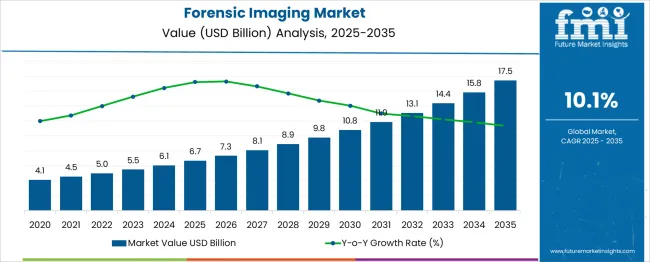

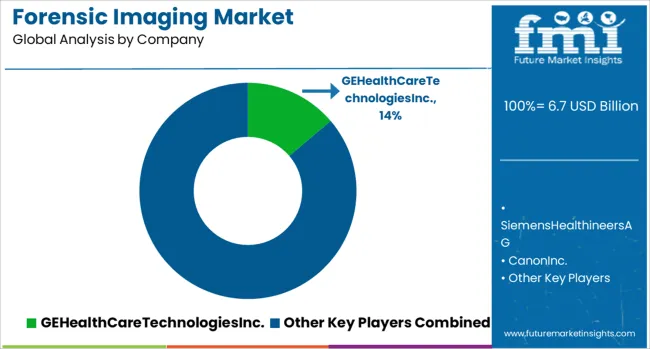

The Forensic Imaging Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 17.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

The forensic imaging market demonstrates consistent growth throughout the decade, expanding from USD 4.1 billion in 2021 to USD 9.8 billion by 2030, marking an absolute dollar increase of USD 5.7 billion and an estimated CAGR of around 9.6%. Year-wise progression underscores steady demand driven by increased adoption of digital imaging technologies in law enforcement, criminal investigations, and legal documentation. The market grows from USD 4.1 billion in 2021 to USD 4.5 billion in 2022 and USD 5.0 billion in 2023, as early adoption of 3D reconstruction and high-resolution imaging systems gains traction. By 2024, it reaches USD 5.5 billion, supported by the growing role of imaging in evidence analysis and courtroom visualization, and climbs to USD 6.1 billion in 2025, reflecting the impact of digital transformation initiatives in forensic departments.

The second half of the forecast period shows accelerated uptake as advanced imaging systems, including AI-enhanced image reconstruction and virtual autopsy solutions, become integral to forensic practices. Market value rises to USD 6.7 billion in 2026, USD 7.3 billion in 2027, and crosses USD 8.1 billion by 2028. By 2029, it stands at USD 8.9 billion, culminating at USD 9.8 billion in 2030.

This strong expansion is influenced by stringent legal requirements for high-accuracy evidence, rapid integration of imaging in pathology, and cloud-based storage solutions for digital evidence. Vendors focusing on AI-powered forensic imaging platforms, enhanced resolution systems, and scalable solutions for law enforcement agencies will capture the most significant share of this growing market, driven by both technological innovation and rising complexity of criminal investigations.

| Metric | Value |

|---|---|

| Forensic Imaging Market Estimated Value in (2025 E) | USD 6.7 billion |

| Forensic Imaging Market Forecast Value in (2035 F) | USD 17.5 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

The forensic imaging market occupies a critical niche within broader segments such as digital forensics solutions, crime scene investigation equipment, medical imaging systems, legal evidence management technologies, and security and surveillance infrastructure. Within the digital forensics solutions category, forensic imaging contributes approximately 18 %, as it plays a vital role in acquiring and preserving electronic evidence for legal proceedings.

In crime scene investigation equipment, its share is around 14%, reflecting its use in capturing high-resolution visual and structural data for reconstruction and analysis. The medical imaging systems segment accounts for nearly 9%, as forensic radiology and autopsy imaging solutions are utilized for cause-of-death examinations and injury pattern analysis. Within legal evidence management technologies, the share is estimated at 12 %, as forensic imaging supports the documentation and chain-of-custody requirements essential for admissibility in court.

For security and surveillance infrastructure, the contribution is about 7%, where imaging tools complement investigative frameworks for detailed case studies and verification. This specialized domain is expanding due to the growing need for accurate visual documentation in criminal investigations, disaster victim identification, and insurance fraud detection. The integration of 3D imaging, AI-based enhancement tools, and cloud-enabled evidence storage is accelerating adoption. Vendors prioritizing interoperability, high-resolution accuracy, and compliance with judicial standards are expected to secure a dominant position as demand for forensic-grade imaging solutions intensifies.

The forensic imaging market is undergoing significant evolution as legal and healthcare institutions adopt non-invasive, high-resolution imaging technologies to support postmortem examinations, criminal investigations, and cause-of-death assessments. This shift is being driven by growing concerns over the limitations of traditional autopsy methods and the need for more accurate, faster, and culturally sensitive alternatives.

Imaging technologies such as CT, MRI, and 3D reconstruction are being increasingly utilized to deliver detailed internal analyses without compromising the body’s integrity. The growing emphasis on digital evidence, coupled with legal admissibility of radiological data, is also boosting the demand for forensic imaging in both civil and criminal justice systems.

The rise in suspicious death cases, traumatic injuries, and global terrorism incidents has further heightened the role of forensic imaging in public health surveillance. With advancements in imaging software, artificial intelligence integration, and remote diagnostics, the market is expected to experience long-term growth through its applications in forensic pathology, anthropology, and medico-legal documentation.

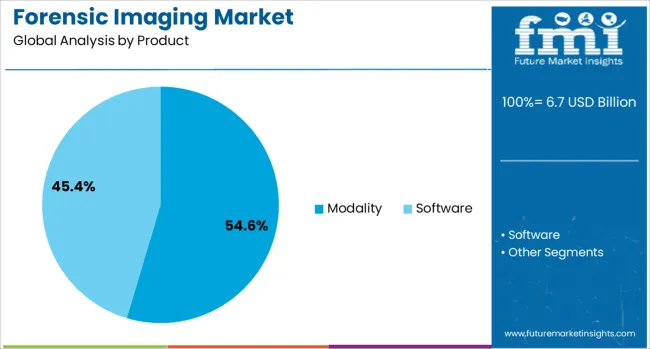

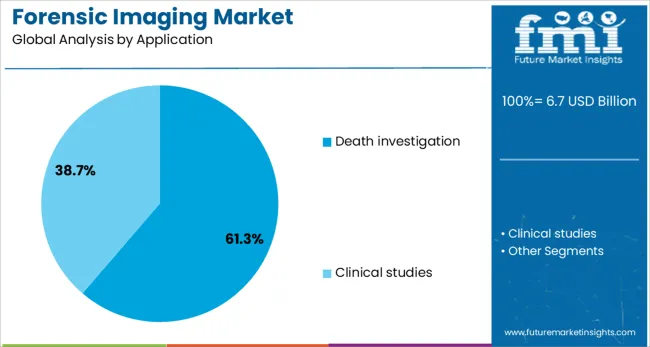

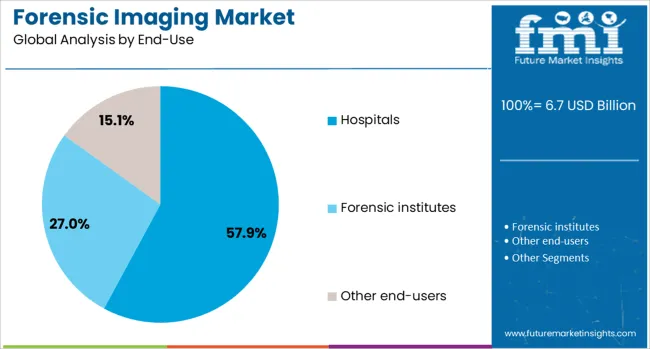

The forensic imaging market is segmented by product, application, end-use, and geographic regions. The forensic imaging market is divided into Modality and Software. The forensic imaging market is classified into Death investigation and Clinical studies. The forensic imaging market is segmented based on end-use into Hospitals, Forensic institutes, and Other end-users. Regionally, the forensic imaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The modality segment is projected to account for 54.6% of the total forensic imaging market revenue in 2025, reflecting its critical role in the delivery of high-resolution, diagnostic-quality images essential for forensic analysis. This leading share is being driven by the widespread use of computed tomography and magnetic resonance imaging systems, which provide detailed internal visualizations that are crucial in identifying trauma, internal hemorrhage, and pathological anomalies. Modalities have enabled forensic professionals to perform virtual autopsies with a higher degree of precision, efficiency, and repeatability than conventional methods.

The increasing acceptance of digital imaging as a legally valid tool has further contributed to its adoption. Modalities also offer enhanced 3D visualization and segmentation capabilities, which support comprehensive reporting and archiving for court proceedings.

Their integration with artificial intelligence-based tools and data storage platforms has enabled scalable, automated analysis while reducing the margin for human error. These capabilities have positioned modalities as the technological backbone of modern forensic imaging practices.

The death investigation segment is anticipated to capture 61.3% of the forensic imaging market revenue share in 2025, highlighting its dominance in the application landscape. This segment's leadership is being influenced by the increasing need for timely, non-invasive determination of the cause of death in both natural and unnatural cases. Forensic pathologists are extensively utilizing imaging tools to detect internal injuries, concealed trauma, and foreign objects without the need for dissection, which is especially valuable in sensitive or legally complex cases.

The segment has also seen growing relevance in mass casualty incidents, where rapid, scalable methods for body assessment are critical. Enhanced accuracy in identifying fractures, organ damage, and intracranial injuries has made imaging an essential part of postmortem protocols.

Death investigations are also benefiting from real-time sharing of imaging data with legal authorities and specialists, which expedites case resolutions. The convergence of imaging with digital reporting systems has made this application a cornerstone of forensic evidence management.

The hospitals segment is expected to represent 57.9% of the total revenue in the forensic imaging market by 2025, making it the most prominent end-use segment. This growth is being driven by the availability of advanced imaging infrastructure and trained radiology personnel within hospital settings, which allows integration of forensic analysis into existing diagnostic workflows. Hospitals have increasingly adopted forensic imaging practices as part of their emergency and trauma care services, particularly in medico-legal cases involving unexplained deaths, accidents, and assault victims.

The role of hospitals in supporting legal investigations has expanded with their ability to generate, store, and transmit high-resolution imaging records securely. Regulatory mandates requiring proper documentation in trauma and death cases have further increased demand for forensic imaging capabilities within hospital networks.

The collaborative framework between forensic teams, emergency departments, and radiology units has positioned hospitals as pivotal nodes in the forensic imaging ecosystem. Their ability to offer 24/7 access to imaging technologies ensures timely, legally compliant diagnostic evaluations in high-stakes scenarios.

AI-driven automation and advanced analytics are enhancing forensic imaging accuracy and case resolution. 3D and multimodal imaging technologies are improving evidence reconstruction, courtroom visualization, and on-site investigation efficiency.

The adoption of artificial intelligence in forensic imaging has been positioned as a transformative factor. Automated image enhancement and pattern recognition have been widely implemented to strengthen evidence accuracy in complex investigations. Facial reconstruction and object identification are being accelerated through machine learning algorithms, improving case-solving timelines for law enforcement agencies. Cloud-based platforms have been utilized for secure image storage, ensuring immediate access for authorized investigators across jurisdictions. Demand for advanced analytics has been increasing due to the need for precise image interpretation during criminal proceedings. Courts are placing higher reliance on digital evidence integrity, which is influencing procurement decisions toward AI-powered forensic imaging systems. This trend is expected to continue reshaping operational workflows within the sector.

The preference for 3D imaging solutions has been accelerating as they provide highly detailed reconstruction of crime scenes. Law enforcement has been adopting these solutions to create accurate spatial visualizations, aiding better courtroom presentations and jury understanding. Integration of multimodal imaging, combining infrared, X-ray, and ultraviolet methods, has been improving the detection of hidden elements in evidence. These technologies have been reducing human error while strengthening the chain of custody, which remains critical in legal validation. The availability of portable imaging systems has extended field-level applications, making them practical for time-sensitive investigations. Increased funding for advanced forensic tools has been boosting the use of these solutions, particularly in high-profile and cross-border criminal cases.

The forensic imaging market is experiencing strong momentum as law enforcement agencies and legal bodies prioritize advanced imaging tools for accurate evidence documentation. High-resolution digital imaging, 3D reconstruction, and multispectral imaging are gaining traction due to their ability to capture intricate details from crime scenes, biological samples, and digital devices. These technologies reduce human error and ensure precise evidence preservation for court proceedings. Growing reliance on virtual autopsy systems and forensic radiology in medical investigations is further expanding application areas. Adoption is also driven by rising global demand for faster and more reliable case resolutions, particularly in complex investigations involving cybercrime, violent offenses, and disaster victim identification.

The integration of artificial intelligence with forensic imaging systems is transforming traditional workflows by enabling automated image enhancement, pattern recognition, and anomaly detection. AI-powered platforms streamline evidence analysis by reducing manual processing time and improving accuracy in identifying key visual elements. Cloud-enabled solutions are also playing a significant role in evidence storage and sharing, ensuring compliance with legal standards while facilitating remote collaboration between agencies. This convergence of AI and cloud technology is strengthening the operational efficiency of forensic teams, supporting scalability, and positioning digital imaging as an indispensable tool in modern forensic and judicial ecosystems worldwide.

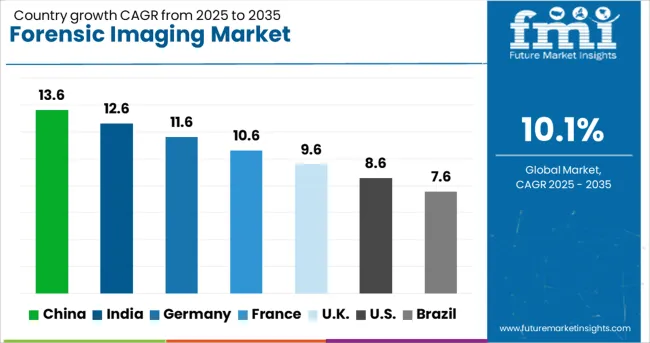

| Country | CAGR |

|---|---|

| China | 13.6% |

| India | 12.6% |

| Germany | 11.6% |

| France | 10.6% |

| UK | 9.6% |

| USA | 8.6% |

| Brazil | 7.6% |

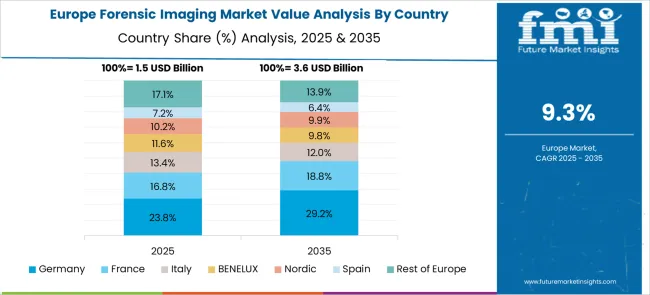

The forensic imaging sector, projected to grow at a global CAGR of 10.1% from 2025 to 2035, exhibits significant variations in growth across major regions. A 13.6% CAGR is being recorded in China, a BRICS member, driven by extensive integration of AI-based imaging and government-backed crime investigation initiatives. India, another BRICS nation, is witnessing a 12.6% CAGR supported by accelerated adoption of digital evidence systems and increased investment in law enforcement modernization.

Germany, an OECD member, is posting an 11.6% CAGR owing to the uptake of high-precision 3D imaging for judicial processes and forensic laboratories. The United Kingdom, also in the OECD, demonstrates a 9.6% CAGR, influenced by the steady deployment of portable imaging tools for field-level investigations. The United States is observing an 8.6% CAGR, supported by advanced multimodal imaging integration and high reliance on digital evidence integrity in federal investigations. The report presents an extensive evaluation of 40+ countries, with the top five highlighted as reference points.

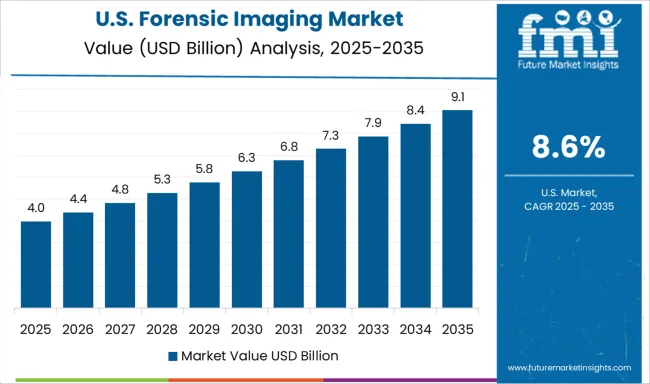

The CAGR for the United States forensic imaging sector moved from approximately 6.7% during 2020–2024 to 8.6% for 2025–2035, with the introduction of multimodal imaging protocols in investigative procedures. Integration of 3D crime scene reconstruction in judicial processes has played a critical role in improving evidence presentation and accuracy. AI-based image interpretation is being gradually adopted within federal crime units, providing higher efficiency in handling complex cases. Increased funding for digital evidence validation is influencing technology adoption in both law enforcement and court systems. Portable forensic imaging tools have become a preferred choice in the USA for on-site crime scene documentation, improving investigation timelines.

The CAGR in Germany advanced from nearly 9.2% in 2020–2024 to 11.6% during 2025–2035, supported by greater adoption of advanced 3D imaging technology across federal and regional crime investigation units. Integration of image enhancement systems into court procedures has improved the credibility of visual evidence during trials. German forensic laboratories have been upgrading infrastructure to incorporate AI-powered imaging analytics for faster and more accurate pattern recognition. Expansion of mobile forensic units equipped with portable imaging technology is enhancing field-level case analysis. Increased regulatory standards for evidence integrity in Europe have influenced accelerated investments in next-generation forensic imaging systems.

The CAGR in the United Kingdom increased from about 6.4% in 2020–2024 to 9.6% during 2025–2035, largely due to the broader deployment of portable imaging tools in law enforcement and improved integration of evidence management software. The introduction of high-resolution 3D imaging technologies into crime scene investigations has improved accuracy in evidence interpretation. AI-driven forensic platforms are being incorporated in major metropolitan police units, strengthening the reliability of digital evidence. Public funding allocations toward advanced forensic tools have created strong demand for cloud-enabled image storage systems that ensure secure and compliant evidence sharing among judicial authorities.

China’s CAGR shifted from roughly 9.8% during 2020–2024 to 13.6% for the 2025–2035 period, driven by state-backed modernization of forensic infrastructure. High funding has supported the integration of AI-driven image processing tools across provincial investigation departments. Expansion of crime scene digitization initiatives is propelling demand for advanced 3D and multimodal imaging platforms. Strategic partnerships with global forensic solution providers have accelerated local production capabilities. Public security bureaus have prioritized the development of portable imaging systems to enable rapid deployment during high-profile criminal investigations. These dynamics are strengthening China’s leadership position in forensic imaging technology adoption across Asia-Pacific.

India witnessed a CAGR rise from nearly 8.9% in 2020–2024 to 12.6% in 2025–2035, supported by increasing adoption of forensic imaging in criminal case handling across state and central investigation agencies. Implementation of advanced imaging software in courtrooms has improved the efficiency of digital evidence examination. Investments in AI-enabled interpretation tools are accelerating, primarily in high-case-load urban crime labs. The demand for portable imaging solutions is growing due to their suitability for remote and on-field investigations. Initiatives from government bodies to upgrade forensic capabilities have driven the procurement of multimodal imaging platforms, ensuring better crime detection and evidence analysis.

The forensic imaging market is shaped by established players and emerging innovators developing advanced solutions for evidence acquisition and analysis. GE HealthCare Technologies Inc., Siemens Healthineers AG, and Canon Inc. lead the sector with integrated imaging platforms tailored for forensic radiology, virtual autopsy, and crime scene reconstruction, offering high-precision outputs critical for legal admissibility. FUJIFILM Holdings Corporation and Philips are advancing high-resolution modalities with superior image clarity to handle complex forensic scenarios, including injury pattern visualization and hidden evidence detection. Samsung Electronics Co., Ltd. and Hitachi Ltd. are focusing on scalable imaging architectures combined with secure cloud-based data management to ensure compliance and interoperability across law enforcement networks.

Carestream Health, Shimadzu Corporation, and Analogic Corporation have strengthened their portfolios with portable forensic imaging devices that support field investigations and disaster victim identification, addressing the growing need for mobility and on-site evidence capture. Esaote SPA, Mindray Bio-Medical Electronics, and PLANMED OY have expanded into niche imaging applications such as low-dose radiography and compact systems optimized for forensic and medical-legal cases. Neusoft Corporation and Teratech Corporation are leveraging AI-driven analytics and multimodal imaging technologies to automate evidence enhancement and pattern recognition, significantly reducing processing time. Collectively, these companies are investing in AI integration, miniaturization, and cloud connectivity to transform forensic imaging into a highly efficient, accurate, and technology-driven investigative solution globally.

In April 2024, Carestream Health price increases were announced globally for medical imaging and non-destructive testing films, citing rising material and energy costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.7 Billion |

| Product | Modality and Software |

| Application | Death investigation and Clinical studies |

| End-Use | Hospitals, Forensic institutes, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GEHealthCareTechnologiesInc., SiemensHealthineersAG, CanonInc., FUJIFILMHoldingsCorporation, Philips, SamsungElectronicsCo.Ltd., HitachiLtd., CarestreamHealth, ShimadzuCorporation, AnalogicCorporation, EsaoteSPA, MindrayBio-MedicalElectronics, PLANMEDOY, NeusoftCorporation, and TeratechCorporation |

| Additional Attributes | Dollar sales, share, regional demand trends, adoption rates of AI-based imaging, competitive positioning, pricing strategies, regulatory compliance insights, and opportunities in cloud-based evidence management systems. |

The global forensic imaging market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the forensic imaging market is projected to reach USD 17.5 billion by 2035.

The forensic imaging market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in forensic imaging market are modality, _computed tomography (ct), _magnetic resonance imaging (mri), _x-ray, _ultrasound and software.

In terms of application, death investigation segment to command 61.3% share in the forensic imaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Forensics Market Size and Share Forecast Outlook 2025 to 2035

Digital Forensics Market Analysis - Size, Share, and Forecast 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Hybrid Imaging System Market

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Quantum Imaging Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Imaging Software Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Imaging Devices Market Size and Share Forecast Outlook 2025 to 2035

Urology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

In Vivo Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA