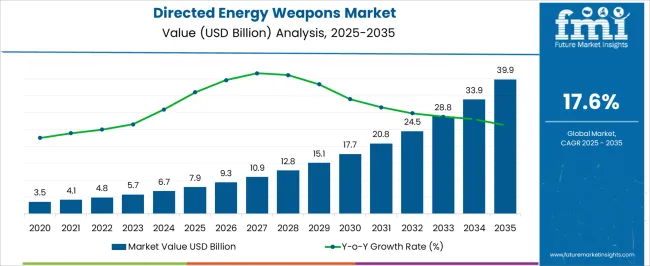

The directed energy weapons (DEW) market is projected to grow at a CAGR of 17.6% from 2025 to 2035, expanding from an estimated USD 7.9 billion in 2025 to USD 39.9 billion by 2035. Growth is being propelled by escalating defense budgets, modernization programs, and the strategic need for advanced missile and drone defense systems. Militaries worldwide are investing in high-energy lasers, high-power microwave, and particle beam technologies to counter evolving aerial and ground threats with precision and reduced collateral damage.

The market is also influenced by increasing naval and air defense deployments, alongside rapid R&D in compact, mobile, and scalable DEW systems suitable for multiple platforms. Procurement trends are shifting toward integrating DEWs with existing defense networks, automated targeting, and battlefield management systems to enhance operational readiness and threat neutralization. Defense collaborations, joint ventures, and international exports are driving adoption, while regulatory frameworks and military technology transfer agreements shape deployment strategies.

As the technology matures, decreasing unit costs and improved energy efficiency will further accelerate adoption across air, land, and maritime defense segments. Market players are focusing on component miniaturization, reliability under extreme conditions, and software-enabled targeting solutions, positioning DEWs as a critical tool in next-generation military arsenals.

| Metric | Value |

|---|---|

| Directed Energy Weapons Market Estimated Value in (2025 E) | USD 7.9 billion |

| Directed Energy Weapons Market Forecast Value in (2035 F) | USD 39.9 billion |

| Forecast CAGR (2025 to 2035) | 17.6% |

The directed energy weapons (DEW) market is strongly shaped by five interconnected parent markets, each contributing distinctly to overall demand and deployment. The military defense modernization market holds the largest share at 35%, driven by the need to upgrade air, land, and naval defense systems with high-precision laser, microwave, and particle beam technologies to counter evolving threats such as drones, missiles, and unmanned combat vehicles. The aerospace and naval defense market contributes 25%, as fighter jets, naval vessels, and surveillance aircraft increasingly integrate DEWs for long-range interception, point defense, and strategic deterrence.

The homeland security and border protection sector accounts for 15%, focusing on perimeter defense, counter-drone operations, and critical infrastructure safeguarding against asymmetric threats. The research and development segment holds a 15% share, encompassing government-funded programs, defense labs, and private partnerships working on compact, energy-efficient, and software-enabled DEW prototypes.

The export and international defense collaboration market represents 10%, facilitating technology transfer, joint development, and global adoption across allied nations. Collectively, military modernization, aerospace/naval defense, and R&D sectors account for 75% of total demand, emphasizing operational superiority, precision targeting, and threat mitigation as the primary growth drivers, while homeland security and international collaboration offer complementary expansion opportunities for the DEW market globally.

The Directed Energy Weapons market is experiencing notable expansion due to increasing defense modernization efforts and evolving warfare tactics emphasizing precision and rapid response. The current market is shaped by rising geopolitical tensions and the strategic shift toward non-kinetic weapons that offer advantages such as reduced collateral damage and lower operational costs.

Investments in research and development are accelerating the deployment of directed energy technologies across military forces worldwide. The future outlook remains positive as advancements in laser technology, power generation, and beam control are overcoming traditional limitations.

Furthermore, integration with existing defense platforms and the growing demand for scalable, versatile weapon systems are driving broader adoption. These factors collectively create opportunities for growth, particularly in areas requiring enhanced target engagement accuracy and rapid threat neutralization.

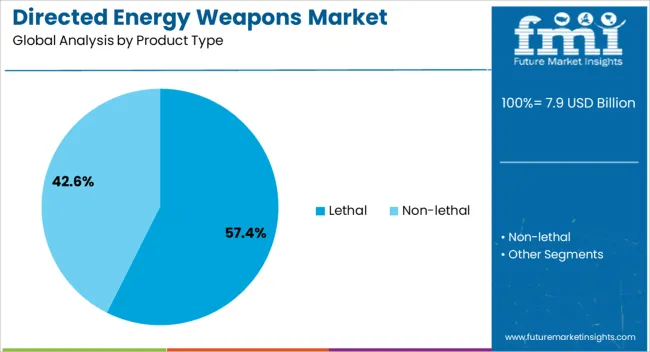

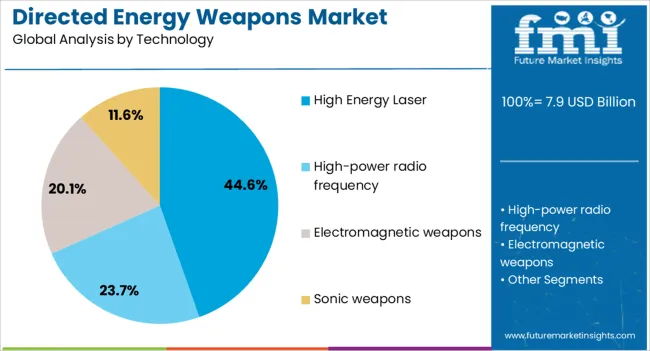

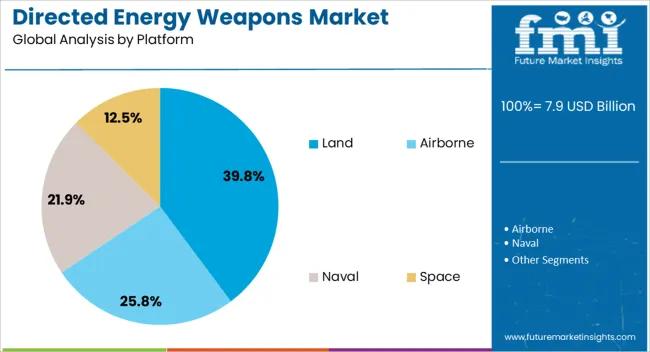

The directed energy weapons market is segmented by product type, technology, platform, application, and geographic regions. By product type, directed energy weapons market is divided into Lethal and Non-lethal. In terms of technology, directed energy weapons market is classified into High Energy Laser, High-power radio frequency, Electromagnetic weapons, and Sonic weapons.

Based on platform, directed energy weapons market is segmented into Land, Airborne, Naval, and Space. By application, directed energy weapons market is segmented into Military & Defense and Homeland security. Regionally, the directed energy weapons industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lethal product type segment is projected to hold 57.4% of the Directed Energy Weapons market revenue share in 2025, establishing it as the dominant product category. This leadership is being attributed to the prioritization of systems capable of neutralizing or destroying targets effectively while minimizing logistical footprints.

The lethal category benefits from advancements in precision targeting and the ability to deliver immediate effects against a wide range of threats, including drones, missiles, and artillery. The increased operational flexibility and strategic value provided by lethal directed energy weapons have made them central to modern defense strategies.

The segment's growth is also supported by escalating military expenditure focused on next-generation weapon systems that emphasize non-traditional kill mechanisms over conventional munitions.

High energy laser technology is expected to capture 44.6% of the total market revenue in 2025, emerging as the leading technology segment. This prominence is due to continuous breakthroughs in laser power scalability, beam control precision, and thermal management, which have made high energy lasers increasingly viable for operational deployment.

The capability to engage multiple targets with minimal collateral impact and relatively low cost per shot has accelerated the adoption of this technology. Additionally, the flexibility of laser systems to integrate with a variety of defense platforms and their potential for rapid upgrades through software enhancements contribute to their market position.

The ongoing focus on enhancing laser efficiency and operational range is anticipated to sustain the segment’s growth trajectory.

The land platform segment is anticipated to hold 39.8% of the Directed Energy Weapons market revenue in 2025, making it the largest platform category. This segment’s growth has been influenced by the suitability of land-based systems for integrating high power directed energy weapons into existing ground combat units and defense installations.

The ability to deploy these systems on mobile vehicles, fixed installations, and forward operating bases allows for versatile mission profiles and rapid response capabilities. The segment benefits from defense priorities focusing on protecting critical ground assets and countering emerging threats such as unmanned aerial systems and rocket attacks.

As a result, investment in land-based directed energy weapon platforms continues to grow, driven by the need for effective and sustainable defense solutions in modern battlefields.

Directed energy weapons growth is propelled by military budgets, platform integration, and counter-drone applications. Government policies, export regulations, and strategic R&D incentives further drive market adoption globally.

Global military expenditure growth is a key driver for directed energy weapons (DEW), with nations allocating significant budgets toward modernizing armed forces. Investment focuses on air, land, and naval systems, emphasizing precision, speed, and operational efficiency. Rising geopolitical tensions, asymmetric warfare threats, and proliferation of unmanned systems compel defense forces to adopt DEWs as part of layered defense strategies. Programs targeting counter-drone operations, missile interception, and border security are prioritized. Government funding, military R&D programs, and public-private partnerships accelerate prototype development and testing. Strategic defense initiatives also encourage the adoption of high-energy laser, microwave, and particle beam technologies to enhance lethality, minimize collateral damage, and ensure mission readiness across multiple theaters of operation.

DEWs are increasingly deployed on multiple platforms, including fighter jets, naval vessels, armored vehicles, and mobile land units. Platform integration enhances tactical flexibility, enabling rapid engagement, precision targeting, and scalability of operations. Modular design and adaptable power systems facilitate retrofitting existing platforms and provide cost-effective deployment options. Integration efforts also include automated targeting systems, real-time monitoring, and energy management solutions to maximize performance. Navies, air forces, and army units coordinate to align operational requirements with DEW capabilities, ensuring that battlefield effectiveness, system reliability, and interoperability with legacy systems are maintained. Platform-specific R&D and collaborative development with OEMs and defense contractors expand application scenarios for directed energy deployment.

The proliferation of drones, cruise missiles, and unmanned combat systems is creating a critical demand for DEWs in defense networks. Governments and defense organizations seek fast-response, high-precision solutions to mitigate swarming attacks and asymmetric threats. DEWs offer scalable engagement ranges, low per-engagement costs, and a minimal logistical footprint compared to conventional ammunition. Defense agencies conduct continuous threat analysis, simulation exercises, and field trials to validate effectiveness. Additionally, international collaborations enable knowledge sharing and accelerate deployment timelines. Counter-UAS (Unmanned Aerial Systems) initiatives, border surveillance, and high-value asset protection increasingly depend on laser and microwave-based systems, positioning DEWs as essential components of modern layered defense strategies.

Government regulations, defense export controls, and R&D funding significantly influence the DEW market. Strategic policies encourage domestic production, licensing partnerships, and joint ventures to enhance technological self-reliance. Export restrictions impact cross-border collaboration, while incentives drive innovation in power efficiency, miniaturization, and targeting systems. Defense R&D programs provide grants, tax benefits, and access to test ranges for prototype evaluation. Policymakers also emphasize cybersecurity, safety standards, and operational compliance for weapon systems. Collaboration between national defense agencies, private contractors, and academic institutions accelerates the commercialization and deployment of DEWs. Regulatory frameworks, funding structures, and policy directives collectively shape market growth, adoption timelines, and competitive dynamics in the global directed energy weapons sector.

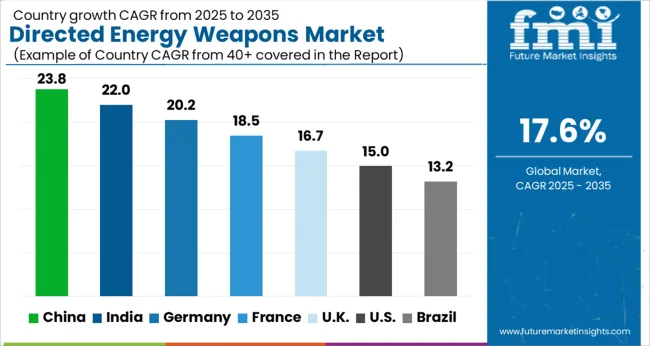

| Country | CAGR |

|---|---|

| China | 23.8% |

| India | 22.0% |

| Germany | 20.2% |

| France | 18.5% |

| UK | 16.7% |

| USA | 15.0% |

| Brazil | 13.2% |

The global directed energy weapons (DEW) market is projected to grow at a CAGR of 17.6% from 2025 to 2035. China leads at 23.8%, followed by India at 22.0%, Germany at 20.2%, the UK at 16.7%, and the USA at 15.0%. Growth is driven by rising defense budgets, counter-drone initiatives, and the integration of DEWs across air, naval, and land platforms. Asia-Pacific countries, particularly China and India, emphasize domestic R&D, military modernization, and regional security threats, while Europe and North America focus on precision systems, interoperability, and layered defense strategies. Strategic partnerships, defense collaborations, and government-backed prototype programs accelerate market penetration and dollar sales. Testing ranges, export policies, and technological validation further strengthen adoption globally. The analysis spans over 40+ countries, with the leading markets detailed below.

The directed energy weapons market in China is projected to grow at a CAGR of 23.8% from 2025 to 2035, fueled by significant defense modernization programs, strategic regional security objectives, and government-backed R&D initiatives. China is focusing on integrating DEWs across naval, aerial, and land platforms to counter emerging threats such as drones, missiles, and unmanned vehicles. Domestic defense manufacturers are investing heavily in high-energy laser systems, microwave weapons, and particle beam technologies. Strategic collaborations with global technology providers, testing facilities, and defense contractors accelerate the development and deployment of advanced DEW solutions. Rising military expenditure, regional security tensions, and initiatives to achieve technological self-reliance drive adoption across PLA forces.

The DEW market in India is expected to grow at a CAGR of 22.0% from 2025 to 2035, driven by defense modernization programs, indigenous defense manufacturing initiatives, and counter-drone operational requirements. The Indian Armed Forces are actively pursuing laser and high-power microwave systems for coastal defense, border security, and urban threat mitigation. Government-backed programs under DRDO and collaborations with domestic defense companies accelerate design, prototyping, and deployment. Rising procurement budgets, technology transfer agreements, and pilot deployment programs enhance adoption rates. Strategic partnerships with global suppliers and focus on indigenous system development further strengthen market growth, supported by increasing focus on homeland security and threat mitigation.

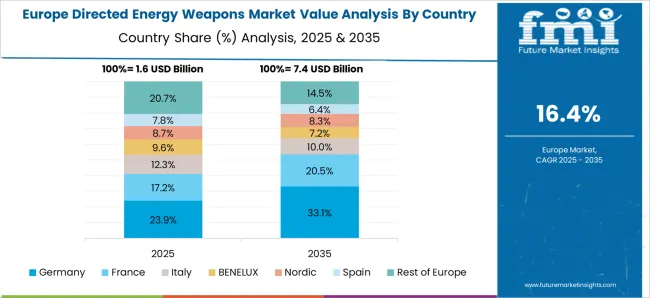

The directed energy weapons market in Germany is projected to grow at a CAGR of 20.2% from 2025 to 2035, propelled by strategic European defense initiatives, NATO commitments, and homeland security programs. Germany emphasizes precision laser systems, high-power microwave weapons, and electromagnetic railgun development for military and civilian defense purposes. Domestic defense contractors collaborate with research institutions and EU-wide defense consortia to advance DEW technologies. Adoption is focused on naval vessels, armored vehicles, and critical infrastructure protection. Growing defense expenditure, modernization of armed forces, and increasing focus on technological superiority support expansion. Integration of DEWs into multi-layered defense networks and cross-border exercises with NATO allies enhances operational capability and adoption.

The DEW market in the UK is expected to grow at a CAGR of 16.7% from 2025 to 2035, supported by advanced defense programs, military modernization, and counter-UAV initiatives. The UK Ministry of Defence is investing in high-energy laser systems and microwave weapons for naval, airborne, and urban security applications. Partnerships with domestic defense contractors and research universities enable prototyping, field trials, and scalable deployment. Focus on homeland protection, anti-drone systems, and fleet defense drives market adoption. Strategic collaborations with NATO allies, defense consortia, and international suppliers strengthen technological capabilities. Government-backed programs prioritize operational readiness, energy efficiency, and integration into existing defense platforms.

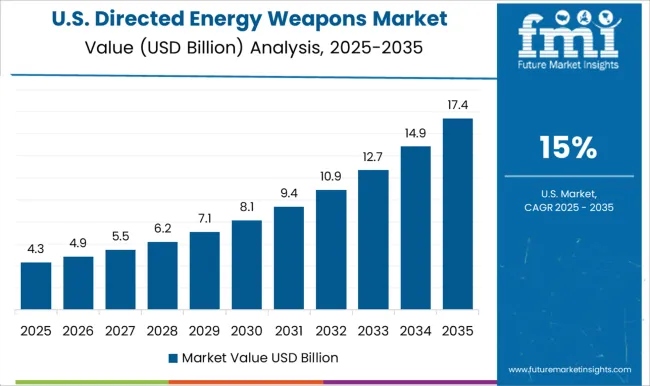

The DEW market in the USA is projected to grow at a CAGR of 15.0% from 2025 to 2035, driven by extensive military R&D, defense modernization programs, and counter-UAV and missile defense initiatives. The USA Department of Defense is investing in laser weapons, microwave systems, and particle-beam technologies across naval, aerial, and land platforms. Domestic defense contractors, alongside DARPA and military labs, focus on prototype development, operational validation, and deployment in combat scenarios. Rising defense expenditure, strategic alliances with international partners, and integration with missile defense networks further accelerate adoption. The USA emphasizes high energy output, operational precision, and multi-platform integration to maintain technological superiority in global defense.

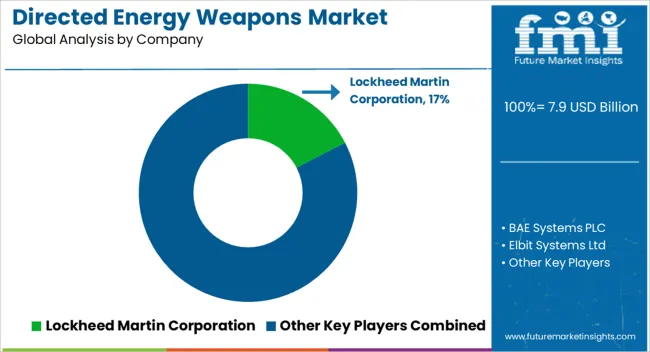

Competition in the directed energy weapons (DEW) market is defined by precision, energy output, platform compatibility, and defense-grade reliability. Lockheed Martin Corporation leads with high-energy laser systems, counter-drone solutions, and multi-platform integration, emphasizing operational effectiveness and advanced R&D capabilities. BAE Systems PLC competes with electromagnetic and directed energy solutions for naval, aerial, and ground applications, focusing on modularity, scalability, and integration with existing defense systems. Elbit Systems Ltd differentiates through battlefield-tested laser and microwave systems, emphasizing compact designs, rapid deployment, and anti-UAV capabilities. Honeywell International Inc. provides precision control, targeting systems, and integration software for DEW platforms, ensuring reliability and interoperability across defense applications. L3Harris Technologies, Inc. focuses on high-power laser systems, operational readiness, and customization for military end-users. Leonardo SpA and Moog, Inc. emphasize design precision, energy efficiency, and platform-specific customization for naval and aerospace DEWs. Northrop Grumman Corporation differentiates through advanced research on particle-beam and laser systems for missile defense, long-range targeting, and high-precision strikes.

QinetiQ Limited and Rafael Advanced Defense Systems Ltd. compete with counter-drone and coastal defense applications, integrating laser and microwave technologies with automated threat recognition systems. Raytheon Technologies Corporation and Rheinmetall AG offer multi-platform DEWs, focusing on battlefield adaptability, high energy output, and interoperability with conventional weapon systems. Textron, Inc., Thales Group, and The Boeing Company provide specialized DEW solutions, emphasizing operational efficiency, robust testing, and strategic integration across naval, aerial, and ground forces. Strategies across the market include partnerships with armed forces, joint development programs with technology providers, and participation in defense consortia to accelerate deployment and ensure compliance with military standards. Companies focus on modular designs, scalability, over-the-air software updates, and energy management to enhance operational flexibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.9 Billion |

| Product Type | Lethal and Non-lethal |

| Technology | High Energy Laser, High-power radio frequency, Electromagnetic weapons, and Sonic weapons |

| Platform | Land, Airborne, Naval, and Space |

| Application | Military & Defense and Homeland security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, BAE Systems PLC, Elbit Systems Ltd, Honeywell International Inc, L3Harris Technologies, Inc, Leonardo SpA, Moog, Inc., Northrop Grumman Corporation, QinetiQ Limited, Rafael Advanced Defense Systems Ltd., Raytheon Technologies Corporation, Rheinmetall AG, Textron, Inc., Thales Group, and The Boeing Company |

| Additional Attributes | Dollar sales, market share, CAGR, defense budgets, adoption by armed forces, counter-UAV and missile defense demand, platform integration (naval, aerial, ground), R&D investments, and strategic partnerships. |

The global directed energy weapons market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the directed energy weapons market is projected to reach USD 39.9 billion by 2035.

The directed energy weapons market is expected to grow at a 17.6% CAGR between 2025 and 2035.

The key product types in directed energy weapons market are lethal and non-lethal.

In terms of technology, high energy laser segment to command 44.6% share in the directed energy weapons market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Directed Energy-Based Surgical Systems Market Growth – Forecast 2025 to 2035

Catheter-Directed Thrombolysis Market Growth - Trends & Forecast 2025 to 2035

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

Energy Supplement Market Analysis by Product Type, End-user and Distribution Channel through 2025 to 2035

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Energy Efficiency Gamification Market Analysis by Type, Deployment, End User, and Region through 2035

Leading Providers & Market Share in Energy Gel Industry

Energy Intelligence Solution Market - Growth & Forecast 2025 to 2035

Energy & Power Quality Meters Market Growth - Trends & Forecast through 2034

Energy Drink Market Outlook – Growth, Demand & Forecast 2024 to 2034

Energy Recovery Ventilator Core Market Growth – Trends & Forecast 2024-2034

Energy Portfolio Management Market Report – Trends & Forecast 2023-2033

Energy Management System Market Analysis – Growth & Forecast 2017-2025

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA