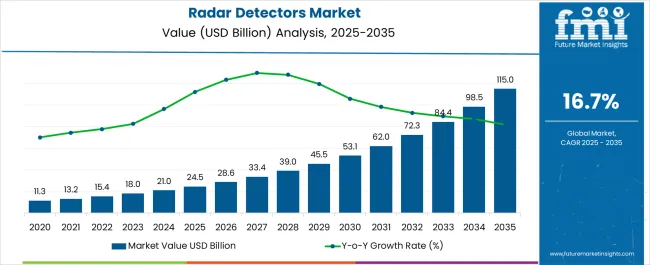

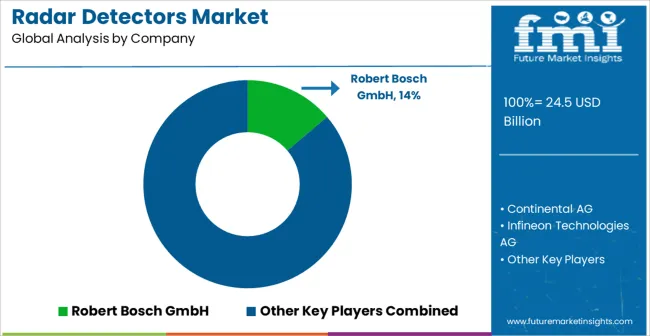

The Radar Detectors Market is estimated to be valued at USD 24.5 billion in 2025 and is projected to reach USD 115.0 billion by 2035, registering a compound annual growth rate (CAGR) of 16.7% over the forecast period.

| Metric | Value |

|---|---|

| Radar Detectors Market Estimated Value in (2025 E) | USD 24.5 billion |

| Radar Detectors Market Forecast Value in (2035 F) | USD 115.0 billion |

| Forecast CAGR (2025 to 2035) | 16.7% |

The Radar Detectors market is experiencing robust growth, driven by the increasing need for advanced vehicle safety solutions and enforcement awareness systems. Rising adoption is being fueled by regulatory requirements, traffic monitoring initiatives, and the growing emphasis on road safety across both developed and emerging regions. Technological advancements in detection accuracy, signal processing, and integration with vehicle electronics are enhancing the effectiveness of radar detectors.

Increasing consumer awareness about speeding penalties and law enforcement measures is further accelerating adoption. The market is also supported by innovations in portable, low-power, and user-friendly devices, allowing seamless integration into different vehicle types. As the automotive industry increasingly focuses on connected mobility, intelligent transport systems, and driver assistance technologies, demand for radar detection solutions continues to expand.

The growing popularity of advanced driver-assistance systems and telematics integration further reinforces the market’s potential With continuous technological enhancements, the Radar Detectors market is expected to witness sustained growth, offering reliable, adaptable, and cost-effective solutions for drivers and fleet operators.

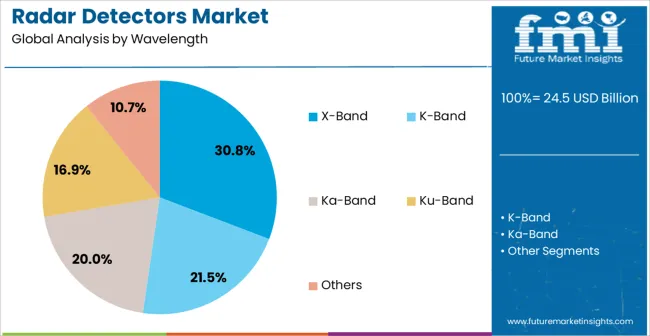

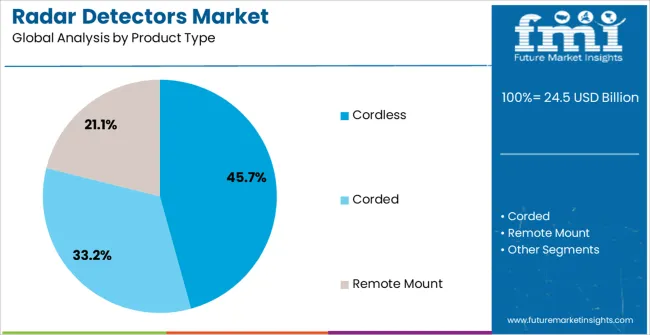

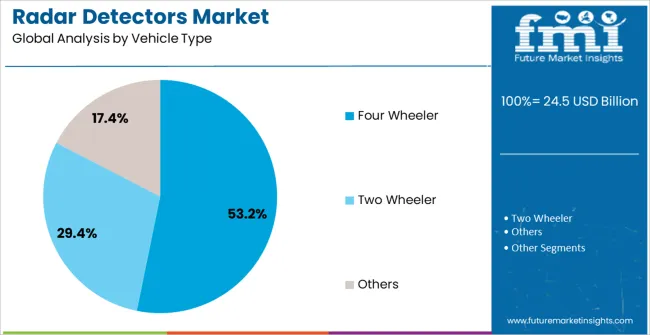

The radar detectors market is segmented by wavelength, product type, vehicle type, and geographic regions. By wavelength, radar detectors market is divided into X-Band, K-Band, Ka-Band, Ku-Band, and Others. In terms of product type, radar detectors market is classified into Cordless, Corded, and Remote Mount. Based on vehicle type, radar detectors market is segmented into Four Wheeler, Two Wheeler, and Others. Regionally, the radar detectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The X-Band wavelength segment is projected to hold 30.8% of the market revenue in 2025, positioning it as the leading wavelength category. Its dominance is being driven by the segment’s ability to provide high detection accuracy for conventional traffic monitoring and enforcement systems. X-Band radar detectors offer reliable performance under varied environmental conditions, including urban and highway scenarios, enhancing driver awareness and compliance.

The technology’s compatibility with a wide range of radar frequencies used by law enforcement agencies ensures its widespread adoption. Advances in signal processing and interference mitigation have further strengthened the segment’s effectiveness. Growing consumer demand for high-precision detection solutions and increased spending on vehicle safety accessories have reinforced market leadership.

The cost-effectiveness and availability of X-Band detectors, combined with proven performance in real-world applications, support continued adoption As traffic regulations tighten and enforcement technologies evolve, the X-Band wavelength segment is expected to maintain its market dominance due to reliability, efficiency, and compatibility with existing monitoring systems.

The cordless product type segment is anticipated to account for 45.7% of the market revenue in 2025, making it the leading product type. Growth in this segment is being driven by increasing consumer preference for portability, ease of installation, and flexibility across multiple vehicles. Cordless radar detectors do not require permanent wiring, allowing drivers to use them in different vehicles without professional installation.

Advances in battery technology and low-power consumption have enhanced operational convenience and extended runtime. The ability to integrate smart features, such as GPS, speed alerts, and real-time updates, has further strengthened adoption. The segment’s leadership is also supported by growing demand for user-friendly devices that combine performance, convenience, and affordability.

As consumers increasingly prioritize mobility and rapid deployment, cordless radar detectors are expected to retain their dominant position The combination of portability, versatility, and technological enhancements ensures that the segment continues to drive revenue growth in the Radar Detectors market.

The four wheeler segment is projected to hold 53.2% of the market revenue in 2025, establishing it as the leading vehicle category. This dominance is being driven by the widespread adoption of radar detectors among passenger car owners, who seek enhanced driving safety and awareness of traffic enforcement measures. Increasing vehicle ownership, rising disposable incomes, and consumer focus on road safety are contributing to demand in this segment.

Radar detectors in four wheelers are being leveraged to provide real-time alerts, reduce speeding violations, and enhance driver confidence. Advances in compact device design and integration with vehicle electronics have strengthened usability and convenience.

The segment is further supported by a growing aftermarket for automotive accessories, enabling easy adoption of radar detectors without major modifications As traffic density increases globally and regulatory enforcement intensifies, four wheelers are expected to remain the primary application segment, reinforcing their position as the largest contributor to market revenue through widespread adoption and continual consumer preference.

Over the years, endless efforts have been made to decrease the number of causalities on roads. In the recent years most of these efforts have been made on developing technologies that helps both warn and help drivers in the events of hazardous situation. Owing to recent advances in information technologies, new applications can be developed to prevent these situations. Therefore, radar detectors provides an effective solutions to avoid the accidents on roads.

Radar detectors are electronics devices used by the vehicle owners to detect if their speed is being monitored by law enforcement or police using a radar gun. Radar detectors are legal in non-commercial vehicles in 49 states (all except Washington D.C. and Virginia).

Now a days, radar detectors have been designed as high performance and high technology devices. Also, in the last decade, advances in micro circuitry, chip design and signal processing have led to the design of premium radar detectors that virtually eliminate false alarms and laser with better accuracy.

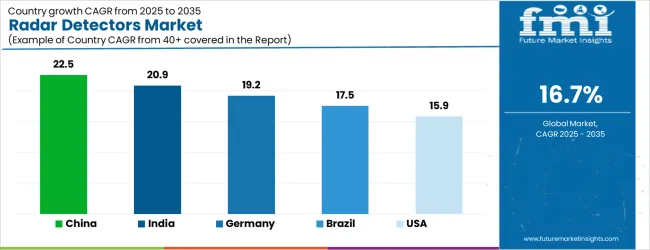

| Country | CAGR |

|---|---|

| China | 22.5% |

| India | 20.9% |

| Germany | 19.2% |

| Brazil | 17.5% |

| USA | 15.9% |

| UK | 14.2% |

| Japan | 12.5% |

The Radar Detectors Market is expected to register a CAGR of 16.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 22.5%, followed by India at 20.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 12.5%, yet still underscores a broadly positive trajectory for the global Radar Detectors Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 19.2%. The USA Radar Detectors Market is estimated to be valued at USD 8.8 billion in 2025 and is anticipated to reach a valuation of USD 8.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.2 billion and USD 736.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.5 Billion |

| Wavelength | X-Band, K-Band, Ka-Band, Ku-Band, and Others |

| Product Type | Cordless, Corded, and Remote Mount |

| Vehicle Type | Four Wheeler, Two Wheeler, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, Continental AG, Infineon Technologies AG, NXP Semiconductors N.V., Denso Corporation, Hella GmbH and Co. KGaA, Veoneer Inc., STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices Inc., Renesas Electronics Corporation, and Aptiv PLC |

The global radar detectors market is estimated to be valued at USD 24.5 billion in 2025.

The market size for the radar detectors market is projected to reach USD 115.0 billion by 2035.

The radar detectors market is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in radar detectors market are x-band, k-band, ka-band, ku-band and others.

In terms of product type, cordless segment to command 45.7% share in the radar detectors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar Simulators Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA