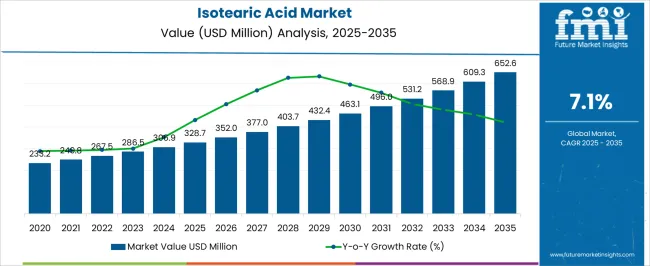

The Isotearic Acid Market is estimated to be valued at USD 328.7 million in 2025 and is projected to reach USD 652.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. During the first five years from 2025 to 2030, values are expected to move from USD 328.7 million to USD 463.1 million, representing a rise of USD 134.4 million. This phase will contribute around 42.3% of the total absolute growth over the decade.

Key factors behind this early expansion include the rising integration of isotearic acid in cosmetics, lubricants, and industrial applications where manufacturers increasingly prioritize product versatility and functional benefits. Between 2025 and 2026, the market is set to reach USD 352.0 million, followed by USD 377.0 million in 2027, USD 403.7 million in 2028, USD 432.4 million in 2029, and USD 463.1 million by 2030.

This steady growth in the early phase reflects higher penetration in performance chemical sectors and growing use in eco-friendly formulations. Demand is also likely to benefit from advancements in manufacturing processes that enable better quality and consistency. The period’s compound effect lays a strong base for the accelerated growth expected in the second half of the forecast window.

| Metric | Value |

|---|---|

| Isotearic Acid Market Estimated Value in (2025 E) | USD 328.7 million |

| Isotearic Acid Market Forecast Value in (2035 F) | USD 652.6 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

Rising awareness around bio-based and skin-friendly ingredients has encouraged manufacturers to substitute synthetic acids with safer, naturally derived alternatives.

Growth is also being influenced by stringent regulatory frameworks promoting clean-label formulations, particularly in regions emphasizing environmental and dermatological safety. Advances in oleochemical extraction technologies have improved the scalability and purity of isostearic acid, supporting adoption across diverse end-use sectors.

In addition, evolving consumer preferences toward plant-derived emollients and multifunctional personal care ingredients are shaping procurement strategies across leading brands. With ongoing investments in sustainable supply chains and R&D focused on high-purity formulations, the market is poised for long-term, environmentally aligned growth.

The isotearic acid market is segmented by type, application, and geographic regions. The isostearic acid market is divided into natural and Synthetic isostearic acid. The isotearic acid market is classified into Personal care and cosmetics, Skin care, Hair care, Makeup, Other, Chemical esters, Lubricant and greases, Textile, and Others.

Regionally, the isotearic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

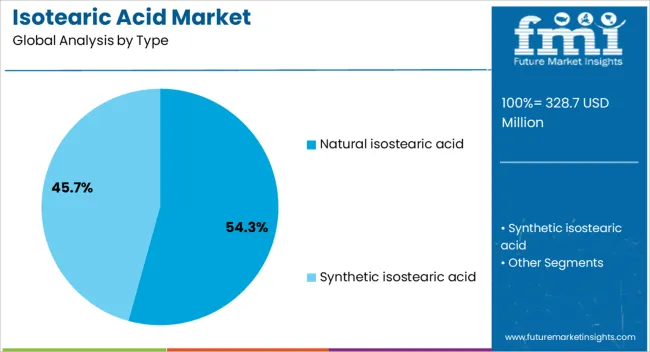

Natural isostearic acid is projected to account for 54.30% of total revenue in the isotearic acid market by 2025, making it the dominant type segment. Its leadership is being supported by growing demand for bio-based and renewable feedstocks in cosmetics and industrial formulations.

This form is derived primarily from plant-based fatty acids, aligning with global sustainability trends and consumer expectations for ethical sourcing. The absence of synthetic additives enhances its appeal among formulators of clean beauty and skin-safe products.

Additionally, natural isostearic acid exhibits excellent oxidative and thermal stability, making it suitable for high-performance applications such as lubricants and coatings. As environmental compliance standards tighten across key markets, the natural segment continues to gain traction for its ability to deliver both performance and sustainability benefits.

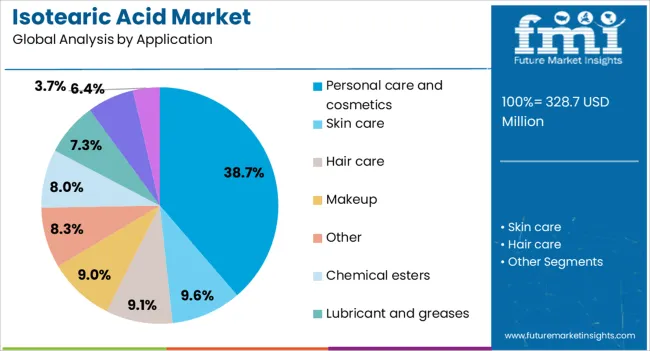

The personal care and cosmetics sector is expected to lead the application landscape, holding a 38.70% revenue share in the isotearic acid market by 2025. This dominance is attributed to the compound’s multifunctional characteristics, including emolliency, pigment dispersion, and stability enhancement in formulations.

Isostearic acid is favored in creams, lotions, lipsticks, and sunscreens due to its mildness on skin and compatibility with active ingredients. The rise of organic and vegan skincare trends has driven the inclusion of isostearic acid in premium and mid-tier product lines.

In addition, its ability to improve product texture and extend shelf life supports its growing utility in formulation science. As cosmetic companies intensify efforts toward safer, non-comedogenic, and biodegradable ingredients, isostearic acid continues to serve as a foundational material in evolving product portfolios.

The isotearic acid market has been expanding due to its growing role in personal care, lubricants, and coatings. In 2024 and 2025, demand from cosmetics and industrial lubricant manufacturers strengthened as producers sought ingredients offering better oxidative stability and formulation flexibility. Opportunities are emerging in bio-based isotearic acid for environmentally compliant applications. Trends point toward its use in high-performance metalworking fluids and specialty coatings. However, raw material price volatility and limited large-scale production facilities remain barriers, making investment in supply chain optimization and manufacturing capacity crucial.

A key growth driver for the isotearic acid market is the rising demand from personal care and lubricant manufacturing industries. In 2024, leading cosmetic brands incorporated isotearic acid in skincare emulsions for improved texture and stability. Its application in synthetic and bio-based lubricants also grew due to enhanced oxidative resistance, making it suitable for high-performance machinery. Coating manufacturers have adopted isotearic acid for its excellent dispersing capabilities, strengthening its industrial footprint. This broad cross-sector adoption has positioned isotearic acid as a versatile and high-value specialty ingredient.

Significant opportunities lie in the expansion of bio-based isotearic acid for applications in eco-compliant product lines. In 2025, several chemical producers announced pilot-scale production using renewable feedstocks to cater to regulatory-driven markets in Europe and North America. Niche opportunities are also arising in marine lubricants and specialty paints, where isotearic acid’s corrosion resistance properties enhance performance. Collaborations between raw material suppliers and end-product manufacturers are enabling faster adoption in targeted segments, strengthening its value proposition in both industrial and consumer-facing applications.

An emerging trend is the increased incorporation of isotearic acid in high-performance coatings and advanced metalworking fluids. In 2024, automotive coating manufacturers adopted it for better pigment dispersion and improved film durability. The metalworking industry has expanded its usage in cutting and cooling fluids, as isotearic acid delivers enhanced lubrication under extreme pressure. Specialty chemical companies are refining formulations to target premium-grade markets, creating a competitive shift toward performance-driven products that elevate isotearic acid’s industrial relevance and commercial potential.

A major restraint in the isostearic acid market is the volatility in raw material pricing, particularly in fatty acid derivatives sourced from palm and coconut oil. In 2025, weather-related supply disruptions in major producing regions impacted availability and production costs. Limited large-scale manufacturing capacity has also led to supply bottlenecks, constraining market penetration in emerging economies. Competition from alternative fatty acids in certain industrial applications continues to challenge pricing stability, making strategic sourcing and production efficiency critical for sustained competitiveness.

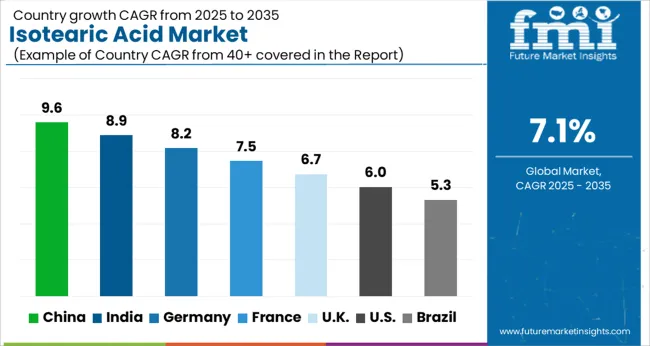

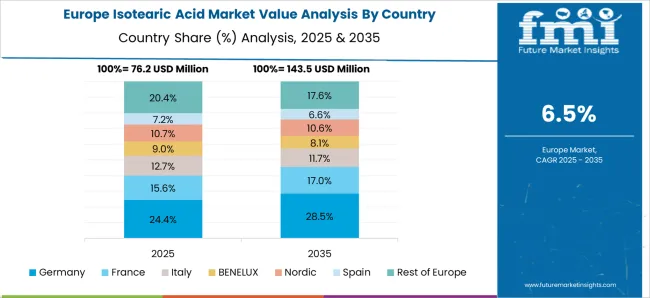

The global isotearic acid market is projected to grow at 7.1% CAGR from 2025 to 2035. China leads with 10% CAGR, driven by the country’s industrial demand for high-performance lubricants and surfactants in various sectors. India follows at 9%, supported by the growing personal care, automotive, and textile industries, which increasingly require advanced chemical additives like isotearic acid.

France records 7% CAGR, driven by demand in the cosmetics, detergents, and lubricant sectors. The United Kingdom and the United States grow at 7% and 6%, respectively, reflecting steady demand in mature markets with a focus on eco-friendly and high-performance additives. Asia-Pacific leads growth, while Europe and North America focus on innovation and environmental compliance.

The isotearic acid market in China is forecasted to grow at 10% CAGR, driven by the rapid expansion of industries requiring high-performance lubricants, surfactants, and additives. As China becomes a global hub for manufacturing and industrial production, the demand for advanced chemical solutions such as isotearic acid rises, particularly in the automotive, textiles, and personal care sectors. The government's push for sustainable manufacturing processes further promotes the use of eco-friendly chemicals, including isotearic acid, in various industrial applications.

The isotearic acid market in India is projected to grow at 9% CAGR, driven by rising demand from industries such as personal care, automotive, and textiles. The country’s growing consumer market, alongside increasing manufacturing capabilities in these sectors, accelerates the use of advanced chemical additives like isotearic acid. The increasing awareness of sustainability and eco-friendly alternatives also contributes to the demand for such additives in India's expanding industrial base.

The isotearic acid market in France is expected to grow at 7% CAGR, driven by steady demand from sectors like cosmetics, detergents, and lubricants. The increasing trend towards natural and sustainable ingredients in personal care products supports the market's growth. Additionally, the demand for high-performance lubricants in the automotive and industrial sectors accelerates the use of isotearic acid in various applications. As part of the European Union’s commitment to environmental sustainability, France also sees a shift toward greener chemical alternatives, enhancing the demand for isotearic acid.

The isotearic acid market in the United Kingdom is projected to grow at 7% CAGR, driven by increasing applications in personal care and industrial sectors. The UK’s growing focus on sustainability, including the adoption of biodegradable and eco-friendly additives, promotes the use of isotearic acid in various formulations. Additionally, the automotive sector’s need for advanced lubricants and the expanding textile industry further contribute to the demand for isotearic acid.

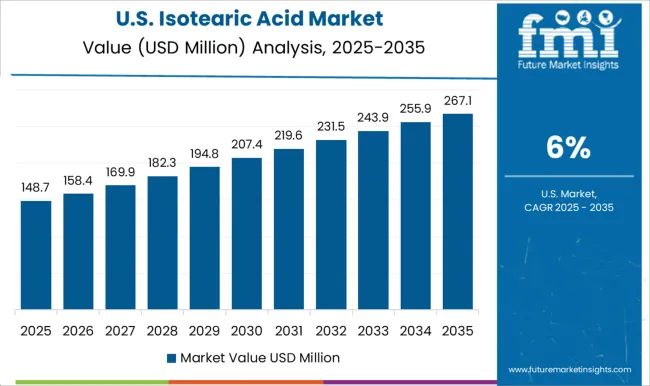

The isotearic acid market in the United States is projected to grow at 6% CAGR, supported by steady demand in personal care, automotive, and industrial sectors. With the increasing focus on eco-friendly solutions and sustainability, there is a growing shift toward biodegradable and green additives like isotearic acid in consumer products and industrial applications. As the demand for high-performance lubricants and surfactants in automotive and manufacturing industries rises, isotearic acid’s adoption continues to grow.

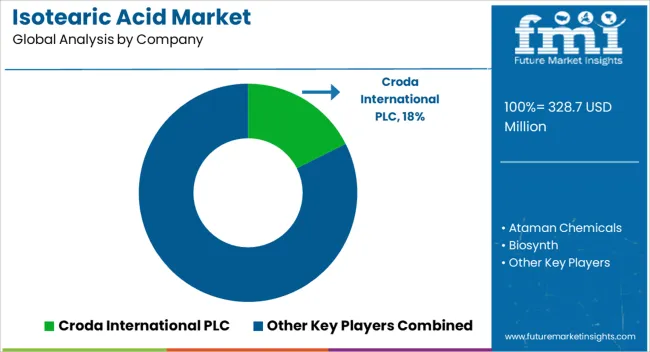

The isotearic acid market is dominated by Croda International PLC, which secures its leadership through high-purity, specialty-grade isotearic acid used in cosmetics, personal care, lubricants, and industrial applications. Croda’s dominance is supported by strong R&D capabilities, a global distribution network, and a focus on tailored formulations that meet stringent quality and regulatory standards.

Key players such as Emery Oleochemicals, KLK Oleo, Oleon, and Cargill Inc. maintain significant market shares by offering bio-based isotearic acid and derivatives designed for enhanced oxidative stability, lubricity, and emollient properties. These companies prioritize sustainable sourcing, application-specific performance, and expansion into emerging markets to strengthen their competitive positions.

Emerging players including Ataman Chemicals, Biosynth, Glentham Life Sciences, KH NeoChem, KOKYO ALCOHOL KOGYO, Santa Cruz Biotechnology, and Vantage Specialty Chemicals are expanding their market presence by focusing on niche applications such as specialty lubricants, fragrance formulations, and advanced coatings.

Their strategies involve offering cost-effective production, maintaining supply chain flexibility, and developing customized grades for unique end-user requirements. Market growth is driven by rising demand from the cosmetics and personal care industry, increasing use of isotearic acid in high-performance lubricants, and its growing application in industrial formulations.

Continuous innovation in bio-based production processes and expansion into performance-driven industrial uses are expected to shape future competitive dynamics globally.

Companies are investing in bio-refinery technologies to produce isotearic acid from vegetable oils and renewable feedstocks, positioning it as a greener alternative to traditional petrochemical-derived fatty acids. R&D investments are focused on improving the efficiency and cost-effectiveness of isotearic acid production. Companies are exploring new catalysts and processing methods to enhance yield and reduce environmental impact, while ensuring the quality of the final product.

| Item | Value |

|---|---|

| Quantitative Units | USD 328.7 Million |

| Type | Natural isostearic acid and Synthetic isostearic acid |

| Application | Personal care and cosmetics, Skin care, Hair care, Makeup, Other, Chemical esters, Lubricant and greases, Textile, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Croda International PLC, Ataman Chemicals, Biosynth, Cargill Inc., Emery Oleochemicals, Glentham Life Sciences, KH NeoChem, KLK Oleo, KOKYO ALCOHOL KOGYO, Oleon, Santa Cruz Biotechnology, and Vantage Specialty Chemicals |

| Additional Attributes | Dollar sales by grade and application, demand dynamics across cosmetics, lubricants, and industrial sectors, regional trends in isotearic acid production and consumption, innovation in bio-based and high-purity formulations, environmental impact of raw material sourcing and processing, and emerging use cases in high-performance and specialty products. |

The global isotearic acid market is estimated to be valued at USD 328.7 million in 2025.

The market size for the isotearic acid market is projected to reach USD 652.6 million by 2035.

The isotearic acid market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in isotearic acid market are natural isostearic acid and synthetic isostearic acid.

In terms of application, personal care and cosmetics segment to command 38.7% share in the isotearic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA