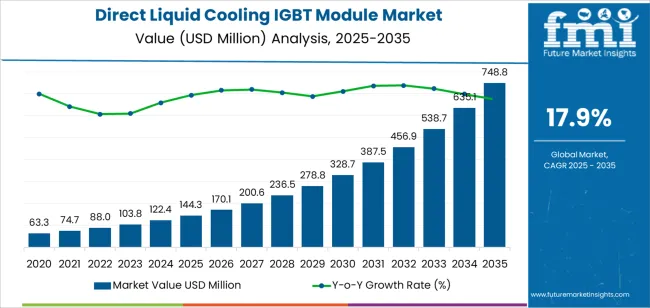

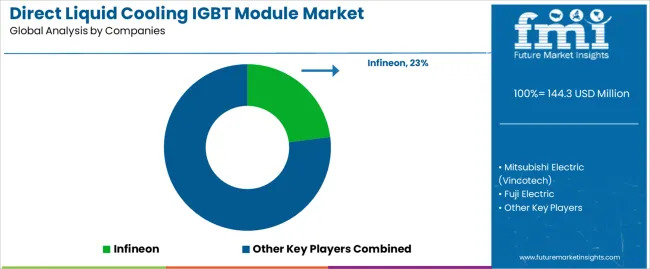

The direct liquid cooling IGBT module market is valued at USD 144.3 million in 2025 and is expected to reach USD 748.8 million by 2035, advancing at a CAGR of 17.9%. Market growth is driven by the increasing demand for high-efficiency power electronics in electric vehicles, renewable energy systems, and industrial automation. The adoption of liquid-cooled designs addresses the limitations of conventional air-cooled modules by improving thermal management, reliability, and power density under high-load conditions. Expanding applications in traction inverters, wind turbines, and high-performance drives continue to reinforce market momentum.

Modules in the 600V to 1200V range represent the leading segment due to their suitability for electric vehicle powertrains, motor drives, and grid-connected converters. Direct liquid cooling enhances heat dissipation through integrated channels or cold plates, reducing thermal resistance and extending component lifespan. Manufacturers are integrating advanced materials, such as copper baseplates and sintered interfaces, to optimize thermal conductivity and system efficiency.

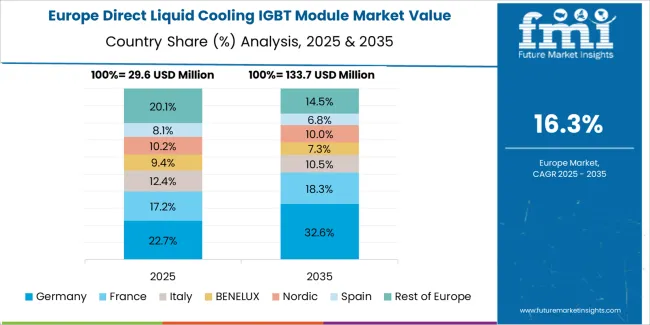

Asia Pacific dominates global market growth, supported by electric vehicle manufacturing and renewable energy deployment in China, Japan, and South Korea. Europe and North America maintain strong demand through industrial electrification and adoption of energy-efficient power conversion systems. Key players include Infineon, Mitsubishi Electric (Vincotech), Fuji Electric, Hitachi Power Semiconductor Device, and Bosch, focusing on thermal design innovation, compact module architecture, and high-reliability power integration.

Year-on-year (YoY) growth analysis indicates a strong upward trajectory supported by rising demand for high-efficiency power electronics in electric vehicles, renewable energy systems, and industrial automation. From 2025 to 2028, annual growth is expected to remain above 16% as liquid cooling technology gains adoption over traditional air-cooled systems due to superior thermal management and reliability advantages.

Between 2029 and 2032, YoY growth may briefly stabilize around 17% as production capacity expands and large-scale integration in electric mobility and wind power inverters reaches maturity. The later phase, from 2033 to 2035, will likely record renewed acceleration as next-generation IGBT modules designed for higher power density and compactness enter commercial use. Regional growth will be strongest in Asia-Pacific, driven by manufacturing expansion and EV infrastructure development. The YoY trend demonstrates consistent double-digit gains across the decade, underpinned by continuous technological improvements, demand for energy-efficient systems, and the scaling of advanced liquid-cooled power modules across high-performance applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 144.3 million |

| Market Forecast Value (2035) | USD 748.8 million |

| Forecast CAGR (2025-2035) | 17.9% |

The direct liquid cooling IGBT module market is growing as power electronics systems demand more efficient thermal management solutions for high-performance applications. Liquid cooling improves heat dissipation, enabling higher power density, longer device lifespan, and greater operational reliability. Industries such as electric vehicles, renewable energy, and industrial automation increasingly adopt liquid-cooled insulated gate bipolar transistor modules to support compact and efficient inverter and converter designs. Rising power conversion requirements in electric mobility, rail transport, and wind energy systems are strengthening adoption due to superior thermal control compared to air-cooled alternatives.

Technological advances in micro-channel structures, cold plate designs, and dielectric coolants enhance cooling efficiency and reduce thermal stress on semiconductor components. The transition toward high-voltage and high-frequency systems supports the use of liquid cooling for stable and continuous performance under heavy electrical loads. Constraints include high initial cost, complex system integration, and maintenance challenges associated with liquid-based systems, which limit adoption in smaller installations and cost-sensitive industries.

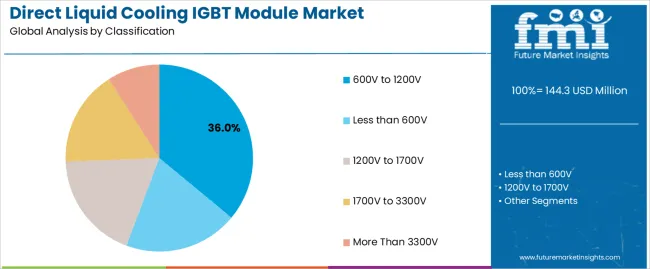

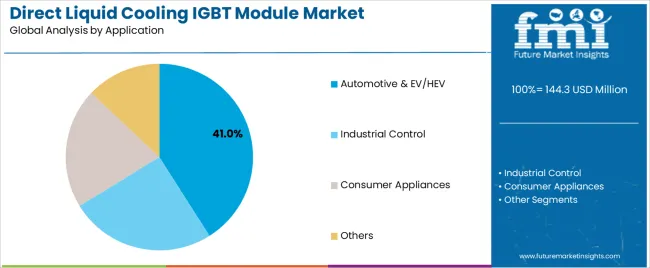

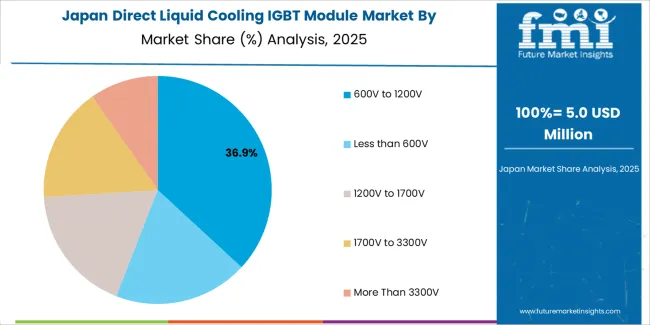

The direct liquid cooling IGBT module market is segmented by classification and application. By classification, the market is divided into less than 600V, 600V to 1200V, 1200V to 1700V, 1700V to 3300V, and more than 3300V modules. Based on application, it is categorized into automotive and EV/HEV, industrial control, consumer appliances, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The 600V to 1200V segment holds the leading position in the direct liquid cooling IGBT module market, accounting for an estimated 36.0% of total market share in 2025. Modules in this voltage range are widely implemented across automotive, renewable energy, and industrial systems due to their balance between voltage handling capacity, efficiency, and cost. These modules deliver optimized switching performance and thermal control, making them suitable for electric traction inverters, motor drives, and power conversion units.

Their dominance is reinforced by the ongoing electrification of transportation and industrial automation expansion. Direct liquid cooling supports higher current density and prolonged operational reliability under elevated thermal loads, a critical requirement in compact, high-performance systems. Lower voltage modules (below 600V) are mainly applied in consumer and small-scale industrial electronics, while higher-voltage modules (above 1200V) are utilized in power grid, rail traction, and wind turbine systems.

Key factors supporting the 600V to 1200V segment include:

The automotive and EV/HEV segment represents the largest share of the direct liquid cooling IGBT module market, holding an estimated 41.0% of the total market in 2025. This dominance is driven by rapid electrification of passenger and commercial vehicles, necessitating efficient thermal management of power electronics components. Direct liquid cooling enables higher performance in vehicle traction inverters, onboard chargers, and DC–DC converters by maintaining optimal operating temperatures during peak load conditions.

The segment’s growth is supported by global initiatives toward decarbonization, expansion of EV infrastructure, and increasing investment in high-efficiency powertrain components. The industrial control segment follows, accounting for approximately 33.0% of the market, supported by applications in motor drives, automation equipment, and renewable energy systems. The consumer appliances and others segments collectively represent the remaining market share, focused on compact, high-efficiency systems in specialized and household applications.

Primary dynamics driving demand from the automotive and EV/HEV segment include:

Rising demand for high-power density electronics, increasing EV and renewable energy adoption, and superior thermal performance requirements.

The market is driven by continuous growth in applications that require high-end power switching with minimal losses. Electric vehicles and renewable energy systems use IGBT modules at high voltages and currents, creating strong demand for cooling solutions that maintain reliability. Direct liquid cooling enables reduced thermal resistance and enhanced heat dissipation compared to traditional cooling, thereby supporting higher switching frequency and performance. The shift toward more compact and efficient power electronics further accelerates adoption of modules that incorporate advanced cooling technologies.

Higher manufacturing and maintenance complexity, strict fluid compatibility requirements, and limited standardisation across industries.

Direct liquid‐cooled IGBT modules tend to be more complex to design and produce than air-cooled or simpler alternatives, which raises cost barriers. The need for precision in coolant flow, sealing, and materials to avoid corrosion or contamination increases engineering and servicing demands. Some sectors or legacy systems may lack compatibility or standards for integrating liquid-cooling systems, reducing willingness to transition. Operational and cooling infrastructure costs can hinder uptake in regions with limited technical support or investment capacity.

Modular and scalable cooling integration, expansion into diverse industrial sectors, and evolution toward higher-voltage classes.

Manufacturers are offering more modular designs allowing scalable cooling solutions tailored to application needs. Adoption is spreading beyond automotive and renewables into sectors such as industrial motor drives and power conversion equipment. There is an increasing shift to higher-voltage IGBT classes, which necessitates more advanced cooling, promoting innovation in module and coolant interface designs. Developments in micro-channel fin structures and direct-immersion cooling are enhancing thermal efficiency and enabling future-proof module architectures.

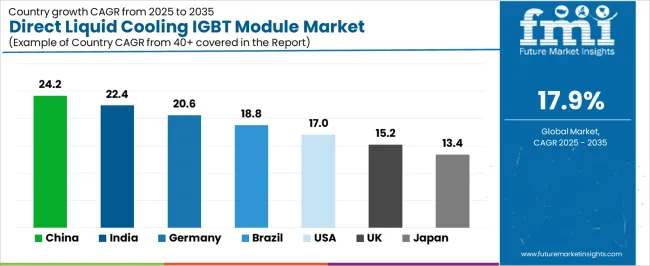

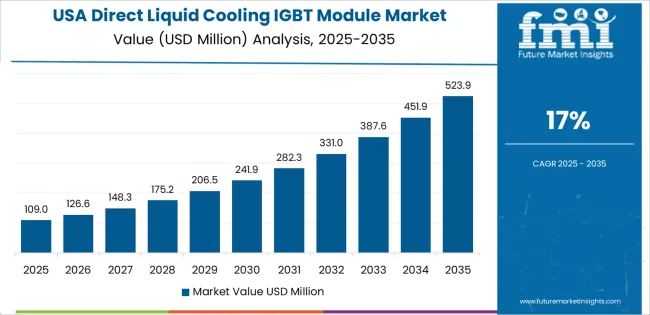

The global direct liquid cooling IGBT (Insulated Gate Bipolar Transistor) module market is growing rapidly through 2035, driven by increased adoption of high-power electronics in electric vehicles (EVs), renewable energy systems, and industrial automation. China leads with a 24.2% CAGR, followed by India at 22.4%, reflecting large-scale electrification and semiconductor manufacturing growth. Germany records 20.6%, supported by engineering innovation and EV supply chain expansion. Brazil grows at 18.8%, aided by renewable power generation and manufacturing development. The United States posts 17.0%, driven by defense and clean energy applications, while the United Kingdom (15.2%) and Japan (13.4%) maintain steady growth through precision power electronics and R&D-led system optimization.

| Country | CAGR (%) |

|---|---|

| China | 24.2 |

| India | 22.4 |

| Germany | 20.6 |

| Brazil | 18.8 |

| USA | 17.0 |

| UK | 15.2 |

| Japan | 13.4 |

China’s market grows at 24.2% CAGR, supported by its dominance in EV manufacturing, industrial power electronics, and renewable energy integration. Domestic semiconductor firms are scaling up production of high-density IGBT modules equipped with direct liquid cooling for superior heat dissipation. The government’s Made in China 2025 policy promotes local production of advanced power components and cooling solutions. Collaborations between automotive OEMs and electronics manufacturers enhance module reliability for EV traction inverters. China’s expanding solar and wind power infrastructure increases the adoption of high-efficiency liquid-cooled IGBT systems in converters and inverters.

Key Market Factors:

India’s market grows at 22.4% CAGR, driven by industrial electrification, electric mobility, and domestic semiconductor ecosystem development. The National Electric Mobility Mission Plan and Production Linked Incentive (PLI) scheme are promoting localized manufacturing of power modules. Indian firms are adopting liquid cooling designs to enhance heat transfer efficiency in electric drivetrain applications. Research collaborations with global semiconductor companies are advancing high-voltage module design and cooling system integration. Growing demand from railways, renewable energy plants, and industrial automation further accelerates deployment. The market benefits from government initiatives supporting clean energy and self-reliant manufacturing ecosystems.

Market Development Factors:

Germany’s market grows at 20.6% CAGR, supported by precision engineering, EV innovation, and industrial efficiency programs. German power electronics manufacturers are producing high-performance IGBT modules with advanced thermal interface materials and liquid cooling plates. The country’s strong automotive and renewable energy industries drive large-scale adoption of power modules for e-mobility and grid systems. Research under Industrie 4.0 and Energiewende initiatives supports integration of thermal management systems with real-time digital monitoring. Manufacturers are also focusing on SiC (silicon carbide)-based IGBT technology for enhanced power density and reliability.

Key Market Characteristics:

Brazil’s market grows at 18.8% CAGR, supported by renewable energy expansion, smart grid projects, and manufacturing investment. Local firms are adopting liquid-cooled IGBT modules for wind and solar inverters to improve energy conversion efficiency in tropical environments. The National Energy Expansion Plan promotes adoption of high-efficiency power electronics across distributed generation systems. Collaborations with global manufacturers are facilitating technology transfer in power module design and thermal management. Industrial automation and electrified transport networks are additional drivers of market expansion.

Market Development Factors:

The United States grows at 17.0% CAGR, supported by innovation in EV platforms, defense-grade electronics, and grid modernization. Manufacturers are investing in advanced packaging designs and liquid cooling structures for thermal stability in high-current environments. The Department of Energy (DOE) supports R&D in power semiconductors under the Advanced Manufacturing Office and Clean Energy Initiative. Growing demand from aerospace, defense, and industrial automation drives high-reliability module deployment. Integration of AI-based temperature monitoring and predictive maintenance systems strengthens performance across large-scale installations.

Key Market Factors:

The United Kingdom’s market grows at 15.2% CAGR, driven by power electronics innovation, EV infrastructure development, and renewable integration. Domestic companies are developing liquid-cooled IGBT modules optimized for electric drivetrains, aerospace systems, and power conversion equipment. R&D under Innovate UK and Faraday Battery Challenge supports energy-efficient and thermally stable electronic systems. Partnerships between universities and industry enhance module design and fluid dynamics analysis. Adoption in offshore wind projects and grid storage converters also supports steady demand.

Market Development Factors:

Japan’s market grows at 13.4% CAGR, reflecting strong R&D in power electronics and energy system reliability. Domestic firms are manufacturing high-efficiency IGBT modules with direct liquid cooling for EV, rail, and industrial automation applications. The Green Innovation Fund supports development of compact, energy-efficient semiconductor systems with advanced cooling channels. Research in SiC and GaN materials is improving thermal conductivity and switching performance. The country’s focus on reliability and miniaturization sustains continuous product improvement and export potential.

Key Market Characteristics:

The direct liquid cooling IGBT module market is moderately concentrated, with around a dozen semiconductor and power electronics manufacturers competing in high-efficiency thermal management applications. Infineon leads the market with an estimated 23.0% global share, supported by its advanced IGBT module portfolio, proprietary cooling interface technology, and strong partnerships across electric vehicle, renewable energy, and industrial automation sectors. Its dominance is reinforced by proven reliability, scalable production, and integration of liquid-cooled systems into high-power density architectures.

Mitsubishi Electric (Vincotech), Fuji Electric, and Hitachi Power Semiconductor Device follow as key competitors, focusing on high-voltage, low-loss IGBT modules with optimized thermal resistance and compact form factors. Their competitive strengths include vertically integrated manufacturing, automotive-grade qualification, and continuous improvement in silicon and packaging materials. Bosch, Onsemi, and Toshiba contribute through hybrid power solutions and thermal management innovations tailored for traction inverters and grid converters.

Microchip, STMicroelectronics, and Denso maintain strong R&D programs targeting liquid-cooled power modules designed for electrified transportation and energy storage applications. BYD and SanRex Corporation compete regionally with in-house module production and system-level expertise in vehicle and industrial power systems. Competition in this market is defined by thermal efficiency, reliability under high current density, and integration capability. Growth is driven by the global shift toward electrification and renewable power infrastructure, where liquid-cooled IGBT modules enable superior thermal management, reduced footprint, and longer service life in demanding high-power environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Classification | Less than 600V, 600V to 1200V, 1200V to 1700V, 1700V to 3300V, More Than 3300V |

| Application | Automotive & EV/HEV, Industrial Control, Consumer Appliances, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Infineon, Mitsubishi Electric (Vincotech), Fuji Electric, Hitachi Power Semiconductor Device, Bosch, Onsemi, Toshiba, Microchip, STMicroelectronics, BYD, Denso, SanRex Corporation |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of IGBT module and semiconductor power device manufacturers; advancements in direct liquid cooling and high-voltage module efficiency; integration with electric vehicles, industrial automation, and renewable energy systems. |

The global direct liquid cooling IGBT module market is estimated to be valued at USD 144.3 million in 2025.

The market size for the direct liquid cooling IGBT module market is projected to reach USD 748.8 million by 2035.

The direct liquid cooling IGBT module market is expected to grow at a 17.9% CAGR between 2025 and 2035.

The key product types in direct liquid cooling IGBT module market are 600v to 1200v, less than 600v, 1200v to 1700v, 1700v to 3300v and more than 3300v.

In terms of application, automotive & ev/hev segment to command 41.0% share in the direct liquid cooling IGBT module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Printing Film Market Size and Share Forecast Outlook 2025 to 2035

Directional Drilling Service Market Forecast Outlook 2025 to 2035

Direct Methanol Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Direct Operated Poppet Valve Market Forecast and Outlook 2025 to 2035

Direct to Garment Printing Market Size and Share Forecast Outlook 2025 to 2035

Direct Burial Fiber Optic Cable Market Size and Share Forecast Outlook 2025 to 2035

Directed Energy Weapons Market Size and Share Forecast Outlook 2025 to 2035

Direct Write Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Direct Oral Anticoagulants Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Linerless Labels Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Inks & Coating Market from 2025 to 2035

Direct-to-Shape Inkjet Printer Market Size, Growth, and Forecast 2025 to 2035

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Direct-to-Consumer Genetic Testing Market Analysis - Trends & Outlook 2025 to 2035

Assessing Direct-to-shape Inkjet Printer Market Share & Industry Trends

Market Share Insights of Leading Direct Thermal Printing Film Providers

Evaluating Direct to Garment Printing Market Share & Provider Insights

Market Share Distribution Among Direct Thermal Inks & Coating Manufacturers

Market Share Insights of Direct Thermal Linerless Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA