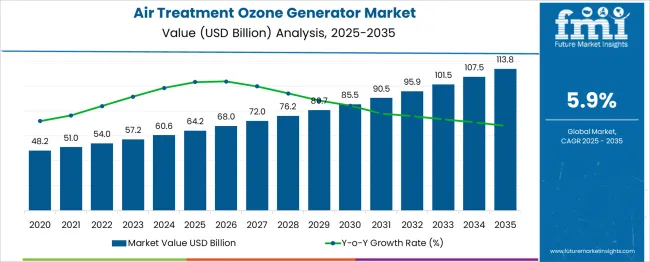

The Air Treatment Ozone Generator Market is estimated to be valued at USD 64.2 billion in 2025 and is projected to reach USD 113.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. The air treatment ozone generator market is currently positioned along the expanding phase of the Market Maturity Curve, progressing steadily through the adoption lifecycle. In the early years (2025–2029), the market is transitioning from early adopters to early majority, driven by increasing concerns over indoor air pollution, industrial emissions, and the need for sterilized air in healthcare, food processing, and public facilities.

Government regulations promoting clean air standards, especially in urban and industrial zones, are accelerating adoption. The market from 2030 onwards enters a more accelerated early majority phase, as commercial, residential, and industrial sectors standardize the integration of ozone-based purification systems. This period witnesses increased product standardization, price optimization, and the emergence of multifunctional and energy-efficient ozone generators. By the final stretch (2033–2035), the market approaches the late majority, characterized by high penetration, greater competition, and innovation-driven differentiation such as IoT-enabled monitoring, automated dosage controls, and safety features. As the market nears USD 113.8 billion, players will need to focus on product diversification and regional customization to sustain growth in a maturing demand environment.

| Metric | Value |

|---|---|

| Air Treatment Ozone Generator Market Estimated Value in (2025 E) | USD 64.2 billion |

| Air Treatment Ozone Generator Market Forecast Value in (2035 F) | USD 113.8 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The air treatment ozone generator market is witnessing steady growth as industries and public institutions seek advanced air purification technologies to address growing air quality concerns. Rising awareness of airborne pathogens, volatile organic compounds (VOCs), and chemical pollutants is driving the demand for ozone-based treatment systems in manufacturing, healthcare, and commercial sectors.

Technological advancements in generator efficiency, miniaturization, and operational safety are supporting expanded application across diverse environments. Stringent regulatory frameworks on industrial emissions and indoor air quality have further accelerated the adoption of ozone generators as a reliable treatment method.

Additionally, the integration of these systems with HVAC infrastructure and smart monitoring capabilities is enhancing usability and compliance, creating strong opportunities for long-term deployment. As urbanization intensifies and environmental regulations tighten globally, ozone generator solutions are expected to play a critical role in meeting clean air benchmarks and sustainability mandates.

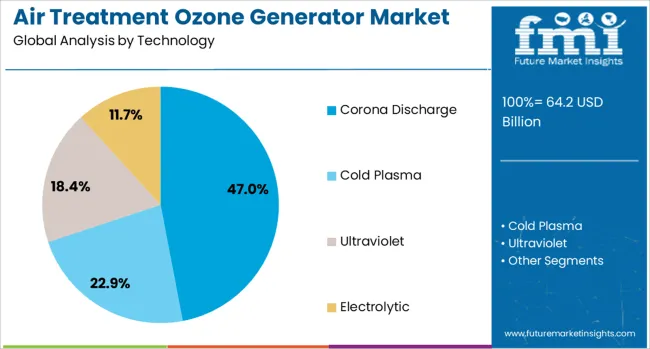

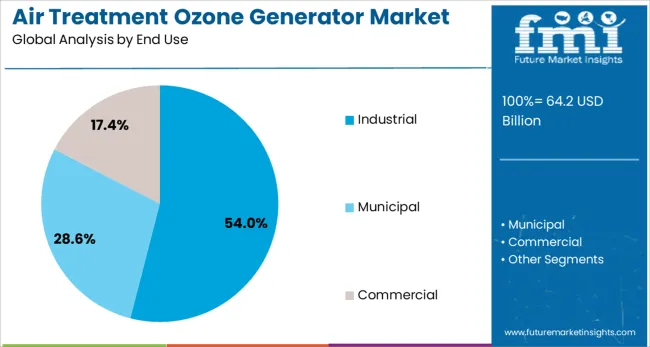

The air treatment ozone generator market is segmented by technology, end use, and geographic regions. The technology of the air treatment ozone generator market is divided into Corona Discharge, Cold Plasma, and Ultraviolet Electrolytic. In terms of end use, the air treatment ozone generator market is classified into Industrial, Municipal, and Commercial. Regionally, the air treatment ozone generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Corona discharge technology is projected to contribute 47.0% of the total revenue in the air treatment ozone generator market by 2025, making it the dominant technological approach. This leadership has been driven by the technology’s proven efficiency in generating high ozone concentrations with relatively low energy input.

Its scalability, ease of integration into fixed and portable air treatment systems, and low operational cost have positioned it as a preferred choice for industrial and commercial air purification. The ability of corona discharge systems to operate continuously and with high reliability has further reinforced their suitability for environments requiring long-duration treatment.

Moreover, advances in dielectric materials and power supply design have enhanced system longevity and ozone output control, supporting their continued preference in mission-critical applications.

The industrial segment is expected to account for 54.0% of the air treatment ozone generator market revenue in 2025, positioning it as the leading end-use category. The increasing need for odor control, emissions reduction, and sterilization in sectors such as food processing, chemical manufacturing, and pharmaceuticals is fueling growth in this segment.

Ozone’s ability to break down complex organic compounds and neutralize airborne contaminants has made it an effective tool for industrial air management. Regulatory compliance on workplace safety and environmental emissions has prompted factories and processing plants to adopt ozone-based solutions to meet air quality standards.

Additionally, the use of ozone generators in high-occupancy facilities such as warehouses and industrial kitchens is expanding, owing to their minimal chemical residue and low maintenance footprint. These functional advantages support broader industrial deployment and long-term adoption.

The air treatment ozone generator market is expanding as industrial, commercial, and residential sectors seek more effective methods for odor removal, air purification, and microbial control. Ozone generators are valued for their ability to neutralize airborne pathogens, volatile organic compounds, and persistent odors without chemical residues. Adoption is strong in waste treatment, food processing, hotel maintenance, and healthcare environments. Market players differentiate through design safety, ozone output control, and portable or duct-integrated solutions that cater to various application scales and regulatory frameworks.

Industrial sectors such as wastewater treatment, food processing, and manufacturing are increasingly using ozone generators to purify air, disinfect environments, and control odors. In these settings, ozone treatment offers a powerful, residue-free alternative to chemical disinfectants. Ozone generators are commonly installed in ventilation systems or as standalone units in storage rooms and sanitation areas. Facilities handling perishable goods or managing waste benefit from ozone’s ability to suppress bacteria and mold. In manufacturing, ozone is used to improve indoor air quality by reducing volatile organic compounds and airborne contaminants. As industries tighten hygiene and environmental control standards, the demand for high-capacity, adjustable-output ozone generators is growing. These systems require robust engineering, advanced safety protocols, and automated controls to prevent human exposure to excess ozone levels. Market growth is supported by increased investment in environmental health systems and air quality compliance, especially in sectors sensitive to odor or contamination-related liabilities.

While ozone generators are effective in many air treatment applications, concerns around safety and health risks limit their use in some commercial and residential environments. High ozone concentrations can be harmful to humans, potentially causing respiratory irritation, chest discomfort, or other adverse health effects. Regulatory agencies have issued strict guidelines on indoor ozone exposure, which makes it necessary for manufacturers to incorporate safety controls and provide proper user education. In commercial settings such as offices, hotels, or public buildings, facility managers must weigh the benefits of ozone use against the potential risks to occupants. Misuse or overuse of ozone-generating equipment can lead to indoor air quality issues rather than improvements. These challenges create hesitation among certain user segments and require continuous training and monitoring protocols. As a result, while the technology holds promise, adoption in sensitive environments is limited without strong safeguards, which restricts the market's potential for mass penetration across general commercial use.

Ozone generators are finding increased use in odor-sensitive commercial and service industries where sanitation is critical. Hotels, gyms, kitchens, and vehicle detailing services rely on ozone treatment to eliminate strong odors from smoke, mildew, and organic decay. In these segments, the appeal lies in ozone’s ability to reach areas traditional cleaning methods cannot, such as ventilation ducts or porous materials. Cleaning services, hospitality operators, and restoration contractors are investing in portable ozone generators that can quickly sanitize rooms or vehicles without leaving chemical traces. The market is also benefiting from rising demand for odor-free indoor spaces in pet care centers, real estate staging, and rental properties. These niche yet high-volume applications drive sales of compact, timer-controlled, and user-friendly devices. Manufacturers focusing on plug-and-play models with digital safety cutoffs are gaining traction. The shift toward higher hygiene standards and odor-free environments in customer-facing businesses continues to open up new demand clusters for ozone-based air treatment systems.

The regulatory environment surrounding ozone generators is inconsistent across regions, which creates challenges for market expansion. In some jurisdictions, ozone generators are considered air purifiers, while in others, they are classified under medical or industrial equipment regulations. Additionally, product labeling requirements vary significantly, particularly in how ozone output and safety instructions must be communicated. Misalignment between safety standards, such as those from environmental or occupational health agencies, complicates global distribution. Manufacturers must navigate country-specific guidelines for allowable ozone concentrations, permitted applications, and usage environments. Failure to meet local labeling or usage rules can result in fines, recalls, or restricted product access. This complex compliance landscape forces producers to customize documentation and sometimes alter product functionality based on target markets. Until a more harmonized framework emerges, especially for indoor-use devices, regulatory unpredictability will remain a hurdle for product standardization and international scaling. Companies investing in certification and transparent performance testing gain an edge in market credibility.

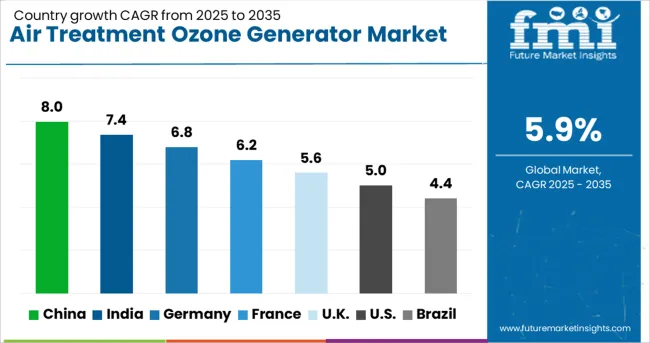

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

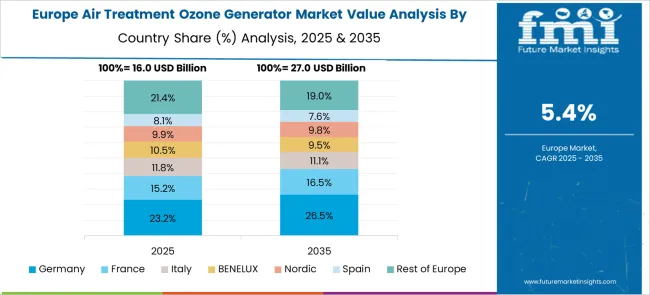

The global air treatment ozone generator market is growing at a CAGR of 5.9%, driven by increasing concerns over indoor air quality, industrial emissions, and the need for effective disinfection technologies. China leads with 8.0% growth, supported by rapid industrialization and rising adoption in water and air purification systems. India follows at 7.4%, fueled by expanding urban infrastructure and rising demand for affordable air treatment solutions. Germany records 6.8% growth, reflecting strong environmental standards and widespread use in industrial and commercial air purification. The United Kingdom shows steady growth at 5.6%, with applications expanding in healthcare, hospitality, and public infrastructure. The United States, growing at 5.0%, remains a key market shaped by stringent air quality regulations and growing integration of ozone technology in HVAC systems. Market trends are influenced by ozone output control, energy efficiency, and compliance with safety guidelines. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the air treatment ozone generator market with an 8.0% CAGR, driven by stringent air quality regulations and rising demand for sterilization across commercial and industrial sectors. Urban pollution concerns and public health awareness are encouraging the installation of ozone-based air purification systems in hospitals, transit hubs, and office complexes. Local manufacturers are scaling up production of portable and centralized ozone generators, offering cost-effective options for building operators. Integration with HVAC systems is becoming common in new commercial buildings. The food processing and pharmaceutical sectors are also adopting ozone generators to ensure contaminant-free environments. Innovation in smart control systems and energy-efficient ozone generation is further expanding application scope.

India is seeing a 7.4% CAGR in the air treatment ozone generator market, driven by demand for indoor air quality improvement in urban centers and public facilities. Rising use in healthcare, hospitality, and manufacturing is contributing to consistent market growth. Ozone generators are increasingly being used for odor control and disinfection in metro stations, malls, and commercial buildings. Domestic manufacturers are introducing compact models suited for small offices and clinics, while international brands are supplying high-capacity systems to industrial clients. Awareness campaigns and hygiene regulations are expanding adoption in food service and pharmaceuticals. Low maintenance costs and minimal chemical usage are viewed as major advantages.

Germany is registering a 6.8% CAGR in the air treatment ozone generator market, supported by environmental standards, technological innovation, and demand from cleanroom and industrial applications. Ozone systems are widely used in laboratories, food processing units, and commercial HVAC integrations for sterilization and odor control. German engineering firms are focusing on low-noise, energy-efficient ozone systems with programmable cycles and remote monitoring. Adoption in public transport infrastructure and hospitals is also growing, especially in large urban centers. Stringent emission and workplace hygiene regulations are encouraging facility managers to integrate ozone treatment in existing air systems.

The United Kingdom is experiencing a 5.6% CAGR in the air treatment ozone generator market, driven by increased focus on indoor air quality across healthcare, education, and hospitality sectors. Ozone-based disinfection is gaining traction in response to public health concerns and workplace hygiene expectations. Small-scale ozone devices are popular in clinics, gyms, and hotel rooms for periodic sterilization. Commercial property managers are integrating ozone generators into HVAC systems to improve efficiency and air safety. Import reliance is shifting as local distributors partner with European suppliers to meet demand. Innovation in low-residue ozone solutions is also being explored.

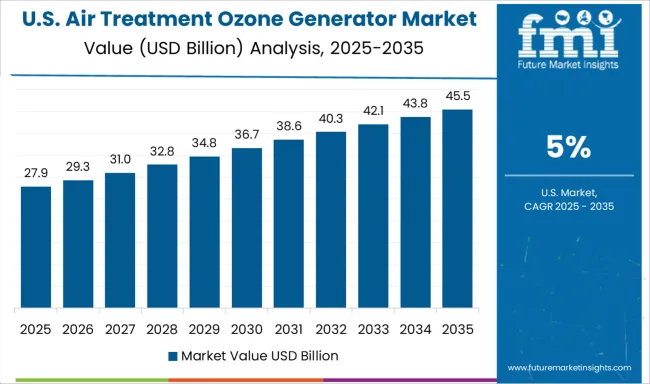

The United States is reporting a 5.0% CAGR in the air treatment ozone generator market, supported by applications in healthcare, commercial buildings, and cleanroom environments. Public demand for air purification systems is rising, particularly in response to concerns about airborne pathogens. Hospitals, schools, and food facilities are utilizing ozone generators for periodic disinfection and odor management. US manufacturers are focusing on scalable, automated systems that can be integrated with building controls. Regulatory awareness regarding safe ozone levels is shaping product design. E-commerce is helping boost access to small-format ozone devices for use in offices and fitness centers.

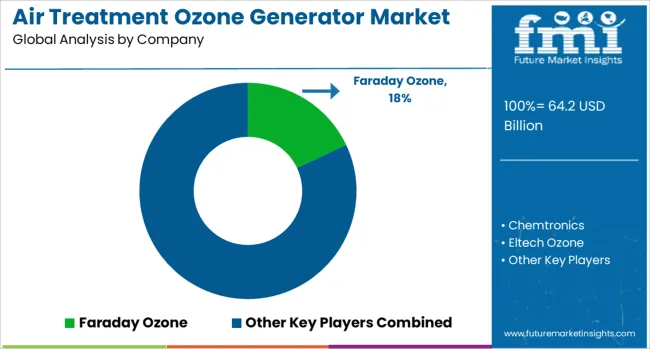

The Air Treatment Ozone Generator Market revolves around equipment designed to purify and disinfect air by generating ozone, which helps neutralize odors, bacteria, viruses, and other contaminants. This technology is widely used in commercial and industrial settings such as healthcare facilities, food processing plants, water treatment, and HVAC systems to improve air quality and maintain hygienic environments. Leading companies in this market include Faraday Ozone, Chemtronics, and Eltech Ozone, which provide reliable and scalable ozone generation systems tailored for diverse applications. These manufacturers focus on delivering ozone generators that can be integrated with existing air treatment solutions or operate as standalone units.

Enaly Ozone and Airthereal emphasize compact and user-friendly designs suitable for smaller commercial spaces or specialized air purification needs. Other important market participants such as Lenntech Air Treatment, OZ-Air, and Ozonetech develop custom solutions catering to large-scale industrial processes, where precise ozone dosing and robust equipment durability are critical. Oxidation Technologies and Ozone Solutions support sectors requiring stringent air quality controls, often working alongside regulatory bodies to ensure compliance and efficiency in ozone application. The increasing attention to air quality in enclosed environments drives steady adoption of ozone generators, with market players continuously refining product reliability and application versatility to meet industry-specific demands.

In 2025, Longsun launched the LS-6G-OGS commercial ozone generator, delivering 6,000 mg/h ozone output with advanced air-cooling and timer features. Certified for multiple safety standards, it targets diverse spaces like schools and offices, enhancing air purification by effectively eliminating odors and pollutants through ozone technology.

| Item | Value |

|---|---|

| Quantitative Units | USD 64.2 Billion |

| Technology | Corona Discharge, Cold Plasma, Ultraviolet, and Electrolytic |

| End Use | Industrial, Municipal, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Faraday Ozone, Chemtronics, Eltech Ozone, Enaly Ozone, Airthereal, Lenntech Air Treatment, OZ-Air, Ozonetech, Oxidation Technologies, and Ozone Solutions |

| Additional Attributes | Dollar sales vary by technology type, with corona discharge, UV, and electrolysis systems; by end-use sector, including commercial, healthcare, and residential applications; by region, led by North America, Asia-Pacific, and Europe. Pricing depends by regulatory compliance and product complexity. Growth driven by IoT-enabled control, compact designs, and increasing air quality standards. |

The global air treatment ozone generator market is estimated to be valued at USD 64.2 billion in 2025.

The market size for the air treatment ozone generator market is projected to reach USD 113.8 billion by 2035.

The air treatment ozone generator market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in air treatment ozone generator market are corona discharge, cold plasma, ultraviolet and electrolytic.

In terms of end use, industrial segment to command 54.0% share in the air treatment ozone generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA