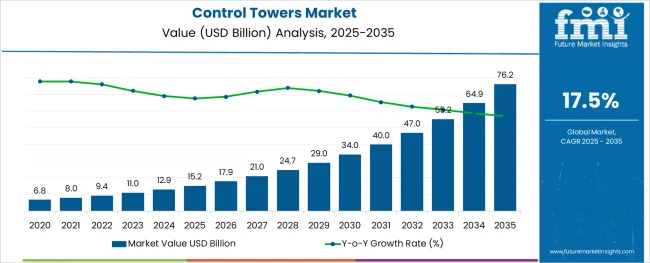

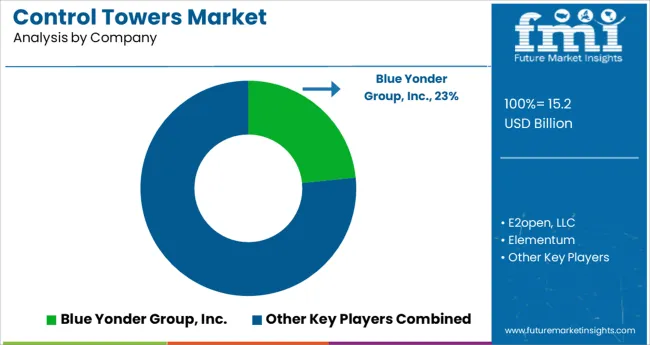

The Control Towers Market is estimated to be valued at USD 15.2 billion in 2025 and is projected to reach USD 76.2 billion by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Type, Application, and End Use and region. By Type, the market is divided into Analytical and Operational. In terms of Application, the market is classified into Supply Chain and Transportation. Based on End Use, the market is segmented into Aerospace & Defense, Chemicals, Retail & Consumer Goods, Healthcare, Manufacturing, High Technology Products, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

The global demand for Control Towers is projected to increase at a CAGR of 17.5% during the forecast period between 2025 and 2035, reaching a total of USD 76.2 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 15%.

The rising requirement for effective centralized infrastructure and supply chain solutions with better security to boost operational efficiency and ensure data visibility can be linked to the widespread usage of control towers across numerous industrial sectors. In accordance with this, increased demand for information-sharing tools and control towers, which enable omnichannel access to information via smart devices, is a major development driver.

Moreover, the widespread adoption of artificial intelligence (AI), machine learning (ML), big data analytics, cloud-based, real-time analytics, and other technologies for generating intelligent, actionable insights, breaking down data silos, and improving lead times is fueling the market growth. This is bolstered further by the introduction of AI-driven resolution rooms and playbooks, in conjunction with supply chain apps, to enhance product flow and apply predictive modeling to third-party logistics. Furthermore, the widespread use of control towers in the healthcare sector for monitoring supplies and controlling medical equipment supplies for treatment processes is fueling market expansion.

Aside from that, strategic cooperation among key companies has resulted in the development of telematics-enabled control towers with real-time tracking systems, resulting in a strong market outlook.

Big Data Analysis, Real-Time Analytics, and Cognitive Technologies are expected to drive Market Growth

With the globalization of the whole economy, the requirement for enhanced logistics and supply chain management methods has become unavoidable. The capacity of any supply management program to obtain, organize, and evaluate data is critical to its success.

Control tower solutions are in great demand from enterprises across a wide range of industries, and demand is growing rapidly. Numerous benefits given by these technologies, such as accurate forecasting and Business Intelligence (BI), help in supply chain efficiency, waste reduction, and revenue growth.

Businesses are seeking to use automated methods to disseminate information, evaluate and filter out customer input, and operate in these areas in order to function more effectively and efficiently across a wide range of sectors while cooperating with a wide range of partners.

To manage these brand-new, potentially priceless data sets, predictive analytics has been coded, and new big data science approaches have been developed. There are several methods to leverage big data in logistics and supply chains to improve procurement strategy.

Big data enhances the precision, transparency, and perspective of supplier networks, allowing supply chains to communicate more complicated information. These factors are expected to drive the control tower's market expansion throughout the estimated time period.

Enterprises' Concerns about Data Security May Limit Market Growth

The biggest problem that may prevent a company from employing a control tower is data security. Inadequate or nonexistent security measures dramatically increase the risk of a cyberattack occurs.

A supply chain assault involves penetration or attack via a third-party supplier on an organization. If one of these firms has inadequate Cyber Security threat protection, it may wind up functioning as the point of entry for the whole supply chain. Due to the wide range of risks, a corporation's danger surface may be extremely complex.

Cyberattacks and data breaches can cause considerable damage to a corporation in the form of brand damage, cleaning costs, lost income, and other reasons.

Various cloud-based platforms may or may not be capable of ensuring data security and preventing unauthorized access to crucial information. Internet thieves, unauthorized users, and hackers may try to get this information, which might be detrimental to the business.

Increasing Integration of AI and ML with Supply Chain Widening Profit Margins

During the projection period, the Asia Pacific Control Tower Market will soar at an astronomical rate.

In addition to monitoring, visibility, and alerting, supply chain control towers can leverage machine learning (ML) or artificial intelligence (AI) to provide insights. Professionals spend less time analyzing and sorting through large volumes of data. Artificial intelligence-powered supply chain control towers enable experts to connect with solutions using natural language.

As a result, the increasing integration of AI and ML with supply chain control towers assists experts in producing relevant and useful advice. The primary benefit of control towers for businesses is that they may use technological solutions, such as delivery management software, to get real-time order information without relying on a third party. Because of the enhanced visibility, the organization will have the knowledge it requires to know exactly what to do at each stage of the process.

The staff may use a control tower to undertake analysis to improve judgments, uncover process problems, and handle orders more efficiently depending on cycle times. Teams who monitor control towers can make better judgments based on the information provided by this technology. They also contribute to the dissemination of novel insights on their performance by gathering data from day-to-day delivery methods.

The region's supply chain and logistics business is growing, and the region's use of contemporary and digital technology is increasing. Supply chain management, or SCM, is the control of the flow of materials, information, and money involved with an item or service from raw material procurement to shipment to the ultimate site. Although the terms supply chain and logistics are frequently used interchangeably, logistics is simply one component of the supply chain.

China dominated the Asia Pacific Control Towers Market in 2024 and will continue to do the same over the assessment period. The Japanese and Indian markets are also expected to show lucrative growth prospects.

Increasing Use of Transportation Management Systems and Third-Party Logistics Service Providers

The North American control towers market is anticipated to lead the sales during the forecast period.

The use of transportation management systems and third-party logistics service providers to manage certain portions of a company's transportation and logistics network has boosted the need for control towers in North America.

North American organizations are increasingly using techniques to handle the massive volumes of information created by value chains and use the data to develop business insights.

As companies explore methods to save costs and raise profitability, tough competition, and rising operational expenses are driving the use of control towers in the region's organized retail sector. Organizations in the region are increasingly adopting digitization and other cutting-edge technology.

North America is increasingly depending on its supply chains to develop more customer-centric growth engines while remaining resilient and responsible. The advent of new disruptive technologies and business models has created new opportunities for the control tower in the supply chain.

The Supply Chain Segment to enhance Sales Prospects

In 2024, the supply chain prevailed with a stellar revenue share of the total market share. Many businesses are concentrating on implementing control towers to gain tight control over their supply chain, allowing them to plan for disruptions in inventory movement and deliver to their consumers what they want and when they want it online. Furthermore, supply chain control towers provide several benefits such as real-time monitoring, shipment delivery, cost analysis, and effective warehouse administration. Such variables are positive for segment growth.

The transportation category is expected to grow at a rapid pace throughout the projected period. Control towers typically give visibility into inbound and outbound shipments, as well as visibility into deliveries, ASN, on-time delivery, track and trace, freight expenditure, and other related information.

Automotive businesses are implementing cloud-based control tower technology to provide accurate information to their suppliers and to ensure the seamless execution of supply chain activities.

The Operational Segment is likely to Drive Market Growth

In 2024, the operational segment accounted for a lion’s share of total revenue. Operational control towers are utilized for analysis as well as implementation. They notify authorized operators of any difficulties as they occur, allowing them to remedy the issue in real-time. Through the control tower system, operational control towers also provide end-to-end supply chain visibility and management. Furthermore, an operational control tower enables transparent control of corporate operations using predictive, analytical, and real-time applications, allowing businesses to make better operational choices.

On the other hand, the analytical segment is expected to grow at the quickest rate over the projection period. The analytical control tower's capacity to provide real-time analytics information is a crucial driver driving the segment's growth.

It can assist in the management and monitoring of choices and implementation across departments and enterprises in order to optimize the entire network.

Large volumes of data are collected and analyzed by analytical control towers, which then employ predictive analytics to automate decision-making.

From offering new and innovative product lines to consolidating their market presence, these aforementioned start-ups have left no stone unturned. Some specific instances of key Control Towers start-ups are as follows:

Leading firms are working on providing control towers that may assist enterprises in improving operational efficiency and improving work conditions. The majority of players are concentrating on initiatives such as collaborations to expand their product offerings. Key players in the Control Towers market are Blue Yonder Group, Inc., E2open, LLC, Elementum, Infor, Kinaxis, Coupa Software Inc., One Network Enterprises, PearlChain, SAP, and Viewlocity Technologies Pty Ltd.

Recent Developments:

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 15.2 Billion |

| Market Value in 2035 | USD 76.2 Billion |

| Growth Rate | CAGR of 17.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Application, End-use, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Malaysia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Blue Yonder Group, Inc.; E2open, LLC; Elementum; Infor; Kinaxis; Coupa Software Inc.; One Network Enterprises; PearlChain; SAP; Viewlocity Technologies Pty Ltd. |

| Customization | Available Upon Request |

The global control towers market is estimated to be valued at USD 15.2 billion in 2025.

It is projected to reach USD 76.2 billion by 2035.

The market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types are analytical and operational.

supply chain segment is expected to dominate with a 64.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Sun Control Films Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

PID Controller Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Sun Control Films Manufacturers

PLC Controlled Packing Machine Market Trends – Forecast 2024-2034

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

Dust Control System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA