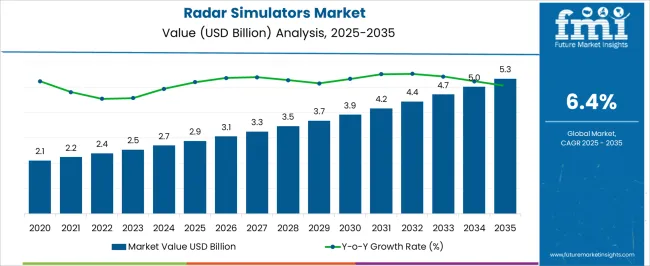

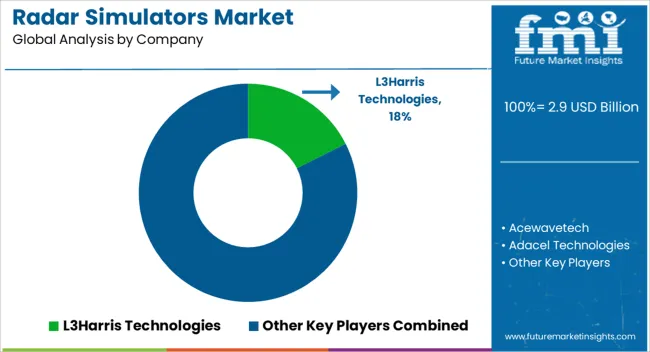

The radar simulators market is expected to grow from USD 2.9 billion in 2025 to USD 5.3 billion by 2035, with a CAGR of 6.4%. A market share erosion or gain analysis indicates a consistent increase in market value, suggesting overall market share gain rather than erosion. Between 2025 and 2030, the market grows from USD 2.9 billion to USD 3.9 billion, adding USD 1 billion with a CAGR of 6.7%. This period shows strong growth as radar simulators are increasingly adopted for defense and aerospace training, as well as testing and research applications. The early stage of growth reflects expanding use cases and technological advancements, resulting in significant market share gain. From 2030 to 2035, the market grows from USD 3.9 billion to USD 5.3 billion, contributing USD 1.4 billion in growth, with a CAGR of 5.7%. This slower growth rate indicates a potential stabilization of demand as the market matures, but the overall market share continues to increase due to continued demand for advanced radar systems in simulation and testing. The market share gain is driven by continued innovation and the integration of radar simulators into new applications such as autonomous vehicles and advanced military systems, showing a trend of strong market expansion throughout the forecast period.

| Metric | Value |

|---|---|

| Radar Simulators Market Estimated Value in (2025 E) | USD 2.9 billion |

| Radar Simulators Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The radar simulators market is experiencing strong traction, supported by the modernization of defense training infrastructure and heightened demand for real-time, cost-effective simulation systems. As geopolitical tensions persist, defense organizations are investing in advanced simulator platforms to improve combat readiness while reducing the operational risks and expenses associated with live training.

The integration of AI, 3D mapping, and signal jamming simulation capabilities has enhanced the realism and strategic value of radar-based training environments. Additionally, emphasis on hardware-software interoperability and cybersecurity resilience is shaping procurement decisions across both air and naval forces.

Market momentum is also being fueled by increasing collaborations between defense contractors and government research establishments to localize simulator manufacturing and boost domestic capabilities. In the coming years, sustained defense budget allocations and the rapid development of multi-domain operational strategies are expected to further drive the adoption of radar simulators in both tactical and strategic defense planning.

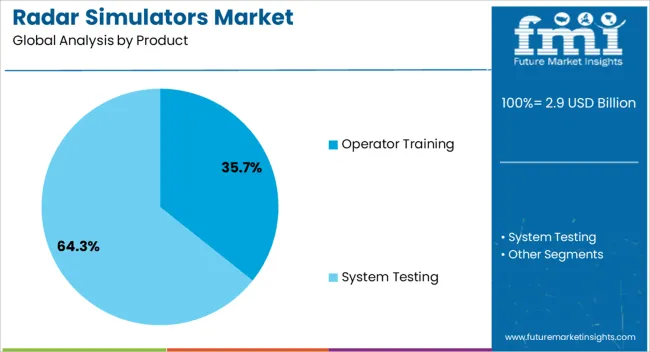

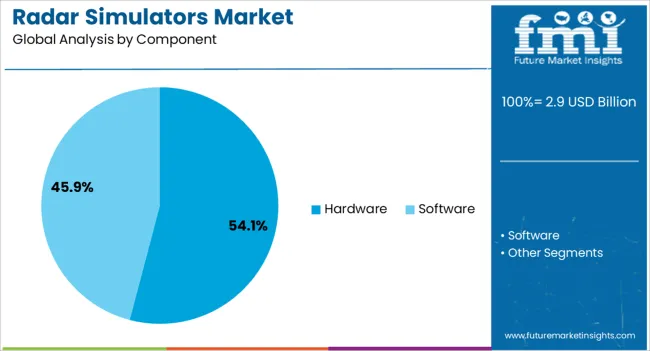

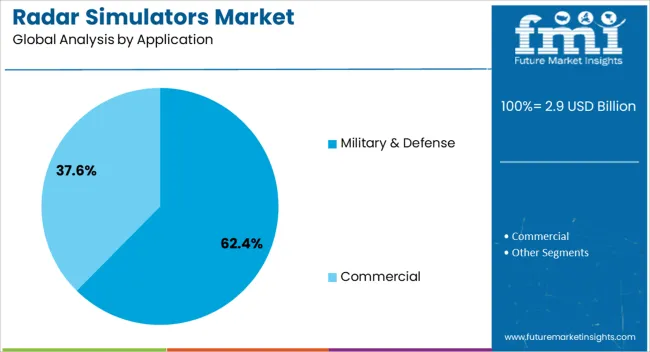

The radar simulators market is segmented by product, component, application, and region. By product, the market is divided into operator training and system testing. In terms of component, it is classified into hardware and software. Based on application, the market is segmented into military & defense and commercial. Regionally, the radar simulators industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Operator training systems are projected to account for 35.70% of the total revenue in the radar simulators market by 2025, making it the leading product segment. This dominance is attributed to the rising need for mission-critical skill development in high-risk radar environments without real-world deployment.

These systems enable operators to simulate a broad range of scenarios including electronic warfare, target detection, and signal disruption, thereby enhancing decision-making under complex battlefield conditions. The scalability of training modules and integration with real-time feedback analytics have significantly improved learning curves and operational readiness.

Additionally, cost containment goals within defense programs have accelerated the shift from live exercises to high-fidelity virtual training solutions, further solidifying operator training simulators as a strategic investment in force preparation.

Hardware is expected to hold 54.10% of the radar simulators market share in 2025, positioning it as the dominant component segment. This lead is being driven by the essential role of physical radar signal generators, transceivers, and interface modules in delivering authentic simulation outputs.

Advances in processor speeds, signal accuracy, and modular design have improved the scalability and interoperability of radar hardware systems. The ability to replicate multi-frequency and multi-platform signals has expanded their relevance in both air and ground-based simulation environments.

Furthermore, hardware investments are often prioritized by defense procurement agencies due to their long lifecycle value, upgrade flexibility, and reduced reliance on third-party software compatibility. As training doctrines increasingly demand realistic, scenario-driven simulations, hardware components continue to form the backbone of radar simulator architecture.

Military and defense applications are forecast to contribute 62.40% of the total market revenue in 2025, establishing this as the leading application segment. This position is being reinforced by a global uptick in defense preparedness initiatives and the proliferation of radar systems in surveillance, missile tracking, and anti-access/area-denial strategies.

Radar simulators are playing a pivotal role in enabling safe and repetitive testing of various tactical approaches without compromising operational assets. Governments and armed forces are increasingly integrating simulation training into standard military curricula to reduce time-to-readiness and improve force efficiency.

Strategic investments in electronic warfare units and combat air training programs are further driving demand for high-fidelity simulation environments. The sector's commitment to modernizing defense training ecosystems ensures continued reliance on radar simulators as a mission-critical capability.

The radar simulators market is witnessing growth due to increasing demand for testing and training solutions in defense, aerospace, and automotive industries. Radar simulators provide a controlled environment for testing radar systems, improving the accuracy and efficiency of operational systems. They are used in the design, testing, and maintenance of radar systems, enabling operators to simulate various scenarios and enhance system performance. With the increasing adoption of radar technology in applications like autonomous vehicles, air traffic control, and military defense systems, the market for radar simulators is expanding. Despite challenges in high initial costs, there are numerous opportunities for innovation and market expansion.

The radar simulators market is driven by the growing need for advanced testing and training solutions, particularly in the defense and aerospace industries. Radar simulators offer realistic training environments for military personnel and air traffic controllers, enabling them to simulate various radar scenarios without the need for costly and time-consuming field tests. As defense spending increases, particularly in developed nations, there is a heightened need for radar systems that can perform under diverse conditions. Radar simulators provide a cost-effective and efficient way to evaluate radar performance and conduct scenario-based training, driving the adoption of these simulators in defense and aerospace sectors. The growing integration of radar technology in commercial applications, such as autonomous vehicles and drones, contributes to this demand.

The radar simulators market faces challenges related to the high initial investment required for the development and deployment of advanced systems. Radar simulators, especially those used in defense and aerospace applications, are often complex and require significant resources for design, integration, and testing. The need for highly accurate and reliable simulations increases the technological complexity of these systems. The specialized nature of radar simulators means that they require skilled personnel for operation and maintenance, adding to the overall costs. These high costs and the need for continuous technological upgrades can limit adoption, especially among smaller defense contractors and companies with limited budgets, affecting growth potential in certain segments of the market.

There are significant opportunities in the radar simulators market due to the increasing adoption of radar technology in autonomous vehicles and expanding defense budgets. Autonomous vehicles, particularly self-driving cars and drones, require radar systems for navigation and obstacle detection, creating demand for advanced radar simulators to test and refine these systems. As these technologies continue to evolve, radar simulators will play an essential role in their development. Additionally, with rising defense budgets and a growing emphasis on national security, the demand for advanced radar systems for surveillance, navigation, and defense applications is expected to rise, further increasing the need for radar simulators to support the testing and training of radar operators and system performance.

The radar simulators market is experiencing a trend toward advancements in simulation technology, particularly the integration of artificial intelligence (AI) and machine learning (ML) to enhance the realism and accuracy of simulations. These technologies enable radar simulators to generate more complex and dynamic testing environments, mimicking real-world conditions with higher fidelity. AI and ML are used to simulate unpredictable scenarios, improving the ability of operators to respond to evolving situations in training. Furthermore, the trend toward modular, customizable simulators allows for more flexible and scalable solutions, catering to the specific needs of different industries. These trends are improving the efficiency and effectiveness of radar testing, driving the demand for advanced simulators.

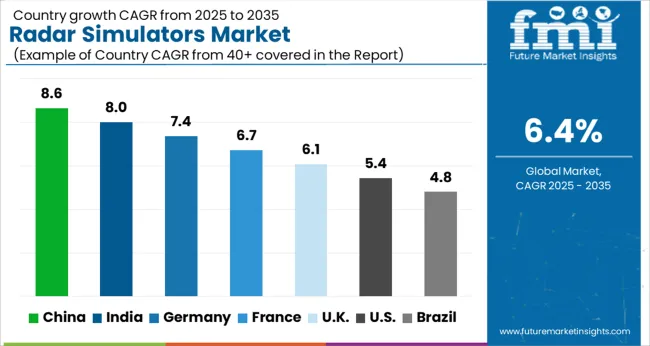

The radar simulators market is projected to grow at a CAGR of 6.4% from 2025 to 2035. China leads at 8.6%, followed by India at 8.0%, and France at 6.7%. The United Kingdom records 6.1%, while the United States stands at 5.4%. The increasing demand for radar simulators in defense, aviation, and autonomous vehicle industries is driving growth in BRICS countries like China and India, while OECD countries such as France, the UK, and the USA show steady growth due to technological advancements and the rising need for radar training systems. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 8.6% through 2035, driven by its substantial investments in defense and technological innovation. The demand for radar simulators is expanding as China enhances its military capabilities, particularly in radar technology, to strengthen national defense. China’s focus on modernizing its air force and military infrastructure, as well as the growing application of radar systems in autonomous vehicles, is driving the adoption of radar simulators. The robust aerospace sector is contributing to the growth of radar training systems and simulators.

India is expected to grow at a CAGR of 8.0% through 2035, driven by increasing investments in defense and aerospace sectors. The growing need for advanced radar training systems, coupled with the rise in the defense budget and technological advancements, is fueling the demand for radar simulators. India’s expanding aerospace industry and modernization of its defense forces further boost the demand for radar training systems. Government initiatives aimed at strengthening national security through advanced radar and defense systems also contribute to market growth.

France is projected to grow at a CAGR of 6.7% through 2035, with demand for radar simulators driven by its growing defense and aerospace sectors. France has a strong presence in the European aerospace industry, and radar simulators are in high demand for training military and aviation personnel. The need for advanced radar training systems, coupled with the country’s focus on strengthening its defense capabilities and improving aviation safety, further drives the market. France’s technological advancements in radar systems for both defense and civilian applications boost the demand for radar simulators.

The United Kingdom is projected to grow at a CAGR of 6.1% through 2035, with demand for radar simulators driven by the defense and aviation sectors. The UK is investing heavily in advanced radar systems for defense applications, which creates a rising need for radar simulators for training military personnel. Furthermore, with the growing use of radar systems in autonomous technologies and aviation, the demand for radar simulators continues to rise. The UK’s focus on improving radar technologies for both national security and civilian aviation further supports the market’s growth.

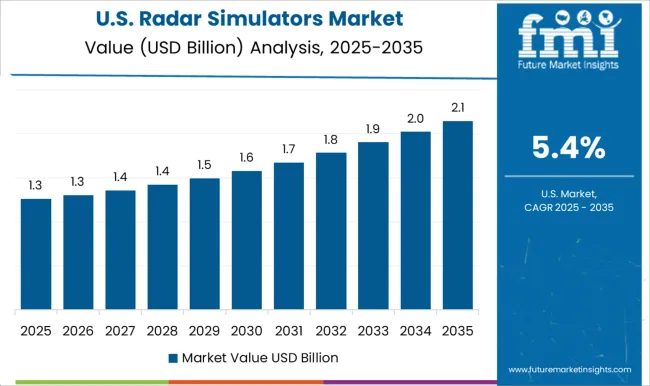

The United States is projected to grow at a CAGR of 5.4% through 2035, with the defense sector driving demand for radar simulators. The USA is a leader in military and aerospace technology, and radar simulators play a vital role in training defense personnel, air traffic controllers, and autonomous vehicle systems. With the increasing use of radar technologies in aviation, autonomous vehicles, and national security, the demand for simulators is on the rise. The USA government’s focus on enhancing radar technologies for defense and civilian applications further accelerates market growth.

The radar simulators market is driven by leading technology and defense companies specializing in advanced radar simulation systems used for military training, defense testing, and research applications. L3Harris Technologies is a market leader, providing cutting-edge radar simulators that cater to both military and commercial sectors with a focus on real-time simulation for complex radar systems. Mercury Systems and Textron Systems also play significant roles, offering innovative radar simulation solutions for military and aerospace applications, with a strong emphasis on enhancing the fidelity and realism of training systems. Acewavetech and Adacel Technologies provide radar simulators tailored for both research and defense, specializing in high-precision simulation software for training and mission rehearsal.

ARI Simulation and Mistral Solutions focus on radar simulation systems designed for tactical operations, supporting military forces in scenario-based training and operational planning. Buffalo Computer Graphics and Cambridge Pixel are well-known for developing radar simulation tools with high-resolution graphics and scenario modeling to provide advanced training platforms for defense and aviation sectors. RTX and Ultra Intelligence & Communications offer integrated radar simulation and analysis solutions, advancing the use of radar in defense and national security. Competitive differentiation in the radar simulators market is driven by simulation accuracy, integration with radar systems, and the ability to replicate real-world scenarios. Barriers to entry include the high cost of development, regulatory compliance, and the need for advanced software and hardware integration. Strategic priorities include enhancing simulation software, improving system integration, and expanding partnerships with defense contractors and training institutions.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Operator Training and System Testing |

| Component | Hardware and Software |

| Application | Military & Defense and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L3Harris Technologies, Acewavetech, Adacel Technologies, ARI Simulation, Buffalo Computer Graphics, Cambridge Pixel, Mercury Systems, Mistral Solutions, RTX, Textron Systems, and Ultra Intelligence & Communications |

| Additional Attributes | Dollar sales by simulator type (hardware, software) and end-use segments (military, aviation, research). Demand dynamics are driven by growing military training needs, advancements in radar technology, and increased use of simulation for operational planning. Regional trends highlight strong growth in North America and Europe, with innovation focusing on AI integration, real-time feedback, and virtual reality applications. |

The global radar simulators market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the radar simulators market is projected to reach USD 5.3 billion by 2035.

The radar simulators market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in radar simulators market are operator training, _fixed, _portable, system testing, _fixed and _portable.

In terms of component, hardware segment to command 54.1% share in the radar simulators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA