Global anisic aldehyde market will be expect to see prices from 2025 onwards in order to generate a permanent income. Its application as a fragrant ingredient in the market mainly, and anisic aldehyde was re-exported for springboard to these markets. Anisic aldehyde, valued for its fragrance of flowers, is widely used in perfumes, personal care commodities and household wares such as cleaners.

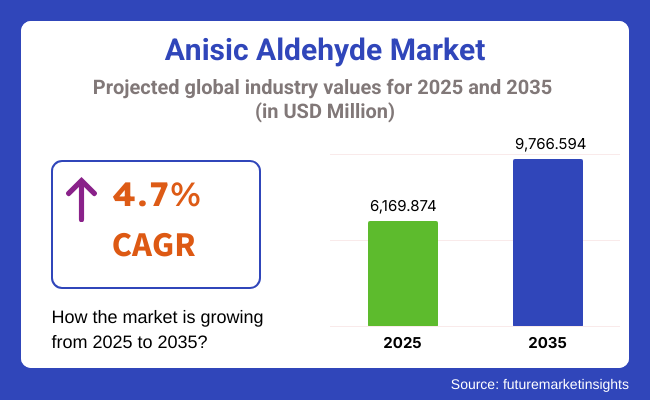

In addition, the booming food and drinks industry shall lead to greater demand on this scale, natural flavourings agent. With advancements in chemical synthesis and production technology to improve sustainability, to improve market prospects. As the status of natural and organic ingredients ascends in consumer products. The market is projected to exceed USD 9,766.594 Million by 2035, growing at a CAGR of 4.7% during the forecast period.

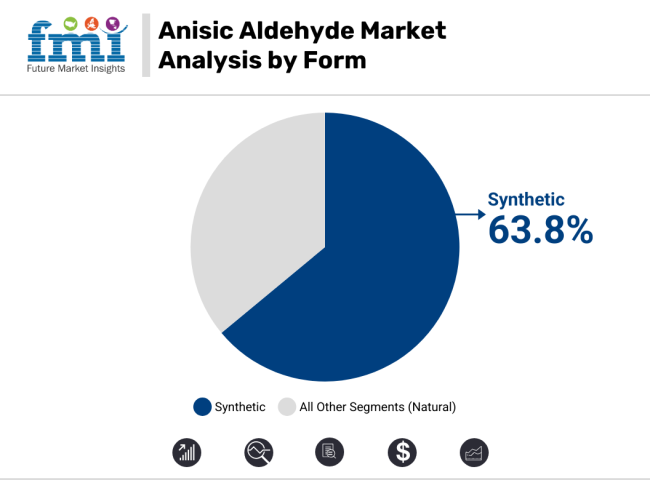

As the demand for synthetic variants keeps apace, Anisic Aldehyde market is growing as well. In 2025, synthetic types covered 63.8 percent of total market share. Due to its cost-effectiveness, consistent quality and simple manufacturing process, synthetic anisic aldehyde is by far the most popular of all forms in production today.

Controlled chemical synthesis, rather than merely extracting from plants including anise and fennel as with its natural counterpart, is used to ensure regular and unbroken supplies for the industrialist. Perfumes, deodorants, and other scented personal care products rely on the fact that the synthetic variant remains stable much longer than its natural counterpart.

But price is another factor for manufacturers in using synthetic Anisic Aldehyde, it costs them less than naturally sourced alternatives. Moreover, progression in synthetic fragrance technology has given us high-purity anisic aldehyde production with low environmental impact in accordance to the principles of sustainability.

By 2025, Perfumes account for approximately 45.2% of the Market's and Deodorants remains the segment that holds the largest share. Popular for its mild sweet-scented, aniseed flavour as well a fragrance with"vanillia", anise or almond qualities, anisic aldehyde is widely used in fragrance formulation for high quality bulk selling perfumes and body sprays.

With rising incomes, consumer preference for personal grooming and urbanization, there is a growing global demand for high-quality fragrances. To enhance the sweet, fresh and lasting scents they require, anisic aldehyde is used by luxury niche perfume brands as well as your everyday deodorants.

In addition to olfactory bank, other platforms specializing in perfumes and deodorants have emerged one after another. This has in return (resulted in) an increased growth rate which makes up the rest of our streaming statistics. It is also this move towards natural and organic fragrances that is making such an impact on the anisic aldehyde market, inducing manufacturers to synthesize this chemical entirely an eco-friendly and sustainable offshoot.

With consumers continuing to make personal care and hygiene a priority, Perfumes & Deodorants will remain the primary market for anisic aldehyde. This product line is expected to grow as the result of consumer demand for new products and innovations.

North America still accounts for an important market for anisic aldehyde. With the cosmetics and personal care industries extensively using it, this has led to continuing high demand. Also, manufacturers are increasingly moving toward biodegradable alternatives as they seek to reduce the harmful environmental effects at their plants and in product life-cycles, further impacting market trends.

The demand for quality fragrances and flavors in Europe is driving its anisic aldehyde market. Such regions as Germany, France and Italy- with flower essences industry traditions second to none worldwide- currently claim visible leadership. The growing preference for organic ingredients in both foods as well personal care products raises demand for anisic aldehyde.

Besides, EU regulations aimed at replacing and controlling synthetic chemicals also are pushing research into new sustainable production technologies. That way, long-term market stability is ensured.

Asia-Pacific is expected to be the fastest-growing region for the anisic aldehyde market, driven by China, India and Japan amongst others. Both the expanding cosmetics and personal care industry, coupled with consumers who are spending more on premium products, means this market continues to experience rapidity of growth.

In terms of regional supply, China is the main producer of specialty chemicals. And in India, where there is a growing pharmaceutical sector, demand for natural flavour ingredients is higher than anywhere else in Asia probably because even more people are aware of them.

Regulatory Restrictions and Environmental Concerns

Production and use of anisic aldehyde are restricted by severe laws because there may be environmental or safety dangers. Complying with those laws raises production costs and makes regions limited for marketing.

Fluctuations in Raw Material Prices

Anisic aldehyde is derived from anisole, which in turn finds its source from petroleum-based feedstocks. The fluctuations in crude oil prices affect its plant costs and consequently the profits of manufacturers.

Expansion in the Pharmaceutical and Food Industries

The compound's anti-bacterial and flavour-enhancing properties have led to its application in food additives and pharmaceuticals, expanding the scope of anisic aldehyde markets

From 2020 to 2024, the market for anisic aldehyde was driven by the rapid growth of its applications in fragrance, flavouring, and cosmetics. The movement toward natural and synthetic substitutes gave industrial participants chances as well as challenges.

During the period of 2025 to 2035, sustainable production methods and bio-based sourcing will completely change the market. Adaptation of regulations that reflect this development, along with increasing investments in research and development, mean more trick than ever for market change dynamics.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with chemical safety standards |

| Market Demand | High demand in perfumes and cosmetics |

| Industry Adoption | Increasing use in synthetic fragrance formulations |

| Supply Chain and Sourcing | Dependence on petroleum-based raw materials |

| Market Competition | Dominated by key fragrance and chemical manufacturers |

| Market Growth Drivers | Cosmetic industry expansion |

| Sustainability and Energy Efficiency | Limited focus on eco-friendly production |

| Integration of Digital Innovations | Minimal impact of digitalization |

| Advancements in Product Design | Focus on stability and scent enhancement |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental policies and sustainability mandates |

| Market Demand | Expansion in food, pharmaceuticals, and natural fragrance sectors |

| Industry Adoption | Shift towards bio-based and sustainable sourcing methods |

| Supply Chain and Sourcing | Diversification into renewable and green chemistry sources |

| Market Competition | Entry of new eco-conscious players in the market |

| Market Growth Drivers | Rising demand for organic and natural ingredients |

| Sustainability and Energy Efficiency | Increased adoption of green chemistry and biodegradable products |

| Integration of Digital Innovations | AI and automation for optimized production and quality control |

| Advancements in Product Design | Development of multifunctional and sustainable fragrance compounds |

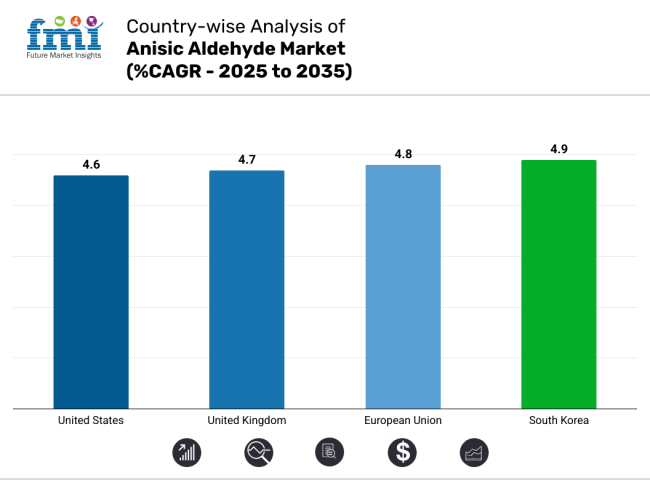

Owing to success in its application to the fragrance, cosmetics and pharmacy industries, the Anisic Aldehyde economic stone in the United States has been growing cumulatively. The increasing demand of consumers for natural and synthetic fragrances in personal care products has led to an expanding market. Major manufacturers present in the USA and increasing R&D activities further support this rapid economic development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The Anisic Aldehyde market in the United Kingdom benefits from expansion in the cosmetics and perfume industry. Growing preference for nature-identical and organic compounds in scents, skincare formulations, is increasing demand. At the same time, environmental friendliness safety of chemicals are getting encouragement from legislation thus driving this market positively.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

The Anisic Aldehyde market in the European Union is subject to three main trends. First, as demand grows from personal care products, pharmaceuticals and food flavoring industries as well; secondarily Germany, France, and Italy taste a societal shift toward high-end perfume fragrance and food additives smell-savvy. Vital too is the welfare of people and the environment, product safety policies that are linchpined by the EU are shaping market trends in this region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

In South Korea, the first Anisic Aldehyde market is growing rapidly along with the expanding cosmetics and personal care industries. As consumers are demanding premium scents and flavourings scents in their beauty and skincare products, this helps improve consumption and thus market expansion takes place. The country's active involvement in K-beauty innovation and development further supports this growth as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Driven by growing demand in the fragrance, flavour and pharmaceutical industries, there the market for anisic aldehyde has been seeing steady increases in recent years. Recognized for its sweet floral smell, anisic aldehyde is an important ingredient in perfume, personal care products, and food additives. How Pleased of the measures it will turn in it units between now and 2014.

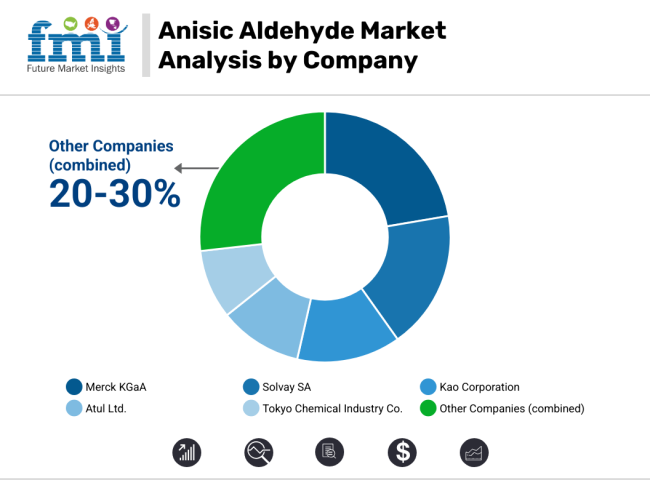

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Merck KGaA | In March 2024, expanded its high-purity anisic aldehyde production. In January 2025, introduced a new line of sustainable fragrance ingredients. |

| Solvay SA | In April 2024, launched an eco-friendly production process. In February 2025, collaborated with major fragrance brands for innovative formulations. |

| Kao Corporation | In May 2024, developed a new synthesis method for enhanced stability. In March 2025, expanded distribution networks in the Asia-Pacific region. |

| Atul Ltd. | In June 2024, increased production capacity to meet rising demand. In February 2025, introduced cost-effective solutions for industrial applications. |

| Tokyo Chemical Industry Co. | In August 2024, launched a premium-grade anisic aldehyde for pharmaceutical use. In March 2025, enhanced quality control processes for higher consistency. |

Key Company Insights

Merck KGaA (20-25%)

A leading global supplier of specialty chemicals, Merck focuses on high-purity anisic aldehyde for premium fragrance and pharmaceutical applications.

Solvay SA (15-20%)

Solvay is investing in eco-friendly production methods, strengthening its position in the sustainable chemicals sector.

Kao Corporation (10-15%)

Kao Corporation prioritizes innovation in synthesis techniques to improve product performance and expand into emerging markets.

Atul Ltd. (8-12%)

Atul Ltd. is a key player in industrial-grade anisic aldehyde, catering to both fragrance and flavor industries with cost-effective solutions.

Tokyo Chemical Industry Co. (5-10%)

Known for high-quality chemical reagents, TCI specializes in premium-grade anisic aldehyde for pharmaceutical and research applications.

Other Key Players (20-30% Combined)

The overall market size for Anisic Aldehyde market was USD 6,169.874 Million in 2025.

The Anisic Aldehyde market is expected to reach USD 9,766.594 Million in 2035.

The anisic aldehyde market will grow due to rising demand in personal care and cosmetics, driven by its use in perfumes, soaps, and lotions, along with increasing consumer preference for aromatic and natural ingredients.

The top 5 countries which drives the development of Anisic Aldehyde market are USA, European Union, Japan, South Korea and UK.

Synthetic Anisic Aldehyde demand supplier to command significant share over the assessment period.

Table 1: Global Anisic Aldehyde Market Value (US$ Bn) Forecast by Region, 2017-2032

Table 2: Global Anisic Aldehyde Market Volume (Tonnes) Forecast by Region, 2017-2032

Table 3: Global Anisic Aldehyde Market Value (US$ Bn) Forecast by Application, 2017-2032

Table 4: Global Anisic Aldehyde Market Volume (Tonnes) Forecast by Application, 2017-2032

Table 5: North America Anisic Aldehyde Market Value (US$ Bn) Forecast by Country, 2017-2032

Table 6: North America Anisic Aldehyde Market Volume (Tonnes) Forecast by Country, 2017-2032

Table 7: North America Anisic Aldehyde Market Value (US$ Bn) Forecast by Application, 2017-2032

Table 8: North America Anisic Aldehyde Market Volume (Tonnes) Forecast by Application, 2017-2032

Table 9: Latin America Anisic Aldehyde Market Value (US$ Bn) Forecast by Country, 2017-2032

Table 10: Latin America Anisic Aldehyde Market Volume (Tonnes) Forecast by Country, 2017-2032

Table 11: Latin America Anisic Aldehyde Market Value (US$ Bn) Forecast by Application, 2017-2032

Table 12: Latin America Anisic Aldehyde Market Volume (Tonnes) Forecast by Application, 2017-2032

Table 13: Europe Anisic Aldehyde Market Value (US$ Bn) Forecast by Country, 2017-2032

Table 14: Europe Anisic Aldehyde Market Volume (Tonnes) Forecast by Country, 2017-2032

Table 15: Europe Anisic Aldehyde Market Value (US$ Bn) Forecast by Application, 2017-2032

Table 16: Europe Anisic Aldehyde Market Volume (Tonnes) Forecast by Application, 2017-2032

Table 17: Asia Pacific Anisic Aldehyde Market Value (US$ Bn) Forecast by Country, 2017-2032

Table 18: Asia Pacific Anisic Aldehyde Market Volume (Tonnes) Forecast by Country, 2017-2032

Table 19: Asia Pacific Anisic Aldehyde Market Value (US$ Bn) Forecast by Application, 2017-2032

Table 20: Asia Pacific Anisic Aldehyde Market Volume (Tonnes) Forecast by Application, 2017-2032

Table 21: MEA Anisic Aldehyde Market Value (US$ Bn) Forecast by Country, 2017-2032

Table 22: MEA Anisic Aldehyde Market Volume (Tonnes) Forecast by Country, 2017-2032

Table 23: MEA Anisic Aldehyde Market Value (US$ Bn) Forecast by Application, 2017-2032

Table 24: MEA Anisic Aldehyde Market Volume (Tonnes) Forecast by Application, 2017-2032

Figure 1: Global Anisic Aldehyde Market Value (US$ Bn) by Application, 2022-2032

Figure 2: Global Anisic Aldehyde Market Value (US$ Bn) by Region, 2022-2032

Figure 3: Global Anisic Aldehyde Market Value (US$ Bn) Analysis by Region, 2017-2032

Figure 4: Global Anisic Aldehyde Market Volume (Tonnes) Analysis by Region, 2017-2032

Figure 5: Global Anisic Aldehyde Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 6: Global Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 7: Global Anisic Aldehyde Market Value (US$ Bn) Analysis by Application, 2017-2032

Figure 8: Global Anisic Aldehyde Market Volume (Tonnes) Analysis by Application, 2017-2032

Figure 9: Global Anisic Aldehyde Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 10: Global Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 11: Global Anisic Aldehyde Market Attractiveness by Application, 2022-2032

Figure 12: Global Anisic Aldehyde Market Attractiveness by Region, 2022-2032

Figure 13: North America Anisic Aldehyde Market Value (US$ Bn) by Application, 2022-2032

Figure 14: North America Anisic Aldehyde Market Value (US$ Bn) by Country, 2022-2032

Figure 15: North America Anisic Aldehyde Market Value (US$ Bn) Analysis by Country, 2017-2032

Figure 16: North America Anisic Aldehyde Market Volume (Tonnes) Analysis by Country, 2017-2032

Figure 17: North America Anisic Aldehyde Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 18: North America Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 19: North America Anisic Aldehyde Market Value (US$ Bn) Analysis by Application, 2017-2032

Figure 20: North America Anisic Aldehyde Market Volume (Tonnes) Analysis by Application, 2017-2032

Figure 21: North America Anisic Aldehyde Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 22: North America Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 23: North America Anisic Aldehyde Market Attractiveness by Application, 2022-2032

Figure 24: North America Anisic Aldehyde Market Attractiveness by Country, 2022-2032

Figure 25: Latin America Anisic Aldehyde Market Value (US$ Bn) by Application, 2022-2032

Figure 26: Latin America Anisic Aldehyde Market Value (US$ Bn) by Country, 2022-2032

Figure 27: Latin America Anisic Aldehyde Market Value (US$ Bn) Analysis by Country, 2017-2032

Figure 28: Latin America Anisic Aldehyde Market Volume (Tonnes) Analysis by Country, 2017-2032

Figure 29: Latin America Anisic Aldehyde Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 30: Latin America Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 31: Latin America Anisic Aldehyde Market Value (US$ Bn) Analysis by Application, 2017-2032

Figure 32: Latin America Anisic Aldehyde Market Volume (Tonnes) Analysis by Application, 2017-2032

Figure 33: Latin America Anisic Aldehyde Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 34: Latin America Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 35: Latin America Anisic Aldehyde Market Attractiveness by Application, 2022-2032

Figure 36: Latin America Anisic Aldehyde Market Attractiveness by Country, 2022-2032

Figure 37: Europe Anisic Aldehyde Market Value (US$ Bn) by Application, 2022-2032

Figure 38: Europe Anisic Aldehyde Market Value (US$ Bn) by Country, 2022-2032

Figure 39: Europe Anisic Aldehyde Market Value (US$ Bn) Analysis by Country, 2017-2032

Figure 40: Europe Anisic Aldehyde Market Volume (Tonnes) Analysis by Country, 2017-2032

Figure 41: Europe Anisic Aldehyde Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 42: Europe Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 43: Europe Anisic Aldehyde Market Value (US$ Bn) Analysis by Application, 2017-2032

Figure 44: Europe Anisic Aldehyde Market Volume (Tonnes) Analysis by Application, 2017-2032

Figure 45: Europe Anisic Aldehyde Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 46: Europe Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 47: Europe Anisic Aldehyde Market Attractiveness by Application, 2022-2032

Figure 48: Europe Anisic Aldehyde Market Attractiveness by Country, 2022-2032

Figure 49: Asia Pacific Anisic Aldehyde Market Value (US$ Bn) by Application, 2022-2032

Figure 50: Asia Pacific Anisic Aldehyde Market Value (US$ Bn) by Country, 2022-2032

Figure 51: Asia Pacific Anisic Aldehyde Market Value (US$ Bn) Analysis by Country, 2017-2032

Figure 52: Asia Pacific Anisic Aldehyde Market Volume (Tonnes) Analysis by Country, 2017-2032

Figure 53: Asia Pacific Anisic Aldehyde Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 54: Asia Pacific Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 55: Asia Pacific Anisic Aldehyde Market Value (US$ Bn) Analysis by Application, 2017-2032

Figure 56: Asia Pacific Anisic Aldehyde Market Volume (Tonnes) Analysis by Application, 2017-2032

Figure 57: Asia Pacific Anisic Aldehyde Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 58: Asia Pacific Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 59: Asia Pacific Anisic Aldehyde Market Attractiveness by Application, 2022-2032

Figure 60: Asia Pacific Anisic Aldehyde Market Attractiveness by Country, 2022-2032

Figure 61: MEA Anisic Aldehyde Market Value (US$ Bn) by Application, 2022-2032

Figure 62: MEA Anisic Aldehyde Market Value (US$ Bn) by Country, 2022-2032

Figure 63: MEA Anisic Aldehyde Market Value (US$ Bn) Analysis by Country, 2017-2032

Figure 64: MEA Anisic Aldehyde Market Volume (Tonnes) Analysis by Country, 2017-2032

Figure 65: MEA Anisic Aldehyde Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 66: MEA Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 67: MEA Anisic Aldehyde Market Value (US$ Bn) Analysis by Application, 2017-2032

Figure 68: MEA Anisic Aldehyde Market Volume (Tonnes) Analysis by Application, 2017-2032

Figure 69: MEA Anisic Aldehyde Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 70: MEA Anisic Aldehyde Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 71: MEA Anisic Aldehyde Market Attractiveness by Application, 2022-2032

Figure 72: MEA Anisic Aldehyde Market Attractiveness by Country, 2022-2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aldehydes Market Size and Share Forecast Outlook 2025 to 2035

No-Aldehyde Acid Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Formaldehyde Removal Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Benzaldehyde Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Formaldehyde-Free Resin Market Growth & Demand 2025 to 2035

Butyraldehyde Market Growth – Trends & Forecast 2024-2034

Perillaldehyde Market Size and Share Forecast Outlook 2025 to 2035

Crotonaldehyde Market Growth - Trends & Forecast 2025 to 2035

Glutaraldehyde Market Growth - Trends & Forecast 2025 to 2035

Lauric Aldehyde Market Growth - Trends & Forecast 2025 to 2035

Paraformaldehyde Market Size and Share Forecast Outlook 2025 to 2035

Urea Formaldehyde Market Size and Share Forecast Outlook 2025 to 2035

Cinnamic Aldehyde Market Growth - 2025 to 2035

Ortho Phthalaldehyde Market Size and Share Forecast Outlook 2025 to 2035

Melamine Formaldehyde (MF) Market Size and Share Forecast Outlook 2025 to 2035

Global Terephthalic Aldehyde Market Insights – Trends, Demand & Growth 2022–2032

Ortho Phthalic Aldehyde Market Growth - Trends & Forecast 2025 to 2035

Synthetic Cinnamaldehyde Market Growth - Trends & Forecast 2025 to 2035

Natural Cinnamic Aldehyde Market 2025 to 2035

Alkylation Melamine-Formaldehyde Resin for Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA