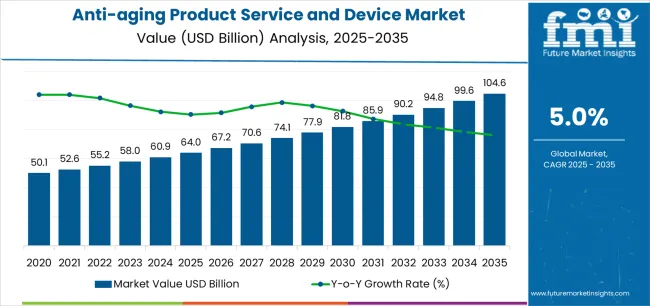

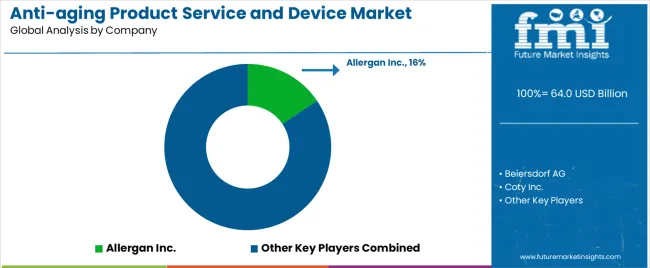

The Anti-aging Product Service and Device Market is estimated to be valued at USD 64.0 billion in 2025 and is projected to reach USD 104.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The Anti-aging Product Service and Device market is experiencing robust growth, driven by increasing consumer awareness of skin health, appearance management, and preventive skincare solutions. Rising demand for products and treatments that reduce visible signs of aging is being supported by innovations in dermatological technologies, cosmetic formulations, and minimally invasive procedures. Anti-aging solutions are increasingly being adopted across diverse demographics, with a particular focus on individuals seeking targeted treatments to maintain youthful appearance and improve skin elasticity.

The market is further influenced by the integration of advanced ingredients, biotechnology-based actives, and device-assisted therapies, which enhance efficacy and consumer satisfaction. Growing disposable incomes, urbanization, and lifestyle factors are supporting higher adoption of premium skincare products and clinical services.

The emphasis on evidence-based results, safety, and personalization is shaping market growth As dermatology and cosmetic sectors continue to innovate and expand, the Anti-aging Product Service and Device market is expected to maintain strong growth, with opportunities emerging from personalized solutions, clinical treatments, and device-based therapies.

| Metric | Value |

|---|---|

| Anti-aging Product Service and Device Market Estimated Value in (2025 E) | USD 64.0 billion |

| Anti-aging Product Service and Device Market Forecast Value in (2035 F) | USD 104.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

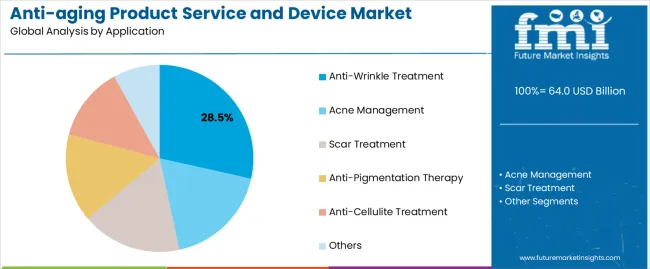

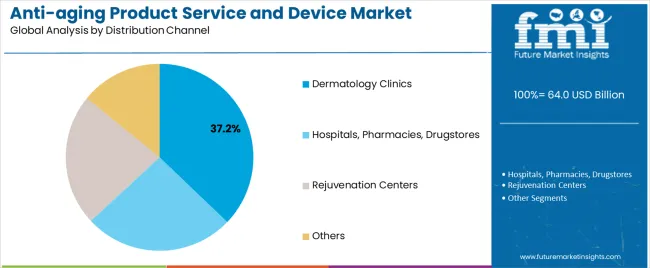

The market is segmented by Application, Product Type, and Distribution Channel and region. By Application, the market is divided into Anti-Wrinkle Treatment, Acne Management, Scar Treatment, Anti-Pigmentation Therapy, Anti-Cellulite Treatment, and Others. In terms of Product Type, the market is classified into Moisturizers, Retinols, Dermal Fillers, Botulinum Toxin, Chemical Peels, Cellulite Treatment, Non-Surgical Fat Reduction, Creams, and Others. Based on Distribution Channel, the market is segmented into Dermatology Clinics, Hospitals, Pharmacies, Drugstores, Rejuvenation Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The anti-wrinkle treatment segment is projected to hold 28.5% of the market revenue in 2025, establishing it as the leading application category. Growth in this segment is being driven by increasing demand for effective wrinkle reduction therapies among consumers seeking youthful and healthy skin. Clinical treatments, including minimally invasive procedures and device-assisted therapies, are being adopted due to their proven efficacy, safety, and ability to deliver targeted results.

The segment is also supported by rising awareness of early preventive care and cosmetic dermatology practices. Technological advancements in treatment delivery systems, such as laser, radiofrequency, and ultrasound-based devices, are improving performance outcomes and expanding accessibility. The combination of clinical solutions with adjunctive topical products enhances treatment efficacy and consumer satisfaction.

Increasing investments in research and development by skincare and medical device companies are contributing to the introduction of novel formulations and innovative therapies As awareness of aging prevention and appearance management grows globally, the anti-wrinkle treatment segment is expected to continue leading market adoption, driven by clinical effectiveness, safety, and rising consumer interest in aesthetic solutions.

The moisturizers segment is anticipated to account for 18.8% of the market revenue in 2025, making it the leading product type. Its growth is being driven by the widespread consumer preference for topical skincare solutions that improve hydration, maintain skin barrier function, and reduce visible signs of aging. Advances in formulation science, including incorporation of bioactive compounds, antioxidants, and peptides, have enhanced the efficacy of moisturizers, driving consumer trust and adoption.

The convenience of daily use, broad availability, and integration with anti-aging regimens make moisturizers highly popular across demographic groups. Increasing awareness of preventive skincare and the importance of hydration in reducing wrinkle formation supports the market.

Retail distribution channels, including online platforms and pharmacy networks, have further expanded accessibility As demand for functional and science-backed skincare products rises, the moisturizer segment is expected to sustain its leadership in the market, driven by formulation innovation, ease of use, and growing consumer emphasis on preventive and maintenance-focused skin care.

The dermatology clinics distribution channel segment is projected to hold 37.2% of the market revenue in 2025, establishing it as the leading channel. Growth in this segment is being driven by consumer preference for professional consultation, supervised treatments, and clinical-grade product offerings that ensure safety and efficacy. Clinics provide access to advanced anti-aging procedures, such as injectables, laser treatments, and device-assisted therapies, which are difficult to replicate in retail or at-home settings.

The ability to receive personalized treatment plans and evidence-based guidance enhances consumer confidence and adoption. Dermatology clinics also act as a trusted source for high-quality skincare products that complement clinical procedures, driving revenue growth.

Increasing collaboration between product manufacturers and clinics for training, product launches, and promotional programs further supports the channel’s dominance As awareness of clinical efficacy and professional skincare solutions continues to grow, dermatology clinics are expected to remain the most preferred distribution channel, offering both treatments and complementary products, thereby reinforcing their leading position in the market.

The anti-aging product service market has experienced considerable technological advancements, particularly in skin care products and treatments.

This comprises progressions such as laser therapy, microdermabrasion, radiofrequency devices, and LED light therapy systems, which target various signs of aging. In light of this trend, it is reasonable to suggest that an amplification in the anti-aging product market growth is seen.

Combination therapies involving the simultaneous adoption of multiple anti-aging products have gained recognition. This perspective delivers more thorough outcomes by simultaneously targeting various factors of aging. It can be inferred that an escalation in sales of anti-aging product services and devices is experienced.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 36100.72 million |

| Market Value for 2025 | USD 60,462.10 million |

| Market CAGR from 2020 to 2025 | 9.80% |

The segmented anti-aging product service and device market analysis is included in the following subsection. Based on inclusive probes, the anti-wrinkle treatment segment is controlling the application category. Likewise, the moisturizers segment is dominating the product type category.

| Segment | Anti-wrinkle Treatment |

|---|---|

| Share (2025) | 24.70% |

An expedition to look beautiful and have younger-looking skin thrusts the demand for anti-wrinkle treatments globally. FMI analysts comment that anti-wrinkle products have the leading sales in the market share, enticing the maximum revenue.

The mounting inclination among people to look young and decelerate the aging process has intensified the demand for anti-wrinkle treatments. The anti-wrinkle treatment demand is likely to be augmented with the advancing influence of social media.

| Segment | Moisturizers |

|---|---|

| Share (2025) | 18.80% |

With a concentration on hydration and skin barrier protection, moisturizers denominate fundamental issues collectively to a vast consumer base, escalating the anti-aging product service demand. The amplifying consumer awareness as per preventive skin care measures magnifies the moisturizer segment.

The versatile adoption of moisturizers proffers to a widespread range of consumer needs, escalating consistent demand. Moisturizers are a foundational product in skincare and serve as an entry point for consumers into anti-aging treatments, ushering sales of anti-aging product services and devices.

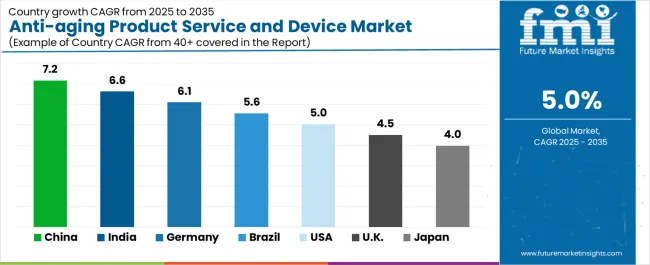

The market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous market opportunities for anti-aging product devices and services.

Anti-Aging Product Services and Devices Sales Analysis in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 1.80% |

| Canada | 2.60% |

Technological progress and close attention to beauty and wellness thrust the anti-aging product service and device market upwards in the United States. The escalating perception about the usefulness of skincare and healthy aging elevates the adoption of anti-aging solutions in the United States.

Regulatory laws and rules accentuating safety and efficiency widen the prospect of anti-aging products and services in Canada, facilitating consumer trust. Consumers progressively prioritize precautionary skincare actions, ushering in the demand for anti-aging products and services in Canada.

Potential for Anti-Aging Product Market in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 4.750% |

| Spain | 4.530% |

| Italy | 4.310% |

| Germany | 3.800% |

| United Kingdom | 3.200% |

The customers in France reflect an inclination for premium anti-aging products, indicating an eagerness to invest in effective solutions. The anti-aging product service and device market witnesses a positive trend towards customized anti-aging product devices and services, Gratifying diverse skin types and concerns in France.

A desire for organic and eco-friendly products sculpts Italy's anti-aging product service and device market, indicating an evolving eco-consciousness among consumers. The beauty culture in Italy concentrates on timeless elegance, affecting the innovation of anti-aging products that aim to augment natural beauty, which amplifies sales of anti-aging product service and devices.

Impacted by Mediterranean beauty ideals, Spain's market stresses the significance of sun protection and way of life factors in tackling aging. Spanish consumers favor multifunctional anti-aging products that deliver convenience and productivity in skincare routines, intensifying the market growth.

Opportunities in the Asia Pacific Anti-Aging Product Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.80% |

| Malaysia | 5.30% |

| Thailand | 5.70% |

| Indonesia | 4.80% |

India's anti-aging product service and device market is thrusted by an elevating size of the middle-class population on the lookout for youthful solutions. The conventional Ayurvedic activities consolidate with modern anti-aging product devices and service trends, amplifying India's anti-aging product market remarkably.

The spurring urbanization and cognizance proliferate the demand for anti-aging products and services in India. India's diverse cultural influences deliver an assorted landscape for anti-aging product innovations. The Indian anti-aging market notices a boom in demand for organic and environment-friendly skincare solutions.

Malaysia's tropical climate stimulates demand for anti-aging products customized for exposure to humidity and sun. Multicultural effects in Malaysia add up to a diverse range of anti-aging preferences, proliferating sales of anti-aging product services and devices.

Malaysia seeks technological progression in anti-aging treatments and devices to intensify the market growth.

Augmenting health awareness among Thai consumers soars the demand for anti-aging products. Thailand's encouragement as a destination for cosmetic procedures advances its anti-aging market. Imaginative spa treatments and comprehensive wellness approaches carve Thailand's market delivery.

The persistent desire to look young and have flawless skin has gained traction in anti-aging product market expansion and competition. To dominate the competition, major anti-aging product service and device vendors are presenting innovative and practical items.

The two main strategies anti-aging product service and device producers have used to compete are combination therapies and product launches. To develop innovative products, anti-aging product service providers are working together and forming partnerships with leading brands to increase their customer base and attract a global audience.

Amplifying adoption of social media and heightened consumer awareness of skincare products force the major anti-aging product service and device producers to generate innovative and efficient equipment to meet the rapidly growing market to earn lucrative income.

Pre-eminent Progressions

| Company | Details |

|---|---|

| Sofwave | Synchronous Ultrasound Parallel Beam, an anti-aging technique developed by Sofwave based in Israel was instigated in October 2025. It received the approval of FDA for the purposes of firming skin on the face and neck and lifting up the chin and eyebrows. This was presented at the International Congress on Medical Aesthetics and Anti-aging in Tel Aviv. |

| LR Health and Beauty | LR Health and Beauty, headquartered in Germany set forward the ZEITGARD PRO, a home cosmetic gadget with replaceable beauty equipment and devices, in October 2025. |

| Crescita Therapeutics Inc. | A significant commercial dermatology competitor based in Canada, Crescita Therapeutics Inc., stated in January 2024 that it received a certification for its New Cellular Treatment Factor and new ART FILLER product line in Canada from Laboratories FILMED. |

| Merck KGaA | A collaborative agreement was signed in August 2024 between Merck KGaA, headquartered in Germany, and Pechoin Group, a Chinese cosmetics company, to devise herbal technology and send to market a new product line named the Pechoin Zhenyan anti-wrinkle repair series. |

| AdventHealth Nicholson Center | A formal joint venture was confirmed in March 2024 between Lumenis Ltd, a manufacturer of energy-based medical devices, and AdventHealth Nicholson Center (rooted in Orlando, Florida), a medical research and training center. The partnership aims to set up a committed Center of Excellence as a medical training initiative. |

The global anti-aging product service and device market is estimated to be valued at USD 64.0 billion in 2025.

The market size for the anti-aging product service and device market is projected to reach USD 104.6 billion by 2035.

The anti-aging product service and device market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in anti-aging product service and device market are anti-wrinkle treatment, acne management, scar treatment, anti-pigmentation therapy, anti-cellulite treatment and others.

In terms of product type, moisturizers segment to command 18.8% share in the anti-aging product service and device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Aging Devices Market

Algae-Based Anti-Aging Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Product Cost Management Market

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Competitive Overview of CBD Product Packaging Market Share

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Date Product Market Share

Teff Products Market

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA