The ISO container market refers to the global industry for intermodal freight containers built to the standards set by the International organization for standardization (ISO). These containers are crucial for global trade, logistics, and supply chain management, enabling seamless transport across ships, railways, and trucks.

ISO containers include a range of types such as dry containers, reefer containers, tank containers, flat rack containers, and open-top containers, commonly used in shipping, chemical logistics, food transport, and industrial equipment hauling.

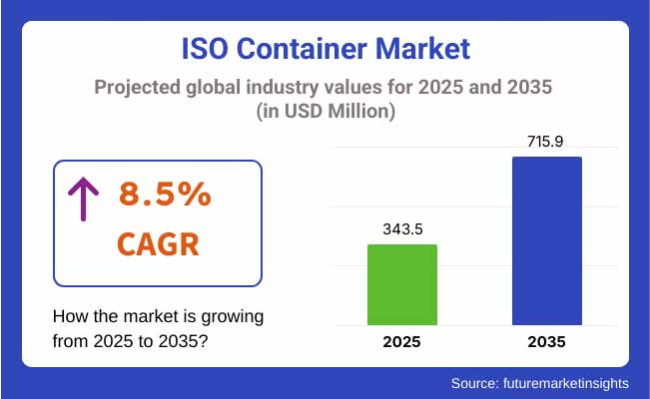

In 2025, the global ISO container market is projected to reach approximately USD 343.5 million, with expectations to grow to around USD 715.9 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period.

The market is driven by global trade expansion, rising e-commerce logistics, growth in perishable goods transportation, and infrastructure upgrades in ports and freight corridors. Additionally, sustainability-focused innovations in container materials and tracking technologies are transforming the sector.

The North American region holds a significant market share due to its well-developed intermodal system and high container traffic at major ports, including but not limited to Los Angeles, Long Beach, and Vancouver. The growing exports, increasing demand for the cold chain logistics along with the implementation of smart containers integrated with GPS and condition-monitoring features has thus resulted in the growth of the studied market.

Europe is a mature but innovation-led market focusing on sustainable container materials, logistics digitalization and expansion of multimodal transportation corridors. Iso tank containers are primarily used for chemical and food-grade transportation, while reefer containers are highly significant for cross-border fresh produce transportation, especially in notable markets such as Germany, the Netherlands, and France.

Asia-Pacific will advance the fastest, led by China, India, Japan, and Southeast Asia, due to rapid industrialization, port facilities development, and solid manufacturing and export bases propelling demand. China is the largest container producer in the world, and dominates global supply, whilst growth in India is driven by the government-led Sagarmala and Make-in-India logistics centers.

Challenges

Volatility in Freight Demand and Port Congestion

The ISO container market is also plagued with challenges in freight demand volatility, usually caused by global trade disruptions, geopolitics tensions, and pandemic residuals. Disruptions are responsible, then, for the patchy container supply, port congestion, container imbalance, and especially emerging markets.

Moreover, high steel and high production costs, for instance, and the old age of container fleets are immediate problems. Green pressure along the lifecycle emissions of containers, especially on maritime logistics, incentivizes sustainable evolution among manufacturers, too.

Opportunities

Intermodal Logistics Expansion, Smart Container Technologies, and Green Shipping Initiatives

Despite these constraints, the ISO container market is poised for robust growth due to the global surge in intermodal transportation, which integrates rail, road, and sea freight for efficiency. There's growing adoption of smart ISO containers equipped with IoT trackers, temperature sensors, and condition monitoring tools, particularly in pharma, food, and high-value cargo.

The rising interest in modular, reusable containers, along with green shipping mandates (IMO 2030/2050), is driving demand for lightweight, corrosion-resistant, and recyclable containers with low carbon footprints.

Between 2020-2024 was characterized by pandemic-era port congestions, exploding freight rates, and a global container shortage. It led to production of more containers, especially in China. Although container manufacturing did see a surge, slow-moving inefficiencies in the repositioning of containers and subpar digital visibility remained two of the leading pain points.

From 2025 to 2035, the market is expected to evolve into a digitally orchestrated, circular economy-driven ecosystem of smart, modular, and energy-efficient ISO containers, with increased emphasis on fleet traceability, predictive maintenance, and design for disassembly.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with CSC safety conventions and IMO emissions reporting |

| Technology Innovations | Growth in standard dry, reefer, and tank containers with basic tracking |

| Market Adoption | Heavy demand in shipping, oil & gas, chemicals, and reefer logistics |

| Sustainability Trends | Early adoption of aluminum and corten steel-based recyclables |

| Market Competition | Led by CIMC, Singamas, Maersk Container Industry, CXIC Group, TLS Offshore |

| Consumer Trends | Demand for durability, standardization, and capacity optimization |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Introduction of mandatory lifecycle assessments, carbon footprint reporting, and modular design compliance |

| Technology Innovations | Expansion into IoT-enabled, solar-powered, self-cleaning, and foldable smart containers |

| Market Adoption | Growth into e-commerce logistics, modular housing, military, and disaster relief sectors |

| Sustainability Trends | Shift to carbon-neutral containers, composite materials, and reverse logistics-enabled reuse models |

| Market Competition | Entry of container-as-a-service (CaaS) platforms, smart logistics startups, and modular container innovators |

| Consumer Trends | Preference for connected, adaptive, eco-compliant containers with digital integration |

Strong growth in intermodal freight volume, expansion in chemical exports, and increased utilization of tank containers for transporting hazardous and non-hazardous liquids have been driving the United States ISO Container market.

However, the growing food-grade application can significantly add up to the demand for oil & gas transport. Simultaneously, the expansion of container fleets is tributary to the development of port and logistics centre infrastructure, and the shift towards supply chain resilience.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.8% |

The UK ISO container market which is supported by the increasing international trade and cargo transportation of food, pharmaceuticals, and specialty chemicals. As reusable and efficient alternatives to drums and IBCs, ISO tank containers are increasingly in demand as a sustainable shipping option.

Strategic investments in the country’s logistics infrastructure and geographical proximity to the EU and international shipping lanes are driving demand for containers. Trade policies are also driving diversification and growth in the market post-Brexit.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.2% |

Demand is increasing for containers with respect to a new generation of efficient, consolidated ship-to-shore vessels in the EU ISO container segment. Like Germany, the Netherlands and Belgium are among those seeking to adopt the same to freight in chemicals, industrial gases and food ingredients.

KyleBredgensEU EU-wide decarbonisation policies driving increased demand for multimodal, energy-efficient containers increased cross-border trade is driving leasing operators and companies to expand their fleets of ISO containers.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.1% |

Japan's ISO container market is flourishing, owing to strong demand for chemical, pharmaceutical and food exports. Soaring use of specialized ISO containers, such as reefer and tank versions, is largely attributable to the country’s focus on high-value, temperature-sensitive shipments.

Given that Japan is a hub of manufacturing and technology, ISO containers are critical to efficiency in logistics optimization and international trade. Market growth is also being propelled by government efforts to enhance container terminal automation and digital supply chain monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

South Korean ISO container market is booming due to its top position in international trade, ship building, and petrochemical exports. Bulk liquids such as solvents, oils, and chemicals are increasingly transported in pressure ISO tank containers.

Investing in port expansions, intelligent logistics infrastructure, and integrated intermodal transport systems enables shipping blocks to be loaded and unloaded more quickly and securely. The rise in pharmaceutical and specialty food exports has also contributed to increased use of ISO containers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.6% |

| Segmentation Type | Market Share (2025) |

|---|---|

| Cryogenic & Gas Tanks | 58.4 % |

Cryogenic and gas tanks will remain the majority container type in the ISO container market with a maximum market share of 58.4%. Their rise is in response to burgeoning global demand for liquefied gases, industrial chemicals and cryogenic materials in energy, health care and manufacturing sectors.

Its tanks provide you with super secure, thermally insulated containment systems that can endure the high driving and temperature extremes required to safely ship high unstable, hazardous, or low-boiling-point freight great distances.

The growing global shift towards clean energy sources is the key reason contributing to cryogenic and gas tanks leading the market. As liquefied natural gas (LNG), hydrogen, and other cryogenic fuels accumulate speed in the net-zero emissions race, ISO tanks provide a scalable, mobile and globally acknowledged means of circulation.

And these bespoke containers deliver the stringent thermal and structural requirements imposed by energy stakeholders, whether carrying LNG to offshore regasification terminals or liquid hydrogen to advanced mobility nodes. Typical bulk transport approaches simply can't match their ability to preserve product integrity during transit.

And international trade in industrial and specialty gases such as oxygen, nitrogen, argon and carbon dioxide has increased as use climbs in pharmaceutical manufacturing, food processing, electronics and metalworking. These applications require consistent quality and uninterrupted supply chains, both of which are facilitated by cryogenic ISO tanks.

Within pandemic and post-pandemic circumstances, the need for the delivery of medical-grade oxygen to remote or underdeveloped regions created an additional reminder of the nonreplaceable role such container designs played in the context of public health supply chains.

The evolving technology has improved the performance and safety offerings of cryogenic ISO vessels. Vacuum-insulated double walls with multi-layer reflective insulation and integrated pressure control valves have significantly enhanced operational safety without affecting the boil-off rates and product loss.

Additionally, manufacturers are incorporating smart sensors and IoT functionality into next-generation cryogenic tanks, enabling operators to track temperature, pressure, fill levels and route tracking remotely and in real time. The predictive maintenance with the application of AI and machine learning for preventive measures significantly enables accuracy and cost reduction along with compliance to standards and safety.

Regulatory compliance-wise, cryogenic ISO and gas ISO tanks are on par with or exceed international standards such as the International Maritime Dangerous Goods (IMDG) Code, UN Portable tank regulations and U.S. Department of Transportation (DOT). That ability to comply with multi-jurisdictional regulations is one reason they are a popular choice for shippers on transcontinental routes, and especially for highly regulated verticals, such as chemicals and energy.

Yet, the other reason of their spread is its rising long-distance and cross-border hauls. Many businesses today require secure long distance transport without unnecessary and frequent transfer and retransfer, which compromise safety or increases price. Cryogenic tanks are built for long-distance travel, with hold times of the best part of a week under protected conditions, making them the optimal form of intercontinental transport of valuable inputs.

Unlike other types of ISO containers lined tanks, reefer tanks, and swap bodies cryogenic and gas tanks serve a niche but much higher value market. Lined tanks are suitable for aggressive chemicals but lack the thermal management required for gas and cryogenic liquids. Reefer tanks are designed for perishable goods logistics, which are necessary but do not have such extreme operational requirements.

Multi-compartment tanks and swap bodies give you operational variety and regional distribution, but they're not suitable for transporting hazardous or high-pressure freight. As for the safety, benefits and global applications criteria, cryogenic and gas tanks hold the biggest share due to their significance in transporting energy and specialty chemicals.

While global powership company, Karpowership will keep pushing in the footsteps of the movers and shakers of tomorrow by utilizing high-integrity specialized containment as the world economy transitions towards decarbonized and decentralized energy systems, while developing economies industrialize further. The trends ensure that the ISO container market will continue to rely heavily on cryogenic and gas tanks through 2035 and well beyond.

| Segmentation Type | Market Share (2035) |

|---|---|

| Marine | 41.6% |

ISO container market forecasting that maritime transport will continue leading the way in the ISO container market, with 41.6% market share. Ocean shipping has a monopoly on “last mile” shipping of long-distance freight, and is also the transportation system at the center of the global intermodal logistics network.

ISO containers were originally designed for seawater transport, and their structural requirements closely overlap with cargo ship, terminal, and marine facilities. Modern shipping remains the most frequent and also cost-efficient way of transferring bulk and liquid goods across continents.

The world merchant fleet has expanded enormously in the last few decades the container ships today capable of transporting tens of thousands of TEUs (twenty-foot equivalent units) at a time. This ability is key for sectors that need to manage bulk liquid transportation, such as chemicals, oil products or food great commodities or industrial solvents, all of which are typically moved in ISO tanks.

Shipping costs per unit of shipment decrease with the use of marine transport because of the economies of scale obtained, making the sea routes particularly attractive for exporters and importers on a continental basis.

Seaborne commerce have proven to be surprisingly resilient to economic shocks, geo-political shocks, and, even, pandemic driven supply chain disarray. ISO containers are uniform, easing the connection between ships, ports, trucks, and rail networks giving strategic advantage to marine logistics operators. ISO containers are the solution of choice for ocean shipping, specifically for the transit of both cryogenics and costly fluids that must be kept intact during the whole trip.

Energy and environmental efficiency are other important advantages of sea transport. Ocean shipping is the most carbon-efficient mode of transport per ton per kilometre. As the maritime industry moves towards low-sulphur fuels, liquefied natural gas (LNG)-fueled, and even electric container vessels, the carbon footprint of sea freight continues to shrink.

This green transition of ocean transport goes hand in hand with ISO containers particularly long dwell time tank containers with very low product loss. ISO tanks and green marine freight make a fascinating story about responsible transportation in the sense of bulk.

Marine transportation gives rise to the construction of maritime port infrastructure surrounding the marine transportation system. Important international ports as in Rotterdam, Shanghai, Singapore, and Los Angeles feature specialized terminals for handling, cleaning, and maintaining tank containers.

Such terminals promote the safety and efficiency of maritime ISO shipping, allowing port-to-port standardization of safety and quality control provisions. Customs automation, digital port integration, and blockchain-based vessel monitoring have made marine logistics smarter, faster, and more transparent, giving it a secure place in the global trade ecosystem.

On the contrary, the road and rail transport modes are basically supportive or regional. Road transport serves first and last mile delivery, taking ISO containers from docks to end destinations such as processing plants, warehouses, or customers. Yet road transport is more expensive for long distances, vulnerable to traffic clogging and constrained by weight and local road surface quality of roads.

Rail may offer high inland reach, as well, especially for landlocked states and industrial sites, but it depends on fixed infrastructure and risks intermodal compatibility, where gauges are not standardized or if tracks are deemed low-quality.

Furthermore, sea transport can accommodate the most diverse range of ISO container types, from cryogenic containers to food-grade liners and corrosive chemical containers. This allows shippers to consolidate different types of cargo on the same ship, reducing routing and logistics planning. Direct maritime services also allow shippers to avoid multimodal transfer, limiting handling risk and maximizing cargo safety.

In other words, marine transport's dominance in the ISO container domain is not only a matter of historical legacy but also careful reinvention. Not least of all, it is still the base layer upon which world supply chains are built; especially in the context of cross-continent flow of bulk liquids (oil, chemicals et-al) and regulated products (food, pharmaceuticals).

As global trade lanes evolve and shipping technologies advance, marine transport will remain the backbone infrastructure through which ISO containers are deployed cross-sector.

The ISO containers market is expanding due to the increasing global trade volume, demand for intermodal transportation, and high utilization of standardized, robust, and recycled unit delivery loads. ISO containers are critical for ISO container transportation of products via sea, rail, and road, providing safety, strength, and compliance with relevant global regulations.

Some principal growth drivers include e-commerce explosion, developing cold chain logistics, global infrastructure spending and sustainability through reuse of containers and module-based logistics.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| China International Marine Containers (CIMC) | 18-22% |

| CXIC Group Containers Company Limited | 14-18% |

| Singamas Container Holdings Ltd. | 12-16% |

| Maersk Container Industry (A.P. Moller-Maersk) | 10-14% |

| TLS Offshore Containers / Suretank | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| CIMC | As of 2024, CIMC launched smart ISO containers integrated with GPS tracking and condition monitoring, leading the market in dry, reefer, and tank container segments globally. |

| CXIC Group | In 2023, CXIC introduced custom-engineered ISO tank containers for hazardous chemicals and food-grade liquids, targeting high-growth Asia-Pacific logistics markets. |

| Singamas | As of 2024, Singamas unveiled modular ISO containers with custom shelving and insulation options, designed for cold chain and e-commerce fulfillment sectors. |

| Maersk Container Industry | In 2023, Maersk debuted Star Cool® reefer containers with enhanced energy efficiency and CO₂ reduction features, aligned with global sustainability goals. |

| TLS Offshore Containers / Suretank | In 2023, TLS launched offshore-certified ISO containers with fire-rated and pressurized designs for the oil & gas and defense sectors. |

Key Market Insights

CIMC (18-22%)

CIMC leads the ISO container market with a broad portfolio of dry cargo, reefer, and tank containers, supplying major logistics and shipping firms worldwide. Its technological integration (IoT, RFID, condition sensors) gives it a strong edge in fleet visibility and cold chain management.

CXIC Group (14-18%)

CXIC specializes in durable tank and liquid transport containers, catering to the chemical, food, and beverage industries, particularly in APAC and Middle Eastern markets.

Singamas (12-16%)

Singamas delivers customized container solutions, including reefer containers for pharmaceuticals and specialized box units for e-commerce logistics, focused on modular usage and high stacking efficiency.

Maersk Container Industry (10-14%)

A division of A.P. Moller-Maersk, this firm develops reefer containers with low energy use, designed to meet the sustainability goals of global logistics firms involved in food, vaccines, and floral transport.

TLS Offshore Containers / Suretank (8-12%)

TLS and Suretank focus on specialty ISO containers for oil rigs, remote site camps, and military logistics, offering DNV-certified and offshore-compliant designs with added fire, explosion, and chemical protection.

Other Key Players (26-32% Combined)

Numerous regional and specialty container manufacturers support the market with cost-effective, modular, and industry-specific ISO container solutions, including:

The overall market size for ISO container market was USD 343.5 million in 2025.

The ISO container market is expected to reach USD 715.9 million in 2035.

Growth in global trade and logistics, increasing demand for standardized and secure shipping solutions, and rising adoption in intermodal transportation will drive market growth.

The top 5 countries which drives the development of ISO container market are USA, European Union, Japan, South Korea and UK.

Cryogenic and gas tanks expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Container Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Container Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Transport Mode, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Transport Mode, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Container Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Container Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Transport Mode, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Transport Mode, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Container Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Container Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Transport Mode, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Transport Mode, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Container Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Container Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Transport Mode, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Transport Mode, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Container Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Container Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Transport Mode, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Transport Mode, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Container Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Container Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Transport Mode, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Transport Mode, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Container Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Transport Mode, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Container Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Container Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Container Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Container Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Transport Mode, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Transport Mode, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Transport Mode, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Transport Mode, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Container Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Transport Mode, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Container Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Transport Mode, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Container Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Container Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Container Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Container Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Transport Mode, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Transport Mode, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Transport Mode, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Transport Mode, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Container Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Transport Mode, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Container Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Transport Mode, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Container Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Container Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Container Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Container Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Transport Mode, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Transport Mode, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Transport Mode, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Transport Mode, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Container Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Transport Mode, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Container Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Transport Mode, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Container Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Container Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Container Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Container Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Transport Mode, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Transport Mode, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Transport Mode, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Transport Mode, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Container Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Transport Mode, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Container Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Transport Mode, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Container Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Container Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Container Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Container Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Transport Mode, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Transport Mode, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Transport Mode, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Transport Mode, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Container Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Transport Mode, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Container Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Transport Mode, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Container Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Container Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Container Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Container Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Transport Mode, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Transport Mode, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Transport Mode, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Transport Mode, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Container Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Transport Mode, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ISO Tank Container Market Growth – Trends & Forecast 2024-2034

Isopropyl Myristate Market Size and Share Forecast Outlook 2025 to 2035

Isotropic Films Market Size and Share Forecast Outlook 2025 to 2035

Isoprene Rubber Latex Market Size and Share Forecast Outlook 2025 to 2035

Iso-Octene Market Size and Share Forecast Outlook 2025 to 2035

Isobornyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Isoprenol Market Size and Share Forecast Outlook 2025 to 2035

Isodecyl Citrate Market Analysis Size Share and Forecast Outlook 2025 to 2035

Isotearic Acid Market Size and Share Forecast Outlook 2025 to 2035

Isovaleric Acidemia Treatment Market Size and Share Forecast Outlook 2025 to 2035

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isoflavones Market - Size, Share, and Forecast Outlook 2025 to 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Isocitrate Dehydrogenase (IDH) Inhibitors Industry Analysis by Type, Molecule Types, Route of Administration, and Region through 2035

Isomaltulose Market Growth - Size, Trends & Forecast 2025 to 2035

Isostatic Pressing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Isooctyl Alcohol Market Growth - Trends & Forecast 2025 to 2035

Isomalto-oligosaccharide Market Analysis by Form, Source, End-use Application and Region through 2035

Isoleucine Market Growth - Dietary Supplement & Pharmaceutical Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA