The Bio-based and Low VOC Paints Market is estimated to be valued at USD 20.3 billion in 2025 and is projected to reach USD 44.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded from USD 13.7 billion to USD 18.7 billion, driven by increasing regulatory pressure to reduce volatile organic compounds, rising environmental awareness, and demand from eco-conscious consumers. Early adopters focused on high-performance, environmentally friendly paint formulations for commercial and residential applications, establishing proof of concept and validating product performance.

From 2025 to 2030, the market enters the scaling phase, growing from USD 20.3 billion to USD 30.1 billion. Broader adoption occurs as industrial and architectural sectors increasingly switch to bio-based and low-VOC paints. Technological advancements improve coverage, durability, and color range, while manufacturers expand production capacity and distribution networks. Strategic collaborations with construction companies, architects, and paint formulators accelerate adoption across large projects.

Between 2030 and 2035, the market consolidates, reaching USD 44.6 billion. Leading players capture significant market share through innovation, cost optimization, and global expansion. Smaller players focus on niche or specialty applications. Growth stabilizes with steady demand from end-use industries, incremental product enhancements, and widespread regulatory compliance, reflecting a mature and competitive market environment.

| Metric | Value |

|---|---|

| Bio-based and Low VOC Paints Market Estimated Value in (2025 E) | USD 20.3 billion |

| Bio-based and Low VOC Paints Market Forecast Value in (2035 F) | USD 44.6 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The bio-based and low VOC paints market is experiencing significant traction driven by a confluence of environmental mandates, health-conscious consumer behavior, and sustainability goals across the construction and manufacturing sectors. Governments across regions have introduced strict regulations on solvent emissions and are incentivizing the use of environmentally responsible alternatives, positioning low VOC and bio-derived formulations as essential components of future-compliant coatings.

Manufacturers are increasingly investing in renewable feedstock technologies and green chemistry approaches to meet performance expectations while reducing ecological impact. Market dynamics are further influenced by the growing demand from green building projects, LEED certifications, and consumer preferences for non-toxic indoor environments.

Technological innovations in plant-based binders, solvent-free additives, and odorless formulations are enabling product differentiation and scalability As supply chain transparency and eco-labelling become standard expectations, the market is poised to expand, particularly in regions where sustainability regulations intersect with growing urban infrastructure development and residential renovation trends.

The bio-based and low VOC paints market is segmented by type, application, resins, distribution channel, end user, and geographic regions. By type, bio-based and low VOC paints market is divided into Low-VOC Paints, Bio-Based Paints, and Bio-Based and Low-VOC Hybrid Paints. In terms of application, bio-based and low VOC paints market is classified into Architectural Coatings, Industrial Coatings, Automotive Coatings, Marine Coatings, and Specialty Coatings.

Based on resins, bio-based and low VOC paints market is segmented into Acrylic Resins, Polyurethane Resins, Epoxy Resins, Alkyd Resins, and Other Resins. By distribution channel, bio-based and low VOC paints market is segmented into Retail Stores, Online Retail, Contractors/Distributors, and Direct Sales. By end user, bio-based and low VOC paints market is segmented into Residential Buildings, Commercial Buildings, Industrial Facilities, Transportation, and Other Industries. Regionally, the bio-based and low VOC paints industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Low VOC paints are projected to account for 44.6% of the total revenue share in the bio-based and low VOC paints market in 2025, establishing themselves as the leading type segment. This leadership is being shaped by evolving regulatory landscapes that prioritize reduced solvent emissions and by the increased adoption of healthier alternatives in both commercial and residential applications. These formulations provide a balance between performance and safety, meeting demand for durability and ease of application while minimizing health hazards associated with traditional coatings.

Manufacturers have focused on enhancing the composition of low VOC variants to match the adhesion, coverage, and longevity of solvent-based counterparts. The segment’s growth has also been supported by institutional mandates for eco-certified construction materials and increasing procurement preferences for sustainable building products.

Rising awareness among end users regarding indoor air quality and allergic sensitivities has accelerated market penetration. As environmental certifications and green procurement guidelines continue to proliferate, low VOC paints are expected to remain a primary solution for compliant, eco-conscious surface finishing.

Architectural coatings are anticipated to represent 41.3% of the overall revenue share in the bio-based and low VOC paints market by 2025, reflecting their dominance within the application category. The expansion of this segment has been supported by the rising number of green-certified residential and commercial buildings, along with increased regulatory scrutiny over emissions in indoor environments.

Bio-based and low VOC architectural coatings have gained traction in both new construction and refurbishment projects due to their compatibility with eco-design standards and human health considerations. Enhanced demand for aesthetically pleasing yet environmentally responsible finishes has spurred innovation in odor-free, fast-drying, and mildew-resistant solutions.

The broader adoption has also been enabled by builder and contractor preference for formulations that comply with regional air quality standards while offering ease of application and reduced recoat times. Public infrastructure upgrades and government incentives for sustainable materials have further reinforced the role of architectural coatings in advancing environmental building goals.

Acrylic resins are expected to account for 35.9% of the total revenue share in the bio-based and low VOC paints market in 2025, making them the most prominent resin type. This segment’s strength is attributed to the superior versatility, weather resistance, and film-forming properties that acrylic binders offer in waterborne formulations.

Their compatibility with low VOC solvents and capacity for high pigment loading have made them foundational in developing high-performance coatings that meet stringent environmental benchmarks. Acrylic resins have been widely adopted across decorative and protective coating applications due to their ability to deliver consistent sheen, UV stability, and surface adhesion under varied climatic conditions.

The transition to greener chemistry has led to the introduction of bio-based acrylic variants derived from renewable monomers, supporting eco-labeling requirements and lifecycle assessments. The segment's continued growth is being shaped by increased R&D into bio-acrylics and by rising construction activity in regions adopting sustainable architectural practices.

The bio-based and low VOC paints market is experiencing strong growth due to rising environmental awareness, stringent regulations, and increasing demand for sustainable and healthy indoor environments. These paints, formulated from renewable materials and with reduced volatile organic compounds, are used across residential, commercial, and industrial applications.

Governments in North America and Europe are promoting eco-friendly coatings through incentives and regulations, while the Asia-Pacific region is emerging due to rapid urbanization and green building initiatives. Manufacturers focus on enhancing color quality, durability, and drying performance while maintaining low emissions. Market expansion is supported by innovation in bio-resins, plant-based binders, and advanced waterborne technologies. Collaborations with construction and architectural firms, along with e-commerce distribution channels, are helping brands reach environmentally conscious consumers.

Stringent environmental regulations and building standards drive the adoption of bio-based and low VOC paints. Compliance with laws such as the USA EPA VOC limits, EU REACH regulations, and LEED certification requirements is essential for market acceptance. Paint manufacturers must ensure formulations meet VOC limits without compromising performance or color stability. Testing, documentation, and certification increase operational complexity and costs, especially for multi-region distribution. Failure to comply can result in penalties, restricted market access, and reputational damage. Companies investing in sustainable raw materials, eco-friendly binders, and certified production processes gain credibility and competitive advantage. Until uniform global environmental standards are established, manufacturers must navigate diverse regional regulations while delivering paints that meet both performance and eco-friendly criteria.

Technological innovation plays a critical role in the growth of bio-based and low VOC paints. Developments in waterborne resins, plant-based binders, and nano-additives improve adhesion, durability, color retention, and drying times while reducing harmful emissions. Innovations in anti-microbial, anti-fungal, and weather-resistant coatings enhance functional performance for commercial and residential applications. Advanced formulation technologies allow manufacturers to match or exceed the performance of conventional solvent-based paints while maintaining sustainability. Companies investing in R&D for high-quality, eco-friendly coatings differentiate themselves in competitive markets. As consumers and architects prioritize healthy, safe, and durable coatings, technological innovation becomes a key factor for brand recognition and market expansion.

Growing consumer awareness about indoor air quality, environmental sustainability, and health hazards of VOCs is a major driver for the market. Homeowners, architects, and contractors increasingly prefer bio-based and low VOC paints to ensure safer living and working spaces. Trends such as green building certifications, sustainable architecture, and eco-friendly home improvement projects further boost demand. Social media, eco-labeling, and educational campaigns help consumers identify sustainable paint options. Manufacturers offering certified, visually appealing, and high-performance eco-friendly paints gain consumer trust and loyalty. Until traditional solvent-based paints are gradually replaced in mainstream applications, consumer preference for low-emission, environmentally responsible coatings will continue to shape product development and marketing strategies.

The bio-based and low VOC paints market is highly competitive, with multinational coating companies, regional manufacturers, and specialty eco-paint brands vying for market share. Differentiation relies on performance, sustainability certifications, aesthetic appeal, and price. Supply chain challenges include sourcing bio-based resins, natural pigments, and low-VOC additives, which can be affected by raw material price fluctuations and logistics constraints. Strategic partnerships with suppliers, distributors, and construction firms help secure a stable supply and a wider market reach. Companies investing in localized production, R&D innovation, and sustainable sourcing strategies enhance reliability and brand credibility. Until raw material availability and supply chain efficiency improve, competitiveness will remain driven by product quality, sustainability, and the ability to meet eco-conscious consumer demand.

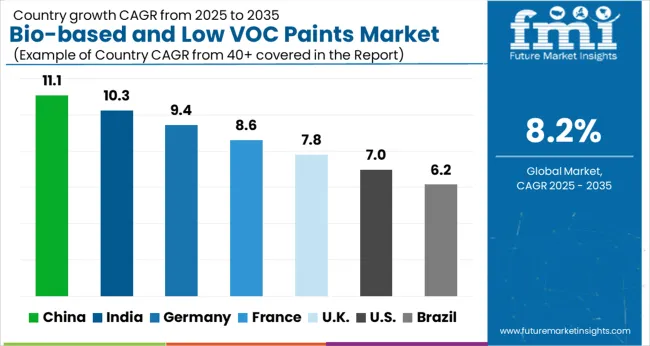

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global Bio-based and Low VOC Paints Market is projected to grow at a CAGR of 8.2% through 2035, supported by increasing demand across architectural, industrial, and decorative coating applications. Among BRICS nations, China has been recorded with 11.1% growth, driven by large-scale production and deployment in industrial and decorative coatings, while India has been observed at 10.3%, supported by rising utilization in architectural and specialty paints. In the OECD region, Germany has been measured at 9.4%, and France at 8.6%, where production and adoption for industrial, architectural, and decorative applications have been steadily maintained. The United Kingdom has been noted at 7.8%, reflecting consistent use in coatings and specialty paints, while the USA. has been recorded at 7.0%, with production and utilization across architectural, industrial, and decorative applications being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The bio-based and low VOC paints market in China is growing at a CAGR of 11.1%, fueled by increasing awareness of environmental health and government regulations on chemical emissions. These paints provide reduced volatile organic compounds, ensuring safer indoor air quality while meeting performance standards in coatings for residential, commercial, and industrial applications. Expansion of the construction and real estate sectors drives demand for eco-friendly coatings. Domestic manufacturers are investing in research to improve color performance, durability, and application efficiency. Adoption in automotive coatings, furniture, and decorative finishes contributes to consistent market growth. Technological advancements in formulation and production allow manufacturers to scale eco-friendly paints without compromising quality. Rising consumer preference for sustainable products and government incentives for green building materials strengthen market growth in China.

The bio-based and low VOC paints market in India is expanding at a CAGR of 10.3%, supported by increased adoption in residential, commercial, and industrial coatings. Demand is driven by stricter environmental regulations and growing awareness of indoor air quality among consumers. Paint manufacturers are introducing advanced bio-based formulations with superior durability, color retention, and low environmental impact. Growth in the construction, automotive, and furniture sectors contributes significantly to market expansion. Government initiatives promoting sustainable building materials and green construction practices enhance adoption. Technological developments in VOC reduction, improved adhesion, and faster drying times improve application efficiency. The combination of rising environmental consciousness and the need for high-quality performance paints ensures a steady increase in the bio-based and low VOC paints market across India.

The bio-based and low VOC paints market in Germany is growing at a CAGR of 9.4%, driven by stringent environmental regulations, green building practices, and rising consumer demand for sustainable products. These paints offer low emissions, improved indoor air quality, and high performance in coatings for residential, commercial, and industrial applications. German manufacturers focus on advanced formulations that combine bio-based raw materials with durability, color retention, and ease of application. Adoption is prominent in construction, automotive, and furniture industries. Regulatory support and consumer preference for eco-friendly solutions fuel market expansion. Technological innovations, such as high-performance waterborne coatings and faster drying paints, enhance product efficiency. Germany’s commitment to environmental sustainability and industrial excellence ensures continued growth in the bio-based and low VOC paints market.

The bio-based and low VOC paints market in the United Kingdom is expanding at a CAGR of 7.8%, driven by environmental awareness, regulatory compliance, and growing adoption in construction and industrial coatings. Low VOC paints reduce chemical emissions, ensuring safer indoor air quality while maintaining high performance for residential, commercial, and industrial applications. Manufacturers focus on innovative bio-based formulations that deliver superior durability, adhesion, and color retention. Government incentives and green building initiatives promote adoption in commercial projects and residential construction. Increasing consumer preference for sustainable products and environmental responsibility drives market growth. Technological developments, such as faster drying times and improved coverage, enhance product efficiency and applicability. The UK market continues to grow steadily due to the convergence of regulatory support, industrial demand, and environmental consciousness.

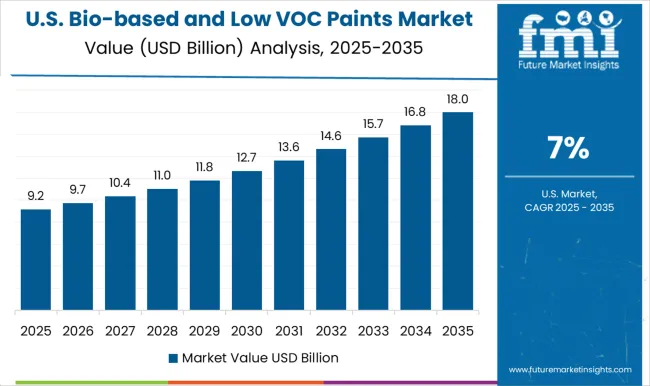

The bio-based and low VOC paints market in the United States is growing at a CAGR of 7.0%, with demand supported by sustainability trends, environmental regulations, and green building practices. Low VOC paints minimize harmful emissions, making them suitable for residential, commercial, and industrial coatings while ensuring high performance. The construction, automotive, and furniture sectors are major drivers of market expansion. Manufacturers are investing in research and development to enhance bio-based formulations for improved durability, color consistency, and application efficiency. Government programs encouraging eco-friendly building materials and consumer demand for healthier living spaces further strengthen market adoption. Technological advancements, such as waterborne coatings, faster drying, and improved coverage, improve operational efficiency. The USA market benefits from a combination of regulatory compliance, consumer awareness, and industrial growth, ensuring steady expansion of the bio-based and low VOC paints segment.

Dominant players include Sherwin Williams, PPG Industries, Akzo Nobel, Nippon Paint, Asian Paints, Jotun, Benjamin Moore, Dulux Group, and Hempel, leveraging national dealer networks, private label programs, and certified contractor ecosystems. Their portfolios span waterborne acrylics, plant oil alkyd emulsions, polyurethane dispersions, high solids industrials, powder, and UV cure lines positioned for very low VOC and low odor rooms. Key players across raw materials such as BASF, Arkema, Evonik, Allnex, Croda, Cargill, Covestro, and NatureWorks supply bio based binders, polyols, coalescents, and additives that lift bio content while protecting scrub resistance, block resistance, corrosion protection, and stain holdout. Emerging players including Auro, Livos, Earthborn, Graphenstone, and Mowilex differentiate with natural mineral systems, lime or silicate chemistries, and third party ecolabels. Differentiation rests on ASTM D6866 biocarbon verification, VOC grams per liter across categories, formaldehyde free claims, low odor return to service windows, antimicrobial preservative strategy, and field productivity with airless spray, fast dry, and wide temperature cure.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.3 Billion |

| Type | Low-VOC Paints, Bio-Based Paints, and Bio-Based and Low-VOC Hybrid Paints |

| Application | Architectural Coatings, Industrial Coatings, Automotive Coatings, Marine Coatings, and Specialty Coatings |

| Resins | Acrylic Resins, Polyurethane Resins, Epoxy Resins, Alkyd Resins, and Other Resins |

| Distribution Channel | Retail Stores, Online Retail, Contractors/Distributors, and Direct Sales |

| End User | Residential Buildings, Commercial Buildings, Industrial Facilities, Transportation, and Other Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Cargill Inc., Benjamin Moore & Co. (Berkshire Hathaway), Auro Pflanzenchemie AG, BioAmber, Dulux, and Mowilex (Asia Coatings Enterprises) |

| Additional Attributes | Dollar sales vary by paint type, including bio-based paints, low-VOC paints, and hybrid formulations; by application, such as architectural coatings, industrial coatings, and automotive finishes; by end-use industry, spanning construction, automotive, and commercial infrastructure; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising environmental regulations, increasing demand for sustainable products, and growing awareness of indoor air quality. |

The global bio-based and low VOC paints market is estimated to be valued at USD 20.3 billion in 2025.

The market size for the bio-based and low VOC paints market is projected to reach USD 44.6 billion by 2035.

The bio-based and low VOC paints market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in bio-based and low VOC paints market are low-voc paints, bio-based paints and bio-based and low-voc hybrid paints.

In terms of application, architectural coatings segment to command 41.3% share in the bio-based and low VOC paints market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Green and Bio-based Polyol Market Size and Share Forecast Outlook 2025 to 2035

GCC Green and Bio-based Polyol Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Germany Green and Bio-based Polyol Market Report – Trends, Demand & Industry Forecast 2025–2035

United States Green and Bio-based Polyol Market Report – Trends, Demand & Industry Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA