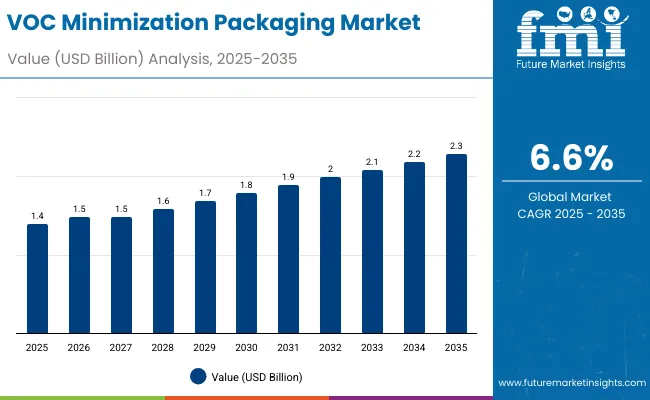

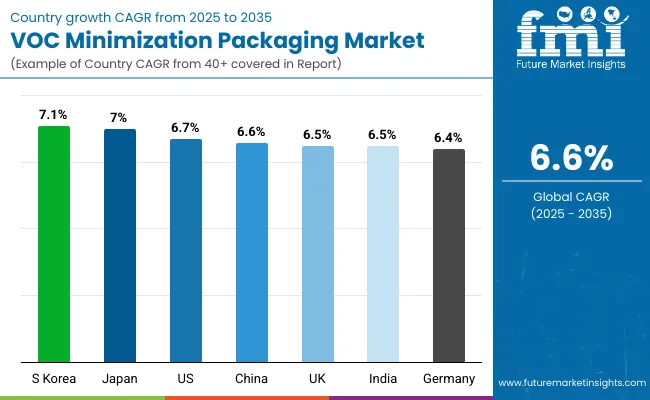

The VOC minimization packaging market will expand from USD 1.4 billion in 2025 to USD 2.7 billion by 2035, advancing at a CAGR of 6.6%. Growth is driven by regulatory pressure to reduce volatile organic compound (VOC) emissions and the increasing use of water-based and solvent-free materials. Solvent-free laminates lead adoption due to reduced environmental impact and superior adhesion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.5 billion from flexible packaging adoption. From 2030 to 2035, another USD 0.8 billion will be generated from eco-friendly inks and coatings. Asia-Pacific leads expansion, driven by green manufacturing policies and low-VOC technology investments.

From 2020 to 2024, VOC minimization packaging technologies gained traction amid global initiatives to reduce solvent emissions. Food and pharmaceutical packaging manufacturers replaced solvent-based coatings with water-based and UV-curable alternatives.

By 2035, the market will reach USD 2.7 billion, growing at 6.6% CAGR. Solvent-free adhesives and bio-based plastics will dominate the segment. Asia-Pacific will lead innovation through stricter emission laws, while North America and Europe will focus on recyclability and corporate carbon footprint reduction.

Growth is driven by sustainability goals, emission regulations, and the transition from solvent-based to low-VOC materials. Food, beverage, and healthcare packaging producers adopt water-based inks, solvent-free laminations, and recyclable coatings to meet regulatory standards.

Governments and brands aim for net-zero VOC emissions by 2030, reinforcing demand for sustainable packaging technologies. Adoption of eco-adhesives and low-VOC inks ensures reduced environmental footprint and improved occupational safety.

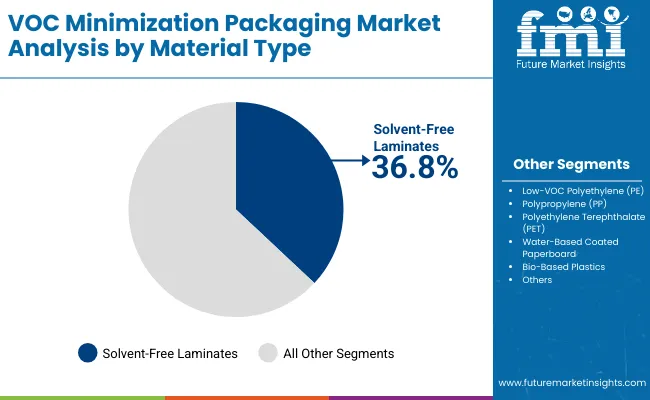

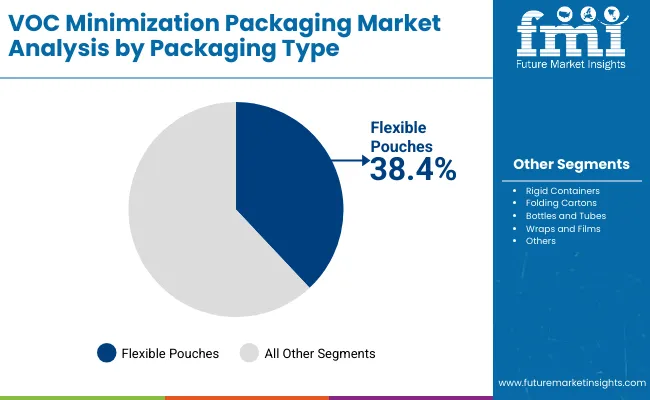

The market is segmented by material, technology, packaging type, end-use industry, and region. Materials include solvent-free laminates, low-VOC polyethylene, PP, PET, coated paperboard, and bio-based plastics. Technologies include solvent-free lamination, water-based coatings, UV-curable coatings, plasma/corona treatments, and extrusion with VOC capture. Packaging types include flexible pouches, rigid containers, folding cartons, bottles, and wraps.

Solvent-free laminates will hold 36.8% share in 2025, favored for sustainability, high bond strength, and food safety compliance. They are used extensively in flexible pouches and folding cartons.

Future demand will rise with improved solvent-free adhesive performance and biodegradable film compatibility.

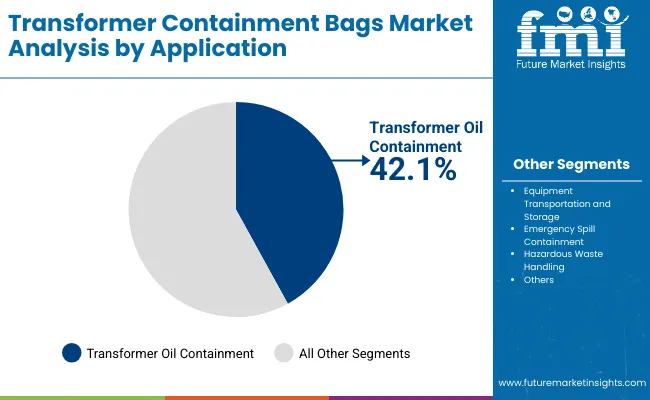

This technology will account for 42.1% share in 2025, driven by high-speed lamination, VOC reduction, and consistent bonding strength. It supports food and pharmaceutical packaging where emission control is crucial.

By 2035, advanced resin chemistries and automation will further enhance solvent-free lamination adoption.

Flexible pouches will represent 38.4% share in 2025, supported by lightweight structure, minimal material waste, and adaptability to solvent-free adhesives.

By 2035, these will continue dominating due to recyclability improvements and the expansion of bio-based plastic films.

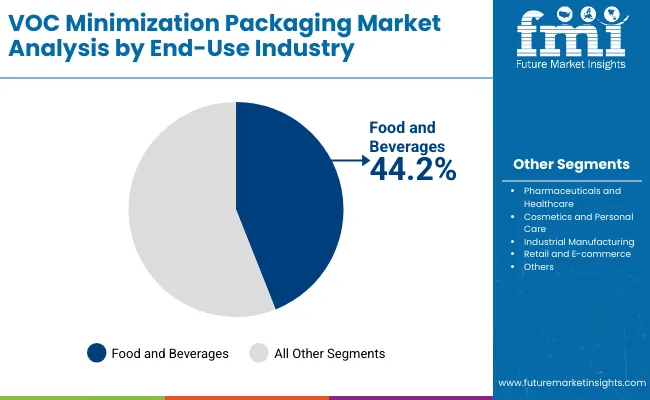

The food and beverages sector will hold 44.2% share in 2025, driven by regulatory requirements for safe, emission-free packaging.

Future growth will benefit from rapid development of eco-inks and laminates for processed and on-the-go products.

Strict global emission regulations and rising demand for sustainable packaging drive adoption. Water-based coatings and UV-curable inks replace traditional solvent-based options.

High setup costs and slower curing speeds in water-based systems hinder adoption. Adhesion challenges with certain substrates also limit scalability.

Innovations in bio-based adhesives and hybrid coating technologies create new possibilities. Recyclable flexible packaging offers future potential in FMCG and healthcare.

Emerging trends include VOC capture systems, UV-curable digital printing, and hybrid adhesive chemistries. Digital automation ensures uniform coating and emission control.

The global VOC minimization packaging market is growing rapidly as sustainability, emission control, and green packaging mandates reshape industry practices. Asia-Pacific leads in adoption, supported by large-scale eco-policy enforcement and rising FMCG production. Europe focuses on certified low-emission materials under strict environmental laws, while North America integrates VOC-free coatings across major food and personal care lines. Global investments in water-based adhesives, solvent-free laminates, and eco-compliant films are driving the shift toward next-generation sustainable packaging.

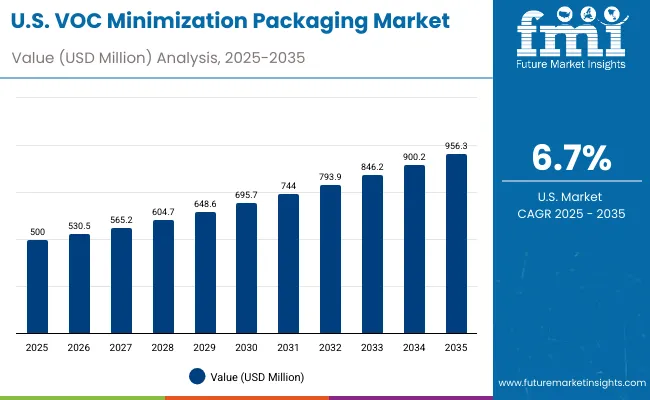

The USA market will grow at a CAGR of 6.7% from 2025 to 2035, driven by VOC-free solutions in food and personal care packaging. Green manufacturing initiatives are fueling adoption of solvent-free coatings and adhesives. FMCG players are replacing conventional laminations with water-based alternatives to meet EPA and sustainability standards. Continuous R&D in low-VOC materials ensures improved safety, compliance, and durability in packaging operations across sectors.

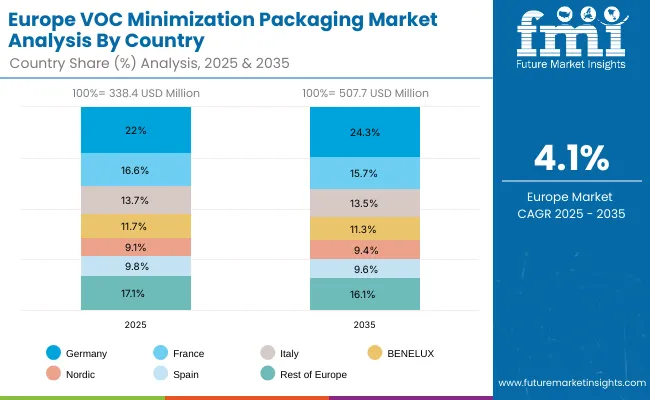

Germany will expand at a CAGR of 6.4%, underpinned by EU emission control regulations and sustainability commitments. Packaging manufacturers are transitioning to water-based and solvent-free adhesives aligned with circular economy goals. High investment in R&D for low-VOC coatings is boosting exports. The integration of smart quality systems ensures compliance with evolving EU directives, making Germany a leader in sustainable packaging material innovation.

The UK market will grow at a CAGR of 6.5%, driven by increased demand for recyclable and bio-based pouch packaging. Retailers and FMCG producers are shifting to VOC-free inks and laminates to meet environmental and retail compliance standards. The government’s packaging waste regulations are reinforcing the shift toward eco-certified products. Local converters are investing in greener coating technologies, positioning the UK as an innovator in recyclable flexible packaging.

China will grow at a CAGR of 6.6%, supported by strong government-led eco-policy reforms and industrial modernization. Domestic manufacturers are scaling production of low-VOC films and adhesives to replace traditional solvent-based products. Rapid urbanization and e-commerce expansion are creating high demand for sustainable packaging across industries. The government’s push for green factories and emission-free packaging solutions is accelerating adoption nationwide.

India will grow at a CAGR of 6.5%, propelled by policy-driven sustainability goals and growing FMCG demand. Packaging manufacturers are transitioning to water-based printing inks and solvent-free laminates to meet global compliance standards. Government reforms encouraging cleaner industrial practices are accelerating modernization. SMEs are also adopting low-VOC technologies to meet export requirements, reinforcing India’s position as a key green packaging hub.

Japan will grow at a CAGR of 7.0%, led by increasing adoption of low-emission, recyclable packaging materials. Advanced technology integration supports VOC reduction and recyclability across high-end packaging applications. Manufacturers are introducing lightweight pouches with improved barrier and eco-properties. Japan’s continuous innovation in bio-based coatings and solvent-free adhesives ensures competitiveness in export-driven sectors like healthcare and electronics.

South Korea will lead with a CAGR of 7.1%, supported by advanced R&D incentives and the rapid adoption of smart eco-packaging systems. The focus on bioplastic laminates and advanced VOC-free coatings aligns with national green certification programs. Integration of digital monitoring in packaging processes is improving quality control. South Korea’s export-oriented industries are accelerating use of VOC-minimized packaging, positioning it as a technology hub for sustainable solutions.

Japan’s VOC minimization packaging market, valued at USD 200 million in 2025, is dominated by solvent-free laminates with a 35.0% share, owing to their reduced emissions and strong barrier performance. Low-VOC polyethylene accounts for 16.7%, widely used for flexible films in food and healthcare packaging. Polypropylene represents 15.3%, favored for recyclability and cost efficiency. PET contributes 14.0% due to high clarity and heat resistance, while water-based coated paperboard (12.1%) and bio-based plastics (6.8%) support eco-friendly material substitution. Market expansion is driven by Japan’s strict VOC emission standards and the packaging industry’s transition to solventless, low-carbon production technologies.

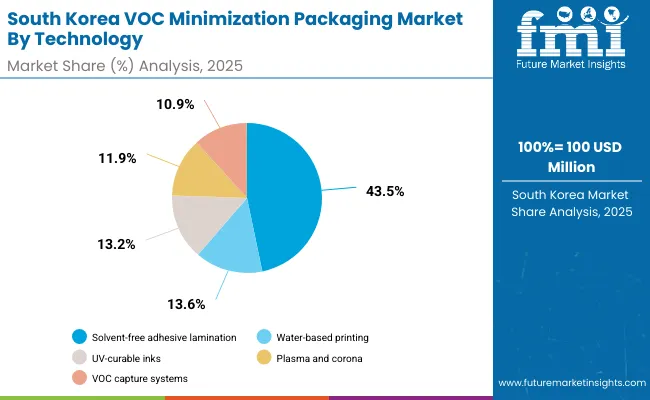

South Korea’s VOC minimization packaging market, estimated at USD 100 million in 2025, is led by solvent-free adhesive lamination with a 43.5% share, reflecting widespread use in flexible packaging lines. Water-based printing and coating account for 13.6%, supporting eco-compliant labeling and decorative finishes. UV-curable inks and coatings represent 13.2%, offering rapid curing and minimal solvent release. Plasma and corona surface treatments contribute 11.9%, enhancing adhesion for recyclable substrates, while extrusion coating with VOC capture systems holds 10.9%. Rising environmental regulations, energy-efficient curing systems, and automation-based upgrades are accelerating Korea’s move toward sustainable packaging technologies.

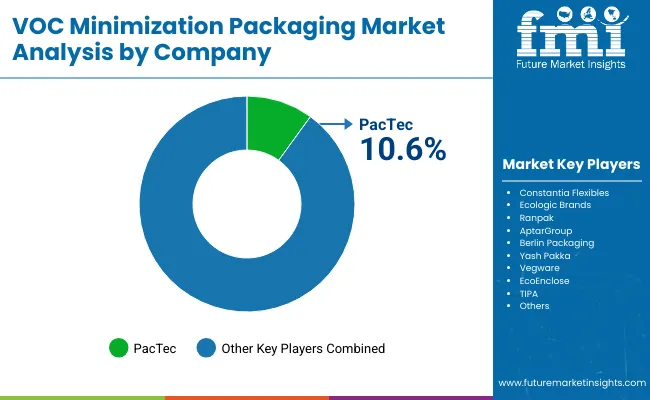

The market is moderately fragmented with key players PacTec, Constantia Flexibles, Ecologic Brands, Ranpak, AptarGroup, Berlin Packaging, YashPakka, Vegware, EcoEnclose, and TIPA. These companies focus on low-VOC technologies, recyclable films, and water-based adhesives.

Constantia Flexibles and TIPA lead solvent-free laminate innovations. YashPakka and Vegware pioneer bio-based packaging solutions. AptarGroup and Berlin Packaging focus on VOC-free coatings for food and pharmaceuticals. Competition centers on sustainability, recyclability, and emission compliance.

Key Developments of VOC Minimization Packaging Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| By Material | Solvent-Free Laminates, Low-VOC PE, PP, PET, Paperboard, Bio-Based Plastics |

| By Technology | Solvent-Free Adhesive Lamination, Water-Based Coatings, UV Inks, Plasma & Corona, Extrusion with VOC Capture |

| By Packaging Type | Flexible Pouches, Rigid Containers, Folding Cartons, Bottles, Wraps |

| By End-Use Industry | Food & Beverages, Pharmaceuticals, Cosmetics, Industrial, E-commerce |

| Key Companies Profiled | PacTec, Constantia Flexibles, Ecologic Brands, Ranpak, AptarGroup, Berlin Packaging, Yash Pakka, Vegware, EcoEnclose, TIPA |

| Additional Attributes | Growth driven by emission control mandates, solvent-free adhesive innovation, and recyclable film development. |

The market will be valued at USD 1.4 billion in 2025.

The market will reach USD 2.7 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Solvent-free adhesive lamination will dominate with a 42.1% share in 2025.

Flexible pouches will lead with a 38.4% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Avocado Oil Market Size and Share Forecast Outlook 2025 to 2035

Levocarnitine Market Size and Share Forecast Outlook 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Japan Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Online Advocacy Platform Market

Employee Advocacy Software Market Size and Share Forecast Outlook 2025 to 2035

Customer Advocacy Software Market - Enhancing Brand Loyalty

Bio-based and Low VOC Paints Market Size and Share Forecast Outlook 2025 to 2035

Volatile Organic Compound (VOC) Detector Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Avocado Oil in Western europe Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA