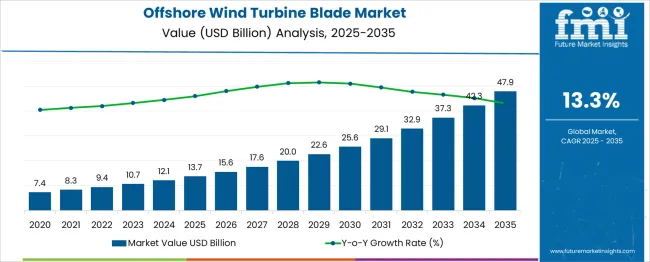

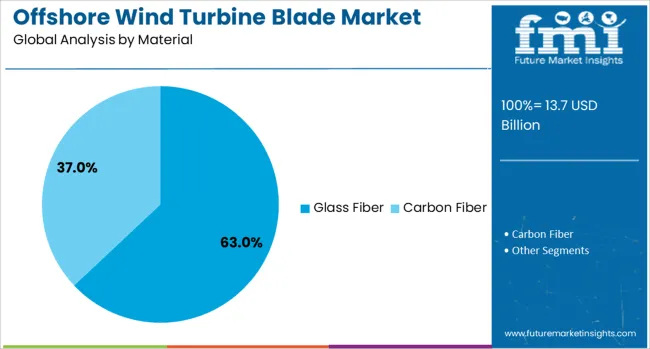

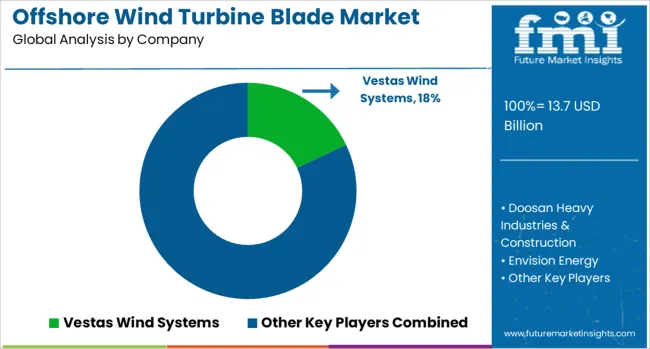

The Offshore Wind Turbine Blade Market is estimated to be valued at USD 13.7 billion in 2025 and is projected to reach USD 47.9 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period. Market share erosion or gain analysis reveals significant structural shifts among blade materials and manufacturing technologies. Initially, composite blades using glass fiber dominate installations, accounting for the majority share in the early phase (2025–2030) as the market scales from USD 13.7 billion to USD 25.6 billion, adding USD 11.9 billion or nearly 35% of the forecasted growth, driven by cost competitiveness and well-established production lines.

However, during the second half (2030–2035), as the market accelerates from USD 25.6 billion to USD 47.9 billion, carbon fiber-based blades and hybrid-material designs capture incremental share due to their ability to reduce weight while supporting larger rotor diameters exceeding 100 meters. This material transition results in the gradual erosion of conventional blade technologies in favor of high-performance designs optimized for deep-water installations and floating offshore platforms. Companies investing in automated blade fabrication, modular construction, and recyclable resin systems will consolidate share, as OEMs prioritize durability, aerodynamic efficiency, and enhanced energy capture to meet global renewable energy expansion targets.

| Metric | Value |

|---|---|

| Offshore Wind Turbine Blade Market Estimated Value in (2025 E) | USD 13.7 billion |

| Offshore Wind Turbine Blade Market Forecast Value in (2035 F) | USD 47.9 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The offshore wind turbine blade market represents a critical segment across multiple parent markets due to its key role in energy generation systems. Within the wind turbine components market, blades account for roughly 20–25% of total component value, given their size, material cost, and engineering complexity. In the offshore wind turbine market, blade systems contribute around 30–35% of equipment value, as blade length and material innovations drive energy capture efficiency. For the dedicated wind turbine blades market, offshore blades typically made with carbon fiber or hybrid composites capture 40–45% of the total blades market share, as offshore installations demand larger and stronger blades than onshore. In the broader wind energy infrastructure market, blades represent about 15–18% of capital equipment cost, integrating with foundations, towers, and electrical systems.

Finally, within the renewable energy equipment manufacturing market, offshore blade assembly comprises around 10–12%, as manufacturers balance demand for both wind and solar infrastructure. Growth momentum is supported by ongoing advancements in aerodynamic design and composite materials that enable blades longer than 90 meters, alongside a rising global pipeline of offshore wind projects in Asia Pacific and Europe, driving demand for high performance blade solutions.

Increased investment in offshore wind farms has led to greater demand for larger, more efficient blades that can operate under extreme marine conditions. Innovations in lightweight composite materials and advancements in automated blade manufacturing are enabling greater scalability and performance. Favorable government policies, green funding mechanisms, and carbon-neutral mandates are further accelerating adoption.

Additionally, the shift toward deep-sea installations is prompting OEMs to prioritize high-durability, long-span blades that can maximize energy output while minimizing maintenance costs. Over the forecast period, the market is expected to benefit from intercontinental collaboration and localized manufacturing strategies that address supply chain resilience and cost efficiency.

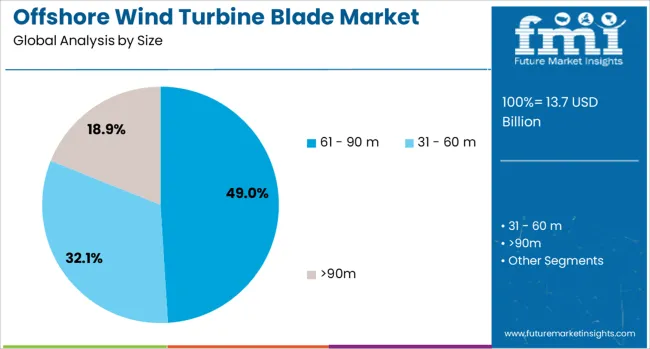

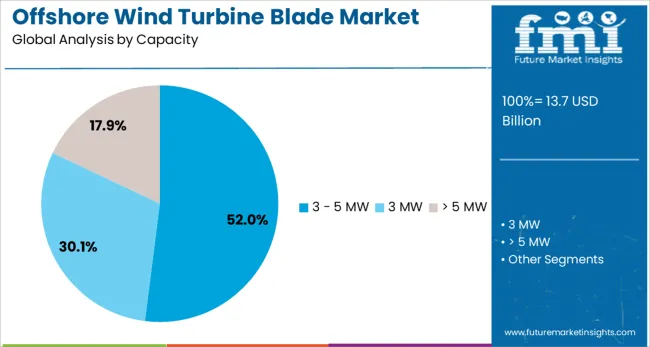

The offshore wind turbine blade market is segmented by size, capacity, material, and geographic regions. The offshore wind turbine blade market is divided by size into 61 - 90 m, 31 - 60 m, and >90m. The offshore wind turbine blade market is classified into 3 - 5 MW, 3 MW, and > 5 MW. The offshore wind turbine blade market is segmented into Glass Fiber and Carbon Fiber. Regionally, the offshore wind turbine blade industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Blades measuring between 61 and 90 meters are anticipated to contribute 49.0% of the offshore wind turbine blade market revenue in 2025, making them the dominant size category. This growth is being driven by the segment’s optimal balance between aerodynamic efficiency and structural feasibility for mid-to-large capacity turbines.

These blade lengths are compatible with most existing offshore platforms and enable significant energy capture without incurring prohibitive transport or installation costs. Demand has been reinforced by upgrades in rotor dynamics and material stress tolerance, allowing longer blades to remain stable under turbulent offshore wind conditions.

As offshore wind farms scale up in both number and capacity, this segment is likely to remain central to standardized turbine deployments.

The 3-5 MW capacity range is projected to command 52.0% of the market share by 2025, establishing it as the leading segment in terms of energy output. Its dominance is supported by its proven deployment history, economic scalability, and regulatory compliance with most marine energy development zones.

This range offers an efficient trade-off between generation efficiency and capital expenditure, making it suitable for both pilot projects and mid-scale offshore farms. The segment benefits from well-established supply chain infrastructure and serviceability, which is encouraging developers to prefer this category over higher capacity models that face logistical challenges.

Continued optimization of turbine control systems and blade designs within this capacity class is expected to drive ongoing demand.

Glass fiber blades are forecast to hold a commanding 63.0% share of the offshore wind turbine blade market in 2025, making them the top material segment. Their leading position is underpinned by the material’s favorable cost-to-performance ratio, corrosion resistance, and high strength-to-weight properties.

Glass fiber composites enable streamlined production, greater design flexibility, and ease of molding into aerodynamic shapes, all of which are critical in large-scale blade manufacturing. The material's long-standing use across both onshore and offshore turbines has also contributed to a mature manufacturing ecosystem and established standards.

With continual enhancements in resin infusion and layering techniques, glass fiber is expected to remain the default choice, especially where cost-efficiency is a primary concern.

Offshore wind turbine blades are critical components designed for high-strength performance and aerodynamic efficiency in harsh marine environments. These blades are typically manufactured using composite materials to ensure durability and optimized energy capture. Growth has been influenced by rising offshore wind farm installations, technological developments in blade design, and increasing investment in renewable power infrastructure. Manufacturers are focusing on lightweight composites, modular blade concepts, and advanced molding techniques to enhance performance and reduce maintenance. Expansion in deep-water projects and floating wind platforms is creating new opportunities for large-dimension blade solutions.

Adoption of advanced blades has been driven by the global push for higher offshore energy output and the shift toward larger turbine installations exceeding 10 MW capacity. Longer blades improve energy capture, lowering the levelized cost of electricity (LCOE), which has strengthened their demand. Increased government support through auctions and favorable regulatory frameworks has accelerated offshore wind farm projects in Europe, Asia-Pacific, and North America. The move toward deeper waters requiring higher hub heights has emphasized the need for efficient aerodynamic designs. Development of specialized installation vessels and port infrastructure has also supported the adoption of next-generation offshore blades.

Growth in this segment has faced barriers due to the complex manufacturing requirements for large blades, which involve advanced composite materials and precision molding processes. High capital investment in production facilities and tooling has raised entry barriers. Transportation and installation of blades longer than 100 meters pose significant logistical challenges, requiring specialized vessels and cranes. Harsh marine conditions contribute to erosion and fatigue issues, increasing maintenance costs. Limited global manufacturing capacity and dependence on skilled labor have created supply chain constraints. Compliance with regional certification standards for offshore performance further adds to cost and development time for blade manufacturers.

Significant opportunities exist in the development of blades designed for floating wind platforms, enabling deployment in deep-water regions with strong wind resources. Modular blade systems that simplify transport and assembly at sea are attracting investment for cost optimization. Advancements in hybrid composite materials and automated production technologies provide avenues for lightweight, high-durability solutions. Collaboration between blade manufacturers and offshore wind developers for customized designs aligned with regional wind conditions is creating additional prospects. Emerging markets such as Asia-Pacific offer long-term growth potential as large-scale offshore projects expand. Digital monitoring technologies for predictive maintenance offer further value-added opportunities.

Recent trends highlight the use of carbon fiber-reinforced composites to achieve strength-to-weight advantages in ultra-long blades. Adoption of automated manufacturing processes such as resin infusion and robotic trimming is improving precision and reducing cycle times. Integration of digital twin technology is enabling simulation-driven design optimization and real-time structural health monitoring during operation. Development of segmented and jointed blades is gaining momentum to overcome transportation limitations. Manufacturers are also investing in surface coatings to enhance erosion resistance in marine environments. The combination of smart materials and digital engineering platforms continues to shape the evolution of offshore wind blade technology.

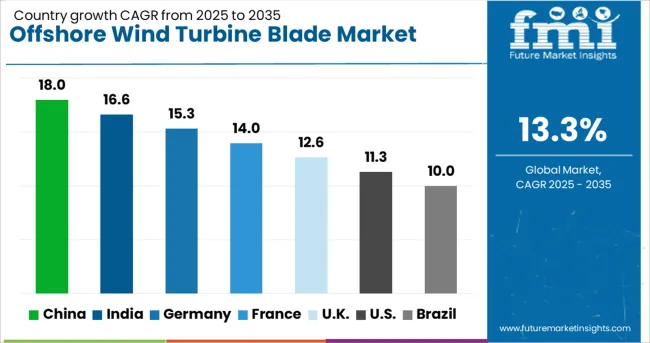

| Country | CAGR |

|---|---|

| China | 18.0% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14.0% |

| UK | 12.6% |

| USA | 11.3% |

| Brazil | 10.0% |

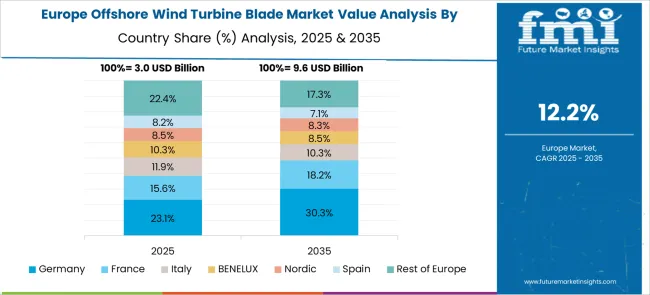

The offshore wind turbine blade market is projected to grow at a CAGR of 13.3% through 2035, supported by aggressive renewable energy targets and large-scale offshore wind farm projects. China leads at 18.0%, fueled by massive coastal projects and strong government incentives. India follows with 16.6%, driven by energy diversification goals and international collaborations for offshore installations. Germany posts 15.3%, emphasizing advanced blade technologies and hybrid material innovations. The United Kingdom records 12.6%, leveraging policy-driven offshore capacity expansion, while the United States grows at 11.3%, supported by federal investments in offshore wind infrastructure and supply chain development. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 18.0% through 2035, underpinned by its status as the world’s largest offshore wind market. State-driven renewable energy policies and aggressive capacity targets are accelerating turbine and blade manufacturing. Chinese OEMs are deploying extra-long rotor blades exceeding 100 meters to improve turbine efficiency in low-wind-speed regions. Investments in carbon-fiber composites and aerodynamic optimization are enhancing durability and energy output. Local manufacturers are scaling production facilities and adopting automated molding processes for faster blade delivery. International partnerships with European blade designers strengthen China’s technological base for next-generation offshore systems.

India is forecasted to grow at a CAGR of 16.6% through 2035, driven by national renewable energy targets and emerging offshore projects along the western and southern coasts. Government-backed programs, combined with global developer participation, are creating strong demand for advanced blade technology. Domestic manufacturers are investing in production of large-scale composite blades to reduce dependency on imports. Partnerships with European firms are introducing innovations such as modular blade designs and recyclable materials. India’s initiatives for localized manufacturing and logistics infrastructure are also improving cost efficiency for offshore wind farm development.

Germany is expected to grow at a CAGR of 15.3% through 2035, leveraging its strong engineering capabilities and leadership in offshore wind technology. Blade development focuses on lightweight composites and aerodynamic enhancements to improve capacity factors in deep-water projects. German manufacturers are pioneering recyclable blade designs using thermoplastic resins for sustainability compliance and cost reduction. Offshore wind initiatives supported by European Union funding are enabling large-scale installations in the North Sea. Integration of digital twins and sensor-based monitoring systems is improving blade lifecycle management and predictive maintenance capabilities.

The United Kingdom is projected to expand at a CAGR of 12.6% through 2035, supported by its position as one of the largest offshore wind energy markets globally. National policies aiming for carbon-neutral power generation are driving investment in large rotor blade designs for higher efficiency. British manufacturers are focusing on optimizing blade aerodynamics to meet requirements for high-capacity turbines exceeding 14 MW. Investments in automated blade manufacturing facilities and logistics solutions for oversized components are reducing project timelines. Partnerships with composite suppliers enhance durability and minimize maintenance costs in harsh marine environments.

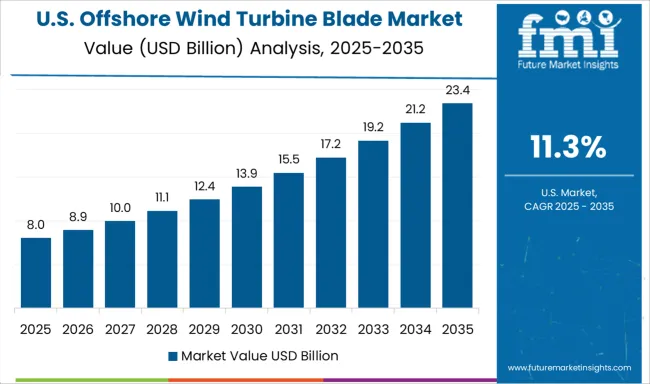

The United States is projected to grow at a CAGR of 11.3% through 2035, driven by federal renewable energy programs and state-level offshore wind capacity targets. East Coast projects dominate current installations, while floating offshore wind farms on the West Coast create new opportunities for long, lightweight blades. USA-based manufacturers are scaling composite blade production using advanced resin infusion techniques to meet demand for 12–15 MW turbine models. Collaborations with global OEMs and local suppliers are building a robust supply chain, reducing reliance on imports. Integration of structural health monitoring systems and predictive analytics ensures improved blade performance and reliability.

The offshore wind turbine blade market is driven by global renewable energy giants and specialized manufacturers developing advanced blade designs to maximize efficiency, reduce weight, and withstand harsh marine environments. Vestas Wind Systems leads the market with a broad portfolio of high-capacity turbine blades featuring aerodynamic optimization and carbon fiber integration for durability and performance. GE Renewable Energy focuses on ultra-long blades for next-generation offshore turbines, leveraging its Haliade-X platform to enhance power output and lower Levelized Cost of Energy (LCOE). Goldwind, Envision Energy, and MingYang Smart Energy dominate the Chinese market, emphasizing cost competitiveness and rapid scalability for large offshore projects.

Doosan Heavy Industries & Construction targets Asia-Pacific markets with localized production strategies and blades designed for typhoon resilience. Nordex SE and Senvion cater primarily to European projects, offering modular blade designs for simplified transport and installation in challenging offshore locations. Shanghai Electric Wind Power integrates blade manufacturing with complete offshore turbine systems, ensuring strong supply chain control in China. Suzlon Energy maintains a niche presence with composite blade solutions for medium-capacity turbines. Hitachi Energy contributes with advanced materials and engineering support for offshore blade technologies. Competitive differentiation is driven by lightweight composite materials, aerodynamic performance, and advanced manufacturing techniques for extra-long blades (80m+). Barriers to entry include high R&D investment, precision manufacturing requirements, and certification for marine conditions. Strategic initiatives focus on carbon fiber reinforcement, hybrid composites for durability, and smart blade monitoring systems to predict fatigue and optimize maintenance cycles.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.7 Billion |

| Size | 61 - 90 m, 31 - 60 m, and >90m |

| Capacity | 3 - 5 MW, 3 MW, and > 5 MW |

| Material | Glass Fiber and Carbon Fiber |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Vestas Wind Systems, Doosan Heavy Industries & Construction, Envision Energy, GE Renewable Energy, Goldwind, Hitachi Energy, MingYang Smart Energy, Nordex SE, Senvion, Shanghai Electric Wind Power, and Suzlon Energy |

| Additional Attributes | Dollar sales by blade length category (≤70m, 71–90m, >90m) and application (fixed-bottom offshore turbines, floating offshore turbines). Demand dynamics are supported by large-scale offshore wind farm installations aimed at boosting renewable capacity and reducing carbon footprints. Regional trends highlight Europe as a leader in offshore projects, followed by rapid capacity expansion in China and emerging installations in the USA and Asia-Pacific. Innovation focuses on automated blade manufacturing for consistency, modular blade sections for simplified transport, and integration of embedded sensors for real-time performance monitoring. |

The global offshore wind turbine blade market is estimated to be valued at USD 13.7 billion in 2025.

The market size for the offshore wind turbine blade market is projected to reach USD 47.9 billion by 2035.

The offshore wind turbine blade market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in offshore wind turbine blade market are 61 - 90 m, 31 - 60 m and >90m.

In terms of capacity, 3 - 5 mw segment to command 52.0% share in the offshore wind turbine blade market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Fibre Optic Cable Lay Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Infrastructure Market

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Wind Power Forecasting System Market Size and Share Forecast Outlook 2025 to 2035

Wind Energy Consulting Service Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA