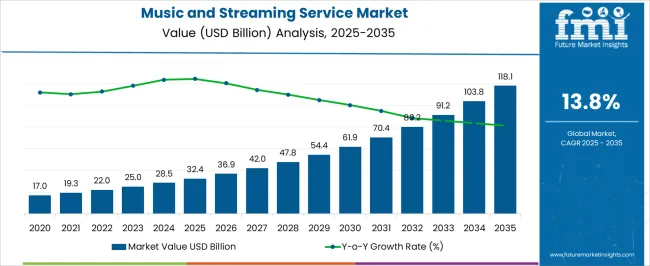

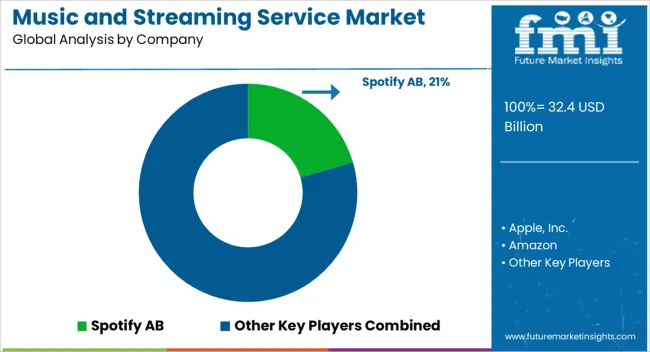

The Music and Streaming Service Market is estimated to be valued at USD 32.4 billion in 2025 and is projected to reach USD 118.1 billion by 2035, registering a compound annual growth rate (CAGR) of 13.8% over the forecast period.

| Metric | Value |

|---|---|

| Music and Streaming Service Market Estimated Value in (2025 E) | USD 32.4 billion |

| Music and Streaming Service Market Forecast Value in (2035 F) | USD 118.1 billion |

| Forecast CAGR (2025 to 2035) | 13.8% |

The music and streaming service market is demonstrating sustained growth, supported by the rising global consumption of digital content and the shift from ownership-based to access-based media models. Increasing smartphone penetration, affordable data plans, and advancements in 5G connectivity are enabling seamless music access across devices and geographies. Growth is further encouraged by expanding subscription-based offerings that provide consumers with ad-free experiences, personalized playlists, and enhanced audio quality.

The rise of smart speakers, in-car connectivity, and wearable devices is expanding streaming touchpoints, creating more consistent engagement with users. Industry players are investing heavily in content acquisition, artist collaborations, and platform innovations to attract and retain subscribers, while advertising-based tiers are widening accessibility.

With growing emphasis on exclusive content, algorithm-driven discovery, and regional language catalogs, consumer adoption is increasing across both developed and emerging markets As technology evolves and audiences demand convenience and personalization, the music and streaming service market is positioned for strong long-term expansion driven by content diversity and global digital adoption.

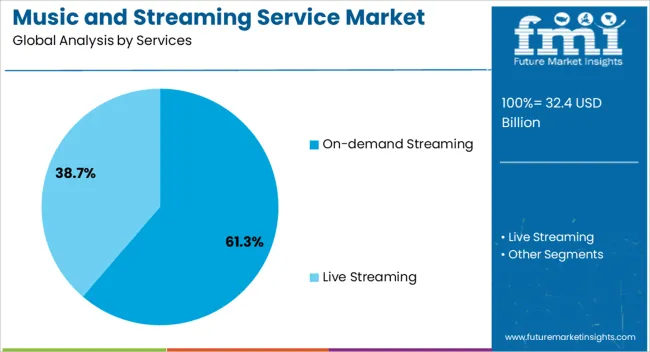

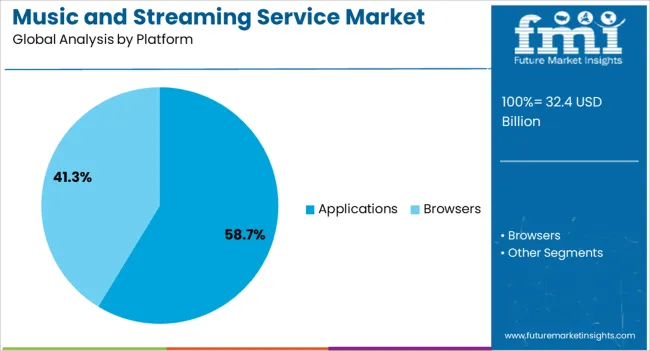

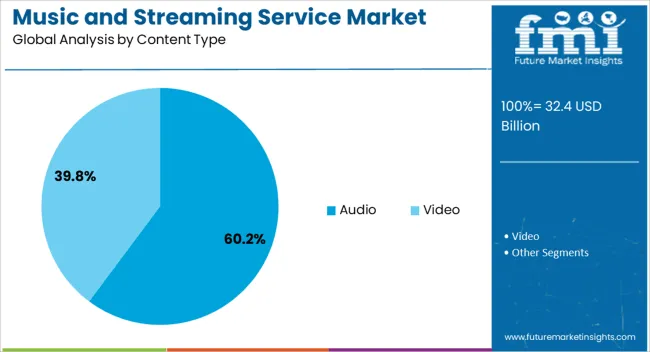

The music and streaming service market is segmented by services, platform, content type, end-use industry, and geographic regions. By services, music and streaming service market is divided into On-demand Streaming and Live Streaming. In terms of platform, music and streaming service market is classified into Applications and Browsers. Based on content type, music and streaming service market is segmented into Audio and Video. By end-use industry, music and streaming service market is segmented into Consumer Goods, Electronics, Automotive, Healthcare, and Others. Regionally, the music and streaming service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The on-demand streaming services segment is expected to hold 61.3% of the music and streaming service market revenue share in 2025, making it the dominant services category. This leadership is being reinforced by the increasing consumer preference for flexible, user-controlled access to music libraries without dependence on scheduled broadcasting. On-demand platforms enable users to select, download, or stream tracks at their convenience, improving overall engagement and consumption.

The availability of personalized recommendations powered by AI algorithms is further enhancing user experiences, encouraging longer streaming durations and higher subscription uptake. Strategic partnerships with artists, record labels, and entertainment ecosystems are expanding exclusive content availability, strengthening consumer loyalty.

The segment is also benefiting from the growth of ad-supported tiers, which provide free access while creating monetization opportunities for providers With rising disposable incomes and growing willingness to pay for premium ad-free subscriptions, the on-demand streaming segment is expected to sustain its leadership position, supported by continuous innovation and widespread accessibility.

The applications platform segment is projected to account for 58.7% of the music and streaming service market revenue share in 2025, positioning it as the leading platform category. Its dominance is being driven by the convenience of mobile and desktop applications that allow users to access streaming services seamlessly across devices. Applications provide integrated features such as offline downloads, curated playlists, voice command integration, and synchronized multi-device playback, which are improving user adoption and retention.

Enhanced app functionalities including recommendation engines, social sharing options, and in-app purchases are increasing consumer engagement while creating additional revenue streams for providers. Growth in app usage is further reinforced by high smartphone penetration and the widespread adoption of digital ecosystems across both mature and developing markets.

Continuous updates and improvements in user interface design, security protocols, and interactive features are ensuring superior user experiences The segment’s ability to deliver consistent access, personalization, and cross-platform synchronization is reinforcing its leadership in the overall market landscape.

The audio content type segment is anticipated to represent 60.2% of the music and streaming service market revenue share in 2025, making it the leading content category. This dominance is being driven by the growing demand for high-quality, easily accessible music libraries that span global, regional, and independent catalogs. Audio content remains the core driver of consumer engagement due to its portability, compatibility with diverse devices, and ability to be consumed while multitasking.

Expanding investments in digital rights, artist partnerships, and regional language music catalogs are increasing the richness and accessibility of audio libraries. The segment is also benefiting from technological enhancements such as high-definition audio, spatial sound, and AI-powered personalization, which are improving listener experiences.

Widespread integration of audio streaming into vehicles, smart speakers, and fitness devices is further reinforcing consumption As users increasingly seek affordable, convenient, and uninterrupted music experiences, the audio content type is expected to maintain its leadership and play a central role in the future growth trajectory of the market.

The music and streaming service market has witnessed remarkable growth, largely propelled by several key drivers. Foremost among these is the unparalleled accessibility and convenience offered by streaming platforms, enabling users to enjoy a vast array of music anytime, anywhere, and on any device.

Additionally, the affordability of subscription-based models has democratized access to music, eliminating the need for expensive purchases of individual albums or tracks. Moreover, advancements in internet connectivity, particularly the widespread availability of high-speed broadband and mobile data, have facilitated seamless streaming experiences, further fueling market expansion.

The ubiquity of smartphones has also played a pivotal role, as users can effortlessly access their favorite tunes on-the-go with just a few taps on their mobile devices. Furthermore, the implementation of sophisticated personalization algorithms has enhanced user engagement and retention by delivering tailored recommendations based on individual preferences.

Exclusive content, artist collaborations, and integration with other digital platforms have further enriched the streaming experience, attracting a diverse audience. With the continued global expansion of streaming services and ongoing technological innovations, the music and streaming service market is poised for sustained growth, reflecting evolving consumer behaviors and preferences towards accessible, personalized, and immersive music experiences.

In the dynamic landscape of the music and streaming service market, several formidable challenges persist. Licensing and royalties stand out as a primary hurdle, as navigating complex agreements with artists, labels, and publishers while ensuring fair compensation remains a delicate balance.

Moreover, the market is saturated with competition, leading to pricing pressures and difficulties in distinguishing offerings amidst a crowded field of platforms. The persistent specter of copyright infringement and piracy further compounds these challenges, threatening revenue streams and the integrity of the industry. Additionally, the question of artist compensation looms large, with ongoing debates over the adequacy of streaming revenues to support creators.

Content moderation and censorship add another layer of complexity, as platforms must navigate the fine line between freedom of expression and maintaining community guidelines. Technological limitations, infrastructure costs, and data privacy concerns also present significant hurdles, requiring substantial investments and adherence to evolving regulations.

Finally, regional restrictions and licensing agreements pose challenges to providing consistent content globally, creating disparities in available offerings across different regions. Addressing these multifaceted challenges demands collaborative efforts from stakeholders across the industry to foster innovation, ensure fairness, and sustain the growth of the music streaming ecosystem.

The music and streaming service market offers compelling investment opportunities amidst its rapid growth and evolving landscape. One prominent avenue is technological innovation, where investments in AI-driven recommendation algorithms, immersive audio experiences, and content personalization can enhance user engagement and retention.

Moreover, the expansion of streaming services into emerging markets presents a promising opportunity for growth, as increasing internet penetration and smartphone adoption drive demand for digital music consumption. Additionally, strategic investments in exclusive content and artist partnerships can differentiate platforms, attract subscribers, and foster brand loyalty.

Infrastructure development, including server scalability and content delivery networks, is another area ripe for investment to ensure seamless streaming experiences and accommodate growing user bases.

Furthermore, there is potential for investment in data analytics and machine learning to optimize content curation, improve user targeting, and drive advertising revenue. Lastly, exploring synergies with adjacent industries, such as podcasting, live events, and merchandise sales, can unlock new revenue streams and diversify offerings within the music streaming ecosystem.

By capitalizing on these investment opportunities, stakeholders can position themselves to capitalize on the continued expansion and innovation within the music and streaming service market.

The music and streaming service market is undergoing a transformative phase, characterized by several key trends that are reshaping the industry landscape. One prominent trend is the continued dominance of subscription-based models, driven by their affordability and convenience. This shift from ownership to access reflects changing consumer preferences towards on-demand content consumption.

Personalization has emerged as a critical differentiator, with streaming platforms leveraging AI algorithms to deliver tailored recommendations and curated playlists, enhancing user engagement and retention. Moreover, the integration of podcasts into streaming platforms has gained traction, catering to the growing demand for audio content beyond music.

High-definition audio formats and immersive experiences, such as spatial audio and virtual concerts, are also gaining popularity, offering users enhanced audio quality and immersive listening experiences. Furthermore, exclusive content and artist partnerships have become increasingly prevalent, with streaming platforms vying for exclusive rights to music releases and live performances to attract subscribers and differentiate their offerings.

Global expansion is another notable trend, with streaming services targeting emerging markets to capitalize on growing internet penetration and smartphone adoption. However, the market also faces challenges, including licensing complexities, copyright infringement, and regulatory scrutiny, which necessitate careful navigation.

Overall, the music and streaming service market is dynamic and evolving, driven by technological innovation, changing consumer behaviors, and strategic industry partnerships. Adaptation to these trends will be crucial for stakeholders to remain competitive and capitalize on the opportunities presented by this dynamic sector.

In the United States, the music and streaming service market remains a dynamic and competitive landscape, shaped by evolving consumer preferences and technological advancements. Streaming services dominate the market, with platforms like Spotify, Apple Music, and Amazon Music leading the way. Subscription-based models have gained widespread acceptance, offering consumers access to vast music libraries for a monthly fee.

Personalization has emerged as a key differentiator, with streaming platforms leveraging algorithms to deliver customized playlists and recommendations tailored to individual tastes. Additionally, the integration of podcasts into streaming platforms has expanded their appeal, catering to users seeking a diverse range of audio content. Exclusive content and artist partnerships are increasingly common strategies to attract subscribers and differentiate offerings.

Despite the market's growth, challenges persist, including licensing complexities, artist compensation debates, and copyright infringement concerns. Regulatory scrutiny, particularly regarding antitrust issues and data privacy, also poses challenges for industry players.

However, the market's resilience and continued innovation suggest promising opportunities for growth and expansion, particularly as streaming services target emerging technologies and untapped demographic segments. As the industry continues to evolve, stakeholders must navigate these challenges while capitalizing on emerging trends to maintain competitiveness and drive further market growth in the United States.

The United Kingdom boasts a vibrant music scene with a rich history of producing internationally renowned artists across various genres. This cultural richness contributes to the diversity of content available on streaming platforms, catering to a broad spectrum of tastes and preferences.

Furthermore, the United Kingdom's regulatory environment plays a significant role in shaping the market. Regulatory bodies such as the Competition and Markets Authority (CMA) closely monitor the industry to ensure fair competition and protect consumer interests. Recent investigations into the dominance of major streaming platforms and their impact on competition highlight the importance of regulatory oversight in the United Kingdom market.

Moreover, the United Kingdom's music industry is closely intertwined with its live music sector, which has faced significant challenges due to the COVID-19 pandemic. As live events gradually resume, streaming platforms are exploring opportunities to integrate live streaming and virtual concert experiences, providing additional revenue streams for artists and enhancing the overall music ecosystem.

Looking ahead, the United Kingdom's music and streaming service market is poised for continued growth and innovation. Strategic partnerships between streaming platforms, artists, and other industry stakeholders will be crucial in driving engagement and expanding the reach of music content.

Additionally, investments in technological advancements, such as AI-driven content recommendations and immersive audio experiences, will further enhance the user experience and sustain market growth in the United Kingdom.

China's vast market potential has become a driving force behind diversification in the music and streaming service industry. With a population of over 1.4 billion and a rapidly growing middle class, China presents an enormous opportunity for streaming platforms to expand their user base and revenue streams. Recognizing this potential, both domestic and international players are investing heavily in the Chinese market, leading to increased competition and innovation.

One notable trend is the convergence of music streaming with other forms of entertainment, such as live streaming, gaming, and social media. Platforms like Tencent Music Entertainment (TME) have capitalized on this trend by offering integrated services that combine music streaming with live performances, virtual gifts, and social networking features.

This diversification not only enhances the user experience but also creates additional monetization opportunities through advertising, virtual goods, and premium subscriptions.

On-demand streaming services have emerged as the dominant force in the music industry, capturing leading shares in the market due to several key factors. Firstly, on-demand streaming offers unparalleled convenience and accessibility, allowing users to access a vast library of music anytime, anywhere, and on any device. This shift from traditional ownership models to subscription-based streaming reflects changing consumer preferences towards access over ownership.

Moreover, on-demand streaming services leverage sophisticated recommendation algorithms and personalized playlists to enhance user engagement and satisfaction. By analyzing user preferences and listening habits, streaming platforms deliver tailored recommendations, ensuring that users discover new music they are likely to enjoy. This personalized approach not only fosters user loyalty but also drives increased usage and subscription renewals.

Furthermore, the integration of social features and community engagement tools has enhanced the appeal of on-demand streaming services. Users can share playlists, follow friends, and discover new music through social connections, fostering a sense of community and belonging within the platform. This social aspect not only drives user retention but also serves as a powerful marketing tool, as users share their favorite music with their social networks.

Video-based music streaming services have emerged as a significant player in the digital music landscape, offering unique insights and opportunities within the industry. One of the key insights is the growing popularity of consuming music through visual content. Video streaming platforms like YouTube Music and Vevo have capitalized on this trend by providing users with access to a vast library of music videos, live performances, and other visual content.

One notable advantage of video-based music streaming is the immersive and engaging nature of the content. Music videos offer artists an additional medium to express their creativity and connect with their audience on a deeper level. By combining music with visuals, artists can convey emotion, storytelling, and artistic vision in ways that audio alone cannot achieve. This immersive experience enhances user engagement and retention, driving increased usage and consumption on video streaming platforms.

The competitive landscape of the music and streaming service market is characterized by fierce rivalry among both established players and emerging entrants vying for market share. At the forefront of this competition are industry giants like Spotify, Apple Music, and Amazon Music, which command significant user bases and offer extensive music libraries. Spotify, the world's largest music streaming service, boasts millions of tracks and a user-friendly interface, while Apple Music leverages its integration with Apple devices and ecosystem to attract subscribers.

Recent Developments

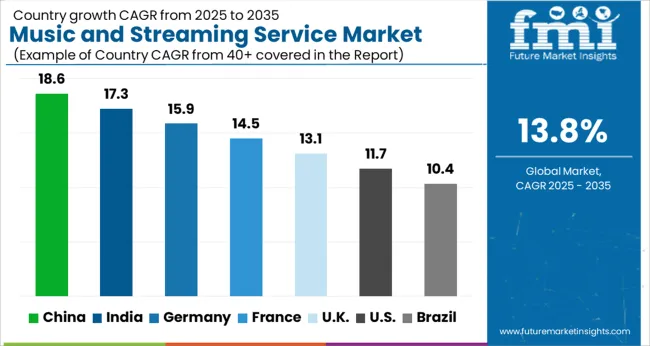

| Country | CAGR |

|---|---|

| China | 18.6% |

| India | 17.3% |

| Germany | 15.9% |

| France | 14.5% |

| UK | 13.1% |

| USA | 11.7% |

| Brazil | 10.4% |

The Music and Streaming Service Market is expected to register a CAGR of 13.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 18.6%, followed by India at 17.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 10.4%, yet still underscores a broadly positive trajectory for the global Music and Streaming Service Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 15.9%. The USA Music and Streaming Service Market is estimated to be valued at USD 11.9 billion in 2025 and is anticipated to reach a valuation of USD 36.0 billion by 2035. Sales are projected to rise at a CAGR of 11.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.5 billion and USD 923.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.4 Billion |

| Services | On-demand Streaming and Live Streaming |

| Platform | Applications and Browsers |

| Content Type | Audio and Video |

| End-Use Industry | Consumer Goods, Electronics, Automotive, Healthcare, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Spotify AB, Apple, Inc., Amazon, SoundCloud Limited, JioSaavn, Tidal, Deezer, Pandora, LiveOne, Jamendo, and Kukufm |

The global music and streaming service market is estimated to be valued at USD 32.4 billion in 2025.

The market size for the music and streaming service market is projected to reach USD 118.1 billion by 2035.

The music and streaming service market is expected to grow at a 13.8% CAGR between 2025 and 2035.

The key product types in music and streaming service market are on-demand streaming and live streaming.

In terms of platform, applications segment to command 58.7% share in the music and streaming service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Streaming Media Services Market Insights - Growth & Forecast through 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Music Speed Changer Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Musical Instrument Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Streaming Analytics Market Analysis by Solution, Application, Enterprise Size, Industry, and Region Through 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Analyzing Musical Instrument Market Share & Industry Leaders

Music Tourism Market Growth – Forecast 2024-2034

Service Integration & Management Market Report – Forecast 2017-2027

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA