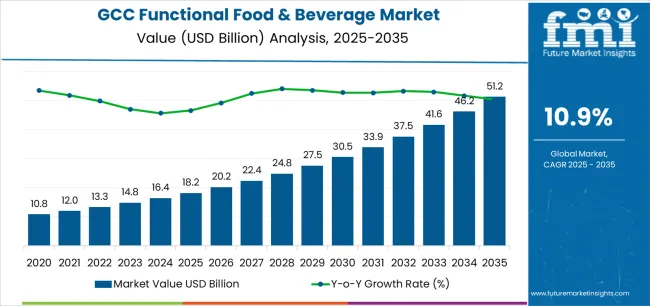

The GCC functional food and beverage market stands at the threshold of a decade-long expansion trajectory that promises to reshape the regional nutrition industry and health-focused consumption patterns. The market's journey from USD 18.2 billion in 2025 to USD 51.7 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced nutritional technology and functional ingredient standardization across retail facilities, foodservice operations, and healthcare sectors.

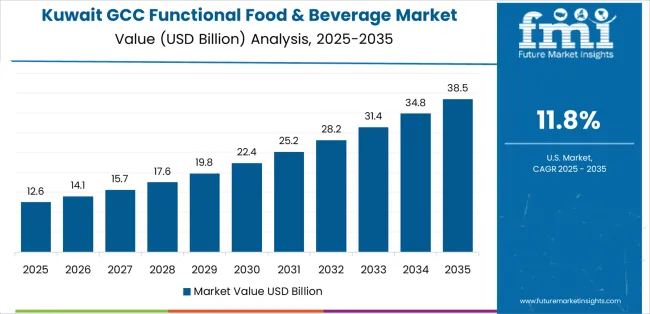

Future Market Insights, valued for comprehensive research in beverage reformulation and health-driven product trends states that the first half of the decade (2025-2030) will witness the market climbing from USD 18.2 billion to approximately USD 31.8 billion, adding USD 13.6 billion in value, which constitutes 48% of the total forecast growth period. This phase will be characterized by the rapid adoption of probiotic dairy systems, driven by increasing health awareness volumes and the growing need for preventive nutrition solutions across the GCC region. Enhanced formulation capabilities and automated quality systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 31.8 billion to USD 51.7 billion, representing an addition of USD 19.9 billion or 52% of the decade's expansion. This period will be defined by mass market penetration of personalized nutrition technologies, integration with comprehensive health tracking platforms, and seamless compatibility with existing retail infrastructure. The market trajectory signals fundamental shifts in how GCC consumers approach nutrition and wellness management, with participants positioned to benefit from growing demand across multiple product types and distribution segments.

Regulatory navigation reveals jurisdictional complications as companies discover that functional health claims approved in UAE face rejection in Saudi Arabia due to differing clinical evidence requirements. Regulatory affairs teams maintain separate dossiers for each Gulf country, creating documentation costs that consume 12-15% of product development budgets. Ministry liaisons in different countries provide conflicting guidance on acceptable protein fortification levels while import authorities apply varying interpretation standards that result in product seizures worth millions of dollars annually.

Distribution partnerships expose infrastructure limitations as cold chain logistics providers cannot guarantee temperature maintenance during the six-month period when ambient temperatures exceed probiotic survival thresholds. Warehouse managers report spoilage rates reaching 15-20% for temperature-sensitive functional products while retail partners demand full replacement costs. Logistics coordinators schedule deliveries during nighttime hours to minimize heat exposure, creating labor cost increases of 25-30% while truck utilization drops to 60% of normal capacity.

Ingredient sourcing creates supply chain vulnerabilities as specialized functional components require European suppliers who face Middle East logistics challenges during geopolitical tensions. Procurement teams maintain strategic inventory levels worth $3-5 million to buffer against supply disruptions while facing working capital pressures from finance departments. Alternative supplier qualification processes extend 12-18 months as functional ingredient suppliers must demonstrate halal compliance and heat stability performance under Gulf-specific conditions.

| Period | Primary Revenue Buckets | Share (%) | Notes |

|---|---|---|---|

| Today | Traditional Functional (Dairy: yogurt, laban) | 38% | Volume-led, established categories |

| Fortified Beverages & Juices | 28% | Energy drinks, vitamin waters | |

| Sports Nutrition | 18% | Protein supplements, recovery drinks | |

| Dietary Supplements | 16% | Pills, capsules, traditional formats | |

| Future (3–5 yrs) | Personalized Nutrition | 25–30% | DNA-based, customized formulations |

| Gut Health Solutions | 20–25% | Prebiotics, probiotics, synbiotics | |

| Plant-based Functional | 18–22% | Alternative proteins, dairy alternatives | |

| Cognitive Enhancement | 15–18% | Nootropics, focus formulas | |

| Immunity Boosters | 12–15% | Post-pandemic demand, preventive health | |

| Digital Integration | 8–10% | App-connected products, tracking services |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 18.2 billion |

| Market Forecast (2035) | USD 51.7 billion |

| Growth Rate (2025–2035) | 10.9% CAGR |

| Leading Technology | Probiotic Dairy Systems |

| Primary Distribution | Hypermarkets & A-class Stores |

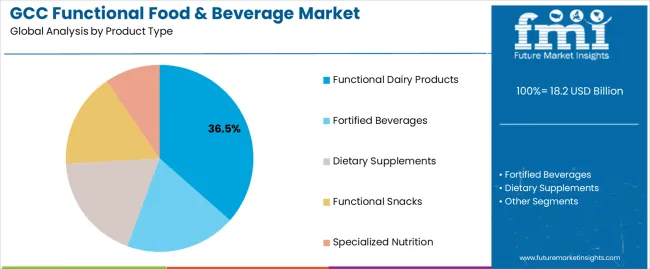

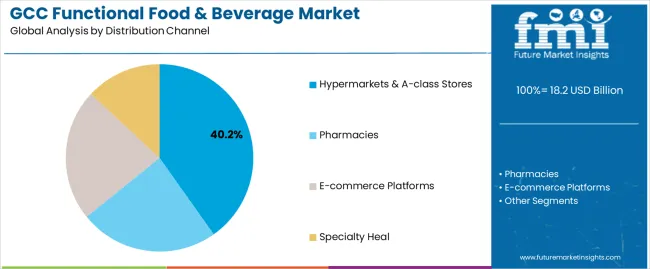

The market demonstrates strong fundamentals with functional dairy products capturing a dominant 36.5% share through advanced probiotic formulations and digestive health optimization. Hypermarket and A-class store distribution drives primary sales at 40.2% share, supported by premium positioning and expanding health-conscious consumer segments. Geographic expansion remains concentrated in affluent GCC markets with established retail infrastructure, while emerging segments show accelerating adoption rates driven by government health initiatives and rising lifestyle disease prevalence.

Primary Classification: The market segments by product type into functional dairy products, fortified beverages, dietary supplements, functional snacks, and specialized nutrition, representing the evolution from basic fortification to targeted health solutions for comprehensive wellness optimization.

Secondary Classification: Health benefit segmentation divides the market into digestive health, immunity support, energy enhancement, weight management, and cognitive function sectors, reflecting distinct requirements for efficacy standards, clinical validation, and consumer health alignment.

Tertiary Classification: Distribution channels include hypermarkets and A-class stores, pharmacies, e-commerce platforms, specialty health stores, and convenience stores, while consumer segments span health-conscious millennials, diabetic populations, athletes, and aging demographics.

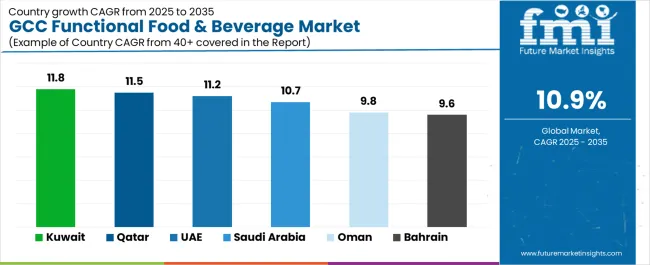

Regional Classification: Country distribution covers Saudi Arabia, UAE, Kuwait, Qatar, Oman, and Bahrain, with Kuwait and Qatar leading growth rates while Saudi Arabia maintains the largest market value through population size and established retail infrastructure.

The segmentation structure reveals technology progression from standard fortification toward specialized functional systems with enhanced bioavailability and clinical validation capabilities, while application diversity spans from everyday wellness to medical nutrition requiring precise formulation and efficacy standards.

Market Position: Functional dairy products command the leading position with 36.5% market share (USD 6.64 billion in 2025) through advanced probiotic features, including superior gut health benefits, operational flexibility, and manufacturing optimization that enable dairy facilities to achieve optimal product consistency across diverse retail and foodservice environments.

Value Drivers: The segment benefits from consumer preference for familiar formats that provide proven health benefits, cultural acceptance, and nutritional optimization without requiring significant dietary modifications. Advanced formulation features enable automated quality control, probiotic viability, and integration with existing dairy production lines, where operational performance and health efficacy represent critical facility requirements.

Competitive Advantages: Functional dairy systems differentiate through proven clinical benefits, consistent probiotic delivery, and integration with automated manufacturing systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse health and wellness applications.

Key market characteristics:

Fortified beverage systems maintain significant market position due to their convenience properties and hydration advantages. These systems appeal to active consumers requiring on-the-go nutrition with enhanced bioavailability for sports and lifestyle applications. Market growth is driven by expanding fitness culture, emphasizing functional hydration solutions and performance optimization through advanced formulation designs.

Market Context: Hypermarkets and A-class stores dominate with 40.2% share (USD 7.32 billion in 2025) due to widespread presence in premium shopping destinations and established supply infrastructure, particularly strong in Saudi Arabia and UAE where modern retail drives procurement decisions.

Appeal Factors: Premium retail operators prioritize product variety, quality assurance, and integration with loyalty programs that enable coordinated marketing across multiple store operations. The segment benefits from established cold chain infrastructure and merchandising capabilities that emphasize premium functional products for health-conscious consumers.

Growth Drivers: Mall-based shopping culture incorporates functional foods as lifestyle products, while expanding expatriate populations increase demand for international brands that comply with quality standards.

Market Challenges: Growing e-commerce competition and direct-to-consumer models may challenge traditional retail dominance.

Distribution dynamics include:

E-commerce platforms capture accelerating market share through convenience positioning and subscription models, particularly among younger demographics. These channels demand efficient logistics systems capable of maintaining cold chain integrity while providing personalized recommendation features.

| Category | Factor | Impact (★) | Why It Matters |

|---|---|---|---|

| Driver | Lifestyle Disease Prevalence | ★★★★★ | Rising diabetes, obesity, and cardiovascular risks push consumers toward preventive nutrition. |

| Driver | Government Health Initiatives | ★★★★★ | Vision 2030 and similar programs promote wellness and preventive healthcare adoption. |

| Driver | High Disposable Income | ★★★★☆ | Affluent populations are willing to pay premiums for functional and health-driven products. |

| Restraint | Import Dependency | ★★★★☆ | Limited local production creates supply chain vulnerabilities and reliance on imports. |

| Restraint | Cultural Dietary Preferences | ★★★☆☆ | Traditional food habits may slow adoption of novel functional formats. |

| Trend | Personalization & Customization | ★★★★★ | AI-driven nutrition, DNA testing, and targeted solutions reshape product development. |

| Trend | Immunity Focus | ★★★★☆ | Post-pandemic consumer emphasis on immune health sustains demand for functional solutions. |

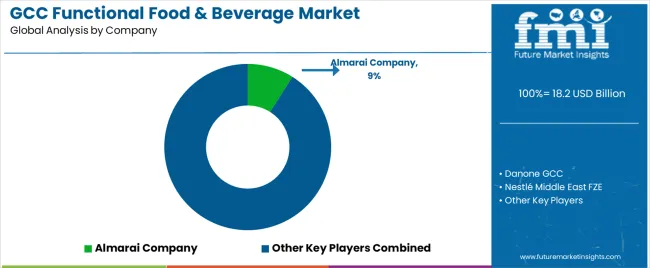

The GCC functional food and beverage market demonstrates varied regional dynamics with Growth Leaders including Kuwait (11.8% growth rate) and Qatar (11.5% growth rate) driving expansion through affluent populations and health infrastructure investments. High Performers encompass UAE (11.2% growth rate) and Saudi Arabia (10.7% growth rate), benefiting from large consumer bases and retail modernization. Steady Markets feature Oman (9.8% growth rate) and Bahrain (9.6% growth rate), where smaller populations but increasing health awareness support consistent growth patterns.

Regional synthesis reveals Kuwait and Qatar leading per capita consumption through highest income levels and health consciousness, while Saudi Arabia maintains largest absolute market value through population size and retail infrastructure. UAE shows strong innovation adoption driven by expatriate diversity and premium positioning trends.

| Region / Country | Growth (CAGR) | How to Win | What to Watch Out |

|---|---|---|---|

| Kuwait | 11.8% | Premium positioning; health-focused marketing | Small market size; high competition |

| Qatar | 11.5% | Sports nutrition; leverage World Cup legacy | Import regulations; price sensitivity |

| UAE | 11.2% | Innovation leadership; diverse expat-focused offerings | Market saturation; fragmented preferences |

| Saudi Arabia | 10.7% | Volume plays; local partnerships; Saudization compliance | Distribution costs; regulatory requirements |

| Oman | 9.8% | Value positioning; basic nutrition formats | Limited retail infrastructure; slower adoption |

| Bahrain | 9.6% | Niche & medical nutrition; cross-border positioning | Smallest GCC market; regional competition |

Kuwait establishes fastest market growth through exceptional health awareness levels and comprehensive wellness infrastructure development, integrating functional foods as lifestyle essentials in premium retail and healthcare applications. The country's 11.8% growth rate reflects highest regional per capita income and proactive health management that drives demand for premium functional systems in retail and foodservice facilities. Growth concentrates in Kuwait City metropolitan area, including The Avenues, 360 Mall, and Al Kout Mall, where modern retail showcases integrated wellness concepts that appeal to health-conscious Kuwaiti nationals seeking preventive nutrition and lifestyle optimization.

Kuwaiti consumers are adopting premium functional solutions that combine international brands with localized offerings, including probiotic dairy products and fortified beverages. Distribution channels through premium retailers and specialty health stores expand market access, while government health campaigns support adoption across diverse demographic segments.

Strategic Market Indicators:

In Doha's affluent districts, retail facilities and health centers are implementing functional food programs as standard wellness offerings, driven by World Cup infrastructure legacy and Vision 2030 health objectives. The market holds an 11.5% growth rate, supported by sports culture development and wellness tourism initiatives that promote functional nutrition for performance optimization. Qatari operators are adopting premium functional systems that provide clinical validation and international certification, particularly appealing in expatriate communities where health consciousness and quality standards represent critical purchase requirements.

Market expansion benefits from growing sports infrastructure and international event hosting that enables premium positioning of functional nutrition for athletic performance and recovery applications. Technology adoption follows patterns established in healthcare modernization, where evidence-based nutrition drives procurement decisions and consumer acceptance.

Market Intelligence Brief:

UAE establishes market sophistication through comprehensive retail infrastructure and diverse consumer demographics, integrating functional foods across mainstream and specialty applications. The country's 11.2% growth rate reflects cosmopolitan consumption patterns and innovation adoption that supports widespread use of advanced functional systems in retail facilities. Growth concentrates in Dubai and Abu Dhabi, where premium retail showcases cutting-edge functional products that appeal to health-conscious expatriates seeking personalized nutrition and wellness optimization.

Emirati retailers leverage international brand portfolios and omnichannel capabilities, including e-commerce integration and subscription services that create consumer convenience and market advantages. The market benefits from liberal regulatory environment and innovation ecosystem that supports functional food development while advancing technology integration and personalization.

Market Intelligence Brief:

Saudi Arabia's expansive consumer base demonstrates broad functional food adoption with documented market penetration across demographic segments through Vision 2030 health initiatives and retail modernization. The country leverages population scale and purchasing power to maintain a 10.7% growth rate. Major cities, including Riyadh, Jeddah, and Dammam, showcase mass-market deployment where functional products integrate with everyday consumption patterns to address lifestyle disease prevention and wellness management.

Saudi processors prioritize local partnerships and Saudization compliance in market development, creating demand for domestic production with international quality standards, including halal certification and regulatory compliance. The market benefits from government health programs and public awareness campaigns that promote functional nutrition adoption across socioeconomic segments.

Market Intelligence Brief:

Oman's market expansion benefits from increasing health awareness, government wellness initiatives, and retail modernization that positions the country as an emerging functional food market. The country maintains a 9.8% growth rate, driven by lifestyle disease concerns and preventive health adoption, including diabetes management and cardiovascular health.

Market dynamics focus on value positioning while addressing infrastructure limitations that affect premium segment development and category expansion. Growing health consciousness creates continued demand for accessible functional products in mainstream retail and pharmacy channels.

Strategic Market Considerations:

| Stakeholder | What They Actually Control | Typical Strengths | Typical Blind Spots |

|---|---|---|---|

| Regional Dairy Giants | Production capacity, distribution networks, halal credentials, brand loyalty | Local trust, strong distribution reach | Innovation gaps; limited R&D |

| Global MNCs | Innovation pipeline, R&D resources, clinical studies, global product portfolio | Technology leadership, marketing power | Local preferences; cultural nuances |

| Specialty Brands | Niche functional segments, premium positioning, direct-to-consumer channels | Targeted solutions, authenticity, consumer engagement | Scale limitations; high distribution costs |

| Local Importers | Market access, regulatory compliance, logistics & inventory management | Regional knowledge, established relationships | Margin pressure; regulatory risks |

| E-commerce Platforms | Digital reach, subscription models, customer data & analytics | Convenience, personalization, scalable direct sales | Logistics complexity; quality control issues |

| Item | Value |

|---|---|

| Quantitative Units | USD 18.2 billion |

| Product Type | Functional Dairy Products, Fortified Beverages, Dietary Supplements, Functional Snacks, Specialized Nutrition |

| Health Benefit | Digestive Health, Immunity Support, Energy Enhancement, Weight Management, Cognitive Function |

| Distribution Channel | Hypermarkets & A-class Stores, Pharmacies, E-commerce Platforms, Specialty Health Stores, Convenience Stores |

| Consumer Segment | Health-conscious Millennials, Diabetic Population, Athletes & Fitness Enthusiasts, Aging Demographics, Families with Children |

| Countries Covered | Saudi Arabia, UAE, Kuwait, Qatar, Oman, Bahrain |

| Key Companies | Almarai Company, Nestlé Middle East FZE, Danone Middle East, Agthia Group PJSC, National Food Products Company (NFPC), Baladna Q.P.S.C., IFFCO, Savola Foods Company, PepsiCo, and Coca-Cola |

| Additional Attributes | Dollar sales by product type & health benefit categories; country adoption trends (Kuwait leading growth at 11.8% CAGR); competitive landscape with regional dairy giants & global MNCs; consumer preferences for halal-certified & clinically validated products; integration with digital health platforms & wellness programs; innovations in personalized nutrition & bioactive ingredients; government health initiatives & Vision 2030 alignment |

The global GCC functional food & beverage market is estimated to be valued at USD 18.2 billion in 2025.

The market size for the GCC functional food & beverage market is projected to reach USD 51.2 billion by 2035.

The GCC functional food & beverage market is expected to grow at a 10.9% CAGR between 2025 and 2035.

The key product types in GCC functional food & beverage market are functional dairy products, fortified beverages, dietary supplements, functional snacks and specialized nutrition.

In terms of distribution channel, hypermarkets & a-class stores segment to command 40.2% share in the GCC functional food & beverage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GCC Functional Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverages Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Protective Cultures Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Microalgae Market - Demand & Future Innovations 2025 to 2035

Analysis and Growth Projections for Food and Beverage Additive Market

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Food & Beverage Disinfection Market – Safety & Industry Trends 2025 to 2035

Food and Beverage Air Filtration Market Analysis by Filter Type, End Use, and Region Through 2035

Functional Foods Market Size and Share Forecast Outlook 2025 to 2035

Functional Food Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Functional Beverage Market Analysis by Ingredient Type, Product Type, Distribution Channel, and Region Through 2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Functional Seafood Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Multifunctional Food Ingredient Business

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Sanitary Food & Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA