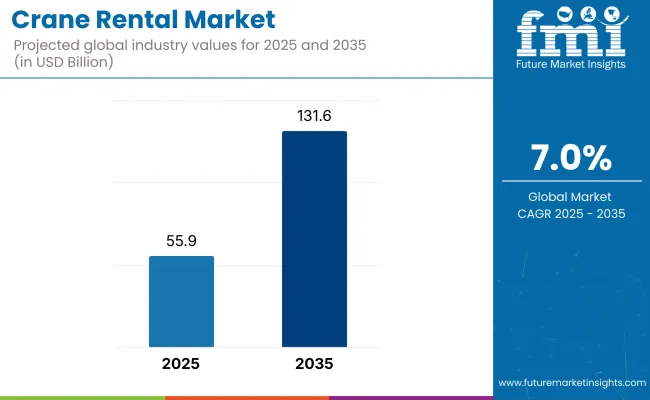

The global crane rental market is estimated to account for USD 55.9 billion in 2025. It is anticipated to grow at a CAGR of 7.0% during the assessment period and reach a value of USD 131.6 billion by 2035. Globally, the crane rental market in 2024 recorded consistent growth with rising construction activity, infrastructure development, and industrialization in emerging industries.

Demand for rental cranes grew in the Asia-Pacific and Middle Eastern regions as these regions undertook massive projects such as smart cities, renewable energy plants, and transportation systems. North America and Europe also experienced growth, driven by demand for sophisticated crane solutions in urban regeneration and logistics industries.

Supply chain disruptions and volatile raw material prices presented challenges, prompting rental companies to implement digital solutions for fleet management and customer engagement. Growth in the future until 2025 and beyond is anticipated to continue, with a projected CAGR of 7.0%.

The adoption of high-tech cranes, including telematics-enabled and green cranes, is expected to accelerate due to mandates for sustainability and the need for operational efficiency. Furthermore, increased modular construction and offsite fabrication will contribute further to increased demand for crane rental.

By 2035, the industry is expected to reach USD 131.6 billion as a result of increased preference for renting over ownership based on cost-effectiveness and flexibility. In general, the crane rental industry is poised to play a central part in facilitating world infrastructure and industrial expansion.

FMI Survey Findings: Rental Cranes Dynamics According to Stakeholder Insights

Top Concerns of Stakeholders

Use of Sophisticated Technologies

Equipment Choices

Price Sensitivity

Pain Points in the Value Chain

Future Investment Priorities Alignment

Regulatory Impact

Conclusion: Consensus vs. Variance

| Countries | Impact of Government Regulations and Mandatory Certifications |

|---|---|

| United States | Crane operators are required to obtain certification when working on construction sites, demonstrating they have passed written and practical tests. Certification can be achieved through accredited testing organizations, employer qualification programs, the USA military, or state/local government licenses. |

| Germany | There are no statutory regulations for crane operators. Training periods vary significantly across countries, ranging from a few days to up to three years. The European Crane Operators Licence (ECOL) aims to standardize these regulations to enhance safety and facilitate international operations. |

| Netherlands | Operators of hoisting and lifting machines must be sufficiently skilled and registered with the TCVT registry administration. This requirement applies to operators of mobile cranes, automatic loading cranes with hoist functions, earthmoving machines with hoist functions, telescopic handlers with hoisting functions, fixed or mobile tower cranes, and foundation rigs. |

| United Kingdom | The Lifting Operations and Lifting Equipment Regulations 1998 (LOLER) require that all lifting equipment is strong, stable, and marked with safe working loads. Equipment must be positioned to minimize risks, used safely by competent persons, and subjected to thorough examinations by qualified individuals. |

| Eurasian Customs Union (Russia, Belarus, Kazakhstan, Armenia, Kyrgyzstan) | Jib cranes exported to these countries are subject to mandatory EAC TR CU certification of conformity with Technical Regulation of the Customs Union (TR CU) 010/2011 "On safety of machinery and equipment." This certification ensures compliance with safety standards within the union. |

| Australia | ISO certifications, such as ISO 9001 (Quality Management Systems), ISO 14001 (Environmental Management Systems), and ISO 45001 (Occupational Health and Safety), are recommended for crane hire companies. These certifications enhance safety, operational efficiency, and sector ability for clients. |

| European Union | The Machinery Directive 2006/42/EC sets binding requirements for machinery, including cranes, to ensure safety and compliance across member states. TÜV SÜD provides testing and certification services to help companies meet these standards. |

2020 to 2024

2025 to 2035

Mobile cranes are applied more extensively than fixed cranes because they are economical, versatile, and flexible. Mobile cranes, unlike fixed cranes, mounted and dedicated to doing particular jobs, can be relocated to any working site with ease, thus being applicable to a variety of tasks such as construction work, infrastructure development projects, and industrial maintenance.

Their mobility between locations minimizes downtime and maximizes operational efficiency, which is especially beneficial for projects with changing needs or multiple locations. Mobile cranes are also typically less costly for short-term projects since they do away with the use of costly installation and dismantling processes involved with fixed cranes.

Low and low-medium-capacity cranes are widely used in the crane rental business because they are versatile, inexpensive, and capable of meeting a wide variety of applications. These cranes, usually ranging from 10 to 100 tons, are suitable for small to medium-sized projects like residential construction, light industrial projects, and city infrastructure development.

Their small size and mobility allow them to be easily moved and placed in tight or space-restricted spaces, which is a typical requirement in city centers. Low and low-medium-capacity cranes are also less expensive to rent and maintain as opposed to heavy and extremely heavy cranes and so can provide a practical solution for budget-restricted jobs or jobs that run over shorter periods.

Building & Construction is the most commonly employed segment for crane rental, mainly because cranes are in high demand in urban planning, infrastructure projects, and commercial/residential development. Cranes play a key role in the process of lifting heavy loads, building structures, and assembling prefabricated sections, and as such, play a crucial part in construction works of any magnitude.

The multi-functionality of cranes, especially mobile and tower cranes, makes them suitable for multiple construction purposes ranging from high-rise buildings to roads and bridges. The construction industry also prefers leasing cranes as opposed to outright purchases because the latter is cost-effective, offers flexibility, and entails lower maintenance burdens.

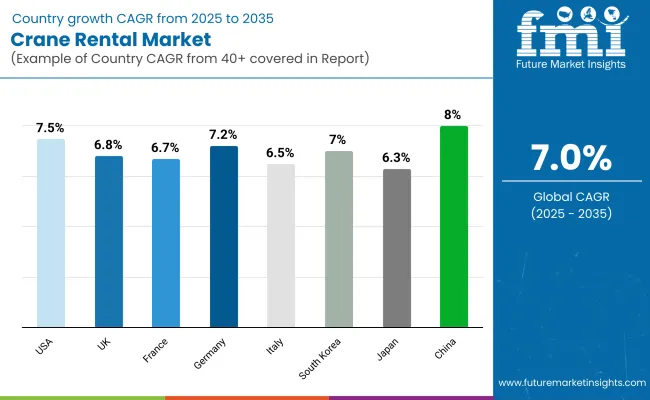

| Countries | CAGR |

|---|---|

| USA | 7.5% |

| UK | 6.8% |

| France | 6.7% |

| Germany | 7.2% |

| Italy | 6.5% |

| South Korea | 7.0% |

| Japan | 6.3% |

| China | 8.0% |

The USA crane rental industry will witness growth at a CAGR of 7.5% during the period 2025 to 2035, led by strong infrastructure development, urbanization, and the use of newer crane technologies. The USA is a world leader in construction and industrial projects with high investment in renewable energy, transport, and smart city projects. The industry for mobile cranes, especially telematics-equipped and high-capacity cranes, is increasing with their flexibility and effectiveness in heavy-duty projects.

Moreover, tight safety standards and the requirement of cost-effective measures are compelling construction companies to resort to rental rather than ownership. The USA industry is also shifting towards green cranes such as electric and hybrid cranes to meet sustainability targets. Although challenges like supply chain breakdown and the rising cost of materials can retard growth for some time, overall the USA is one of the most profitable markets for crane rental business with good demand from both public as well as private sectors.

The UK crane rental industry will increase at 6.8% between 2025 to 2035, driven by infrastructure upgrading and green initiatives. The UK government's emphasis on renewable energy ventures like offshore wind farms is generating demand for heavy-lifting and high-specialized cranes. Urban development schemes in Manchester and London are also driving growth with demand for compact and mobile cranes because of limited space.

UK stringent emissions rule is compelling rental organizations to adopt hybrid and electric cranes, and the industry thus is an early adopter of green solutions. Brexit uncertainty and labor shortages, however, pose challenges to the industry. Still, the great UK focus on sustainability and innovation makes crane rental progress at a higher rate.

France's crane rental industry is anticipated to grow at a CAGR of 6.7% during 2025 to 2035, led by infrastructure spending and renewable energy projects. France's government investment in the transport network, including high-speed rail and urban transport networks, is fueling demand for cranes. The nation's emphasis on wind and nuclear power projects is also offering opportunities for heavy and high-specialized cranes.

France's tough environmental policies are fostering the use of electric and hybrid cranes, especially within urban centers. The sector is, nonetheless, plagued by high labor costs and regulatory problems. Despite such setbacks, France's emphasis on sustainability and infrastructure investment ensures the future of crane renting shines bright.

The German crane rental market will grow at 7.2% CAGR during the forecast period 2025 to 2035, fueled by its strong industrial sector and focus on sustainability. Germany leads the world in renewable energy production, and substantial investments have been made in solar and wind schemes, requiring large and specialty cranes. Its construction industry is also thriving with the construction of residential buildings, commercial premises, and infrastructure, all demanding more cranes.

Germany's stringent emissions regulations are compelling rental homes to move towards electric and hybrid cranes, and the sector is paving the way for green technology. The market has, nonetheless, had to contend with operations costs that are too high and supply chain blockages. Despite it all, Germany's emphasis on innovation and environmental sustainability promises robust growth in the crane rental market.

Italy's crane rental industry is projected to advance at a CAGR of 6.5% during 2025 to 2035, fueled by infrastructure construction and tourism-related projects. The investments by the Italian government in transportation infrastructure, including highways and railways, are increasing demand for cranes.

Moreover, the nation's emphasis on renovating historical monuments and constructing tourist infrastructure is providing opportunities for compact and mobile cranes. Italy's embracement of sophisticated crane technologies, including telematics and IoT, is also fueling growth.

Furthermore, economic uncertainty and regulatory challenges pose some challenges to the industry. The rich cultural life and infrastructure needs of Italy ensure consistent growth in the crane rental sector in spite of the challenges.

South Korea's rental industry for cranes is expected to register a CAGR of 7.0% between 2025 to 2035, bolstered by urbanization and industrial growth. The focus on tower and smart city construction in South Korea is creating demand for tower and mobile cranes. The manufacturing and shipbuilding industries of South Korea also rely significantly on cranes to assemble and handle materials.

The market is also witnessing a movement towards small and modular cranes, particularly in cities with limited spaces. High competition and cost consciousness may discourage growth, however. South Korea's dynamic industrial base and urbanization trends are comforting in the prospect of a bright future for the crane rental market.

The crane rental market in Japan will expand at 6.3% CAGR from 2025 to 2035, backed by infrastructure initiatives and disaster rehabilitation programs. Japan's aging infra and occasional natural calamities are creating demand for cranes to be employed for reconstruction and rehab activities.

Japan particularly focuses on compact and multi-purpose cranes due to limited space in urban cities. The industry is, however, constrained by high costs and a preference for traditional models. Despite this, Japan's emphasis on innovation and infrastructure development ensures steady growth of the crane rental market.

China's crane rental market is anticipated to grow at a CAGR of 8.0% during 2025 to 2035, driven by massive infrastructure spending and urbanization. The country's Belt and Road Initiative and focus on renewable energy projects are creating massive demand for heavy and specialized cranes. China's construction building sector is also booming, with crane demand in residential, commercial, and industrial building projects.

The sector is witnessing rapid uptake of advanced technologies, such as telematics and IoT, to improve efficiency. Economic slowdowns and regulation issues, though, may hurt growth. Despite these challenges, China's widespread infrastructure needs ensure robust growth for the crane rental sector. Market Share Analysis

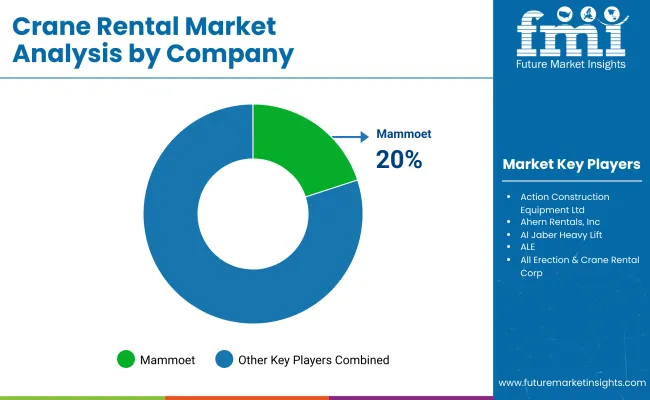

Mammoet: (20%)

Mammoet is a global leader in crane rental and heavy lifting expertise with engineered solutions. It is the market leader in heavy and heavily heavy cranes, particularly for the oil & gas, renewable energy, and infrastructure markets.

Mammoet's competitive strength is its sophisticated technologies such as modular lifting systems and SPMT (Self-Propelled Modular Transporters) which are able to safely handle oversized loads. The company has a strong foothold in Europe, the Middle East, and Asia-Pacific and is therefore the first choice partner for large projects.

Sarens: (18%)

Sarens is another industry giant of crane rentals with a strong position in the market for heavy and specialty cranes. The company has a large fleet, including crawler cranes, tower cranes, and jack-up systems.

Sarens has a strong establishment in Europe, the Americas, and Asia, and is strongly involved in renewable energy projects, which include offshore wind farms. Its focus on innovation, for instance via its Smart Cranes technology, has helped it remain at the forefront of competitors in the industry.

Maxim Crane Works: (15%)

Maxim Crane Works is a leading crane rental company in North America that specializes in mobile and crawler cranes. It is well established in the USA market, supplying the construction, industrial, and energy sectors. Maxim's strengths lie in its big fleet, nationwide coverage, and customer orientation.

The company has also invested in telematics and IoT-enabled cranes, which have increased operational efficiency and safety. Maxim's concentration on mid-sized projects and ability to offer tailor-made solutions have contributed to its being a strong market player. Lampson

International: (10%)

Lampson International is a prominent brand in the extreme heavy crane and heavy crane market, especially in North America and the Middle East. Transi-Lift cranes have been popularizing the company through their uptake in the oil & gas and power generation industries.

Lampson's demonstrated capability to perform difficult lifting jobs has positioned it as the first-choice contractor for high-value industrial projects. The company's focus on safety, in addition to its strategy for innovation, has enabled it to establish a strong industry foothold.

Sanghvi Movers: (8%)

Sanghvi Movers is the largest crane rental company in India and a significant player in the Asia-Pacific region. The company specializes in hydraulic and crawler cranes, catering to the construction, infrastructure, and energy sectors.

Sanghvi’s extensive fleet and strong regional presence have helped it capture a substantial share of the Indian sectors. The company is also expanding its footprint in Southeast Asia and the Middle East, driven by increasing infrastructure investments in these regions.

ALE Heavylift: (7%)

ALE Heavylift is the leading world provider of heavy transportation and heavy lift solutions. ALE boasts a huge footprint in Europe, the Middle East, and Asia with a deep focus on oil & gas, renewable energy, and infrastructure development.

ALE's advanced techno-solutions, such as the Mega Jack system, have driven the company's success. The company's capability to execute complex and heavy-duty projects has assisted in building ag in the heavy crane business. Action Construction Equipment (ACE): (6%)

ACE is one of India's most prominent crane rental firms, specializing in mobile and tower cranes. It enjoys a strong domestic customer base in the infrastructure and construction sectors. ACE's emphasis on affordability and reliability has resulted in it becoming the first choice company for small and medium-scale projects. The company is also spreading its wings in Africa and Southeast Asia as a result of growing infrastructure development in these regions.

The crane rental sector is heavily affected by worldwide macroeconomic trends, such as infrastructure development, urbanization, and industrial expansion. During the last decade, growing investments in infrastructure projects, especially in emerging economies, have spurred demand for cranes.

Governments across the globe are focusing on transportation networks, renewable energy projects, and smart city developments, all of heavy-lifting heavy lifting equipment. Take the example of China's Belt and Road Initiative and the USA Infrastructure Investment and Jobs Act, which hugely changed the mood.

Yet the industry also reacts to economic times. Increased interest rates, inflation, and supply chain interruptions have put up operating expenses, affecting rental rates and profitability. In addition, the transition towards sustainability is reconfiguring the industry, with an increasing demand for hybrid and electric cranes in response to strict emission regulations, especially in North America and Europe.

The COVID-19 pandemic temporarily affected the industry, but post-pandemic stimulus packages and recovery have stimulated growth. Innovation in technology, including telematics and IoT, which enhances operational efficiency and safety, will propel the industry in the future. Overall, the crane rental industry is projected to grow steadily with infrastructure expenditure, urbanization, and higher demand for renting over owning.

With respect to type, it is classified into mobile cranes and fixed cranes.

In terms of weight lifting capacity, it is divided into low, low-medium, heavy, and extreme heavy.

In terms of end-use, it is divided into building & construction, marine & offshore, mining & excavation, oil & gas, transportation, and others.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Prices vary with crane type, duration of rental, transport, operator charges, and project complexity.

Mobile cranes, tower cranes, crawler cranes, and all-terrain cranes are the favorites.

Yes, safety legislation is country-dependent, calling for certified operators, routine inspections, and adherence to lifting regulations.

Optimizing rental time, offering bundled services, and selecting the appropriate crane for the task can save costs.

Yes, electric and hybrid crane demand is on the rise owing to sustainability measures and emission policies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crane Aftermarket Growth – Trends & Forecast 2025 to 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Crane Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in Crane Scales Industry

Crane Scales Market Analysis – Growth, Demand & Forecast 2024-2034

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Yard Crane Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Market Growth - Trends & Forecast 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Spider Cranes Market Analysis based on Lifting Capacity, Operation, Control System, Application, Ownership and Region: A Forecast from 2025 to 2035

Stacker Crane Market Growth – Trends & Forecast 2025 to 2035

Lattice Cranes Market

Stiffleg Crane Market Size and Share Forecast Outlook 2025 to 2035

Overhead Crane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA