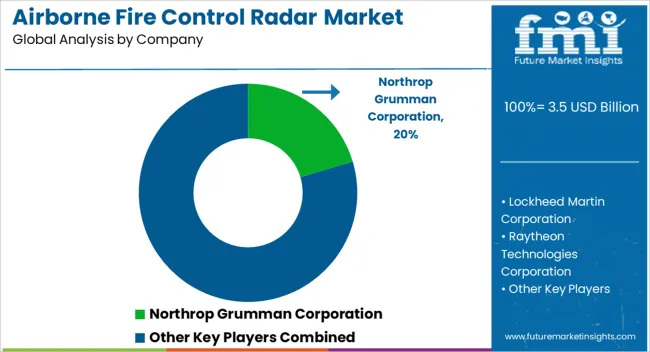

The airborne fire control radar market is projected to grow from USD 3.5 billion in 2025 to USD 6.2 billion by 2035, creating an absolute dollar opportunity of USD 2.7 billion at a steady CAGR of 6%. During the first five-year phase (2025 to 2030), the market is expected to increase from USD 3.5 billion to USD 4.7 billion, adding USD 1.2 billion, which accounts for 44.4% of the total incremental growth.

This growth phase is driven by increasing demand for advanced radar systems in military aircraft, enhanced targeting capabilities, and modernization of airborne defense platforms. The second half (2030 to 2035) will contribute USD 1.5 billion, representing 55.6% of incremental growth, signaling sustained momentum as new radar technologies, such as active electronically scanned arrays (AESA), gain wider adoption.

Annual increments during the early phase average USD 0.24 billion, while later years will see stronger growth supported by increased defense budgets, geopolitical tensions, and technological innovation in sensor integration. Manufacturers focusing on compact, multifunctional radar systems and digital signal processing will be well-positioned to capture the largest share of this USD 2.7 billion opportunity, especially in North America, Europe, and Asia-Pacific defense markets.

| Metric | Value |

|---|---|

| Airborne Fire Control Radar Market Estimated Value in (2025 E) | USD 3.5 billion |

| Airborne Fire Control Radar Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The airborne fire control radar market is expanding steadily due to increasing defense modernization initiatives, evolving aerial threat landscapes, and the growing deployment of next-generation combat aircraft. The rise in asymmetric warfare and cross-border tensions has intensified the demand for precise, high-speed target detection and tracking systems.

Investments by defense ministries in multirole aircraft and enhanced situational awareness systems are directly influencing radar technology upgrades. Innovations in electronically scanned arrays (ESA), miniaturized radar components, and frequency agility have enabled high-performance integration into agile airframes.

Future growth is expected to be fueled by cross-platform radar standardization, AI-driven threat assessment modules, and multi-band radar systems tailored for network-centric warfare environments.

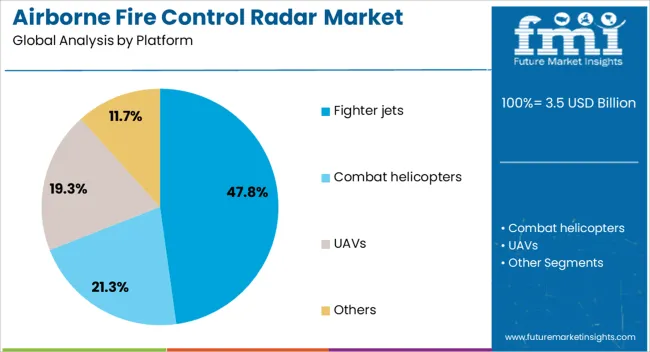

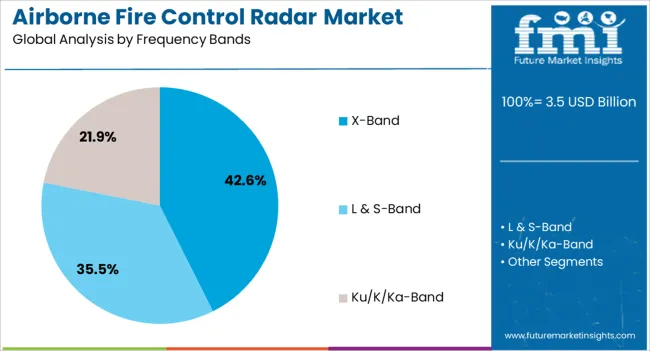

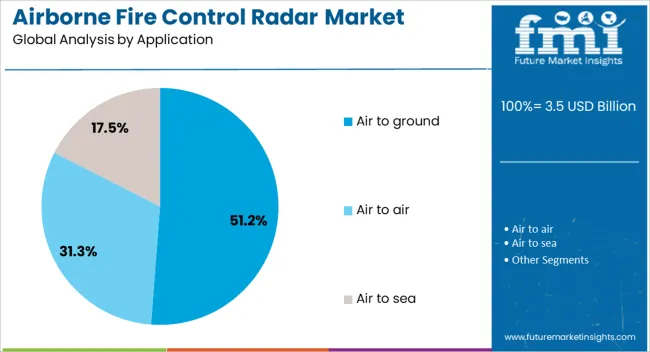

The airborne fire control radar market is segmented by platform (fighter jets, combat helicopters, UAVs, others), by frequency band (X-Band, L & S-Band, Ku/K/Ka-Band), and by application (air-to-ground, air-to-air, air-to-sea). Regionally, the airborne fire control radar industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fighter jets are expected to account for 47.80% of the overall market revenue in 2025, establishing this platform as the dominant segment. This leadership is being driven by increased procurement of advanced combat aircraft globally, especially those designed for multirole missions involving both air-to-air and air-to-ground engagements.

Fire control radars installed on fighter jets are critical for threat detection, missile guidance, and beyond-visual-range targeting capabilities. Advancements in stealth-compatible radar systems and active electronically scanned array (AESA) technology have significantly enhanced detection range and target resolution, making them indispensable to modern air forces.

With air superiority remaining a core priority in national defense strategies, radar integration into next-gen fighter platforms continues to receive sustained investment.

The X-Band frequency segment is anticipated to represent 42.60% of the total market share in 2025, positioning it as the leading frequency band. Its predominance is attributed to its optimal balance of range, resolution, and size, making it ideally suited for tactical fire control applications.

X-Band radars support high-frequency wave propagation, enabling detailed target imaging, rapid acquisition, and effective discrimination between threats. Their compact footprint allows seamless integration into both manned and unmanned airborne platforms without compromising payload efficiency.

Additionally, X-Band technology is preferred for real-time engagement scenarios where precise tracking and rapid data refresh rates are essential. As threat dynamics evolve, reliance on agile and modular X-Band radar systems is expected to intensify across military air operations.

Air-to-ground targeting is forecast to lead the market by contributing 51.20% of total revenue in 2025, making it the top application area for airborne fire control radar systems. This dominance is underpinned by the increasing role of precision strikes in modern military operations, particularly in counter-insurgency and close air support missions.

Airborne fire control radars configured for air-to-ground roles are critical for detecting, locking, and guiding munitions toward static and moving surface targets. The growing adoption of terrain mapping, synthetic aperture radar (SAR) imaging, and ground moving target indication (GMTI) features has enhanced the strategic value of these systems.

As militaries prioritize minimized collateral damage and mission flexibility, demand for advanced air-to-ground radar capabilities continues to rise, especially among nations investing in multirole aircraft fleets.

The airborne fire control radar market is expanding due to increasing defense expenditure and advancements in radar technology. Growth in 2024 and 2025 was driven by the rising demand for precision targeting systems in military aircraft. Opportunities exist in the development of advanced radar systems for unmanned aerial vehicles (UAVs) and the integration of AI for improved target identification. Emerging trends include multi-mode radar systems with enhanced resolution. However, high development costs and regulatory restrictions remain significant market barriers.

The major growth driver is increasing defense spending worldwide, particularly for advanced targeting systems. In 2024, defense budgets in regions like North America and Asia boosted investments in modernizing military equipment, especially for airborne platforms. This led to increased demand for advanced airborne fire control radars capable of improving accuracy in targeting and enhancing operational effectiveness in combat missions. The ongoing need for military superiority continues to propel the demand for high-performance radar systems in military aircraft.

Significant opportunities lie in the development of airborne fire control radar systems for unmanned aerial vehicles (UAVs) and the incorporation of artificial intelligence (AI) for enhanced targeting. In 2025, the defense sector’s interest in UAVs, which can operate in high-risk environments, opened new opportunities for radar manufacturers. Additionally, AI-powered radar systems capable of real-time target identification and tracking have become increasingly important in both military and defense sectors. These developments position radar manufacturers to capture growing demand from next-generation aircraft platforms.

Emerging trends in the market include the rise of multi-mode radar systems with enhanced resolution and signal processing capabilities. In 2024, military aviation platforms began adopting radars that integrate multiple operational modes, such as synthetic aperture radar (SAR) and ground moving target indication (GMTI). These systems offer improved imaging, even in challenging environments. This trend reflects the increasing demand for highly reliable, all-weather radar systems capable of providing enhanced operational flexibility and precision across diverse mission types, from surveillance to combat operations.

Key market restraints include high research and development costs and stringent regulatory restrictions. In 2024 and 2025, the high costs associated with developing advanced airborne fire control radar systems limited access to smaller defense contractors. Additionally, regulatory hurdles related to export controls, safety standards, and certification processes posed barriers to global market penetration. These factors emphasized the need for efficient cost management and compliance strategies to maintain competitiveness in a market driven by advanced technology and security concerns.

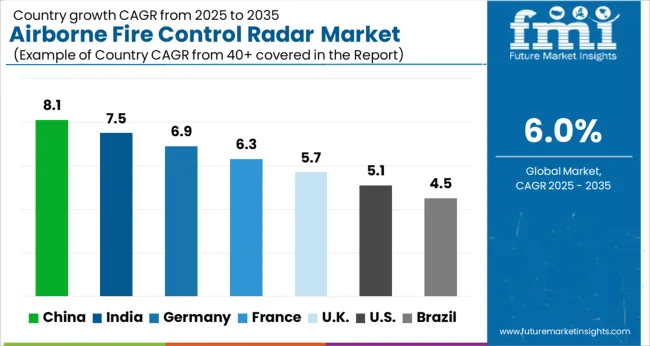

The global airborne fire control radar market is projected to grow at 6% CAGR from 2025 to 2035. China leads with 8% CAGR, driven by strong investments in defense technology and the increasing demand for modern, high-performance radar systems for military aircraft. India follows at 8%, supported by rising defense spending and a growing need for advanced radar systems in both defense and surveillance applications.

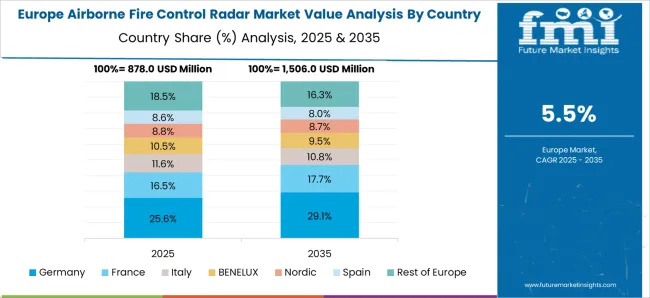

Germany records 7% CAGR, focusing on integrating advanced radar solutions into military aircraft and homeland security systems. The United Kingdom grows at 6%, while the United States posts 5%, reflecting steady demand in mature markets with a focus on technological innovation and military modernization. Asia-Pacific leads market growth, while Europe and North America emphasize high-performance, next-generation radar systems.

The airborne fire control radar market in China is forecasted to grow at 8% CAGR, driven by the country’s large-scale investments in defense modernization and military aircraft upgrades. China’s rapidly expanding aerospace and defense industries require cutting-edge radar technologies for tactical and surveillance aircraft. The increasing focus on enhancing radar capabilities to improve target detection, tracking, and fire control in military operations accelerates market growth. Furthermore, the development of indigenous radar systems further strengthens China’s position in the market.

The airborne fire control radar market in India is projected to grow at 8% CAGR, supported by rising defense budgets and the country’s increasing demand for advanced radar systems in military aircraft. India’s modernization efforts in the defense sector, including the acquisition of advanced fighter jets and surveillance aircraft, fuel the need for state-of-the-art radar technologies. Additionally, the strategic importance of enhancing national security through effective air surveillance and fire control systems contributes to market growth.

The airborne fire control radar market in Germany is expected to grow at 7% CAGR, supported by the country’s strong aerospace and defense industries. As part of its defense modernization efforts, Germany continues to invest in cutting-edge radar technologies for military aircraft, including fighter jets and reconnaissance planes. The growing demand for highly accurate fire control radar systems to enhance combat capabilities, target tracking, and situational awareness further accelerates market growth in the country.

The airborne fire control radar market in the United Kingdom is projected to grow at 6% CAGR, driven by rising demand for advanced radar systems in both defense and surveillance applications. As the UK continues to modernize its fleet of military aircraft and enhance defense capabilities, the need for high-performance radar systems for target acquisition and tracking intensifies. Additionally, the UK’s commitment to innovation in military technology and the integration of radar systems into next-generation aircraft contribute to market growth.

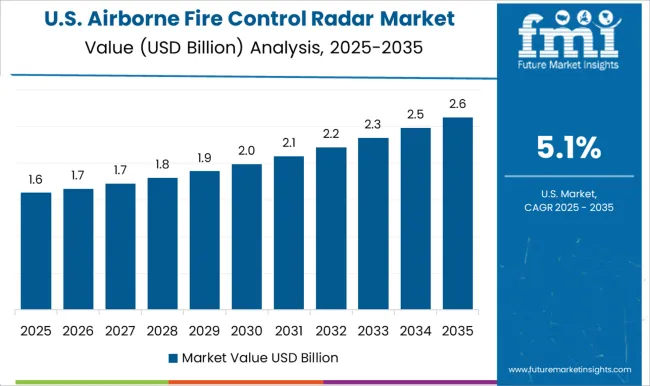

The airborne fire control radar market in the United States is projected to grow at 5% CAGR, reflecting steady demand in a mature defense sector. The USA military’s focus on technological innovation, situational awareness, and enhanced fire control capabilities continues to drive the adoption of advanced radar systems in military aircraft. While the USA market is mature, the growing demand for radar integration in unmanned aerial vehicles (UAVs), fighter jets, and surveillance aircraft contributes to the continued growth of the market.

AESA upgrades have been prioritized across fighter fleets. Competitive posture has been built around fielded performance, integration speed, lifecycle cost. Northrop Grumman has been positioned through AN/APG-83 SABR on F-16 recapitalization programs; multi-mode agility, simultaneous air-to-air and air-to-surface tasking, low downtime are stressed. Raytheon has been present via AN/APG-79 on F/A-18E/F and EA-18G; rapid beam steering, multi-target tracking, combat use cases are emphasized. Leonardo has been active with Raven ES-05 for Gripen E; wide field-of-regard, interleaved modes, reliability claims are featured. Thales has supplied RBE2-AA for Rafale; Europe’s first in-service AESA was delivered, combat validation has been recorded. HENSOLDT has developed ECRS Mk1 for Eurofighter; multi-channel reception, broadband TRMs, electronic-attack potential are cited. Saab has advanced PS-05/A Mk4 for Gripen C/D; upgraded processing, range extension, growth path are noted. IAI Elta has offered EL/M-2052; multi-target tracking, long-range detection, precision strike support are listed.

Strategies are diverging. Retrofit revenue is being prioritized across legacy fleets. New-build access is being secured through consortium structures on Eurofighter programs. Open architectures are being pushed to ease future mode insertion. Export viability is being protected through modular line-replaceable units. Mission-data reprogramming is being framed as sovereign capability. Performance-based sustainment is being offered to hold total cost of ownership. Survivability gains are being argued via electronic-attack features, low-probability-of-intercept waveforms, ultra-high-resolution SAR imaging, Meteor-class weapon integration (observed industry pattern where verified details are restricted). F-16 refresh cycles favor Northrop Grumman. Carrier aviation ties Raytheon to Super Hornet, Growler operators. Rafale operators anchor Thales. Gripen customers align to Saab with Leonardo. Eurofighter users transition to HENSOLDT ECRS Mk1. Regional tenders evaluate EL/M-2052 for upgrades.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Platform | Fighter jets, Combat helicopters, UAVs, and Others |

| Frequency Bands | X-Band, L & S-Band, and Ku/K/Ka-Band |

| Application | Air to ground, Air to air, and Air to sea |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Northrop Grumman Corporation, Lockheed Martin Corporation, Raytheon Technologies Corporation, Leonardo S.p.A, Saab AB, Thales Group, and Israel Aerospace Industries Ltd. |

| Additional Attributes | Dollar sales by radar type and defense application, demand dynamics across military aviation and defense sectors, regional trends in airborne fire control radar adoption, innovation in radar signal processing and accuracy, impact of regulatory standards on defense technology, and emerging use cases in unmanned aerial systems and advanced weaponry. |

The global airborne fire control radar market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the airborne fire control radar market is projected to reach USD 6.2 billion by 2035.

The airborne fire control radar market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in airborne fire control radar market are fighter jets, combat helicopters, uavs and others.

In terms of frequency bands, x-band segment to command 42.6% share in the airborne fire control radar market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne Warning and Control System Market Growth - Trends & Forecast 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA