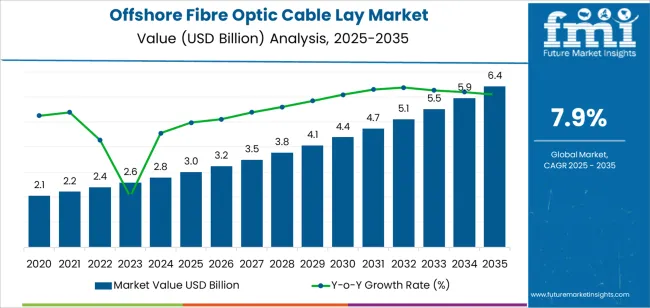

The offshore fibre optic cable lay market is valued at USD 3.0 billion in 2025 and is forecasted to reach USD 6.5 billion by 2035, registering a CAGR of 7.9%. Market growth is driven by increasing global data transmission requirements, expanding subsea communication infrastructure, and rising investments in transoceanic connectivity projects. The rapid deployment of 5G networks, offshore wind farms, and intercontinental data routes continues to boost demand for specialized cable-laying systems that ensure precision, durability, and reliability under deep-sea conditions.

Deep sea laying systems represent the leading market segment due to their ability to handle large-capacity fibre optic cables, operate under extreme pressure, and execute long-distance installation with minimal signal attenuation. These systems integrate dynamic positioning technology, advanced tension control, and automated monitoring to ensure secure and efficient subsea deployment. Growing demand for high-bandwidth connectivity and cloud-based services further supports the expansion of undersea communication infrastructure.

Asia Pacific leads global market growth, driven by large-scale projects across China, Japan, and Southeast Asia. Europe and North America maintain strong participation through extensive interregional cable networks and offshore renewable installations. Key companies include Royal IHC, SubCom, Alcatel Submarine Networks, NEC, HMN Tech, Orange, NKT Cables, and Ulstein, focusing on vessel modernization, precision installation technologies, and cross-border infrastructure development.

The 10-year growth comparison highlights a strong upward trajectory supported by expanding offshore wind projects, subsea data connectivity, and energy interconnection infrastructure. Between 2025 and 2030, growth will be driven by rapid cable installations for offshore wind farms in Europe, East Asia, and North America. The increasing need for reliable power transmission and high-capacity data links will fuel investment in new-generation cable-laying vessels and deep-sea installation technologies.

From 2030 to 2035, the growth rate will remain steady as the market transitions from expansion to optimization. Demand will shift toward replacement and maintenance projects as early offshore networks reach mid-life cycles. Technological advancements in cable materials, fiber protection, and remote installation monitoring will maintain consistent revenue flow during this phase. The decade-long comparison demonstrates a market evolving from infrastructure expansion toward operational stability, supported by long-term energy transition goals, digital connectivity needs, and sustained government investments in subsea communication and renewable energy systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.0 billion |

| Market Forecast Value (2035) | USD 6.5 billion |

| Forecast CAGR (2025-2035) | 7.9% |

The offshore fibre optic cable lay market is expanding as global demand for high-capacity subsea connectivity and offshore infrastructure increases. Growth in offshore wind farms, undersea telecommunications networks and seabed data centre links drives requirement for fibre optic cable laying operations in marine environments. Developments in regional digital infrastructure programmes and cloud-interconnectivity force addition of new submarine cables and replacement of ageing systems. Improvement in vessel technology, remote-operated cable-lay systems and automated trenching support more efficient deployment in deep-sea conditions.

The convergence of energy transition and digitalisation efforts means more combined projects where fibre optic cables accompany power export lines or offshore platforms. The market is constrained by high logistical and marine-installation costs, regulatory and environmental permitting challenges, and limited availability of specialised cable-lay vessels and skilled subsea crews. Variations in seabed geology, marine traffic routing and regional regulatory complexity also affect project execution timelines and investment decisions.

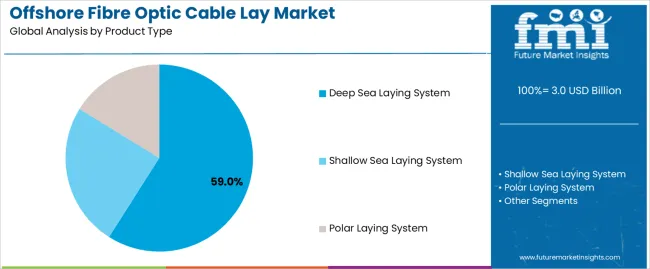

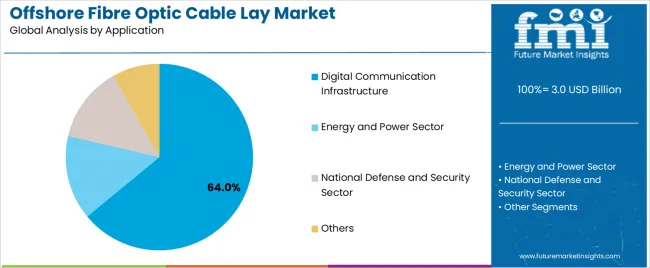

The offshore fibre optic cable lay market is segmented by product type and application. By product type, the market is divided into deep sea laying system, shallow sea laying system, and polar laying system. Based on application, it is categorized into digital communication infrastructure, energy and power sector, national defense and security sector, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

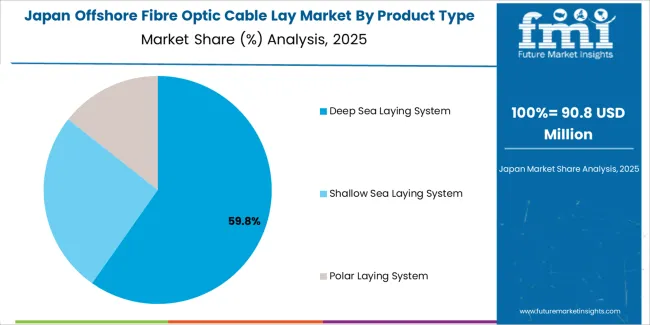

The deep sea laying system segment holds the leading position in the offshore fibre optic cable lay market, representing an estimated 59.0% of total market share in 2025. Deep sea systems are designed for the installation of long-distance submarine fibre optic cables across oceanic routes, ensuring global connectivity between continents and major communication hubs. These systems employ advanced cable-laying vessels equipped with dynamic positioning, tension control, and route-mapping technologies to ensure precise deployment at depths exceeding 1,000 meters.

The dominance of this segment is driven by increasing investment in transoceanic data infrastructure projects and growing demand for high-capacity, low-latency international data transmission. Deep sea laying systems require specialized engineering for pressure endurance, corrosion resistance, and environmental compliance, making them critical for modern global telecommunications networks. The shallow sea laying system segment, estimated at 31.0%, focuses on coastal, inter-island, and offshore platform connections, while the polar laying system category, representing about 10.0%, serves emerging routes in Arctic and sub-Arctic regions where climate shifts are opening new communication corridors.

Key factors supporting the deep sea laying system segment include:

The digital communication infrastructure segment accounts for approximately 64.0% of the offshore fibre optic cable lay market in 2025. This dominance reflects the extensive role of fibre optic networks in supporting global data traffic, internet services, and cloud computing connectivity. Submarine cable networks carry over 95% of intercontinental internet data, making reliable offshore cable installation essential for telecommunications operators, cloud service providers, and hyperscale data centers.

The energy and power sector segment follows, representing about 20.0% of the market, supported by the deployment of fibre optic cables for real-time monitoring and communication in offshore oil, gas, and renewable energy installations. The national defense and security sector, accounting for approximately 11.0%, utilizes offshore cable systems for secure data transfer, surveillance, and strategic communication networks. The others category, comprising scientific research and marine observation projects, holds the remaining 5.0%.

Primary dynamics driving demand from the digital communication infrastructure segment include:

Increasing demand for global data connectivity, expansion of offshore wind and oil & gas infrastructure, and inter-continental digital and power links accelerate growth.

The offshore fibre optic cable lay market is driven by the surge in subsea fibre-optic cable deployments to connect continents, data centres and remote islands. The growth of cloud computing, 5G/6G backhaul requirements and international bandwidth expansion create strong demand for undersea fibre-optic networks. Offshore renewable energy projects, such as wind farms, also require fibre-optic and hybrid cables for communications, monitoring and power export, which boosts cable-laying services and equipment. New oil & gas field developments and platform networking needs increase subsea cable lay activity in offshore marine environments.

High installation cost and technical complexity, regulatory and environmental challenges, and vulnerability to physical hazards limit market pace.

Laying fibre-optic cables offshore involves high capital expenditure, long project preparation cycles, complex marine survey and installation operations, which slow execution and raise risk. Environmental permitting, seabed use rights, and cross-border regulatory issues complicate project planning and add cost layers. Cables laid on the seabed are exposed to hazards such as fishing activity, anchoring, seabed landslides and corrosion, which drives maintenance, repair expenses and mitigates return-on-investment in some cases.

Growth of deep-water and high-capacity cable systems, modular installation and regional expansion in Asia-Pacific and Africa shape future direction.

Manufacturers and installers are shifting toward deep-water fibre-optic cable systems that support higher bandwidth throughput and longer spans, leveraging advanced cable technology and laying techniques. Modular lay systems and hybrid service models combining fibre-optic cable lay with power or sensor cable deployment are gaining traction to optimise vessel utilisation and reduce project overhead. Regional growth is strongest in Asia-Pacific and Africa, where digital-economy initiatives, offshore wind development and improved submarine connectivity drive new project pipelines and open opportunities for providers of cable-laying services.

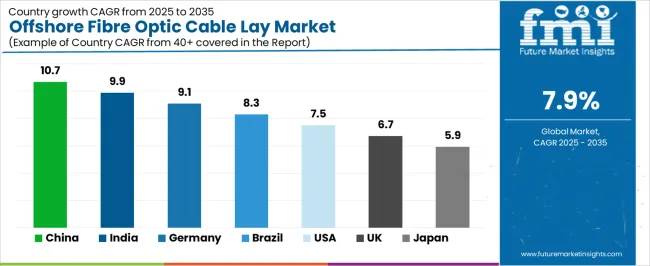

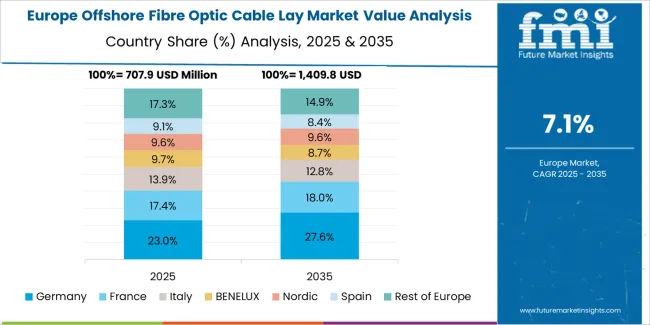

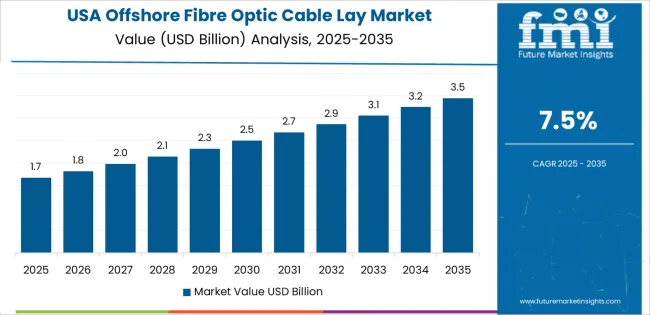

The global offshore fibre optic cable lay market is expanding rapidly through 2035, driven by growing data transmission demand, offshore renewable energy projects, and global subsea connectivity initiatives. China leads with a 10.7% CAGR, followed by India at 9.9%, reflecting large-scale infrastructure expansion in subsea telecommunications and energy systems. Germany grows at 9.1%, supported by offshore wind integration and data backbone deployment. Brazil records 8.3%, driven by marine connectivity and regional interlink projects. The United States grows at 7.5%, emphasizing transoceanic cable projects and defense networks, while the United Kingdom (6.7%) and Japan (5.9%) maintain stable growth through technological innovation and subsea engineering specialization.

| Country | CAGR (%) |

|---|---|

| China | 10.7 |

| India | 9.9 |

| Germany | 9.1 |

| Brazil | 8.3 |

| USA | 7.5 |

| UK | 6.7 |

| Japan | 5.9 |

China’s offshore fibre optic cable lay market grows at 10.7% CAGR, supported by government-backed marine infrastructure programs and rapid expansion of telecommunication networks. The Marine Economy Development Plan and Digital China Initiative promote large-scale subsea connectivity across the Asia-Pacific. Domestic companies are constructing advanced cable-laying vessels and deploying deep-sea cables linking regional data centers. Integration with offshore wind farms and energy transmission lines further accelerates demand. Research institutions collaborate with cable manufacturers to improve fiber durability, optical amplification, and subsea installation efficiency.

Key Market Factors:

India’s market grows at 9.9% CAGR, driven by digital infrastructure expansion, coastal connectivity, and international submarine cable collaborations. The National Broadband Mission and Digital India program support undersea cable projects enhancing regional bandwidth. Deployment of optical networks to the Andaman and Nicobar Islands and upcoming global links strengthen India’s data transmission backbone. Partnerships with global cable manufacturers are enabling technology transfer and vessel deployment expertise. Growing offshore wind development along the Gujarat and Tamil Nadu coasts also contributes to market growth.

Market Development Factors:

Germany’s market grows at 9.1% CAGR, supported by offshore wind power development, European data corridor projects, and marine engineering expertise. The Energy Transition (Energiewende) framework promotes subsea cable installation for power and data integration. Domestic companies specialize in hybrid power–fiber cable systems connecting offshore platforms to grid and control centers. Collaboration with EU partners under Connecting Europe Facility (CEF) strengthens cross-border digital and energy interlinks. Continuous investment in vessel automation, precision navigation, and monitoring technology ensures safe and efficient cable-laying operations.

Key Market Characteristics:

Brazil’s market grows at 8.3% CAGR, driven by offshore oil and gas modernization, coastal broadband expansion, and regional data connectivity. The Atlantic Cable System and Ellalink projects have enhanced intercontinental data routes. Domestic telecommunication operators are extending marine fibre infrastructure across coastal and island regions. The Blue Amazon strategy encourages monitoring and defense-oriented subsea network expansion. Partnerships with global engineering firms support deployment of fiber optic systems integrated with marine sensors for research and offshore energy applications.

Market Development Factors:

The United States grows at 7.5% CAGR, supported by transoceanic cable projects, cloud data expansion, and defense network modernization. Federal initiatives under the National Telecommunications and Information Administration (NTIA) promote subsea connectivity for national security and digital infrastructure. Collaboration between hyperscale data operators and subsea construction firms drives investment in Pacific and Atlantic routes. Growth in offshore renewable energy installations further strengthens fiber demand for monitoring and control systems. USA companies lead in deep-sea vessel automation, route optimization software, and environmental compliance standards.

Key Market Factors:

The United Kingdom’s market grows at 6.7% CAGR, driven by digital infrastructure renewal, offshore renewable expansion, and secure data network deployment. The UK Digital Strategy and Offshore Wind Sector Deal promote subsea cable integration across marine zones. Domestic marine engineering firms specialize in shallow-water installations and maintenance services. Cross-border connections to Europe and the North Atlantic maintain high data reliability. Policy focus on cybersecurity and sovereign data routes sustains domestic demand for advanced fibre networks.

Market Development Factors:

Japan’s market grows at 5.9% CAGR, reflecting mature infrastructure, technological leadership, and export-oriented marine engineering. Domestic companies are constructing next-generation submarine cables with higher bandwidth capacity and low-latency design. The Society 5.0 initiative promotes intelligent coastal and marine connectivity. Integration of fibre optics into offshore monitoring systems supports disaster resilience and environmental data collection. Ongoing investment in vessel technology ensures precision in deep-sea deployment. Japan’s expertise in cable insulation, thermal protection, and repeater technology reinforces its regional supply chain role.

Key Market Characteristics:

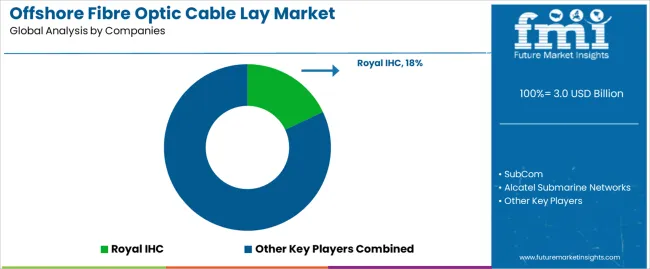

The offshore fibre optic cable lay market is moderately consolidated, with around eight key global companies specializing in subsea cable manufacturing, installation, and integrated marine engineering. Royal IHC leads the market with an estimated 18.0% global share, supported by its advanced cable lay vessel technology, offshore engineering expertise, and long-term contracts with telecommunications and energy network operators. Its leadership is reinforced by in-house design capabilities, integrated marine handling systems, and experience across deepwater and shallow-water projects.

SubCom, Alcatel Submarine Networks, and NEC follow as major global competitors, operating large-scale cable manufacturing and installation fleets. Their competitive strengths lie in high-capacity data transmission solutions, precision cable laying technology, and extensive maintenance service networks. HMN Tech and Orange play significant roles in the Asia-Pacific and Europe–Africa corridors, respectively, contributing to global connectivity through high-bandwidth subsea infrastructure and turnkey system integration.

NKT Cables and Ulstein provide essential technical and engineering support, focusing on vessel design optimization, modular lay systems, and power–data hybrid cable capabilities used in offshore wind and intercontinental communication networks.

Competition in this market centers on laying precision, vessel capability, subsea reliability, and project execution efficiency. Growth is driven by rising global data traffic, offshore renewable energy expansion, and new transoceanic connectivity projects. Companies combining end-to-end system integration, fleet modernization, and subsea engineering expertise are positioned to maintain long-term competitiveness in this technically demanding industry.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Deep Sea Laying System, Shallow Sea Laying System, Polar Laying System |

| Application | Digital Communication Infrastructure, Energy and Power Sector, National Defense and Security Sector, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Royal IHC, SubCom, Alcatel Submarine Networks, NEC, HMN Tech, Orange, NKT Cables, Ulstein |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of offshore cable installation and marine engineering companies; advancements in fibre optic cable laying systems for deep, shallow, and polar environments; integration with global communication networks and offshore energy transmission infrastructure. |

The global offshore fibre optic cable lay market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the offshore fibre optic cable lay market is projected to reach USD 6.4 billion by 2035.

The offshore fibre optic cable lay market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in offshore fibre optic cable lay market are deep sea laying system, shallow sea laying system and polar laying system.

In terms of application, digital communication infrastructure segment to command 64.0% share in the offshore fibre optic cable lay market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Energy Infrastructure Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Fibreglass Trays Market Size and Share Forecast Outlook 2025 to 2035

Fibre Film Market Growth from 2025 to 2035

Fibre Optic Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA