The rubber coating market is estimated to be valued at USD 8.2 billion in 2025 and is projected to reach USD 15.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

Contribution analysis by technology highlights that multiple coating technologies are driving this growth, each playing a differentiated role in the value chain. Conventional solvent-based coatings continue to hold a significant portion of the market due to their proven performance, ease of application, and compatibility with diverse substrates. However, their contribution is gradually stabilizing as environmental regulations and rising awareness regarding volatile organic compounds push end-users toward alternative solutions.

Water-based rubber coatings are projected to contribute increasingly to overall market expansion. Their adoption is fueled by regulatory compliance, lower environmental impact, and improved formulation properties, enabling use across construction, automotive, and industrial applications. Performance enhancements such as improved adhesion, flexibility, and durability further strengthen their market share, particularly in applications demanding extended service life and resistance to environmental stressors.

The emerging technologies such as powder coatings and UV-curable rubber coatings are gaining traction, albeit from a smaller base, due to niche applications requiring rapid curing and energy efficiency. The contribution by technology demonstrates a gradual shift from traditional solvent-based systems toward environmentally compliant, high-performance water-based and advanced coating technologies.

This trend underlines the interplay between regulatory pressures, technological innovation, and application-specific performance requirements, which collectively define the growth dynamics of the Rubber Coating Market over the forecast period.

The rubber coating market represents a specialized segment within the protective coatings and specialty materials industry, emphasizing durability, chemical resistance, and surface protection. Within the broader coatings market, it accounts for about 5.9%, driven by adoption across automotive, construction, and industrial applications. In the industrial equipment and machinery segment, it holds nearly 6.4%, reflecting demand for abrasion-resistant and waterproof coatings.

Across the automotive components and aftermarket coatings market, the segment captures 4.7%, supporting corrosion protection and aesthetic enhancement. Within the consumer goods and electronics coatings category, it represents 3.3%, highlighting insulation and protective applications. In the construction and infrastructure materials sector, it secures 3.9%, emphasizing use in pipelines, roofing, and protective surfaces. Recent developments in this market have focused on formulation advancement, eco-friendly solutions, and performance optimization.

Innovations include polyurethane, silicone, and fluoropolymer blended rubber coatings for enhanced chemical and weather resistance. Key players are collaborating with industrial and automotive manufacturers to deliver high-performance and long-lasting coatings. Application techniques such as spray, dip, and brush-on methods have been optimized for uniform coverage and adhesion.

The low-VOC and solvent-free formulations are gaining traction in response to environmental regulations. Research into self-healing, anti-corrosive, and flexible coatings is increasing for diverse substrate compatibility. These advancements demonstrate how durability, regulatory compliance, and innovation are shaping the rubber coating market.

| Metric | Value |

|---|---|

| Rubber Coating Market Estimated Value in (2025 E) | USD 8.2 billion |

| Rubber Coating Market Forecast Value in (2035 F) | USD 15.2 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The rubber coating market is witnessing sustained growth, driven by rising demand for protective and performance-enhancing surface solutions across multiple industrial applications. Increasing awareness regarding durability, weather resistance, and chemical protection is influencing procurement decisions, particularly in sectors where equipment longevity and safety standards are paramount. The current market landscape is characterized by advances in formulation technology, enabling higher adhesion, flexibility, and environmental compliance.

Price dynamics are being influenced by fluctuations in raw material costs, especially synthetic polymers and additives, prompting manufacturers to optimize sourcing and production efficiency. Regulatory frameworks promoting eco-friendly and low-VOC products are accelerating the adoption of sustainable formulations, thereby reshaping competitive positioning.

Emerging economies are contributing significantly to volume growth due to rapid industrialization and infrastructure expansion, while mature markets are driving value growth through premium, high-performance product demand Over the forecast period, a combination of product innovation, tailored application solutions, and expanded distribution networks is expected to enhance market penetration and maintain steady revenue momentum.

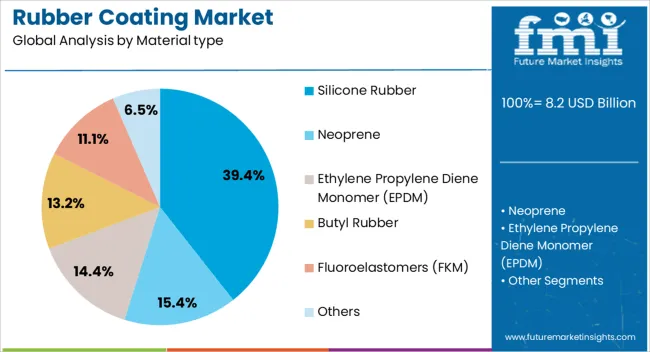

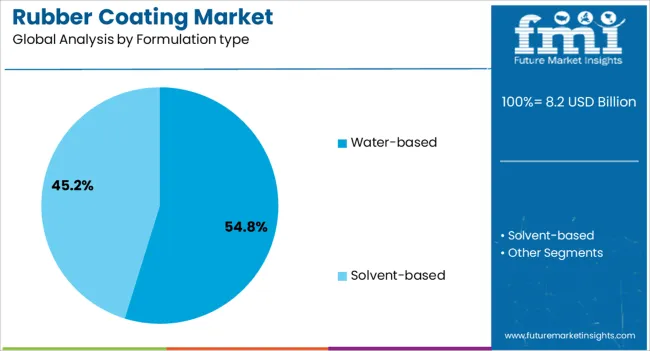

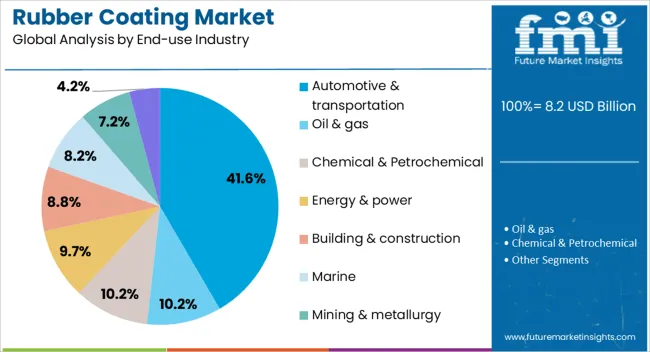

The rubber coating market is segmented by material type, formulation type, end-use industry, and geographic regions. By material type, rubber coating market is divided into silicone rubber, neoprene, ethylene propylene diene monomer (EPDM), butyl rubber, fluoroelastomers (FKM), and others. In terms of formulation type, rubber coating market is classified into water-based and solvent-based. Based on end-use industry, rubber coating market is segmented into automotive & transportation, oil & gas, chemical & petrochemical, energy & power, building & construction, marine, mining & metallurgy, and others. Regionally, the rubber coating industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The silicone rubber segment, commanding 39.40% of the material type category, has maintained its leadership position due to superior thermal stability, elasticity, and resistance to weathering. Its use in critical industrial and outdoor applications has been supported by the material’s ability to retain performance across extreme temperature ranges.

This segment benefits from sustained demand in high-specification environments where operational reliability is essential, particularly in sectors such as automotive, aerospace, and industrial machinery. Manufacturing efficiencies have been enhanced through advancements in curing and molding techniques, resulting in consistent product quality and reduced waste.

Pricing resilience has been observed despite raw material volatility, supported by value-driven procurement from sectors prioritizing long-term performance over short-term cost savings Market expansion is further supported by the development of specialized grades tailored to niche applications, ensuring the silicone rubber segment’s strong positioning within the broader rubber coating industry.

The water-based formulation segment, representing 54.80% of the formulation type category, has emerged as the dominant choice due to growing environmental regulations and the industry’s shift toward sustainable, low-VOC solutions. This formulation type is favored for its ease of application, reduced toxicity, and compliance with stringent emission norms, making it well-suited for both industrial and consumer use.

Cost efficiencies in storage, transportation, and cleanup have further strengthened its appeal among end-users seeking operational convenience without compromising performance. Technological advancements have improved water-based coating adhesion, flexibility, and resistance characteristics, enabling its adoption in applications that were historically reliant on solvent-based alternatives.

The segment’s market share is being reinforced by consistent demand from industries aligning their procurement strategies with environmental certifications and corporate sustainability goals, ensuring its continued dominance in the coming years.

The automotive and transportation segment, accounting for 41.60% of the end-use industry category, leads the market due to the sector’s high reliance on protective coatings that enhance vehicle durability, aesthetics, and resistance to environmental stressors. Rubber coatings in this segment are applied extensively for corrosion prevention, sealing, and vibration damping, aligning with stringent industry standards for safety and performance.

The segment’s strong share is supported by the ongoing growth of automotive production and the expansion of aftermarket maintenance services in both developed and emerging economies. Adoption has been further boosted by the integration of advanced coating technologies into lightweight vehicle designs, enabling manufacturers to meet fuel efficiency and emission targets.

Strategic collaborations between coating suppliers and OEMs have facilitated the development of tailored solutions, strengthening long-term demand prospects and ensuring the automotive and transportation segment retains its leadership position in the rubber coating market.

The market has witnessed strong growth as industries increasingly seek protective, durable, and corrosion-resistant coatings for diverse applications. Rubber coatings are widely used in construction, automotive, electrical, and marine sectors due to their flexibility, chemical resistance, waterproofing properties, and ability to enhance surface durability. Technological advancements in formulation, such as solvent-free, eco-friendly, and UV-resistant coatings, have improved performance while reducing environmental impact. Rising demand for protective coatings in industrial infrastructure, pipelines, machinery, and consumer products has reinforced adoption.

The construction and industrial sectors have emerged as significant drivers for rubber coating adoption. Rubber coatings provide protective layers on pipelines, tanks, machinery, and structural surfaces, offering resistance against corrosion, moisture, and chemical exposure. Industrial plants, oil and gas facilities, and manufacturing units increasingly rely on rubber coatings to extend equipment lifespan, reduce maintenance costs, and ensure operational safety. In infrastructure projects, rubber coatings are applied to bridges, roofs, and flooring to provide waterproofing, abrasion resistance, and structural protection. The combination of cost-effectiveness, durability, and multifunctionality has reinforced adoption in industrial and infrastructure applications globally.

Continuous innovation in rubber coating formulations has expanded functionality, performance, and environmental compliance. Water-based, solvent-free, UV-resistant, and anti-microbial coatings are increasingly adopted for enhanced durability and sustainability. Advancements in nano-additives and hybrid materials have improved adhesion, chemical resistance, and surface smoothness. Application techniques such as spray, brush, and dipping have been refined for industrial and consumer use. Rubber coatings now offer thermal insulation, noise reduction, and anti-slip properties, increasing versatility across applications. These technological enhancements have elevated product performance, facilitated adoption in challenging environments, and allowed manufacturers to address diverse industrial and consumer needs.

The automotive and consumer goods sectors have significantly contributed to rubber coating demand. In vehicles, rubber coatings are applied to underbody parts, engine components, door trims, and exterior panels to prevent corrosion, reduce vibration, and enhance aesthetics. Consumer products, including appliances, sporting goods, and electronic devices, utilize rubber coatings for enhanced grip, impact resistance, and protection against wear and moisture. Growing vehicle production, emphasis on longevity and durability, and increasing consumer preference for premium finishes have reinforced market growth. Manufacturers are also developing customized coatings for specific automotive and consumer applications, creating opportunities for product differentiation.

Emerging markets in Asia-Pacific, Latin America, and the Middle East present strong growth potential due to expanding industrialization, construction activities, and automotive production. Rising awareness of sustainable coatings, eco-friendly formulations, and regulatory compliance drives adoption of water-based and low-VOC rubber coatings. Infrastructure modernization, industrial expansion, and urban development projects are creating long-term demand across residential, commercial, and industrial applications. Investment in localized production facilities, distribution networks, and research for advanced coatings further strengthens market presence. The combined effect of industrial growth, environmental consciousness, and technological innovation positions emerging regions as strategic areas for future rubber coating market expansion.

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

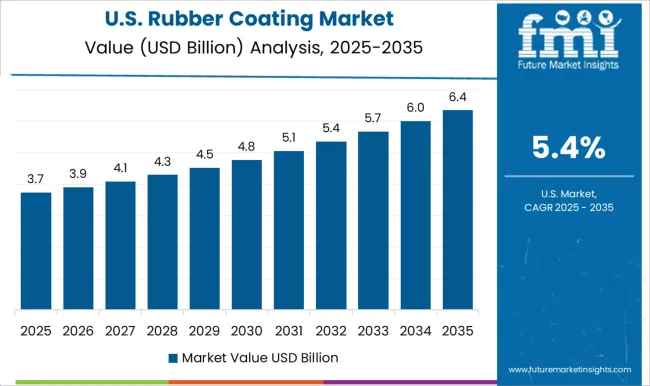

| USA | 5.4% |

| Brazil | 4.8% |

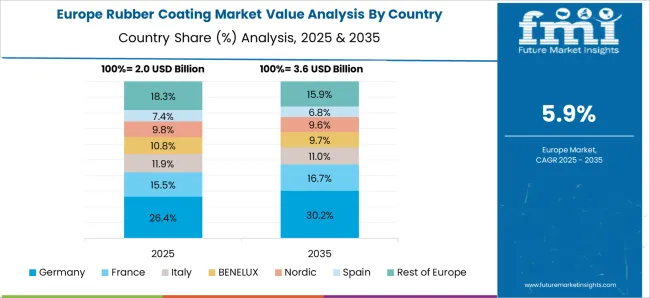

The market is projected to grow steadily, driven by increased industrial applications, corrosion protection needs, and technological advancements in coating materials. China leads with an 8.6% growth rate, fueled by extensive industrial expansion and adoption of advanced protective coatings. India follows at 8.0%, scaling through infrastructure development and rising demand across automotive and construction sectors. Germany grows at 7.4%, supported by innovations in high-performance and environmentally friendly coatings. The United Kingdom records 6.1%, innovating through R&D in specialized protective and insulating coatings.

The United States achieves 5.4%, where industrial modernization and maintenance needs sustain consistent market activity. These countries demonstrate a dynamic landscape of production, deployment, and technological advancement in rubber coatings. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s market is projected to grow at a CAGR of 8.6%, driven by increasing industrial applications, automotive manufacturing, and infrastructure development. The rising demand for corrosion-resistant coatings, anti-slip solutions, and protective layers across various sectors is fueling market growth. Manufacturers are focusing on enhancing product performance through innovative formulations, chemical additives, and sustainable solutions.

E-commerce platforms and industrial distributors are expanding access to a wide range of rubber coating products. Urban industrial expansion, coupled with stricter regulatory standards for equipment protection and surface durability, is supporting the market’s steady growth. Strategic partnerships with automotive and construction companies are helping increase product penetration and adoption in diverse applications across China.

India is anticipated to grow at a CAGR of 8.0%, supported by rapid industrialization, automotive sector expansion, and infrastructure projects. Consumers and industries are increasingly opting for coatings that enhance durability, chemical resistance, and surface protection. Manufacturers are investing in product innovation, including eco-friendly and high-performance coatings suitable for varied applications.

Availability through distributors, e-commerce platforms, and industrial supply chains is improving accessibility across urban and semi-urban regions. Marketing efforts highlighting longevity, surface protection, and safety benefits are shaping consumer preferences. Partnerships with automotive, construction, and manufacturing companies are helping increase market penetration, ensuring steady adoption in India.

Germany is expected to expand at a CAGR of 7.4%, driven by the demand for protective coatings in automotive, industrial machinery, and construction applications. Consumers prioritize high-performance coatings that offer resistance against wear, corrosion, and environmental factors. Manufacturers are focusing on advanced formulations, eco-friendly materials, and customized solutions to cater to industrial and commercial needs.

Strong presence of distributors, industrial suppliers, and online platforms ensures product availability across urban and industrial hubs. Strategic marketing campaigns emphasizing durability, chemical resistance, and product versatility further support adoption. Collaboration with engineering, automotive, and infrastructure sectors is accelerating market growth in Germany.

The UK market is projected to grow at a CAGR of 6.1%, supported by industrial modernization, automotive sector requirements, and infrastructure development. There is a rising preference for coatings that provide enhanced surface protection, corrosion resistance, and long-term durability. Availability through industrial suppliers, distributors, and online platforms is improving market reach.

Marketing strategies emphasizing product performance, sustainability, and safety features are influencing consumer decisions. Collaboration with automotive, manufacturing, and construction companies is enabling broader adoption and reinforcing market presence. Increasing regulatory focus on quality standards and product compliance is further shaping the market trajectory in the United Kingdom.

The United States market is expected to expand at a CAGR of 5.4%, driven by industrial demand, automotive sector growth, and the need for protective coatings in construction. Consumers are seeking high-quality, durable coatings that provide anti-corrosion, anti-slip, and surface protection benefits. Manufacturers are investing in advanced formulations, environmentally friendly products, and customized solutions to meet diverse industrial needs.

Marketing campaigns highlighting longevity, performance, and safety are shaping purchase decisions. Collaboration with key automotive, manufacturing, and infrastructure companies is facilitating adoption. Continued focus on regulatory compliance and industrial standards is expected to reinforce market expansion in the US.

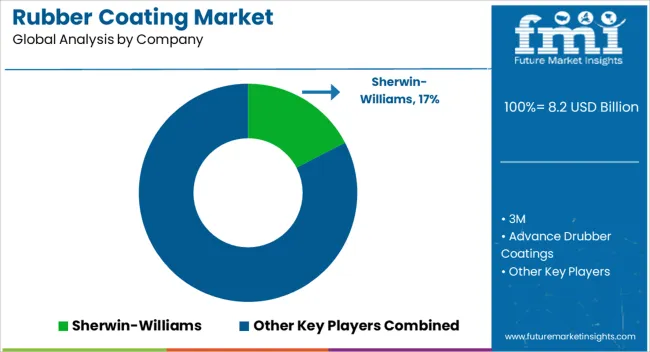

The market has expanded significantly in response to the growing need for protective and performance-enhancing coatings across multiple industries including automotive, construction, manufacturing, and industrial equipment. Sherwin-Williams and 3M lead the market by providing innovative rubberized coatings that offer exceptional resistance against corrosion, abrasion, chemicals, and extreme environmental conditions.

AkzoNobel and BASF contribute with high-performance solutions developed through global R&D networks, addressing applications that require flexibility, durability, and compliance with evolving environmental regulations. Advance Drubber Coatings and APOC focus on specialized industrial coatings, delivering tailored products that meet stringent performance and safety standards in sectors such as heavy machinery and transportation.

Contitech and Kimball Midwest serve the industrial and mechanical segments by offering coatings that enhance the operational lifespan of components, reduce maintenance cycles, and improve surface resilience. Liquid Rubber and Luxa Pool have positioned themselves in niche markets like waterproofing, flooring, and recreational surfaces, emphasizing user-friendly and environmentally safe products.

The market is driven by continuous innovation in coating formulations, rising adoption of protective layers to improve efficiency and durability, and a growing emphasis on sustainability and eco-friendly materials. These combined efforts create a highly diversified market landscape where both global leaders and specialized players actively contribute to expanding applications and technological advancements.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.2 billion |

| Material type | Silicone Rubber, Neoprene, Ethylene Propylene Diene Monomer (EPDM), Butyl Rubber, Fluoroelastomers (FKM), and Others |

| Formulation type | Water-based and Solvent-based |

| End-use Industry | Automotive & transportation, Oil & gas, Chemical & Petrochemical, Energy & power, Building & construction, Marine, Mining & metallurgy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sherwin-Williams, 3M, Advance Drubber Coatings, AkzoNobel, APOC, BASF, Contitech, Kimball Midwest, Liquid Rubber, and Luxa Pool |

| Additional Attributes | Dollar sales by coating type and application, demand dynamics across automotive, industrial, and construction sectors, regional trends in protective coating adoption, innovation in durability, flexibility, and corrosion resistance, environmental impact of chemical use and disposal, and emerging use cases in anti-slip surfaces, insulation, and specialty protective applications. |

The global rubber coating market is estimated to be valued at USD 8.2 billion in 2025.

The market size for the rubber coating market is projected to reach USD 15.2 billion by 2035.

The rubber coating market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in rubber coating market are silicone rubber, neoprene, ethylene propylene diene monomer (epdm), butyl rubber, fluoroelastomers (fkm) and others.

In terms of formulation type, water-based segment to command 54.8% share in the rubber coating market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Silicone Rubber Insulation Coating Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Rubber Linings Market 2022 to 2032

Rubber Molding Market Forecast Outlook 2025 to 2035

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Anti-Tack Agents Market Size and Share Forecast Outlook 2025 to 2035

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rubber-to-Metal Adhesion Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Rubber choppers Market

Gas Scrubber Market Size and Share Forecast Outlook 2025 to 2035

Air Scrubbers Market

Sleeve Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Sterile Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA