, progressing from USD 3.7 billion, 3.9 billion, 4.1 billion, and 4.3 billion. This phase reflects a steady increase in demand for coating pretreatment solutions driven by growth in industries such as automotive, aerospace, and construction, where surface preparation is crucial for enhancing the adhesion and durability of coatings.

From 2026 to 2030, the market accelerates, advancing from USD 4.6 billion to USD 6.3 billion. The values progress through USD 4.8 billion, 5.1 billion, 5.4 billion, 5.7 billion, and 6.0 billion, fueled by the rising demand for corrosion-resistant coatings, environmental regulations requiring more eco-friendly processes, and the shift towards advanced pretreatment techniques. During this period, the momentum is particularly strong in emerging economies, where industrialization and infrastructure development are increasing.

Between 2031 and 2035, the market continues its upward trajectory, reaching USD 7.8 billion, with values passing through USD 6.7 billion, 7.0 billion, and 7.4 billion. The growth momentum during this phase is driven by continuous innovations in pretreatment technologies, such as nanocoatings and sustainable chemical solutions, as industries focus on improving product quality and reducing environmental impact.

| Metric | Value |

|---|---|

| Coating Pretreatment Market Estimated Value in (2025 E) | USD 4.6 billion |

| Coating Pretreatment Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The coatings and paints market is a major contributor, accounting for around 30-35%, as pretreatment processes are essential for preparing surfaces to ensure better adhesion, durability, and resistance of coatings on materials like metals and plastics. The automotive and transportation market plays a significant role, contributing approximately 25-30%, as pretreatment is widely used for corrosion protection and to ensure proper adhesion of coatings on automotive parts, including body panels and undercarriages. The construction and building materials market also plays a part, contributing about 15-20%, as pretreatment processes are crucial in preparing metal structures, roofing materials, and infrastructure components, ensuring the longevity and protective qualities of the coatings.

The electronics and electrical equipment market accounts for around 10-12%, as pretreatment is necessary for preparing components such as casings, circuit boards, and connectors, which are then coated to protect them from corrosion and enhance their performance. Finally, the industrial equipment market contributes approximately 8-10%, as manufacturing machinery and other industrial components require pretreatment before coatings are applied, providing enhanced durability and resistance to wear and tear. These parent markets highlight the growing demand for coating pretreatment in automotive, construction, electronics, and industrial sectors, focusing on surface preparation for high-quality coatings.

The coating pretreatment market is experiencing steady growth as industries increasingly prioritize durability, corrosion resistance, and surface preparation in manufacturing and finishing processes. Growing demand for high-performance coatings across automotive, aerospace, construction, and general manufacturing is contributing to the need for advanced pretreatment technologies that ensure coating adhesion and long-term surface integrity. As environmental regulations tighten globally, manufacturers are shifting toward eco-friendly and low-VOC pretreatment formulations while continuing to rely on proven chemical systems for performance-critical applications.

The ability to improve coating consistency, reduce rework rates, and enhance lifecycle performance of treated parts is reinforcing adoption across industrial supply chains. Significant growth is being observed in emerging economies where rapid industrialization and rising investments in infrastructure are creating demand for surface finishing solutions.

Additionally, manufacturers are adopting automated and integrated pretreatment systems that improve efficiency and reduce waste With innovation driving both product development and process improvements, the coating pretreatment market is expected to continue expanding, supported by strong demand across transportation, construction, energy, and consumer goods sectors.

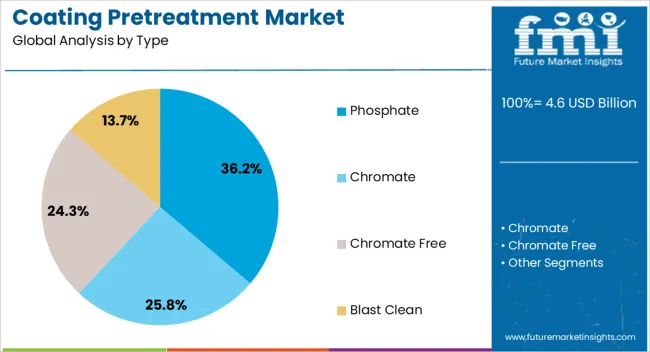

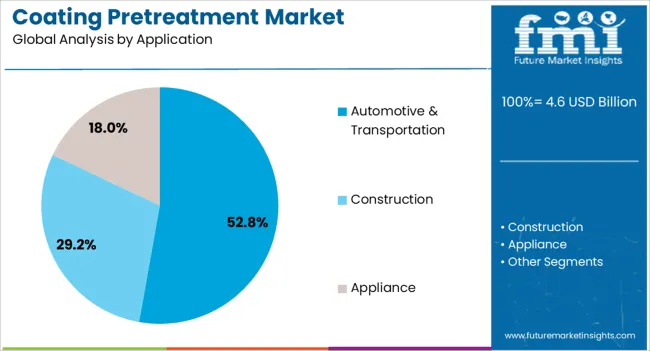

The coating pretreatment market is segmented by type, application, and geographic regions. By type, coating pretreatment market is divided into phosphate, chromate, chromate free, and blast clean. In terms of application, coating pretreatment market is classified into automotive & transportation, construction, and appliance. Regionally, the coating pretreatment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The phosphate segment is projected to hold 36.2% of the coating pretreatment market revenue share in 2025, making it the leading product type. This leadership is supported by the phosphate pretreatment's proven ability to enhance corrosion resistance, improve paint adhesion, and create a uniform base for subsequent coating layers. It is widely adopted across various industries for its compatibility with multiple metal substrates and its suitability for high-performance coating systems.

The process contributes to longer service life and reduced maintenance costs of coated components, particularly in environments where durability is critical. The segment is also benefiting from widespread industrial familiarity and process stability, making it a reliable choice for large-scale manufacturing operations.

Although alternative technologies are gaining traction, phosphate-based systems continue to be preferred in applications where performance requirements remain stringent Growing demand from sectors such as automotive, construction, and general metal finishing is expected to support the continued dominance of phosphate pretreatment methods in the market, particularly in regions with established manufacturing infrastructure and high-volume production requirements.

The automotive and transportation segment is expected to account for 52.8% of the coating pretreatment market revenue share in 2025, making it the dominant application area. This leading position is being driven by the critical need for surface protection, corrosion resistance, and coating durability in automotive bodies, components, and chassis systems. Coating pretreatment is essential in ensuring long-term performance and aesthetic quality of painted surfaces, particularly in vehicles exposed to harsh weather conditions, road salts, and mechanical stress.

Automotive manufacturers are adopting advanced pretreatment solutions to meet evolving quality standards and extend product lifespan while reducing warranty claims and maintenance costs. Increasing vehicle production volumes globally, combined with rising consumer expectations for durability and finish, are reinforcing the role of pretreatment processes in automotive finishing lines.

Moreover, pretreatment technologies are being integrated with environmentally compliant coating systems to align with global sustainability goals As demand for fuel-efficient and corrosion-resistant vehicles rises, the segment is expected to maintain its leading share and continue driving innovation in the coating pretreatment industry.

Coating pretreatment processes are essential steps in enhancing the adhesion of coatings to substrates, ensuring long-lasting finishes in industries like automotive, aerospace, and construction. The market is driven by the increasing demand for advanced corrosion protection, particularly in industries dealing with harsh environmental conditions. Challenges include fluctuating raw material costs, particularly for chemicals used in pretreatment solutions, and the complexity of compliance with stringent environmental regulations. Opportunities exist in the development of eco-friendly pretreatment solutions, with a focus on low-VOC and water-based formulations. Trends include the growing preference for automated, more efficient pretreatment processes and the rise of pretreatment solutions that enhance the sustainability of coatings. Suppliers that offer cost-effective, environmentally friendly, and high-performance pretreatment solutions are positioned for growth.

The coating pretreatment market is experiencing growth driven by the increasing demand for coatings that offer enhanced durability and corrosion resistance. Industries such as automotive, aerospace, and construction require high-performance coatings that can withstand harsh conditions, including extreme temperatures, humidity, and exposure to chemicals. Coating pretreatment plays a crucial role in improving the adhesion of coatings to metal and other substrates, ensuring that the protective layers provide long-lasting protection. The rise in infrastructure development and the expanding automotive sector, particularly in regions with high humidity or corrosive environments, is driving the need for advanced pretreatment solutions. As industries continue to focus on improving the longevity and reliability of their products, the demand for high-quality pretreatment processes is expected to rise.

The coating pretreatment market faces several challenges, particularly in terms of raw material costs, such as those for chemicals used in pretreatment solutions. Variability in raw material prices can affect production costs and impact the final cost of pretreatment products. Furthermore, regulatory constraints, especially in the context of environmental concerns, are pushing for the development of more sustainable and eco-friendly pretreatment solutions. Governments worldwide are implementing stricter regulations regarding VOC (volatile organic compound) emissions, which require pretreatment manufacturers to adapt their products to meet these standards. Additionally, the complexity of ensuring compatibility between pretreatment chemicals and various substrates can limit the adoption of certain pretreatment solutions. Manufacturers must focus on meeting regulatory requirements while maintaining product performance and cost-effectiveness.

Opportunities in the coating pretreatment market are growing with the increasing demand for eco-friendly and automated pretreatment solutions. There is a significant shift toward low-VOC and water-based pretreatment formulations as industries seek to reduce their environmental impact. Eco-friendly pretreatment solutions are becoming a key focus for manufacturers in response to both consumer demand for sustainable products and tightening environmental regulations. Additionally, the trend toward automation in pretreatment processes is driving market growth. Automated systems offer better control, consistency, and efficiency, leading to improved coating quality and reduced operational costs. As industries strive to improve the efficiency and sustainability of their production processes, pretreatment solutions that offer enhanced performance, reduced environmental impact, and automation will continue to gain traction.

The coating pretreatment market is trending toward the integration of smart technologies and advanced coatings that enhance the overall performance of substrates. Manufacturers are increasingly using sensors and real-time monitoring to optimize pretreatment processes, ensuring more precise control and reducing waste. Furthermore, there is growing interest in the development of advanced pretreatment solutions that not only enhance corrosion resistance but also improve the aesthetics and functionality of coatings. For example, innovations in nano-coatings and surface treatments that enhance adhesion and reduce wear and tear are gaining traction. These advanced technologies are expected to become more common in industries such as aerospace, automotive, and electronics, where high-performance coatings are crucial. As smart and sustainable solutions gain momentum, pretreatment solutions will play a more critical role in the overall efficiency and performance of coated products.

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

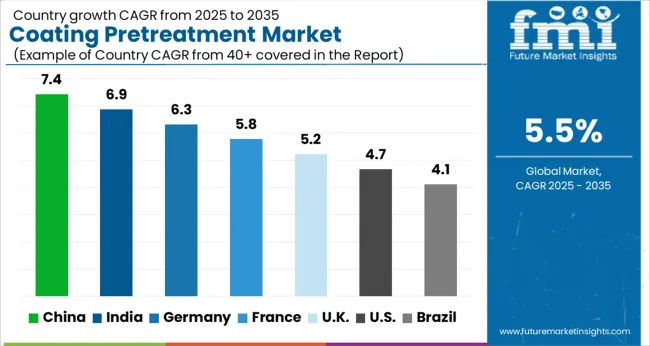

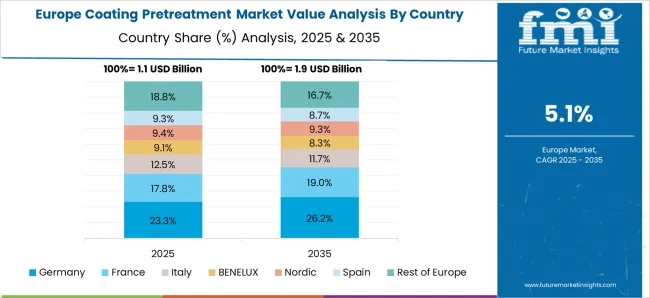

The global coating pretreatment market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with a CAGR of 7.4%, followed by India at 6.9% and Germany at 6.3%. The UK and USA show growth rates of 5.2% and 4.7%, respectively. The market is primarily driven by the increasing demand for durable and high-performance coatings across sectors like automotive, aerospace, and construction. Technological advancements, government regulations, and the rising trend of eco-friendly coating solutions further contribute to the growth of the coating pretreatment market. The analysis covers over 40 countries, with the leading markets shown below.

The coating pretreatment market in China is projected to grow at a CAGR of 7.4% from 2025 to 2035. The growth is primarily driven by the expanding manufacturing and automotive industries, as well as the rapid urbanization and industrialization occurring in the country. Coating pretreatment processes are crucial for enhancing the adhesion, durability, and corrosion resistance of coatings in various industries, including automotive, aerospace, and construction. China’s booming automotive sector, which is increasingly adopting coating technologies to improve vehicle lifespan and performance, is a significant contributor to the demand for coating pretreatment services. The country’s investments in infrastructure development, including transportation and construction projects, are boosting the need for coating services for various materials. The rise of electric vehicles (EVs) and other sustainable technologies in China is also prompting the need for high-quality and advanced coating pretreatment solutions.

The coating pretreatment market in India is expected to grow at a CAGR of 6.9% from 2025 to 2035. The increasing demand for coatings in automotive, construction, and industrial applications is driving the growth of the market. As India focuses on infrastructure development, including residential and commercial buildings, as well as transportation, the need for durable and corrosion-resistant coatings is growing. The automotive industry, particularly in the production of two-wheelers and small passenger vehicles, is also contributing to the increased adoption of coating pretreatment processes. India’s expanding manufacturing base, along with the rise in consumer demand for improved product quality, is further driving market growth. the country’s emphasis on eco-friendly solutions in industrial processes is fueling the demand for green pretreatment technologies.

The coating pretreatment market in Germany is projected to expand at a CAGR of 6.3% from 2025 to 2035. As a leader in the automotive and manufacturing industries, Germany’s demand for coating pretreatment processes is driven by the need for high-performance coatings for various applications. The country’s strong automotive sector, particularly the demand for high-end vehicles and electric vehicles (EVs), is a key driver for advanced coating solutions. Germany’s focus on technological innovation and sustainability in industrial processes is pushing the demand for eco-friendly and energy-efficient coating pretreatment solutions. The market is also benefiting from the growing investments in infrastructure, including rail and road construction, where durable and corrosion-resistant coatings are required. With Germany’s emphasis on improving product quality and extending the lifespan of industrial materials, the demand for coating pretreatment is expected to rise.

The UK’s coating pretreatment market is expected to grow at a CAGR of 5.2% from 2025 to 2035. The market growth is supported by the UK’s increasing demand for high-quality coatings in sectors such as automotive, construction, and aerospace. The country’s automotive industry, driven by both traditional and electric vehicles, is a key consumer of coating pretreatment services. The expanding construction sector, including both commercial and residential projects, is generating demand for corrosion-resistant coatings. The UK’s focus on innovation and eco-friendly technologies is leading to a rise in the adoption of sustainable and energy-efficient coating pretreatment processes. The growing trend of digitalization and automation in manufacturing processes is pushing the demand for advanced coating technologies. The rise in demand for premium coatings in industries like aerospace and electronics is also contributing to the market growth.

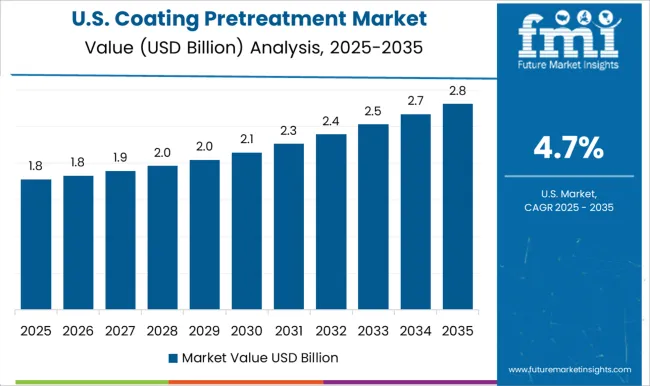

The USA coating pretreatment market is forecasted to grow at a CAGR of 4.7% from 2025 to 2035. The demand for coating pretreatment solutions in the USA is driven by the need for high-performance coatings in various sectors, including automotive, aerospace, and industrial manufacturing. The USA automotive industry, with a significant focus on electric vehicles (EVs), is a major driver for the adoption of advanced coating pretreatment technologies. The construction industry, with increasing demand for durable and corrosion-resistant coatings for infrastructure projects, is also contributing to the market’s growth. Furthermore, the USA is seeing a rise in the adoption of eco-friendly and energy-efficient coating processes, driven by both government regulations and industry standards. The market is also benefiting from technological advancements in coating materials and pretreatment processes, such as the use of nanotechnology and automation in coating applications.

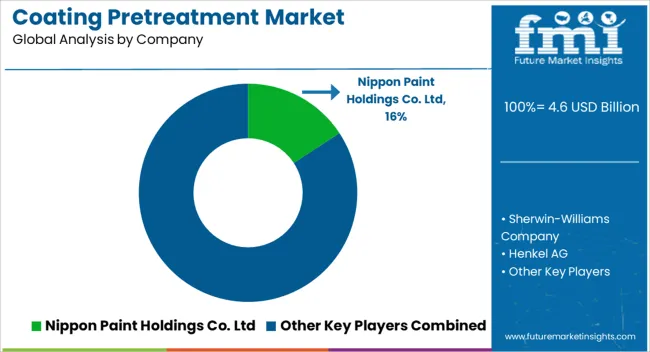

The coating pretreatment market is shaped by competition among major global players who focus on offering high-performance, durable, and environmentally-friendly pretreatment solutions for coatings in various industries, including automotive, construction, and manufacturing. Nippon Paint Holdings Co. Ltd. is a leading player, offering innovative pretreatment products that enhance the adhesion, durability, and corrosion resistance of coatings. The company’s focus on sustainable solutions and environmentally friendly pretreatment methods has strengthened its position in the market. Sherwin-Williams Company competes with a broad portfolio of coating pretreatment solutions designed for automotive, industrial, and architectural applications, emphasizing quality and performance consistency.

Henkel AG is another dominant competitor, providing cutting-edge pretreatment solutions for automotive and industrial coatings. Henkel’s offerings are widely recognized for their ability to optimize adhesion while reducing environmental impact through water-based and eco-friendly formulations. Troy Chemical Industries stands out by offering specialized, high-performance pretreatment chemicals for the automotive and metal industries. The company focuses on corrosion prevention and improving coating performance across a wide range of substrates. 3M Company competes by providing innovative coating pretreatment products that improve adhesion, corrosion resistance, and longevity. Their solutions are designed to meet the rigorous demands of industries such as automotive, aerospace, and electronics.

PPG Industries, Inc. offers an extensive range of coating pretreatment solutions, with a strong focus on enhancing coating adhesion and corrosion resistance, catering to both the industrial and commercial sectors. NIPSEA International Limited (Wuthelam Holdings Ltd.) is a major player in the Asia Pacific region, offering high-quality pretreatment products designed to meet the specific needs of local markets. Axalta Coating Systems and AkzoNobel N.V. bring strong competition with their advanced pretreatment technologies, especially in automotive and industrial applications. Axalta is known for its environmentally-conscious solutions, while AkzoNobel focuses on improving product performance and surface protection through a variety of pretreatment chemicals.

Competitive strategies in this market emphasize improving product durability, enhancing environmental performance, and offering customized solutions for a range of industries. Product brochures from these companies highlight key features such as corrosion resistance, adhesion improvement, water-based formulations, and eco-friendly properties. As demand for high-quality coatings increases across sectors, these companies aim to provide comprehensive pretreatment solutions that ensure long-lasting and reliable coatings.

| Items | Values |

|---|---|

| Quantitative Units | USD 4.6 billion |

| Type | Phosphate, Chromate, Chromate Free, and Blast Clean |

| Application | Automotive & Transportation, Construction, and Appliance |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nippon Paint Holdings Co. Ltd, Sherwin-Williams Company, Henkel AG, Troy Chemical Industries, 3M Company, PPG Industries, Inc., NIPSEA International Limited (Wuthelam Holdings Ltd.), Kansai Paint, Axalta Coating Systems, and AkzoNobel N.V. |

| Additional Attributes | Dollar sales by product type (phosphating, chromating, electrocoating, others), application (automotive, industrial, architecture, consumer goods), and chemical composition (solvent-based, water-based). Demand dynamics are driven by the growing need for enhanced surface protection, sustainability regulations, and increased demand for durable coatings in sectors like automotive, construction, and electronics. Regional trends indicate growth in Asia-Pacific, North America, and Europe, with rising investments in advanced coating technologies and eco-friendly pretreatment processes driving market expansion. |

The global coating pretreatment market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the coating pretreatment market is projected to reach USD 7.8 billion by 2035.

The coating pretreatment market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in coating pretreatment market are phosphate, chromate, chromate free and blast clean.

In terms of application, automotive & transportation segment to command 52.8% share in the coating pretreatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Coating Auxiliaries Market Size and Share Forecast Outlook 2025 to 2035

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

Coating Additives Market Growth – Trends & Forecast 2025 to 2035

Coating Thickness Gauge Market

Coating Thickness Measurement Instruments Market

AR Coating Liquid Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Nano Coating Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Coating Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA