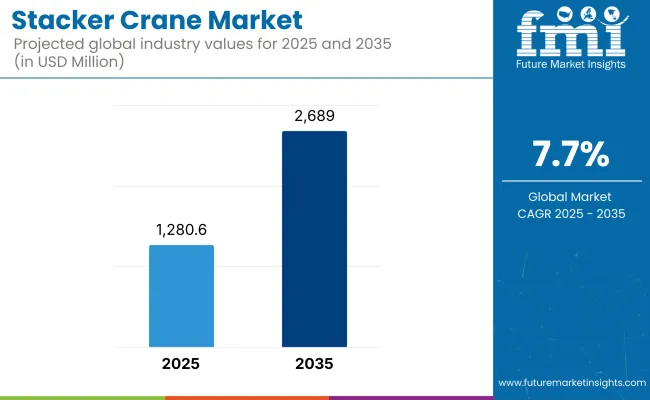

The stacker crane market is projected to grow significantly over the forecast period, with an estimated CAGR of 7.7% until 2035, reaching USD 2,689 million in 2035 from USD 1,280.6 million in 2025.

The stacker crane market is projected to witness strong growth over the next ten years owing to the implementation of automated storage and retrieval system (ASRSs) in many end-use industries. Stacker cranes are now a part of modern logistics solutions as companies look to enhance their efficiency while optimizing storage space in both warehousing and material handling.

As e-commerce activities increase and require quick and precise order execution, the need for automated systems that effectively serve this purpose has also increased. Additionally the intravenous use of implementing new innovative technology with Internet of Things (IoT) and robotics with stacker cranes is expected to add functionality as well as value globally to stacker crane technology in the world market.

North America being one among the major contributor for the stacker crane market as the region has a sufficient developed logistics and warehousing infrastructure. The coexistence of major e-commerce and retail players along with the rapid expansion of the regional automotive industry are deliberate contributing factors anticipated to further drive the adoption of stacker cranes. Notably, the USA market is expected to grow at a considerable CAGR throughout the forecast period.

The stacker crane market in Europe is gradually growing, aided by the region's focus on automation, and efficiency in material handling. Germany, France, and the UK are pioneering with a lot of manufacturing and logistics companies investing in automated solutions. Another factor for the growth of stacker cranes in the region is the local government focus towards sustainability and reduction of operational costs.

Asia-Pacific is anticipated to record the most rapid growth, driven by rapid industrialization and growth of e-commerce. China, India, and several other countries are investing heavily in manufacturing & logistics infrastructure, which is driving the demand for cost-effective material handling solutions such as stacker cranes. Market growth is further propelled by increasing population and consumer demand in the region.

Challenges

High Capital Investment, Retrofit Limitations, and Skilled Labor Dependency

High initial investment and complex infrastructure requirements have always been one of the prominent challenges for the stacker crane market, resulting in a slow adoption rate from small to mid-sized warehouses. Incorporating stacker cranes into traditional warehouse modules can be challenging, mainly requiring structural changes and sophisticated warehouse control system (WCS).

Moreover, the operation in a smooth flow is highly reliant on trained technicians and warehouse automating experts which causes labor and operational bottlenecks especially in geographical locations where there are limited automation knowledge.

Opportunities

E-commerce Expansion, Smart Warehousing, and Vertical Space Optimization

The stacker crane market is undergoing rapid growth due to a global shift towards automated storage and retrieval systems (AS/RS), especially in e-commerce fulfillment centres, cold chain logistics and industrial manufacturing, despite these hindrances. space-constrained warehouses, Stackers cranes are vertical space optimizers making them a chosen solution.

With the emergence of smart warehousing solutions, opportunities are rising, where stacker cranes are integrated with IoT sensors, AI algorithms and WMS/WCS platforms to facilitate precision inventory handling, real-time tracking and energy-efficient movement.

Legitimately, the push for temperature-resilient, rapid stacker crane systems will pressure cold storage automation in pharmaceuticals and frozen food logistics. In addition, industries are looking for dual-deep and multi-deep configurations to increase throughput and storage density while enabling larger volumes in minimal facility footprints.

The pandemic was a major selling point for the market between 2020 and 2024 as in 2020 labor shortages, supply chain digitization and warehouse boom for e-commerce ensured increased adoption. Supply chain delays and semiconductor shortages slowed the high-end automation solution deployments in some regions, however.

Between 2025 and 2035, energy-efficient AI-optimized stacker cranes offering enhanced predictive maintenance, adaptive speed controls, and seamless integration with warehouse robotics will dominate the market. More focus and specification will centre around modular crane systems offering scalability, low-noise operation and multi-temperature zone compatibility, giving a robust response to the emerging demands of evolving Omni channel supply chains.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on workplace safety and automated equipment compliance |

| Consumer Trends | Adoption in retail distribution, consumer goods, and basic warehousing |

| Industry Adoption | Implemented in high-volume e-commerce and logistics networks |

| Supply Chain and Sourcing | Dependent on steel, motors, and basic control systems |

| Market Competition | Led by AS/RS vendors and warehouse integrators |

| Market Growth Drivers | Boosted by space-saving needs and labor shortages |

| Sustainability and Environmental Impact | Growing interest in energy recovery systems and carbon audits |

| Integration of Smart Technologies | Basic HMI and sensor-based motion control |

| Advancements in Crane Design | Single-mast and dual-mast systems with wired control |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-powered system validation, warehouse automation safety codes |

| Consumer Trends | Increased use in cold storage, pharmaceuticals, and smart manufacturing hubs |

| Industry Adoption | Broader adoption in multi-tiered storage, green warehouses, and hybrid automation ecosystems |

| Supply Chain and Sourcing | Integration of AI chips, modular robotic arms, and cloud-based inventory platforms |

| Market Competition | Entry of AI-driven warehouse tech firms and autonomous material handling startups |

| Market Growth Drivers | Accelerated by hyperlocal fulfillment, ESG goals, and warehouse-as-a-service platforms |

| Sustainability and Environmental Impact | Widespread use of low-power servo systems, regenerative braking, and recyclable crane materials |

| Integration of Smart Technologies | Transition to predictive load balancing, AI-enabled pathfinding, and blockchain inventory logs |

| Advancements in Crane Design | Adoption of multi-axis autonomous cranes, remote diagnostics, and battery-powered mobile cranes |

Advanced e-commerce logistics, growing cold storage capacity, and strong investment in automated fulfillment infrastructure leave the USA market in the global lead. Large retailers and 3PLs are (re)deploying stacker cranes at high-density storage centers, for multi-temperature goods and last-mile hubs.

| Country | CAGR (2025 to 2035) |

|---|---|

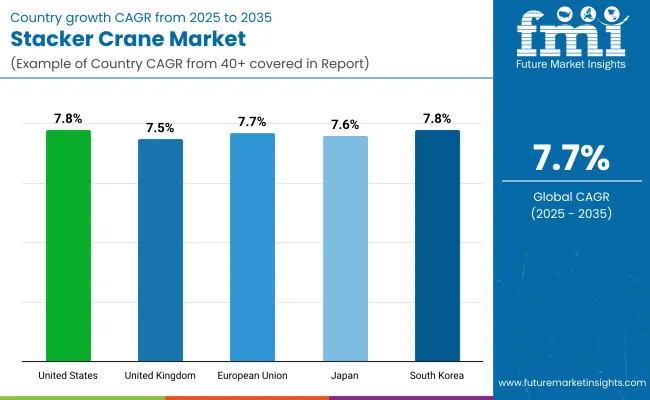

| USA | 7.8% |

In the UK demand is fueled by urban micro-fulfillment centers, healthcare logistics, and post-Brexit supply chain restructuring. Features such as dual-deep stacker cranes in vertical constructed warehouses, and modular crane units in tighter city facilities are seeing increased acceptance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

Industry 4.0 and green logistics initiatives are driving EU nations to ramp up smart warehouse infrastructure. Union German, France, and Netherlands are merging stacker cranes with AGVs and AI-enabled WMS systems, particularly in aerospace, chemicals, and precision parts storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.7% |

For example, Japan’s automation-first manufacturing ecosystem has contributed to the high adoption of compact, high-speed stacker cranes for electronics, automotive, and pharmaceutical storage. Due to recovery from the pandemic, there are now space constraints and real estate costs at a premium, and manufacturers are leveraging vertical automation with multi-level stacker crane systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.6% |

South Korea is riding to the forefront of automated cold chain and semiconductor warehousing, where the stacker crane allows for concurrent high-frequency inventory moves in real-time. The government is actively supporting smart factory development and logistics tech startups, which is stimulating the deployment of crane systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

Warehouse automation, alignment to just-in-time delivery models and a focus on space optimization for overall efficiency of the supply chain is driving the growth of the stacker crane market steadily. Stacker cranes are found in automated storage and retrieval systems (AS/RS) for accurate handling of pallets and containers in high-density storage environments.

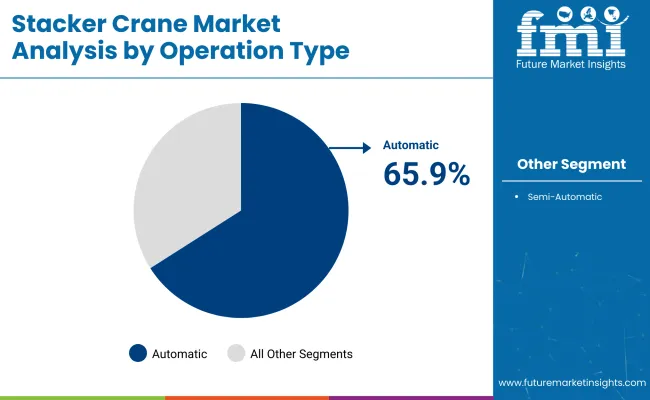

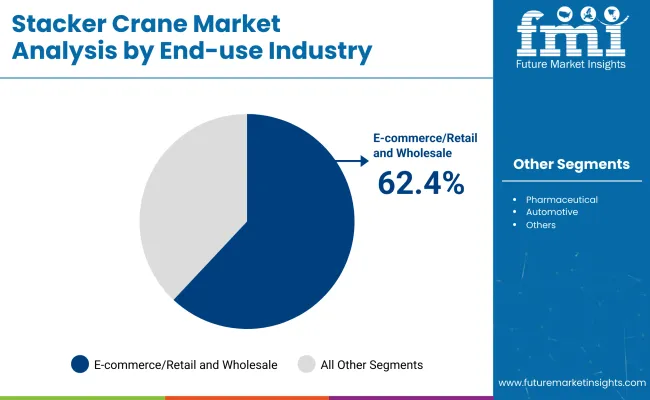

When it comes to configurations, automatic operation types and e-commerce/retail applications have the maximum market share because their unmatched speed, scalability, and the contribution in supporting 24/7 distribution models.

These segments improve operational performance, minimize human error, and assist peak demand cycles. Motivated by the demand for real-time inventory tracking, shorter order fulfillment times, and lower labor costs, stacker cranes have become a key component of warehousing facility modernization across industries. Their optimization of vertical storage in smaller footprints is especially advantageous for e-commerce fulfillment centers and large retail distributors.

| Operation Type | Market Share (2025) |

|---|---|

| Automatic | 65.9% |

The Narrow Aisle Stacker Crane Market has been further segmented into Electric Stacker Crane and Automatic Stacker Crane. These cranes also work in unison with warehouse management systems (WMS), conveyors and robotic palletizing lines to support rapid-speed, accurate, and lights-out operation in the distribution centers of today. In multi-shift environments, in high-volume facilities, and in cold storage where it is impractical or inefficient to have humans operate a system, automatic systems provide significant advantages.

The accuracy and speed with which they handle pallets, totes or cartons substantially reduces breakage and misplacement but significantly improves cycle time. Multi-deep storage capabilities, flexible load handling devices, and energy efficient drive systems continue to be developed by the vendors.

Labor supply shortages continue to impact companies, while service-level expectations grow; automatic stacker cranes continue to top the most sought after investments for warehouses looking to future-proof their operations. They still exist in lower-volume or hybrid facilities with semi-automatic systems, but their market share is decreasing and is where we begin to identify fully automated solutions.

| End-use Industry | Market Share (2025) |

|---|---|

| E-commerce/Retail and Wholesale | 62.4% |

E-commerce, retail, and wholesale are the most prominent application segments for stacker cranes as consumers today expect their orders to be delivered quickly, accurately, and with track-and-trace capabilities. Stacker cranes are used in these industries to handle the rise of SKU diversity, seasonality and volume of orders efficiently. The implementation of a stacker crane allows for live inventory updates, integration with picking manufacturers and proposed scalable use in ambient and temperature-controlled settings.

In retail fulfillment centers, they enable the next-day and same-day delivery set by standards based on quick replenishment and automated dispatch. The high-load stacker cranes specially built for the wholesale sector, in particular, FMCG and bulk goods, which help reduce the labor dependence and use cubic of storage space to the maximum.

Automated cranes also assist in managing inventory, reducing stock shrinkage and improving traceability. Consumer goods applications remain a leading driver of demand in packaging and beverage facilities, but the dynamic nature and volume pressures present in e-commerce keeps this sector at the front of the adoption queue.

The growing demand for automated warehousing, cold storage, e-commerce, and manufacturing sectors are driving significant growth for the stacker crane market. The demand for high-density storage, real-time inventory tracking, and space optimization is leading to innovative multi-deep, telescopic and robotic stacker crane systems.

Those investments include AI-based navigation, hybrid cranes to handle pallets and totes, and energy-efficient lifting mechanisms. Vertical scalability, WMS integration, and low-maintenance operation remain the most important focal points for intralogistics providers and automation technology makers.

Market Share Analysis by Key Players & Stacker Crane Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Daifuku Co., Ltd. | 14-18% |

| SSI SCHAEFER Group | 12-16% |

| Murata Machinery, Ltd. | 10-14% |

| Swisslog Holding AG (KUKA) | 8-12% |

| TGW Logistics Group | 6-9% |

| Other Stacker Crane Providers | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Daifuku Co., Ltd. | In 2024, launched the Shuttle Rack M system with advanced AI routing for multi-level pallet handling; in 2025, unveiled energy-regenerative hoist drives to reduce warehouse power consumption. |

| SSI SCHAEFER Group | Introduced Exyz® 2.0 stacker crane in 2024 with modular design for deep-freeze and ambient zones; in 2025, added real-time diagnostics via WAMAS® software integration. |

| Murata Machinery, Ltd. | Released high-speed Uni-Shuttle G in 2024 for mixed-case handling; in 2025, developed dual-mast stacker cranes with precision vision sensors for automated replenishment. |

| Swisslog Holding AG (KUKA) | Upgraded its Vectura stacker crane series in 2024 with lightweight carbon fiber booms; in 2025, integrated SynQ platform with predictive maintenance and robotics orchestration. |

| TGW Logistics Group | Debuted Mustang Evo X in 2024 for high-throughput tote handling; in 2025, launched hybrid pallet-tote cranes with multiformat compatibility and energy-saving drives. |

Key Market Insights

Daifuku Co., Ltd. (14-18%)

Daifuku continues to lead global automation with its AI-enhanced, energy-efficient crane systems. Its 2024–2025 innovations address sustainability and high-throughput needs across manufacturing and retail distribution.

SSI SCHAEFER Group (12-16%)

SSI SCHAEFER’s modular Exyz® line and WAMAS® integration strengthen its presence in temperature-controlled and multilevel storage. Its 2025 software-driven enhancements reinforce intelligent crane operation.

Murata Machinery, Ltd. (10-14%)

Murata stands out for its precision and adaptability. The 2024–2025 systems provide fast, stable movement in mixed-load applications, supporting both high-volume retail and just-in-time industrial environments.

Swisslog Holding AG (KUKA) (8-12%)

Swisslog leverages robotics and lightweight materials for performance and flexibility. The 2025 orchestration tools and Vectura updates position it as a key provider for modern e-commerce fulfillment hubs.

TGW Logistics Group (6-9%)

TGW’s hybrid solutions address increasing diversity in warehouse inventory. Its 2024–2025 models deliver format-agnostic handling with high energy efficiency and vertical reach.

Other Key Players (30-40% Combined)

Numerous regional integrators and automation providers are expanding the market with sector-specific stacker crane solutions. These include:

The overall market size for the stacker crane market was USD 1,280.6 Million in 2025.

The stacker crane market is expected to reach USD 2,689 Million in 2035.

The demand for stacker cranes is rising due to increasing automation in warehousing, the surge in e-commerce fulfillment needs, and the growing emphasis on space optimization and operational efficiency. The adoption of automatic systems across logistics and retail sectors is further driving market growth.

The top 5 countries driving the development of the stacker crane market are the USA, China, Germany, Japan, and South Korea.

Automatic systems and e-commerce are expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stacker Truck Market

Reach Stacker Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Stacker Market Size and Share Forecast Outlook 2025 to 2035

Walkie Stackers Market Size and Share Forecast Outlook 2025 to 2035

Electric Stacker Market Size and Share Forecast Outlook 2025 to 2035

Fork Over Stacker Market Size and Share Forecast Outlook 2025 to 2035

Industrial Stackers Market Forecast and Analysis by Type, End- Use Industry & Region 2025-2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Crane Cabin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Crane Rental Market Analysis by Product Type, End-Use Industry, and Region through 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Crane Aftermarket Growth – Trends & Forecast 2025 to 2035

Crane Market Growth - Trends & Forecast 2025 to 2035

Key Companies & Market Share in Crane Scales Industry

Crane Scales Market Analysis – Growth, Demand & Forecast 2024-2034

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Yard Crane Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Fixed Cranes Market Size and Share Forecast Outlook 2025 to 2035

Tower Crane Rental Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA