The directional drilling service market is growing steadily, driven by increasing global exploration and production activities aimed at maximizing hydrocarbon recovery. Technological advancements in well trajectory control and real-time data analytics have enhanced drilling precision, reducing operational risks and costs. The demand for complex well structures in unconventional reserves and offshore basins has further accelerated service adoption.

Service providers are increasingly focusing on digital integration and automated drilling technologies to improve efficiency. The market is supported by continued energy demand, infrastructure expansion in oil-producing regions, and the ongoing transition toward optimized drilling solutions.

Environmental considerations and the need for reduced surface disturbance are also promoting directional drilling as a preferred method. The outlook remains favorable as upstream companies pursue enhanced recovery rates and well longevity through advanced directional drilling applications..

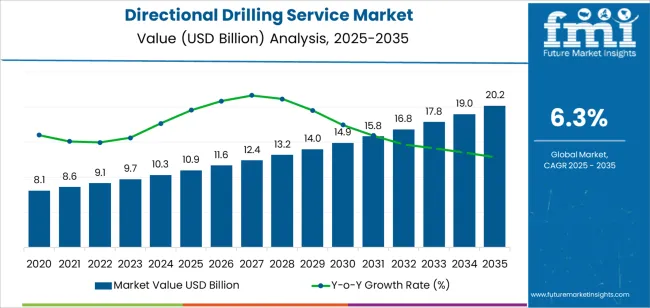

| Metric | Value |

|---|---|

| Directional Drilling Service Market Estimated Value in (2025 E) | USD 10.9 billion |

| Directional Drilling Service Market Forecast Value in (2035 F) | USD 20.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

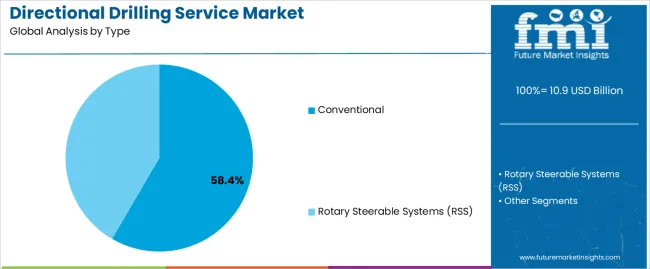

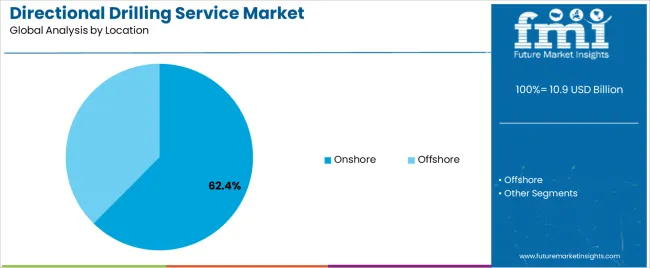

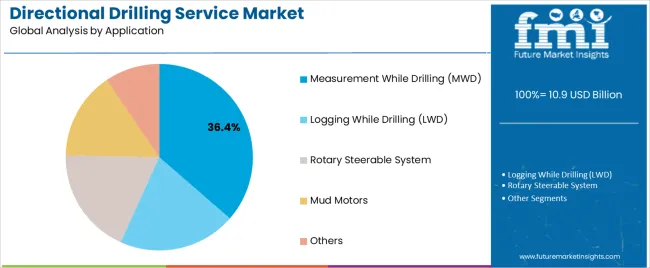

The market is segmented by Type, Location, and Application and region. By Type, the market is divided into Conventional and Rotary Steerable Systems (RSS). In terms of Location, the market is classified into Onshore and Offshore. Based on Application, the market is segmented into Measurement While Drilling (MWD), Logging While Drilling (LWD), Rotary Steerable System, Mud Motors, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

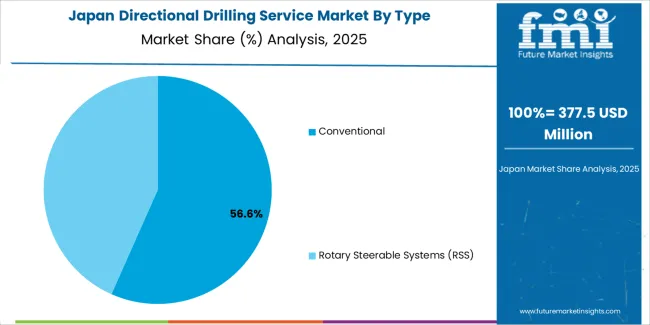

The conventional segment dominates the type category with approximately 58.40% share, attributed to its proven reliability and cost-effectiveness across a wide range of drilling operations. Conventional directional drilling techniques continue to be widely utilized due to established infrastructure, operator familiarity, and suitability for shallow and moderately complex wells.

The segment benefits from steady demand in mature oilfields and onshore projects where capital expenditure optimization is prioritized. Continuous improvements in downhole tools and steering technologies have enhanced performance and accuracy, reinforcing the relevance of conventional services.

With exploration activities expanding in low-risk geological zones and operators seeking dependable, low-cost drilling solutions, the conventional segment is projected to maintain a significant share in the near term..

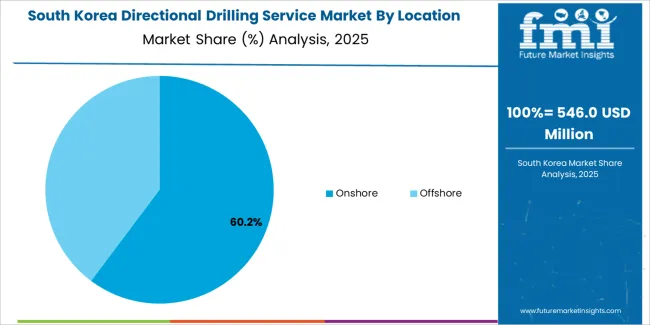

The onshore segment accounts for approximately 62.40% of the market share in the location category, driven by high operational flexibility and cost advantages compared to offshore drilling. Onshore directional drilling is favored due to simpler logistics, faster setup times, and accessibility to infrastructure and labor.

The segment’s dominance is further supported by growing shale gas and tight oil activities in major producing regions. Technological integration, including automated steering systems and real-time well monitoring, has improved operational efficiency and success rates.

Additionally, favorable regulatory conditions in key drilling regions have encouraged investment in onshore fields. With ongoing expansion of exploration and production activities across land-based reserves, the onshore segment is expected to sustain its leading position..

The measurement while drilling (MWD) segment leads the application category with approximately 36.40% share, reflecting its critical role in real-time monitoring and directional control. MWD systems provide continuous data on borehole conditions, enabling accurate well placement and improved drilling performance.

The segment’s growth is driven by rising demand for precision drilling in complex geological formations, where real-time decision-making enhances operational safety and efficiency. Integration of telemetry and sensor technologies has improved data transmission speed and reliability.

The segment also benefits from growing adoption in both conventional and unconventional reservoirs. As the industry shifts toward data-driven drilling operations, the MWD segment is expected to experience sustained expansion through the forecast period..

When it comes to the type of directional drilling services, the conventional method still rules the market. On the other hand, although offshore drilling is gaining popularity, onshore drilling remains the predominant location in the market.

The conventional type of directional drilling services are expected to progress at a CAGR of 6.0% during the forecast period. Factors driving the growth of the conventional directional drilling service market include:

| Attributes | Details |

|---|---|

| Top Type | Conventional |

| Forecasted CAGR (2025 to 2035) | 6.0% |

Onshore directional drilling services are predicted to register a CAGR of 5.8% during the forecast period. Some factors contributing to the growth of the onshore drilling segment in the directional drilling service market include:

| Attributes | Details |

|---|---|

| Top Location | Onshore |

| Forecasted CAGR (2025 to 2035) | 5.8% |

Europe is home to numerous areas where oil rigs and oil drilling are integral parts of life for a significant portion of the population. Similarly, North America also hosts several countries where activities related to oil and gas are prominent features of economies and people's lives. With increasing foreign investment, the market in the Asia Pacific is receiving a boost. The discovery of new oilfields is another factor propelling demand in the region.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 6.6% |

| United Kingdom | 5.3% |

| China | 7.4% |

| Japan | 7.7% |

| South Korea | 3.4% |

The market in Japan is anticipated to register a CAGR of 7.7% during the forecast period. Some factors driving the growth of the market in the country include:

South Korea is set to see the market expand at a CAGR of 3.4% over the forecast period. Prominent factors driving the growth of the market include:

The market in China is expected to register a CAGR of 7.4% through 2035. Some factors driving the growth of the market in China include:

The market is set to progress at a CAGR of 5.3% in the United Kingdom between 2025 and 2035. Factors influencing the growth of the market in the United Kingdom include:

The market is expected to register a CAGR of 6.6% in the United States from 2025 to 2035. Some reasons for the growth of directional drilling services in the country include:

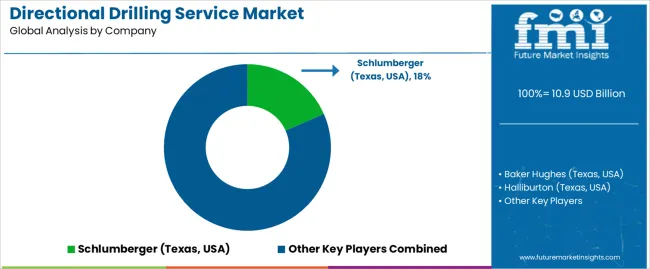

While companies interested in directional drilling to increase fuel output are concentrated, market players providing those services are plentiful. Thus, the nature of the market is fragmented, with local companies competing with reputable names for a piece of the pie. Market players are adopting collaborative strategies to streamline the drilling process. The manufacturing of tools that make the drilling process more efficient is a common concern among market players.

Recent Developments in the Directional Drilling Service Market

The global directional drilling service market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the directional drilling service market is projected to reach USD 20.2 billion by 2035.

The directional drilling service market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in directional drilling service market are conventional and rotary steerable systems (rss).

In terms of location, onshore segment to command 62.4% share in the directional drilling service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Directional Luminaire Market

Bidirectional Charging Units Market Size and Share Forecast Outlook 2025 to 2035

Unidirectional ESD Diode Market Size and Share Forecast Outlook 2025 to 2035

Unidirectional Tape (UD) Market Size and Share Forecast Outlook 2025 to 2035

Bi-Directional Electric Vehicle Charger Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Unidirectional Tape (UD) Market Share Dynamics

3-way Pilot Operated Directional Control Valves Market Forecast and Outlook 2025 to 2035

Drilling Tools Market Size and Share Forecast Outlook 2025 to 2035

Drilling Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling and Completion Fluids Market Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Rotary Drilling Rig Market Size and Share Forecast Outlook 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Onshore Drilling Fluids Market Growth - Trends & Forecast 2025 to 2035

Crawler Drilling Machine Market

Surface Drilling Rigs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA