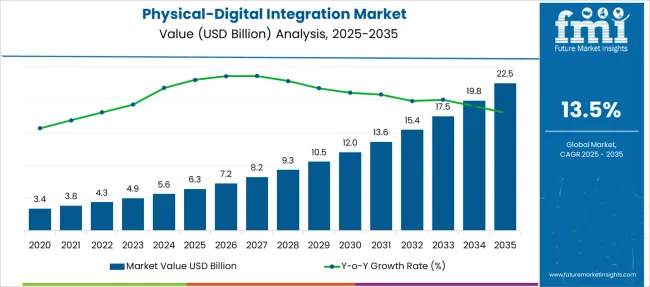

The Physical-Digital Integration Market is estimated to be valued at USD 6.3 billion in 2025 and is projected to reach USD 22.5 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period.

| Metric | Value |

|---|---|

| Physical-Digital Integration Market Estimated Value in (2025 E) | USD 6.3 billion |

| Physical-Digital Integration Market Forecast Value in (2035 F) | USD 22.5 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The physical-digital integration market is witnessing significant traction as industries across sectors seek real-time data synchronization between physical operations and digital ecosystems. Growing investments in Industrial Internet of Things (IIoT), sensor-based automation, and digital twin technologies are driving adoption across manufacturing and infrastructure.

Enhanced regulatory frameworks encouraging predictive maintenance, energy efficiency, and process visibility have created a robust environment for deployment. The convergence of cloud, edge computing, and AI-powered analytics has further enabled faster and more intelligent decision-making, reducing operational downtime and enhancing throughput.

Organizations are also leveraging physical-digital convergence to ensure traceability, enhance product quality, and comply with ESG mandates. As supply chains and factory floors become increasingly interconnected, the market is expected to expand across legacy systems through integration retrofits and next-gen deployments, positioning it as a foundational pillar of Industry 4.0 transformation strategies.

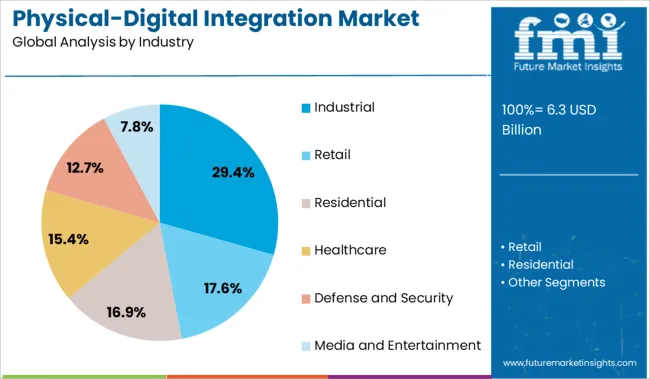

The market is segmented by Industry and region. By Industry, the market is divided into Industrial, Retail, Residential, Healthcare, Defense and Security, and Media and Entertainment. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial segment is projected to account for 29.4% of the total revenue in the physical-digital integration market by 2025, making it the leading vertical. This dominance is being driven by the sector’s increasing reliance on smart manufacturing frameworks, machine-level automation, and cyber-physical systems.

Integration of real-time sensor networks with ERP and MES systems is enabling improved asset utilization, energy management, and quality control. Operational demands for predictive analytics, remote equipment monitoring, and process optimization have accelerated the deployment of digital twins and augmented reality tools.

Industrial players are prioritizing digital transformation to enhance resilience, reduce downtime, and meet global compliance standards. The growing need for scalable, interoperable systems that unify factory data with enterprise workflows has reinforced the industrial sector's leadership in the adoption of physical-digital integration technologies.

The analysts at FMI have analyzed various elements that are likely to boost the growth of the physical-digital integration market in the coming years and unravel a positive dimension of the concerned market.

These elements are as follows:

Besides the factors bolstering the growth of the physical-digital integration market, the expert analysts at FMI have also identified some elements that are likely to hinder the pace of advancement in the long run. They are as follows:

Further, cyberattacks and data breaches are some of the limiting factors that might provide hurdles in the growth of the market in the upcoming years.

Statistics:

| Region | Statistics |

|---|---|

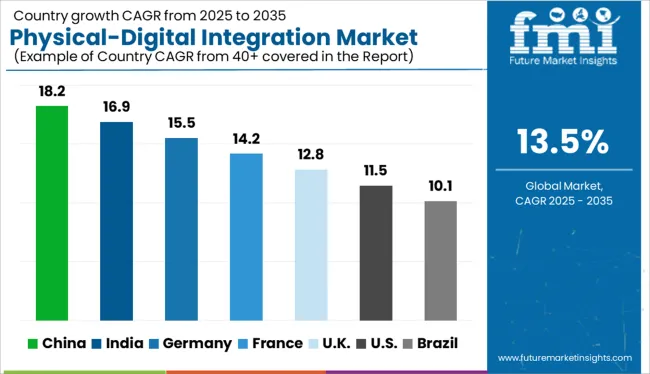

| North America | North America is projected to dominate the global physical-digital integration market through 2035. At present, this region is accountable for a market share of 30.1% globally. |

| Europe | Europe is projected to hold the second-largest share in the global physical-digital integration market after North America. Currently, the European region is accountable for a market share of 23.7% in 2025. |

| Asia Pacific | The Asia Pacific region is projected to witness rapid growth in the global physical-digital integration market over the forecast period. |

Responsible Factors:

| Region | Responsible Factors |

|---|---|

| North America | The factors attributing to the rising market size for physical-digital integration in North America are:

|

| Europe | Key elements bolstering the market size in Europe can be identified:

|

| Asia Pacific | The aspects fueling the growth of the physical-digital integration market in the Asia Pacific region are:

|

Biggies Revolutionizing the Market

The physical-digital integration market is thriving due to the increasing demand for solutions that deliver refined interactive customer experiences. The demand for these solutions gained momentum in recent years and is expected to expand exponentially over the forecast period. Physical-digital integration has been witnessing demand in numerous end-use industries, including retail, residential, industrial, healthcare, and defense and security, among others.

In the healthcare system, the emphasis is being laid upon the interconnection of virtual and physical space to offer new health solutions around remote care, well-being, smart homes, and communities., thereby accelerating the demand for physical-digital integration in the respective sector.

Likewise, the rising demand for these solutions in the retail sector to integrate digital and physical retail formats and offer personalized customer experiences is providing abundant stimulus to the market growth. Further, the investments in physical spaces by e-commerce retailers like Amazon are rising, consequently tapping into the gigantic uncharted potential for unattended retail.

Recent developments in the market include:

Some of the key companies in the market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 13.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Industry, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

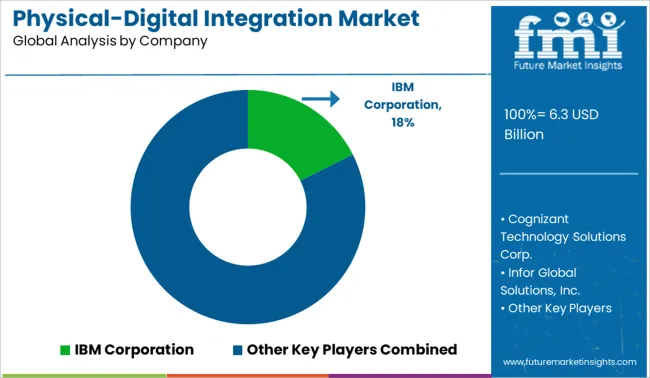

| Key Companies Profiled | Cognizant Technology Solutions Corp.; IBM Corporation; Infor Global Solutions, Inc.; Infosys Ltd.,; Oracle Corporation, Salesforce.com, Inc.; SAP SE; Toshiba Corporation |

| Customization | Available Upon Request |

The global physical-digital integration market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the physical-digital integration market is projected to reach USD 22.5 billion by 2035.

The physical-digital integration market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in physical-digital integration market are industrial, retail, residential, healthcare, defense and security and media and entertainment.

In terms of , segment to command 0.0% share in the physical-digital integration market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disintegration Analyzers Market

Data Integration Software/Tool Market

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Service Integration & Management Market Report – Forecast 2017-2027

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

MEA Cloud Integration Market - Trends & Forecast 2025 to 2035

Continuous Integration Tools Market

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Healthcare IT Integration Market

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Substation Automation and Integration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA