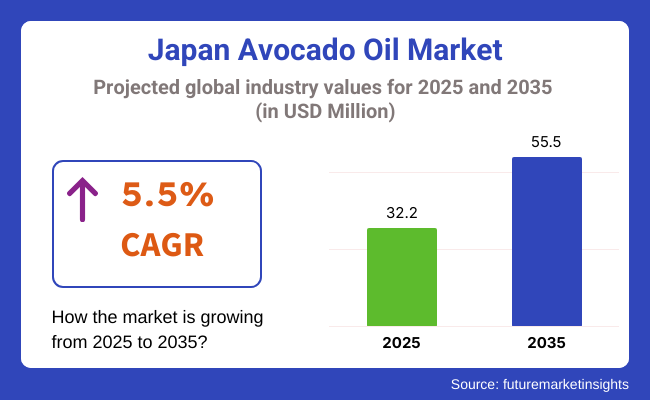

The Japan avocado oil market is poised to register a valuation of USD 32.2 million in 2025. The industry is slated to grow at 5.5% CAGR from 2025 to 2035, witnessing USD 55.5 million by 2035. The industry is experiencing consistent growth, driven by a mix of health consciousness, culinary innovation, and growing demand for high-quality, natural products.

Japanese consumers, who are renowned for their focus on quality and health value in food consumption, are increasingly adding avocado oil to their diets because of its high level of monounsaturated fats, antioxidants, and vitamins like E and K.

Due to increasing awareness of its cardiovascular, anti-inflammatory, and skin health value, the product is increasingly viewed as a worthy substitute for oils such as sesame or canola among health-oriented population. In addition, Japan's changing food culture has played an important role in driving this shift.

Although traditional Japanese food is still prevalent, there is increasing receptiveness to international food influences, especially from Western and fusion foods that encourage the use of the product for salad dressings, sautéing, and baking. The high smoke point and mild, buttery taste of the oil make it suitable for both Japanese and foreign dishes, and it is attractive to home cooks and gourmet chefs.

In addition, the growth of organic and plant-based food trends has made the product a clean-label, natural product that aligns with the preferences of a growing number of consumers that look for minimally processed ingredients.

Outside of food, Japan's beauty and personal care industry is also fueling demand. The product is finding more applications in skin and hair care products because of its moisturizing, anti-aging, and nourishing benefits.

With Japanese consumers valuing highly natural, gentle skincare products, the use of the product in lotions, serums, and hair oils is increasing. The industry is also being driven by a robust distribution channel via health food stores, online sites, and specialty beauty stores.

In Japan's industry, trends throughout end-use categories demonstrate an expanding industry for natural, health-promoting, and premium-grade products. Within the food preparation segment, consumers are opting increasingly for avocado oil as a functional substitute for conventional cooking oils, attracted to its cardiovascular-protecting attributes, antioxidant level, and superior smoke point.

With growing popularity of international and fusion cuisine, the product works easily in Western-style as well as Japanese preparation. Buying decisions are greatly driven by considerations like cold-pressed extraction, organic certification, non-GMO status, and country of origin, with Japanese consumers highly valuing transparency, traceability, and product safety.

Clean-label and additive-free product preference also significantly influences buying behavior in this segment. In the emerging nutraceutical and personal care markets, the product is gaining traction because of its soothing, moisturizing properties and fit with Japan's clean beauty trend.

In haircare and skincare, it is popular because of its moisturizing, anti-aging, and anti-inflammatory benefits, and it is a sought-after ingredient in natural products such as facial oils, lotions, and conditioners. Purity, few additives, environmentally friendly packaging, and dermatological safety are what consumers look for. In the nutraceutical industry, the product is being increasingly used in supplements and functional foods designed to enhance cardiovascular well-being, joint health, and general wellness-particularly in the case of aging populations.

Between 2020 and 2024, the Japanese industry witnessed development characterized by consumer consciousness, cultural movement towards more healthy lifestyles, and other factors. The outbreak of the COVID-19 pandemic significantly contributed towards the shift in consumer behavior toward more home-cooked food as individuals turned toward seeking more nutrients from food due to lockdown periods.

The product started becoming increasingly popular as an upscale cooking oil for its heart-health properties, antioxidant profile, and usability in both Japanese and Western cuisines. During this time, applications extended beyond the table to skincare, where consumers were increasingly looking for natural plant-derived products with moisturizing and anti-aging benefits.

Nevertheless, the industry was dominated by imports and, although relatively niche, the product was confined to health food stores, organic specialty stores, and the internet. During the 2025 to 2035 period, the business is poised to grow, with ongoing health trends, product format innovation, and increased consumption of functional foods and wellness products backing the trend.

As consumer demand becomes more mature, firms will increasingly prioritize localized branding, transparent sourcing, and environmental sustainability, resonating with Japan's quality-conscious and ethically oriented consumers.

The product will increasingly be incorporated into a wider variety of daily products-from fortified cooking oils and salad dressings to dietary supplements and clean-label cosmetics. Technological innovation in processing and packaging will enhance shelf life, preserve nutrient integrity, and minimize environmental footprint.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| In the initial phase, the product was marketed as a niche, high-end health product primarily targeting organic food supporters, health-conscious consumers, and customers looking for alternative oils for food preparation. | By 2025 to 2035, the product will enter mainstream product status, gaining wider acceptance among all consumer groups. The marketing approach will emphasize affordability, versatility, and the increasing demand for plant-based and heart-healthy oils in daily diets. |

| In 2020 to 2024, awareness of avocado oil was largely confined to niche consumer segments who were aware of its health benefits, especially for heart health, skin hydration, and antioxidants. | From 2025 onward, consumer consciousness of the product will grow extensively on the back of increased education regarding its multiple advantages such as healthier skin, anti-aging capabilities, and nutritional benefits. |

| During the 2020 to 2024 timeframe, the product was utilized primarily within food applications including salad dressings, sautéing, and grilling, with its premium pricing discouraging its incorporation into regular cooking. | The product will be used in a much wider variety of products by 2025 to 2035. It will experience substantial growth in the nutraceutical industry , being used in functional foods, dietary supplements, and smoothies because of its antioxidant and anti-inflammatory effects. |

| D istribution channels reached the early adopters and health consumers who were well aware of the product's utility. Yet, avocado oil wasn't generally seen in mass-level supermarkets or even mainstream grocery chains. | Online channels will remain significant, but physical retail will grow considerably, reaching more consumers. The large retailers will provide premium as well as value versions of avocado oil, so it becomes widely available to consumers. |

The Japanese industry, though demonstrating high growth prospects, is subject to a number of risks that may affect its growth path. One of the main risks is reliance on imports since Japan lacks a local avocado oil manufacturing sector. The supply chain is vulnerable to interruptions, either through international trade policies, transportation problems, or weather-related issues in production nations such as Mexico or Peru.

Any break in the supply chain has the potential to cause price instability and scarcity, which may impact industry stability and consumer availability of the product. Moreover, international trade tensions or tariff fluctuations might make importation of the product more expensive, which may lower consumer demand, especially in a price-insensitive segment of the industry.

Another critical risk is based on consumer education and industry acceptance. Although the product is gaining recognition as a healthy food, some Japanese consumers might be hesitant to embrace it because it is not familiar to them or because they prefer conventional cooking oils such as sesame or canola oil.

The absence of deep cultural connections with the product requires educating the masses on how to use it, its benefits, and its versatility. If the marketing efforts are not able to reach and convince a larger audience effectively, then the product can be stuck in a niche industry of health seekers and can't expand the overall industry.

In Japan, extra virgin avocado oil is most commonly sold and recommended variety because of its high quality, health properties, and natural processing. This oil is cold-pressed and without heat or chemicals to ensure that the oil's natural antioxidants, vitamins, and healthy monounsaturated fats are not destroyed.

These considerations resonate with the Japanese consumer industry, which highly values goods that lead to health and longevity. The oil's buttery, rich flavor and versatility in preparation, as well as its skin care benefits, make it a favorite among health-conscious consumers. Furthermore, the increased demand for natural and organic foods in Japan has created demand for extra virgin oil since it supports consumers' tastes for clean, low-processed food.

On the contrary, virgin oil and refined oil are less popularly traded than extra virgin. Virgin oil, while also cold-pressed, has a milder taste and lower antioxidant content compared to extra virgin oil. This could make it less desirable among Japanese consumers who value both taste and health aspects.

The largest application of the product in Japan is in the food and beverage processing industry. This leadership is fueled by the nation's fast-increasing health-conscious consumers who are looking for heart-healthy, great-tasting alternatives to mainstream cooking oils.

The product, especially extra virgin and Hass-based types, is well known for its light taste and high level of monounsaturated fats, which fit well with Japanese food culture and the growing trend towards healthier food ingredients. The product is now a household staple in Japan, changing cooking practices in homes and commercial kitchens.

With its high smoke point and nutrient profile, the oil is the best for multiple cooking methods such as stir-frying, sautéing, and even salad dressing. The versatility of the oil has led to cooking innovation, as chefs and home cooks include it in many recipes, ranging from traditional Japanese fare to fusion and modern dishes.

The Japanese industry is competitive with a combination of long-established trading houses, specialist food importers, and new niche brands. They differentiate based on quality, supply reliability, and the capability to provide for Japan's rigorous standards of food safety and sustainability.

Strategic alliances, product innovation (e.g., extra virgin and Hass-based oils), and premiumization are key to success in the industry. With growing health awareness and food experimentation, leaders are increasing presence and investing in retail and foodservice channels to tap increased demand.

ITOCHU Corporation, one of Japan's largest trading houses, uses its worldwide sourcing network to provide a continuous supply of quality oil for both mass-market food producers and upscale retail chains. Interoleo Co., Ltd. and Royal Co Ltd. are key importers and distributors, emphasizing premium quality and sustainable sources to attract health-conscious consumers and gourmet chefs.

Meiwa Co., Ltd., while rooted in agricultural technology and sustainability, is increasingly involved in the import and distribution of specialty oils, including avocado oil, aligning with Japan’s eco-conscious consumer trends.

Sumifru Japan Corporation, which has historically been a leading fruit importer, has branched out into avocado oil, leveraging its established distribution and logistics networks. Timipere Allison and Hanwa Co., Ltd. operate in both bulk and specialty oil markets, catering to food manufacturers and the expanding functional food industry.

Spectrum Organics Products, LLC aims at niche markets with cold-pressed and organic oils, targeting a consumer segment that values purity and traceability. Global brands such as Bella Vado Inc. and The Village Press are also picking up pace, particularly in the premium and artisanal segments, and are usually partnering with local distributors to boost industry penetration.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Interoleo Co., Ltd. | 15-20% |

| AVOCADO OIL JAPAN, K.K. | 10-15% |

| Spectrum Organics Products, LLC | 8-12% |

| Royal Co., Ltd. | 6-10% |

| Sumifru Japan Corporation | 5-8% |

| Hanwa Co., Ltd. | 4-6% |

| Meiwa Co., Ltd. | 3-5% |

| The Village Press | 2-4% |

| Bella Vado Inc. | 1-2% |

| Other Key Players (Combined) | 25-30% |

ITOCHU Corporation is a market leader, utilizing its global procurement capabilities and established reputation to ensure consistent quality and supply. Strong market positions have been developed by Interoleo Co., Ltd. and Royal Co Ltd. through an emphasis on premiumization and sustainability and appeal to retail and foodservice customers.

Meiwa Co., Ltd. is differentiated through a strong sustainability philosophy, responding to Japan's increasing demand for environmentally friendly products. Sumifru Japan Corporation's large logistics network and history of importing fruits give it a competitive advantage as it diversifies into avocado oil.

Global entrants such as Spectrum Organics, Bella Vado, and The Village Press are targeting niches through accents on organic, cold-pressed, and artisanal characteristics, frequently partnering with local distributors for access.

In terms of product type, the industry is divided into extra virgin oil, virgin oil, and refined.

Based on variety, the market is classified into hass, fuerte, zutano, bacon, lamb hass, gwen, and others.

In terms of nature, the market is bifurcated into organic and conventional.

With respect to end use, the industry is divided into personal care and cosmetics, food and beverage processing, functional food and dietary supplements, foodservice, and retail.

Based on distribution channel, the industry is divided into direct sales and indirect sales.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 32.2 million in 2025.

The industry is projected to witness USD 55.5 million by 2035.

The industry is projected to witness 5.5% CAGR during the study period.

Conventional products are widely sold.

Leading companies include Kurakon, Cargill Inc., Alishan Organic Textured Soy Protein, Fuji Oil Company Limited, Miracle Meats, Puris Proteins, LLC., Rice protein-based meat analogues, Archer Daniels Midland Company, CHS Inc., Roquette Frères, and Beneo GmbH.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Litres) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: Kanto Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 16: Kanto Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 18: Kanto Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 19: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: Kanto Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 21: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: Kanto Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Chubu Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 26: Chubu Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 27: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Chubu Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 29: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Chubu Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 31: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Chubu Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Kinki Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 35: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 36: Kinki Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 37: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 38: Kinki Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 39: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Kinki Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 41: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: Kinki Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 43: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 45: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 46: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 47: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 48: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 49: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 51: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 52: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 53: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: Tohoku Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 55: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 56: Tohoku Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 57: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 58: Tohoku Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 59: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: Tohoku Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 61: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 62: Tohoku Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Product Type, 2018 to 2033

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Variety, 2018 to 2033

Table 66: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Variety, 2018 to 2033

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 68: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Nature, 2018 to 2033

Table 69: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by End Use, 2018 to 2033

Table 71: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 72: Rest of Industry Analysis and Outlook Volume (Litres) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Industry Analysis and Outlook Volume (Litres) Analysis by Region, 2018 to 2033

Figure 9: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 13: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 16: Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 17: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 18: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 19: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 20: Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 21: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 22: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 23: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 24: Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 25: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 26: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 27: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 28: Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 29: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 30: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 31: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 32: Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 33: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 34: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 35: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 37: Kanto Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Kanto Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 40: Kanto Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 41: Kanto Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 42: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 43: Kanto Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 44: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 45: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 46: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 47: Kanto Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 48: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 49: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 50: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 51: Kanto Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 52: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 53: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 54: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: Kanto Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 56: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 59: Kanto Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 60: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 61: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 62: Kanto Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 63: Kanto Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 64: Kanto Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 65: Kanto Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 66: Kanto Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 68: Chubu Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 69: Chubu Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 70: Chubu Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 72: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 73: Chubu Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 74: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 75: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 76: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 77: Chubu Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 78: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 79: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 80: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 81: Chubu Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 82: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 83: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 84: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Chubu Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 86: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 89: Chubu Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 91: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 92: Chubu Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 93: Chubu Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 94: Chubu Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 95: Chubu Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 96: Chubu Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 97: Kinki Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Kinki Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 99: Kinki Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 100: Kinki Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 101: Kinki Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 102: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 103: Kinki Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 104: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 105: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 106: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 107: Kinki Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 108: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 109: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 110: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 111: Kinki Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 112: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 113: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 114: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 115: Kinki Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 116: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 119: Kinki Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 120: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 121: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 122: Kinki Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 123: Kinki Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 124: Kinki Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 125: Kinki Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 126: Kinki Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 127: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 129: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 130: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 131: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 132: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 133: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 134: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 135: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 136: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 137: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 138: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 139: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 140: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 141: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 142: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 143: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 144: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 145: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 146: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 147: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 148: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 149: Kyushu & Okinawa Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 150: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 151: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 152: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 153: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 154: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 155: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 156: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 157: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 158: Tohoku Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 159: Tohoku Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 160: Tohoku Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 161: Tohoku Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 162: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 163: Tohoku Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 164: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 165: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 166: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 167: Tohoku Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 168: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 169: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 170: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 171: Tohoku Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 172: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 173: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 174: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 175: Tohoku Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 176: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 177: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 178: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 179: Tohoku Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 180: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 181: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 182: Tohoku Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 183: Tohoku Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 184: Tohoku Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 185: Tohoku Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 186: Tohoku Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Figure 187: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 188: Rest of Industry Analysis and Outlook Value (US$ Million) by Variety, 2023 to 2033

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 190: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 191: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 192: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 193: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Product Type, 2018 to 2033

Figure 194: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 195: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 196: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Variety, 2018 to 2033

Figure 197: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Variety, 2018 to 2033

Figure 198: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Variety, 2023 to 2033

Figure 199: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Variety, 2023 to 2033

Figure 200: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 201: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Nature, 2018 to 2033

Figure 202: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 203: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 204: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 205: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by End Use, 2018 to 2033

Figure 206: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 207: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 208: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 209: Rest of Industry Analysis and Outlook Volume (Litres) Analysis by Distribution Channel, 2018 to 2033

Figure 210: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 211: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 212: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 213: Rest of Industry Analysis and Outlook Attractiveness by Variety, 2023 to 2033

Figure 214: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 215: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 216: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA