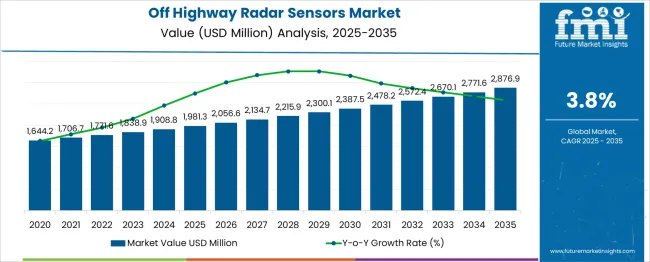

The global off highway radar sensors market is projected to grow from USD 1,981.3 million in 2025 to approximately USD 2876.9 million by 2035, recording an absolute increase of USD 895.6 million over the forecast period. This translates into a total growth of 45.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.46X during the same period, supported by the rising adoption of advanced safety systems in off-highway vehicles and increasing demand for autonomous capabilities in construction, agriculture, and mining applications.

Between 2025 and 2030, the off highway radar sensors market is projected to expand from USD 1,981.3 million to USD 2,369.1 million, resulting in a value increase of USD 387.8 million, which represents 43.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of radar-equipped vehicles in global construction and agricultural fleets, increasing focus on operator safety and collision avoidance systems, and growing awareness among fleet operators about the importance of advanced sensing technologies. Equipment manufacturers are expanding their radar capabilities to address the growing complexity of modern off-highway vehicle sensor systems.

From 2030 to 2035, the market is forecast to grow from USD 2,369.1 million to USD 2876.9 million, adding another USD 507.8 million, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of 360° surround radar systems, integration of multi-frequency radar technologies, and development of standardized radar protocols across different vehicle manufacturers. The growing adoption of autonomous and semi-autonomous off-highway vehicles will drive demand for more sophisticated radar sensing solutions and specialized technical expertise.

Between 2020 and 2025, the off highway radar sensors market experienced steady expansion, driven by increasing safety regulations in construction and mining sectors and growing awareness of radar system benefits following workplace safety initiatives. The market developed as off-highway vehicle manufacturers recognized the need for advanced sensing equipment and integrated safety systems to properly protect operators and equipment. Insurance companies and equipment manufacturers began emphasizing proper radar system integration to maintain vehicle safety standards and warranty coverage.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,981.3 million |

| Forecast Value in (2035F) | USD 2876.9 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

Market expansion is being supported by the rapid increase in safety-equipped off-highway vehicles worldwide and the corresponding need for advanced radar sensing capabilities for collision avoidance, blind spot detection, and autonomous operation support. Modern off-highway vehicles rely on precise radar detection and ranging to ensure proper functioning of safety systems including automatic emergency braking, proximity warning, and object detection systems. Even minor operational environments or equipment modifications can require comprehensive radar system integration to maintain optimal system performance and operator safety.

The growing complexity of off-highway vehicle operations and increasing liability concerns are driving demand for professional radar solutions from certified providers with appropriate equipment and expertise. Insurance companies are increasingly requiring proper radar system documentation and integration to maintain coverage and ensure vehicle safety compliance. Regulatory requirements and equipment manufacturer specifications are establishing standardized radar system procedures that require specialized sensors and trained technicians.

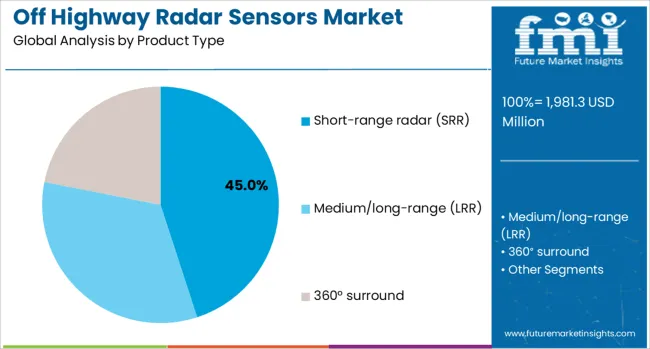

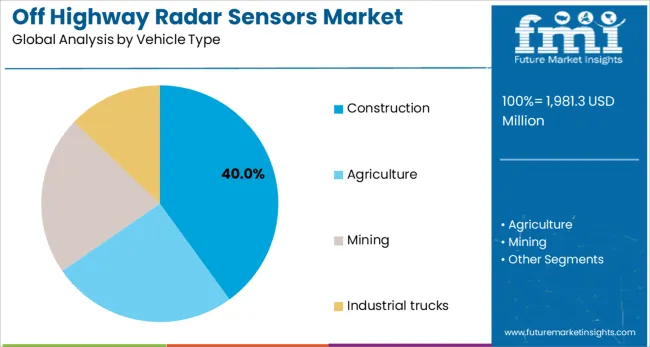

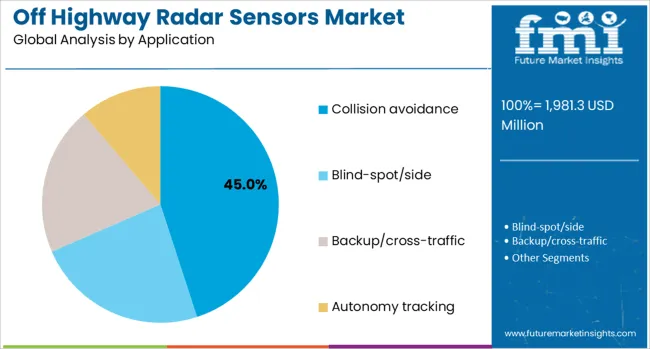

The market is segmented by product type, vehicle type, application, frequency/technology, and region. By product type, the market is divided into short-range radar (SRR), medium/long-range radar (LRR), and 360° surround systems. Based on vehicle type, the market is categorized into construction, agriculture, mining, and industrial trucks. In terms of application, the market is segmented into collision avoidance, blind-spot/side detection, backup/cross-traffic warning, and autonomy tracking. By frequency/technology, the market is classified into 77/79 GHz, 24 GHz, and multi-band/other configurations. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The short-range radar (SRR) segment is projected to account for 45% of the Off-Highway Radar Sensors market in 2025, reflecting its pivotal role in proximity detection and collision avoidance. SRR systems are designed to deliver highly accurate object detection at close distances, leveraging advanced antenna configurations and signal processing to provide real-time hazard awareness.

These features make SRR the preferred technology for operator safety and equipment protection in off-highway environments such as mining, agriculture, and construction. The segment benefits from broad supplier availability and the integration of SRR into standardized safety systems, which lowers barriers to adoption. In many off-highway vehicles, SRR forms the baseline radar layer, often operating alongside medium- and long-range radar for comprehensive coverage. As safety regulations tighten and equipment automation advances, SRR will continue to be a cornerstone technology driving adoption and market share growth.

Construction vehicles are expected to account for 40% of off-highway radar sensor demand in 2025, underscoring their role as the largest consumer segment for advanced safety technologies. Excavators, loaders, bulldozers, and cranes increasingly rely on radar sensors to mitigate risks in crowded and dynamic construction environments. Modern construction machinery is often fitted with multiple radar systems working in tandem to detect hazards, protect operators, and prevent costly collisions with nearby equipment or personnel.

This trend is amplified by stricter safety requirements on construction sites and the rising cost of downtime due to accidents. Equipment manufacturers are embedding radar systems directly into new vehicle designs, while aftermarket adoption continues to grow for older fleets. The segment benefits from heightened awareness of worker safety and the financial benefits of accident prevention, positioning construction vehicles as the primary driver of radar sensor demand.

The collision avoidance application is projected to represent 45% of the Off-Highway Radar Sensors market in 2025, cementing its role as the primary safety function for radar integration. These systems employ dedicated radar arrays and advanced processing algorithms to deliver real-time hazard detection, warning, and intervention capabilities. Collision avoidance solutions are often configured to monitor multiple detection zones simultaneously, ensuring comprehensive coverage for large and complex vehicles operating in high-risk environments.

Beyond preventing equipment damage, these systems significantly improve operator safety and reduce liability for equipment owners. Demand is further supported by increasing regulatory emphasis on vehicle safety standards in sectors such as mining and construction. As operational environments grow more complex, the importance of collision avoidance systems expands, reinforcing their position as the leading application for radar sensor deployment in the off-highway vehicle market.

77/79 GHz radar technology is forecasted to hold 65% of the Off-Highway Radar Sensors market in 2025, reflecting its superior technical performance and alignment with industry requirements. Compared to legacy 24 GHz systems, higher frequency 77/79 GHz radar provides enhanced detection accuracy, improved resolution, and the ability to detect smaller objects at greater distances. These capabilities are critical in demanding off-highway environments where precision is essential for safety and productivity.

The segment also benefits from the automotive industry’s transition toward 77/79 GHz radar, creating economies of scale and technology transfer opportunities for off-highway applications. With radar increasingly expected to serve multiple functions, ranging from collision avoidance to blind-spot monitoring, high-frequency systems are becoming the preferred standard. Their reliability, adaptability, and regulatory support position 77/79 GHz technology as the backbone of future off-highway radar safety solutions, ensuring continued dominance in the market.

The off highway radar sensors market is advancing steadily due to increasing safety regulations and growing recognition of radar system importance in equipment protection. However, the market faces challenges including high system integration costs, need for continuous training on new radar technologies, and varying detection requirements across different vehicle manufacturers. Standardization efforts and certification programs continue to influence system quality and market development patterns.

The growing deployment of 360° surround radar systems is enabling comprehensive detection coverage around off-highway vehicles, construction equipment, and agricultural machinery. Complete surround detection equipped with advanced radar processing provides enhanced operator awareness and reduced equipment damage risk while expanding detection capabilities. These systems are particularly valuable for large equipment operators and high-value machinery that require comprehensive detection coverage without operational blind spots.

Modern off-highway radar system providers are incorporating multi-frequency radar equipment and automated detection systems that improve accuracy and reduce false alarm rates. Integration of advanced signal processing and real-time environmental adaptation enables more precise detection procedures and comprehensive system performance documentation. Advanced radar equipment also supports detection of next-generation safety requirements including autonomous operation support and advanced collision prediction systems.

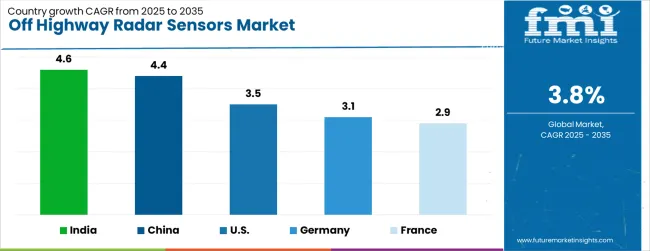

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.6% |

| China | 4.4% |

| United States | 3.5% |

| Germany | 3.1% |

| France | 2.9% |

The off highway radar sensors market is growing rapidly, with India leading at a 4.6% CAGR through 2035, driven by strong construction sector growth, infrastructure development programs, and expanding agricultural mechanization. China follows at 4.4%, supported by massive construction projects, mining operations expansion, and increasing safety regulation enforcement. The United States grows steadily at 3.5%, integrating radar systems into established construction and agricultural equipment fleets. Germany records 3.1%, emphasizing precision radar technology, quality standards, and advanced engineering expertise. France shows steady growth at 2.9%, focusing on agricultural automation and construction safety compliance. Overall, India and China emerge as the leading drivers of global off highway radar sensors market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from off highway radar sensors in India is projected to exhibit the highest growth rate with a CAGR of 4.6% through 2035, driven by rapid infrastructure development projects, expanding construction activities, and increasing adoption of advanced safety systems in off-highway vehicles. The country's growing construction and agricultural sectors are creating significant demand for radar-equipped equipment. Major equipment manufacturers and technology providers are establishing comprehensive radar integration networks to support the growing population of safety-equipped vehicles across urban and rural markets.

Revenue from off highway radar sensors in China is expanding at a CAGR of 4.4%, supported by massive construction projects, expanding mining operations, and growing adoption of safety technologies in industrial vehicles. The country's expanding construction industry and increasing equipment safety requirements are driving demand for professional radar integration services. Authorized equipment dealers and specialized radar facilities are establishing capabilities to serve the growing population of radar-equipped off-highway vehicles.

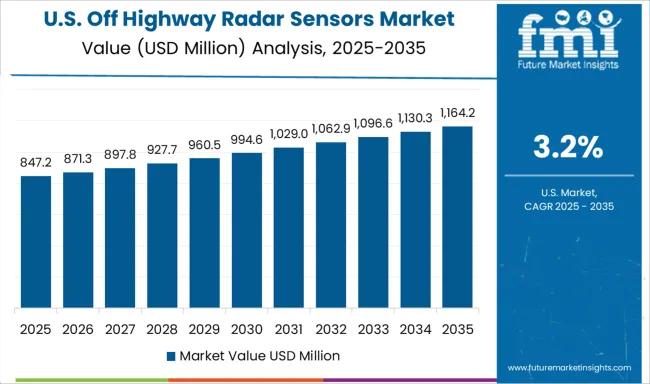

Revenue from off highway radar sensors in the United States is growing at a CAGR of 3.2%, driven by equipment fleet modernization, increasing safety regulations, and growing recognition of radar system importance in operator protection. The country's established construction and agricultural equipment industry is integrating radar capabilities to serve modern safety requirements. Equipment dealers and service facilities are investing in radar system integration and training to address growing market demand.

Demand for off highway radar sensors in Germany is projected to grow at a CAGR of 3.1%, supported by the country's emphasis on precision engineering and advanced radar system integration. German equipment manufacturers and service providers are implementing comprehensive radar capabilities that meet stringent quality standards and manufacturer specifications. The market is characterized by focus on technical excellence, advanced radar equipment integration, and compliance with comprehensive industrial safety regulations.

Demand for off highway radar sensors in France is expanding at a CAGR of 2.9%, driven by agricultural automation initiatives, construction safety compliance requirements, and growing emphasis on standardized radar integration procedures. Equipment service networks and specialized radar providers are establishing comprehensive integration capabilities to serve diverse customer needs. The market benefits from agricultural industry requirements for proper radar system documentation and equipment manufacturer safety compliance following installations and maintenance activities.

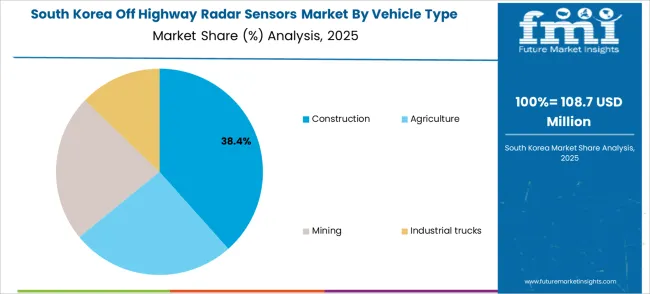

In South Korea, the off-highway radar sensors market is projected to reach USD 108.7 million in 2025, with a clear dominance of the construction vehicle segment, accounting for 38.4% of the market share. Agriculture, mining, and industrial trucks together form the remaining share, highlighting the diverse application of radar sensor technology across sectors. Construction’s strong lead reflects the country’s sustained infrastructure development and equipment modernization, while the presence of agriculture and mining indicates adoption beyond urban projects into broader industrial domains.

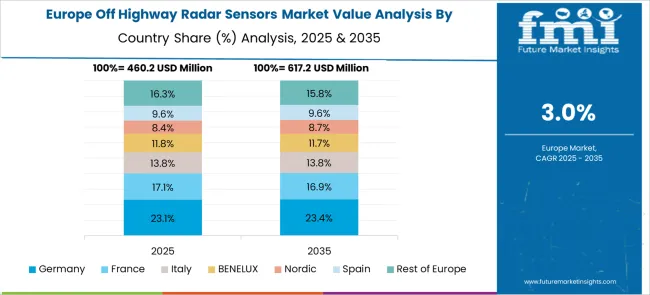

The off highway radar sensors market in Europe demonstrates sophisticated development across major economies with Germany leading through its advanced automotive electronics expertise and precision engineering capabilities, supported by companies like Bosch, Continental, and ZF (WABCO) pioneering cutting-edge radar technologies for construction and agricultural machinery applications. France shows significant growth in agricultural automation and smart farming initiatives, while the UK focuses on industrial truck safety systems and mining equipment applications. Italy and Spain exhibit expanding interest in construction equipment radar integration, driven by infrastructure development and workplace safety regulations.

Nordic countries emphasize sustainable agriculture and automated forestry equipment, while Eastern European markets show growing adoption in mining and heavy industrial applications. SICK and ifm electronic contribute through their industrial automation expertise, supporting diverse off highway applications. The market benefits from stringent safety regulations, environmental sustainability goals, and the region's leadership in industrial automation, positioning Europe as a key innovation center for advanced radar sensor technologies across multiple off highway vehicle segments.

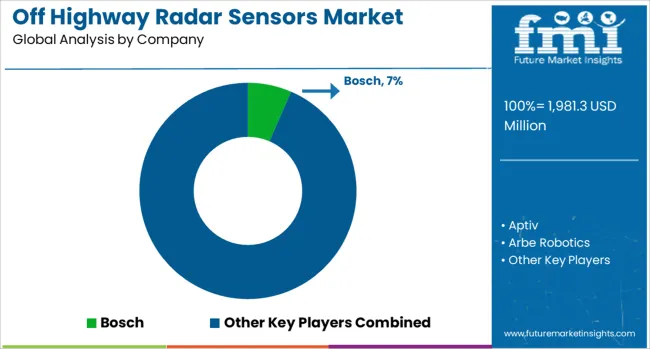

The off highway radar sensors market is defined by competition among specialized technology providers, equipment manufacturers, and automotive radar companies expanding into industrial applications. Companies are investing in advanced radar technologies, application-specific solutions, standardized integration procedures, and technical support services to deliver precise, reliable, and cost-effective radar sensing solutions. Strategic partnerships, technological innovation, and vertical market expansion are central to strengthening product portfolios and market presence.

Bosch (Germany) offers comprehensive off-highway radar solutions with focus on precision, durability, and integrated safety systems for construction and agricultural applications. Continental (Germany) provides advanced radar technologies with emphasis on multi-frequency capabilities and harsh environment operation. DENSO (Japan) delivers specialized radar systems with focus on reliability and integration with existing vehicle electronic systems.

ZF (WABCO) (Germany) emphasizes integrated safety solutions and comprehensive radar system packages for commercial vehicle applications. Aptiv (Ireland) offers advanced radar technologies with focus on autonomous vehicle capabilities and next-generation sensing solutions. Arbe Robotics (Israel) provides innovative radar processing technologies and high-resolution imaging radar systems.

Banner Engineering (USA) delivers industrial-grade radar sensors with emphasis on harsh environment operation and easy integration. SICK (Germany) offers specialized off-highway radar solutions with focus on safety applications and industrial automation integration. VEONEER (Sweden/USA) provides advanced sensing technologies and radar system integration capabilities. ifm electronic (Germany) delivers mobile radar solutions with emphasis on compact design and versatile mounting options.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,981.3 million |

| Product Type | Short-range radar (SRR), Medium/long-range radar (LRR), 360° surround systems |

| Vehicle Type | Construction, Agriculture, Mining, Industrial trucks |

| Application | Collision avoidance, Blind-spot/side detection, Backup/cross-traffic warning, Autonomy tracking |

| Frequency/Technology | 77/79 GHz, 24 GHz, Multi-band/other configurations |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, and 40+ countries |

| Key Companies Profiled | Bosch, Continental, DENSO, ZF (WABCO), Aptiv, Arbe Robotics, Banner Engineering, SICK, VEONEER, and ifm electronic |

| Additional Attributes | Dollar sales by radar frequency band and sensing range, regional demand trends, competitive landscape, buyer preferences for collision avoidance versus terrain mapping, integration with autonomous/off-highway platforms, innovations in solid-state design, sensor fusion, and ruggedized packaging |

The global off highway radar sensors market is estimated to be valued at USD 1,981.3 million in 2025.

The market size for the off highway radar sensors market is projected to reach USD 2,876.9 million by 2035.

The off highway radar sensors market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in off highway radar sensors market are short-range radar (srr), medium/long-range (lrr) and 360° surround.

In terms of vehicle type, construction segment to command 40.0% share in the off highway radar sensors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Office Supply Market Forecast and Outlook 2025 to 2035

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Office Boiler Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Off-road Tires Market Size and Share Forecast Outlook 2025 to 2035

Offset Ink Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Off Road Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Office Seat Cushion Market Analysis - Trends, Growth & Forecast 2025 to 2035

Off-Road All Terrain E-Scooter Market Growth - Trends & Forecast 2024 to 2034

Off-road Motorcycle Market Growth – Trends & Forecast 2024 to 2034

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA