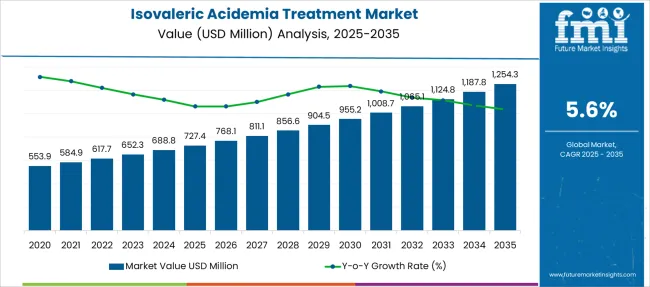

The Isovaleric Acidemia Treatment Market is estimated to be valued at USD 727.4 million in 2025 and is projected to reach USD 1254.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Isovaleric Acidemia Treatment Market Estimated Value in (2025 E) | USD 727.4 million |

| Isovaleric Acidemia Treatment Market Forecast Value in (2035 F) | USD 1254.3 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Isovaleric Acidemia Treatment market is advancing steadily, influenced by improved diagnostic practices, growing patient awareness, and the emphasis on early intervention in rare metabolic disorders. The current scenario reflects a rising number of newborn screenings and the adoption of evidence-based clinical guidelines, which are enabling timely and accurate identification of isovaleric acidemia cases.

As indicated in clinical journals and healthcare institutional publications, increased collaboration among medical research bodies and regulatory authorities is supporting the approval and distribution of targeted therapies. The outlook remains promising, as advancements in genomics, personalized treatment approaches, and improved access to orphan drugs are expected to broaden therapeutic adoption.

Institutional reports and pediatric care guidelines highlight the importance of dietary management and metabolic support as critical components in reducing hospitalization rates and improving long-term patient outcomes These combined developments are expected to continue supporting the market’s upward trajectory, especially in developed regions with strong healthcare infrastructure and rare disease funding programs.

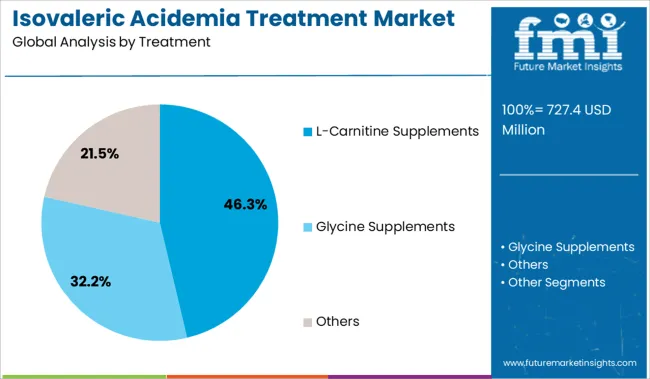

The market is segmented by Treatment and region. By Treatment, the market is divided into L-Carnitine Supplements, Glycine Supplements, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The L-Carnitine Supplements segment is anticipated to account for 46.3% of the Isovaleric Acidemia Treatment market revenue share in 2025, establishing it as the leading treatment segment. This position has been supported by its established efficacy in enhancing metabolic function and facilitating the excretion of toxic metabolites, as recognized in pediatric metabolic treatment protocols and clinical practice guidelines.

The segment’s prominence has also been maintained due to its widespread adoption in both acute and maintenance phases of therapy, reducing the risk of metabolic decompensation in affected individuals. Clinical publications have emphasized that the safety profile, ease of administration, and availability of L-Carnitine in oral and injectable formulations have contributed significantly to its continued use.

Hospitals and metabolic disorder clinics have standardized its inclusion in treatment regimens, further driving demand The affordability of L-Carnitine Supplements compared to enzyme replacement or investigational therapies has also strengthened its market position, making it a cornerstone in the clinical management of isovaleric acidemia.

The isovaleric acidemia treatment market was valued at USD 553.9 Million in 2020 while exhibiting a CAGR of 4.64%. Adoption of new technology such as mRNA in metabolic testing procedures is expected to shift the pharmaceutical industry to new heights which are augmenting the demand for the Isovaleric Acidemia treatment market. Considering these factors, the market is estimated to be valued at USD 1,125.15 Million, growing at a CAGR of 5.6% by end of the forecast period.

The advent of new technologies in IVA fuelling market growth

The advent of tandem mass spectrometry expanded newborn screening (NBS) and has become a mandatory public health strategy in most developed and developing countries, which will drive market growth.

Moreover, this technology allows inexpensive simultaneous detection of more than 30 different metabolic disorders like Isovaleric Acidemia Treatment, in one single blood spot specimen at a cost of about USD 10 per baby, with commendable analytical accuracy and precision, which will bolster the demand for Isovaleric Acidemia Treatment drug and therapeutics during the forecast period. studies have confirmed that the savings achieved through the use of expanded NBS programs are significantly greater than the costs of implementation.

Autonomy for local screening agencies to develop their screening programs in order to keep pace with international advancements is expected to support market expansion. Integration of existing clinical IEM services with the expanded NBS program to enable close communication between the laboratory, clinicians, and allied health parties.

The adjuvant therapy with sapropterin is also helpful for PKU treatment. In recent years, private medical insurers in the USA and a few other countries are also offering reimbursement programs for the consumption of certain medical foods. Thus, the rising adoption of medical food and nutrient supplements is expected to foster market growth during the forecast period.

High cost of diagnostic treatment restraining market expansion

Inadequate reimbursement scenario, high cost of treatment and delayed adoption of new emerging diagnostic and therapeutic technologies will restrain the market growth during the forecast period.

North America was the largest market for Isovaleric Acidemia Treatment therapeutics with a market share of 41.8% in 2025. The market revenue in this region is projected to be valued at around USD 1254.3 Million by 2035. It is likely to show prominent growth while retaining its dominance during the forecast period.

This is due to the increase in demand for sapropterin and kuvan for amino acid metabolism disorders treatments in the region. Moreover, the region boasts of a wide availability of treatments and a well-established healthcare infrastructure.

The extensive presence of several end-users focusing on treatment and studies of chronic disease makes use of metabolomics, and this is the primary driver of market growth in the region. The active participation of the government in the form of investment and world-class resources for research activities is driving the growth of the metabolomics market in the region of Canada.

The market in Asia Pacific is estimated to be valued at USD 350 Million, trailing at a CAGR of 4.9% during the forecast period. Growing investments in diagnostic healthcare, increasing adoption of new technologies, rising prevalence of inherited metabolic disorders in other regions, and increasing awareness regarding health are fuelling the demand for isovaleric acidemia disorder therapeutics in the region.

China is expected to dominate the Inborn errors of metabolism market with more than 41% market share in this region owing to the rapid adoption of mRNA technology in diagnostics and surging advancements in the medical sector.

The supplements carnitine and glycine can reduce the toxicity of isovaleric acid and aid in its removal from the body. L-Carnitine supplements are expected to dominate the treatment segment with a share of 79% and are projected to retain the highest weight during the forecast period.

Administration of equimolar amounts of glycine or L-carnitine separately with leucine demonstrated that isovaleryl-coenzyme A is removed by supplemental L-carnitine in the form of isovalerylcarnitine as effectively as it is by glycine, in the form of isovalerylglycine. Treatment with L-carnitine alone has proven effective in preventing further hospitalizations in a patient with this disorder, which will drive the segment growth by end of the forecast period.

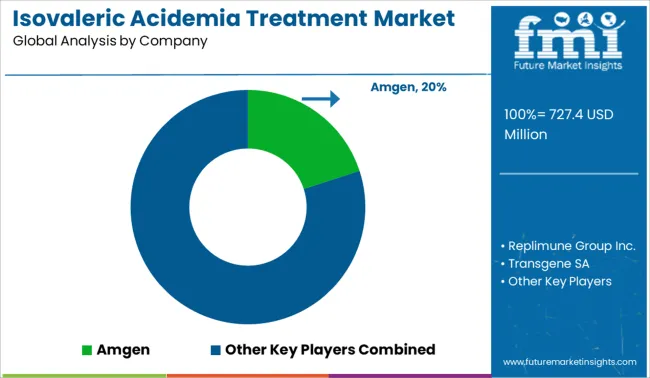

Key players in the Isovaleric Acidemia Treatment Market are Amgen, Replimune Group Inc., Transgene SA, Oncolys BioPharma, Targovax, Lokon Pharma, Vyriad, TILT Biotherapeutics, VCNBiosciences, DNAtrix.

Some Recent Developments in this industry are:

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 727.4 million |

| Market Value in 2035 | USD 1254.3 million |

| Growth Rate | CAGR of 5.6% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in US Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Treatment, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa (MEA) |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The UK, France, Spain, Russia, Italy, India, China, Japan, South Korea, Saudi Arabia, Australia, New Zealand, UAE, South Africa, Israel |

| Key Companies Profiled | Amgen; Replimune Group Inc.; Transgene SA; Oncolys BioPharma; Targovax; Lokon Pharma; Vyriad; TILT Biotherapeutics; VCNBiosciences; DNAtrix |

| Customization | Available Upon Request |

The global isovaleric acidemia treatment market is estimated to be valued at USD 727.4 million in 2025.

The market size for the isovaleric acidemia treatment market is projected to reach USD 1,254.3 million by 2035.

The isovaleric acidemia treatment market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in isovaleric acidemia treatment market are l-carnitine supplements, glycine supplements and others.

In terms of , segment to command 0.0% share in the isovaleric acidemia treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA