The Air Pollution Control Equipment Market is estimated to be valued at USD 91.1 billion in 2025 and is projected to reach USD 152.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. A critical breakpoint is observed between 2029 and 2031, where absolute gains shift from gradual to compounded expansion. From 2025 to 2029, the market adds USD 20.9 billion over four years, while the subsequent four-year span from 2029 to 2033 contributes USD 26.6 billion, marking a 27.2% increase in net incremental value. This point of inflection aligns with global recalibration of emissions control policies and regional industrial air quality mandates, especially across OECD and ASEAN blocs. Another subtle but relevant breakpoint lies in the 2033–2035 period.

While the annual gains between 2025 and 2030 range between USD 4.5 billion and USD 5.3 billion, the final two years contribute nearly USD 15 billion, accelerating the trailing curve. This divergence indicates improved adoption of electrostatic precipitators, flue gas desulfurization units, and baghouse filters in waste-to-energy and cement sectors. Rather than exhibiting a smooth uniform trend, the growth curve manifests clustered step-ups driven by policy enforcement thresholds and industrial retrofitting deadlines. These breakpoints serve as temporal markers where equipment demand scales beyond compliance into optimization.

| Metric | Value |

|---|---|

| Air Pollution Control Equipment Market Estimated Value in (2025 E) | USD 91.1 billion |

| Air Pollution Control Equipment Market Forecast Value in (2035 F) | USD 152.7 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The air pollution control equipment market is gaining momentum due to tightening environmental regulations, escalating industrial emissions, and rising public health concerns globally. Regulatory bodies are enforcing strict emission norms across sectors such as automotive, power generation, and manufacturing, prompting widespread adoption of advanced control systems. Governments and environmental agencies are pushing for pollution mitigation technologies to curb particulate matter, volatile organic compounds (VOCs), and NOx emissions.

Moreover, the growth of urbanization and industrialization, particularly in emerging economies, is increasing demand for retrofit solutions and integrated emission control systems. Technological advancements in filtration, separation, and electrostatic systems are enhancing operational efficiency and energy savings.

The integration of smart sensors and automated diagnostics is further expanding the appeal of modern equipment. As companies strive to meet net-zero and sustainability goals, the market is poised for sustained investment and expansion over the next decade.

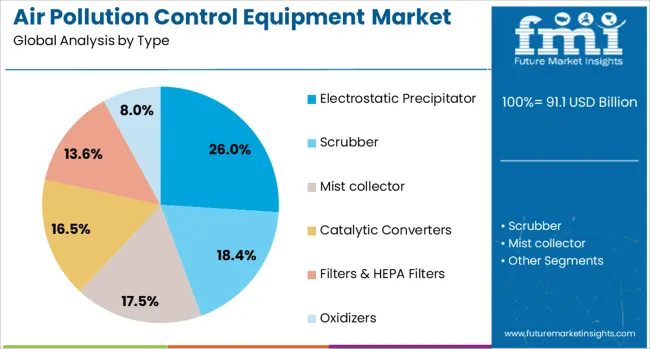

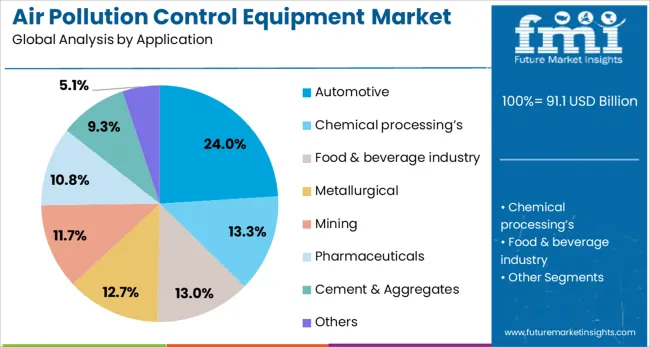

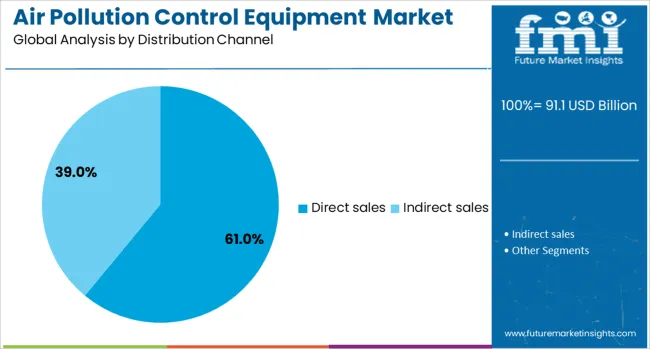

The air pollution control equipment market is segmented by type, application, distribution channel, and geographic regions. The air pollution control equipment market is divided into Electrostatic Precipitator, Scrubber, Mist collector, Catalytic Converters, Filters & HEPA Filters, and Oxidizers. In terms of application, the air pollution control equipment market is classified into Automotive, Chemical processing, Food & beverage industry, Metallurgical, Mining, Pharmaceuticals, Cement & Aggregates, and Others. The distribution channel of the air pollution control equipment market is segmented into Direct sales and Indirect sales. Regionally, the air pollution control equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electrostatic precipitators are projected to lead the market by type, contributing 26.00% of revenue in 2025. Their dominance is being supported by high efficiency in removing fine particulate matter from industrial exhaust streams. These systems operate with minimal pressure drop, making them energy-efficient and suitable for large-scale operations.

Their adaptability across industries such as power generation, cement, and steel has further solidified their presence. Long operational life and low maintenance requirements have contributed to widespread adoption.

Additionally, recent innovations in modular and compact designs are enabling easier integration with existing systems, reinforcing their relevance in both retrofit and greenfield projects. As regulatory thresholds for particulate emissions tighten, demand for electrostatic precipitators is expected to remain robust.

By application, the automotive sector is expected to account for 24.00% of the market revenue in 2025, positioning it as a key consumer of air pollution control equipment. This demand is being driven by regulatory mandates on vehicular emissions, particularly in regions implementing Euro VI and Bharat Stage VI standards.

Automakers are increasingly deploying advanced filtration and catalytic reduction systems to comply with carbon and nitrogen oxide limits. Rising production of commercial and heavy-duty vehicles, especially in logistics and freight-intensive economies, is amplifying equipment demand.

Additionally, growing public and regulatory focus on urban air quality has led to increased scrutiny of vehicular emissions, further accelerating technology upgrades in this segment.

Direct sales are projected to capture 61.00% of the total market revenue by 2025, making it the dominant distribution channel. This trend is being shaped by the need for customized equipment solutions, comprehensive service contracts, and strong post-sale technical support.

Manufacturers are prioritizing direct engagement with industrial clients to ensure compliance with site-specific emission standards and performance guarantees. Direct sales enable better integration of system design, installation, and aftersales services, resulting in improved customer satisfaction and retention.

The complex nature of large-scale pollution control systems also demands technical consultations and on-site evaluations, making direct sales a preferred channel over third-party or retail distribution. As demand for turnkey solutions grows, the direct sales model continues to gain strategic relevance.

Growth in the air pollution control equipment market is being driven by tightening regulatory standards, industrial modernization, and urban air quality concerns. Key sectors such as power generation, cement, steel, and chemical processing are deploying technologies such as electrostatic precipitators, scrubbers, and baghouse filters. Interest in selective catalytic reduction and particulate filtration has risen where stricter emissions caps are enforced. Expansion is strongest in regions with sustained industrial activity and environmental policy enforcement, where aging infrastructure is being retrofitted with advanced control equipment to meet compliance and public health targets.

Aging industrial facilities in several regions are being upgraded with modern pollution control systems to comply with new emission norms. Utilities, manufacturing plants, and refineries are installing multi-stage filtration and gas cleaning technologies. Flue gas desulfurization units and electrostatic dust collection systems are widely used to reduce sulfur and particulate release. As emission thresholds have become more stringent, plant retrofits have become essential, creating significant demand for high-efficiency equipment. Service contracts focusing on installation, maintenance, and periodic monitoring have also become a standard for ongoing compliance and performance assurance.

Recent innovations have improved the efficiency and operability of pollution control systems. Low energy fabric filters and compact wet scrubbers are being used in space-constrained facilities. Integration of real-time emission monitoring and automatic control has optimized system performance and reduced downtime. Catalytic systems using low-temperature catalysts are being adopted to improve NOₓ removal efficiency while reducing energy usage. Hybrid systems combining filtration and adsorption modules are being implemented for volatile organic compound management. Such advancements are supporting cost-effective operational upgrades and enabling plants to achieve compliance without major structural changes.

Growth trajectories vary by region according to industrial density and environmental regulation. Asia Pacific leads in unit deployments driven by coal-based power generation and industrial expansion. Stricter cross-border air quality standards in Europe and North America have supported adoption of sophisticated control systems. In Latin America and parts of the Middle East, infrastructure funding for clean tech has begun stimulating demand. Regulatory enforcement intensity, public health awareness, and industrial composition are shaping equipment adoption patterns. Countries facing frequent air pollution episodes are particularly keen to deploy retrofit programs on major emission sources.

Despite the benefits of emission control systems, several challenges limit broader adoption. Capital costs for large-scale equipment remain high, especially when retrofitting legacy plants. Operational complexity—such as high energy usage and maintenance needs—can deter adoption in low-margin plants. Integration with existing plant systems and space limitations pose technical hurdles. Variation in regional regulatory standards often demands multiple equipment configurations, increasing business complexity. As alternative energy and decentralized models gain feasibility, investment cycles for traditional source control systems are being reevaluated, creating uncertainty in long-term market growth projections.

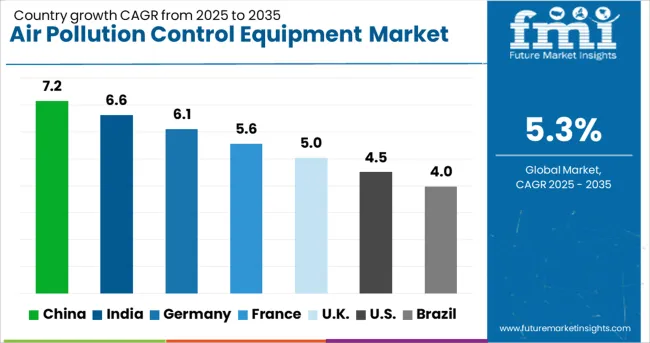

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

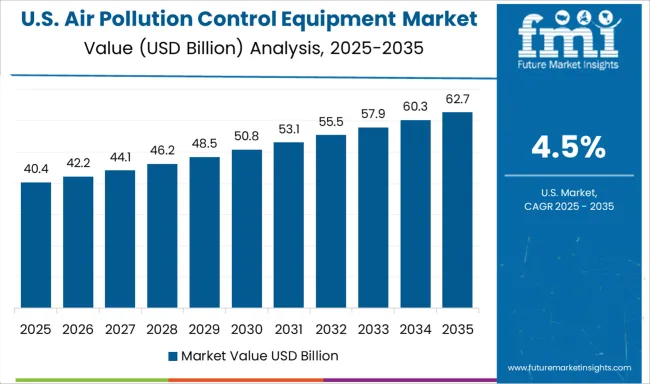

| USA | 4.5% |

| Brazil | 4.0% |

Global demand for Air Pollution Control Equipment is expected to rise at a CAGR of 5.3% from 2025 to 2035. China is projected at 7.2%, 36% above the baseline. India follows at 6.6% and Germany at 6.1%, showing premiums of +25% and +15%. The United Kingdom and United States register 5.0% and 4.5% respectively, trailing the global rate by –6% and –15%. Industrial emission mandates, coal phase-outs, and selective catalytic reduction systems remain core drivers. ASEAN economies have increased equipment imports due to rapid manufacturing growth, while OECD members are upgrading aging scrubber systems and particulate controls. Market evolution is being shaped by evolving environmental compliance standards, carbon reduction policies, and the regional pace of green infrastructure rollouts.

China is forecast to lead the global Air Pollution Control Equipment market with a CAGR of 7.2%, outpacing the global average by 36%. Regulatory pressure from the Ministry of Ecology and Environment has pushed installations across steel, cement, and power sectors. Urban regions such as Hebei and Shandong have mandated high-efficiency scrubbers and desulfurisation units. Industrial zones are shifting from electrostatic precipitators to hybrid filter-based systems. The expansion of waste-to-energy plants has also driven demand for advanced flue gas purification technologies. State-backed projects continue to prioritise PM2.5 and NOx control solutions.

India is expected to grow at a CAGR of 6.6% in the Air Pollution Control Equipment segment, placing it 25% above the global benchmark. Expansion has been observed in thermal power plants and biomass energy units, where flue gas desulfurisation systems have seen increased deployment. Regulatory actions by the Central Pollution Control Board have tightened norms for PM and SO2 emissions. Smart cities across Maharashtra, Tamil Nadu, and Gujarat are investing in ambient air quality monitoring and pollution control retrofits. Domestic manufacturers are developing low-cost electrostatic precipitators and baghouse filters tailored for SME clusters.

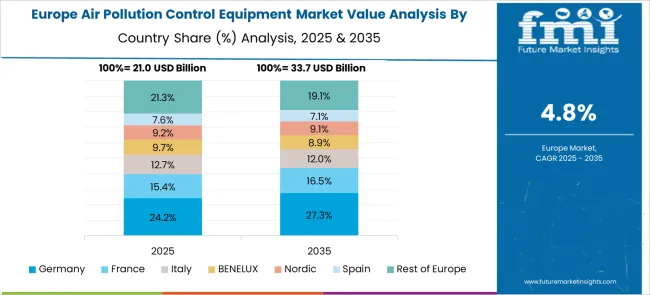

Germany is anticipated to record a CAGR of 6.1% in the Air Pollution Control Equipment market through 2035, a 15% premium over the global average. Regulatory updates under EU directives have required older industrial sites to adopt secondary filtration systems and high-efficiency dust collectors. Municipal incineration and recycling centres have integrated multi-stage scrubber systems to meet carbon neutrality targets. Power utilities in North Rhine-Westphalia and Saxony-Anhalt are transitioning to carbon capture-ready emission control setups. Innovation incentives have supported the use of AI-based pollutant monitoring platforms and automated feedback loops.

United Kingdom is forecast to grow at a CAGR of 5.0%, slightly under the global baseline by –6%. Industrial decarbonisation initiatives have prioritised low-emission upgrades in legacy systems. Municipal waste treatment and recycling sectors are the largest end users of dry and semi-dry scrubbers. Regulatory alignment with EU policies has continued post-Brexit, ensuring consistency in emission ceilings. Urban low-emission zones and pollution alert frameworks are driving demand for compact air quality systems in public infrastructure. Adoption rates are uneven outside London and major cities, partly due to regional funding disparities.

United States is projected to grow at a CAGR of 4.5% in the Air Pollution Control Equipment market, trailing the global trend by 15%. The Environmental Protection Agency has focused on enforcement in petrochemical hubs and heavy industrial zones. Air quality control equipment adoption is highest in California, Texas, and Ohio, where state-level mandates exceed federal minimums. Public-private collaborations are advancing retrofitting of coal-fired and diesel-based systems with hybrid emission control technology. Slower uptake is observed in sectors with limited policy pressure or investment in plant modernisation. Data-driven compliance tracking and emissions reporting are being piloted in key metropolitan areas.

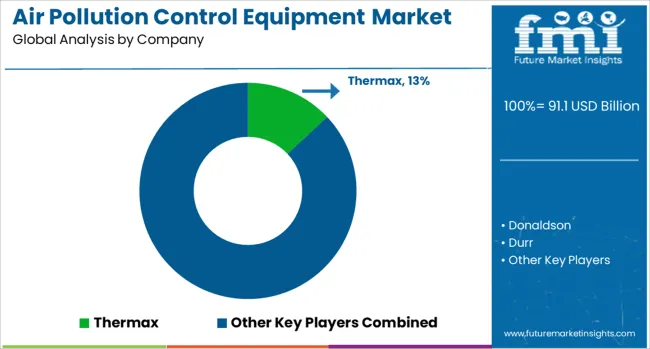

The air pollution control equipment market is shaped by players addressing stricter emission norms, especially across industrial, energy, and municipal sectors. Mitsubishi Power and Siemens have focused on large-scale systems for thermal power plants and waste-to-energy facilities, integrating flue gas desulfurization (FGD) and selective catalytic reduction (SCR) technologies. Thermax has expanded its footprint across Asia and the Middle East by offering turnkey dust extraction and wet scrubber solutions tailored for cement and steel industries. Donaldson and MANN+HUMMEL have dominated the filtration segment through advanced particulate capture technologies, while Lydall has strengthened its position in filter media, including PTFE membranes and HEPA-rated materials.

Durr and Nederman have leveraged growing demand for volatile organic compound (VOC) control and industrial air filtration, especially in the chemical and manufacturing sectors. GEA Group and Pall have emphasized cleanroom and high-purity filtration solutions for the pharmaceutical and food industries. Competitive strategies hinge on lifecycle cost optimization, automation integration, energy recovery from emission control units, and compliance with PM2.5 and NOx thresholds. Demand is increasingly aligned with retrofitting needs in existing plants and technology upgrades that align with EU Industrial Emissions Directive and US EPA MACT standards.

From 2023 to 2025, the air pollution control equipment market saw active technology rollouts across industrial zones in the US, EU, Japan, and South Korea. Hybrid filtration systems integrating electrostatic precipitators and scrubbers were deployed to reduce fine particulates and gaseous pollutants in power plants. AI-enabled monitoring systems were adopted to automate emission tracking and maintenance. South Korean facilities introduced modular flue gas treatment units. These advancements supported stricter environmental compliance and improved air quality control in manufacturing and energy sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 91.1 Billion |

| Type | Electrostatic Precipitator, Scrubber, Mist collector, Catalytic Converters, Filters & HEPA Filters, and Oxidizers |

| Application | Automotive, Chemical processing’s, Food & beverage industry, Metallurgical, Mining, Pharmaceuticals, Cement & Aggregates, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermax, Donaldson, Durr, GEA Group, Lydall, MANN+HUMMEL, Mitsubishi Power, Nederman, Pall, and Siemens |

| Additional Attributes | Dollar sales by equipment type (scrubbers, filters, precipitators) and end-use sectors (power, chemical, cement), demand driven by regulations and industrial emissions, Asia Pacific leads, innovations in IoT-enabled smart filtration, environmental gains via emission reduction and sustainable recycling, and emerging use in urban air quality systems and modular treatment units. |

The global air pollution control equipment market is estimated to be valued at USD 91.1 billion in 2025.

The market size for the air pollution control equipment market is projected to reach USD 152.7 billion by 2035.

The air pollution control equipment market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in air pollution control equipment market are electrostatic precipitator, scrubber, mist collector, catalytic converters, filters & hepa filters, oxidizers, _thermal oxidizers, _catalytic oxidizers, _regenerative thermal oxidizers and _others (activated carbon adsorption, flue gas desulfurization (fgd) systems, etc.).

In terms of application, automotive segment to command 24.0% share in the air pollution control equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

End-of-Pipe Air Pollution Control Equipment Market- Trends & Forecast 2025 to 2035

Competitive Overview of Air Pollution Control Systems Providers

Air Pollution Control Systems Market – Applications & Growth Forecast 2025-2035

Air Traffic Control Equipment Market

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Air Audit Equipment Market Growth - Trends & Forecast 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Airborne Fire Control Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lift Control Devices Market

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne SATCOM Equipment Market

Riot Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dairy Processing Equipment Market Outlook – Growth, Demand & Forecast 2023-2033

Solid Control Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pollution Monitoring Equipment Market Insights – Size, Trends & Forecast 2025-2035

Airborne Warning and Control System Market Growth - Trends & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Aircraft Survivability Equipment (ASE) Market Size and Share Forecast Outlook 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA