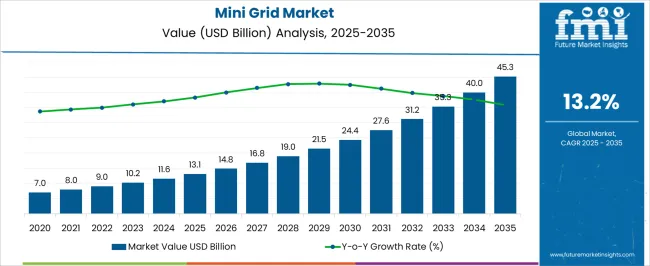

The global mini grid market is projected at USD 13.1 billion in 2025 and is anticipated to reach USD 45.3 billion by 2035, expanding at a CAGR of 13.2% over the forecast period. The market growth curve demonstrates a pronounced upward trajectory, reflecting accelerating adoption driven by energy access initiatives, decentralized power solutions, and investment in renewable-based microgrid systems. In the initial stage, from USD 7.0 billion to USD 11.6 billion, the curve rises steadily as pilot projects, government incentives, and off-grid electrification programs begin to gain traction, supporting incremental growth in rural and semi-urban regions.

The mid-phase, spanning USD 13.1 billion to USD 24.4 billion, shows a steeper slope, indicating faster market penetration fueled by technological advancements, cost reductions in solar and battery storage systems, and increased private-sector participation. The later stage, from USD 27.6 billion to USD 45.3 billion, highlights sustained momentum with a sharply ascending curve, reflecting large-scale deployment, integration of smart grid management, and heightened emphasis on energy resilience and sustainability.

The shape of the growth curve, with its gradual early rise followed by a steep acceleration in the middle and later years, underscores how mini grids are transitioning from niche solutions to mainstream energy alternatives.

| Metric | Value |

|---|---|

| Mini Grid Market Estimated Value in (2025 E) | USD 13.1 billion |

| Mini Grid Market Forecast Value in (2035 F) | USD 45.3 billion |

| Forecast CAGR (2025 to 2035) | 13.2% |

The mini grid market is closely influenced by five interconnected parent markets that collectively drive its adoption and long-term growth. The largest contributor is the renewable energy generation market, which accounts for about 35% share, as mini grids rely on solar, wind, biomass, and hybrid systems to provide decentralized, reliable power solutions to off-grid and remote communities. The energy storage and battery solutions sector contributes around 25%, supported by the critical role of advanced battery technologies and storage systems in stabilizing supply, ensuring consistent electricity access, and enabling load management. The rural electrification and infrastructure development market holds close to 15% influence, driven by government programs, public-private partnerships, and funding initiatives aimed at expanding energy access in underserved regions.

The smart grid and energy management systems sector adds nearly 12%, as mini grids increasingly incorporate intelligent monitoring, remote control, and predictive maintenance technologies to optimize performance and reduce operational costs.

The community and industrial micro-utilities market contributes nearly 8%, as mini-grids are deployed to serve localized industrial clusters, small businesses, and community facilities, thereby enhancing economic development and energy security. The distribution of market influence indicates that renewable energy generation and storage solutions form the backbone of the mini-grid market, while rural electrification programs and smart technologies continue to enhance operational efficiency and adoption.

The mini grid market is evolving rapidly due to growing emphasis on decentralized energy systems capable of providing reliable power to remote and underserved regions. Rising concerns over energy access, coupled with governmental and institutional support for rural electrification, are propelling adoption of mini grid solutions.

The integration of renewable energy sources, particularly solar, has gained momentum as regulatory frameworks and declining component costs make deployment more viable. Technological advancements in energy storage and smart grid infrastructure are enhancing the efficiency and scalability of mini grids.

As countries aim to meet energy sustainability targets and reduce dependence on fossil fuels, the market is projected to expand steadily. Future growth is expected to be driven by investments in hybrid systems, innovations in storage technology, and expanding demand from commercial and small industrial users in off-grid locations.

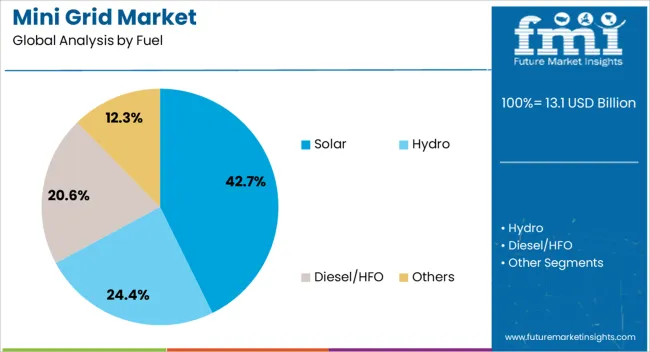

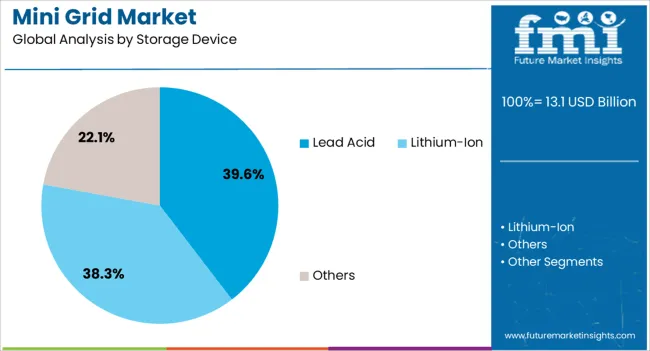

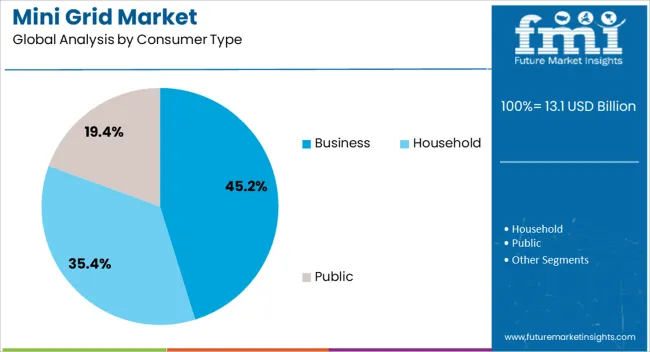

The mini grid market is segmented by fuel, storage device, consumer type, and geographic regions. By fuel, mini grid market is divided into Solar, Hydro, Diesel/HFO, and Others. In terms of storage device, mini grid market is classified into Lead Acid, Lithium-Ion, and Others. Based on consumer type, mini grid market is segmented into Business, Household, and Public. Regionally, the mini grid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solar segment accounts for 43% of the mini grid market under the fuel category, reflecting the increasing preference for clean and renewable energy sources in decentralized power systems. The decline in photovoltaic panel costs, along with government incentives for solar infrastructure, has positioned solar as the primary energy source in mini grid installations.

Solar-based mini grids are favored for their low operating costs, minimal environmental impact, and scalability across different terrains. Advancements in solar module efficiency and hybrid integration with battery systems have improved reliability and output consistency.

This segment continues to expand as donor agencies and private players invest in solar-powered mini grids to enhance rural electrification. The consistent reduction in solar technology costs is expected to further accelerate adoption, reinforcing the solar segment’s dominance within the mini grid market.

The lead acid battery segment commands a 40% market share in the storage device category, due to its long-standing reliability, low cost, and suitability for basic energy storage needs in mini grid systems. Despite the emergence of lithium-ion alternatives, lead acid remains widely adopted in cost-sensitive and remote projects where affordability and proven performance are critical.

This segment benefits from a well-established supply chain, ease of recycling, and resilience in fluctuating temperature conditions. Recent innovations have improved deep-cycle durability and charge efficiency, supporting prolonged use in solar-powered and hybrid systems.

As governments and developers seek practical and economical energy storage solutions for community-scale power systems, the lead acid segment is expected to maintain a strong presence, particularly in developing regions where budget constraints and maintenance simplicity are prioritized.

The business segment represents 45% of the mini grid market by consumer type, highlighting the growing reliance of small and medium enterprises on decentralized power systems for consistent and cost-effective electricity. Businesses in remote or underserved areas are increasingly turning to mini grids to overcome unreliable grid connections and reduce dependence on expensive diesel generators.

This segment includes agricultural processing units, cold storage facilities, retail outlets, and small-scale manufacturing units that require dependable power for operations. Reliable electricity access not only boosts productivity but also supports business growth and job creation in off-grid communities.

Favorable financing models, public-private partnerships, and tailored energy solutions have further encouraged commercial adoption. As economic development programs prioritize energy access for income-generating activities, the business segment is expected to remain a key driver of mini grid deployments globally.

The mini grid market is being shaped by rising demand for decentralized energy solutions, integration of renewable technologies, government incentives, and commercial and industrial adoption. Off-grid and rural electrification needs are driving deployment, while solar, wind, and hybrid systems enhance reliability and cost-effectiveness. Supportive policies and subsidies are reducing entry barriers and encouraging private sector participation. Commercial and industrial users are adopting mini grids for operational continuity and energy independence. Together, these factors are driving steady growth, expanding market penetration, and positioning mini grids as a key solution for reliable and localized electricity generation worldwide.

The market is being driven by increasing demand for decentralized electricity generation, particularly in rural and off-grid regions. Mini grids offer localized power supply, reducing dependency on centralized utility networks and improving energy accessibility. Governments and private investors are promoting mini grid deployment to provide reliable electricity to underserved communities, thereby supporting socio-economic development. The adoption of renewable energy sources like solar, wind, and biomass in mini grids is enhancing energy efficiency and cost-effectiveness. Rising awareness about reliable and continuous electricity supply is encouraging households, small businesses, and microenterprises to adopt mini grid systems, fostering consistent market growth.

Mini grid solutions are increasingly integrating renewable energy technologies to reduce operational costs and enhance sustainability. Solar photovoltaic panels, small-scale wind turbines, and hybrid configurations are being deployed to provide clean energy and optimize grid performance. Energy storage solutions, such as batteries, are included to ensure uninterrupted power supply during low-generation periods. These technological integrations enable mini grids to serve remote communities effectively while reducing reliance on fossil fuels. Companies are offering turnkey solutions that combine generation, storage, and distribution systems, which improves scalability and reliability. The integration of renewable technologies is driving adoption and shaping market dynamics globally.

Government policies, subsidies, and incentive programs are significantly influencing mini grid adoption. Several countries are implementing favorable regulatory frameworks, financial assistance, and tax benefits to encourage private sector participation. Support mechanisms for renewable energy integration, tariff structures, and simplified licensing processes are facilitating faster project execution. Development agencies and NGOs are also collaborating with local communities to promote mini grid implementation. Such institutional support reduces initial capital constraints and operational risks for developers, encouraging expansion of mini grids in both rural and semi-urban areas. Policy-driven growth is enhancing market penetration and attracting new entrants to the sector.

Mini grids are increasingly being deployed for commercial and industrial applications where reliable power supply is critical. Small-scale manufacturing units, agro-processing facilities, and commercial establishments are adopting mini grids to ensure operational continuity and reduce energy costs. Industries in regions with unreliable grid infrastructure benefit from localized electricity generation, which improves productivity and lowers downtime. Companies are also integrating smart metering and energy management systems to optimize consumption and operational efficiency. Growing awareness of cost savings, operational reliability, and energy independence is driving adoption of mini grids across commercial and industrial segments, expanding market opportunities.

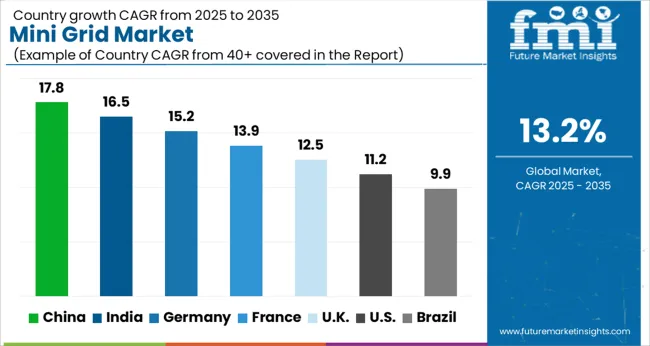

| Country | CAGR |

|---|---|

| China | 17.8% |

| India | 16.5% |

| Germany | 15.2% |

| France | 13.9% |

| UK | 12.5% |

| USA | 11.2% |

| Brazil | 9.9% |

The global mini grid market is projected to grow at a CAGR of 13.2% from 2025 to 2035. China leads with 17.8%, followed by India at 16.5%, France at 13.9%, the UK at 12.5%, and the USA at 11.2%. Growth is driven by increasing demand for decentralized energy, rural electrification, and renewable integration to support off-grid communities. BRICS countries, particularly China and India, are scaling infrastructure, financing models, and local manufacturing to accelerate deployment. OECD nations such as France, the UK, and the USA focus on advanced microgrid technologies, regulatory support, and integration with smart energy systems to enhance reliability and efficiency. The analysis spans over 40+ countries, with the leading markets detailed below.

The mini grid market in China is projected to grow at a CAGR of 17.8% from 2025 to 2035, driven by rural electrification initiatives, renewable energy integration, and government support for decentralized power systems. Rapid industrialization in remote and off-grid regions is increasing demand for reliable and independent electricity sources. Solar, wind, and hybrid mini grids are increasingly deployed to ensure energy access, reduce dependence on conventional grids, and enhance energy security. Technological innovation in smart grid monitoring, storage, and control systems supports scalable deployment. Policy incentives, subsidies, and public-private partnerships further accelerate adoption, making China a key growth hub for mini grid solutions.

The mini grid market in India is expected to grow at a CAGR of 16.5% from 2025 to 2035, fueled by government programs targeting energy access in off-grid and remote areas. Solar and hybrid mini grids are being deployed in villages and industrial clusters to improve electricity reliability and reduce dependency on conventional grids. Policy support, including subsidies, financing schemes, and renewable energy mandates, encourages private and public sector investment. The expansion of rural micro-enterprises, increasing energy demand for irrigation and small industries, and rising awareness of clean energy solutions further drive market growth. Technological advancements in energy storage and smart monitoring enhance efficiency and scalability of mini grids.

The mini grid market in France is projected to grow at a CAGR of 13.9% from 2025 to 2035, driven by renewable energy integration and rural electrification in overseas territories. Decentralized energy solutions, including solar and wind-based mini grids, are deployed to enhance energy security and reduce grid dependency. Policy frameworks and incentives for clean energy adoption encourage both public and private sector investments. France’s focus on sustainable energy targets, combined with smart grid innovations and energy storage systems, supports market expansion. Demand is further enhanced by industrial clusters and isolated communities seeking reliable and autonomous energy solutions.

The mini grid market in the UK is expected to grow at a CAGR of 12.5% from 2025 to 2035, driven by off-grid energy solutions, renewable integration, and industrial applications. Solar and wind mini grids, often combined with battery storage, are increasingly deployed in remote regions, islands, and industrial estates. Policy incentives and funding programs support private investment and pilot projects, while local utilities explore hybrid and smart grid systems to enhance reliability. Demand is further driven by corporate sustainability initiatives and decentralized energy projects. Technological improvements in monitoring, storage, and hybridization are enhancing the scalability and efficiency of mini grids.

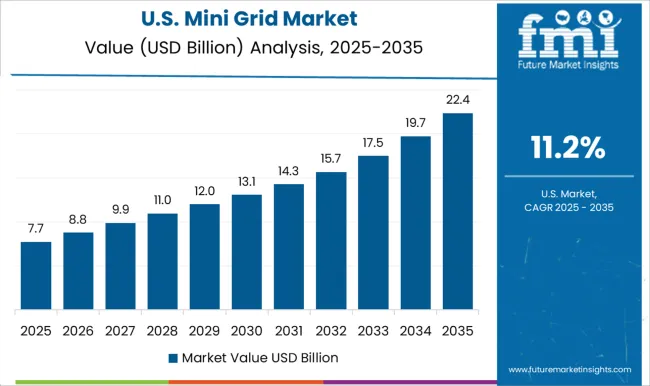

The mini grid market in the USA is projected to grow at a CAGR of 11.2% from 2025 to 2035, supported by rising interest in decentralized energy solutions, renewable adoption, and resilience planning. Remote communities, islands, and critical infrastructure projects are increasingly deploying solar, wind, and hybrid mini grids to ensure reliable energy supply. Federal and state incentives for renewable energy, energy storage, and smart grid integration further drive adoption. Industrial and commercial applications, including microgrids for campuses and manufacturing facilities, are emerging as key growth areas. Technological advancements in energy management and hybrid systems enhance operational efficiency, reliability, and scalability of mini grid projects.

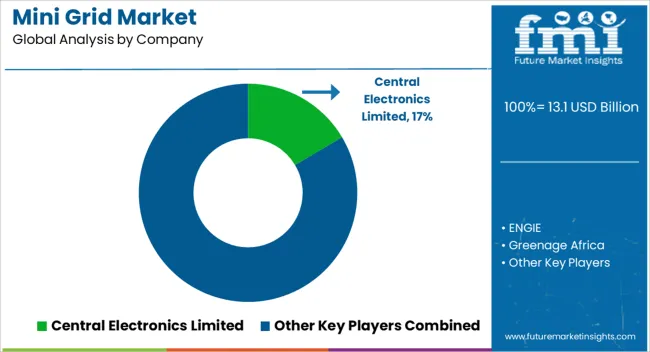

Competition in the mini grid market is primarily influenced by technology adoption, deployment efficiency, and service reliability. Central Electronics Limited, ENGIE, Greenage Africa, GSOL Energy, Husk Power Systems, Nuru SASU, OMC Power, PowerGen Renewable Energy, Solar Philippines, and Zola Electric lead by offering solar, hybrid, and biomass-based mini grid solutions specifically designed for rural and off-grid regions. Product differentiation is achieved through modular and scalable system designs, advanced smart metering, energy storage integration, and hybrid control systems, which ensure uninterrupted power supply even in regions with highly variable demand. Regional and emerging market players focus on cost-efficient, scalable solutions with rapid deployment capabilities, addressing the energy needs of communities with limited access to centralized grids. Emphasis is placed on robust energy management software, remote monitoring, predictive maintenance, and real-time system diagnostics to enhance reliability and reduce operational downtime. Market strategies across leading companies prioritize turnkey project execution, strategic local partnerships, and service-oriented business models, including pay-as-you-go and community-based energy programs. Advanced digital monitoring platforms, automated load balancing, and predictive analytics are leveraged as key differentiators to optimize grid performance while ensuring adherence to local regulatory frameworks. Differentiation is further reinforced through IoT-enabled smart meters, mobile payment integration, and intuitive user interfaces for end consumers. Companies aim to achieve a balance between affordability and technical reliability, ensuring mini grids deliver continuous energy access while complying with regional energy policies and environmental standards. The market demonstrates intense competition based on operational efficiency, innovative financing models, and technology-driven solutions. Global and regional players maintain leadership by providing scalable, reliable, and community-focused energy systems, with an emphasis on performance optimization, cost-effectiveness, and sustainable energy delivery. Long-term growth is supported through ongoing technology enhancements, flexible deployment strategies, and customer-centric service offerings, reflecting a highly dynamic market landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.1 Billion |

| Fuel | Solar, Hydro, Diesel/HFO, and Others |

| Storage Device | Lead Acid, Lithium-Ion, and Others |

| Consumer Type | Business, Household, and Public |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Central Electronics Limited, ENGIE, Greenage Africa, GSOL Energy, Husk Power Systems, Nuru SASU, OMC Power, PowerGen Renewable Energy, Solar Philippines, and Zola Electric |

| Additional Attributes | Dollar sales, share, energy generation capacity, regional deployment, technology type demand, government incentives, competitor landscape, pricing trends, rural electrification projects, system efficiency, financing models, maintenance services. |

The global mini grid market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the mini grid market is projected to reach USD 45.3 billion by 2035.

The mini grid market is expected to grow at a 13.2% CAGR between 2025 and 2035.

The key product types in mini grid market are solar, hydro, diesel/hfo and others.

In terms of storage device, lead acid segment to command 39.6% share in the mini grid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Miniplate for Bone Fixation Market Size and Share Forecast Outlook 2025 to 2035

Miniature Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mini Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Mini Packaging Market Size, Growth, and Forecast for 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA