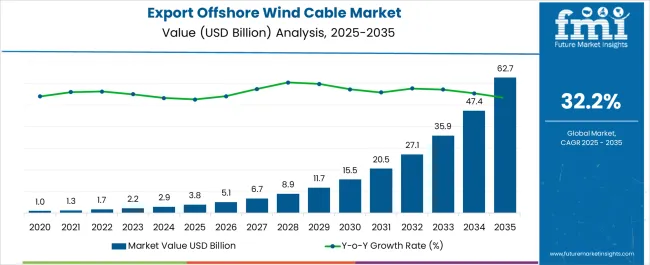

The Export Offshore Wind Cable Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 62.7 billion by 2035, registering a compound annual growth rate (CAGR) of 32.2% over the forecast period. An inflection point mapping analysis reveals significant growth acceleration, followed by periods of sustained expansion driven by advancements in offshore wind power infrastructure. Between 2025 and 2030, the market grows from USD 3.8 billion to USD 15.5 billion, contributing USD 11.7 billion in growth, with a CAGR of 32.4%. This early-phase acceleration is driven by the increasing global investment in offshore wind energy and the need for high-performance export cables to connect offshore wind farms to the grid.

The demand is further fueled by government incentives, a growing shift toward renewable energy, and large-scale offshore wind projects in regions like Europe, the USA, and Asia. The first inflection point occurs around 2030, when the market reaches USD 15.5 billion. From 2030 to 2035, the market continues to expand from USD 15.5 billion to USD 62.7 billion, contributing USD 47.2 billion in growth, with a slightly lower CAGR of 29.8%. The deceleration reflects market maturity in early adopters, with growth slowing as offshore wind farms become more integrated into national energy grids. Despite this, demand remains strong due to the ongoing global commitment to renewable energy, further driving large-scale offshore wind energy projects. The mapping highlights strong early-phase acceleration, followed by steady growth as the technology scales.

| Metric | Value |

|---|---|

| Export Offshore Wind Cable Market Estimated Value in (2025 E) | USD 3.8 billion |

| Export Offshore Wind Cable Market Forecast Value in (2035 F) | USD 62.7 billion |

| Forecast CAGR (2025 to 2035) | 32.2% |

The export offshore wind cable market is expanding steadily as nations accelerate renewable energy adoption and invest in offshore wind infrastructure to meet carbon neutrality targets. Increased offshore wind farm installations and technological advancements in high-voltage subsea transmission are creating sustained demand for efficient and durable export cable solutions.

Governments across Europe, Asia, and North America are implementing supportive policies, funding programs, and grid expansion strategies, which are strengthening the offshore wind value chain. Manufacturers are focusing on corrosion-resistant insulation materials, improved mechanical flexibility, and longer cable spans to address harsh subsea environments.

The market outlook remains promising as project developers prioritize operational efficiency, electrical stability, and long-term durability in export cabling systems to maximize offshore wind farm output.

The export offshore wind cable market is segmented by voltage rating, conductor material, and geographic regions. By voltage rating, the export offshore wind cable market is divided into 132 kV & Less and 132 kV & Above. In terms of conductor material, the export offshore wind cable market is classified into Aluminum and Copper. Regionally, the export offshore wind cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

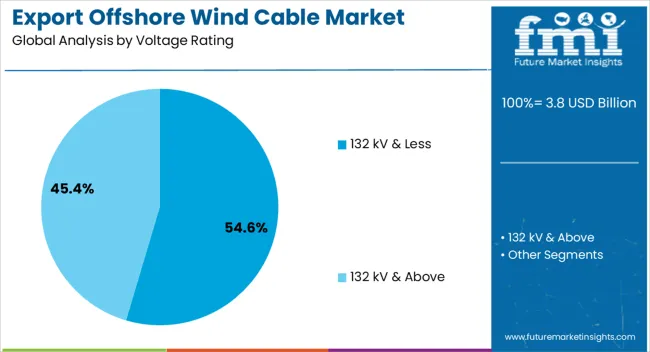

The 132 kV and less segment is projected to hold 54.60% of total market revenue by 2025 within the voltage rating category, positioning it as the leading segment. This share is driven by the widespread deployment of medium-scale offshore wind farms that require stable yet cost-effective power evacuation solutions.

These voltage levels are well-suited for near-shore projects and interconnection between turbines and substations. The segment has gained traction due to reduced installation complexity, lower material costs, and compatibility with existing grid architectures.

As governments encourage modular offshore wind development and grid-connected pilot projects, the demand for 132 kV and below-rated cables continues to rise. This segment remains a cost-efficient choice for operators aiming to scale projects while managing technical risk and infrastructure investment.

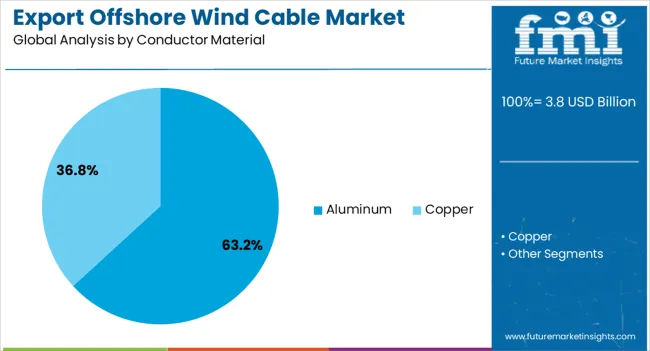

The aluminum conductor material segment is expected to contribute 63.20% of the overall market revenue by 2025, establishing it as the dominant material type. This dominance stems from the material’s favorable strength-to-weight ratio, corrosion resistance, and cost advantages compared to copper.

Aluminum is particularly advantageous in long-distance offshore installations where lighter cable weight simplifies handling and reduces structural load. Its thermal stability and improved manufacturing techniques have enhanced its performance reliability in challenging marine environments.

Growing preference for aluminum conductors is also linked to project developers seeking economically viable solutions without compromising transmission efficiency. As offshore wind scales up, aluminum continues to be the material of choice for high-performance, cost-effective export cables.

Offshore wind farms require specialized cables to transmit electricity generated from turbines to the grid. These cables are crucial for ensuring efficient and safe energy transmission over long distances. As more countries invest in offshore wind energy, especially in Europe, Asia, and North America, the demand for high-performance export offshore wind cables continues to rise. Technological advancements and innovations in cable design are also fueling market growth, despite challenges such as high installation costs and harsh environmental conditions at sea.

The primary driver of the export offshore wind cable market is the growing expansion of offshore wind energy projects worldwide. Offshore wind farms are being increasingly deployed to meet renewable energy targets set by governments aiming to reduce their reliance on fossil fuels and lower carbon emissions. Offshore wind energy is seen as a promising solution for large-scale energy production, particularly in coastal regions with strong wind resources. As countries push for cleaner energy solutions, the demand for reliable and high-performance cables to transmit electricity from offshore wind farms to onshore grids is rising. In regions such as Europe, where offshore wind capacity is expanding rapidly, and in countries like the USA and China, government support and incentives for offshore wind energy projects continue to drive the demand for specialized cables.

A significant challenge in the export offshore wind cable market is the high cost of installation and the harsh environmental conditions that offshore cables face. Offshore wind farms are located in deep waters and exposed to rough seas, which makes cable installation complex and expensive. The cables must be resistant to corrosion, physical stress, and damage from marine life, requiring the use of high-quality, durable materials, which adds to the cost. The installation of these cables often involves specialized ships and equipment, leading to further logistical challenges and increasing costs. Environmental factors such as strong waves and currents can delay installation, leading to extended project timelines and increased costs. Overcoming these challenges requires ongoing technological innovations in cable design, installation techniques, and materials.

The export offshore wind cable market offers significant opportunities driven by technological advancements in cable design and the global expansion of offshore wind farms. Innovations in cable insulation, power transmission efficiency, and durability are opening new avenues for growth. As manufacturers develop cables that can withstand extreme underwater conditions, the reliability of offshore wind farms increases, encouraging further investments in these projects. The global shift toward renewable energy and the expansion of offshore wind capacity, particularly in regions like Europe, North America, and Asia-Pacific, create vast opportunities for cable manufacturers. As countries continue to invest in offshore wind infrastructure, the demand for high-performance export cables will continue to grow. The use of digital monitoring and maintenance solutions to improve the lifespan and efficiency of cables is another area of growth, with potential for integration into future offshore wind projects.

A key trend in the export offshore wind cable market is the increasing innovation in cable design and installation techniques. With the expansion of offshore wind energy projects into deeper waters, manufacturers are developing cables that are more flexible, durable, and capable of handling higher capacities over longer distances. Advanced materials such as high-strength steel wire and specialized coatings are being used to enhance the durability of offshore cables and protect them from damage. Installation techniques are becoming more advanced, with the use of remotely operated vehicles (ROVs) and specialized cable-laying ships to ensure precision and efficiency in underwater installation. These technological innovations are helping to reduce the overall cost of offshore wind farm projects while improving the reliability and efficiency of energy transmission. Moreover, the rise of floating wind turbines is further shaping the market, as these turbines require more flexible cable solutions for energy transmission.

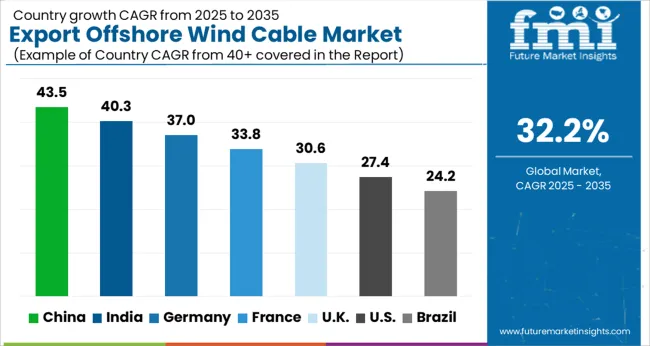

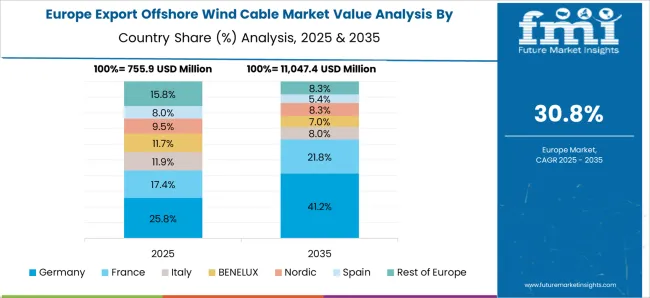

Global export offshore wind cable market demand is projected to rise at a 32.2% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 43.5%, followed by India at 40.3%, and France at 33.8%, while the United Kingdom records 30.6% and the United States posts 27.4%. Divergence reflects local catalysts: large-scale offshore wind farm projects in China and India, while more mature markets like the United States and the United Kingdom face slower growth due to established wind infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

The export offshore wind cable market in China is expanding rapidly at a CAGR of 43.5%, driven by the country’s large-scale investments in offshore wind farms. As the world’s largest producer of wind energy, China is focusing on expanding its offshore wind capacity to meet growing energy demands. The government’s support through policy incentives and green energy targets is accelerating the adoption of offshore wind technologies, including export cables. China’s robust manufacturing base and technological advancements in cable production further enhance the country’s position as a global leader in the export of offshore wind cable market.

The export offshore wind cable market in India is growing at a CAGR of 40.3%, supported by the country’s commitment to renewable energy and increasing offshore wind projects. With coastal regions ideal for offshore wind farms, India is positioning itself as a key player in the offshore wind energy sector. The Indian government’s push for clean energy, coupled with international partnerships, is further boosting the demand for offshore wind cables. The rising focus on green energy solutions in India and the expansion of its infrastructure are critical drivers of this market’s growth.

The export offshore wind cable market is expanding at a CAGR of 33.8%, driven by the country’s growing commitment to offshore wind energy. France’s offshore wind farm projects, particularly in the Atlantic Ocean, are fueling the demand for export cables. The government’s emphasis on energy transition and renewable sources of power is accelerating the adoption of offshore wind technologies. France’s strong maritime heritage and expertise in offshore installations position it as a key player in the European offshore wind market, further enhancing the demand for high-quality cables.

The United Kingdom’s export offshore wind cable market is growing at a CAGR of 30.6%, supported by the country’s large number of offshore wind farms and ongoing investments in renewable energy. The UK is one of the largest offshore wind producers globally, with ambitious targets to expand its wind capacity. The need for high-performance export cables is increasing as offshore wind farms scale up. The government’s policy framework, which encourages clean energy development and offshore wind projects, is a key driver for the market, ensuring continued growth in the coming years.

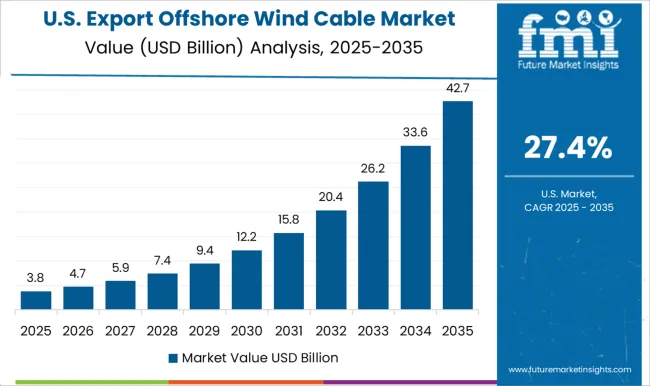

The USA offshore wind cable market is growing at a CAGR of 27.4%, with increasing offshore wind energy projects along the Atlantic and Pacific coasts. While the USA offshore wind market is in its nascent stage compared to Europe and Asia, investments in clean energy and the country’s offshore wind farm capacity are growing. The government’s support for renewable energy and offshore wind development is fueling demand for export cables. With new offshore wind projects underway and future expansions planned, the USA market is poised for significant growth in the coming years.

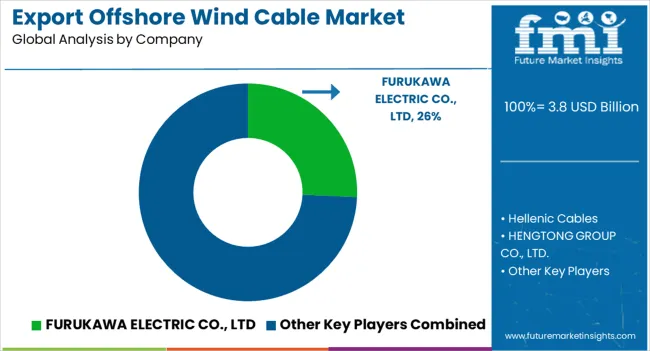

The export offshore wind cable landscape is led by manufacturers that deliver high-voltage subsea export links for reliable transmission from offshore substations to shore. Prysmian Group, Nexans, NKT, LS Cable and System, Sumitomo Electric, Hellenic Cables, ZTT, Hengtong Group, and Furukawa Electric supply HVAC and HVDC export lines with proven durability in marine environments. JDR Cable Systems focuses on array and inter-array cables and is expanding toward higher voltage products.

Ningbo Orient Wires and Cables provides regional supply for offshore applications. Installation and engineering are addressed by Seaway7 and Jan De Nul, which execute transport, laying, and protection services to integrate export routes within wind farm infrastructure. Hydro Group contributes subsea connectivity and terminations that support turbine and substation links. Across the value chain, emphasis is placed on reliability, long service life, and efficient project execution while meeting stringent environmental and safety requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Voltage Rating | 132 kV & Less and 132 kV & Above |

| Conductor Material | Aluminum and Copper |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Furukawa Electric Co., Ltd.; Hellenic Cables; Hengtong Group Co., Ltd.; Hydro Group Systems Ltd.; Jan De Nul Group; JDR Cable Systems Ltd.; LS Cable & System Ltd.; Nexans; Ningbo Orient Wires & Cables Co., Ltd. (Orient Cable); NKT A/S; Prysmian Group; Seaway7; Sumitomo Electric Industries, Ltd.; ZTT. |

| Additional Attributes | Dollar sales by product type (subsea cables, inter-array cables, export cables) and end-use segments (offshore wind energy, renewable energy, subsea applications). Demand dynamics are driven by the global expansion of offshore wind farms and the increasing need for efficient power transmission. Regional trends show significant growth in Europe, North America, and Asia-Pacific, with innovation in cable technology, enhanced durability in harsh marine conditions, and cost-effective solutions driving the market forward. |

The global export offshore wind cable market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the export offshore wind cable market is projected to reach USD 62.7 billion by 2035.

The export offshore wind cable market is expected to grow at a 32.2% CAGR between 2025 and 2035.

The key product types in export offshore wind cable market are 132 kv & less and 132 kv & above.

In terms of conductor material, aluminum segment to command 63.2% share in the export offshore wind cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nuclear Export Inhibitor Drugs Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Infrastructure Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA