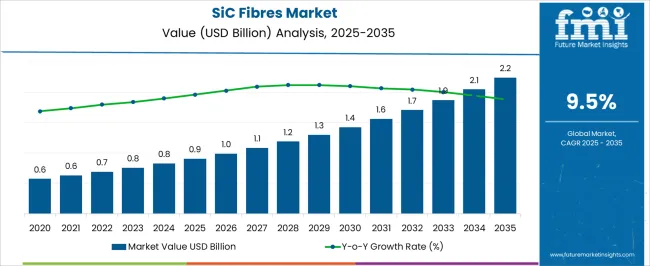

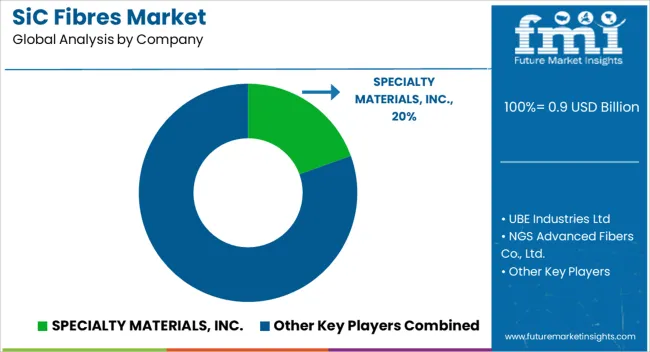

The SiC Fibres Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| SiC Fibres Market Estimated Value in (2025 E) | USD 0.9 billion |

| SiC Fibres Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The SiC fibres market is witnessing significant growth driven by the rising demand for advanced materials with superior mechanical, thermal, and chemical properties across aerospace, defense, and industrial applications. These fibers are increasingly being adopted for applications requiring high strength, lightweight characteristics, and exceptional thermal stability under extreme conditions. Continuous research and development efforts in manufacturing techniques, including chemical vapor deposition and polymer-derived routes, are enhancing fiber quality, scalability, and performance consistency.

The market is also being supported by the growing utilization of SiC fibers in high-performance composites, which are employed in next-generation aircraft, turbines, and industrial equipment to improve efficiency and durability. Increasing government and private sector investments in aerospace modernization, coupled with stricter environmental and performance regulations, are driving adoption of advanced fiber-reinforced composites.

Furthermore, the rising focus on lightweighting in automotive and transportation sectors is encouraging the use of SiC fibers in weight-sensitive applications These factors collectively position the market for sustained growth over the forecast period.

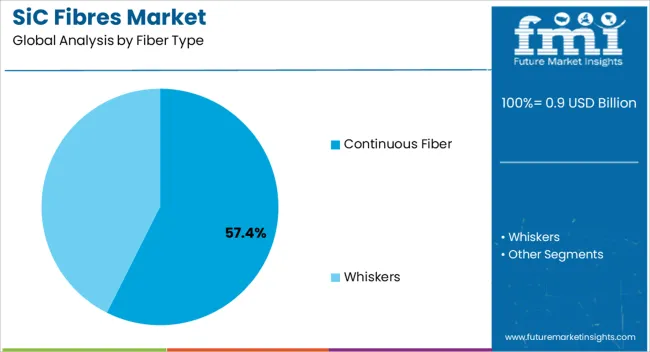

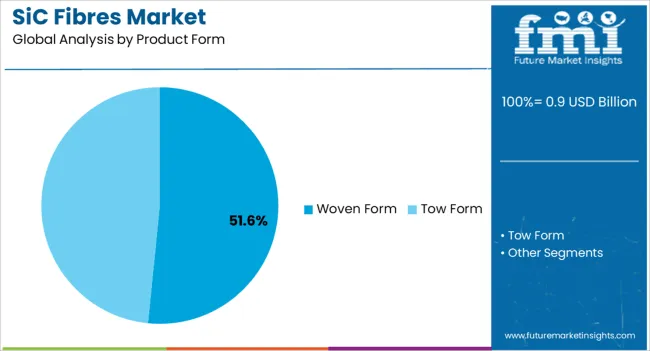

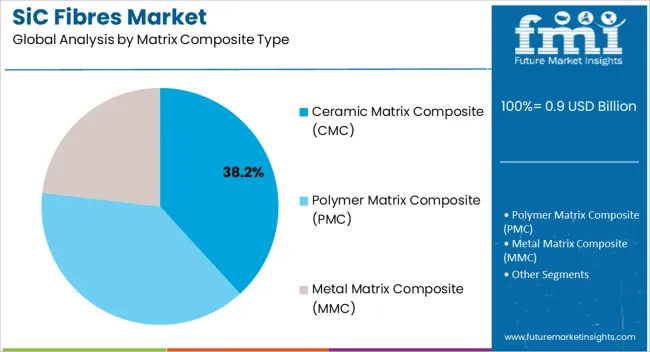

The sic fibres market is segmented by fiber type, product form, matrix composite type, application, and geographic regions. By fiber type, sic fibres market is divided into Continuous Fiber and Whiskers. In terms of product form, sic fibres market is classified into Woven Form and Tow Form. Based on matrix composite type, sic fibres market is segmented into Ceramic Matrix Composite (CMC), Polymer Matrix Composite (PMC), and Metal Matrix Composite (MMC). By application, sic fibres market is segmented into Aerospace, Power Generation, Nuclear, Defense, and Others. Regionally, the sic fibres industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The continuous fiber type segment is projected to hold 57.4% of the SiC fibres market revenue share in 2025, establishing it as the leading fiber type. This segment’s dominance is being driven by its exceptional tensile strength, high thermal stability, and uniformity in mechanical properties, which make it highly suitable for high-performance composite applications. Continuous fibers provide superior load transfer efficiency when embedded in matrix materials, enhancing overall structural integrity and fatigue resistance.

Their adaptability for weaving, braiding, and filament winding processes allows manufacturers to produce complex geometries required for aerospace, defense, and industrial applications. The high adoption of continuous fibers is also reinforced by the growing demand for lightweight and durable components in turbines, engine parts, and structural panels.

Technological advancements in continuous fiber production have reduced defects, improved uniformity, and enhanced compatibility with multiple composite matrices, further boosting market preference As industries increasingly prioritize performance optimization and component longevity, continuous SiC fibers are expected to maintain their leading position in the global market.

The woven form product form segment is expected to account for 51.6% of the SiC fibres market revenue share in 2025, making it the dominant product form. Its leadership is being driven by the ability to provide multi-directional reinforcement, which significantly improves strength, stiffness, and impact resistance in composite applications.

Woven SiC fabrics are highly compatible with resin transfer molding, chemical vapor infiltration, and other advanced composite manufacturing techniques, making them suitable for complex aerospace, defense, and industrial components. The segment benefits from the ease of handling and uniform distribution of mechanical stresses, which enhances structural performance and reliability.

Increasing adoption in high-performance composite laminates and ceramic matrix composites has contributed to its growth, as manufacturers seek products that enable precise fiber alignment and improved energy absorption Additionally, woven forms facilitate scalability in production while maintaining consistent quality, supporting growing demand across applications that require durability, thermal resistance, and lightweight construction.

The ceramic matrix composite (CMC) segment is projected to hold 38.2% of the SiC fibres market revenue share in 2025, making it the leading matrix composite type. This dominance is being driven by the superior thermal stability, oxidation resistance, and mechanical strength offered by CMCs in extreme temperature environments. CMCs reinforced with SiC fibers are increasingly used in turbine engines, heat shields, and aerospace components, where conventional metals or polymer-based composites cannot withstand operational stresses.

The adoption is being further accelerated by the need for high-efficiency power generation and lightweight structures that maintain integrity under continuous thermal cycling. Technological advancements in fiber-matrix bonding, infiltration techniques, and coating solutions have improved performance consistency, allowing CMCs to meet demanding industry standards.

The growing emphasis on durability, safety, and extended lifecycle in aerospace and defense applications is reinforcing the preference for SiC fiber-reinforced CMCs As manufacturers continue to optimize manufacturing processes and reduce production costs, the CMC segment is expected to sustain its leading position in the global SiC fibers market.

SiC fibres have grown in popularity over the last few years which can be attributed to their high strength-to-weight ratio, better stiffness and oxidation resistance, as well as wettability. The demand for SiC fibres is becoming stronger, particularly in high-temperature and high-pressure structural construction applications. Aviation and military, automotive & transportation, power generation, and electronics industries are some of the rapidly expanding end-use sectors that have increased the sales of SiC fibres these days.

Until the year 2025, the United States led the global SiC fiber market and is also projected to continue in this position over the greater part of the forecast years. The US dominance can be attributed to an increase in aviation engine manufacturing and a rise in the volume of defense aircraft exports to many countries. However, China is emerging as a strong competitor for the US and is anticipated to overtake the US in the later part of the forecast years.

By the virtue of the presence of major electronics manufacturing firms in the country, as well as considerable investment in R&D and technical advances, China is projected to boost the emergence of new SiC fibres market players that could compete on a global level. These prominent market players are extending their footprints across multiple new sectors and are reaching new developing regions to strengthen their consumer base and enhance their market presence.

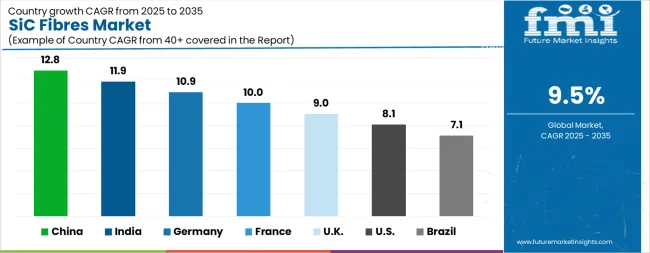

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

The SiC Fibres Market is expected to register a CAGR of 9.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.8%, followed by India at 11.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.1%, yet still underscores a broadly positive trajectory for the global SiC Fibres Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.9%. The USA SiC Fibres Market is estimated to be valued at USD 311.8 million in 2025 and is anticipated to reach a valuation of USD 677.9 million by 2035. Sales are projected to rise at a CAGR of 8.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 41.7 million and USD 24.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.9 Billion |

| Fiber Type | Continuous Fiber and Whiskers |

| Product Form | Woven Form and Tow Form |

| Matrix Composite Type | Ceramic Matrix Composite (CMC), Polymer Matrix Composite (PMC), and Metal Matrix Composite (MMC) |

| Application | Aerospace, Power Generation, Nuclear, Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SPECIALTY MATERIALS, INC., UBE Industries Ltd, NGS Advanced Fibers Co., Ltd., Saint-Gobain, COI Ceramics, Incorporated, Volzhsky Abrasive Works, SGL Group – The Carbon Company, and Washington Mills |

The global SiC fibres market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the SiC fibres market is projected to reach USD 2.2 billion by 2035.

The SiC fibres market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in SiC fibres market are continuous fiber and whiskers.

In terms of product form, woven form segment to command 51.6% share in the SiC fibres market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SiC and GaN Power Semiconductor Market Trends – Growth & Forecast 2024-2034

Sickle Cell Anemia Market

Basic Violet 10 Market Size and Share Forecast Outlook 2025 to 2035

Desiccant Bags Market Size and Share Forecast Outlook 2025 to 2035

Desiccants Market Size and Share Forecast Outlook 2025 to 2035

Music Speed Changer Market Size and Share Forecast Outlook 2025 to 2035

Music and Streaming Service Market Size and Share Forecast Outlook 2025 to 2035

Desiccated Coconut Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Desiccant Dehumidifiers Market Size, Growth, and Forecast 2025 to 2035

Musical Instrument Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Desiccant Wheel Market Growth - Trends & Forecast 2025 to 2035

Analyzing Musical Instrument Market Share & Industry Leaders

Music Tourism Market Growth – Forecast 2024-2034

Desiccant Paper Market

Physical Therapy Supplies Market Size and Share Forecast Outlook 2025 to 2035

Physical-Digital Integration Market Size and Share Forecast Outlook 2025 to 2035

Physical Security Information Management (PSIM) Market Size and Share Forecast Outlook 2025 to 2035

Anisic Aldehyde Market Growth - Trends & Forecast 2025 to 2035

Physical Security Market Insights - Growth & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA