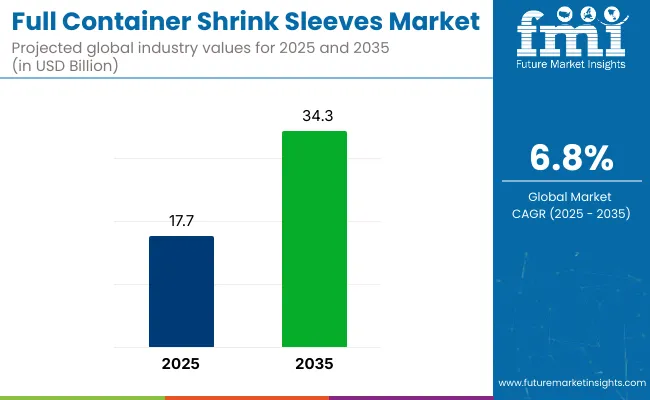

In 2025, the global full container shrink sleeves (FCSS) market is expected to reach USD 17.7 billion, growing to USD 34.3 billion by 2035 at a 6.8% CAGR. This growth is fueled by increasing demand for visually striking, tamper-evident labels with 360° coverage, especially in the food & beverage, pharmaceutical, cosmetic, and household chemical sectors.

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 17.7 billion |

| Industry Size (2035) | USD 34.3 billion |

| CAGR (2025 to 2035) | 6.8% |

FCSS labels offer superior shelf appeal and fit complex container shapes, enhancing brand value. Eco-friendly films like PET-G, PLA, and polyolefins are gaining traction amid ecofriendly mandates. Advancements in digital and flexographic printing support faster, customized runs, with Asia-Pacific leading due to strong manufacturing and consumption bases.

The market holds varying degrees of share across its parent markets. It accounts for approximately 5-7% of the global packaging market, driven by its niche but growing role in product differentiation. Within the labeling and decoration market, it commands a larger share around 18-22%, due to its increasing preference over traditional labels for 360-degree coverage.

In the plastic films and sheets market, it represents roughly 3-4%, as it is just one of many applications for plastic films. It forms about 6-8% of the flexible packaging market, with rising adoption in retail sectors. In the beverage and food packaging market, it makes up around 12-15%, supported by branding needs, tamper evidence, and high-volume usage.

In a November 2024 interview with Packaging Strategies, Geoffrey Martin, CEO of CCL Label, emphasized the growing role of shrink sleeves as a strategic branding asset. He noted that as packaging evolves into a primary medium for conveying sustainability and innovation, clients increasingly demand solutions that balance high performance with visual appeal.

Hill underscored CCL’s commitment to expanding eco-efficient shrink sleeve options that maintain premium print quality. This perspective highlights the industry's dual priorities brand differentiation and environmental responsibility. With ongoing material innovation and changing consumer expectations, FCSS are expected to become a core element of product marketing strategies well into 2035.

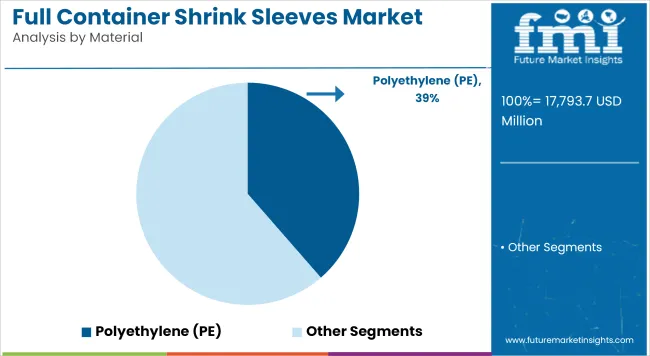

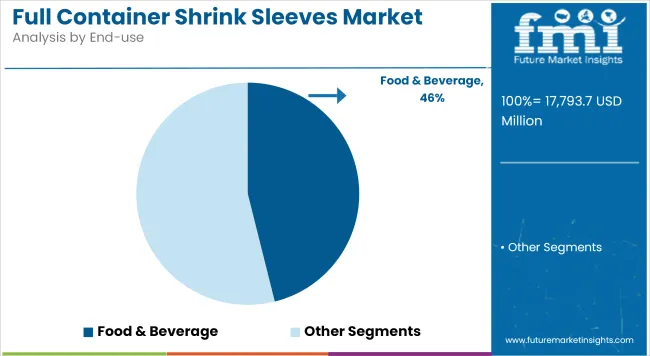

Polyethylene (PE) dominates the material segment with a 39% market share, while food & beverage leads end-use applications with 46% share in 2025. Market growth is attributed to increasing demand for tamper-proof labeling, enhanced branding space, and growing global packaging volumes across FMCG, pharmaceutical, and personal care sectors.

Polyethylene (PE) is projected to command 39% of the global market share in 2025, making it the top material used for shrink sleeves. Its dominance is driven by its high flexibility, low production cost, and print adaptability. Major producers like Berry Global, Clicker Pentaplast, and Amcor have expanded PE-based production lines due to its widespread application across beverage and personal care markets.

The food & beverage industry will lead end-use demand with a 46% market share in 2025, equivalent to approximately USD 8.19 billion in value. High consumption of bottled drinks, sauces, and dairy products has led to widespread deployment of shrink sleeves for 360-degree branding. Companies like Nestlé, PepsiCo, and Danone use full-body sleeves on high-SKU product lines to improve visual differentiation and shelf appeal.

Demand patterns in the full container shrink sleeves market are shifting toward low-waste, application-efficient formats driven by filling line upgrades and label contamination controls. Resin cost instability, recycling mandates, and brand-specific artwork complexity are pushing converters to rethink material blends, adhesive chemistries, and line-speed compatibility for beverage, homecare, and nutraceutical products.

Line Throughput Optimization and Mislabeling Risk Reduction

Filling operators in Mexico and Poland upgraded shrink tunnel systems to infrared-assisted variants, improving label adhesion on PET containers at high speeds. Average sleeve application errors dropped from 3.2% to 1.4% on 600 bpm lines after shifting to low-memory polyolefin films.

Thailand-based beverage co-packers reported a 17% rise in line efficiency after replacing full-body PVC sleeves with hybrid PETG formulations. Automated optical verification tools introduced on French nutraceutical lines reduced downstream rejection tied to sleeve rotation by 23%. These refinements allowed shorter job changeovers, lowering idle time between batch runs and improving SKU flexibility in private-label and short-run segments.

Artwork Complexity Driving Print and Waste Management Shifts

Label art variation across SKUs has led converters in Brazil and South Korea to transition toward inline digital print systems for 500-5,000-unit runs. Across Q1 2025, average print-ready file processing time fell by 34% with AI-driven prepress automation.

Shrink sleeve scrap generation in short-run projects dropped 12% due to better alignment between artwork layout and cutter registration marks. Homecare brands switching to tamper-evident full-body sleeves added variable data zones QR, batch ID, localized barcodes triggering retrofits across flexo-digital hybrid lines. The move has intensified material planning cycles and prompted downstream recyclers to request pre-separated substrates for waste stream compatibility.

Margin Strain from Resin Prices and Film Transition Costs

From January to May 2025, PETG and OPS resin prices rose by 9-12% YoY, squeezing converter margins. European brands seeking PVC-free compliance accelerated trials of recyclable mono material films, raising formulation costs and slowing large-scale rollouts.

Mid-sized converters in India reported per-unit cost increases of USD 0.006 to USD 0.009 due to adhesive changes needed for new eco-aligned films. Some FMCG buyers reduced SKU counts and froze price points, passing inventory risk to converters. Vendors responded by consolidating procurement cycles, extending roll lengths to cut changeovers, and adjusting customer contracts to include resin price indexing. These adaptations are reshaping delivery terms across beverage, cosmetic, and household supply chains.

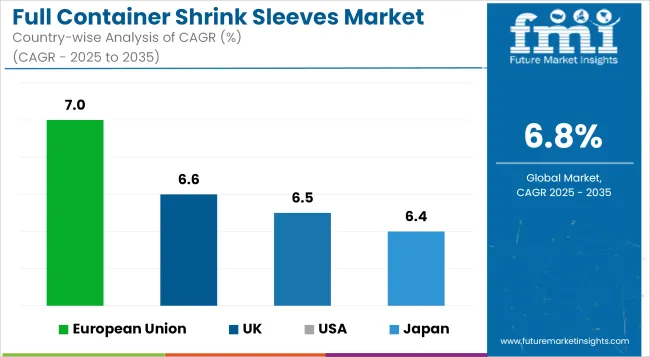

| Countries | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.0% |

| South Korea | 6.7% |

| United Kingdom | 6.6% |

| United States | 6.5% |

| Japan | 6.4% |

The global market for FCSS is anticipated to grow at a 6.8% CAGR between 2025 and 2035. Among OECD participants, the European Union leads with a 7.0% CAGR -0.2% points above the global benchmark. South Korea follows closely at 6.7% (-0.1%), while the United Kingdom and United States trail slightly at 6.6% (-0.2%) and 6.5% (-0.3%), respectively.

Japan registers the lowest among this group at 6.4% (-0.4%). No BRICS members appear among the top performers, highlighting an ongoing regional divergence in packaging technology adoption. These figures reflect a steady push in OECD economies for automated packaging workflows and visual branding continuity, with growth variations largely shaped by regulatory momentum and localized production capabilities.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The EU full container shrink sleeves market is advancing at a CAGR of 7.0%, supported by stringent labeling regulations across sectors like food, beverages, and pharmaceuticals. Over 58% of beverage manufacturers in the region have transitioned to full body shrink sleeves for SKU differentiation and tamper evidence.

Moreover, thermoform-compatible sleeve labels are now found on over 35% of dairy and yogurt-based drink packaging. The market is driven by increasing investments in high-barrier sleeve films, with Germany and France accounting for nearly 40% of the regional demand.

With a projected CAGR of 6.5%, the USA shrink sleeves market is being propelled by SKU proliferation and shelf-level visual competition. As of 2024, over 67% of flavored water and carbonated soft drinks feature shrink sleeve labeling, up from 52% in 2020.

Around 48% of brand managers in the mid-tier cosmetics sector identified shrink sleeves as their top strategy for visual differentiation. Increasing usage in functional beverages and cold-brew coffee segments has led to a 9.4% increase in demand for seamless 360° sleeve formats.

The FCSS market in UK, growing at 6.6% CAGR, is witnessing a strategic shift post-Brexit, with over 59% of FMCG exporters opting for sleeves to strengthen brand recognition abroad. Sleeve adoption in the UK’s alcoholic beverage sector has surged, with 72% of craft distilleries using shrink sleeves for branding flexibility. In Q2 2025 alone, more than 19 million units of shrink-sleeve-labeled condiments were distributed via private-label supermarket chains.

The FC shrink sleeves market in Japan is expanding at 6.4% CAGR, backed by high-tech manufacturing and packaging automation. Over 43% of personal hygiene and wellness drinks now feature shrink sleeves with anti-fraud QR integrations.

Packaging audits in Q1 2025 revealed that over 60% of limited-edition beverages used shrink sleeves as the primary labeling format. The high-resolution CMYK shrink sleeves are seeing usage in over 35% of functional drink SKUs in Japan’s convenience store channel.

The full container shrink sleeves market in South Korea is growing at 6.7%, powered by beauty-beverage innovation and cross-category design influence. In 2024, more than 66% of K-beauty beverage SKUs featured stylized shrink sleeves, with gradient and UV-reactive designs seeing sharp growth.

An estimated 24% increase in e-commerce-ready packaging formats was recorded between 2023 and 2024. Packaging resilience testing indicated shrink sleeves outperformed conventional labels by 31% in transit durability across DTC (direct-to-consumer) fulfillment models.

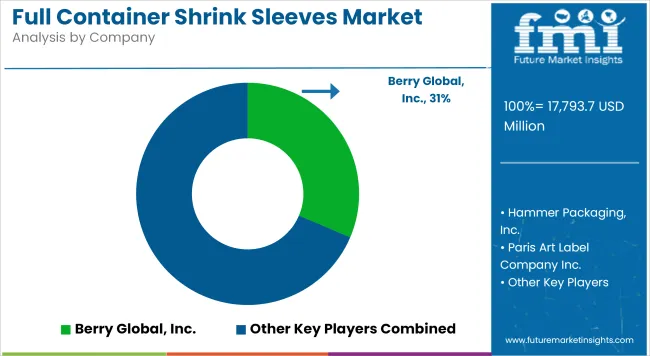

Berry Global, Inc. holding 31% Industry share

The industry is dominated by key players like Berry Global, Inc. and Avery Dennison Corporation, which leverage acquisitions and product innovations to maintain leadership. Fuji Seal International, Inc. invests in R&D for high-performance films, while Klöckner Pentaplast and Constantia Flexibles benefit from economies of scale.

Emerging competitors, such as Taurus Packaging and Bothra Industries, focus on affordability and niche markets to gain traction. Entry barriers include high capital costs for advanced machinery and compliance with strict industry standards.

Established brands like Hammer Packaging, Inc. and Macfarlane Group PLC enjoy strong customer loyalty, making it difficult for new entrants to compete. Smaller firms, including Paris Art Label Company Inc., differentiate through rapid customization and unique designs to carve out market share. Regulatory complexities further increase operational challenges.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 17.7 billion |

| Projected Market Size (2035) | USD 34.3 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million square meters for volume |

| Material Types Analyzed (Segment 1) | Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polylactic Acid (PLA), Others |

| End-use Industries Covered (Segment 2) | Food & Beverage, Pharmaceuticals, Household, Personal Care & Cosmetics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Tracked | United States, Canada, Germany, France, Italy, India, China, Japan, Brazil, South Korea |

| Key Players | Berry Global, Inc., Hammer Packaging, Inc., Paris Art Label Company Inc., Avery Dennison Corporation, Constantia Flexibles, Klöckner Pentaplast, Macfarlane Group PLC, Fuji Seal International, Inc., Bothra Industries, Taurus Packaging |

| Additional Attributes | Dollar sales, share by resin type and end-use, demand driven by FMCG and pharmaceutical packaging, rapid shift toward PET and PLA films, expansion of personalization and digital printing, regional production hubs emerging in South Asia Pacific and Latin America |

The industry is expected to reach USD 34.3 billion by 2035, up from USD 17.7 billion in 2025.

Polyethylene (PE) holds the largest share in 2025, accounting for 39% of the total material usage.

The food and beverage sector leads with a 46% market share, equivalent to approximately USD 8.19 billion in 2025.

The European Union is projected to grow at a 7.0% compound annual growth rate, exceeding the global average.

Berry Global, Inc. leads the market with a 31% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fully Automatic Blood Gas Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Cell Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Wet Chemical Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic High Speed Nail Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Solid-Liquid Purge Trap Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Liquid Metal Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Full-frame Oblique Cameras Market Size and Share Forecast Outlook 2025 to 2035

Full-size Pickup Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Full Body Scanner Market Analysis - Size, Share & Forecast 2025 to 2035

Full-Service Restaurants Market Analysis by Model, Service, Location, and Region Through 2035

Fully Automated Coagulometer Market

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Container As A Service (CaaS) Market Size and Share Forecast Outlook 2025 to 2035

Container Washing System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA