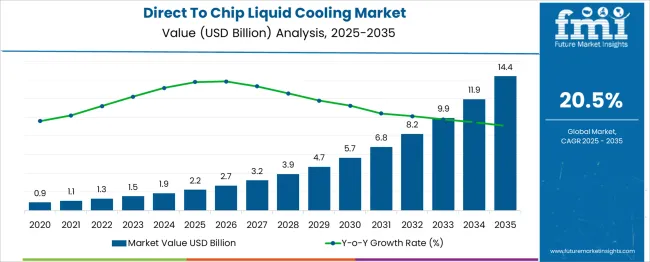

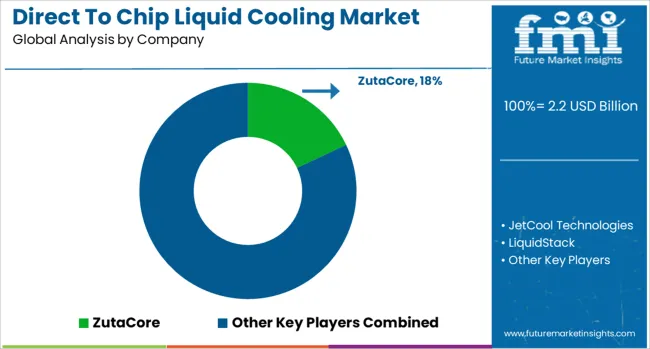

The Direct To Chip Liquid Cooling Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 14.4 billion by 2035, registering a compound annual growth rate (CAGR) of 20.5% over the forecast period. A 10-year growth comparison highlights significant acceleration in adoption, driven by the rising thermal management requirements of high-performance computing (HPC), data centers, and AI-driven workloads. In the first half (2025–2030), the market grows from USD 2.2 billion to USD 5.7 billion, adding USD 3.5 billion, or nearly 29% of the total market size, as hyperscale data centers adopt liquid cooling to manage dense chip architectures and reduce energy consumption. This early phase reflects a rapid transition from air cooling to direct-to-chip systems to meet cost and efficiency benchmarks.

The second half (2030–2035) demonstrates exponential momentum, with the market rising from USD 5.7 billion to USD 14.4 billion, contributing USD 8.7 billion, or 71% of incremental gains, fueled by expansion in cloud infrastructure, AI supercomputing clusters, and edge computing facilities requiring high thermal stability. Companies investing in custom cold plate designs, advanced dielectric coolants, and integrated rack-level cooling solutions will dominate, as the market shifts from niche deployments to a critical standard for future data center architectures.

| Metric | Value |

|---|---|

| Direct To Chip Liquid Cooling Market Estimated Value in (2025 E) | USD 2.2 billion |

| Direct To Chip Liquid Cooling Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 20.5% |

The direct to chip liquid cooling market holds an important role across multiple cooling segments with varying levels of penetration. In the server cooling equipment market, it accounts for nearly 18–20%, as direct-to-chip technology offers greater thermal efficiency compared to conventional air cooling. Within the data center liquid cooling market, its share is around 30–35%, making it the fastest-growing segment, driven by AI workloads and hyperscale deployment needs. For the high performance computing (HPC) cooling market, it contributes about 25–28%, as chip-level thermal management becomes critical in systems with extreme power density. In the industrial and laboratory electronics cooling market, its presence is smaller at 5–6%, limited to specialized high-voltage and power electronics requiring precise temperature control. Within the telecommunications and edge infrastructure cooling market, the share stands at approximately 10–12%, supported by edge data centers and 5G base stations demanding compact, efficient cooling solutions.

Growth is fueled by the scaling of AI and machine learning models, rising data traffic, and performance-driven requirements across hyperscale, HPC, and edge environments. As thermal design power ratings continue to rise beyond conventional cooling capacity, direct to chip liquid cooling is set to emerge as a dominant solution in next-generation computing ecosystems.

The direct-to-chip liquid cooling market is undergoing significant acceleration due to the increasing demand for high-performance computing, data center efficiency, and thermal management in dense server environments. Traditional air-cooling systems are being phased out in favor of more energy-efficient, low-noise, and scalable cooling alternatives.

Support for sustainable data infrastructure by governments and enterprises has incentivized the adoption of liquid-based solutions, especially in AI workloads, cloud computing, and blockchain processing centers. Infrastructural retrofits, along with advances in cold plate design and leak-proof manifold systems, have made integration of direct to chip solutions more cost-competitive.

As global data volumes expand and thermal limits become more challenging, investments are expected to pivot strongly toward direct-contact liquid thermal strategies.

The direct to chip liquid cooling market is segmented by cooling solution type, component cooling, liquid coolant type, application, end use, and geographic regions. By cooling solution type of the direct to chip liquid cooling market is divided into Single-phase liquid cooling and Two-phase liquid cooling. In terms of component cooling, the direct-to-chip liquid cooling market is classified into CPU cooling, GPU cooling, ASIC cooling, Memory cooling, and Other. Based on liquid coolant type, the direct-to-chip liquid cooling market is segmented into Water-based coolants, Dielectric fluids, Mineral oils, and Engineered fluids. The direct-to-chip liquid cooling market is segmented into data centers, Workstations, Artificial Intelligence/Machine Learning systems, High-performance computing (HPC), Edge computing devices, Supercomputers, and Others. The end use of the direct-to-chip liquid cooling market is segmented into Telecommunications, Financial services, Healthcare and life sciences, Oil and gas, Aerospace and defense, and Others. Regionally, the direct to chip liquid cooling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

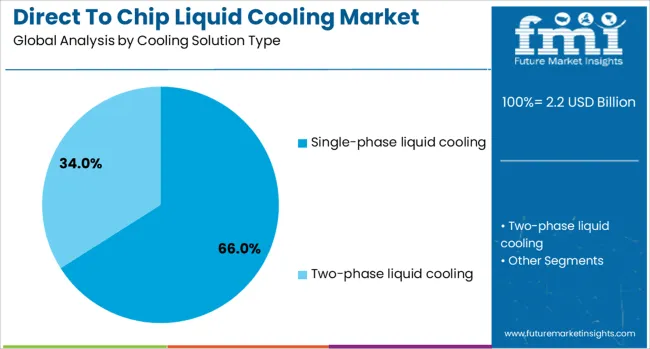

Single-phase liquid cooling is expected to account for 66.00% of total market revenue in 2025, making it the leading solution type. Its dominance is attributed to its comparatively simpler system architecture, lower fluid management complexity, and lower initial cost when compared with two-phase solutions.

These systems are easier to maintain, making them appealing for enterprise-scale rollouts. Compatibility with standard heat exchangers and efficient thermal conductivity have further bolstered uptake in data centers aiming for minimal operational disruption.

Additionally, enhanced safety and fluid stability have made single-phase systems the preferred choice among operators transitioning from traditional air-based setups.

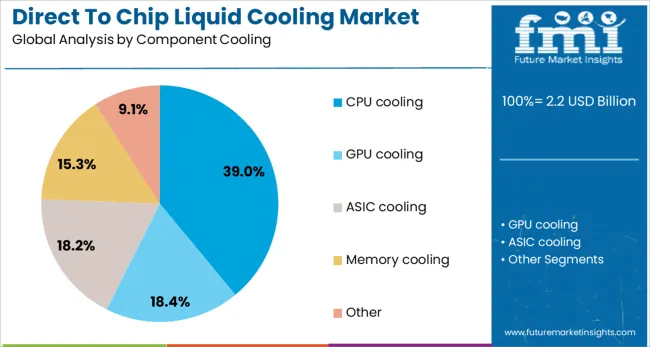

CPU cooling is projected to represent 39.00% of revenue within the component cooling segment in 2025, establishing it as the leading application. This prominence is driven by the escalating thermal design power (TDP) of next-generation processors used in AI, analytics, and simulation tasks.

Direct-to-chip cooling allows for more precise temperature control and is being favored for critical compute operations that demand stability and consistent performance.

As CPUs continue to evolve with denser architecture and higher core counts, thermal bottlenecks have necessitated more localized, liquid-based thermal management, accelerating investment in CPU-specific liquid cooling solutions.

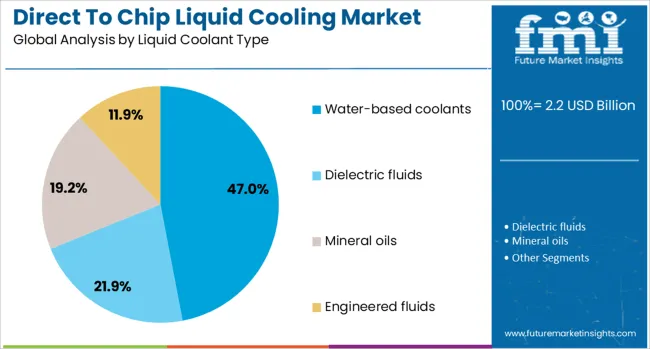

Water-based coolants are anticipated to dominate the market with a 47.00% share in 2025, positioning them as the leading coolant type. Their selection is influenced by high thermal conductivity, availability, and eco-friendly properties compared to synthetic alternatives.

Effective heat absorption at a relatively low cost makes water-based coolants ideal for large-scale deployment. Additionally, advancements in corrosion inhibitors and biocide formulations have improved their long-term reliability in closed-loop systems.

Data centers and high-performance computing facilities are increasingly opting for these solutions due to their balance of performance, safety, and cost-effectiveness, especially in environments where sustainability and ROI are prioritized.

Direct to chip liquid cooling technology is deployed in high-performance computing (HPC), data centers, and AI-intensive workloads to manage heat efficiently at the processor level. This method uses liquid coolants circulating through cold plates mounted directly on CPUs or GPUs, improving thermal performance compared to traditional air cooling. Growth has been supported by escalating data processing requirements, increased AI model complexity, and the push for energy-efficient thermal management. Manufacturers are focusing on modular liquid-cooling designs, advanced cold plate materials, and integration with facility-level cooling architectures to address expanding workloads and reduce operational costs.

The adoption of direct to chip liquid cooling has been driven by growing demand for high-density servers and advanced processors operating in AI, big data, and cloud computing environments. Conventional air cooling methods have reached thermal limits, prompting the transition to liquid-based solutions offering superior heat transfer and reduced energy consumption. Increased focus on operational efficiency and reduction of Power Usage Effectiveness (PUE) in data centers has reinforced adoption. The rise in edge computing deployments and high-performance clusters has further accelerated demand for chip-level liquid cooling systems, ensuring reliable performance and minimal downtime for mission-critical applications.

Market expansion has been hindered by high upfront investment requirements for installing liquid cooling systems, including specialized plumbing, pumps, and monitoring systems. Retrofitting existing air-cooled data centers to accommodate liquid cooling often involves significant redesign costs. Concerns over potential leakage and maintenance complexity have raised operational risk perceptions among facility managers. Standardization issues related to cold plate dimensions, coolant compatibility, and manifold design across OEMs have added integration challenges. Limited awareness in emerging markets and the need for skilled technicians to manage advanced cooling systems have further slowed large-scale deployment outside hyperscale environments.

Significant opportunities exist in AI and machine learning data centers where computational loads generate unprecedented heat levels, demanding advanced cooling solutions. Growth of liquid cooling-as-a-service and modular rack-based systems offers scalable and flexible deployment options. Integration of direct-to-chip cooling in edge data centers and 5G infrastructure creates additional avenues for expansion. The development of standardized open architectures under initiatives such as Open Compute Project (OCP) supports broader adoption. Partnerships between cooling technology providers and hyperscale cloud operators are accelerating design innovation. Growing investment in sustainability programs presents opportunities for eco-friendly coolants and closed-loop systems that minimize water usage.

Recent trends include the development of optimized cold plate geometries using copper and aluminum for higher thermal conductivity. Quick-disconnect systems are being introduced to simplify installation and reduce downtime during maintenance. Integration of intelligent control platforms with real-time monitoring and predictive analytics is gaining traction to improve operational efficiency. Industry collaboration is accelerating to establish common standards for manifolds, hoses, and connectors. Increasing demand for plug-and-play modular cooling units is reshaping deployment strategies for data centers with limited floor space. Continuous innovation in cooling fluids and component design is focused on extending reliability while minimizing energy usage.

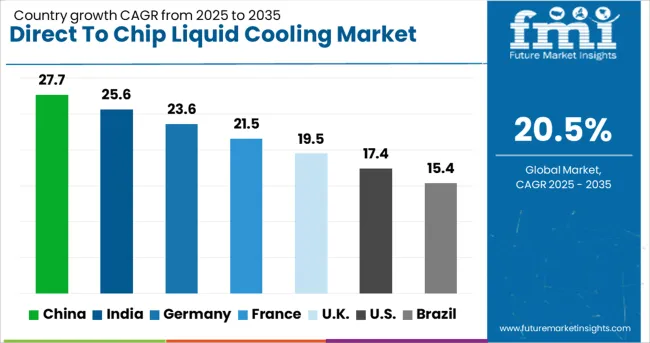

| Country | CAGR |

|---|---|

| China | 27.7% |

| India | 25.6% |

| Germany | 23.6% |

| France | 21.5% |

| UK | 19.5% |

| USA | 17.4% |

| Brazil | 15.4% |

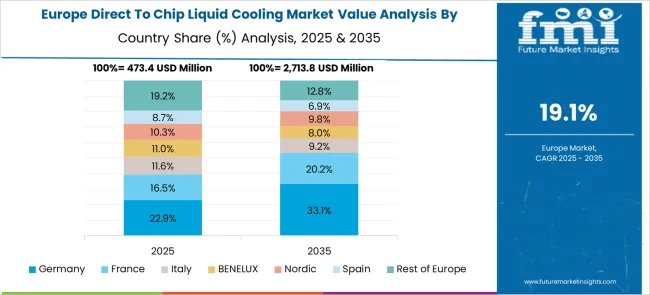

The direct-to-chip liquid cooling market is expected to expand at an impressive CAGR of 20.5% through 2035, driven by rapid adoption in data centers, HPC systems, and AI workloads requiring superior thermal management. China leads with a CAGR of 27.7%, propelled by hyperscale data center deployments and government-backed digital infrastructure programs. India follows at 25.6%, benefiting from AI-driven computing and rising colocation facilities. In Europe, France posts 21.5%, reflecting strong adoption in enterprise and edge computing networks, while the United Kingdom records 19.5%, supported by cloud service expansion. The United States grows at 17.4%, emphasizing energy-efficient cooling for HPC clusters and AI training environments. The analysis includes over 40 countries, with the top five detailed below.

China is forecasted to grow at a CAGR of 27.7% through 2035, driven by an exponential increase in hyperscale data centers and HPC clusters for AI applications. National policies promoting digitalization and green energy solutions are accelerating adoption of direct-to-chip cooling systems as a sustainable alternative to traditional air cooling. Leading Chinese cloud providers are investing in custom liquid cooling solutions to reduce power usage effectiveness (PUE) and improve operational efficiency. Local manufacturers are enhancing cold plate technology and thermal interface materials to ensure compatibility with high-density server architectures. Collaborations with global technology vendors are fueling innovation in modular immersion-based solutions for future-ready data centers.

India is projected to grow at a CAGR of 25.6% through 2035, supported by rapid expansion of colocation data centers and adoption of AI-powered computing systems. Increasing investments in high-density server installations for cloud and edge networks are creating strong demand for direct-to-chip cooling solutions. Data center operators are prioritizing energy-efficient systems to meet rising workloads while controlling operational costs. Indian IT service providers are collaborating with liquid cooling technology firms to implement high-performance solutions compatible with existing infrastructure. Growing reliance on HPC clusters for research, analytics, and generative AI accelerates adoption. The push for lower PUE and thermal efficiency improvements positions direct-to-chip cooling as a critical enabler for next-generation computing in India.

France is anticipated to grow at a CAGR of 21.5% through 2035, driven by government-backed digital infrastructure programs and rising demand for HPC in research and industrial applications. Direct-to-chip cooling solutions are gaining traction among French cloud service providers and colocation operators seeking energy-efficient alternatives to conventional systems. Integration of advanced cold plate systems with modular data centers ensures better thermal control for AI and machine learning workloads. Local technology firms are investing in hybrid cooling architectures that combine liquid cooling with optimized airflow for cost-effectiveness. Strategic partnerships with OEMs and hyperscale providers are further boosting adoption, particularly in facilities handling financial analytics and climate modeling.

The United Kingdom is expected to expand at a CAGR of 19.5% through 2035, supported by rapid cloud adoption, AI-focused research initiatives, and edge computing projects. Growing emphasis on operational efficiency and heat recovery in data centers is fueling demand for direct-to-chip cooling. British colocation providers and hyperscale operators are increasingly deploying liquid-cooled servers for better thermal management under high computing densities. Integration of AI-based monitoring systems enables predictive performance optimization and fault detection in cooling operations. Strategic investments in modular facilities for financial services and healthcare sectors reinforce market expansion.

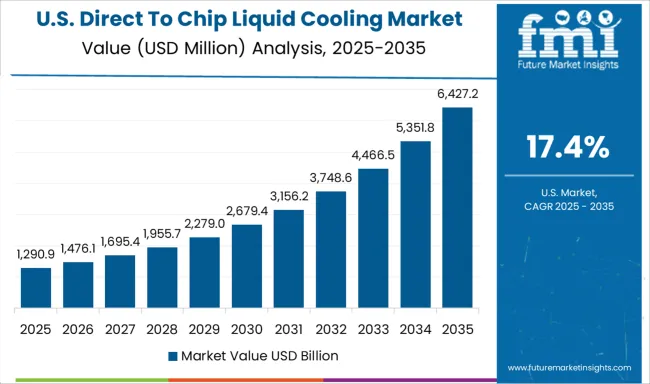

The United States is forecasted to grow at a CAGR of 17.4% through 2035, driven by hyperscale and enterprise data center operators embracing energy-efficient cooling solutions for HPC clusters and AI workloads. Adoption is propelled by rising computational requirements in sectors such as cloud services, research institutions, and government facilities. U.S.-based OEMs are developing next-generation cold plate technologies with advanced thermal conductivity and low-maintenance designs. Strategic partnerships between cooling technology providers and chip manufacturers are optimizing designs for higher performance servers. Integration with software-driven thermal management systems enhances operational efficiency and scalability. Growing demand for sustainable data center practices and carbon-neutral operations further reinforces the shift toward direct-to-chip cooling across North America.

The direct-to-chip liquid cooling market is driven by technology innovators and established thermal management providers delivering high-efficiency cooling solutions for data centers, high-performance computing (HPC), and AI workloads. ZutaCore leads with its patented two-phase liquid cooling technology, offering enhanced thermal transfer and scalability for dense computing environments. JetCool Technologies focuses on microconvective cooling, enabling localized heat removal at the chip level with minimal fluid usage, reducing energy costs and improving performance. LiquidStack, known for immersion cooling expertise, extends its capabilities into direct-to-chip solutions for hyperscale and edge deployments where thermal efficiency is critical. CoolIT Systems is a prominent player providing modular direct-to-chip liquid cooling systems integrated into OEM servers, optimizing energy efficiency in HPC clusters and enterprise applications.

Asetek, traditionally known for liquid cooling in gaming and workstation segments, has expanded into data center markets with customizable direct-to-chip solutions for CPUs and GPUs. Fujitsu leverages its engineering expertise in electronics and IT infrastructure to deliver integrated liquid cooling solutions for supercomputing and cloud applications. Competitive differentiation relies on thermal performance, leak-proof reliability, scalability, and compatibility with diverse chip architectures. Barriers to entry include complex engineering requirements, stringent reliability standards, and the need for partnerships with server OEMs. Strategic priorities involve advancing two-phase cooling systems, developing eco-friendly coolants, and integrating monitoring systems for predictive thermal management.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Cooling Solution Type | Single-phase liquid cooling and Two-phase liquid cooling |

| Component Cooling | CPU cooling, GPU cooling, ASIC cooling, Memory cooling, and Other |

| Liquid Coolant Type | Water-based coolants, Dielectric fluids, Mineral oils, and Engineered fluids |

| Application | Datacenter, Workstations, Artificial Intelligence/Machine Learning systems, High-performance computing (HPC), Edge computing devices, Supercomputers, and Others |

| End Use | Telecommunications, Financial services, Healthcare and life sciences, Oil and gas, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ZutaCore, JetCool Technologies, LiquidStack, CoolIT Systems, Asetek, and Fujitsu |

| Additional Attributes | Dollar sales by cooling type (single-phase liquid cooling, two-phase liquid cooling) and application (hyperscale data centers, HPC, edge computing, AI infrastructure). Demand dynamics are driven by rising chip power densities and energy efficiency mandates across global data centers. Regional trends highlight North America and Europe leading adoption due to large hyperscale deployments, while Asia-Pacific is emerging rapidly with growing AI workloads and cloud infrastructure. Innovation trends include dielectric fluids for enhanced safety, modular cold-plate systems for easy deployment, and integration of smart sensors enabling real-time thermal monitoring and predictive maintenance. |

The global direct to chip liquid cooling market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the direct to chip liquid cooling market is projected to reach USD 14.4 billion by 2035.

The direct to chip liquid cooling market is expected to grow at a 20.5% CAGR between 2025 and 2035.

The key product types in direct to chip liquid cooling market are single-phase liquid cooling and two-phase liquid cooling.

In terms of component cooling, cpu cooling segment to command 39.0% share in the direct to chip liquid cooling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Forecast Outlook 2025 to 2035

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Direct Operated Poppet Valve Market Forecast and Outlook 2025 to 2035

Direct Burial Fiber Optic Cable Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Direct Oral Anticoagulants Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Linerless Labels Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Inks & Coating Market from 2025 to 2035

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Market Share Insights of Leading Direct Thermal Printing Film Providers

Market Share Distribution Among Direct Thermal Inks & Coating Manufacturers

Market Share Insights of Direct Thermal Linerless Providers

Direct Drive Wind Turbine Market Growth - Trends & Forecast 2025 to 2035

Direct Reduced Iron Market Growth – Trends & Forecast 2024-2034

Directional Luminaire Market

Direct-Fed Microbial Products Market

Direct-acting Antiviral Medicines Market

Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA