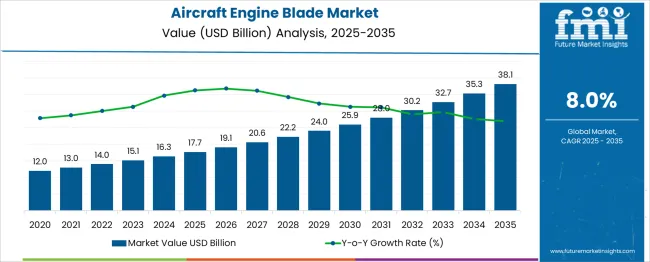

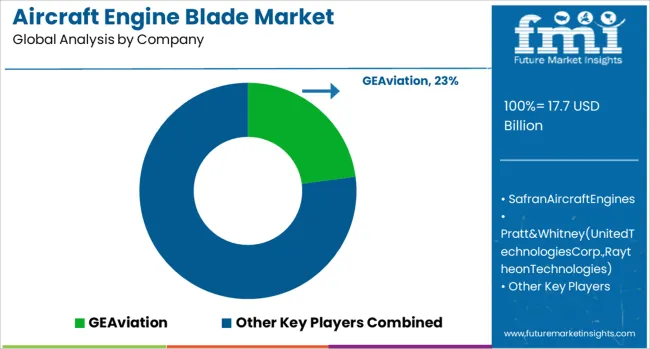

The aircraft engine blade market is set to grow from USD 17.7 billion in 2025 to USD 38.1 billion by 2035, with a global CAGR of 8.0%. A Growth Momentum Analysis shows consistent and strong acceleration throughout the forecast period, with increasing growth rates as the market progresses. This early-phase acceleration is driven by the increasing demand for high-performance, fuel-efficient engines in response to growing air traffic, sustainability concerns, and the push for reduced fuel consumption in the aviation industry.

From 2030 to 2035, the market continues its upward trajectory, moving from USD 17.7 billion to USD 38.1 billion, adding USD 20.4 billion in growth, with a CAGR of 15.1%. This later-phase acceleration is driven by technological innovations in engine efficiency, enhanced materials for longer-lasting blades, and the growing adoption of next-generation aircraft engines, particularly in commercial aviation. The Growth Momentum Analysis indicates that while the market experiences steady growth early on, the latter half of the forecast sees a sharp acceleration as advancements in blade technology, weight reduction, and durability take center stage, reflecting strong industry momentum and increasing global demand for advanced aircraft engine blades.

| Metric | Value |

|---|---|

| Aircraft Engine Blade Market Estimated Value in (2025 E) | USD 17.7 billion |

| Aircraft Engine Blade Market Forecast Value in (2035 F) | USD 38.1 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The aircraft engine blade market is experiencing robust expansion due to the increasing focus on engine efficiency, thrust-to-weight optimization, and sustainability targets in aviation. Airlines and aircraft manufacturers are investing heavily in next-generation propulsion systems that rely on high-performance engine blades to improve fuel economy and reduce emissions. The rising production of narrow-body and wide-body aircraft, along with the accelerated replacement of aging fleets, is driving the demand for precision-engineered blades capable of withstanding extreme pressure and thermal conditions.

Material advancements in titanium alloys and composite reinforcements have enabled enhanced mechanical strength and weight reduction, aligning with stringent performance and environmental standards. Moreover, ongoing innovations in forging, casting, and additive manufacturing processes are enhancing structural reliability while lowering life-cycle costs.

The market outlook is further supported by increased investments in defense aviation programs and growing demand from emerging economies, where regional aircraft and military jet development are advancing rapidly. Over the forecast period, the market is poised to benefit from technology integration, regulatory compliance, and cross-industry collaboration.

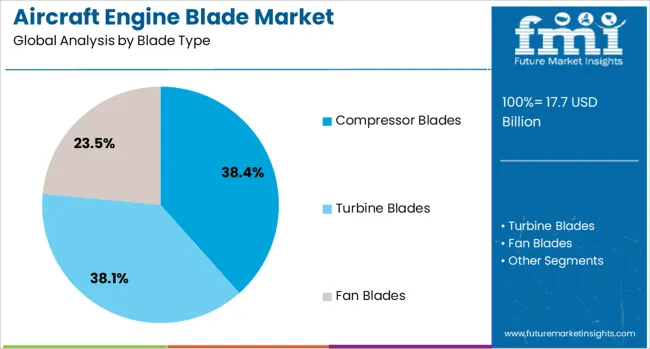

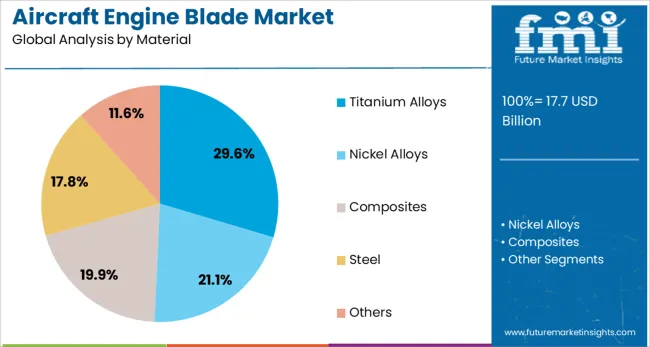

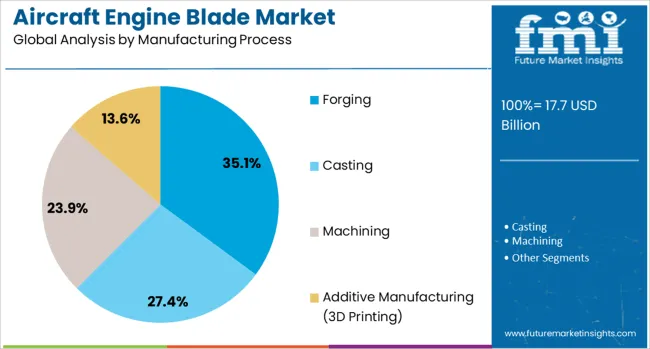

The aircraft engine blade market is segmented by blade type, material, manufacturing process, aircraft type, and geographic regions. By blade type, the market is divided into Compressor Blades, Turbine Blades, Fan Blades. In terms of material, the market is classified into Titanium Alloys, Nickel Alloys, Composites, Steel, Others. Based on manufacturing process, the market is segmented into Forging, Casting, MachiningAdditive Manufacturing (3D Printing). By aircraft type, the market is segmented into Commercial Aircraft, Military Aircraft, Business Jets, Helicopters. Regionally, the aircraft engine blade industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The compressor blades segment is expected to hold 38.4% of the total revenue share in the aircraft engine blade market in 2025, making it the leading blade type. This segment’s dominance is driven by the critical role compressor blades play in determining overall engine efficiency and thrust performance.

These blades operate under high-pressure environments and are responsible for compressing incoming air before it enters the combustion chamber, which directly affects fuel combustion quality and emission levels. Advancements in aerothermal modeling and blade aerodynamic design have enabled the development of high-efficiency compressor blades that contribute to reduced fuel burn and lower operating costs.

Continuous demand for narrow-body aircraft and high-bypass turbofan engines has further increased the production and maintenance cycles for compressor blades. Their enhanced fatigue resistance, optimized flow path configuration, and improved temperature handling have positioned this segment as an essential component of modern jet engines, both in commercial and military aviation programs.

Titanium alloys are projected to account for 29.6% of the total revenue share in the aircraft engine blade market in 2025, reflecting their widespread use as a preferred material. The selection of titanium alloys is largely influenced by their high strength-to-weight ratio, corrosion resistance, and ability to endure extreme mechanical and thermal stress.

These characteristics make them ideal for use in compressor sections and intermediate engine stages where both durability and weight reduction are essential. The material’s compatibility with modern forging and machining techniques has contributed to high-volume adoption in engine programs aimed at improving fuel efficiency.

Additionally, titanium’s non-magnetic and heat-resistant properties align well with engine performance requirements across both commercial aviation and defense sectors. As OEMs and MROs continue to seek materials that balance reliability and lightweight performance, the adoption of titanium alloys is expected to remain robust, supported by technological advancements and secure global supply chains.

The forging segment is anticipated to contribute 35.1% of the total revenue share in the aircraft engine blade market in 2025, establishing itself as the dominant manufacturing process. This process has been widely adopted due to its ability to deliver blades with high structural integrity, fatigue resistance, and dimensional accuracy, all of which are critical for engine safety and performance.

Forging enables enhanced grain flow alignment and minimized internal defects, ensuring consistent mechanical properties across large production runs. The scalability of closed-die forging techniques and compatibility with high-performance materials like titanium and nickel-based alloys have supported its use in mass production for both civil and military aircraft engines.

Moreover, the process offers better resistance to thermal distortion and stress, enabling blades to function efficiently under fluctuating loads and temperatures. As aircraft engines evolve to meet stricter performance and environmental benchmarks, forging remains the manufacturing method of choice for high-reliability engine blade components.

The aircraft engine blade market is expanding due to the increasing demand for high-performance and fuel-efficient aircraft. Engine blades, critical components in jet engines, are designed to withstand extreme operating conditions while maintaining optimal performance. As airlines and aircraft manufacturers prioritize reducing fuel consumption and improving engine efficiency, the demand for advanced engine blade materials and technologies is rising. Despite challenges such as high manufacturing costs and regulatory compliance, innovations in materials science, including advanced composites and alloys, are providing significant growth opportunities in the market.

The primary driver for the growth of the aircraft engine blade market is the rising demand for fuel-efficient, high-performance engines. Airlines and manufacturers are increasingly focusing on improving fuel economy to reduce operating costs and meet environmental regulations. Engine blades play a crucial role in achieving these goals, as they are directly responsible for the efficiency of the engine’s compression, combustion, and thrust processes. Advanced materials such as titanium alloys, composites, and ceramics are being utilized to improve the durability, strength, and weight of engine blades, further driving the market. With increasing global air travel and rising competition in the airline industry, there is a growing emphasis on improving engine performance and reducing fuel consumption.

A key challenge in the aircraft engine blade market is the high manufacturing costs associated with producing high-performance blades. These blades require advanced materials like titanium, nickel alloys, and ceramics, which are expensive to source and process. The complex manufacturing processes, such as precision casting and machining, also contribute to high production costs. Additionally, ensuring the reliability and safety of engine blades under extreme operating conditions, such as high temperatures and pressures, requires stringent testing and quality control, further driving up costs. These factors pose challenges to both manufacturers and customers, particularly in price-sensitive markets or in the face of economic downturns.

The aircraft engine blade market presents significant opportunities through advancements in materials science and design technologies. The development of advanced composite materials, such as carbon-fiber-reinforced polymers and next-generation alloys, is making engine blades lighter, stronger, and more durable. These innovations are improving engine efficiency while reducing fuel consumption, addressing both cost and environmental concerns. The increasing adoption of additive manufacturing (3D printing) is enabling the creation of more complex and customized engine blade designs, further enhancing performance. As air travel continues to rise globally, especially in emerging markets, the demand for more efficient and advanced aircraft engines presents substantial growth opportunities for engine blade manufacturers.

A prominent trend in the aircraft engine blade market is the increasing use of high-temperature resistant materials, such as single-crystal superalloys and ceramic matrix composites, to improve performance and reliability. These materials allow engine blades to withstand the extreme heat and stress encountered in modern jet engines, enhancing fuel efficiency and extending the lifespan of the components. The adoption of 3D printing technology in the production of engine blades is gaining traction. This technology enables manufacturers to create complex geometries with reduced waste, improve part performance, and shorten production cycles. As these trends continue to shape the industry, innovations in materials and manufacturing methods will drive the next generation of aircraft engine blades.

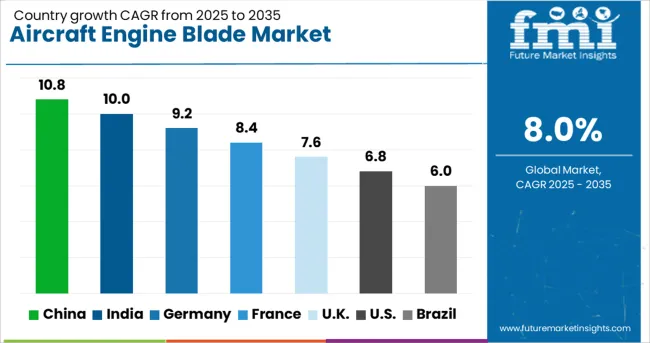

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The aircraft engine blade market is projected to grow at a global CAGR of 8.0% from 2025 to 2035. China leads the market at 10.8%, followed by India at 10.0%, and Germany at 9.2%. France is expected to grow at 8.4%, while the United Kingdom is projected to grow at 7.6%. The United States is expected to grow at 6.8%. The rapid expansion of the aerospace sector in China and India, coupled with the increasing demand for fuel-efficient engines and advanced aircraft systems, is driving growth. In OECD countries like Germany, France, the UK, and the USA, growth is steady, driven by the need for next-generation engine technologies and performance enhancements in aircraft. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 10.8% through 2035, leading the aircraft engine blade market. The demand is primarily driven by China’s rapidly expanding aerospace sector, both in terms of commercial aviation and defense. The country’s focus on modernizing its aircraft fleet and improving fuel efficiency through advanced engine technologies is fueling the growth of the engine blade market. The increasing defense spending and domestic aircraft manufacturing initiatives are contributing to the growth of the market for high-performance engine blades.

India is projected to grow at a CAGR of 10.0% through 2035, driven by the rapid growth in the aviation industry, rising demand for fuel-efficient aircraft, and increased investments in defense aviation. As the country modernizes its air fleet and increases both domestic and international air travel, the demand for advanced aircraft engine blades is expected to rise. The expanding aerospace sector, along with the rise in defense aircraft procurement and the growing emphasis on manufacturing efficiency, supports the adoption of more advanced and durable engine blades.

Germany is projected to grow at a CAGR of 9.2% through 2035, supported by the country’s established position as a leader in the aerospace industry. Germany’s aerospace manufacturers are focused on producing more fuel-efficient, durable, and high-performance aircraft engines. The increasing demand for commercial and military aircraft, along with the development of advanced engine technologies, is driving the growth of the engine blade market. Germany’s participation in international aerospace collaborations and technological innovations further bolsters the demand for aircraft engine blades.

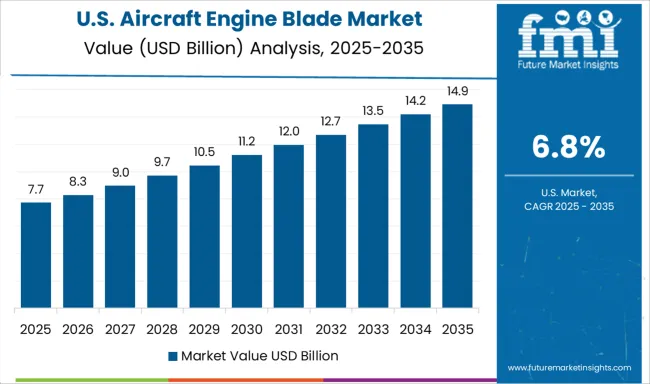

The United States is projected to grow at a CAGR of 6.8% through 2035, driven by the steady demand for aircraft engine blades as part of ongoing upgrades to both commercial and military aircraft. The USA aerospace industry’s strong focus on fuel efficiency, high performance, and next-generation engine technologies continues to drive growth. As demand for new commercial aircraft and defense aviation systems rises, manufacturers of engine blades are increasingly investing in technology advancements for durability, efficiency, and reduced environmental impact.

The aircraft engine blade market in the United Kigdom is expected to grow at a 7.6% CAGR, fueled by investments in the country’s aerospace and defense sectors. The UK continues to modernize its military and commercial fleets, requiring advanced engine components such as high-efficiency engine blades. With a strong focus on reducing environmental impact and improving fuel efficiency, the UK is leading the way in developing and adopting next-generation turbine technologies. As the demand for high-performance, low-emission aircraft grows, so too will the need for advanced engine blades to support these innovations.

The aircraft engine blade market is driven by leading aerospace companies specializing in the design, development, and manufacturing of high-performance engine blades that enhance engine efficiency, performance, and durability. GE Aviation is a market leader, providing advanced turbine blades for commercial and military aircraft engines, focusing on cutting-edge materials and manufacturing techniques to improve fuel efficiency and reduce emissions.

Safran Aircraft Engines is another major player, offering engine blades designed for both traditional and next-generation jet engines, with a strong focus on lightweight materials and heat resistance. Pratt & Whitney (United Technologies Corp., Raytheon Technologies) is a significant competitor, providing high-quality engine blades for their Geared Turbofan (GTF) engines, which are known for their fuel efficiency and reduced environmental impact.

GKN Aerospace (Melrose Industries) specializes in the production of advanced engine blade solutions, emphasizing additive manufacturing techniques and lightweight materials to enhance engine performance. CFAN Company (GE Aviation System LLC, Safran Aircraft Engines) plays a key role in the market, focusing on the development of innovative composite engine blades for turbine engines, improving overall engine performance and reliability.

Rolls-Royce offers a wide range of advanced engine blades for its Trent engine family, emphasizing high efficiency, reduced fuel consumption, and low carbon emissions. Competitive differentiation in this market is driven by advanced materials, manufacturing techniques such as additive manufacturing, performance optimization, and meeting stringent aerospace safety and regulatory standards.

Barriers to entry include high capital investment, complex engineering expertise, and long development cycles. Strategic priorities include enhancing blade durability, reducing fuel consumption, and expanding the adoption of lightweight, heat-resistant materials.

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD 17.7 Billion |

| Blade Type | Compressor Blades, Turbine Blades, and Fan Blades |

| Material | Titanium Alloys, Nickel Alloys, Composites, Steel, and Others |

| Manufacturing Process | Forging, Casting, Machining, and Additive Manufacturing (3D Printing) |

| Aircraft Type | Commercial Aircraft, Military Aircraft, Business Jets, and Helicopters |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GE Aerospace / Rolls-Royce / Safran Aircraft Engines |

| Additional Attributes | Dollar sales by engine blade type (turbine blades, compressor blades, fan blades) and end-use segments (commercial aviation, military aviation, business jets). Demand dynamics are influenced by the increasing focus on fuel efficiency, growing demand for commercial and military aircraft, and advancements in engine technologies. Regional trends indicate strong growth in North America and Europe, driven by major aerospace manufacturers and defense spending, with significant expansion in Asia-Pacific due to growing air travel and military modernization. |

The global aircraft engine blade market is estimated to be valued at USD 17.7 billion in 2025.

The market size for the aircraft engine blade market is projected to reach USD 38.1 billion by 2035.

The aircraft engine blade market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in aircraft engine blade market are compressor blades, turbine blades and fan blades.

In terms of material, titanium alloys segment to command 29.6% share in the aircraft engine blade market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA