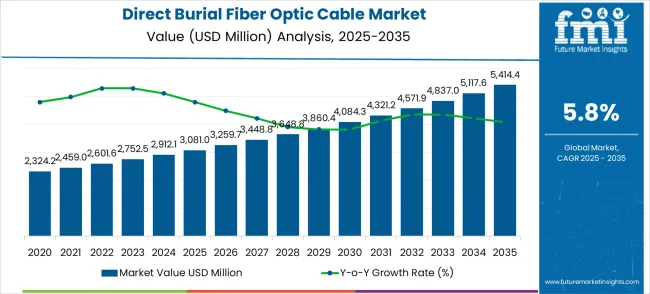

The direct burial fiber optic cable market is growing at USD 3,081.0 million in 2025 and is expected to reach USD 5,414.4 million by 2035, reflecting a CAGR of 5.8%. To determine the typical expansion rate over this period, the mean annual growth can be calculated by averaging the year-on-year revenue increases. From USD 3,081.0 million in 2025 to USD 5,414.4 million in 2035, the total growth amounts to USD 2,333.4 million. Dividing this by the 10-year period provides an approximate average annual growth of USD 233.3 million, which represents the market’s steady, consistent expansion. This metric highlights the general pace at which the market is expected to expand, offering a clear benchmark for stakeholders.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,081 million |

| Forecast Value in (2035F) | USD 5,414.4 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

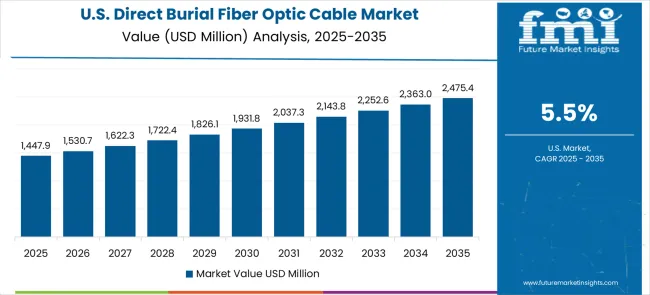

Examining the growth trajectory year by year, the market rises from USD 3,081.0 million in 2025 to USD 4,084.3 million by 2030, reflecting an average annual increase of approximately USD 200–233 million. This period demonstrates the early and mid-decade expansion, driven primarily by increasing demand for high-capacity, durable fiber optic infrastructure in telecommunications, data centers, and industrial connectivity applications. The mean growth provides a typical rate of expansion, allowing stakeholders to anticipate incremental revenue contributions and plan capacity, production, and investment strategies accordingly. Incremental gains in this period reflect steady adoption of direct burial solutions across new and replacement projects.

From 2030 to 2035, the market grows from USD 4,084.3 million to USD 5,414.4 million, resulting in an average annual expansion of around USD 266 million. The slightly higher increment compared with earlier years reflects accelerated adoption in emerging regions and expansion of high-speed fiber networks globally. The mean growth over the full 10-year horizon remains approximately USD 233 million annually, reinforcing a predictable pattern of market increase. This steady expansion demonstrates the sector’s resilience and its critical role in enabling robust telecommunication infrastructure, making direct burial fiber optic cables a consistent contributor to revenue growth across the decade.

Market expansion is being supported by the increasing global demand for high-speed internet connectivity and the corresponding need for robust underground fiber optic infrastructure that can provide reliable service while withstanding harsh environmental conditions. Modern telecommunications networks are increasingly focused on fiber optic solutions that can deliver superior bandwidth capacity while minimizing maintenance requirements and environmental exposure. The proven capability of direct burial fiber optic cables to provide long-term reliability, environmental protection, and installation flexibility makes them essential components of comprehensive telecommunications infrastructure.

The growing emphasis on digital transformation and smart infrastructure development is driving demand for underground connectivity solutions that can support expanding data requirements while providing enhanced network resilience and security. Industry preference for installation methods that can minimize visual impact, reduce maintenance costs, and provide long-term operational stability is creating opportunities for direct burial cable technology advancement. The rising influence of rural broadband initiatives and 5G network deployment is also contributing to increased adoption of underground fiber optic solutions across different geographic and application scenarios.

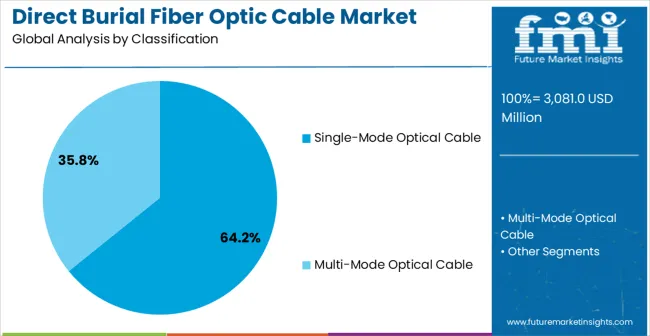

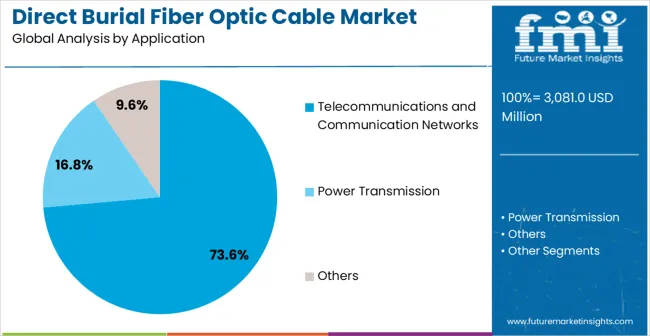

The market is segmented by classification, application, and region. By classification, the market is divided into single-mode optical cable, multi-mode optical cable, and others. Based on application, the market is categorized into telecommunications and communication networks and power transmission applications. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

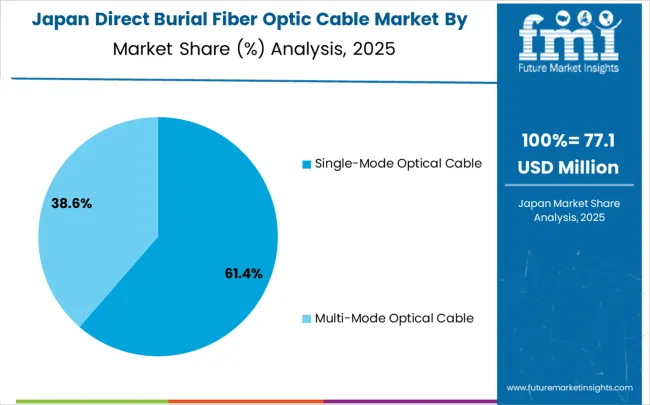

The single-mode optical cable classification is projected to account for 64.2% of the direct burial fiber optic cable market in 2025, reaffirming its position as the dominant fiber technology. This segment is preferred for its superior transmission distance, minimal signal attenuation, and high bandwidth capabilities, which make it suitable for long-haul, metropolitan, and high-capacity network applications. Network engineers rely on single-mode fiber for its scalability, future-proofing, and compatibility with advanced optical equipment, including high-speed transceivers and DWDM systems. Advances in manufacturing processes, optical purity, and installation techniques have improved performance, reliability, and operational efficiency, reinforcing its market leadership. Single-mode fiber supports diverse deployment scenarios such as intercity backbone networks, metro networks, and enterprise connectivity, providing consistent, high-speed data transmission over extended distances. Its widespread adoption is further strengthened by the growing demand for next-generation communication infrastructure that requires high-capacity, long-distance connectivity.

Telecommunications and communication networks applications are projected to represent 73.6% of direct burial fiber optic cable demand in 2025, establishing this segment as the primary market driver. Network operators increasingly require durable and high-performance fiber solutions to support broadband infrastructure, fiber-to-the-home (FTTH) deployments, long-haul networks, and metropolitan area networks. Direct burial cables offer environmental protection, mechanical strength, and longevity, making them ideal for underground and outdoor installations across urban and rural regions. The demand is further fueled by growing internet penetration, video streaming, cloud computing, and enterprise connectivity requirements worldwide. Additionally, ongoing upgrades to network bandwidth, low-latency systems, and next-generation optical technologies continue to drive adoption of reliable fiber cables. Investment in comprehensive optical infrastructure ensures high-capacity, low-loss transmission that meets current and future network requirements. These factors collectively reinforce the segment’s leading position in the direct burial fiber optic cable market.

The direct burial fiber optic cable market is advancing steadily due to increasing broadband infrastructure investment and growing demand for high-speed connectivity solutions. However, the market faces challenges including high installation costs, complex permitting requirements, and competition from alternative deployment methods. Innovation in cable protection technology and installation techniques continue to influence product development and market expansion patterns.

The growing deployment of 5G networks is creating enhanced opportunities for direct burial fiber optic cable integration with backhaul and fronthaul network infrastructure. Advanced 5G networks require high-capacity fiber connections that can support ultra-low latency and massive data throughput requirements. Rural broadband expansion programs provide opportunities for comprehensive underground fiber deployments that can deliver reliable connectivity to underserved areas while minimizing environmental impact.

Modern utility companies are incorporating fiber optic communication networks for smart grid applications, distributed energy management, and infrastructure monitoring systems. These applications require ruggedized underground cables that can withstand utility installation environments while providing reliable communication capabilities. Advanced utility integration also enables optimized network sharing and improved infrastructure utilization across multiple service providers.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.4% |

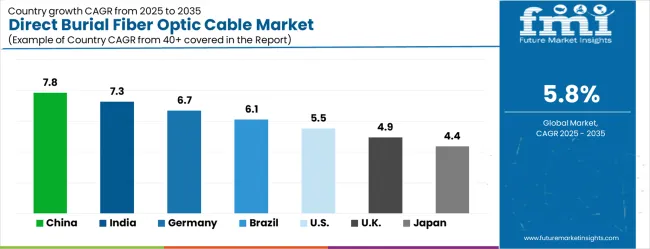

The direct burial fiber optic cable market is experiencing solid growth globally, with China leading at a 7.8% CAGR through 2035, driven by massive telecommunications infrastructure expansion, government support for broadband development, and extensive fiber-to-the-home deployment programs. India follows at 7.3%, supported by growing digital infrastructure initiatives, increasing internet penetration, and expanding telecommunications network modernization. Germany shows growth at 6.7%, emphasizing precision telecommunications engineering and comprehensive fiber network deployment. Brazil records 6.1% growth, focusing on expanding broadband connectivity and growing adoption of fiber optic infrastructure. The USA shows 5.5% growth, representing steady demand from established telecommunications networks and rural broadband expansion programs.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is driving large-scale deployment of underground fiber optic networks, supporting direct burial fiber optic cable adoption at a CAGR of 7.8% through 2035. The expansion of 5G and broadband networks, combined with government-backed digital connectivity initiatives, is fueling demand for robust underground cable solutions. Domestic and international telecommunications equipment providers are establishing manufacturing, installation, and distribution capabilities to meet rapidly growing infrastructure requirements. Focus areas include improving network resilience, increasing high-speed internet coverage in urban and rural regions, and enhancing fiber-to-the-home deployment. Policy support for digital connectivity, infrastructure incentives, and large-scale public-private partnerships are accelerating technology adoption nationwide.

India is witnessing rapid digital infrastructure expansion, enabling direct burial fiber optic cable adoption at a CAGR of 7.3% through 2035. Rising internet penetration, 5G rollout programs, and government-backed digitalization initiatives are creating substantial demand for reliable underground fiber systems. Telecom operators and equipment manufacturers are integrating advanced optical components to enhance network performance across urban and rural regions. Domestic and international technology providers are collaborating to deliver high-quality cables and support large-scale network deployment. Priority areas include expanding broadband access, strengthening connectivity reliability, and increasing capacity for future data growth. Policy and funding support for telecom modernization further catalyze fiber optic cable adoption across residential, commercial, and industrial applications.

Germany is leveraging precision telecommunications engineering to drive adoption of direct burial fiber optic cables at a CAGR of 6.7% through 2035. Emphasis on advanced network reliability, high-speed data transmission, and robust infrastructure quality is boosting demand for underground fiber deployment. German telecom companies and equipment providers are investing in sophisticated optical systems, integrating research-led solutions to optimize network performance. Collaboration with engineering institutions ensures consistent innovation, operational efficiency, and superior installation quality. Network modernization programs across urban centers emphasize performance, sustainability, and precision deployment. Industrial expertise, regulatory standards, and technology partnerships are enabling Germany to maintain leadership in advanced fiber optic network implementation throughout Europe.

Brazil is advancing broadband and telecommunications modernization, fostering direct burial fiber optic cable adoption at a CAGR of 6.1% through 2035. Expanding fiber optic networks and increasing digital service requirements are driving operators to deploy high-performance underground cables. Telecom equipment providers and international partners are collaborating with local firms to enhance domestic infrastructure capabilities and meet growing connectivity demands. Focus areas include improving network reliability, extending coverage to underserved regions, and supporting emerging digital services. Government-backed broadband initiatives, combined with private investment, are accelerating network expansion and enhancing fiber optic technology adoption across urban and rural regions.

The United States is strengthening nationwide fiber optic networks, supporting direct burial cable adoption at a CAGR of 5.5% through 2035. Widespread rural broadband initiatives, 5G deployment programs, and ongoing network modernization are fueling demand for underground fiber solutions. Telecom providers and technology vendors are deploying high-performance cables to ensure reliable connectivity, improved latency, and enhanced network resilience. Investment in next-generation infrastructure, data center interconnectivity, and urban fiber networks is accelerating adoption across residential, commercial, and industrial applications. Policy frameworks and infrastructure funding programs further support consistent deployment, network optimization, and operational standardization across established and emerging service regions.

The United Kingdom is modernizing legacy networks to accelerate adoption of direct burial fiber optic cables at a CAGR of 4.9% through 2035. Telecom operators are investing in advanced underground fiber systems to improve network performance, extend high-speed coverage, and optimize service reliability. Collaboration with equipment providers ensures precision cable installation and maintenance across metropolitan and regional areas. Government-supported broadband initiatives and network modernization programs are fostering widespread adoption of advanced fiber solutions. Priority objectives include strengthening rural connectivity, enhancing network efficiency, and meeting increasing digital traffic demands. The market emphasizes reliable deployment, operational excellence, and high-quality infrastructure integration across service providers nationwide.

Japan is advancing precision optical engineering to strengthen underground fiber optic networks, supporting direct burial cable adoption at a CAGR of 4.4% through 2035. Leading telecom companies are integrating high-performance fiber systems to improve network reliability, reduce latency, and enhance high-speed connectivity. Emphasis on meticulous engineering standards, technology-driven deployment, and operational excellence ensures robust underground infrastructure. Collaborative programs between industry and research institutions support innovation, performance optimization, and system reliability. Strategic investment in urban and regional fiber networks, combined with long-term infrastructure planning, is driving consistent technology adoption. Market focus includes improving service quality, increasing network resilience, and expanding high-capacity broadband coverage nationwide.

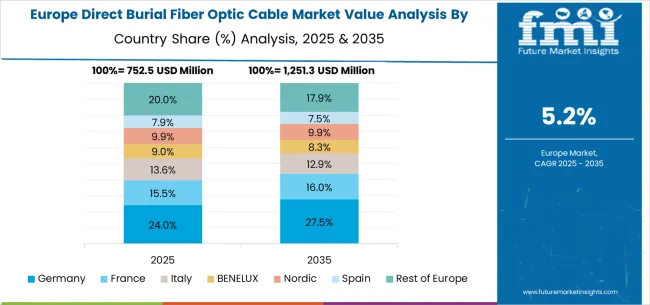

The direct burial fiber optic cable market in Europe is projected to grow from USD 752.5 million in 2025 to USD 1,251.3 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany will remain the largest market, rising from 24.0% in 2025 to 27.5% by 2035, driven by advanced telecommunications engineering capabilities, broadband expansion, and comprehensive fiber deployment programs.

France will account for 15.5% in 2025, edging up to 16.0% by 2035, reflecting investments in nationwide telecom modernization and high-speed connectivity. Italy will hold 13.6% in 2025, remaining stable at 13.8% by 2035, supported by consistent expansion in fixed-line broadband coverage.

The BENELUX region will contribute 9.2% in 2025, increasing to 9.3% by 2035, supported by its strong role in European telecom interconnection hubs. The Nordic countries will account for 9.9% in 2025, softening slightly to 8.3% by 2035, reflecting high early adoption but slower incremental growth post-2030.

Spain will capture 7.9% in 2025, easing to 7.5% by 2035, reflecting moderate demand growth in southern markets. Meanwhile, the Rest of Europe will decline from 20.0% in 2025 to 17.9% by 2035, reflecting slower adoption rates in Eastern Europe compared to Western broadband leaders.

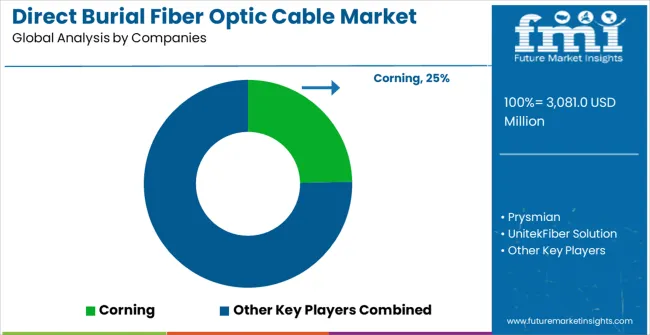

The direct burial fiber optic cable market is characterized by competition among established telecommunications equipment manufacturers, specialized fiber optic cable producers, and innovative connectivity solution providers. Companies are investing in advanced cable protection technologies, manufacturing process optimization, strategic partnerships, and installation support to deliver high-performance, reliable, and cost-effective direct burial fiber optic solutions. Technology development, quality assurance, and customer support strategies are central to strengthening competitive advantages and market presence.

Corning leads the market with significant expertise in fiber optic technologies, offering comprehensive direct burial cable solutions with focus on performance optimization and environmental durability. Prysmian provides established cable manufacturing capabilities with emphasis on advanced protection systems and installation efficiency. Shenzhen Unitekfiber Solution Limited focuses on specialized fiber optic solutions with comprehensive underground installation expertise. Fujikura delivers advanced fiber optic technologies with strong focus on precision manufacturing and reliability.

Furukawa operates with focus on telecommunications equipment and comprehensive fiber optic systems. YOFC provides comprehensive fiber optic manufacturing with emphasis on large-scale production capabilities. HTGD, FiberHome, Sumitomo, Nexans, CommScope, and LS Cable&System provide diverse technological approaches and manufacturing capabilities to enhance overall market development and fiber optic infrastructure advancement.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3,081 million |

| Classification | Single-Mode Optical Cable, Multi-Mode Optical Cable, Others |

| Application | Telecommunications and Communication Networks, Power Transmission |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Corning, Prysmian, Shenzhen Unitekfiber Solution Limited, Fujikura, Furukawa, YOFC, HTGD, FiberHome, Sumitomo, Nexans, CommScope, LS Cable&System |

| Additional Attributes | Dollar sales by cable type and application, regional deployment trends, competitive landscape, telecommunications partnerships, integration with network infrastructure, innovations in cable protection and installation technologies, performance analysis, and network reliability optimization strategies |

The global direct burial fiber optic cable market is estimated to be valued at USD 3,081.0 million in 2025.

The market size for the direct burial fiber optic cable market is projected to reach USD 5,414.4 million by 2035.

The direct burial fiber optic cable market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in direct burial fiber optic cable market are single-mode optical cable and multi-mode optical cable.

In terms of application, telecommunications and communication networks segment to command 73.6% share in the direct burial fiber optic cable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Forecast Outlook 2025 to 2035

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Direct Operated Poppet Valve Market Forecast and Outlook 2025 to 2035

Direct to Garment Printing Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Direct To Chip Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Direct Write Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Direct Oral Anticoagulants Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Linerless Labels Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Inks & Coating Market from 2025 to 2035

Direct-to-Shape Inkjet Printer Market Size, Growth, and Forecast 2025 to 2035

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Direct-to-Consumer Genetic Testing Market Analysis - Trends & Outlook 2025 to 2035

Assessing Direct-to-shape Inkjet Printer Market Share & Industry Trends

Market Share Insights of Leading Direct Thermal Printing Film Providers

Evaluating Direct to Garment Printing Market Share & Provider Insights

Market Share Distribution Among Direct Thermal Inks & Coating Manufacturers

Market Share Insights of Direct Thermal Linerless Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA