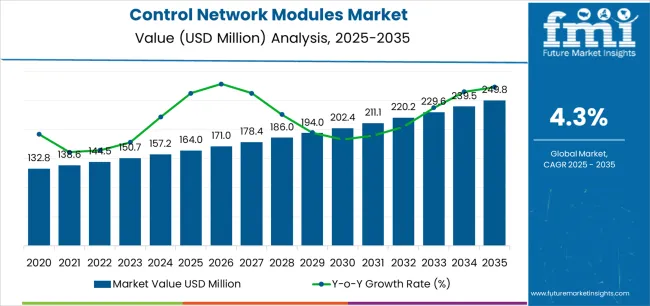

The global control network modules market is set to grow from USD 164.0 million in 2025 to USD 249.8 million by 2035, at a 4.3% CAGR, driven by steady industrial automation upgrades, modernization of communication interfaces, and retrofits of legacy control systems. Demand strengthens as manufacturers shift toward Ethernet-based modules, modular architectures, and protocol-flexible designs that support Ethernet/IP, Modbus, and PROFINET environments. North America, Europe, and East Asia anchor adoption due to high-value manufacturing and strong digital infrastructure, while emerging markets grow gradually through industrial digitalization initiatives.

Growth from 2025 to 2030 accounts for 45.9% of the decade’s expansion, driven by IoT-enabled communication systems and real-time data exchange in smart factories. The 2030–2035 phase accelerates through edge computing, AI-driven control systems, and digital twin integration. Buildings lead application demand, supported by HVAC, lighting, and security automation, while semiconductor component availability remains a key supply constraint. Competition is led by Honeywell, Schneider Electric, Johnson Controls, Rockwell Automation, Mitsubishi Electric, Siemens, and Phoenix Contact, with strategic differentiation centered on interoperability, cybersecurity resilience, and scalable deployment for next-generation industrial and smart infrastructure environments.

Adoption is strongest in North America, Western Europe, and East Asia, where high-value manufacturing sectors drive continual infrastructure renewal. Emerging markets are expanding gradually, aided by public and private investment in industrial digitalization programs. Supply stability for semiconductor components and communication chips remains a practical determinant of production capacity and pricing trends. Through 2035, sustained automation growth and consistent hardware standardization are expected to maintain steady structural advancement within the control network modules industry.

Between 2025 and 2030, the Control Network Modules Market is anticipated to grow from USD 164.0 million to USD 202.4 million, reflecting a 23.5% increase and accounting for 45.9% of the total forecast expansion for the decade. Growth during this period will be fueled by the rising adoption of industrial automation, expanding use of IoT-enabled communication systems, and integration of real-time data exchange technologies in manufacturing and infrastructure. The shift toward modular, scalable network architectures will drive demand, while vendors focus on enhancing interoperability, cybersecurity, and network efficiency to support smart factory and process automation applications.

From 2030 to 2035, the market is projected to expand from USD 202.4 million to USD 249.8 million, registering a 23.4% growth and contributing 54.1% of the decade’s overall increase. This stage will be shaped by the rapid advancement of edge computing, AI-driven control systems, and digital twin technologies. The growing demand for high-speed, low-latency communication modules in industrial robotics and energy systems will further propel innovation. Strategic partnerships between automation system providers and semiconductor companies will enable the development of high-performance, energy-efficient control network modules optimized for next-generation industrial and smart infrastructure environments.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 164.0 million |

| Market Forecast Value (2035) | USD 249.8 million |

| Forecast CAGR (2025–2035) | 4.3% |

The control network modules market is expanding as industries accelerate automation programs requiring precise, real-time communication across distributed control systems. These modules form the interface between controllers, sensors, and actuators, enabling synchronized operation within industrial, energy, and transportation infrastructures. Growing adoption of Industrial Internet of Things (IIoT) frameworks and machine-to-machine communication increases reliance on modular, protocol-flexible network components that ensure interoperability among legacy and modern equipment.

Manufacturers develop modules supporting multiple communication standards—such as PROFINET, EtherCAT, and Modbus TCP—to accommodate diverse industrial environments without extensive reconfiguration. Demand is particularly strong in process industries, where consistent data transmission and low-latency performance are essential for safety and efficiency. Upgrading existing systems with advanced modules reduces downtime and supports predictive maintenance strategies, aligning with the broader shift toward digitalized plant management. The transition to Ethernet-based control networks and cloud-integrated supervisory systems further reinforces the need for scalable, cyber-secure connectivity solutions. However, high integration costs and the requirement for skilled personnel to manage network protocols present adoption barriers in smaller operations. Continuous technological refinement and increasing emphasis on standardized communication architectures maintain the control network modules market’s growth trajectory across global automation and industrial modernization projects.

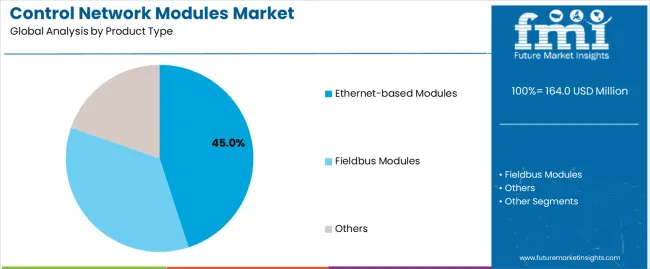

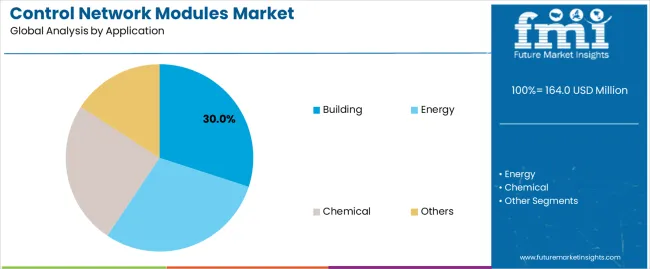

The control network modules market is segmented by product type, application, and region. By product type, the market is divided into Ethernet-based modules, Fieldbus modules, and others. Based on application, it is categorized into building, energy, chemical, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect variations in technology preferences, industrial automation adoption, and infrastructure modernization across global markets.

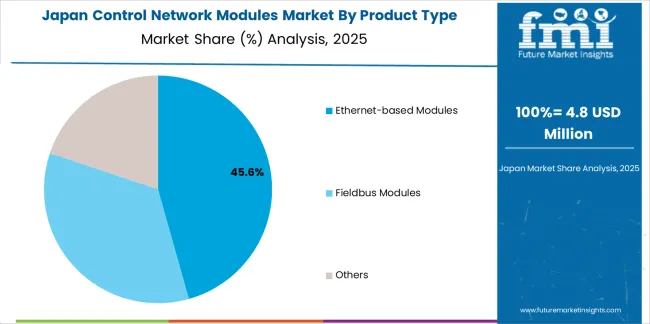

The Ethernet-based modules segment accounts for approximately 45.0% of the global control network modules market in 2025, making it the leading product category. This dominance is driven by the widespread adoption of Ethernet communication standards in modern industrial control and automation systems. Ethernet-based modules offer scalability, high data transfer speeds, and compatibility with existing enterprise networks, supporting integration between operational technology and information systems.

These modules are increasingly deployed in process industries, manufacturing facilities, and building automation systems, where real-time data exchange and remote monitoring are critical for operational efficiency. Their flexibility enables seamless communication across multiple devices and platforms, reducing configuration complexity and enhancing system interoperability. The segment’s growth is further supported by advancements in industrial Ethernet protocols such as EtherNet/IP, PROFINET, and Modbus TCP, which provide reliable and secure connectivity in industrial environments. Vendors continue to invest in Ethernet-enabled solutions that support cloud connectivity and predictive maintenance frameworks. The combination of high-speed communication, network reliability, and standardization across industries ensures the ongoing dominance of Ethernet-based modules within the global control network modules market

The building segment represents about 30.0% of the total control network modules market in 2025, holding the largest share by application. This segment’s position reflects the expanding implementation of automation technologies in commercial, industrial, and residential infrastructure. Control network modules are widely integrated into building management systems for applications such as lighting control, HVAC regulation, and security monitoring, enabling centralized and efficient facility operation.

Growing emphasis on energy efficiency and smart infrastructure development continues to support demand for connected building control systems. Ethernet and Fieldbus-based modules facilitate communication between distributed sensors, actuators, and controllers, improving system responsiveness and operational oversight. In developed regions such as North America and Europe, adoption is encouraged by regulatory standards promoting sustainable and automated building solutions. Meanwhile, urbanization and industrialization trends in East Asia and South Asia contribute to steady market expansion. The building segment’s consistent demand is reinforced by modernization of legacy systems and integration of networked control solutions into smart city initiatives. Its role as a primary application area highlights the importance of reliable communication modules in achieving efficient, secure, and scalable automation within the global built environment.

The control network modules market is witnessing steady expansion as industrial and building automation increasingly rely on modular communication units that integrate sensors, controllers and networks. Growing adoption of Industry 4.0, rising demand for connectivity in factories and smart infrastructure, and the shift toward standardised Ethernet-based modules support market growth. Cost pressures, legacy system compatibility issues and concerns about cybersecurity constrain adoption in some segments. A notable trend is the movement toward open-protocol, wireless-enabled network modules that facilitate flexible deployment and support converged IT/OT environments.

One major growth driver is the surge in industrial automation and smart infrastructure deployment worldwide. Manufacturers and building operators are upgrading control systems to support real-time monitoring, predictive maintenance and seamless data exchange across devices. Network modules that support high-speed Ethernet protocols and integration with enterprise systems are increasingly demanded as automation architectures evolve. As ageing plants retrofit and new smart factories build out, control network modules become critical enablers of connected operations.

A key restraint arises from compatibility challenges and high switching costs associated with replacing or upgrading legacy control systems. Many industrial installations continue to rely on older fieldbus or proprietary communication modules, which creates friction when integrating newer modular network units. In addition, concerns about cybersecurity in connected control networks, and the need for certified modules and firmware updates, increase the complexity and perceived risk of adoption. These factors slow the migration to advanced network-module solutions despite performance benefits.

A significant trend is the development of open-protocol, wireless and modular network modules designed for flexible deployment in distributed control, building automation and mobile assets. Manufacturers are introducing modules that support Ethernet/IP, Profinet, Modbus TCP as well as wireless standards like Wi-Fi and 5G for OT applications. The capability to plug-and-play modules with software-defined connectivity and remote configuration is becoming more common. This shift allows easier scaling, faster commissioning and better alignment with converged IT/OT strategies in modern automation landscapes.

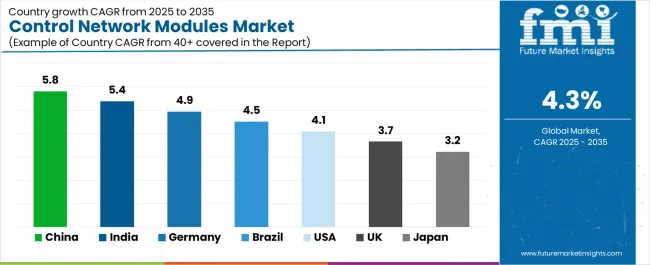

| Country | CAGR (%) |

|---|---|

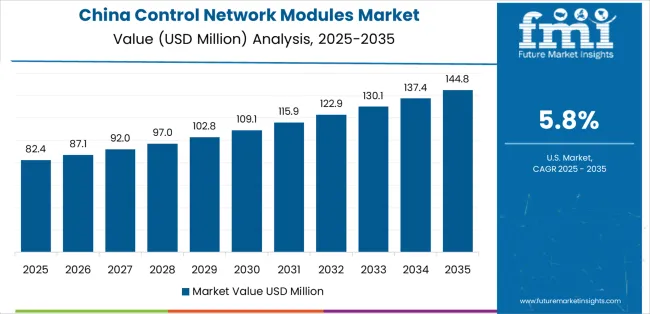

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

| USA | 4.1% |

| UK | 3.7% |

| Japan | 3.2% |

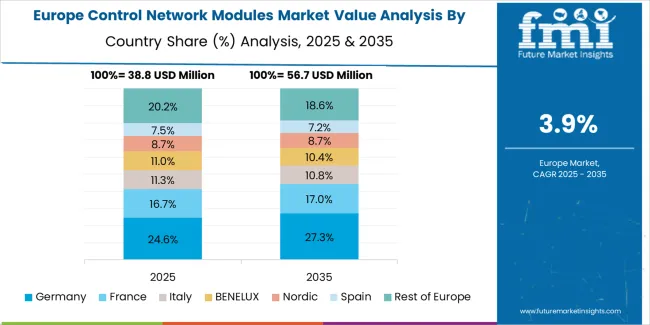

The control network modules market is growing steadily across key global economies, led by China at a 5.8% CAGR through 2035, driven by industrial automation expansion, smart manufacturing adoption, and strong semiconductor advancements. India follows at 5.4%, supported by government-led digitalization programs, rapid industrial growth, and integration of IoT-based control systems. Germany records 4.9%, leveraging engineering precision and leadership in industrial connectivity solutions. Brazil shows a 4.5% CAGR, fueled by infrastructure modernization and increased automation in energy and utilities. The USA grows at 4.1%, maintaining a strong base in industrial networking and control technologies, while the UK (3.7%) and Japan (3.2%) continue focusing on system reliability, automation efficiency, and technological innovation in network module development.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from control network modules in China is projected to grow at a CAGR of 5.8% through 2035, supported by rapid industrial automation and modernization across manufacturing and energy sectors. Increasing implementation of smart factory systems and industrial IoT infrastructure is driving adoption of network modules for real-time communication and control integration. Government initiatives promoting intelligent manufacturing and digital transformation are strengthening domestic production capabilities. Leading automation firms and module suppliers are expanding partnerships to meet rising industrial connectivity requirements.

Revenue from control network modules in India is increasing at a CAGR of 5.4%, supported by the country’s growing manufacturing modernization initiatives and focus on industrial connectivity. Expansion of process industries and renewable energy projects is driving demand for reliable network communication hardware. Government programs encouraging digital transformation in small and medium enterprises are supporting market development. Local distributors are forming alliances with global technology providers to expand system access and technical support.

Revenue from control network modules in Germany is advancing at a CAGR of 4.9%, supported by established industrial automation frameworks and precision engineering standards. Manufacturers are incorporating network modules into factory automation, robotics, and process control systems to optimize production reliability. The country’s strong industrial base and commitment to Industry 4.0 continue to generate equipment demand. Research programs in connectivity and industrial communication protocols are supporting ongoing innovation.

Revenue from control network modules in Brazil is projected to rise at a CAGR of 4.5%, supported by ongoing modernization in manufacturing, oil and gas, and utilities sectors. Industrial facilities are adopting advanced communication systems to enhance process monitoring and control efficiency. Public and private investment in energy infrastructure and automation technology is sustaining equipment procurement. Import partnerships are improving access to specialized modules and software integration services.

Revenue from control network modules in the United States is expanding at a CAGR of 4.1%, supported by strong adoption of smart manufacturing technologies and widespread use of industrial IoT systems. Factories and logistics operations increasingly employ network modules to connect sensors, controllers, and monitoring systems. Continuous investment in digital infrastructure and cybersecurity enhances system integration. Manufacturers are focusing on standardized protocols to improve interoperability across production networks.

Revenue from control network modules in the United Kingdom is increasing at a CAGR of 3.7%, supported by industrial digitalization programs and modernization in energy and transport sectors. Manufacturers and service providers are deploying modular network systems to improve communication and operational consistency. Ongoing investment in industrial connectivity research supports technological refinement and interoperability. The presence of established automation integrators sustains stable market activity.

Revenue from control network modules in Japan is growing at a CAGR of 3.2%, supported by advanced industrial automation standards and a strong focus on production efficiency. Manufacturers across electronics, automotive, and robotics sectors employ network modules for precision communication and process control. Domestic technology companies prioritize miniaturized and energy-efficient module development. Continuous refinement of control systems and integration standards supports stable market growth.

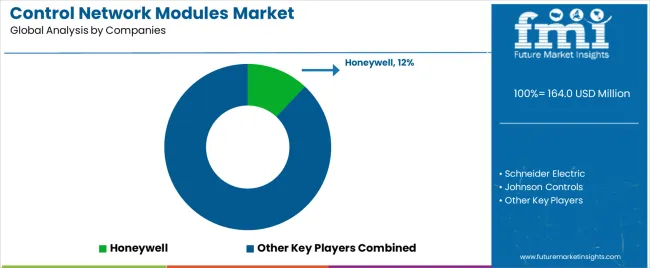

The global control network modules market demonstrates high concentration, led by diversified industrial automation and building management system manufacturers. Honeywell holds a leading position through its extensive integration of control modules within building automation, energy management, and industrial connectivity systems. Schneider Electric competes closely, emphasizing modular control architectures and interoperability across industrial Ethernet and fieldbus networks. Johnson Controls focuses on control module development aligned with building management and HVAC optimization, leveraging compatibility with existing automation platforms.

Rockwell Automation and Mitsubishi Electric maintain strong global positions through their emphasis on programmable automation controllers, industrial networking standards, and high-reliability communication modules. Siemens delivers a broad range of control and communication modules designed for process automation and factory digitization, supported by its global industrial ecosystem. Phoenix Contact contributes specialized expertise in modular networking components, offering flexible configurations for distributed control systems and process monitoring. Competition in this market is influenced by interoperability, real-time data transmission capability, and cybersecurity resilience. Strategic differentiation depends on software integration, network redundancy, and system scalability across industrial and commercial applications. Continuous investment in industrial IoT connectivity, edge processing, and secure communication protocols defines the evolving technological direction of the control network modules sector.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type (Product Type) | Ethernet-based Modules, Fieldbus Modules, Others |

| Application | Building, Energy, Chemical, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Honeywell, Schneider Electric, Johnson Controls, Rockwell Automation, Mitsubishi Electric, Siemens, Phoenix Contact |

| Additional Attributes | Dollar sales by product type and application; regional adoption trajectories; interoperability and cybersecurity considerations; protocol support (PROFINET, EtherCAT, Modbus TCP); retrofit and legacy-integration challenges; analysis of drivers such as Industry 4.0 adoption and smart building investment; constraints including integration cost, protocol fragmentation, and skills requirements. |

The global control network modules market is estimated to be valued at USD 164.0 million in 2025.

The market size for the control network modules market is projected to reach USD 249.8 million by 2035.

The control network modules market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in control network modules market are ethernet-based modules, fieldbus modules and others.

In terms of application, building segment to command 30.0% share in the control network modules market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Control Network Modules in UK Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA