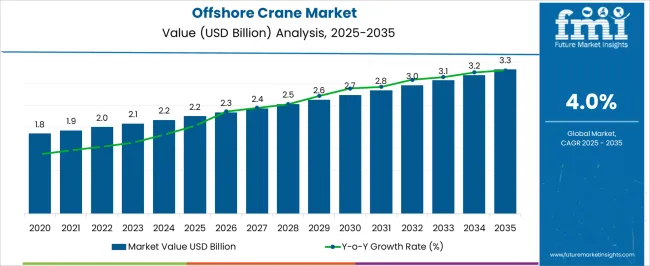

The Offshore Crane Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 2.2 billion to USD 2.7 billion, driven by increasing offshore oil and gas exploration activities, renewable energy projects, and the need for specialized lifting equipment in challenging marine environments.

Year-on-year analysis shows steady growth, with values reaching USD 2.3 billion in 2026 and USD 2.4 billion in 2027, supported by technological advancements and increasing investments in offshore infrastructure. By 2028, the market is forecasted to hit USD 2.5 billion, advancing to USD 2.6 billion in 2029 and USD 2.7 billion by 2030. Growth is expected to be further fueled by the rising demand for offshore cranes in the installation and maintenance of offshore wind farms, as well as in deep-water drilling and subsea operations. These dynamics position the offshore crane market as a critical component in offshore industrial operations, offering significant opportunities for innovation and growth in the coming years.

| Metric | Value |

|---|---|

| Offshore Crane Market Estimated Value in (2025 E) | USD 2.2 billion |

| Offshore Crane Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The offshore crane market is experiencing steady expansion, supported by a rebound in offshore energy investments and technological advancements in load handling systems. As offshore projects move toward deeper waters and harsher environments, there is growing demand for cranes that offer high precision, durability, and safety. The market is being influenced by rising global energy consumption, increasing oil and gas offshore rig count, and expansion of offshore wind energy projects.

The integration of digital control systems, condition monitoring, and automated safety features has further enhanced the performance and reliability of offshore cranes. Additionally, the shift toward modular platforms and floating production, storage and offloading units is contributing to the need for adaptable and efficient lifting equipment.

Strategic investments by offshore vessel operators in upgrading their crane systems, combined with stricter maritime safety regulations, are paving the way for sustained market growth. In the coming years, demand is anticipated to be driven by both brownfield upgrades and greenfield projects across regions such as the North Sea, Gulf of Mexico, and Asia Pacific.

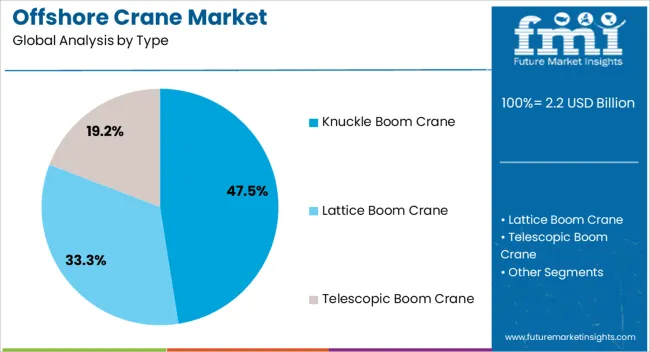

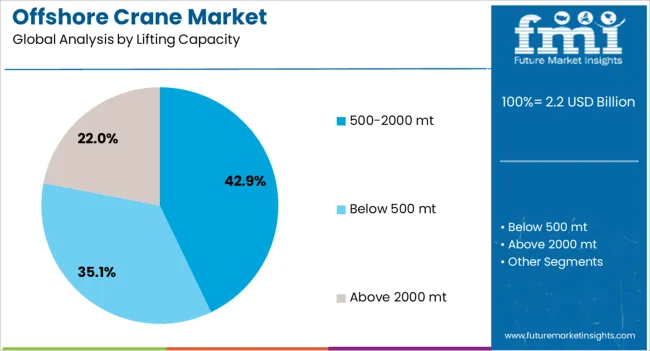

The offshore crane market is segmented by type, lifting capacity, application, and geographic regions. By type, the offshore crane market is categorized into Knuckle Boom Cranes, Lattice Boom Cranes, and Telescopic Boom Cranes. In terms of lifting capacity, the offshore crane market is classified into 500-2000 mt, below 500 mt, and Above 2000 MT.

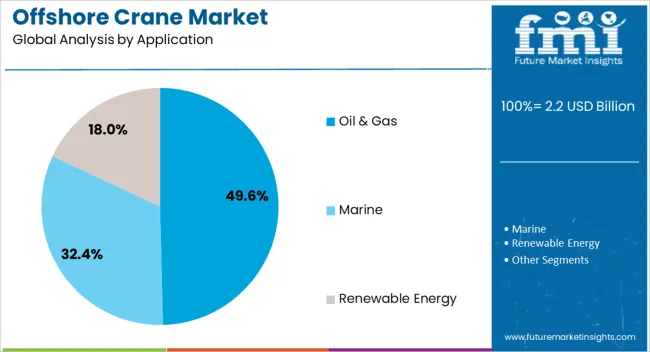

Based on application, the offshore crane market is segmented into oil and gas, Marine, and Renewable Energy. Regionally, the offshore crane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The knuckle boom crane segment is expected to account for 47.5% of the offshore crane market’s revenue share in 2025, making it the leading type in offshore lifting operations. This prominence is attributed to its compact design and enhanced maneuverability, which make it ideal for installations with limited deck space. The articulated arm structure allows for flexible movement in tight areas, enabling safer and more efficient handling of loads in dynamic offshore environments.

This type of crane has become preferred for subsea lifting, pipe handling, and support vessel operations due to its reduced risk of load swing and lower structural stress. Its capability to stow compactly when not in use contributes to increased deck utilization.

Technological advancements such as load moment indicators, real-time monitoring, and automatic overload protection have further improved operational safety. The ability to operate under challenging weather and sea state conditions has led to higher deployment of knuckle boom cranes across offshore oil, gas, and wind installations.

The lifting capacity segment of 500 to 2000 metric tons is projected to contribute 42.9% of the offshore crane market’s revenue in 2025, establishing it as the dominant lifting class. This segment’s growth is being supported by the increasing scale of offshore structures and the growing need for mid to heavy-duty lifting across platforms and floating units.

Cranes in this capacity range are capable of supporting modular construction activities, deepwater subsea equipment installation, and heavy component replacement operations. The balance between lifting power and structural footprint has made this range optimal for multi-purpose offshore vessels and production units.

Enhanced stability, hydraulic precision, and integration of load monitoring systems have improved the operational efficiency of cranes in this class. As offshore operations expand into ultra-deepwater zones and complex project requirements, lifting equipment within the 500 to 2000 metric ton capacity range is being increasingly selected for its ability to manage heavy loads without compromising safety or installation timelines.

The oil and gas segment is forecast to hold 49.6% of the offshore crane market revenue in 2025, highlighting its dominant role as an end-use application. This leadership is driven by the resumption of exploration and production activities and a growing emphasis on offshore field development. Cranes play a critical role in lifting heavy components, transferring supplies, and supporting maintenance activities on fixed and floating platforms.

The need for reliable, high-capacity lifting solutions in harsh marine environments has led to the integration of corrosion-resistant materials, automation features, and advanced diagnostics in crane systems specifically designed for oil and gas operations. Increased investment in subsea installations and floating production systems has further boosted demand for offshore cranes capable of precise and safe load handling.

With an aging offshore asset base requiring maintenance and decommissioning support, the deployment of advanced cranes is expected to remain strong. Regulatory standards focused on operational safety and efficiency are also encouraging continued investment in crane technologies specifically designed for oil and gas infrastructure.

The offshore crane market is driven by growing offshore oil and gas exploration and the increasing need for specialized equipment. New opportunities in the offshore wind energy sector present further growth potential. Trends toward compact, high-capacity cranes are reshaping the market, particularly in confined offshore spaces. However, high installation and maintenance costs remain key challenges. By 2025, innovations in cost reduction and cross-sector applications will be critical in driving the market's growth, especially in offshore oil and gas and renewable energy industries.

The growth of the offshore crane market is primarily driven by the increasing demand for offshore oil and gas exploration. As companies expand their operations to deep-water and remote locations, the need for efficient cranes capable of lifting heavy equipment and handling materials in harsh environments is growing. The market is expected to benefit from continued investments in offshore energy projects, especially in regions like the North Sea and Asia-Pacific. By 2025, the market will likely continue expanding, driven by both exploration and infrastructure projects in offshore sectors.

Emerging opportunities in the offshore wind energy sector are expected to significantly influence the offshore crane market. As governments and private sectors increasingly focus on renewable energy, the demand for specialized cranes to install and maintain offshore wind turbines is rising. These cranes are essential for heavy lifting tasks in offshore wind farms, especially in deeper waters. By 2025, the growing interest in wind energy projects will likely push the market for offshore cranes to expand beyond traditional oil and gas applications.

A key emerging trend in the offshore crane market is the demand for compact yet high-capacity cranes. As offshore installations become more confined and space on platforms becomes limited, smaller but powerful cranes are needed to perform multiple tasks without compromising on lifting capacity. These innovations are expected to drive market growth, especially as offshore platforms and vessels become more versatile. By 2025, demand for multifunctional, space-efficient cranes is anticipated to rise, especially in the offshore oil and gas and wind energy sectors.

The offshore crane market faces restraints related to the high installation and maintenance costs associated with these systems. Offshore cranes are highly specialized equipment, requiring significant investment in both hardware and operational upkeep. The cost of installation, combined with ongoing maintenance in harsh offshore environments, makes it difficult for smaller operators to adopt these systems. By 2025, manufacturers will need to address these high costs by innovating cost-effective solutions, allowing more widespread adoption across different sectors, including renewable energy.

| Countries | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

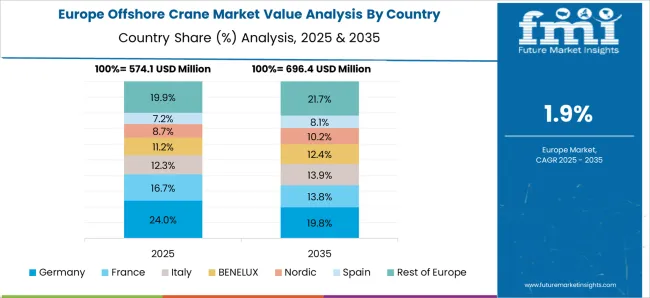

The global offshore crane market is projected to grow at a 4% CAGR from 2025 to 2035. China leads with a growth rate of 5.4%, followed by India at 5%, and Germany at 4.6%. The United Kingdom records a growth rate of 3.8%, while the United States shows the slowest growth at 3.4%. These varying growth rates are driven by the increasing demand for offshore construction, oil and gas exploration, and renewable energy projects, such as offshore wind farms. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, energy infrastructure expansion, and increased investments in offshore energy projects, while more mature markets like the USA and the UK see steady growth driven by advancements in offshore crane technologies, environmental regulations, and the growing demand for sustainable energy solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The offshore crane market in China is growing rapidly, with a projected CAGR of 5.4%. China’s expanding offshore oil and gas exploration activities, coupled with its growing offshore wind energy sector, is driving the demand for advanced offshore cranes. The country’s government investments in offshore infrastructure, along with the rising focus on sustainable energy sources, further accelerates the adoption of offshore cranes. Additionally, China’s focus on upgrading its offshore construction capabilities and increasing demand for energy-efficient equipment continues to support market growth. The growing need for cranes in shipbuilding, offshore construction, and maintenance further contributes to the market expansion.

The offshore crane market in India is projected to grow at a CAGR of 5%. India’s increasing investments in offshore oil and gas exploration, along with the growing demand for renewable energy infrastructure, is driving market growth. The country’s expanding offshore energy projects, particularly in the oil and gas sector and offshore wind farms, contribute to the rising demand for offshore cranes. Additionally, India’s growing industrialization and expanding coastal infrastructure further accelerate the need for advanced crane solutions. The country’s emphasis on offshore resource development, coupled with government policies promoting clean energy, fuels the adoption of energy-efficient and eco-friendly offshore cranes.

The offshore crane market in Germany is projected to grow at a CAGR of 4.6%. Germany’s growing demand for offshore cranes is primarily driven by its commitment to renewable energy, particularly offshore wind farms. The country’s strong focus on energy transition, combined with its leadership in sustainable offshore construction, continues to drive the adoption of advanced crane technologies. Additionally, Germany’s industrial base, with its expertise in offshore infrastructure and equipment manufacturing, contributes to the steady growth of the market. The increasing focus on safety and environmental regulations in offshore projects further accelerates the demand for high-performance, eco-friendly offshore cranes in Germany.

The offshore crane market in the United Kingdom is projected to grow at a CAGR of 3.8%. The UK’s increasing investments in offshore wind energy, coupled with growing offshore oil and gas exploration activities, continue to drive market growth. The country’s strong regulatory framework supporting renewable energy and environmental sustainability accelerates the adoption of energy-efficient and eco-friendly offshore cranes. The UK’s growing focus on reducing carbon emissions in offshore industries and promoting offshore construction capabilities further contributes to market expansion. Additionally, advancements in crane design, automation, and digitalization further support the growth of the market in the UK

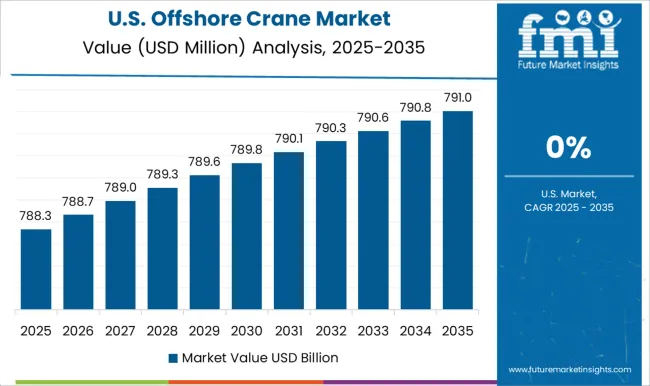

The offshore crane market in the United States is expected to grow at a CAGR of 3.4%. The USA market remains steady, driven by increasing offshore oil and gas exploration and a growing focus on renewable energy projects, particularly offshore wind farms. The country’s regulatory framework promoting safety, environmental sustainability, and clean energy continues to drive the adoption of high-performance offshore cranes. Additionally, the USA market benefits from advancements in crane technologies, including automation and digitalization, which contribute to the efficiency and performance of offshore construction and energy projects. The rise of offshore resource development continues to support market growth.

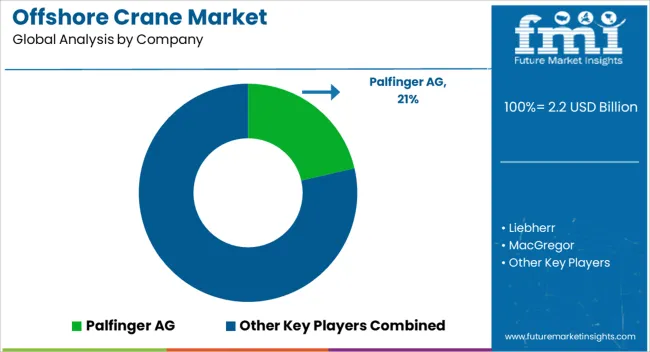

The offshore crane market is dominated by Palfinger AG, which leads with its cutting-edge crane solutions used in offshore oil, gas, and renewable energy sectors. Palfinger’s dominance is supported by its strong innovation in crane technology, robust design, and its ability to provide safe, efficient, and high-performance cranes for harsh offshore environments. Key players such as Liebherr, MacGregor, and Konecranes PLC maintain significant market shares by offering specialized offshore cranes that ensure optimal load handling, precision, and operational safety.

These companies focus on delivering advanced crane systems with high lifting capacities and efficient power solutions to meet the demands of offshore construction, decommissioning, and energy projects. Emerging players like Huisman Equipment, Kenz Figee, and Heila Group are expanding their market presence by offering innovative offshore cranes tailored for niche applications such as offshore wind farm construction, marine logistics, and deep-water exploration. Their strategies include enhancing automation, reducing energy consumption, and improving crane mobility and efficiency. Market growth is driven by the increasing investments in offshore wind energy, the demand for safe and reliable lifting solutions in challenging offshore environments, and the rising global energy needs. Innovations in crane design, remote monitoring systems, and advanced materials are expected to continue shaping the competitive landscape and drive further growth in the global offshore crane market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Type | Knuckle Boom Crane, Lattice Boom Crane, and Telescopic Boom Crane |

| Lifting Capacity | 500-2000 mt, Below 500 mt, and Above 2000 mt |

| Application | Oil & Gas, Marine, and Renewable Energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Palfinger AG, Liebherr, MacGregor, Konecranes PLC, Huisman Equipment, Kenz Figee, and Heila Group |

| Additional Attributes | Dollar sales by crane type and application, demand dynamics across offshore oil & gas, renewable energy, and marine sectors, regional trends in offshore crane adoption, innovation in automation and energy-efficient technologies, impact of regulatory standards on emissions and safety, and emerging use cases in offshore wind farms and subsea operations. |

The global offshore crane market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the offshore crane market is projected to reach USD 3.3 billion by 2035.

The offshore crane market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in offshore crane market are knuckle boom crane, lattice boom crane and telescopic boom crane.

In terms of lifting capacity, 500-2000 mt segment to command 42.9% share in the offshore crane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Offshore Wind Turbine Bearing Market Size and Share Forecast Outlook 2025 to 2035

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Offshore Drilling Riser Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Blade Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Turbine Market Size and Share Forecast Outlook 2025 to 2035

Offshore Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Offshore Structural Analysis Software Market Size and Share Forecast Outlook 2025 to 2035

Offshore ROV Market Growth – Trends & Forecast 2024-2034

Offshore Wind Market Growth – Trends & Forecast 2024-2034

Offshore Wind Energy Infrastructure Market

Offshore Equipment Market

Fixed Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Export Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Inter Array Offshore Wind Cable Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA