The sleeve rubber stopper market is experiencing steady growth, supported by the expansion of the pharmaceutical industry and the rising demand for contamination-free drug packaging. Industry publications and company reports have highlighted the increasing importance of container closure integrity, especially in sterile injectable formulations.

Sleeve rubber stoppers play a crucial role in preserving drug stability, preventing microbial ingress, and maintaining proper seal integrity under varying temperature and pressure conditions. Butyl-based formulations, known for their chemical resistance and low permeability, have gained widespread acceptance in pharmaceutical packaging systems.

Regulatory authorities have reinforced the use of high-performance closures to ensure drug safety and extend product shelf life, further influencing purchasing decisions among drug manufacturers. As biologics and sensitive drug formulations gain prominence, the requirement for compatible and inert sealing materials has grown significantly. Looking ahead, the market is expected to expand with rising global pharmaceutical production, stricter regulatory guidelines, and increasing focus on customized container-closure systems. Key growth will be led by butyl rubber materials, mid-sized diameters, and applications in large-scale drug manufacturing operations.

| Metric | Value |

|---|---|

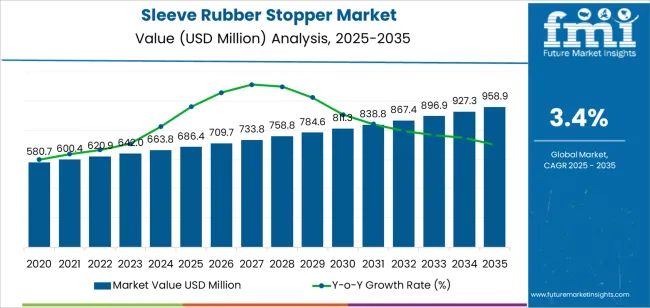

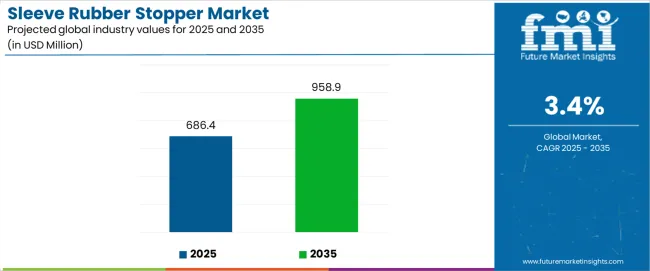

| Sleeve Rubber Stopper Market Estimated Value in (2025 E) | USD 686.4 million |

| Sleeve Rubber Stopper Market Forecast Value in (2035 F) | USD 958.9 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

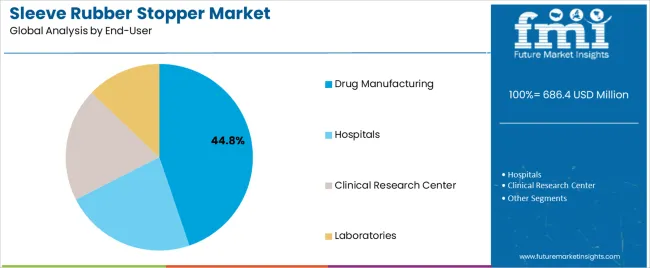

The market is segmented by Material, Diameter, and End-User and region. By Material, the market is divided into Butyl Rubber and Natural Rubber. In terms of Diameter, the market is classified into 15-25 mm, Less than 15 mm, and Above 25 mm. Based on End-User, the market is segmented into Drug Manufacturing, Hospitals, Clinical Research Center, and Laboratories. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

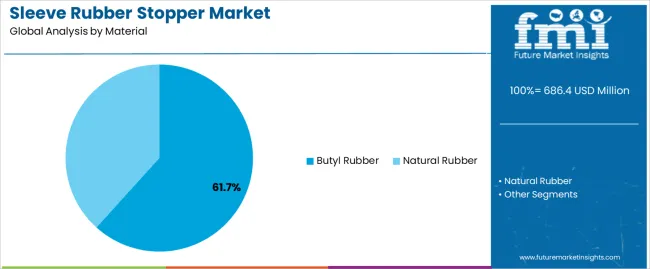

The Butyl Rubber segment is projected to contribute 61.7% of the sleeve rubber stopper market revenue in 2025, sustaining its leadership due to superior performance characteristics demanded in pharmaceutical packaging. Butyl rubber has been widely adopted for its excellent gas impermeability, resistance to chemical leaching, and high compatibility with injectable drug formulations.

Its ability to maintain seal integrity under sterilization and storage conditions has positioned it as the preferred choice for critical pharmaceutical applications. Reports from pharmaceutical packaging experts have emphasized butyl rubber’s low moisture vapor transmission rate and its role in minimizing drug degradation.

Additionally, its formulation flexibility allows manufacturers to customize stoppers for specific vial types and filling processes. As global regulatory bodies increasingly emphasize safety, product stability, and quality assurance in drug packaging, the adoption of butyl rubber stoppers is expected to remain strong across vial closure systems used in biologics, vaccines, and sterile injectables.

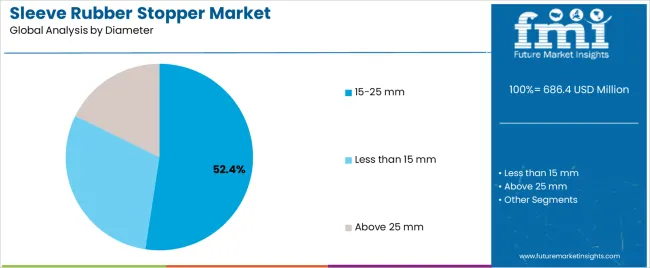

The 15-25 mm segment is projected to account for 52.4% of the sleeve rubber stopper market revenue in 2025, maintaining its dominance due to widespread usage in standard pharmaceutical vials. This diameter range has been favored by pharmaceutical manufacturers for its compatibility with commonly used vial formats in both lyophilized and liquid drug packaging.

Industry standards and manufacturing equipment have been optimized around this range, facilitating streamlined filling and sealing operations. Additionally, this segment supports a balance between material efficiency and secure container closure performance, aligning with productivity and cost optimization goals in high-throughput manufacturing environments.

Packaging specialists have reported that stoppers in this size category offer enhanced dimensional stability and are easier to integrate into automated production lines. With the majority of generic and branded injectable drugs continuing to use this vial size standard, the 15–25 mm diameter segment is expected to retain its dominant share in the market.

The Drug Manufacturing segment is projected to contribute 44.8% of the sleeve rubber stopper market revenue in 2025, reflecting its primary role in large-scale pharmaceutical packaging operations. This segment has grown due to the rising global production of sterile injectable drugs, driven by increasing demand for vaccines, biologics, and specialty pharmaceuticals.

Pharmaceutical manufacturers have prioritized stopper reliability and compatibility with high-speed filling lines, making sleeve rubber stoppers a critical component in the production pipeline. Industry reports and manufacturing audits have highlighted the need for closures that can withstand sterilization methods such as autoclaving and gamma irradiation without compromising integrity.

Moreover, regulatory compliance and risk mitigation strategies have encouraged drug producers to source stoppers with validated performance data and traceable material origins. With increasing investments in new drug manufacturing facilities, particularly in emerging markets and contract manufacturing hubs, demand for high-performance sleeve rubber stoppers is projected to remain strong within this end-user segment.

The table beneath shows the predicted CAGR for the global sleeve rubber stopper market across multiple semi-annual periods from 2025 to 2035. The business is foreseen to develop at a marginal rate of 3.1% in the second half (H2) of the same decade after plunging at a CAGR of 3.2% in the first half (H1) of the decade from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 3.2% (2025 to 2035) |

| H2 | 3.7% (2025 to 2035) |

| H1 | 3.5% (2025 to 2035) |

| H2 | 3.1% (2025 to 2035) |

Moving forward, from H1 2025 to H2 2035, the CAGR is anticipated to fall slightly to 3.2% in the first half and stay relatively stable at 3.1% in the second half. The market value retained by 50 BPS in the first half, but remained constant at 40 BPS in the second half.

Pre-filled Syringes to Shape the Future of Sleeve Rubber Stopper Industry

There has been an increasing adoption of pre-filled syringes and self-administered injectable devices in the medical sector. The demand for these advanced systems is touching the skies due to their convenience, accurate dosing, and reduced risk of contamination.

This, in turn, has driven the demand for precision-engineered sleeve rubber stoppers that can seamlessly integrate with these sophisticated drug delivery systems, ensuring safety and efficacy.

Sustainability Drive to Influence the Sleeve Rubber Stopper Market

There is an observed shift towards sustainable and eco-friendly packaging solutions in the medicare and pharmaceutical sector. Pharmaceutical companies are actively seeking biodegradable and non-toxic materials for their packaging needs.

This has led to innovations in the production of rubber stoppers made from sustainable materials, such as natural rubber blends or recyclable synthetic polymers. Healthcare facilities are thus turning towards manufacturers that can provide these environmentally friendly options.

Competition from Alternative Packaging Solutions to Slow Down Industry Growth

Advancements in the material science and the pharmaceutical sector have led to the development of a multitude of packaging solutions in the medicare industry.

Alternative packaging solutions made from plastic and glass offer similar or even superior performance characteristics. This has posed a challenge to the market share of rubber stoppers, particularly in applications where cost-effectiveness and ease of manufacturing are prioritized over specific material properties.

The sleeve rubber stopper market, in the last couple of decades, has seen fluctuations in its demand. The industry is reliant on the performances of the pharmaceutical and medicare industries.

The sleeve rubber stopper industry experienced sustained growth before the pandemic hit the world. The emergence of biologics and biopharmaceutical industries led to increasing demand. Also, advancements in drug delivery systems further drove the need for high-quality sleeve rubber stoppers.

The pandemic brought unprecedented transformation in these industries, which in turn, significantly boosted the demand for rubber stoppers. The urgent need for COVID-19 vaccines and treatments significantly raised the prominence of vial closures, including sleeve rubber stoppers. In this period, from 2020 to 2025, the industry reported a CAGR of 2.7%. Disruptions in supply chains and shifts in healthcare priorities temporarily affected market dynamics did affect the market in the initial phases.

During the aftereffects of the pandemic, as economies opened and healthcare facilities in emerging economies the sleeve rubber stopper market began to recover and grow. With people becoming more health conscious, the demand for advanced pharmaceuticals also increased. This helped the businesses involved in the manufacturing of sleeve rubber stoppers gain more consumers.

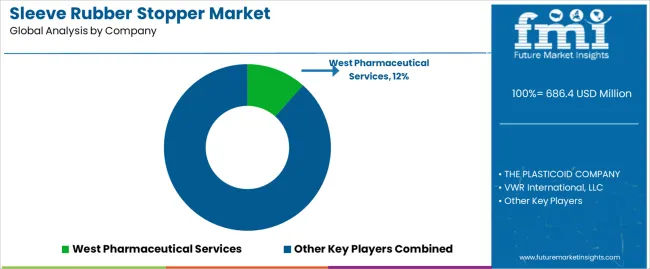

Tier one companies like West Pharmaceutical Services, Inc., Datwyler Holding Inc., and AptarGroup, Inc. are leading the sleeve rubber stopper sector by heavily investing in research and development and technological advancements. They are also focusing on developing high-performance, safe, and reliable stoppers that meet stringent regulatory standards.

These companies are also expanding their global manufacturing capacities and enhancing their supply chain resilience to ensure a steady supply of quality products amidst growing pharmaceutical demands.

VWR International, LLC, SGD Pharma, and DWK Life Sciences GmbH, some of the few examples of tier-two companies in the industry, are catering to the increasing demand by improving their production processes and incorporating sustainable practices.

They are adopting advanced materials and technologies to produce rubber stoppers that are not only effective but also eco-friendly. Additionally, these companies are enhancing their product portfolios to offer a wider range of solutions tailored to the specific needs of the pharmaceutical and healthcare sectors.

Tier-three companies including Hebei First Rubber Medical Technology Co., Ltd., Jiangsu Hualan New Pharmaceutical Material Co., Ltd., and RubberMill, Inc. are focusing on cost-effective production and niche markets. They are investing in modern manufacturing facilities and quality control measures to meet international standards.

The following segment delves into an industry analysis of the sleeve rubber stoppers market across various countries. It offers insights into market demand across key nations in several regions globally, encompassing North America, Asia Pacific, Europe, and other areas. India is projected to maintain its leading position within the Asian region, with an anticipated CAGR of 4.3% extending to 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Canada | 2.8% |

| The United States | 2.9% |

| Germany | 2.7% |

| India | 4.9% |

| Thailand | 4% |

| South Korea | 3.7% |

| China | 4.4% |

The sleeve rubber stopper industry in India is slated to show a 4.9% CAGR for the forecast period of 2025 to 2035.

In India, the growth of the sleeve rubber stopper market is expanding, primarily due to the rapid expansion of the pharmaceutical sector. The country is a major hub for generic drug production, which necessitates large quantities of reliable and high-quality packaging materials, including rubber stoppers. The government's initiatives to boost domestic manufacturing and exports have further spurred demand.

India's large population with increasing access to healthcare services means a higher consumption of medications, particularly injectables. The rise in chronic diseases and the growing emphasis on preventive care and vaccination programs also contribute significantly to the demand for sleeve rubber stoppers.

China also is a promising country in this industry. Over the next ten years, the sleeve rubber stopper industry is projected to rise at 4.4% CAGR.

China's sleeve rubber stopper market is experiencing robust growth due to its booming pharmaceutical industry, supported by strong government policies and investments in healthcare infrastructure. China has been witnessing a high demand for medical packaging solutions to support its vast production of both traditional and modern medicines.

The country's aging population and increasing prevalence of chronic diseases drive the need for injectable medications, thus increasing the demand for sleeve rubber stoppers.

China's focus on becoming a leader in biotechnology and biologics production further fuels the need for high-quality rubber stoppers that ensure the stability and integrity of sensitive pharmaceutical products.

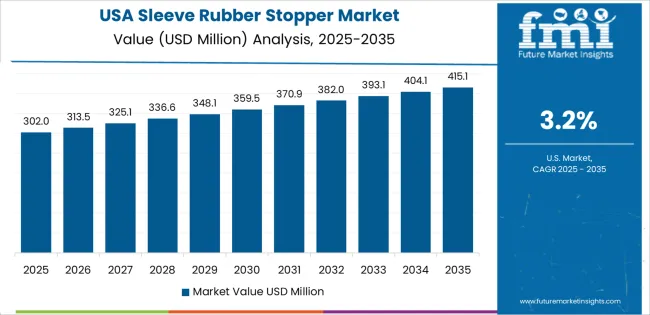

The United States is also one of the most profitable countries in the global sleeve rubber stopper industry. The country is anticipated to exhibit a CAGR of 2.9% through 2035.

The high incidence of chronic diseases and the aging population contribute to the ongoing need for injectable medications, driving demand for sleeve rubber stoppers. The United States also remains a key market for sleeve rubber stoppers due to its advanced pharmaceutical and biotechnology sectors.

The country's strong focus on innovation and development of new drug formulations, including biologics and biosimilars, requires reliable and compatible packaging solutions.

Stringent regulatory standards set by the FDA necessitate the use of high-quality, safe, and effective packaging materials. The healthcare system's emphasis on patient safety and drug efficacy ensures continued demand for precision-engineered rubber stoppers.

The sleeve rubber stopper industry is categorized on the basis of material, end-use, product, and region. The section discusses the top two categories in this industry.

Based on material, the sleeve rubber stopper industry is bifurcated into natural and butyl rubber. Among these, the butyl rubber segment accounts for a majority share of 54.3% in the global marketplace.

| Material | Butyl Rubber |

|---|---|

| Value Share (2025) | 54.3% |

Sleeve rubber stoppers made from butyl rubber are increasingly preferred by industries due to their superior properties compared to natural rubber. Butyl rubber offers excellent chemical resistance, which is crucial for maintaining the integrity of pharmaceutical products.

The demand for rubber stoppers made from butyl rubber is touching the skies as they provide an impermeable barrier to gases and moisture. This ensures the long-term stability of medications.

The reduced risk of allergic reactions associated with butyl rubber compared to natural latex enhances its appeal, particularly in medical applications where patient safety is paramount. Also, butyl rubber's consistent performance and reliability make it a preferred choice for industries that require high-quality packaging solutions.

Sleeve rubber stoppers are used in a wide spectrum of industries such as biotech, cosmetic, healthcare, and laboratory and research industry. The healthcare segment holds a market share of 28%, as of 2025.

| End-use | Healthcare |

|---|---|

| Value Share (2025) | 34.6% |

Sleeve rubber stoppers are highly sought after in the healthcare sector due to their critical role in ensuring the safety and efficacy of injectable medications. These stoppers provide a secure seal that prevents contamination and maintains the sterility of drugs, which is essential for patient safety. The precision-engineered design of sleeve rubber stoppers ensures a tight fit, reducing the risk of leaks or exposure to external elements.

The demand for sleeve rubber stoppers is also touching the skies as they are integral to pre-filled syringes, vials, and other packaging solutions that facilitate easy and accurate administration of medications. Governments in several countries are investing billions of dollars to medically include their citizens. This infrastructural development has also instigated a significant demand for rubber stoppers in the global healthcare sector.

The sleeve rubber stopper market is very competitive, with an enormous number of companies fighting for monopoly. These companies are investing in research and development to create innovative and long-lasting stoppers. These companies are also provide excellent customer service and support can significantly impact a company's reputation and customer loyalty.

Companies are also targeting mid-sized pharmaceutical firms and emerging markets where the demand for high-quality but reasonably priced packaging solutions is very prevalent.

Recent Developments

The sleeve rubber stoppers market is segmented by material into natural rubber and butyl rubber.

The product categories include solid stoppers, two-hole stoppers, three-hole stoppers, lyophilization stoppers, injection stoppers, septum stoppers, and rubber stoppers.

The end-use sectors encompass biotech, cosmetics, healthcare, and the laboratory and research industry.

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The global sleeve rubber stopper market is estimated to be valued at USD 686.4 million in 2025.

The market size for the sleeve rubber stopper market is projected to reach USD 958.9 million by 2035.

The sleeve rubber stopper market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in sleeve rubber stopper market are butyl rubber and natural rubber.

In terms of diameter, 15-25 mm segment to command 52.4% share in the sleeve rubber stopper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sleeve Wrapping Machine Market

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Can Sleeves Market Growth & Packaging Innovations

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Paper Sleeve Market Trends – Growth & Demand Forecast 2024-2034

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Shrink Sleeve Labels Providers

Industry Share Analysis for Shrink Sleeve Label Applicator Manufacturers

Shrink Sleeve Labels Market Analysis by Flexographic and Digital Printing Through 2034

Laptop Sleeve Market Trends & Industry Growth Forecast 2024-2034

Shrink Sleeve Labeling Equipment Market

Suture Sleeve Kit Market

Stretch Sleeve and Shrink Sleeve Labels Market Size and Share Forecast Outlook 2025 to 2035

Sliding Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Tapping Sleeves Market - Size, Share, and Forecast Outlook 2025 to 2035

Plastic Sleeve Market Analysis – Size, Demand & Forecast 2024-2034

Stretch Sleeve Label Market Insights – Growth & Demand 2024-2034

Tray and Sleeve Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Shrink - Sleeve Wrapping Machinery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA