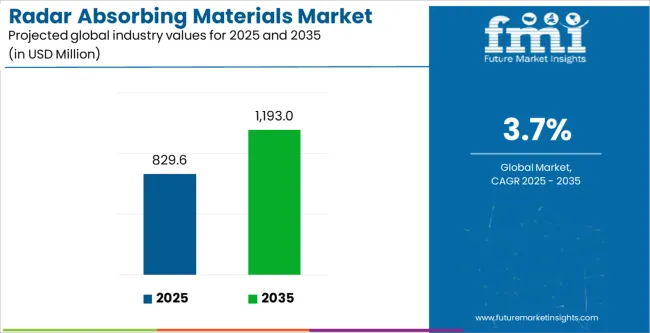

The radar absorbing materials market is estimated to be valued at USD 829.6 million in 2025 and is projected to reach USD 1193.0 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

Between 2021 and 2025, the market rises from USD 691.8 million to USD 829.6 million, indicating steady expansion and gradual market share gains by leading suppliers. Growth during this period is supported by rising defense spending, increasing adoption of stealth technologies, and upgrades in fighter aircraft, naval vessels, and missile systems. Incremental increases are observed with market values reaching USD 717.4 million in 2022, USD 743.9 million in 2023, USD 771.5 million in 2024, and USD 800.0 million prior to attaining USD 829.6 million in 2025. From 2026 to 2030, the market continues its upward trajectory, climbing to USD 994.9 million by 2030. During this period, new material innovations, enhanced electromagnetic absorption efficiency, and expanded applications in military and aerospace sectors contribute to incremental share gains.

Market values rise steadily to USD 860.3 million in 2026, USD 892.1 million in 2027, USD 925.1 million in 2028, USD 959.4 million in 2029, and USD 994.9 million in 2030. Between 2031 and 2035, the market further expands to USD 1,193.0 million. While leading players consolidate positions through technological differentiation and strategic contracts, some smaller players experience minor share erosion due to intense competition and entry barriers.

| Metric | Value |

|---|---|

| Radar Absorbing Materials Market Estimated Value in (2025 E) | USD 829.6 million |

| Radar Absorbing Materials Market Forecast Value in (2035 F) | USD 1193.0 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The radar absorbing materials market is shaped by multiple parent markets that collectively determine its demand and growth across defense, aerospace, and commercial sectors. The advanced materials market plays a fundamental role, with radar absorbing materials accounting for nearly 10-12% of this segment. As engineered composites and coatings designed to control electromagnetic waves, RAM has become an essential category within high-performance materials. The defense and military equipment market represents the largest share, contributing about 25-30%. Fighter aircraft, naval vessels, ground vehicles, and unmanned systems integrate RAM extensively to reduce radar signatures and enhance stealth capabilities, making defense procurement programs a primary driver.

The aerospace and aviation market contributes around 15-18%, as RAM is increasingly applied in aircraft coatings, UAVs, and structural components to reduce detectability and strengthen operational security. The electronics and communication systems market accounts for nearly 8-10% of the share. Here, radar absorbing materials are used to minimize electromagnetic interference in radomes, antennas, and communication devices, ensuring clear and secure signal transmission. The automotive and transportation market is an emerging parent, contributing around 5-7%. With the rise of advanced driver-assistance systems (ADAS) and autonomous vehicles, RAM is being incorporated to manage radar cross-sections and reduce signal interference in radar-based navigation and safety systems.

The market is experiencing significant growth, driven by rising demand for advanced stealth technologies in defense, aerospace, and security applications. The increasing need to reduce radar cross-section for military assets, including aircraft, naval vessels, and ground vehicles, is creating strong adoption momentum. Expanding research and development efforts are leading to the formulation of RAM with broader frequency absorption, improved environmental resistance, and lighter weight.

Civil applications, including telecommunications and electromagnetic interference shielding, are also contributing to the market's growth trajectory. Strategic collaborations between material scientists and defense contractors are enabling the commercialization of RAM solutions with enhanced performance and easier application methods.

With increasing geopolitical tensions and modernization of defense fleets, demand for both traditional and next-generation RAM is expected to accelerate The ability to customize absorption performance across multiple frequency bands is likely to shape future innovations, securing the long-term relevance of RAM in both military and commercial sectors.

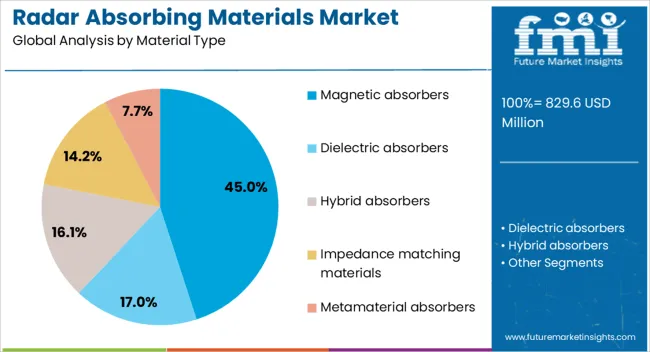

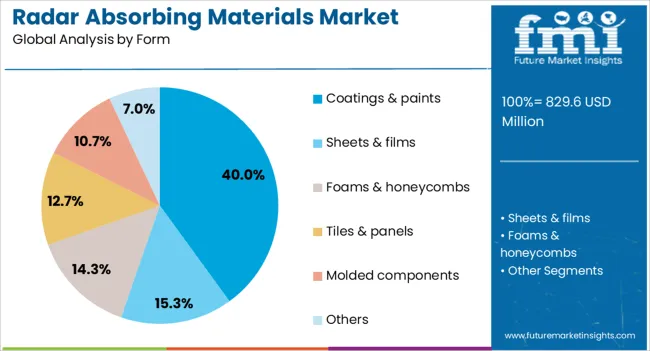

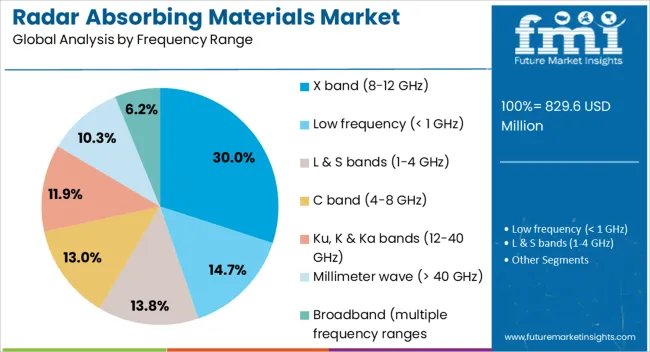

The radar absorbing materials market is segmented by material type, form, frequency range, application, end use industry, company, and geographic regions. By material type, radar absorbing materials market is divided into magnetic absorbers, dielectric absorbers, hybrid absorbers, impedance matching materials, metamaterial absorbers, frequency selective surfaces, and others. In terms of form, radar absorbing materials market is classified into coatings & paints, sheets & films, foams & honeycombs, tiles & panels, molded components, and others. Based on frequency range, radar absorbing materials market is segmented into X band (8-12 GHz), low frequency (< 1 GHz), L & S bands (1-4 GHz), C band (4-8 GHz), Ku, K & Ka bands (12-40 GHz), millimeter wave (> 40 GHz), and broadband (multiple frequency ranges. By application, radar absorbing materials market is segmented into military aircraft, naval vessels, ground vehicles & systems, missiles & projectiles, fixed installations, civilian applications, and others. By end use industry, radar absorbing materials market is segmented into defense, aerospace, electronics & telecommunications, automotive, research & academia, and others. Regionally, the radar absorbing materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The magnetic absorbers segment is projected to hold 45% of the radar absorbing materials market revenue share in 2025, establishing it as the leading material type. Its dominance has been attributed to the superior electromagnetic wave attenuation capabilities of magnetic-based composites, which are particularly effective across a wide range of frequencies. These materials have been preferred in applications where high absorption efficiency and minimal thickness are required, enabling improved stealth performance without significant weight addition. The adaptability of magnetic absorbers to different substrate materials has supported their integration into complex defense platforms. Advancements in nanostructured magnetic fillers and hybrid formulations have further improved their operational stability under extreme temperatures and environmental conditions. The segment’s leadership is also reinforced by consistent demand from aerospace and naval defense projects, where performance, durability, and reduced maintenance needs are critical This sustained requirement for high-performance stealth materials has positioned magnetic absorbers at the forefront of RAM market growth.

The coatings and paints form segment is expected to account for 40% of the market revenue share in 2025, making it the dominant form. Its growth has been supported by the ease of application on various surfaces, including aircraft fuselages, ship hulls, and ground vehicle exteriors. The ability to retrofit existing platforms with RAM coatings without major structural modifications has provided a cost-effective and flexible stealth solution. Advances in formulation technology have enabled coatings with multi-band absorption, increased durability, and resistance to harsh operational environments. The demand for low-maintenance and long-lasting protective layers has also favored the adoption of coating-based RAM. Additionally, the commercial viability of spray-applied or roll-coated RAM has expanded opportunities beyond defense into telecommunications and industrial shielding The scalability, adaptability, and reduced operational downtime offered by RAM coatings continue to solidify their leadership in the market.

The X band (8-12 GHz) frequency range segment is forecasted to hold 30% of the market revenue share in 2025, representing the leading frequency range. This dominance is driven by the critical role of the X band in military radar systems, including surveillance, targeting, and tracking applications. RAM optimized for the X band has been essential for reducing detectability in high-threat environments where radar systems operate within this range. Enhanced material designs have been developed to maintain high absorption efficiency even under dynamic operational conditions. The continued development of advanced defense radar technologies, coupled with the need for stealth capabilities in modern warfare, has sustained strong demand for X band absorption solutions. Additionally, applications in satellite communications and weather monitoring have contributed to the segment’s growth With the strategic importance

The radar absorbing materials market is driven by defense modernization programs and the rising need for stealth technologies in aerial, naval, and ground platforms. High production costs, technical complexities, and regulatory hurdles continue to challenge widespread adoption, particularly in budget-sensitive regions. Expanding opportunities in aerospace, electronics, and automotive radar systems are broadening applications beyond defense. Integration into next-generation platforms, supported by research collaborations and advanced manufacturing techniques, is shaping future demand. These materials are expected to remain essential in countering modern detection systems and strengthening operational capabilities globally.

The radar absorbing materials market is gaining traction as nations prioritize stealth capabilities to strengthen defense systems. These materials are critical in reducing radar signatures of aircraft, naval vessels, and ground vehicles, enabling enhanced survivability in modern warfare. Rising geopolitical tensions and regional conflicts have pushed governments to invest in stealth-focused technologies, making radar absorbing materials integral to next-generation defense platforms. Beyond traditional defense use, these materials are being explored for civilian applications such as telecommunications, where interference reduction is essential. Their ability to manage electromagnetic waves also supports aerospace and electronics sectors, expanding the scope of usage. With defense modernization continuing across developed and developing economies, radar absorbing materials are expected to remain central to strategies focused on achieving technological superiority, deterrence, and advanced operational readiness across multiple mission environments.

The radar absorbing materials market faces challenges related to high production costs and technical barriers. Manufacturing involves specialized polymers, composites, and coatings that require precise formulations and processing to achieve reliable radar attenuation. These processes are resource-intensive, leading to elevated production costs that restrict large-scale deployment, especially for budget-constrained defense programs. Technical complexities in achieving consistent performance across different frequencies also create limitations, as advanced threats demand broader spectrum coverage. Durability under extreme environmental conditions presents another challenge, since materials must maintain effectiveness despite heat, pressure, and mechanical stress. In addition, stringent regulatory frameworks and export restrictions surrounding defense-related technologies can delay procurement and adoption. These hurdles limit affordability and accessibility, making radar absorbing materials more prevalent in nations with established defense budgets while creating barriers for widespread adoption across emerging economies.

Opportunities are expanding as radar absorbing materials find growing adoption beyond defense into aerospace and electronic applications. Their use in commercial aircraft for minimizing radar cross-sections during navigation, as well as in satellite systems to reduce electromagnetic interference, is increasing steadily. In the electronics sector, radar absorbing coatings and films are being developed to enhance signal clarity in devices operating across high-frequency bands. Automotive radar systems used in advanced driver assistance are also emerging as new areas of application, requiring materials that can manage wave reflections and improve accuracy. Research partnerships between defense contractors, aerospace firms, and universities are accelerating innovation in material formulations, targeting lighter, thinner, and more versatile products. These advances are enabling radar absorbing materials to serve a broader range of industries, creating opportunities that extend far beyond traditional defense requirements.

A defining trend in the radar absorbing materials market is integration into advanced defense platforms designed for future warfare. Modern fighter aircraft, unmanned aerial vehicles, and naval systems are being developed with stealth requirements as standard design features, embedding radar absorbing composites directly into structural components. This trend reduces reliance on surface coatings and enhances long-term effectiveness. Modular designs and additive manufacturing are also being adopted to produce complex geometries that optimize radar absorption. Collaboration between defense agencies and material manufacturers is fostering tailored solutions that meet specific platform requirements. The increasing role of network-centric and electronic warfare further underscores the importance of radar absorbing materials, as nations aim to counter advanced detection systems. Integration into next-generation defense programs highlights the strategic importance of these materials, ensuring they remain indispensable in global defense procurement strategies.

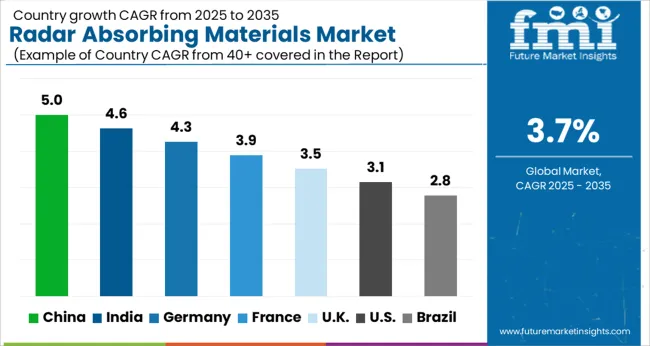

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The global radar absorbing materials market is forecast to grow at a CAGR of 3.7% from 2025 to 2035. China leads with 5.0%, followed by India at 4.6% and Germany at 4.3%. The United Kingdom and the United States show moderate growth rates of 3.5% and 3.1%, respectively. Market expansion is being shaped by defense modernization programs, growing investments in stealth technologies, and increased participation in international collaborative defense projects. While Asia is emerging as the fastest-growing hub, Europe and the USAcontinue to set benchmarks in technological advancements and global defense exports. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to dominate the radar absorbing materials market with a CAGR of 5.0% between 2025 and 2035. The growth is strongly tied to the country’s defense modernization programs and the rising demand for stealth technologies in both aerial and naval platforms. The increasing investment in advanced military aircraft, ships, and unmanned systems supports large-scale adoption of radar absorbing coatings and composites. Domestic research institutions and defense firms are developing innovative materials to enhance stealth efficiency while maintaining cost-effectiveness. Export initiatives and collaborations with international defense partners further contribute to market strength.

India is expected to expand at a CAGR of 4.6% from 2025 to 2035 in the radar absorbing materials market. The demand is largely driven by indigenous defense programs, including advanced fighter jets, warships, and drone technologies. Government-backed defense modernization and the “Make in India” initiative are providing momentum to domestic material development and manufacturing. India’s collaborations with global defense contractors are also enhancing expertise in radar absorbing technologies. Growing security concerns and regional defense strategies are expected to further accelerate adoption. The push for self-reliance in defense procurement places radar absorbing materials as a critical component in India’s long-term defense roadmap.

Germany is forecast to grow at a CAGR of 4.3% between 2025 and 2035 in the radar absorbing materials market. As part of NATO, Germany places strong emphasis on advanced defense capabilities, including stealth technologies in aircraft and naval systems. Demand is also supported by Germany’s aerospace industry, which is integrating radar absorbing composites in experimental and next-generation defense projects. Research institutions and defense contractors are investing in material science innovations to improve absorption efficiency and durability. The growing focus on collaborative European defense projects, such as the Future Combat Air System (FCAS), further strengthens market prospects.

The United Kingdom is expected to grow at a CAGR of 3.5% from 2025 to 2035 in the radar absorbing materials market. The country’s defense strategies are centered on enhancing stealth capabilities of both aircraft and naval fleets. Projects like the Tempest program highlight the importance of advanced radar absorbing materials in next-generation fighter designs. The UK’s strong R&D base and partnerships with European and USA defense contractors are enabling progress in high-performance coatings and composites. Increased budget allocation to aerospace and naval modernization ensures steady demand for radar absorbing technologies.

The United States is projected to grow at a CAGR of 3.1% between 2025 and 2035 in the radar absorbing materials market. As the global leader in defense spending, the USA continues to invest heavily in stealth technology for fighter jets, naval vessels, and drones. Programs such as the F-35 Lightning II and the Next-Generation Air Dominance (NGAD) initiative rely extensively on advanced radar absorbing composites. Domestic defense companies, supported by a strong research ecosystem, focus on continuous innovation to improve material performance and durability. The USA also remains a key exporter of stealth-enabled platforms, further expanding market potential.

In the radar absorbing materials market, competition is shaped by advanced composites, proprietary coatings, and integration into defense and aerospace platforms. BAE Systems focuses on radar-absorbing structures and coatings engineered for stealth aircraft and naval vessels, delivering materials optimized for wideband absorption and durability under extreme conditions. Lockheed Martin integrates radar absorbing composites directly into the airframes of platforms such as the F-35, securing a unique competitive advantage through vertical integration and proprietary low-observable technologies. Northrop Grumman emphasizes radar cross-section reduction materials across its stealth portfolio, supported by in-house R&D and government partnerships.

Laird competes with engineered electromagnetic interference (EMI) absorbers and microwave absorbing foams that serve both defense and commercial electronics. Parker Hannifin offers advanced polymer and elastomer-based absorbers, targeting aerospace and industrial shielding needs with scalable manufacturing capabilities. Specialized companies including Panashield, Mast Technologies, Soliani EMC, Arc Technologies, and Hitek focus on niche applications such as anechoic chambers, shielding enclosures, and test environments. Their competitiveness is defined by customization, rapid delivery, and the ability to design absorbers for specific frequencies or electromagnetic environments.

Strategies across the industry emphasize continual material innovation, lifecycle performance, and integration into stealth platforms as militaries demand advanced survivability solutions. Product brochures highlight radar absorbing coatings, foams, and composite panels designed for aircraft, naval ships, ground vehicles, and electronic enclosures. BAE Systems and Lockheed Martin emphasize defense-grade coatings for mission-critical stealth. Laird and Parker Hannifin present EMI absorber sheets, gaskets, and molded parts for commercial and aerospace markets. Mast, Soliani, Arc, and Hitek showcase absorptive panels and fabrics used in electromagnetic compatibility testing and secure facilities. These brochures underscore precision engineering, frequency-specific design, and the pivotal role of radar absorbing materials in stealth performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 829.6 million |

| Material Type | Magnetic absorbers, Dielectric absorbers, Hybrid absorbers, Impedance matching materials, Metamaterial absorbers, Frequency selective surfaces, and Others |

| Form | Coatings & paints, Sheets & films, Foams & honeycombs, Tiles & panels, Molded components, and Others |

| Frequency Range | X band (8-12 GHz), Low frequency (< 1 GHz), L & S bands (1-4 GHz), C band (4-8 GHz), Ku, K & Ka bands (12-40 GHz), Millimeter wave (> 40 GHz), and Broadband (multiple frequency ranges |

| Application | Military aircraft, Naval vessels, Ground vehicles & systems, Missiles & projectiles, Fixed installations, Civilian applications, and Others |

| End Use Industry | Defense, Aerospace, Electronics & telecommunications, Automotive, Research & academia, and Others |

| Company | BAE Systems, Lockheed Martin, Northrop Grumman, Laird / Lairdtech, Parker Hannifin, Panashield, Mast Technologies, Soliani EMC, Arc Technologies, Hitek, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Additional Attributes | Dollar sales by product type (composite sheets, coatings, foams), material composition (carbon-based, ferrite-based, conductive polymers), and application (aircraft, naval, ground vehicles, electronics). Demand is driven by defense modernization, stealth technology adoption, and aerospace sector expansion. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by increasing defense budgets, R&D initiatives, and advanced military programs requiring radar signature management. |

The global radar absorbing materials market is estimated to be valued at USD 829.6 million in 2025.

The market size for the radar absorbing materials market is projected to reach USD 1,193.0 million by 2035.

The radar absorbing materials market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in radar absorbing materials market are magnetic absorbers, ferrites, carbonyl iron, and others.

In terms of form, coatings & paints segment to command 40.0% share in the radar absorbing materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA