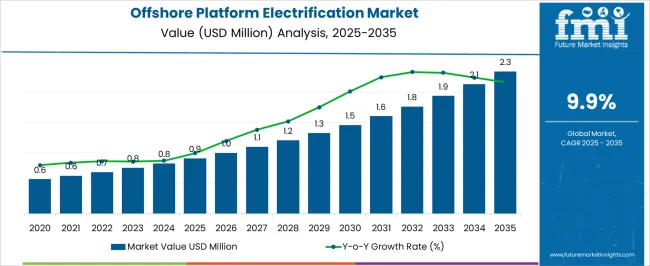

The offshore platform electrification market, estimated at USD 0.9 million in 2025 and projected to reach USD 2.3 million by 2035 at a CAGR of 9.9%, demonstrates characteristics of an early-growth market transitioning along its adoption lifecycle. In the initial years, the market remains in the introductory phase, marked by limited deployments, high technology costs, and cautious adoption by offshore operators. Investment in electrification technologies is concentrated among early adopters focusing on emissions reduction, operational efficiency, and compliance with evolving environmental regulations.

The modest growth between 2025 and 2027 indicates the market’s nascent stage, where technology validation, pilot implementations, and stakeholder awareness are primary drivers. As adoption progresses into the mid-period of the forecast, between 2028 and 2032, the market begins to enter the early growth phase. Increasing regulatory pressures, combined with operational cost benefits and proven technology reliability, support wider adoption. Offshore platforms in regions with stringent emission targets or high energy costs demonstrate accelerated integration of electrification systems. The compound effect of policy incentives, declining equipment costs, and growing industry confidence facilitates gradual scaling and standardization of installations.

By the later years of the forecast, 2033 to 2035, the market is approaching the late growth phase, characterized by broader acceptance across different offshore operations and incremental technology enhancements. While not fully mature, the trajectory suggests increasing market consolidation, supplier diversification, and integration of electrification solutions as a standard practice within offshore energy infrastructure, reflecting a steady evolution along the maturity curve and adoption lifecycle.

| Metric | Value |

|---|---|

| Offshore Platform Electrification Market Estimated Value in (2025 E) | USD 0.9 million |

| Offshore Platform Electrification Market Forecast Value in (2035 F) | USD 2.3 million |

| Forecast CAGR (2025 to 2035) | 9.9% |

The offshore platform electrification market is gaining momentum as the oil and gas industry undergoes an energy transition aligned with decarbonization mandates and sustainability goals. Electrification of offshore assets is being prioritized to reduce operational emissions, enhance process reliability, and align with national climate targets.

Governments and operators are increasingly collaborating to integrate offshore energy infrastructure with renewable sources, particularly offshore wind. Reduced lifecycle emissions, improved safety, and lower maintenance costs are contributing to the positive outlook for electrification.

In parallel, carbon pricing policies and investor pressure are driving upstream operators to adopt cleaner technologies. Future growth is likely to be supported by hybrid power solutions, digital control systems, and expanded interconnection between offshore production and national grids.

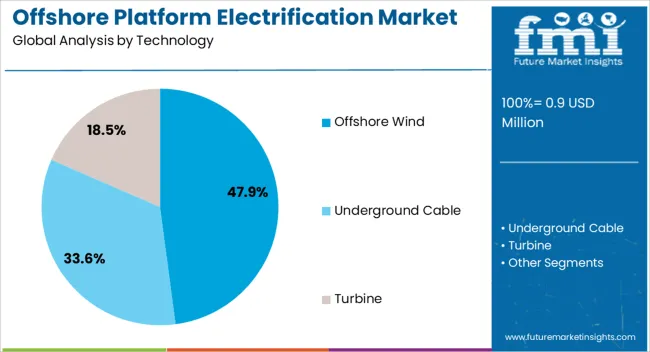

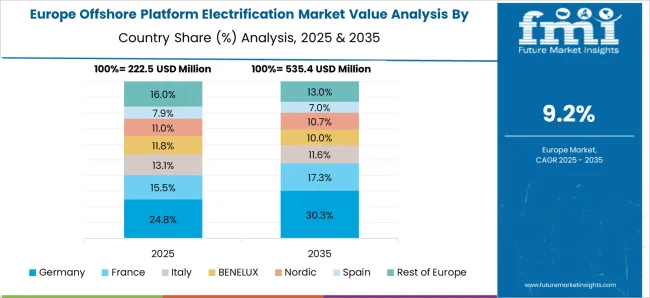

The offshore platform electrification market is segmented by technology, and geographic regions. By technology, the offshore platform electrification market is divided into Offshore Wind, Underground Cable, and Turbine. Regionally, the offshore platform electrification industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Offshore wind is projected to hold 47.9% of the total revenue share in the offshore platform electrification market in 2025, making it the dominant technology segment. This leadership is being driven by increasing grid integration capacity and proximity of offshore wind farms to oil and gas platforms.

Technological advancements in floating wind turbines and subsea cable reliability have enhanced the feasibility of delivering clean power to remote offshore facilities. Offshore wind offers a scalable and emissions-free alternative to traditional gas turbines and diesel generators, enabling operators to meet stringent environmental regulations while maintaining operational efficiency.

The alignment of offshore wind expansion with energy security policies and emission reduction roadmaps has further cemented its position as the preferred electrification method. As investment flows into integrated offshore energy hubs, offshore wind is expected to continue driving transformation across legacy and new offshore assets.

The market has been shaped by the rising need to improve operational efficiency, reduce emissions, and enhance energy management in offshore oil and gas, wind, and renewable platforms. Electrification solutions such as electric drives, motors, and power distribution systems have been integrated to replace traditional mechanical or diesel-based systems. Demand has been reinforced by stricter environmental regulations, technological innovations, and the expansion of offshore exploration and production activities. The market has also benefited from collaborations between platform operators, energy providers, and equipment manufacturers.

Environmental regulations have been the primary driver for offshore platform electrification. International standards and regional mandates have necessitated the reduction of carbon and nitrogen oxide emissions from offshore operations. Electrification of cranes, pumps, and drilling equipment has been increasingly implemented to replace diesel-powered machinery, reducing both operational emissions and fuel consumption. In addition, operators have adopted energy-efficient power management systems to optimize electricity usage and minimize environmental impact. The integration of renewable energy sources, such as offshore wind or solar, into platform grids has further reinforced the transition toward electrification. These measures have not only supported compliance with regulatory frameworks but also strengthened corporate sustainability commitments across offshore industries.

Advancements in electrical systems and power distribution technologies have played a significant role in the market’s growth. High-capacity electric drives, advanced frequency converters, and automated control systems have been developed to improve operational reliability and efficiency on offshore platforms. Improved insulation materials, modular designs, and digital monitoring systems have enhanced system durability in harsh marine environments. Remote monitoring and predictive maintenance solutions have been integrated to reduce downtime and optimize energy consumption. These innovations have enabled the adoption of electrification even in complex offshore structures and deepwater installations, facilitating safer and more efficient operations while maintaining high reliability standards.

Offshore platform operators have increasingly adopted electrification to improve operational efficiency and reduce long-term costs. Electric motors and drives have been deployed in pumps, compressors, and cranes to achieve higher precision, lower maintenance requirements, and reduced fuel dependency. Electrification has also allowed for centralized power distribution systems, which minimize energy losses and simplify platform operations. By transitioning to electric systems, operators have reduced mechanical complexity and improved equipment lifespan. The ability to integrate advanced energy management and automation systems has further enhanced cost savings, enabling operators to maintain efficient offshore operations while meeting production targets and operational safety requirements.

The market has been supported by collaborations between platform operators, equipment manufacturers, and energy solution providers. Joint development projects have focused on creating customized electrification solutions suitable for specific platform layouts and operational conditions. Investments in infrastructure, including power generation, transmission, and distribution equipment, have been prioritized to support the reliable deployment of electric systems. Regional energy policies and incentives have encouraged operators to retrofit existing platforms with electrification solutions, while new offshore installations have increasingly incorporated electrified designs from the planning stage. These partnerships and infrastructure developments have accelerated market adoption, enabling large-scale implementation of electrification technologies in offshore operations worldwide.

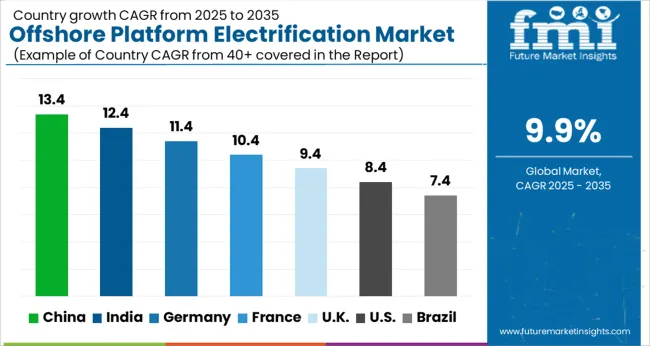

| Country | CAGR |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| France | 10.4% |

| UK | 9.4% |

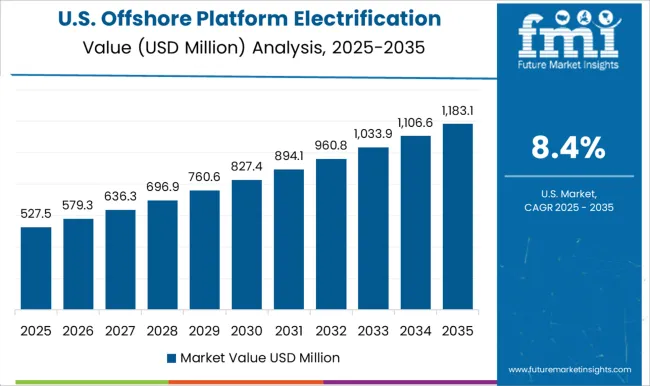

| USA | 8.4% |

| Brazil | 7.4% |

The market is projected to grow at a CAGR of 9.9% from 2025 to 2035, driven by decarbonization initiatives, adoption of renewable energy integration, and technological upgrades in offshore operations. China leads with a 13.4% CAGR, advancing through large-scale offshore electrification projects and strong government policies supporting cleaner energy. India follows at 12.4%, scaling with expanding offshore infrastructure and adoption of hybrid power systems. Germany, at 11.4%, innovates with advanced electrification technologies for offshore oil and gas platforms. The UK, growing at 9.4%, focuses on integrating green energy solutions, while the USA, at 8.4%, witnesses’ steady adoption driven by regulatory incentives and modernization of offshore assets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 13.4%, fueled by initiatives to reduce carbon emissions and improve operational efficiency in offshore oil and gas sectors. Chinese operators are increasingly adopting electrification solutions such as hybrid power systems, battery storage, and electric drives to replace conventional fossil-fuel-powered equipment. Investments in renewable energy integration, coupled with government regulations targeting emission reductions, are further accelerating adoption. Technological advancements and partnerships with global solution providers enhance the deployment of electrification systems across new and existing offshore platforms.

India is expected to grow at a CAGR of 12.4%, with operators aiming to improve energy efficiency and comply with stringent emission norms. Offshore oil and gas companies are investing in electric power distribution systems, battery storage, and automated controls to reduce dependence on diesel generators. Government incentives for cleaner energy solutions, alongside rising environmental awareness, are supporting market expansion. Additionally, collaborations with global engineering firms are helping deploy advanced electrification technologies to enhance safety, reliability, and operational performance of offshore platforms.

Germany is anticipated to register a CAGR of 11.4%, driven by the country’s focus on decarbonization and offshore energy efficiency. Offshore facilities in the North Sea are increasingly adopting electric drives, hybrid power systems, and energy storage solutions to reduce emissions and optimize energy consumption. Government-backed initiatives and strict environmental compliance standards are encouraging operators to modernize existing platforms with electrification technologies. The integration of monitoring systems and digital controls is enhancing operational efficiency while reducing operational costs.

The United Kingdom is forecast to grow at a CAGR of 9.4%, supported by initiatives for cleaner offshore operations and renewable energy integration. Operators are deploying electric drives, hybrid power systems, and battery storage solutions to replace conventional fossil-fuel-based equipment. Government policies promoting low-carbon technologies, along with environmental compliance requirements, are accelerating adoption. Continuous technological advancements and collaboration between offshore operators and solution providers ensure enhanced safety, efficiency, and reduced emissions on platforms across the UK Continental Shelf.

The United States market is expected to advance at a CAGR of 8.4%, as operators focus on reducing carbon emissions and improving offshore operational efficiency. Electrification solutions including battery storage, electric drives, and automated energy management systems are being implemented across Gulf of Mexico platforms. Regulatory pressures for emission reduction, coupled with corporate sustainability goals, are encouraging investments in offshore electrification technologies. Partnerships between energy companies and technology providers facilitate deployment of innovative systems that optimize energy consumption and enhance platform reliability.

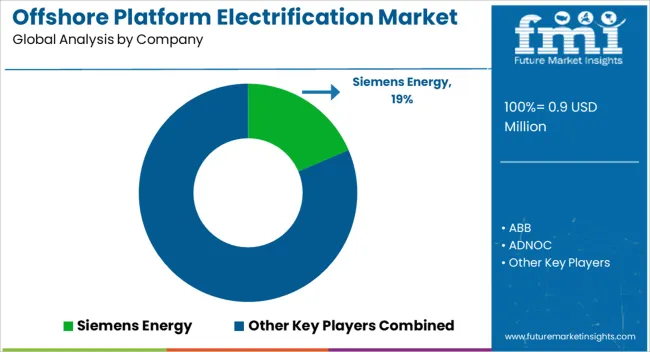

The market is dominated by leading energy and engineering companies that provide integrated electrification solutions for offshore oil and gas platforms. Siemens Energy and ABB offer advanced electrification systems, including high-voltage equipment, power distribution, and automation technologies designed to improve operational efficiency and reduce emissions. Aker Solutions and SLB contribute with engineering, design, and implementation of electrification infrastructure, enabling platforms to adopt cleaner energy sources while maintaining reliability. GE Vernova and Havfram focus on providing turnkey electrification solutions and grid integration services that support both traditional and renewable energy inputs for offshore operations.

Oil and gas operators such as BP, ADNOC, and Equinor play a key role by implementing electrification projects across their offshore platforms to enhance energy efficiency, reduce carbon footprint, and optimize power management. Cable and wiring specialists like LS Cable, Nexans, NKT, Prysmian, Southwire, ZTT, and Norddeutsche Seekabelwerke provide critical high-voltage and subsea cabling solutions that ensure safe and reliable transmission of electricity across offshore installations. Cerulean Winds contributes with renewable energy integration solutions that support hybrid electrification systems. Together, these providers advance the offshore electrification ecosystem by combining innovative technologies, operational expertise, and sustainable energy solutions tailored to the unique challenges of marine environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.9 Million |

| Technology | Offshore Wind, Underground Cable, and Turbine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, ABB, ADNOC, Aker Solutions, BP, Cerulean Winds, Equinor, GE Vernova, Havfram, LS Cable, Nexans, NKT, Norddeutsche Seekabelwerke, Prysmian, SLB, Southwire, and ZTT |

| Additional Attributes | Dollar sales by electrification type and platform application, demand dynamics across oil, gas, and renewable energy sectors, regional trends in offshore energy infrastructure, innovation in power distribution, renewable integration, and automation, environmental impact of emissions reduction and energy efficiency, and emerging use cases in hybrid offshore operations and remote monitoring systems. |

The global offshore platform electrification market is estimated to be valued at USD 0.9 million in 2025.

The market size for the offshore platform electrification market is projected to reach USD 2.3 million by 2035.

The offshore platform electrification market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in offshore platform electrification market are offshore wind, underground cable and turbine.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Wind Market Forecast and Outlook 2025 to 2035

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Crane Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Equipment Market

Offshore Wind Energy Infrastructure Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA