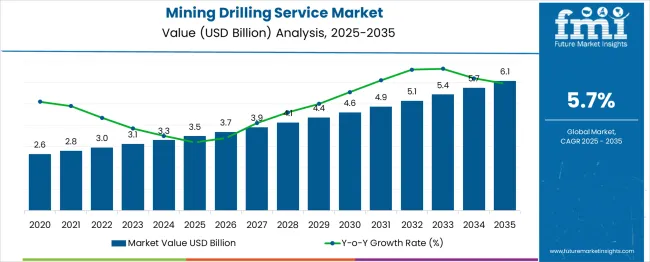

The mining drilling service market, valued at USD 3.5 billion in 2025, is expected to grow to USD 6.1 billion by 2035, with a CAGR of 6%. From 2025 to 2027, the market grows steadily, increasing from USD 3.5 billion to USD 3.7 billion. This early growth phase reflects a gradual recovery in demand as the global mining industry rebounds, driven by the need for increased exploration and extraction services. The market continues its upward trajectory with incremental gains, supported by demand from both established and emerging mining regions seeking efficient drilling solutions.

Between 2027 and 2030, the market accelerates as it moves from USD 3.7 billion to USD 4.6 billion. This period is characterized by an increase in drilling activities due to higher commodity prices and the expanding demand for natural resources. However, the market experiences a slight deceleration after 2030, with growth reaching USD 5.7 billion by 2033. The deceleration is due to the maturity of the mining industry and a shift toward more efficient and automated drilling technologies, leading to a slower rate of expansion. By 2035, the market reaches USD 6.1 billion, marking a steady but moderate long-term growth trend, with no significant peaks or troughs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.5 billion |

| Forecast Value in (2035F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 6% |

The market has shown steady growth, reflecting moderate year-over-year increases, but it remains exposed to several risk factors. One of the key risks is the volatility of commodity prices, which directly impacts demand for mining exploration and drilling services. A decline in commodity prices can result in reduced investment in exploration activities, leading to a slowdown in the drilling services market. Regulatory changes, particularly those related to environmental restrictions, could increase operational costs or limit certain drilling activities, affecting the market's stability.

The market is also sensitive to external factors such as economic cycles and geopolitical instability. Economic downturns typically result in lower demand for mining exploration, which can reduce the need for drilling services. Geopolitical instability in mining-intensive regions, especially in developing countries, can disrupt drilling operations and lead to market uncertainty. Technological disruptions, such as advancements in drilling techniques, may pose both opportunities and challenges, potentially altering the competitive landscape.

Market expansion is being supported by the increasing global demand for minerals and metals driven by infrastructure development, renewable energy technologies, and industrial manufacturing. Modern mining operations require sophisticated drilling services to access deep ore deposits, navigate complex geological formations, and maximize resource extraction efficiency. The growing focus on exploration activities to identify new mineral reserves is creating demand for specialized drilling services.

The rising adoption of advanced drilling technologies such as directional drilling, automated systems, and real-time monitoring is enhancing service capabilities and operational efficiency. Mining companies are increasingly outsourcing drilling operations to specialized service providers to access expertise, reduce capital investments, and focus on core mining activities. The expansion of mining activities in emerging markets and the development of new mining projects are contributing to increased service demand across different geological regions and commodity types.

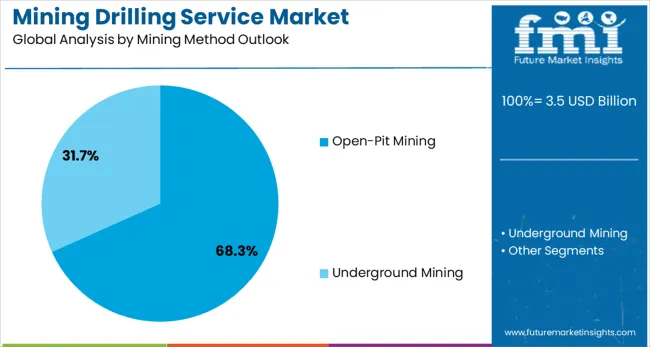

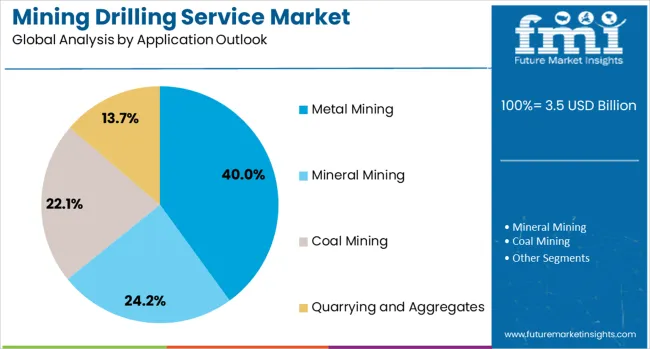

The market is segmented by service type, mining method, and application. By service type, the market is divided into exploration drilling, underground drilling, surface drilling, production drilling, and directional drilling. Based on mining method, the market is categorized into open-pit mining and underground mining. In terms of application, the market is segmented into metal mining, mineral mining, and coal mining. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The exploration drilling service is projected to account for 32% of the mining drilling service market in 2025, reflecting its critical role in mineral discovery and resource evaluation. This segment drives initial mining project development by providing essential geological data and resource estimation capabilities. Mining companies rely heavily on exploration drilling to identify viable ore deposits, assess geological conditions, and determine project feasibility before major capital investments.

The segment benefits from continuous technological advancement in drilling equipment and sampling techniques that improve data quality and operational efficiency. Growing demand for critical minerals and metals for renewable energy applications is driving increased exploration activities across diverse geographical regions. As mining companies seek to expand their resource portfolios and identify new deposits, exploration drilling remains fundamental to industry growth and resource development strategies.

Open-pit mining is projected to represent 68.3% of mining drilling service demand in 2025, underscoring its dominance in large-scale mineral extraction operations. This method requires extensive drilling services for blast hole preparation, grade control, and geological mapping throughout the mining lifecycle. Open-pit operations typically involve high-volume drilling activities that support efficient ore extraction and waste removal processes.

The segment benefits from technological advancement in drilling equipment designed for open-pit environments, including automation capabilities and improved precision systems. Large-scale mining projects favor open-pit methods due to lower operational costs and higher production rates compared to underground mining. As mining companies focus on maximizing resource recovery and operational efficiency, open-pit drilling services continue to dominate market demand across major mining regions.

The metal mining application is forecasted to contribute 40% of the mining drilling service market in 2025, reflecting the critical importance of metal production for global industrial and technological applications. This segment encompasses drilling services for precious metals, base metals, and specialty metals extraction operations. Growing demand for metals in renewable energy technologies, electric vehicle manufacturing, and advanced electronics is driving growth in metal mining activities.

The segment benefits from increasing investment in metal exploration and production projects driven by supply chain diversification and resource security concerns. Advanced drilling technologies are particularly important in metal mining for precise ore body delineation and grade control. As global economies transition toward cleaner technologies and digital infrastructure, metal mining drilling services remain essential for securing reliable mineral supply chains.

The mining drilling service market is advancing rapidly due to increasing mineral demand, technological advancement in drilling equipment, and growing mining activities in emerging markets. The market faces challenges including environmental regulations, skilled labor shortages, and fluctuating commodity prices. Innovation in automation technologies and drilling practices continue to influence service development and market expansion patterns.

The integration of automation and digital technologies is reshaping the mining drilling service market, improving precision, reducing operational costs, and enhancing safety. Automated drilling systems use artificial intelligence (AI) to minimize human error, ensuring consistent performance and optimizing drilling accuracy. The implementation of real-time monitoring systems offers increased operational efficiency by providing instant data on the status of drilling equipment, allowing for predictive maintenance and timely interventions. These innovations not only streamline operations but also enhance productivity by reducing downtime and improving overall resource utilization.

Mining exploration is intensifying in emerging markets as demand for minerals continues to rise. These regions, particularly in Africa, Asia-Pacific, and Latin America, are rich in untapped mineral resources and offer substantial growth potential for the drilling services market. Government initiatives to promote mining sector development, such as tax incentives and infrastructure improvements, are encouraging foreign investments. As mining companies expand their operations into these areas, there is a growing need for advanced drilling services that can efficiently navigate diverse geological conditions, presenting new opportunities for service providers.

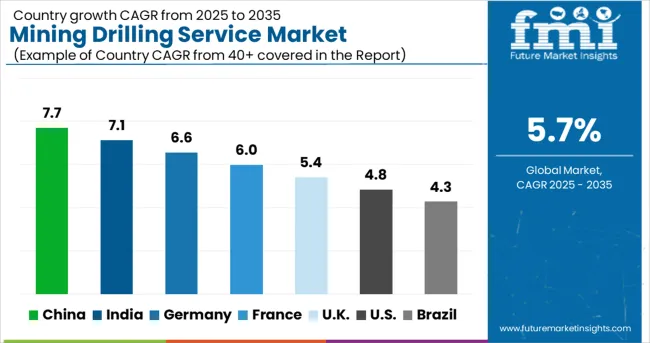

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6% |

| UK | 5.4% |

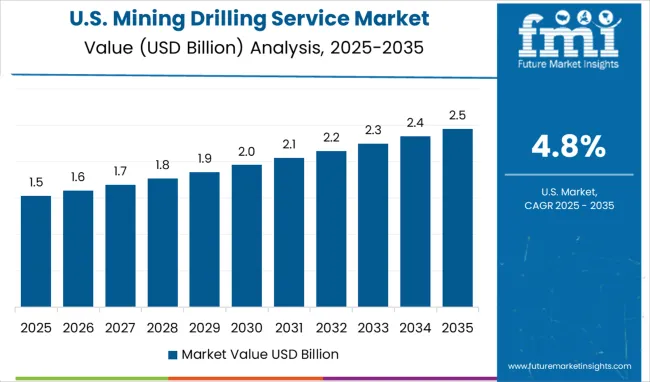

| USA | 4.8% |

| Brazil | 4.3% |

The mining drilling service market is experiencing robust growth globally, with China leading at a 7.7% CAGR through 2035, driven by massive infrastructure development, industrial expansion, and growing demand for minerals and metals. India follows closely at 7.1%, supported by government initiatives for mining sector development and increasing mineral exploration activities. Germany shows steady growth at 6.6%, emphasizing advanced drilling technologies and engineering solutions. France records 6.0%, focusing on specialized drilling services for nuclear and industrial applications. The UK shows 5.4% growth, prioritizing offshore and international drilling expertise.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

Revenue from mining drilling services in China is projected to exhibit strong growth with a CAGR of 7.7% through 2035, driven by massive infrastructure development projects and increasing demand for minerals and metals across industrial sectors. The country's expanding manufacturing base and urbanization programs are creating significant demand for mining operations and associated drilling services. Major domestic and international drilling service providers are establishing comprehensive operations to serve the growing mining industry across diverse geological regions. Government support for mining sector development and technological advancement is driving demand for advanced drilling services throughout major mineral-producing regions. Investment in mining practices and environmental compliance is supporting the adoption of modern drilling technologies and service capabilities nationwide.

The mining drilling services market in India is expanding at a CAGR of 7.1% through 2035. The mining industry is experiencing a boost due to government-backed initiatives aimed at enhancing the mining sector, along with increasing demand for minerals due to rapid industrialization and infrastructure projects. The focus on increasing domestic mineral production to reduce dependency on imports is encouraging exploration and production activities. Both international and domestic drilling service companies are scaling their operations to capitalize on the expanding market opportunities. India’s mining sector continues to be a significant contributor to its GDP, with an increasing need for advanced drilling services across coal, iron ore, and mineral exploration.

The USA mining drilling services market is anticipated to grow at a CAGR of 4.8% through 2035. This growth is supported by technological innovations in drilling equipment and a shift toward enhanced operational efficiency across the mining sector. With a focus on optimizing mining operations, USA mining companies are increasingly adopting automated and digital drilling technologies to reduce operational costs and improve efficiency. The market is characterized by a strong demand for specialized services that combine technical expertise with high-performance equipment. Strategic investments in critical mineral production and supply chain security are encouraging mining companies to develop domestic resources. These efforts are further supported by government policies focusing on reducing the reliance on foreign mineral imports.

Revenue from mining drilling services in Germany is forecasted to grow at a CAGR of 6.6% through 2035, driven by the country's advanced engineering capabilities, precision drilling technologies, and expertise in complex geological formations. German companies consistently focus on innovation and technical excellence in drilling service delivery. The market benefits from strong industrial demand and export opportunities for specialized drilling equipment and services. Ongoing investment in research and development is supporting next-generation drilling technologies that combine efficiency with environmental responsibility. Collaboration between engineering companies and mining operators is enhancing service capabilities and reinforcing Germany's position as a leader in drilling technology innovation.

The mining drilling services market in France is growing at a CAGR of 6.0% through 2035. This growth is primarily driven by specialized applications in nuclear fuel extraction, industrial mineral production, and geological survey operations. France has a highly developed mining sector focused on precise drilling requirements, particularly in nuclear and mineral extraction activities. The country’s commitment to safety and high operational standards is ensuring that only advanced, reliable drilling services are utilized in these operations. French companies have built a strong reputation for their technical expertise and precision in drilling services. The country is also investing heavily in the nuclear energy sector, which is creating a strong demand for specialized drilling services for uranium and other resources.

The mining drilling services market in the UK is estimated to grow at a CAGR of 5.4% through 2035. This growth is driven by the strong expertise in offshore drilling operations, international project management, and consulting services. British companies provide specialized technical expertise for complex drilling operations worldwide, with a strong emphasis on offshore drilling, particularly in the North Sea. The UK is investing in renewable energy projects, including offshore wind and geothermal, which are also boosting demand for specialized drilling services. UK companies are recognized for their ability to manage complex international projects, providing valuable consultancy services to global mining operations. Investment in offshore drilling technologies is opening up new growth avenues for UK-based drilling service providers.

Demand for mining drilling services in Brazil is expanding at a CAGR of 4.3% through 2035, driven by the country’s vast mineral resources and expanding mining operations. Brazil is a significant player in the global mining industry, particularly in iron ore and bauxite production. With large-scale mining operations expanding, the demand for advanced drilling services is increasing to enhance resource extraction and operational efficiency. Brazilian mining companies are investing in modern drilling technologies to boost production capacity and improve cost efficiency. The country’s mining sector is undergoing modernization to increase productivity while meeting environmental regulations. These improvements are opening new opportunities for drilling service providers.

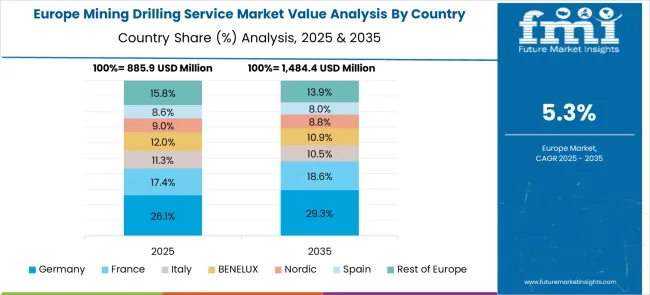

The mining drilling service market in Europe demonstrates steady development across major mining regions, with Germany showing a strong presence through its advanced mining technology sector and engineering expertise in drilling systems, supported by companies leveraging precision engineering to develop efficient drilling solutions that serve both domestic and international mining operations. France represents a significant market driven by its nuclear energy sector and uranium mining requirements, with companies specializing in specialized drilling services for nuclear fuel extraction and geological survey operations.

The UK exhibits considerable activity through its expertise in offshore drilling technologies and consulting services for international mining projects, with companies like specialized drilling contractors leading technical innovation and project management capabilities for complex geological formations. Poland and Sweden show expanding mining activities, particularly in copper and iron ore extraction, driving demand for comprehensive drilling services. Finland and Norway contribute through their expertise in Arctic and challenging environment drilling operations, while other European countries display growing potential driven by increasing focus on critical mineral security and mining practices across diverse geological formations.

The drilling services market is highly competitive, with companies focusing on advanced drilling equipment, automated systems, digital technologies, and the development of a skilled workforce to provide efficient, safe, and cost-effective solutions. Service capabilities, technical expertise, and geographic coverage are key factors driving companies' market positions and strengthening client relationships. As the demand for more precise and efficient drilling techniques grows, these companies are investing in technological advancements to enhance their service offerings and expand their global reach.

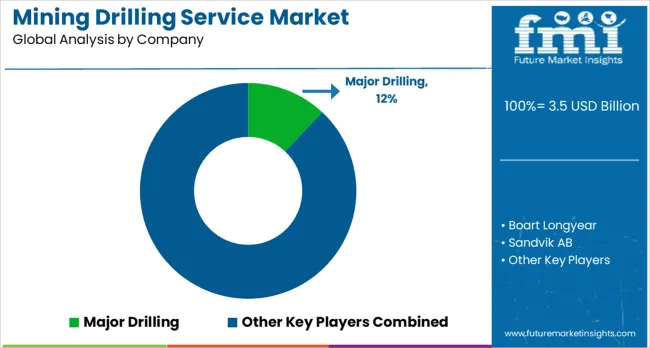

Major Drilling, leading the market with a 12% global value share, offers comprehensive drilling services with a strong emphasis on operational efficiency and safety performance. The company’s ability to optimize drilling operations in challenging environments solidifies its leadership in the sector. Boart Longyear provides specialized drilling solutions, focusing on advanced equipment and technical expertise across various mining applications. The company's global presence and diverse portfolio of drilling services ensure its competitive edge. Sandvik AB delivers integrated drilling systems, combining cutting-edge equipment manufacturing with robust service capabilities, catering to a wide range of mining and exploration needs. Ausdrill, specializing in mining services, offers comprehensive drilling operations and project management, making it a key player in large-scale mining projects.

Foraco International SA operates globally, providing specialized drilling services for mining exploration and production projects. The company’s broad geographic coverage and commitment to high-quality service make it a trusted partner for resource extraction companies. Orbit Garant Drilling Inc. provides comprehensive drilling services, focusing on Canadian and international mining operations. Other notable players such as Action Drill & Blast, SWICK MINING SERVICES, Drillcon Group, and Geodrill offer specialized regional and international drilling services, combining technical expertise with operational excellence to meet the unique needs of mining operations worldwide. Together, these companies are shaping the future of the drilling services market by integrating advanced technologies and maintaining high standards of service quality.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.5 billion |

| Service Type | Exploration Drilling, Underground Drilling, Surface Drilling, Production Drilling, Directional Drilling |

| Mining Method | Open-Pit Mining, Underground Mining |

| Application | Metal Mining, Mineral Mining, Coal Mining |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Major Drilling, Boart Longyear, Sandvik AB, Ausdrill, Foraco International SA, Orbit Garant Drilling Inc., Action Drill & Blast, SWICK MINING SERVICES, Drillcon Group, and Geodrill |

| Additional Attributes | Dollar sales by service type and equipment specifications, regional demand trends, competitive landscape, technological advancement integration, automation and digitalization trends, environmental compliance requirements, safety performance standards, and skilled workforce development initiatives |

The global mining drilling service market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the mining drilling service market is projected to reach USD 6.1 billion by 2035.

The mining drilling service market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in mining drilling service market are exploration drilling, underground drilling, surface drilling, production drilling and directional drilling.

In terms of mining method outlook, open-pit mining segment to command 68.3% share in the mining drilling service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mining Flotation Chemicals Market Size, Growth, and Forecast 2025 to 2035

Mining Drill Market Growth – Trends & Forecast 2025 to 2035

Mining Explosives Consumables Market Growth – Trends & Forecast 2025 to 2035

Mining Locomotive Market

Mining Vehicle AC Kits Market

Mining Collectors Market Size & Demand 2022 to 2032

Mining & Construction Drilling Tools Market Growth – Trends & Forecast 2024-2034

Demining Tool Kits Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Large Mining Shovel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA