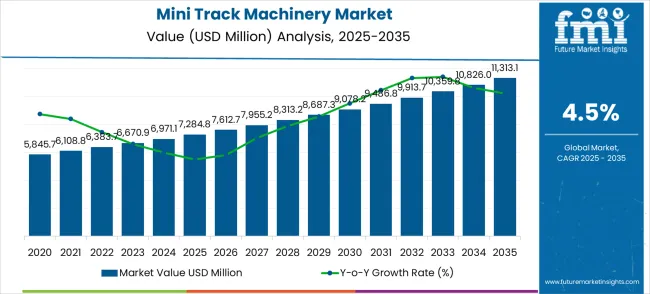

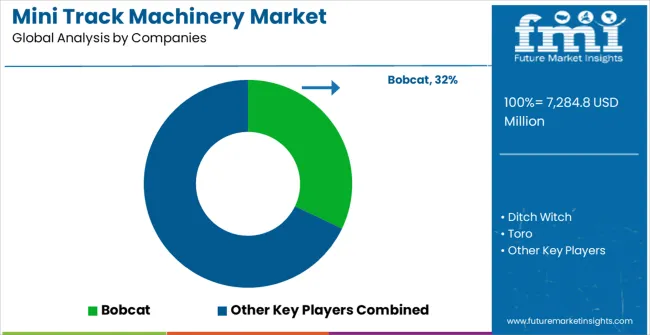

The mini track machinery market is likely to expand from USD 7,284.8 million in 2025 to USD 11,313.1 million by 2035, reflecting a CAGR of 4.5%. Market share gains are likely among manufacturers offering advanced, compact, and energy-efficient machinery that meets evolving construction and landscaping requirements.

Companies that provide versatile, easy-to-operate models with low maintenance needs are positioned to expand their presence in both developed and emerging regions. Early movers focusing on integrating telematics, automation, and operator safety features are expected to consolidate share, capturing demand from commercial construction, agriculture, and infrastructure development projects.

The manufacturers relying on conventional designs without innovation may experience relative market share erosion. Competition intensifies as new entrants and regional players introduce cost-effective solutions targeting price-sensitive segments in emerging markets. Product differentiation through durability, fuel efficiency, and adaptability to diverse terrains becomes a critical factor for retaining and expanding share. Strategic alliances, regional distribution expansion, and after-sales service networks also influence market position. The market dynamics favor companies that combine technological advancements, operational efficiency, and strategic geographic penetration, while those lagging in innovation risk losing ground in an increasingly competitive mini track machinery landscape.

| Mini Track Machinery Market | Value |

|---|---|

| Market Value (2025) | USD 7,284.8 million |

| Market Forecast Value (2035) | USD 11,313.1 million |

| Market Forecast CAGR | 4.5% |

The mini track machinery market is divided into construction and infrastructure projects at 38%, landscaping and horticulture at 27%, agriculture and forestry at 18%, mining and excavation at 10%, and specialty applications such as disaster relief and military operations at 7%. Construction and infrastructure sectors lead adoption as mini track machines provide compact mobility, versatility, and performance on confined or uneven terrain. Landscaping and horticulture use them for precise earthmoving and soil management, while agriculture and forestry benefit from maneuverable machinery for planting, harvesting, and clearing. Mining and excavation deploy mini track equipment for small-scale or difficult-to-access sites, and specialty uses cover emergency response, disaster cleanup, and tactical operations.

Key trends include electric and hybrid powertrains, GPS-based precision control, and modular attachments for multifunctional applications. Lightweight, durable, and energy-efficient models are expanding adoption in urban construction, smart farming, and automated forestry. Partnerships between manufacturers and contractors enable tailored solutions for specific site challenges.

Market expansion is being supported by the rapid increase in urban construction activities worldwide and the corresponding need for compact machinery solutions that provide superior maneuverability and operational efficiency in confined spaces. Modern construction projects rely on versatile equipment and space-efficient operations to ensure optimal project completion including residential construction, commercial development, and infrastructure maintenance. Even minor equipment limitations can require comprehensive project planning adjustments to maintain optimal construction timelines and operational performance.

The growing complexity of urban construction environments and increasing demand for multi-functional compact equipment are driving demand for advanced mini track machinery from certified manufacturers with appropriate performance capabilities and technical expertise. Construction companies are increasingly requiring documented equipment reliability and operational efficiency to maintain project timelines and cost effectiveness. Industry specifications and safety standards are establishing standardized construction procedures that require specialized compact machinery technologies and trained operators.

The shift toward natural construction practices and reduced environmental impact is further accelerating adoption of fuel-efficient mini track machinery that minimizes site disturbance and optimizes resource utilization. Growing focus on precision construction and landscaping applications is creating demand for compact equipment that can operate effectively in sensitive environments while maintaining high productivity levels. Additionally, increasing labor costs and skilled operator shortages are driving investments in user-friendly machinery that can enhance operator productivity and reduce training requirements.

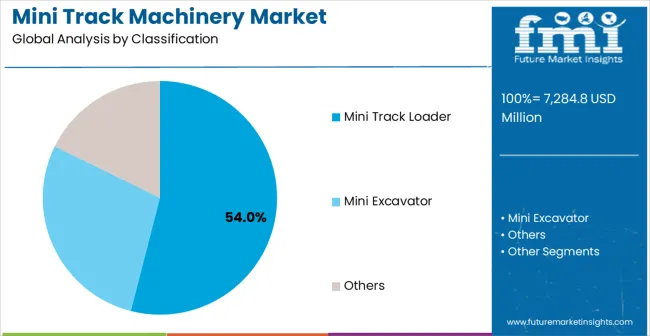

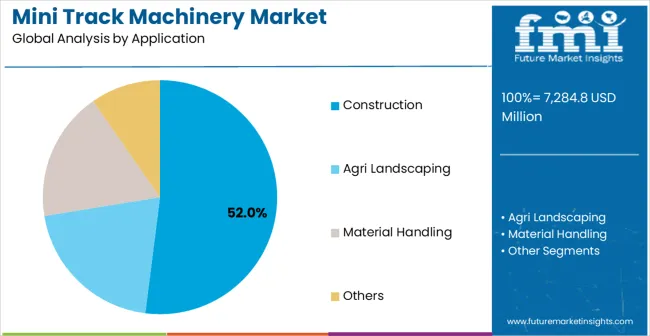

The market is segmented by machinery type, application, and region. By machinery type, the market is divided into mini track loader, mini excavator, and others. Based on application, the market is categorized into construction, agri landscaping, material handling, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the mini track loader segment is projected to capture around 54% of the total market share, making it the leading machinery category. This dominance is largely driven by the widespread adoption of versatile loader systems that combine lifting, digging, and material handling capabilities in a compact platform, catering to diverse construction and landscaping applications. The mini track loader is particularly favored for its ability to accommodate multiple attachment options including buckets, forks, augers, and brush cutters, ensuring operational flexibility across various project requirements.

Construction contractors, landscaping professionals, rental companies, and material handling operations increasingly prefer this machinery type, as it meets diverse operational needs without requiring multiple specialized machines or excessive operational complexity. The availability of well-established attachment ecosystems, along with comprehensive service networks and parts availability from leading manufacturers, further reinforces the segment's market position.

The construction segment is expected to represent 52% of mini track machinery demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of construction projects, where compact machinery with high maneuverability is critical to project efficiency and site management. Construction sites often feature confined spaces and restricted access areas that require specialized compact equipment capable of operating effectively without compromising productivity. Mini track machinery is particularly well-suited to these environments due to its ability to navigate tight spaces while maintaining stability and lifting capacity through various ground conditions.

As construction activities expand globally and focus on improved efficiency standards, the demand for sophisticated compact machinery continues to rise. The segment also benefits from increased urbanization and infrastructure development, where contractors are increasingly prioritizing compact equipment as essential tools to improve project timelines and reduce operational costs. With construction companies investing in equipment efficiency and site productivity, mini track machinery provides an essential solution to maintain high-performance construction capabilities. The growth of residential construction, commercial development, and infrastructure maintenance projects ensures that construction will remain the largest and most stable demand driver for mini track machinery in the forecast period.

The Mini Track Machinery market is advancing steadily due to increasing urbanization and growing recognition of compact equipment advantages over traditional larger machinery in space-constrained environments. The market faces challenges including higher per-unit costs compared to conventional equipment, need for specialized attachment systems, and varying emission regulations across different geographic regions. Equipment optimization efforts and technology advancement programs continue to influence machinery development and market adoption patterns.

The growing development of electric and hybrid power systems is enabling higher operational efficiency with reduced emissions and lower operating costs. Enhanced electric technologies and optimized battery systems provide superior performance while maintaining environmental compliance requirements. These technologies are particularly valuable for urban contractors and indoor applications that require zero-emission operation capabilities supporting extensive construction projects with minimal environmental impact and consistent performance outcomes.

Modern mini track machinery manufacturers are incorporating advanced telematics systems and smart operational features that enhance equipment monitoring and predictive maintenance effectiveness. Integration of GPS tracking, performance analytics, and remote diagnostics enables superior fleet management and comprehensive operational optimization capabilities. Advanced smart features support operation across diverse project sites while meeting various productivity requirements and operational specifications, enabling seamless integration with construction management systems and rental fleet operations.

The Mini Track Machinery market is entering a new phase of growth, driven by demand for compact construction solutions, urban development expansion and operational efficiency standards. By 2035, these pathways together can unlock USD 800-1,000 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Mini Track Loader Dominance (Versatile Multi-Function Equipment) The mini track loader segment already holds the largest share due to its versatility and attachment compatibility. Expanding electric variants, enhanced hydraulics, and smart control systems can consolidate leadership. Opportunity pool: USD 220-280 million.

Pathway B -- Construction Applications Expansion (Urban Development) Construction applications account for the majority of demand. Growing urban development projects, especially in emerging economies, will drive higher adoption of compact track machinery for space-constrained operations. Opportunity pool: USD 180-230 million.

Pathway C -- Electric & Hybrid Technology Integration Growing environmental regulations and indoor application requirements are expanding demand for electric mini track machinery. Battery-powered and hybrid systems offer significant growth potential. Opportunity pool: USD 120-150 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Latin America, and Middle East present growing demand due to urbanization and construction infrastructure development. Targeting regional distributors and cost-effective models will accelerate adoption. Opportunity pool: USD 100-130 million.

Pathway E -- Landscaping & Agricultural Applications Professional landscaping and agricultural operations are expanding, creating demand for specialized track machinery with landscape-specific attachments and features. Opportunity pool: USD 80-100 million.

Pathway F -- Rental Market Growth Equipment rental companies are major customers for mini track machinery. Developing rental-optimized models with enhanced durability and ease of operation offers significant opportunities. Opportunity pool: USD 60-80 million.

Pathway G -- Autonomous & Smart Technology Features Advanced automation, GPS guidance, and semi-autonomous operation capabilities offer premium positioning for high-tech construction and precision applications. Opportunity pool: USD 40-60 million.

Pathway H -- Service, Parts & Telematics Revenue Recurring revenue from maintenance contracts, telematics services, and parts sales creates long-term revenue streams for manufacturers and dealers. Opportunity pool: USD 30-45 million.

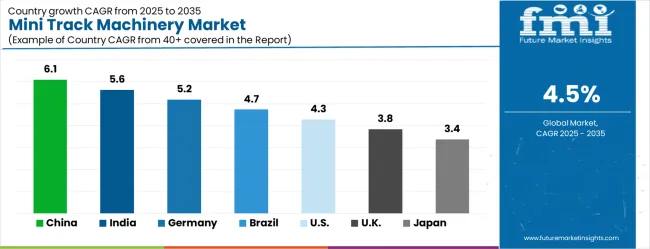

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

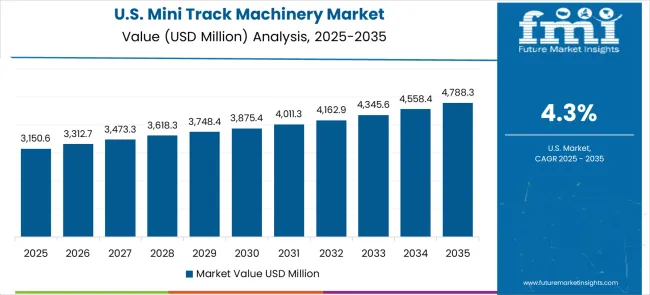

| United States | 4.3% |

| United Kingdom | 3.8% |

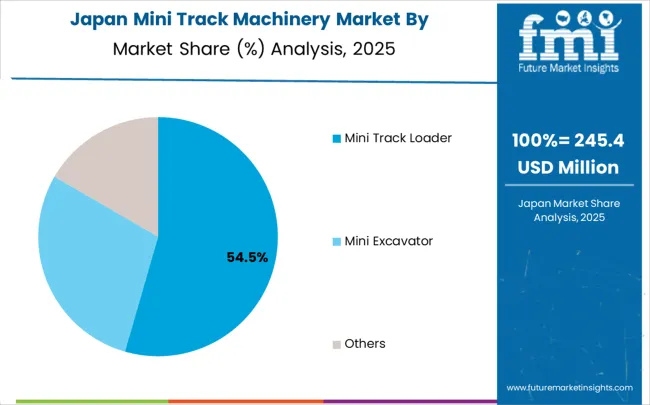

| Japan | 3.4% |

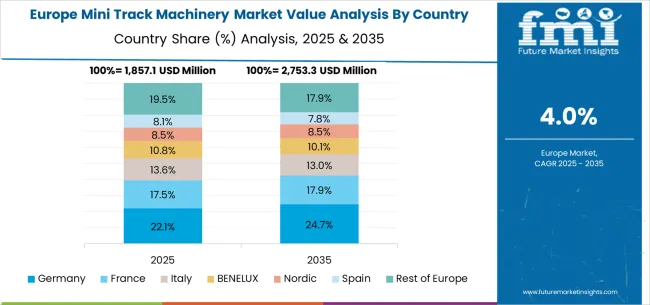

The mini track machinery market is growing steadily, with China leading at a 6.1% CAGR through 2035, driven by extensive urbanization and increasing adoption of compact construction equipment in dense urban environments. India follows at 5.6%, supported by rising infrastructure development and growing demand for versatile construction machinery. Germany grows steadily at 5.2%, integrating advanced compact machinery technology into its established construction and landscaping industries. Brazil records 4.7%, prioritizing construction modernization and equipment efficiency initiatives. The United States shows solid growth at 4.3%, focusing on equipment innovation and operational productivity enhancement. The United Kingdom demonstrates steady progress at 3.8%, maintaining established construction and landscaping applications. Japan records 3.4% growth, concentrating on precision machinery development and operational efficiency optimization.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China is expected to expand at a CAGR of 6.1% from 2025 to 2035, above the global average for small construction machinery. Growth is supported by rapid infrastructure development, rising construction activity, and increasing adoption of compact, versatile machinery for tight urban and rural sites. Manufacturers focus on improving durability, fuel efficiency, and operator comfort while integrating smart controls and automated features. Domestic companies such as SANY and XCMG are enhancing production capabilities and introducing models tailored for urban construction and landscaping applications. The market is further encouraged by government investments in road, rail, and residential infrastructure, as well as the push for higher efficiency and lower operating costs in construction projects.

India is anticipated to grow at a CAGR of 5.6% from 2025 to 2035, driven by construction expansion, infrastructure projects, and urban development. Mini track machinery is increasingly adopted for tasks such as landscaping, excavation, and small-scale construction where larger equipment is impractical. Manufacturers prioritize low-maintenance designs, durability in diverse climates, and fuel-efficient engines. Companies such as JCB India and Escorts Limited are expanding their mini track product lines to meet domestic demand and export opportunities. Government initiatives promoting infrastructure development, rural connectivity, and housing projects are boosting adoption, alongside private sector demand for efficient and versatile compact machinery.

Germany is expected to grow at a CAGR of 5.2% from 2025 to 2035, supported by infrastructure maintenance, landscaping, and small construction projects. Mini track machinery is favored for precision work in urban environments and restricted spaces. Manufacturers focus on advanced controls, low emissions, and ergonomic design to comply with strict European standards. Companies such as Bobcat EMEA and Wacker Neuson are offering compact, modular machinery suitable for varied construction and landscaping applications. Market demand is driven by residential construction, municipal projects, and industrial facility maintenance, where efficiency, reliability, and compliance with environmental standards are essential.

Brazil is expected to grow at a CAGR of 4.7% from 2025 to 2035, influenced by rising construction and landscaping activities, particularly in urban and industrial areas. Mini track machinery is adopted for excavation, landscaping, and small infrastructure projects where space constraints limit the use of larger equipment. Manufacturers focus on durability, ease of maintenance, and cost-effective operation suitable for tropical and high-humidity conditions. Companies such as Agrale and JCB Brazil are collaborating with local contractors to provide machinery adapted to local terrain and climate. Government investment in urban development and rural infrastructure is further supporting market growth.

The United States is expected to grow at a CAGR of 4.3% from 2025 to 2035, driven by residential and commercial construction, landscaping, and small infrastructure projects. Mini track machinery offers versatility and accessibility in confined or uneven spaces where larger machinery is impractical. Manufacturers prioritize fuel efficiency, operator safety, and integration with advanced controls and attachments. Companies such as Bobcat and Caterpillar are offering models with modular attachments for excavation, grading, and landscaping tasks. Adoption is supported by private construction projects, municipal initiatives, and the need for equipment that reduces operational costs while maintaining high performance.

The United Kingdom is expected to grow at a CAGR of 3.8% from 2025 to 2035, driven by residential construction, landscaping, and urban infrastructure projects. Mini track machinery is favored for operations in restricted spaces and high-density areas. Manufacturers focus on emissions compliance, compact design, and operator comfort to meet European regulations and customer expectations. Key suppliers including JCB UK and Wacker Neuson provide modular machinery suitable for multiple construction and landscaping applications. Market growth is supported by government infrastructure investment, urban development initiatives, and private sector demand for reliable, efficient compact equipment.

Japan is expected to grow at a CAGR of 3.4% from 2025 to 2035, reflecting moderate adoption due to limited space in urban construction and residential areas. Mini track machinery is used for excavation, landscaping, and small-scale construction projects requiring precision and maneuverability. Manufacturers focus on compact, low-emission designs, high durability, and ease of operation in densely populated environments. Companies such as Komatsu and Yanmar are providing advanced mini track machinery with modular attachments and automated features. Adoption is supported by urban development projects, residential construction, and municipal landscaping initiatives.

The Mini Track Machinery market is defined by competition among specialized equipment manufacturers, construction machinery companies, and compact equipment solution providers. Companies are investing in advanced hydraulic system development, electric powertrain integration, telematics enhancement, and comprehensive service capabilities to deliver reliable, efficient, and versatile compact machinery solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

Bobcat offers comprehensive mini track machinery solutions with established manufacturing expertise and market-leading compact equipment capabilities. Ditch Witch provides specialized compact track systems with focus on underground construction and utility applications. Toro delivers innovative compact machinery with focus on landscaping and grounds maintenance optimization. Morbark specializes in forestry and land clearing equipment with advanced compact track platforms.

Vermeer Manufacturing offers professional-grade compact machinery with comprehensive attachment ecosystems and service support capabilities. Kanga delivers cost-effective compact track solutions with focus on versatility and operational efficiency. Wacker Neuson provides European-engineered compact equipment with focus on quality and performance optimization. Gehl and Kubota offer specialized compact machinery with focus on agricultural and construction applications across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 7,284.8 million |

| Machinery Type | Mini Track Loader, Mini Excavator, Others |

| Application | Construction, Agri Landscaping, Material Handling, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Bobcat, Ditch Witch, Toro, Morbark, Vermeer Manufacturing, Kanga, Wacker Neuson, Gehl, Kubota, Caterpillar, John Deere, Takeuchi, ASV Holdings, Terex Corporation, JCB |

| Additional Attributes | Dollar sales by machinery type and application segment, regional demand trends across major markets, competitive landscape with established equipment manufacturers and emerging technology providers, customer preferences for different machinery configurations and attachment options, integration with construction management systems and rental fleet operations, innovations in electric powertrains and telematics capabilities, and adoption of smart control features with enhanced operational workflows for improved productivity and operational efficiency. |

The global mini track machinery market is estimated to be valued at USD 7,284.8 million in 2025.

The market size for the mini track machinery market is projected to reach USD 11,313.1 million by 2035.

The mini track machinery market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in mini track machinery market are mini track loader, mini excavator and others.

In terms of application, construction segment to command 52.0% share in the mini track machinery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Miniplate for Bone Fixation Market Size and Share Forecast Outlook 2025 to 2035

Miniature Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Mini LED Solder Pastes and Fluxes Market Size and Share Forecast Outlook 2025 to 2035

Miniature Duplex Connectors Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mini Grid Market Size and Share Forecast Outlook 2025 to 2035

Mini POS Terminals Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Spine Technologies Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mini Hair Straightener Market Size and Share Forecast Outlook 2025 to 2035

Minimally Invasive Laser Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Mini Packaging Market Size, Growth, and Forecast for 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA