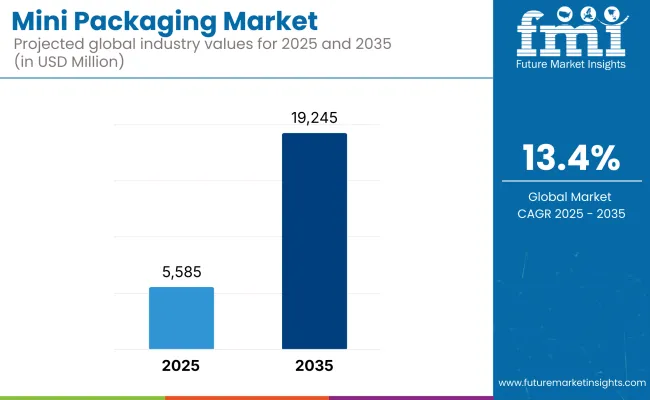

As of 2025, the global Mini Packaging market dedicated to cosmetics and personal care is valued at approximately USD 5,585 million and is expected to grow at aCAGR of 13.2%, reaching around USD 19,245 million by 2035.

Mini Packaging Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5,585 Million |

| Forecast Value in (2035F) | USD 19,245 Million |

| Forecast CAGR (2025 to 2035) | 13.4% |

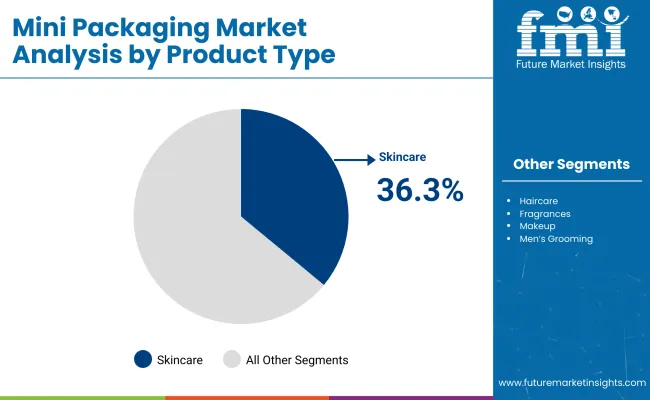

Significant traction is being generated by increased demand for compact, travel-friendly, and single-use product formats, particularly in skincare, where segmental share is pegged at 36.3%. The consumer shift toward trial-size solutions and personalized beauty routines is creating long-term avenues for Mini Packaging to evolve beyond its sampling roots and into core brand strategy. High product turnover and the rising influence of direct-to-consumer (DTC) channels are also playing a central role in accelerating adoption.

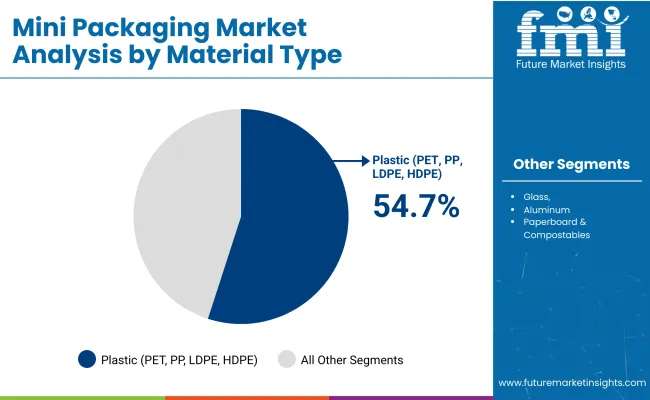

In 2025, plastic materials including PET, PP, LDPE, and HDPE are projected to dominate Mini Packaging construction, accounting for 54.7% of the global market. Mini tubes are emerging as the preferred format for mass and prestige brands alike, generating USD 1,792.7 million in value.

The USA market alone contributes USD 1,318 million in 2025, of which mini tubes command 34.1%, reflecting premiumization and gifting-oriented consumption behavior. China follows with a market worth USD 743 million, where sample sachets account for 36.4%, aligning with a fast-adopting consumer base and a flourishing online retail ecosystem.

Regional disparities in material compliance, consumer purchasing patterns, and brand localization strategies are collectively shaping growth paths across the USA, China, India, Germany, Japan, and the UK

By 2035, Mini Packaging formats are likely to become embedded in mainstream portfolios across both luxury and massive categories. Growth will be increasingly supported by innovations in recyclable and refillable structures, with mono-material packaging and sustainable ink applications gaining prominence. Markets in Asia, particularly India and China, are projected to outperform on the back of favorable demographics and mobile commerce proliferation.

As Albéa Group holds a 23.1% global market share in 2025, competitive focus is expected to intensify around format differentiation, material innovation, and regulatory compliance. By the close of the decade, Mini Packaging will not only respond to consumer convenience but also become a visible representation of brand sustainability commitments.

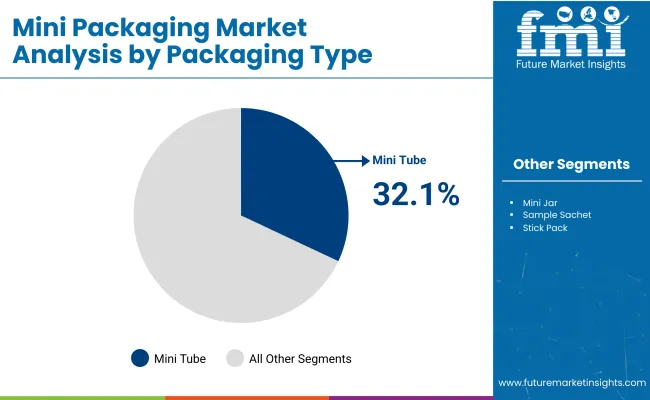

The global Mini Packaging market for cosmetics and personal care is being reshaped by compact lifestyle demands, premium trial culture, and rapid DTC brand proliferation. With an estimated value of USD 5,585 million in 2025, the market is projected to reach USD 19,245 million by 2035, registering a robust CAGR of 13.2%. Growth is being primarily underpinned by the rising influence of mini tubes, which are forecast to command the leading share at 32.1% in 2025.

These formats are being favored for their versatility across creams, gels, and skincare serums, making them a functional and aesthetic fit across mass, masstige, and luxury portfolios. While traditional packaging still dominates high-volume products, mini formats are being positioned as strategic SKUs for customer acquisition, gifting, and refill innovations.

Regional dynamics are playing a critical role in shaping adoption cycles. Asia Pacific is witnessing aggressive uptake fueled by mobile-first e-commerce, rising beauty consumption, and product personalization trends, especially in China, India, and Southeast Asia. North America continues to remain a lucrative zone, where DTC brands are leveraging Mini Packaging for influencer marketing and low-risk trials.

Europe, backed by mature sustainability regulations, is driving adoption of recyclable and mono-material mini formats. Competitive activity from established players like Amcor plc, Berry Global, and Huhtamaki is being directed at innovating compact, high-barrier solutions suited for mini applications. While not all players are mini-exclusive, their technological and material capabilities are being repurposed to address the surge in demand for micro-scale beauty formats.

Demand for Mini Packaging in the cosmetics and personal care industry is being elevated by the increasing adoption of DTC and e-commerce models, where brands are prioritizing compact, lightweight formats to enhance logistics, sampling, and consumer onboarding strategies. Travel-size tubes, sachets, and mini jars are being positioned as core acquisition tools for new customers, especially in skincare, fragrance, and color cosmetics.

Subscription boxes and influencer kits are relying heavily on Mini Packaging to deliver curated product experiences with minimal fulfillment cost. The convenience of small-format packaging is being paired with digitally interactive designssuch as QR-enabled sachets and refill pouchesmaking them effective both for trial and repeat purchase cycles.

Growth is also being shaped by changing consumer behavior favoring portability, personalization, and premium trialing. High interest in on-the-go skincare and grooming routines is driving demand for formats that fit easily into handbags, travel kits, or gym bags. Moreover, as self-care trends strengthen post-pandemic, the need for hygienic, single-use formats is being reinforced.

Mini tubes and dropper bottles are being used to deliver active skincare and serums in precise doses, catering to beauty users who seek control over regimen layering and formula freshness. This shift is further amplified by increased product launches in tiered price ranges, where Mini Packaging is being used to test market response before committing to full-size inventory.

Brand strategies are evolving to embrace Mini Packaging not just as a marketing or sampling tool, but as a retail-ready SKU optimized for limited editions, seasonal gifting, and personalization campaigns. Retail shelf constraints and consumer demand for variety have prompted beauty players to offer value packs of mini-size products.

Environmental concerns are also influencing purchase preferences, with brands experimenting with refill systems where mini containers serve as the refillable core or sample-first option. These evolving dynamicscentered on convenience, experimentation, and digital-led engagementare contributing to the robust uptake of Mini Packaging across both mass and premium beauty segments.

The global Mini Packaging market for cosmetics and personal care is comprehensively segmented across Packaging Type, Material Type, Product Type, Distribution Channel, and Region. In terms of packaging type, the market includes Mini Tubes, Mini Jars, Sample Sachets, Stick Packs, Mini Spray Bottles, Roll-ons, Mini Droppers & Vials, Snap Pods & Capsules, and Travel-size Pouches.

Each format caters to different product textures and consumer usage occasions, from skincare creams in tubes to trial fragrances in vials. On the material front, the segmentation comprises Plastic variants (PET, PP, LDPE, HDPE), Glass, Aluminum, Paperboard & Compostables, Biodegradable Polymers, and Hybrid Materials, reflecting the growing balance between durability, sustainability, and design flexibility.

Product Type segmentation spans a broad range of beauty and hygiene applications, including Skincare, Haircare, Fragrances, Makeup, Men’s Grooming, Bath & Body, Oral Care, and Sun Care & Baby Care. Distribution is spread across multiple channels such as Beauty Retail Chains, DTC & E-commerce Brands, Subscription & Sampling Boxes, Airport Duty-Free & Travel Retail, Hotels & Hospitality Toiletries Suppliers, Dermatology Clinics / Spas / Salons, and Mass Retail.

Regionally, the market is assessed across North America, Latin America, Western and Eastern Europe, Balkan and Baltic Countries, Russia and Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa each reflecting varying levels of adoption and innovation based on consumer demographics, retail infrastructure, and sustainability mandates.

| Packaging Type | Market Value Share, 2025 |

|---|---|

| Mini Tubes | 32.1% |

| Others | 67.9% |

The Mini Tubes segment is projected to account for 32.1% of the global Mini Packaging Market revenue in 2025, emerging as the dominant format within the packaging type segment. This leadership is attributed to its widespread use in skincare, creams, lotions, and serums particularly among both premium and mass-market beauty brands. Mini tubes offer controlled dispensing, portability, and a familiar user experience, making them ideal for daily-use and travel-ready cosmetic applications.

The format's growing popularity is further supported by its compatibility with sustainable materials, such as mono-layer plastics and recyclable laminates. Manufacturers are investing in design flexibility, enabling tubes to support airless pumps, applicator tips, and tamper-evident closures. As consumer expectations shift toward convenient and hygienic delivery systems, mini tubes are being enhanced with aesthetic features and material innovations to appeal across demographics. The segment is expected to retain its dominance through 2035, particularly as refillable and limited-edition product formats become more prominent in skincare and personal care brand strategies.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Plastic (PET, PP, LDPE, HDPE) | 54.7% |

| Others | 45.3% |

The material composition of Mini Packaging in cosmetics and personal care is segmented into Plastic (PET, PP, LDPE, HDPE), Glass, Aluminum, Paperboard & Compostables, Biodegradable Polymers, and Hybrid Materials. Among these, plastics continue to dominate due to their moldability, cost efficiency, and wide compatibility with different product textures like lotions, gels, and serums.

PET and PP are frequently used for mini bottles and jars, while LDPE and HDPE are preferred in squeeze tubes and sachets due to their flexibility. However, the environmental impact of plastics is being increasingly scrutinized, prompting the adoption of sustainable material alternatives.

Glass, while heavier and fragile, is being chosen by premium skincare and fragrance brands for its aesthetic appeal and recyclability. Aluminum is used in roll-ons, sprays, and select luxury containers due to its barrier protection and perceived product purity. Paperboard and compostable are gaining traction as brands experiment with eco-forward sachets and mono-material pouches.

Biodegradable polymers, particularly PLA and PHA, are being tested in sample packaging formats where end-of-life disposal is a key brand concern. Hybrid materials that blend rigid and flexible elementssuch as a recyclable outer with a refillable innerare being piloted for their ability to offer sustainability without compromising functionality. As regulatory pressure builds and conscious consumerism intensifies, material selection in Mini Packaging is expected to evolve rapidly over the forecast period.

| Product Type | Market Value Share, 2025 |

|---|---|

| Skincare | 36.3% |

| Others | 63.7% |

The skincare segment is projected to account for the largest share of the Mini Packaging market in 2025, contributing 36.3% of global revenue. This dominance is being driven by the rising popularity of ingredient-focused beauty, multi-step routines, and travel-ready skincare solutions.

Consumers are gravitating toward smaller, trial-size versions of serums, moisturizers, creams, and cleansers, which allow them to test products before committing to full-size purchases. In addition, skinimalism and dermo-cosmetic trends have fueled demand for precise, hygienic, and portable formatsneeds that Mini Packaging addresses effectively.

Haircare and fragrances follow as notable sub-segments, contributing 14.8% and 11.2% respectively. Hair oils, conditioners, and leave-in treatments in sachets and mini tubes are gaining visibility in both travel and salon formats. Fragrance testers and travel sprays are becoming essential for gifting, personalization, and high-margin retailing.

The sun care and baby care segment, with a 9.1% share, is also showing robust interest as consumers seek convenience and compliance with usage on-the-go. Across categories, brands are leveraging Mini Packaging to diversify retail SKUs, improve accessibility, and align with sustainability-led formulations that encourage mindful consumption. This evolution in product format strategy continues to propel segment-level expansion across multiple personal care domains.

Personalization-Driven SKU Expansion by Indie and DTC Brands

The rise of indie and direct-to-consumer (DTC) beauty brands is actively driving demand for Mini Packaging formats as these players seek to personalize offerings and optimize fulfillment logistics. Instead of launching full-size products in bulk, many startups and challenger brands are adopting mini tubes, vials, and sachets to test consumer response, enable subscription sampling, and offer limited-edition personalized sets.

These small-format SKUs reduce upfront production risks and enhance online conversion through curated experiences. In DTC ecosystems, Mini Packaging is not treated as a secondary trial tool but as a frontline revenue generator strategically deployed in influencer kits, seasonal drops, and subscription bundles.

Regulatory Pressure and Shelf Optimization in Travel Retail and Hotel Amenities

Tightening global regulations on liquid carry-on limits in air travel, along with sustainability mandates in the hospitality sector, are pushing brands and suppliers to prioritize mini packaging. Travel retail channelsincluding airport duty-free, airline kits, and hotel toiletriesare demanding formats that comply with both volume restrictions and eco-packaging criteria.

This has created a surge in demand for compact, recyclable, and refillable formats such as snap pods, mini spray bottles, and compostable sachets. Additionally, hospitality chains are phasing out bulk dispensers in favor of hygienic single-use or refillable mini packs to align with guest safety expectations and ESG reporting standards.

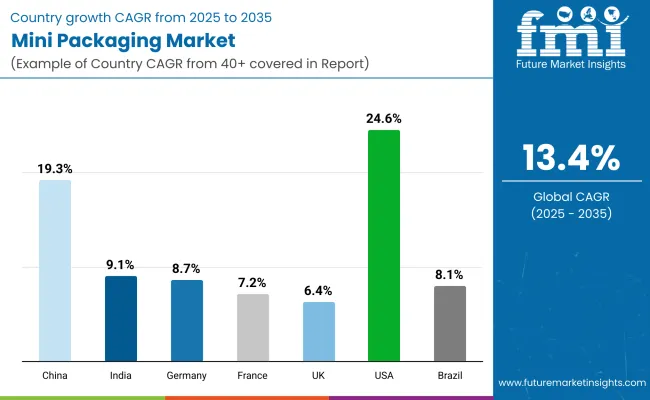

| Countries | CAGR |

|---|---|

| China | 19.3% |

| India | 9.1% |

| Germany | 8.7% |

| France | 7.2% |

| UK | 6.4% |

| USA | 24.6% |

| Brazil | 8.1% |

From 2025 to 2035, the Mini Packaging Market for Cosmetics & Personal Care is expected to expand at varying paces across key global economies, reflecting distinct adoption drivers and maturity levels. The United States emerges as the fastest-growing market, registering a CAGR of 24.6%, attributed to the rapid scale-up of indie brands, premium sampling strategies, and increasing consumer preference for TSA-compliant, on-the-go formats.

China, with a CAGR of 19.3%, ranks second, driven by social media-fueled beauty trends, high adoption of trial-sized skincare products, and increased penetration of e-commerce and influencer-led DTC brands. India posts a moderate CAGR of 9.1%, with growth supported by cost-sensitive consumer behavior, rising demand for affordable sachet formats, and growing rural distribution networks for personal care brands.

Germany and Brazil follow closely with CAGRs of 8.7% and 8.1%, respectively. In Germany, demand is spurred by eco-conscious packaging formats such as paperboard minis and compostables in natural and dermo-cosmetic product lines. Brazil’s performance is rooted in strong demand for mini haircare and bath & body formats in mid-income segments, with innovations in biodegradable tubes gaining traction. France, with a CAGR of 7.2%, benefits from the strong presence of luxury brands and their reliance on travel retail and subscription box sampling formats.

The UK shows relatively slower growth at 6.4% CAGR, hindered by packaging regulation uncertainties post-Brexit and a saturated beauty retail ecosystem, though momentum continues in refillable and recyclable mini-format innovations across skincare and makeup. Overall, growth patterns highlight regional divergences in consumer habits, retail penetration, sustainability mandates, and the degree of DTC beauty adoption.

| Year | USA Mini Packaging Market |

|---|---|

| 2025 | 1317.99 |

| 2026 | 1473.69 |

| 2027 | 1647.78 |

| 2028 | 1842.44 |

| 2029 | 2060.10 |

| 2030 | 2303.47 |

| 2031 | 2575.59 |

| 2032 | 2879.85 |

| 2033 | 3220.06 |

| 2034 | 3600.46 |

| 2035 | 4025.80 |

Between 2025 and 2035, the USA Mini Packaging market is projected to witness explosive growth, expanding nearly 9 timesin value. This growth is driven by the booming demand for travel-friendly, sample-sized, and premium-feel packaging formats across skincare, cosmetics, and fragrance categories. DTC brands and subscription boxes are accelerating the push for variety-driven, trial-based beauty consumption.

Moreover, sustainability mandates are pushing brands toward recyclable and compostable mini formats, further unlocking innovation across the plastic-alternative material spectrum. With strong traction in e-commerce and experiential sampling models, the USA is expected to retain its status as the most lucrative country-level market for Mini Packaging over the decade.

The Mini Packaging market in the United Kingdom is expected to grow at a steady CAGR of 6.4% from 2025 to 2035, supported by the evolving preferences of urban consumers for travel-sized, portable, and on-the-go beauty and personal care products. A surge in premium skincare, fragrance samplers, and travel kits across retail and e-commerce channels is fueling demand.

Moreover, the increasing adoption of sustainability-focused packagingsuch as recyclable paperboard pods and refillable mini vialsis reshaping brand strategies. Growth is further underpinned by rising sampling campaigns, especially through beauty subscription boxes and pharmacy chains, enabling trial-based consumer engagement and incremental volume expansion.

The Mini Packaging market in India is projected to expand at a CAGR of 9.1% between 2025 and 2035, driven by affordability-focused consumer behavior and high demand for low-unit packs across rural and semi-urban regions. The popularity of sachet-based skincare, haircare, and oral care products continues to dominate shelf presence, especially in kirana stores and mass retail formats.

Urban growth is being shaped by travel-friendly packs and e-commerce-led sampling formats, particularly among Gen Z and millennial consumers. Local brands are increasingly investing in biodegradable and recyclable mini formats to align with evolving environmental norms, further boosting volume consumption. The proliferation of DTC beauty brands and dermatology clinics offering trial kits also reinforces Mini Packaging as a critical marketing and access tool in India's fragmented but fast-modernizing personal care ecosystem.

The Mini Packaging market in China is projected to witness strong growth, with sales expected to rise from USD 742.76 million in 2025to approximately USD 4,337.63 million by 2035, registering a robust CAGR of 19.3%. This rapid expansion is being shaped by shifting consumer preferences toward convenience, portability, and aesthetic-driven packaging formats across cosmetics and personal care. Skincare and makeup segments in particular are driving volume growth, with premium brands introducing trial-size kits and travel packs tailored for urban millennial and Gen Z consumers.

Additionally, China’s booming cross-border e-commerce and livestream shopping ecosystem is accelerating the adoption of mini formats as brand sampling tools. Domestic packaging manufacturers are also scaling up capacity for high-precision molding, recyclable plastics, and hybrid material formats in response to regulatory pressure and sustainability goals. With increased investments from global and local players into Mini Packaging innovations, the Chinese market is poised to remain a central growth engine for the global Mini Packaging ecosystem.

| Region | 2025 Share (%) |

|---|---|

| UK | 6.3% |

| Germany | 7.4% |

| Italy | 3.8% |

| France | 5.1% |

| Spain | 2.6% |

| BENELUX | 2.9% |

| Nordic | 3.5% |

| Rest of Europe | 4.8% |

| Region | 2035 Share (%) |

|---|---|

| UK | 5.2% |

| Germany | 6.1% |

| Italy | 3.5% |

| France | 4.4% |

| Spain | 2.3% |

| BENELUX | 2.5% |

| Nordic | 3.2% |

| Rest of Europe | 4.3% |

The Mini Packaging market in Europe is expected to witness a moderate shift in regional market shares between 2025 and 2035. Germany is projected to retain the highest share among the listed countries, though its contribution is estimated to decline slightly from 7.4% in 2025 to 6.1% by 2035, reflecting maturing demand and stronger competition from emerging Asian markets.

The UK follows closely with a projected dip from 6.3% to 5.2%, while France, Italy, and Spain also show marginal contractions, indicating saturation in Western European markets. Meanwhile, the Rest of Europe, Nordic countries, and BENELUX region exhibit more stable trajectories, pointing to consistent but modest growth. These shifts signal a gradual redistribution of global demand, with Europe maintaining relevance but facing intensified global competition in innovation, cost-efficiency, and brand differentiation within the cosmetics and personal care packaging landscape.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Segment | 58.6% |

| Segment | 14.4% |

The Mini Packaging market in Japan is significantly skewed toward plastic-based components, capturing 58.6% of the total value share in 2025. This dominant reliance is attributed to Japan's strong on-the-go beauty culture, lightweight packaging preference, and compatibility of plastics (PET, PP) with mini tubes, jars, and roll-ons.

Glass Mini Packaging follows with a 19.4% share, largely driven by demand for premium skincare and fragrance formats where luxury perception and recyclability hold consumer value. The remaining 22% is accounted for by aluminum, hybrid formats, paper-based materials, and biodegradable polymers.

This segment is expected to witness gradual growth, supported by Japan’s regulatory push for eco-responsible packaging and the rise of refillable, compostable innovations in mini formats. However, traditional consumer trust in quality plastics and glass aesthetics will continue to shape component preferences across Japan’s high-end personal care space.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Segment | 48.2% |

| Segment | 51.8% |

In South Korea’s Mini Packaging market for cosmetics and personal care, skincare applications are projected to account for 48.2% of the total value in 2025. The country's long-standing global influence in skincare trends, coupled with the popularity of 10-step routines and trial-size K-beauty kits, is sustaining demand for mini tubes, jars, and droppers tailored to creams, serums, and essences.

However, the “Others” category dominates slightly at 51.8%, driven by expanding demand for portable formats in haircare, fragrances, and cosmetics. The rise of gender-neutral and youth-targeted makeup lines in stick pack formats, paired with travel-size perfumes and hybrid wellness offerings, are expanding Mini Packaging formats beyond traditional skincare. E-commerce sampling, influencer-curated kits, and consumer openness to format innovation are creating lucrative growth avenues across all product categories in South Korea.

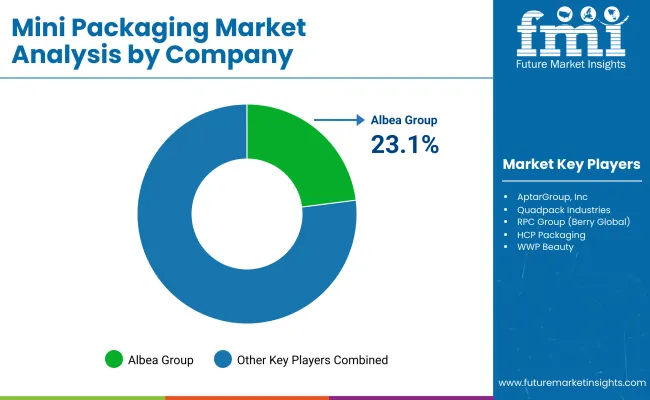

| Players | Global Value Share 2025 |

|---|---|

| Albéa Group | 23.1% |

| Others | 76.9% |

In 2025, Albéa Group is estimated to dominate the global Mini Packaging market in cosmetics and personal care with a 23.1% value share, reflecting its strong global footprint, expansive portfolio in travel-size packaging formats, and strategic partnerships with beauty and skincare brands.

The remaining 76.9% of the market is distributed among several regional and international players, with notable contributions from AptarGroup, Quadpack, Berry Global (RPC Group), and others, each leveraging specialized capabilities across dispensing, material innovation, and design customizations.

Regionally entrenched specialists like Samhwa Co., Ltd., Nest-Filler, and WWP Beauty are capitalizing on the rising regional demand for compact, lightweight packaging in East Asian markets. These companies focus heavily on airless systems, refillable formats, and ergonomically optimized designs, often tailored for K-beauty, J-beauty, and other regional skincare trends. Their strengths lie not in global reach but in localized engineering, fast prototyping, and packaging innovation aligned with regional aesthetic preferences.

Key Developments In Mini Packaging Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,585 Million |

| Packaging Type | Mini Tubes, Mini Jars, Sample Sachets, Stick Packs, Mini Spray Bottles, Roll-ons, Mini Droppers & Vials, Snap Pods & Capsules, Travel-size Pouches. |

| Material Type | Plastic (PET, PP, LDPE, HDPE), Glass, Aluminum, Paperboard & Compostables, Biodegradable Polymers, Hybrid Materials |

| Product Type | Skincare, Haircare, Fragrances, Makeup, Men’s Grooming, Bath & Body, Oral Care, Sun Care & Baby Care |

| Distribution Channel | Beauty Retail Chains, DTC & E-commerce Brands, Subscription & Sampling Boxes, Airport Duty-Free & Travel Retail, Hotels & Hospitality Toiletries Suppliers, Dermatology Clinics / Spas / Salons, Mass Retail. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Companies Profiled | Albéa Group, AptarGroup, Inc., Quadpack Industries, RPC Group (Berry Global), HCP Packaging, WWP Beauty, Nest-Filler, Premi Beauty Industries, Coverpla, Samhwa Co., Ltd. |

| Additional Attributes | Global and regional dollar sales by packaging type, Product Type, and material format; growth patterns across mini tubes, jars, sachets, roll-ons, and vials; segmentation by biodegradable, hybrid, and recyclable materials; rising demand for compact, travel-friendly, and refillable beauty formats; evolving preferences driven by sampling culture, sustainability, and personalization; adoption trends across beauty retail, e-commerce, and travel retail channels; application-specific traction in skincare, haircare, and fragrance segments; integration of functionality enhancements like precision dispensing, tamper-proof sealing, and single-dose delivery; influence of regulatory shifts and sustainable packaging mandates in Europe, North America, and Asia; and competitive benchmarking focused on aesthetic innovation, portability, and mono-material compatibility. |

The global Mini Packaging Market is estimated to be valued at USD 5,585 million in 2025.

The market size for the Mini Packaging Market is projected to reach USD 19,245 million by 2035.

The Mini Packaging Market is expected to grow at a CAGR of 13.2% between 2025 and 2035.

The key product types in the Mini Packaging Market include Mini Tubes, Mini Jars, Sample Sachets, Stick Packs, Mini Spray Bottles, Roll-ons, Mini Droppers & Vials, Snap Pods & Capsules, and Travel-size Pouches.

In terms of packaging type, the Mini Tubes segment is projected to command the largest share of 32.1% in the Mini Packaging Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VOC Minimization Packaging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Printed Aluminium Foil Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Printed Aluminium Foil Packaging

Miniplate for Bone Fixation Market Size and Share Forecast Outlook 2025 to 2035

Miniature Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Mini Track Machinery Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mini Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA