The Radar Security Market is estimated to be valued at USD 19.3 billion in 2025 and is projected to reach USD 44.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Radar Security Market Estimated Value in (2025 E) | USD 19.3 billion |

| Radar Security Market Forecast Value in (2035 F) | USD 44.5 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The Radar Security market is experiencing strong growth, driven by increasing demand for advanced surveillance solutions across defense, border management, and critical infrastructure sectors. Rising security concerns, geopolitical tensions, and the need for real-time situational awareness are fueling adoption of radar-based systems. Technological advancements in radar detection, signal processing, and threat recognition have enhanced performance, enabling accurate monitoring over various terrains and environmental conditions.

Integration with command and control systems, AI-based analytics, and automated alerts is improving operational efficiency and response times. Governments and private organizations are increasingly investing in modernizing border security and critical infrastructure surveillance to reduce vulnerabilities. The market is further supported by growing emphasis on short-range, mobile, and flexible radar systems that can adapt to dynamic security scenarios.

Continuous innovation in radar sensor technology, miniaturization, and interoperability with other security systems is expected to sustain long-term growth As organizations prioritize reliable and cost-effective monitoring solutions, the Radar Security market is poised for continued expansion over the coming decade.

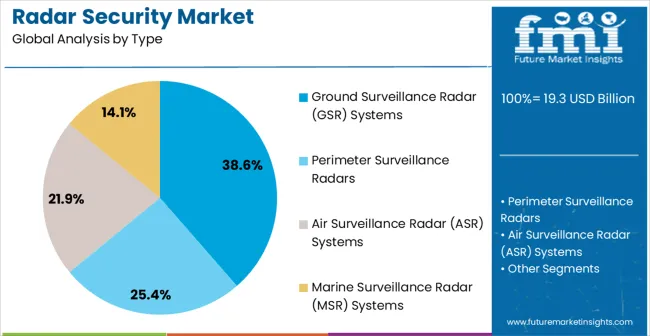

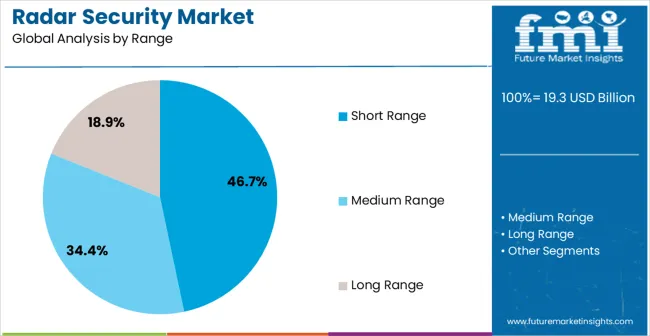

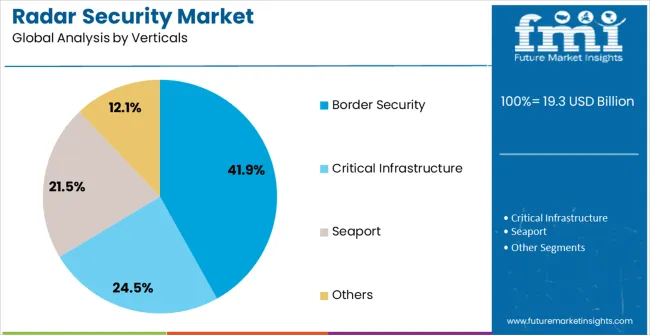

The radar security market is segmented by type, range, verticals, and geographic regions. By type, radar security market is divided into Ground Surveillance Radar (GSR) Systems, Perimeter Surveillance Radars, Air Surveillance Radar (ASR) Systems, and Marine Surveillance Radar (MSR) Systems. In terms of range, radar security market is classified into Short Range, Medium Range, and Long Range. Based on verticals, radar security market is segmented into Border Security, Critical Infrastructure, Seaport, and Others. Regionally, the radar security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ground surveillance radar systems segment is projected to hold 38.6% of the market revenue in 2025, making it the leading type. Growth in this segment is driven by the increasing need for continuous, real-time monitoring of borders, military installations, and critical infrastructure. These systems provide high-precision detection capabilities, even under challenging environmental conditions such as fog, rain, and dust, which ensures operational reliability.

Integration with AI-based analytics and automated alert systems enables faster decision-making and reduces manual surveillance efforts. Ground surveillance radar systems are highly valued for their ability to track multiple targets simultaneously, offering comprehensive situational awareness. Advances in mobility, sensor range, and modular design have improved adaptability for diverse deployment scenarios.

The ability to monitor wide geographic areas efficiently and the growing emphasis on national security have reinforced adoption As governments and defense agencies continue to invest in secure perimeter monitoring, the ground surveillance radar systems segment is expected to maintain its leadership position.

The short range segment is anticipated to account for 46.7% of the market revenue in 2025, establishing it as the leading range category. Its prominence is being driven by the increasing deployment of compact, flexible radar systems capable of providing precise detection in localized areas. Short range radar systems are particularly effective for border posts, checkpoints, and critical infrastructure sites where rapid threat identification is required.

Their smaller footprint and ease of installation enhance adaptability, allowing deployment in constrained and high-traffic areas. Advances in signal processing and target discrimination have improved detection accuracy and reduced false alarms. The integration of short range radar with other security technologies such as surveillance cameras and automated response systems has strengthened operational efficiency.

Rising demand for modular, low-cost, and high-performance radar solutions in both military and commercial verticals has further accelerated adoption As security priorities continue to evolve, the short range segment is expected to remain a primary driver of market growth, supported by innovation in mobility, miniaturization, and real-time analytics.

The border security vertical segment is expected to hold 41.9% of the market revenue in 2025, making it the largest end-use sector. Growth is being driven by the increasing need for advanced surveillance solutions to monitor extensive national boundaries and prevent unauthorized cross-border activity. Radar security systems provide real-time situational awareness, enabling rapid response to threats and improving overall border management efficiency.

Integration with command centers, AI-enabled detection algorithms, and automated alert systems enhances decision-making and reduces operational risks. Border security authorities are adopting both short-range and long-range radar systems to address varying terrain and environmental challenges. Investments in modernized security infrastructure, including checkpoints, fences, and integrated monitoring platforms, are accelerating adoption.

The segment’s expansion is further supported by rising governmental focus on national security, law enforcement efficiency, and prevention of smuggling and illegal migration As countries continue to prioritize border control and surveillance modernization, the border security vertical is expected to remain the primary driver of market growth.

Radar security market is growing significantly worldwide due to increasing demand of radar system in military application which in turn seeks to replace legacy systems. Radar systems are widely used to monitor residential and commercial environment for security purpose. Although it is used in various applications such as monitoring human trafficking, illegal entry of immigrants, it is also used to protect illegal import and export at the border to detect smuggling.

Moreover, due to rapid increase in usage of radar system for civilian application such as highway safety systems and anti-collision system for train pose a significant opportunity to increase in the growth of radar security market. Radar security has various features such as data protection, data reliability, data replication and exchange synchronous security which is used to encrypt communication data via industry standard secure sockets layer (SSL) connection.

| Country | CAGR |

|---|---|

| China | 11.8% |

| India | 10.9% |

| Germany | 10.0% |

| Brazil | 9.2% |

| USA | 8.3% |

| UK | 7.4% |

| Japan | 6.5% |

The Radar Security Market is expected to register a CAGR of 8.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.8%, followed by India at 10.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.5%, yet still underscores a broadly positive trajectory for the global Radar Security Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.0%. The USA Radar Security Market is estimated to be valued at USD 6.7 billion in 2025 and is anticipated to reach a valuation of USD 6.7 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 973.3 million and USD 588.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.3 Billion |

| Type | Ground Surveillance Radar (GSR) Systems, Perimeter Surveillance Radars, Air Surveillance Radar (ASR) Systems, and Marine Surveillance Radar (MSR) Systems |

| Range | Short Range, Medium Range, and Long Range |

| Verticals | Border Security, Critical Infrastructure, Seaport, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies, Saab, Thales Group, Honeywell, Hewlett Packard Enterprise, BAE Systems, Northrop Grumman, Elbit Systems, Texas Instruments, Ultra Electronics, Rohde Schwarz, General Dynamics, and L3Harris Technologies |

The global radar security market is estimated to be valued at USD 19.3 billion in 2025.

The market size for the radar security market is projected to reach USD 44.5 billion by 2035.

The radar security market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in radar security market are ground surveillance radar (gsr) systems, perimeter surveillance radars, air surveillance radar (asr) systems and marine surveillance radar (msr) systems.

In terms of range, short range segment to command 46.7% share in the radar security market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Security Tape Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Radar Simulators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA