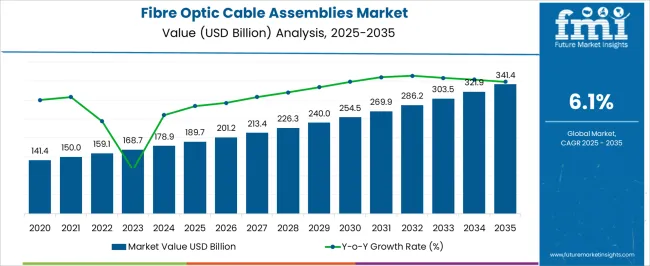

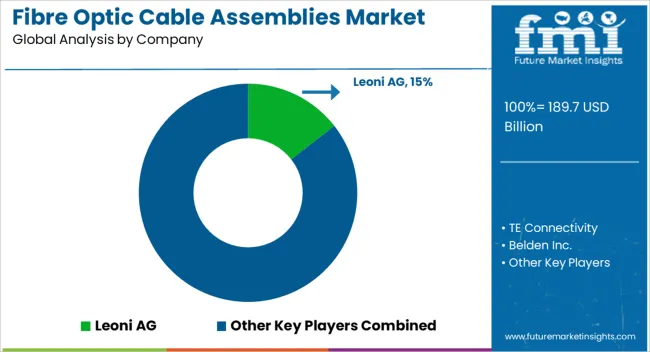

The Fibre Optic Cable Assemblies Market is estimated to be valued at USD 189.7 billion in 2025 and is projected to reach USD 341.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Fibre Optic Cable Assemblies Market Estimated Value in (2025 E) | USD 189.7 billion |

| Fibre Optic Cable Assemblies Market Forecast Value in (2035 F) | USD 341.4 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Fibre Optic Cable Assemblies market is experiencing strong growth, driven by increasing demand for high-speed data transmission and advanced communication infrastructure across telecommunications, data centers, and enterprise networks. The adoption of fiber optic technologies is being supported by the need for reliable, low-latency, and high-bandwidth connectivity to accommodate growing internet traffic and cloud computing requirements.

Continuous advancements in optical fiber materials, connector designs, and assembly techniques are enhancing performance, durability, and scalability of cable assemblies. Integration with emerging technologies such as 5G networks, data center interconnects, and smart city infrastructure is further accelerating adoption.

Market expansion is also being fueled by investments in network modernization and the growing emphasis on energy-efficient and cost-effective transmission solutions As organizations increasingly prioritize network reliability, performance, and future-ready connectivity, the demand for high-quality fibre optic cable assemblies is expected to continue rising, supported by innovations in manufacturing, standardization, and intelligent network management.

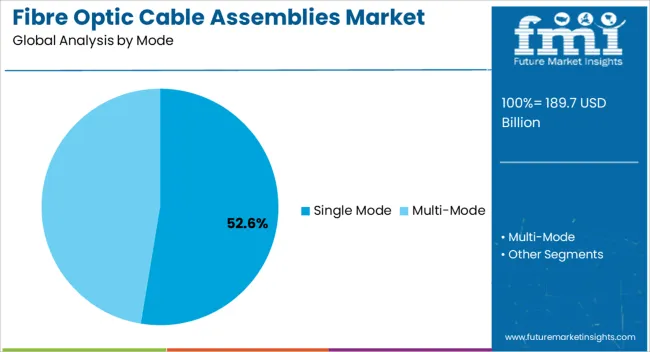

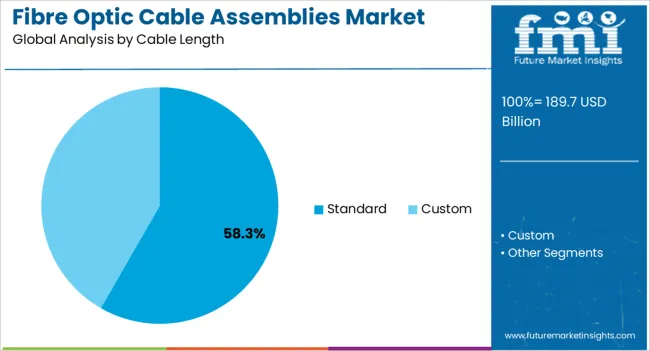

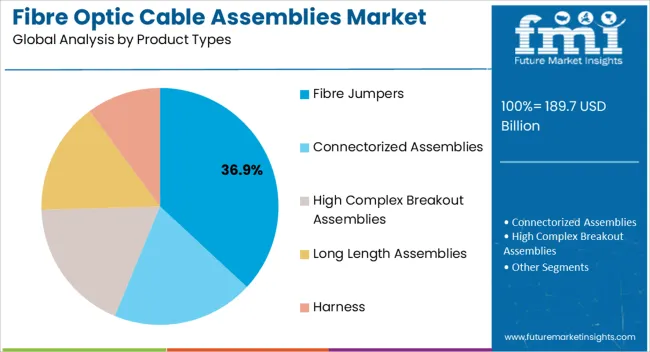

The fibre optic cable assemblies market is segmented by mode, cable length, product types, end use, and geographic regions. By mode, fibre optic cable assemblies market is divided into Single Mode and Multi-Mode. In terms of cable length, fibre optic cable assemblies market is classified into Standard and Custom. Based on product types, fibre optic cable assemblies market is segmented into Fibre Jumpers, Connectorized Assemblies, High Complex Breakout Assemblies, Long Length Assemblies, and Harness. By end use, fibre optic cable assemblies market is segmented into Internet & Telecommunications, IT & Data Management, Defense & Aerospace, Healthcare, Industrial & Automotive, and CATV Broadcasting. Regionally, the fibre optic cable assemblies industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single mode segment is projected to hold 52.6% of the market revenue in 2025, establishing it as the leading mode category. Growth is being driven by the segment’s superior capability for long-distance transmission and high bandwidth performance, which is critical for telecommunications, data centers, and high-speed networking applications. Single mode fiber assemblies reduce signal loss and support high-speed optical transmission over extended distances, making them ideal for backbone networks and enterprise infrastructure.

Advanced manufacturing processes and precision connector technology enhance signal integrity and reliability. Increasing deployment of 5G networks, cloud computing solutions, and metro-area network expansion is further supporting adoption.

The ability to integrate single mode assemblies into complex network architectures without significant performance degradation provides additional operational benefits As network demands continue to grow, single mode assemblies are expected to maintain market leadership due to their high efficiency, scalability, and critical role in modern communication infrastructure.

The standard cable length segment is expected to account for 58.3% of the market revenue in 2025, making it the leading category. Its growth is driven by its suitability for versatile applications across telecommunications, enterprise networks, and data centers. Standard lengths reduce installation complexity and provide cost-effective deployment options for network engineers, ensuring compatibility with existing infrastructure.

The reliability and performance consistency of standard cable lengths make them highly preferred for large-scale deployments and network expansions. Manufacturing improvements, including precision cutting and optimized connector attachment, enhance signal integrity and reduce maintenance requirements.

Increasing adoption of structured cabling in corporate, industrial, and data center environments further supports this segment As organizations prioritize standardized, scalable, and high-performance network solutions, standard cable lengths are expected to continue dominating the market, driven by ease of deployment, compatibility, and cost-effectiveness in diverse fiber optic applications.

The fibre jumpers segment is projected to hold 36.9% of the market revenue in 2025, establishing it as the leading product type. Growth is being driven by the critical need for flexible interconnection solutions that provide reliable connectivity between network components, including switches, routers, and optical distribution frames. Fibre jumpers enable quick installation, modular deployment, and easy maintenance, which reduces operational downtime and network disruptions.

The segment benefits from advancements in fiber polishing, connector precision, and cable flexibility, improving overall signal quality and durability. Widespread adoption of data centers, high-speed enterprise networks, and telecommunications infrastructure further supports growth.

The ability to tailor fibre jumpers to specific network topologies and lengths enhances scalability and performance As network demands continue to rise and the emphasis on efficient and reliable connectivity grows, fibre jumpers are expected to remain a key driver of the market, supported by innovation, modularity, and growing integration requirements.

Fibre optic cable assemblies act as medium of data & electronic (A/V) signal transmission from one point to another in packets of optical energy or light. The characteristics associated with fibre optic cable assemblies are low-noise, distortion free signals, high transmission rate and bandwidth.

These cable assemblies are designed to withstand harsh exterior environments ensuring greater durability. Another key aspect of optical fibre assemblies is their light-weight property, low bulk form, immunity to electromagnetic field interference as compared to other cable types. The evolution of digital technology is attributed to the rise of fibre optic cable assemblies market.

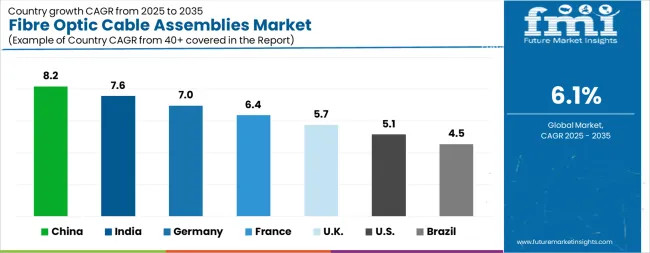

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The Fibre Optic Cable Assemblies Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global Fibre Optic Cable Assemblies Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Fibre Optic Cable Assemblies Market is estimated to be valued at USD 66.5 billion in 2025 and is anticipated to reach a valuation of USD 109.7 billion by 2035. Sales are projected to rise at a CAGR of 5.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 9.0 billion and USD 6.6 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 189.7 Billion |

| Mode | Single Mode and Multi-Mode |

| Cable Length | Standard and Custom |

| Product Types | Fibre Jumpers, Connectorized Assemblies, High Complex Breakout Assemblies, Long Length Assemblies, and Harness |

| End Use | Internet & Telecommunications, IT & Data Management, Defense & Aerospace, Healthcare, Industrial & Automotive, and CATV Broadcasting |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Leoni AG, TE Connectivity, Belden Inc., Aptiv Plc, Tyco Electronics, Hirose Electric Co., Ltd., Delphi Technologies, Amphenol Corporation, Molex, JST Manufacturing Co., Ltd., Sumitomo Electric Industries, Ltd., Yazaki Corporation, and Furukawa Electric Co., Ltd. |

The global fibre optic cable assemblies market is estimated to be valued at USD 189.7 billion in 2025.

The market size for the fibre optic cable assemblies market is projected to reach USD 341.4 billion by 2035.

The fibre optic cable assemblies market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in fibre optic cable assemblies market are single mode and multi-mode.

In terms of cable length, standard segment to command 58.3% share in the fibre optic cable assemblies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fibreglass Trays Market Size and Share Forecast Outlook 2025 to 2035

Fibre Film Market Growth from 2025 to 2035

SiC Fibres Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Metal Fibres Market

Basalt Fibre Market Size & Forecast 2024-2034

Carbon Fibre Prepreg Market

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Offshore Fibre Optic Cable Lay Market Size and Share Forecast Outlook 2025 to 2035

Anti-Static Fibres Market Growth – Trends & Forecast 2025 to 2035

Hydrokinetic Fibre Dressings Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Fibre Market

Staple Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Optical Fiber Cold Joint Market Size and Share Forecast Outlook 2025 to 2035

Optical Spectrum Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Extinction Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Optical Character Recognition Market Forecast and Outlook 2025 to 2035

Optical Satellite Market Size and Share Forecast Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA