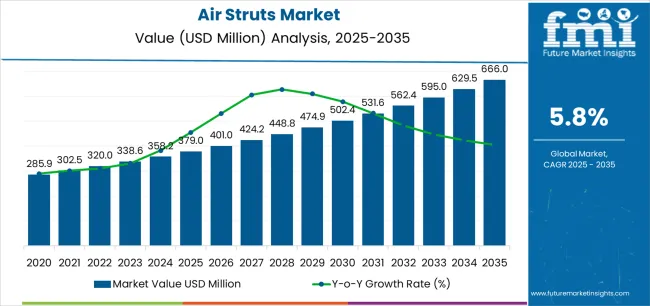

The air struts market is forecast to grow steadily from USD 379 million in 2025 to USD 666 million by 2035, with a CAGR of 5.8%. The key factors driving this growth include rising demand for advanced suspension systems in luxury, electric, and other high-performance vehicles. Air struts are preferred for their ability to offer a smooth, comfortable ride and improved load management, making them ideal for modern automotive designs. As the automotive industry places greater focus on comfort, safety, and performance, air struts will become increasingly integrated into a wide range of vehicles, boosting market demand over the next decade.

With the rise of electric vehicles (EVs) and greater demand for adaptive suspension systems, air struts are expected to see increased adoption due to their ability to improve driving experiences. These systems not only provide better ride quality but also support fuel efficiency and vehicle safety. The growing focus on comfort, reduced emissions, and enhanced vehicle dynamics will likely result in a steady shift toward air suspension systems, further expanding the air struts market. The evolving consumer preferences for high-performance, efficient, and comfortable vehicles will continue to influence market growth, positioning air struts as an essential component in future vehicle designs.

From 2025 to 2030, the air struts market is expected to grow from USD 379 million to USD 502.4 million, representing an increase of USD 123.4 million. This growth accounts for nearly 40% of the total market expansion over the decade, driven by the increased adoption of air suspension systems in luxury cars and electric vehicles (EVs). As vehicle manufacturers focus on enhancing ride quality, comfort, and performance, air struts will become more integrated into the design of next-generation vehicles, particularly those in the high-performance and EV sectors. The push for improved fuel efficiency and better vehicle dynamics will also support this demand, ensuring that air struts remain a critical component of automotive suspension systems.

Between 2030 and 2035, the market will expand further from USD 502.4 million to USD 666 million, adding another USD 163.6 million to its value. This phase will see continued growth driven by the ongoing integration of air suspension systems in electric vehicles and high-performance cars, where comfort, safety, and enhanced driving experience are prioritized. The growing emphasis on fuel-efficient and eco-friendly vehicle designs will lead to further adoption of air struts. As the automotive industry continues to innovate and evolve, the demand for air struts will remain robust, ensuring sustained growth throughout the forecast period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 379 million |

| Market Forecast Value (2035) | USD 666 million |

| Forecast CAGR (2025-2035) | 5.8% |

The air struts market grows as automakers and OEMs adopt air suspension systems to improve vehicle comfort, performance, and stability while meeting growing consumer expectations for enhanced ride quality and handling. Manufacturers face increasing pressure to develop more advanced suspension solutions, as air struts offer significant advantages over traditional suspension systems, including adjustable load capacity and superior ride comfort. These systems, typically providing a 40-60% improvement in vehicle stability and ride quality, are essential for premium vehicles and engineering vehicles that require reliable, high-performance suspension systems.

The automotive industry’s need for innovative suspension solutions, capable of delivering superior comfort and operational effectiveness, drives demand for air struts. The integration of air struts in both luxury vehicles and engineering vehicles ensures consistent vehicle performance under varying load conditions, making them a preferred choice. As electric vehicles (EVs) and sustainable mobility gain momentum, the demand for air struts is expected to rise, as these systems offer enhanced ride quality and weight optimization, key factors in vehicle efficiency.

Government initiatives promoting electric vehicle adoption and sustainable transport technologies are accelerating the transition toward air suspension systems, particularly in markets such as Europe and Asia-Pacific. However, the high upfront cost of air suspension systems, along with the complexity of maintaining and servicing air struts, may limit market accessibility in cost-sensitive segments, restricting growth in developing regions and smaller automotive markets.

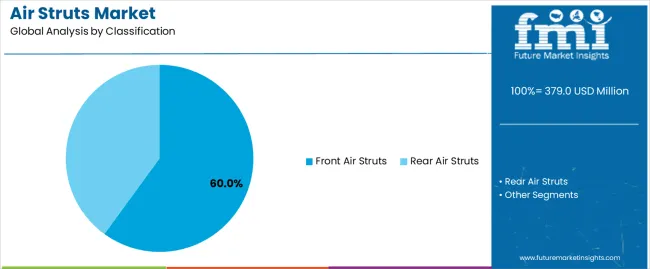

The air struts market is segmented by classification, application, and region. By classification, the market is divided into front air struts and rear air struts, with front air struts leading the market due to their widespread use in passenger vehicles. In terms of application, the market is primarily driven by passenger cars, which make up the largest share, followed by engineering vehicles and other applications such as commercial vehicles. Regionally, Asia-Pacific, particularly China and India, are expected to see significant growth due to increasing demand for electric vehicles and premium cars in these regions, with Europe and North America also showing steady growth, driven by advanced automotive manufacturing and a strong emphasis on vehicle performance and comfort.

The front air struts segment dominates the Air Struts Market, capturing around 60% of the market share. Front air struts are crucial in providing vehicle stability, ride comfort, and enhanced handling in passenger vehicles, making them essential for both luxury vehicles and high-performance cars. They help absorb road shocks, maintain consistent ride height, and improve steering response, which are all vital for ensuring a smooth and controlled driving experience.

As consumer demand for premium vehicles and electric vehicles (EVs) grows, the need for advanced suspension systems like front air struts increases. These systems are particularly popular in luxury and electric vehicles, where vehicle performance, safety, and comfort are top priorities. As a result, front air struts are expected to continue dominating the market in the coming years, particularly as vehicle manufacturers shift towards more sustainable and high-performance suspension systems.

The passenger car segment is the largest application for air struts, accounting for around 55% of the total market share. The growing demand for luxury cars and electric vehicles (EVs) has significantly contributed to the rise in adoption of air suspension systems, including air struts. These systems provide superior ride quality, vehicle stability, and adjustable load capacity, making them an ideal choice for premium cars.

As automakers strive to meet consumer expectations for comfort and vehicle performance, air struts are becoming increasingly integrated into high-end and electric vehicle models. Moreover, electric vehicles benefit from air suspension systems as they help optimize vehicle weight distribution and contribute to fuel efficiency. The focus on ride comfort and handling performance in passenger cars, combined with growing EV adoption, ensures that this segment remains a leading driver of the Air Struts Market growth.

The air struts market is driven by rising demand for premium vehicles and electric vehicles (EVs), where ride comfort and vehicle stability are increasingly prioritized. Air suspension systems, including air struts, offer superior performance and handling, making them essential for high-end and electric models. However, high upfront costs and maintenance requirements are significant barriers to adoption, particularly in low-cost vehicle segments.

Key trends shaping the market include the growing adoption of electric vehicles, the rise of smart suspension systems, and the demand for sustainable and lightweight materials. As automakers continue to emphasize vehicle performance and comfort, and with the increasing need for load-optimizing suspension systems in engineering vehicles, the Air Struts Market is set to experience steady growth.

What Are the Key Drivers of the Air Struts Market?

The air struts market is primarily driven by the growing demand for premium vehicles and electric vehicles (EVs), where ride comfort, vehicle stability, and advanced suspension systems are highly prioritized. Air struts provide superior ride quality and handling performance, which are essential in luxury vehicles and high-performance cars. As consumer preferences shift towards more comfortable and stable driving experiences, automakers are increasingly integrating air suspension systems, including air struts, to meet these demands. The rise of electric vehicles (EVs), which require lightweight and efficient suspension solutions, is further contributing to the growth of this market.

Government incentives promoting clean transportation and sustainable mobility are driving the adoption of electric vehicles and air suspension systems, leading to a boost in air struts demand. Additionally, the increasing focus on engineering vehicles and commercial vehicles that require enhanced load handling and vehicle stability further fuels the market’s growth. As the automotive industry continues to innovate and prioritize vehicle performance, air struts will play a central role in shaping the future of vehicle suspension systems.

What Are the Key Restraints in the Air Struts Market?

Despite its growth potential, the air struts market faces several key restraints. One of the primary challenges is the high upfront cost of air suspension systems, which are more expensive compared to traditional suspension systems. This cost can be a significant barrier, particularly in low-cost vehicle segments. Air struts require more complex manufacturing and specialized components, leading to higher costs that may deter automakers from adopting these systems in economy vehicles. Additionally, maintenance costs associated with air suspension systems, including the need for periodic servicing of air compressors and struts, could be a concern for consumers and fleet operators, especially in developing markets.

The lack of awareness about the benefits of air suspension systems, especially in regions where traditional suspension technologies dominate, also hampers market growth. Moreover, supply chain challenges and fluctuations in raw material prices could lead to price instability and affect the production timelines for air struts, further complicating market dynamics. These factors may limit the widespread adoption of air suspension systems in certain regions or vehicle segments.

What Are the Key Trends in the Air Struts Market?

Several key trends are shaping the future of the air struts market. First, the increasing adoption of electric vehicles (EVs) is driving the demand for air suspension systems, including air struts, due to their lightweight and efficiency in enhancing vehicle performance. EVs, with their growing popularity in luxury and high-performance vehicle segments, require advanced suspension systems for superior ride comfort and handling. The rise of smart suspension systems is another key trend, where air struts are being integrated with adaptive suspension technologies that adjust to real-time road conditions, improving vehicle dynamics.

Additionally, automakers are increasingly integrating air suspension systems in premium vehicles, offering a competitive edge in ride quality and vehicle stability. Sustainability continues to drive the demand for lightweight materials and efficient suspension technologies, making air suspension an attractive solution for reducing vehicle weight and improving overall fuel efficiency. The engineering vehicle segment is also growing due to the demand for load-optimizing suspension systems in construction and heavy machinery, offering growth opportunities for air struts in these applications. These trends are expected to contribute significantly to the ongoing expansion of the Air Struts Market.

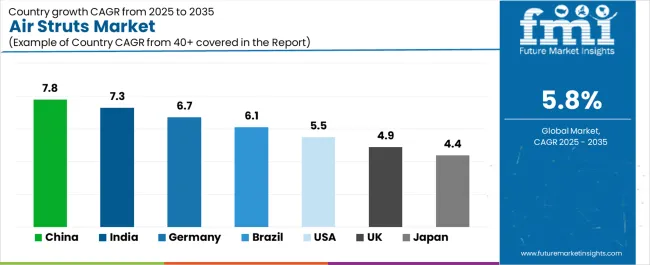

The air struts market is experiencing varied growth across different countries, driven by regional adoption of electric vehicles (EVs), premium vehicles, and engineering vehicles. China and India show the highest growth potential, due to increasing demand for air suspension systems in passenger cars and engineering vehicles. Germany and the USA also represent major markets, benefiting from established automotive industries and a strong focus on vehicle performance and comfort. Meanwhile, Brazil, the UK, and Japan show steady growth driven by the ongoing expansion of premium vehicle adoption and the need for advanced suspension systems. As air struts become increasingly integral to modern vehicle design, the market in these countries is poised for significant expansion.

| Country | CAGR (%) |

|---|---|

| China | 7.8 |

| India | 7.3 |

| Germany | 6.7 |

| Brazil | 6.1 |

| USA | 5.5 |

| UK | 4.9 |

| Japan | 4.4 |

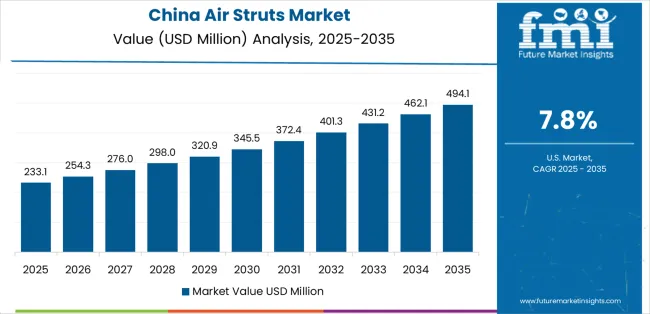

China is expected to dominate the Air Struts Market with a CAGR of 7.8%, primarily due to high automotive production volume, rapid expansion of electric vehicles, and rising demand for premium passenger cars with improved ride comfort and handling stability. The Chinese government continues to promote electric mobility and automotive electrification through subsidies, charging infrastructure expansion, and fuel efficiency mandates, all of which increase the adoption of air suspension systems.

Air struts are also gaining traction in China’s engineering vehicle sector, where heavy construction machinery and commercial vehicles require adjustable load-handling capabilities and improved stability across varied terrains. Local manufacturing clusters, including domestic suppliers with cost-optimized production capabilities, further support market expansion. As automotive OEMs increase their use of advanced suspension systems to differentiate vehicle performance, comfort, and durability, the demand for air struts is expected to remain strong across both premium passenger vehicle platforms and utility-focused engineering vehicles in China.

India, growing at a CAGR of 7.3%, is becoming a key market for air struts, driven by the increasing adoption of electric vehicles (EVs) and premium cars. The Indian government’s push towards electric mobility through initiatives like the FAME initiative is accelerating demand for advanced suspension technologies like air struts. The passenger car segment, particularly in the luxury vehicle market, is driving growth, as consumers demand enhanced ride comfort and vehicle performance. Furthermore, engineering vehicles used in road construction, mining, and logistics are increasingly utilizing air suspension systems to address load-bearing challenges and stability demands.

Indian consumers are also showing greater preference for premium vehicle features associated with comfort and driving smoothness, supporting the adoption of front air struts and adjustable suspension systems. Local suppliers are scaling manufacturing capabilities to reduce component import dependency, which is expected to further strengthen domestic market accessibility for air struts. As automotive infrastructure modernizes, India is positioned to sustain long-term demand growth across both passenger and industrial vehicle segments.

Germany, with a CAGR of 6.7%, remains a central market due to its strong automotive sector, which prioritizes vehicle performance, ride quality, and suspension technologies. Air struts are widely used in performance-focused vehicle platforms produced by German automakers, supporting improved handling stability, adaptive ride height control, and enhanced occupant comfort. The transition toward electric vehicles is further stimulating adoption, as air suspension systems play a role in improving aerodynamic efficiency and load distribution in battery-electric vehicles.

Germany also invests significantly in research and development for smart suspension technologies, where integrated electronic control systems adjust damping in real time based on road and driving conditions. Engineering vehicles used in construction and logistics applications additionally contribute to market demand, given the need for safe and stable transport under variable load conditions. As Germany advances toward sustainability objectives and next-generation automotive platforms, air struts will continue to be integrated into new vehicle architectures.

Brazil, with a CAGR of 6.1%, shows steady growth in the Air Struts Market, driven by the increasing demand for engineering vehicles, commercial fleets, and rising awareness of suspension performance benefits in passenger vehicles. The demand for electric vehicles (EVs) is also on the rise, as consumers seek more fuel-efficient and environmentally friendly transportation options. As a result, air struts are gaining popularity in passenger cars and engineering vehicles, as they offer superior ride comfort, vehicle stability, and load handling capabilities.

In particular, engineering vehicles used in Brazil’s booming construction and mining sectors require suspension systems capable of handling heavy loads while maintaining stability and comfort. As the Brazilian government pushes for sustainability and clean energy solutions, the demand for air struts will continue to grow, contributing to the expansion of the Air Struts Market in the country.

The USA, with a CAGR of 5.5%, shows steady growth in the Air Struts Market, driven by the country’s emphasis on vehicle performance and advanced suspension technologies. As the demand for luxury vehicles and electric vehicles (EVs) increases, air struts are becoming increasingly integrated into premium and high-performance vehicles for their ability to provide superior ride comfort and handling stability. The automotive industry in the USA continues to evolve with a strong focus on electric mobility, and air suspension systems are critical for optimizing the efficiency and performance of these vehicles.

Additionally, the engineering vehicle sector is expanding, as heavy-duty vehicles require advanced suspension systems for improved load handling and vehicle stability. While initial system costs remain a barrier in lower-price vehicle categories, growing emphasis on vehicle ride dynamics and comfort continues to support market expansion. As the USA automotive sector advances toward autonomous mobility, suspension systems that enhance passenger comfort and vehicle stability are expected to gain additional relevance.

The UK, with a CAGR of 4.9%, shows moderate but consistent growth driven by the increasing adoption of electric vehicles and the sustained presence of the premium passenger vehicle market. Air struts are increasingly used in luxury vehicles to provide enhanced comfort and handling performance, aligning with consumer expectations for refinement and smooth ride experiences. Government policy frameworks promoting carbon neutrality and low-emission transport continue to encourage investments in electric vehicle technology, indirectly supporting air suspension integration.

Engineering vehicles used in infrastructure and public works also contribute to demand, as they require suspension systems capable of maintaining load stability across diverse terrain conditions. Supply chain restructuring following Brexit has led to increased collaboration between domestic component distributors and international suspension system manufacturers. As the United Kingdom expands its electric vehicle charging network and urban mobility programs, air struts are expected to gain a stronger position in both passenger vehicle and fleet applications.

Japan, growing at a CAGR of 4.4%, maintains steady demand supported by its strong automotive manufacturing environment and emphasis on advanced vehicle engineering. Air struts are commonly integrated into premium and performance vehicle segments to achieve smooth ride quality and improved handling dynamics. Japan’s growing electric vehicle market further supports adoption, as suspension systems like air struts play a role in maintaining vehicle balance and efficiency, especially where battery weight distribution affects vehicle dynamics.

Engineering vehicles used in infrastructure development and industrial operations also require stable suspension systems to manage fluctuating load conditions. Japan’s focus on high-quality manufacturing and precision engineering ensures continued interest in technologies that enhance driving comfort and safety. Although mass-market penetration is slower due to cost sensitivity, the sustained development of advanced automotive platforms ensures long-term market relevance for air struts.

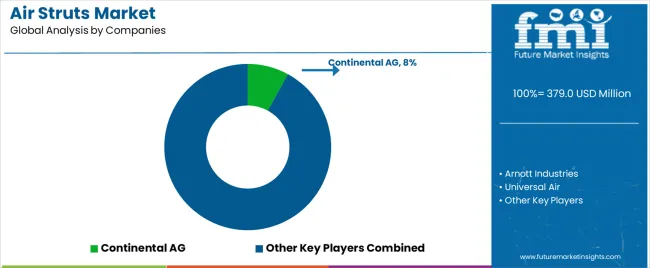

The air struts market is moderately concentrated, with a few key players controlling a significant portion of the market share. Leading companies such as Continental AG, which holds around 8% of the market, dominate through technological innovation, extensive product portfolios, and strong relationships with original equipment manufacturers (OEMs). Other major players, including Arnott Industries, Universal Air, and Guangdong Yiconton Air Spring, focus on developing high-performance air suspension systems for both luxury passenger vehicles and engineering vehicles.

These companies leverage their advanced processing capabilities, ride comfort solutions, and durability to remain competitive, while offering value through suspension system upgrades that meet the growing demand for electric vehicles (EVs) and commercial vehicles. Market leaders continue to invest in R&D to stay ahead of trends, such as the demand for lightweight materials and adaptive suspension technologies, ensuring their position in the expanding market for air suspension systems.

In addition to the major global players, regional companies are contributing to the growth of the Air Struts Market by offering competitive solutions at more cost-effective prices. Companies like Guangzhou Tech Master Auto Parts, Firestone Airide, and Hitachi Astemo are expanding their market share by focusing on specific regional demands and providing products tailored to local automotive manufacturers, particularly in Asia-Pacific and emerging markets.

These regional players are capitalizing on the increasing adoption of engineering vehicles and commercial fleets in markets such as China and India, where the demand for air suspension systems is growing. Their ability to offer cost-effective solutions, paired with localized production capabilities, enables them to compete against established global players, while contributing to the overall expansion of the air struts market. As demand for advanced suspension systems continues to rise, these companies are poised to capture more market share, especially in regions where cost optimization is crucial.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Classification | Front Air Struts, Rear Air Struts |

| Application | Passenger Cars, Engineering Vehicles, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | USA, China, India, Germany, Brazil, Japan, UK, 40+ other countries |

| Key Companies Profiled | Continental AG, Arnott Industries, Universal Air, Guangdong Yiconton Air Spring, Bilstein, Tenneco, Inc., WABCO Holdings Inc., Dunlop Systems & Components, Guangzhou Tech Master Auto Parts, Firestone Airide, Hitachi Astemo, thyssenkrupp AG |

| Additional Attributes | Dollar sales by classification and application categories. It also covers regional adoption trends across major markets such as China, India, Germany, and the USA. The competitive landscape features key players from the automotive components sector, focusing on innovations in air strut systems. Additionally, trends in the growing demand for air struts in passenger cars and engineering vehicles are explored, along with advancements in air suspension technologies and their integration into automotive manufacturing. |

The global air struts market is estimated to be valued at USD 379.0 million in 2025.

The market size for the air struts market is projected to reach USD 666.0 million by 2035.

The air struts market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in air struts market are front air struts and rear air struts.

In terms of application, passenger cars segment to command 55.0% share in the air struts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA