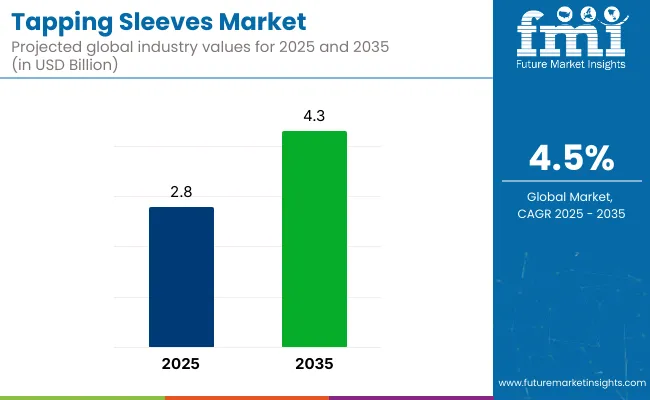

The global tapping sleeves market is valued at USD 2.8 billion in 2025 and is slated to reach USD 4.3 billion by 2035, which shows a CAGR of 4.5%.

| Metric | Value |

|---|---|

| Market Size 2025 | USD 2.8 billion |

| Market Size 2035 | USD 4.3 billion |

| CAGR 2025 to 2035 | 4.5% |

Growth is being driven by increasing investments in pipeline infrastructure, stringent leakage prevention mandates, and the adoption of smart monitoring solutions. Additionally, the rising replacement of aging pipelines in major economies, along with rapid urbanization and industrialization in emerging countries, is further supporting market expansion.

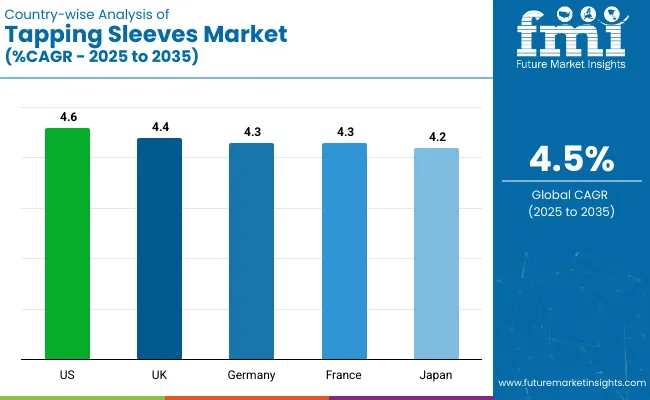

The USA holds the highest CAGR of 4.6% in the market, driven by its extensive infrastructure refurbishment initiatives and rapid technological adoption. The UK follows with a 4.4% CAGR, supported by investments in intelligent water management and leak prevention systems.

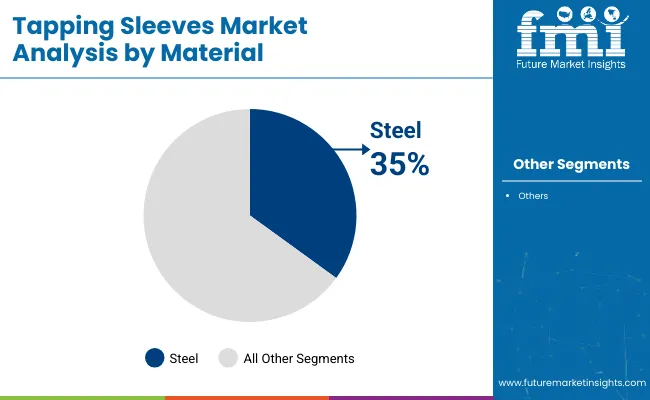

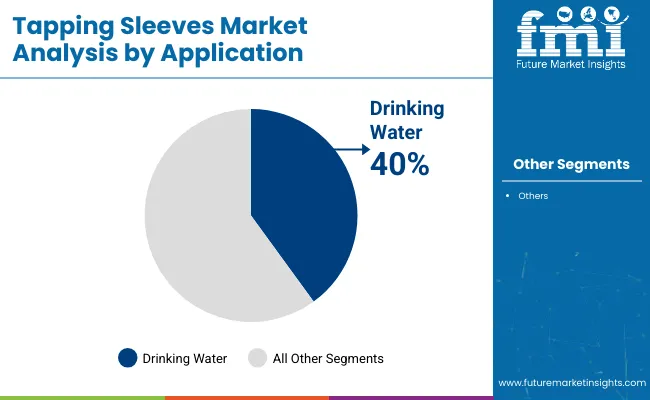

Germany is expected to record a 4.3% CAGR during the forecast period, due to the focus of the nation on sustainable water conservation and infrastructure. The steel segment continues to dominate the material category with a 35% share, while the drinking water segment maintains its leadership with a 40% share in 2025.

The tapping sleeves market holds a relatively small but essential share within its parent markets. In the global pipeline equipment market, tapping sleeves account for approximately 3-5% due to their niche application in branch connections and repairs. Within the industrial fittings market, they hold around 2-4%, as this market also includes valves, couplings, and flanges.

In the broader water infrastructure market, tapping sleeves contribute roughly 1-2% since the category spans treatment plants, pumps, and distribution systems. Similarly, tapping sleeves represent about 1-3% of the oil and gas infrastructure market and 2-4% of the utilities and distribution infrastructure market due to their specialised yet critical role.

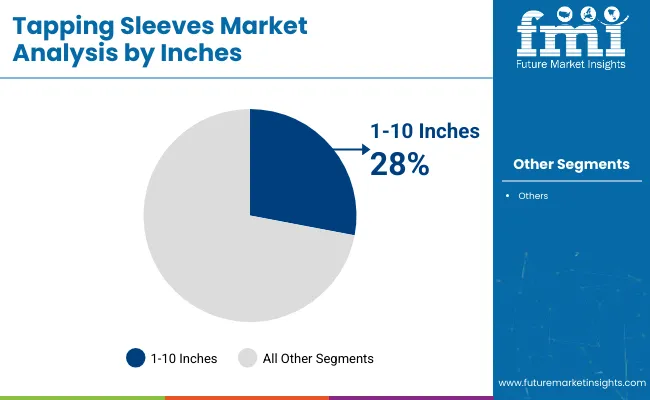

The tapping sleeves market is segmented by material, inches, fluid motion, application, and region. By material, the market is categorized into steel(including fabricated carbon and stainless), ductile iron, and cast iron. Based on inches, the market is segmented into 1-10, 11-20, 21-30, 31-40, and above 40.

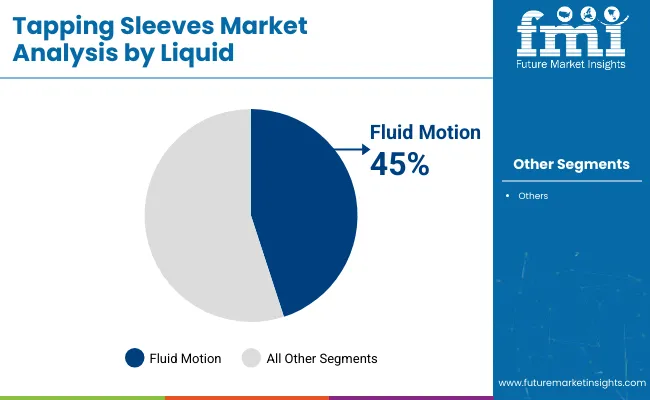

By fluid motion, the market is classified into liquid, gas, and oil. Based on application, the market is segmented into drinking water, waste water system, gas solution, and petroleum. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East and Africa (MEA), East Asia, and South Asia and Pacific.

Steel remains the most lucrative material segment in the tapping sleeves market, accounting for a 35% market share in 2025.

The 1-10 inch segment includes tapping sleeves used for pipelines within this diameter range, serving residential and light commercial applications. This segment holds a 28% market share in 2025, making it the largest within the industry.

The liquid segment dominates the tapping sleeves market, holding a 45% market share in 2025.

The drinking water segment leads the tapping sleeves market, accounting for a 40% market share in 2025.

The global tapping sleeves market is growing steadily, driven by increasing investments in pipeline infrastructure, rising demand for leak-proof and durable pipeline connections, and advancements in corrosion-resistant materials and smart monitoring technologies.

Recent Trends in the Tapping Sleeves Market

Challenges in the Tapping Sleeves Market

Between 2025 and 2035, the USA is expected to lead tapping sleeves market growth with a CAGR of 4.6%, driven by major infrastructure upgrades and smart water management investments. The UK follows with a 4.4% CAGR, supported by intelligent water management and carbon reduction initiatives.

Germany and France are projected to grow at 4.3% CAGR each, with Germany focusing on hydrogen infrastructure and France driven by EU water conservation regulations. Japan records the lowest among these at 4.2% CAGR, due to its focus on seismic-resistant pipelines and modernization efforts. Overall, all five countries show steady, infrastructure-driven growth trends.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA tapping sleeves revenue is projected to grow at a CAGR of 4.6% from 2025 to 2035. Growth is driven by massive infrastructure refurbishment initiatives and rising investments in smart water management systems.

The tapping sleeves revenue in the UK is projected to grow at a CAGR of 4.4% from 2025 to 2035. Growth is supported by rising investments in intelligent water management, leak prevention technologies, and regulatory focus on carbon emission reduction.

Germany’s tapping sleeve demand is projected to grow at a CAGR of 4.3% from 2025 to 2035.

France’s tapping sleeves revenues are projected to grow at a CAGR of 4.3% from 2025 to 2035. Growth is driven by tough EU water conservation regulations and investments in sustainable pipeline infrastructure.

Sales of tapping sleeves in Japan are projected to grow at a CAGR of 4.2% from 2025 to 2035. Growth is driven by efforts to modernize infrastructure, enhance disaster resistance, and upgrade aging water distribution systems.

The market is moderately consolidated, with dominant tier-one players such as Mueller Water Products, Smith-Blair, Inc., and The Ford Meter Box Company, Inc. These leading companies maintain their market position through continuous product innovation, strategic acquisitions, and expansion of smart-enabled tapping sleeve portfolios.

Mueller Water Products leads with its strong municipal water system offerings, while Smith-Blair focuses on corrosion-resistant and IoT-integrated solutions to cater to the rising demand for smart water infrastructure. Their strategies include investing in R&D for advanced materials, entering strategic partnerships with EPC companies and distributors to strengthen market reach, and launching products that comply with evolving regulatory standards for pipeline safety and water conservation.

Recent Tapping Sleeves Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.8 billion |

| Projected Market Size (2035) | USD 4.3 billion |

| CAGR (2025 to 2035) | 4.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in units |

| By Material | Steel (Fabricated Carbon, Stainless), Ductile Iron, and Cast Iron |

| By Inches | 1-10, 11-20, 21-30, 31-40, and Above 40 |

| By Fluid Motion | Liquid, Gas, and Oil |

| By Application | Drinking Water, Waste Water System, Gas Solution, and Petroleum |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | AMERICAN (American Cast Iron Pipe Company), Everett J. Prescott, Inc., JCM Industries Inc., Mueller Water Products (Market leader), Petersen Products Co., Power Seal Corporation, Robar Industries Ltd., Romac Industries, Inc., The Ford Meter Box Company, Inc., UTS Engineering, Seipasa , Smith-Blair, Inc., JM Eagle, McWane , Inc., Kupferle Foundry |

| Additional Attributes | Dollar sales by value, market share by country and region, competitive landscape |

Steel(Fabricated Carbon, Stainless), Ductile Iron, Cast Iron

1-10, 11-20, 21-30, 31-40, Above 40

Liquid, Gas, Oil

Drinking Water, Waste Water System, Gas Solution, Petroleum

North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltic Countries, East and Africa (MEA), East Asia, South Asia and Pacific

The market is valued at USD 2.8 billion in 2025.

The market is expected to reach USD 4.3 billion by 2035.

Steel holds the largest market share of 35% in the segment.

The global market is projected to grow at a CAGR of 4.5% over the forecast period.

The drinking water application segment holds a 40% market share in the market.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA