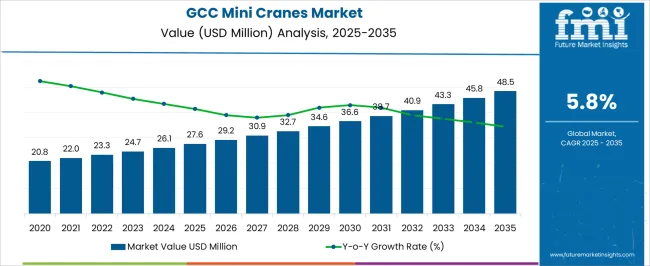

The GCC Mini Cranes Market is estimated to be valued at USD 27.6 million in 2025 and is projected to reach USD 48.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| GCC Mini Cranes Market Estimated Value in (2025 E) | USD 27.6 million |

| GCC Mini Cranes Market Forecast Value in (2035 F) | USD 48.5 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The GCC mini cranes market is experiencing steady expansion, fueled by increasing demand for compact lifting solutions across urban construction, industrial maintenance, and infrastructure projects. The market is benefiting from regional investments in smart cities, transportation hubs, and energy infrastructure where space constraints require versatile, small-footprint lifting equipment.

Labor safety regulations and the push for mechanized operations in confined or hazardous environments are also contributing to adoption. Technological advancements in electric drive systems, load monitoring, and remote controls are enhancing machine productivity while supporting decarbonization goals.

With real estate verticalization and modular construction gaining traction across the Gulf, the role of mini cranes in precision lifting and indoor work environments is becoming increasingly essential. Continued investments in logistics, ports, and renewable energy projects across the GCC are expected to provide further momentum to market growth.

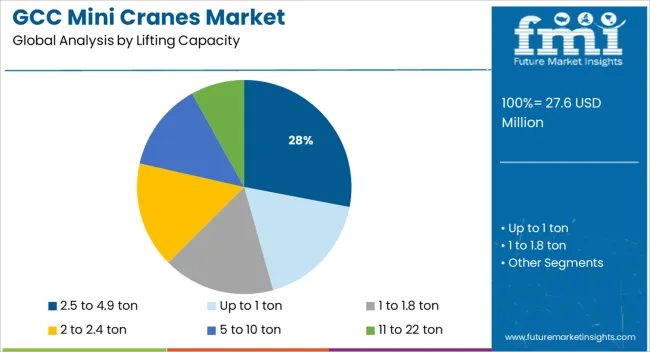

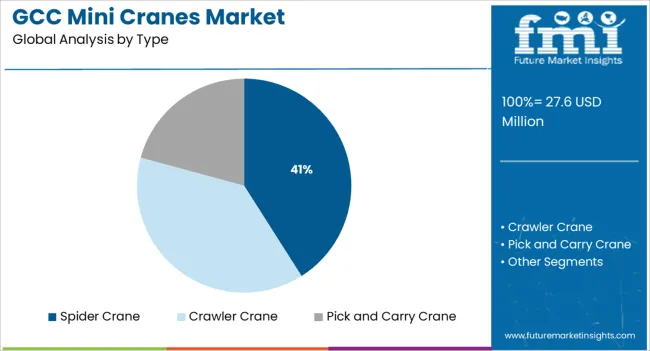

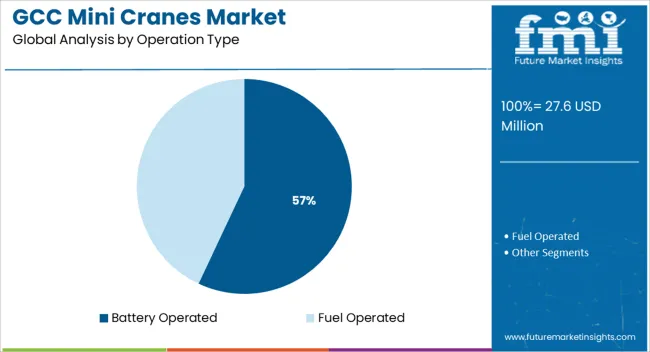

The market is segmented by Lifting Capacity, Type, Operation Type, End Use Sector, and Ownership Type and region. By Lifting Capacity, the market is divided into 2.5 to 4.9 ton, Up to 1 ton, 1 to 1.8 ton, 2 to 2.4 ton, 5 to 10 ton, and 11 to 22 ton. In terms of Type, the market is classified into Spider Crane, Crawler Crane, and Pick and Carry Crane. Based on Operation Type, the market is segmented into Battery Operated and Fuel Operated. By End Use Sector, the market is divided into Construction, Industrial, Facility Management, Marine, Material Handling & Logistics, and Others. By Ownership Type, the market is segmented into Rented and Direct Owned. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Mini cranes in the 2.5 to 4.9 ton range are projected to account for 28.00% of the overall market share in 2025, positioning them as a key lifting capacity segment. Their prominence is being driven by the balance they offer between power and portability, making them suitable for indoor tasks, maintenance work, and mid-scale construction activities.

These models are capable of navigating tight job sites while still handling substantial loads, which has led to widespread adoption across commercial building projects and industrial plants. The ability to operate on uneven surfaces and deploy with minimal setup has improved efficiency in time-sensitive environments.

Regulatory focus on safe load handling and reduced manual labor has further solidified this capacity range as an industry standard in the mini crane segment.

Spider cranes are expected to hold 41.00% of total revenue in 2025, making them the most preferred mini crane type across the GCC region. This preference is attributed to their articulated outriggers, compact footprint, and ability to operate on multi-level or restricted access sites.

Their design facilitates lifting in hard-to-reach areas such as atriums, rooftops, or between structural beams—ideal for the dense urban environments of Gulf cities. Spider cranes also provide enhanced stability on uneven terrain and are increasingly integrated with remote-control capabilities for enhanced operator safety.

Their deployment across HVAC installation, facade work, and infrastructure maintenance has expanded due to their versatility and ease of transport. As project sites demand higher operational flexibility and lower environmental disruption, spider cranes continue to lead in adaptability and performance.

Battery-operated mini cranes are projected to capture 57.00% of the market share by 2025, making them the leading operation type segment. Their leadership is being driven by the growing emphasis on low-emission construction equipment and the operational advantages of electric drive systems in noise- and emission-sensitive environments.

Battery-powered cranes offer quieter operation, zero local emissions, and lower maintenance requirements, making them ideal for indoor applications and high-traffic public projects. The ability to recharge from renewable energy sources and reduced fuel dependency aligns with the GCC’s sustainability goals under national visions and green building regulations.

As large construction contractors and developers increasingly pursue LEED or equivalent certification, demand for battery-operated mini cranes is expected to remain robust.

According to historical data from 2020 to 2024, the market for GCC Mini Cranes increased by volume at a CAGR of 5.5%. The estimated GCC Countries’ market demand for Mini Cranes in 2025 is USD 27.6 Million.

In GCC nations like Saudi Arabia and the United Arab Emirates, construction has increased. Due to rising investment in development projects like high-rise buildings, mini crane manufacturers are focusing on this region. The demand for mini cranes such as spider, crawler, and pick & carry cranes have increased in the region due to an increase in large-scale projects and an increase in lifting and carrying activities at construction sites.

Numerous countries, like the United Arab Emirates(UAE), Saudi Arabia, Kuwait, and Qatar, have seen a surge in industrial production as a result of rising population and disposable income. For instance, the Jafza Logistics Park project launched in Dubai is projected to complete its first phase in 2025.

Manufacturing and logistics are expected to support the economy going forward, notwithstanding the pandemic. Due to rising investment and consumption in various nations, including Qatar and the United Arab Emirates, lifting solutions are becoming more and more necessary in the manufacturing and logistics industries.

Growing Demand from Power Generation and Utility Sectors to Boost Market Demand

Mini cranes are expected to become more popular as the electrical and utility industries develop in the Gulf countries. These cranes have a number of benefits, including minimum ground preparation requirements, limited space requirements, and appropriate lifting capacities. Their acceptance has grown across a number of sectors in the area, particularly in real estate and business development initiatives.

As a result, manufacturers are offering their end users better products, more sophisticated marketing tactics, and adequate service and support. Due to growing capital investment in power plants and utility projects, there is a substantial demand coming from these industries. In order to install machinery, equipment, and metal structures in confined areas, mini cranes are employed in several GCC Countries.

Increasing Demand from Material Handling and Logistics Industry

As production capacity has expanded, sales of material handling equipment have substantially increased. Improvements to existing manufacturing facilities and the rising need for material handling equipment are expected to lead to increased demand for lifting and carrying equipment like spider cranes and mini pick-and-carry cranes.

Due to growing consumption, increased disposable income, and investments in numerous nations, lifting solutions are becoming more and more necessary in the manufacturing and logistics industries. Apart from the oil and gas industry, governments in GCC nations are also making significant investments in a number of other fields to boost their economies, including material handling, logistical infrastructure, and real estate development.

Rising Applications of Mini Cranes in Entertainment Spaces and Civic Infrastructure

Glass panes, glass structures, pipelines, and beams are all easily lifted by mini cranes. Due to their ease of movement through elevators, staircases, and uneven floors, mini cranes are becoming more and more popular in a variety of commercial locations, including shopping centers, for the installation of display panels, shop windows, and glass facades on buildings, homes, and skyscrapers.

Due to the expansion of public infrastructure and the popularity of entertainment venues like museums, galleries, and theme parks that make considerable use of goods lifting equipment due to space constraints, the need for mini cranes has expanded.

Rising Demand for Safety Features in GCC Mini Cranes Market

Mini cranes can execute highly skilled lifting operations and are equipped with modern safety features like outrigger interlocks, which guarantee chassis stabilization prior to any lifting operations. A number of nations are tightening their regulations for manufacturers, crane contractors, and rental businesses as a result of rising health and safety awareness.

There will likely be a rise in demand for battery-powered mini-cranes as a result of the Gulf nations modifying their regulations regarding emissions from buildings and other structures. As awareness about environmentally friendly and renewable energy sources increases, manufacturers are investing in the development of mini cranes that run on batteries.

United Arab Emirates(UAE) Mini Cranes Market accounts for around 40.8% of the GCC mini cranes market followed by Saudi Arabia. Saudi Arabia is expected to grow at a value CAGR of 6.7%, followed by United Arab Emirates(UAE) at a volume CAGR of about 4.9%. In both regions, sales of Mini Cranes are projected to total USD 27.6 Million in 2025.

Due to improved performance, more safety features, and an optimal design that maximizes visibility for the operator, demand for mini cranes is steadily growing. Rising demand for high-risers is projected to boost the safety features of mini cranes. Pick and Carry Cranes is expected to grow over the projected period and create an absolute dollar opportunity of about USD 8.20 Million

Increasing Expenditure on Infrastructural Development in GCC Countries

The need for construction equipment is expected to grow further as a result of rising capital expenditure on infrastructure development for a range of tasks, such as glazing, working on skyscrapers, handling supplies and equipment on rooftops, and performing civil construction work at airports, building sites, and entertainment venues.

Due to their flexible design and low-weight carrying capabilities, mini cranes offer operators the added benefit of being able to easily lift and transfer goods and materials. For instance, the Ministry of Kuwait made a capital expenditure of about USD 26.1 billion on infrastructure projects, including real estate and industrial construction work, in the financial year 2024.

The GCC Countries are anticipated to grow at a volume CAGR of roughly 5.5% during the projected period, reaching a value of about USD 27.6 Million in 2025. Owing to rising capital expenditure, the construction end-use industry is a prominent market contributor in the GCC Mini cranes market and is predicted to develop at a CAGR of 6.2% and reach a value of USD 48.5 Million in 2035.

Saudi Arabia and United Arab Emirates(UAE) together are estimated to create an absolute dollar opportunity of about USD 12.7 Million during the forecast period 2025 to 2035

Market Growth led by Saudi Arabia, and the United Arab Emirates

The majority of Mini Cranes sales are made in United Arab Emirates(UAE) and Saudi Arabia, all of which have stable growth prospects. From 2025 to 2035, the United Arab Emirates(UAE) market for Mini Cranes is anticipated to grow at a value CAGR of 5.3%.

The United Arab Emirates(UAE) market is seeing an increasing demand owing to increased lifting and carrying operations at museums, malls, residential projects, and logistics parks. Increased construction of high-rise buildings for residential and commercial purposes is growing at a value CAGR of 5.8% during the projected period and reaching a value of about USD 11.5 Million.

Spider Cranes by Type to grow with a value CAGR of 6.5% during the projected period

Spider cranes make it possible to complete large-scale building projects with the little space that is available. Spider cranes help to expedite lifting and placing tasks in such small spaces. The need for pick-and-carry cranes is increasing significantly as a result of the operations in the construction, oil, gas, and other associated industries changing as a result of the current regional scenario. Gulf countries are encouraging investment in a wide range of sectors, including tourism and real estate, in order to diversify their economies.

Spider Cranes is estimated to reach a value of about USD 27.6 Million in 2025. Pick and Carry Cranes by Type are projected to grow with a value CAGR of 5.3% to reach a valuation of about USD 48.5 Million by 2035.

Industrial and Construction End Use Sector are increasing demand for Mini Cranes and is projected to create an absolute dollar opportunity of about USD 14.8 Million

Lifting weights around construction sites in constrained places, real estate, and industrial operations require goods and material handling equipment. As they can move loads inside residential and commercial spaces, mini cranes are frequently utilized in the construction sector.

Mini cranes utilized in confined spaces can be operated remotely, making it easy for operators to control the equipment without endangering indoor structures. Mini cranes are widely used in industrial maintenance for all types of lifting and material handling in factories, production lines, chemical plants, and the automotive industry.

Furthermore, the demand for mini cranes for industrial applications is rising in the GCC countries at a value CAGR of 5.9% during the projected period to reach a value of about USD 32.7 Million in 2035. The construction End Use sector is estimated to create an absolute dollar opportunity of about USD 13.4 Million during the projected period.

Owing to their design and safety features, manufacturers of mini cranes are constantly under pressure to increase the machine's performance. A number of players, notably UNIC Cranes, Maeda Seisakusho Co., Ltd., Jekko SRL, Henan Spt Machinery Equipment Co., Ltd., and XCMG Group hold the majority of the market share for mini cranes in this moderately consolidated market.

By introducing new products and collaborating with rental agencies in the GCC market, manufacturing companies intend to improve the market supply of their mini cranes.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value, Units for Volume |

| Key Regions Covered | GCC Countries |

| Key Countries Covered | Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates(UAE) |

| Key Market Segments Covered | Lifting Capacity, Operation, Type, End Use Sector, Ownership, Region |

| Key Companies Profiled | UNIC-Furukawa Company Ltd; MAEDA SEISAKUSHO CO., LTD.; Jekko SRL; HENAN SPT MACHINERY EQUIPMENT CO., LTD; XCMG Group; Hoeflon; Manitex International; Palazzani; BG Lift Cranes; R&B Engineering; Galizia; JMG Cranes |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global gcc mini cranes market is estimated to be valued at USD 27.6 million in 2025.

The market size for the gcc mini cranes market is projected to reach USD 48.5 million by 2035.

The gcc mini cranes market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in gcc mini cranes market are 2.5 to 4.9 ton, up to 1 ton, 1 to 1.8 ton, 2 to 2.4 ton, 5 to 10 ton and 11 to 22 ton.

In terms of type, spider crane segment to command 41.0% share in the gcc mini cranes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Global Mini Cranes Market Share Analysis – Growth, Trends & Forecast 2025–2035

Miniplate for Bone Fixation Market Size and Share Forecast Outlook 2025 to 2035

Miniature Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

GCC Countries Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

GCC Adventure Tourism Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food & Beverage Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

GCC Natural Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA